Clipper Logistics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clipper Logistics Bundle

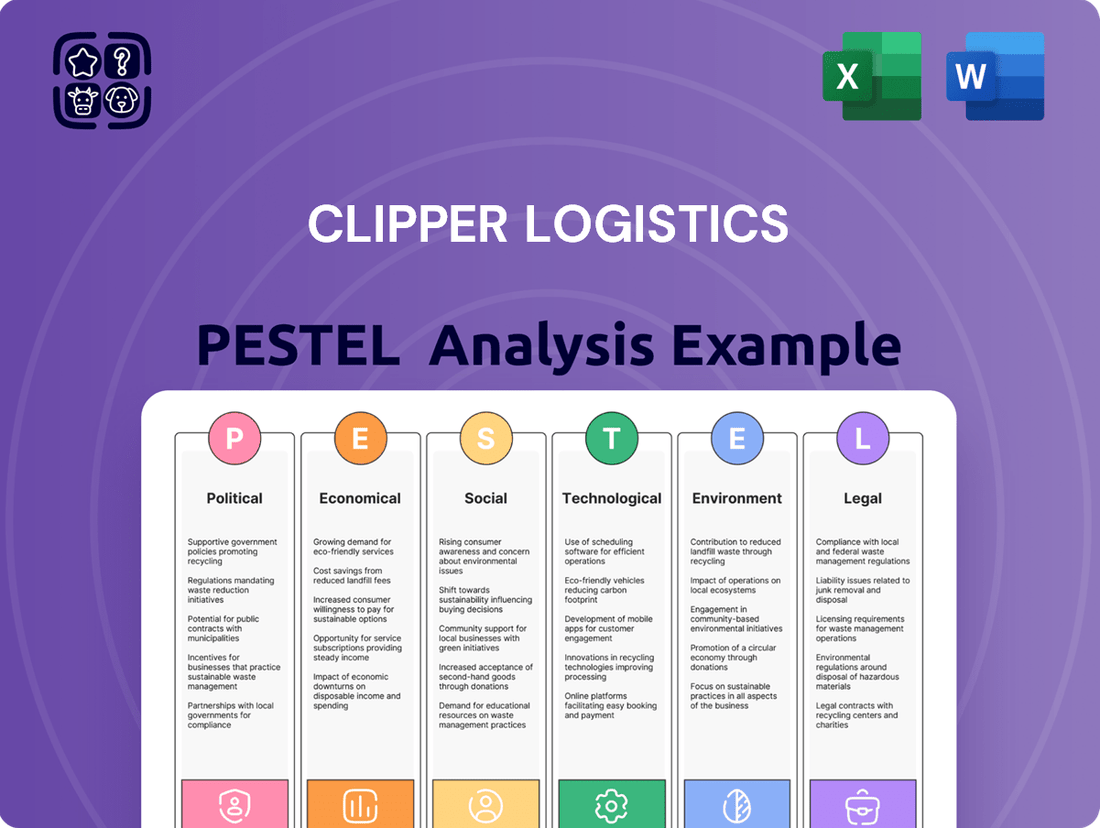

Navigate the complex external landscape impacting Clipper Logistics with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental regulations, and legal frameworks are shaping their operations and future growth. This expertly crafted analysis provides the crucial intelligence you need to anticipate challenges and capitalize on opportunities.

Gain a competitive edge by leveraging our in-depth PESTLE analysis of Clipper Logistics. Discover the external forces driving change and use these actionable insights to inform your own strategic planning and investment decisions. Don't miss out on critical market intelligence—download the full version now for immediate access.

Political factors

The operating environment for Clipper Logistics in the UK and Europe remains complex due to evolving post-Brexit trade rules, particularly with new import control systems like the UK’s Border Target Operating Model fully implemented by 2024. Stricter enforcement of rules of origin, impacting goods movements and requiring detailed declarations, creates significant administrative burdens and potential delays. Navigating these dynamic regulations is crucial to ensure smooth cross-border movements and avoid substantial penalties, impacting operational efficiency and costs for logistics providers. Compliance costs across the sector have risen, with some estimating a 15-20% increase in customs-related overheads for 2024-2025.

Global tensions, including the continued conflict in Ukraine and persistent US-China trade disputes, create significant uncertainty for logistics operations. For example, crude oil prices, impacting transport costs, have remained elevated, with Brent crude trading around $85-$90 per barrel in early 2025. These events can disrupt shipping routes, as seen with rerouting away from the Red Sea in late 2024, increasing transit times and freight expenses. Volatile trade policies and tariffs further challenge supply chain reliability, necessitating robust strategies to maintain resilience for Clipper Logistics.

Government infrastructure investment significantly influences Clipper Logistics' operational efficiency. Robust spending on roads, ports, and rail networks, such as the UK’s projected £700 billion infrastructure pipeline through 2033, directly reduces transit times and fuel costs for logistics providers. For instance, enhanced digital infrastructure, with 80% gigabit-capable broadband coverage targeted by 2025, improves supply chain visibility. Conversely, underinvestment, like delays in key road upgrades, can create bottlenecks, increasing operational expenditures and impacting delivery schedules.

National Policy & Economic Strategy

The UK government recognizes the logistics sector, including Clipper Logistics, as a vital economic growth driver, contributing significantly to the national GDP which saw a 0.2% increase in Q1 2024. Despite this acknowledgment, the industry advocates for enhanced support and prioritization within national policy frameworks.

Future industrial strategies and fiscal policies, such as the 25% corporate tax rate for profits over £250,000 implemented from April 2023 and fluctuating fuel duties, directly influence investment decisions and operational costs for logistics providers. The industry is closely monitoring the UK's economic strategy for 2025, anticipating measures that foster sustainability and efficiency.

- UK logistics sector contributes over £127 billion Gross Value Added annually.

- Industry calls for infrastructure investment, with a £4.8 billion National Roads Fund allocated for 2020-2025.

- Corporate tax rates at 25% (2024) impact profitability and reinvestment capacity.

- Fuel duty remains frozen at 52.95p per litre (2024-2025), affecting operational expenses.

Regulatory Scrutiny on Mergers & Acquisitions

Large-scale acquisitions, like GXO's £965 million takeover of Clipper Logistics, face significant regulatory scrutiny from bodies such as the UK's Competition and Markets Authority (CMA).

This political oversight, crucial in 2024 and 2025, aims to prevent monopolies and ensure fair market competition within the logistics sector. The outcomes of these reviews can profoundly impact the strategic integration and operational synergies of the combined entities, influencing future market structures.

- CMA reviews large mergers to protect consumer interests.

- Potential divestitures or conditions can be imposed on deals.

- Regulatory hurdles can extend acquisition timelines and costs.

Clipper Logistics navigates complex political landscapes, with post-Brexit trade rules, like the Border Target Operating Model (2024), increasing compliance costs by an estimated 15-20% for 2024-2025. Geopolitical tensions, exemplified by Red Sea rerouting in late 2024, elevate fuel costs, with Brent crude around $85-$90 per barrel in early 2025. Government infrastructure investment, including the UK's £700 billion pipeline through 2033, and fiscal policies like the 25% corporate tax rate, directly influence profitability and operational efficiency. Regulatory scrutiny by the CMA on acquisitions, such as GXO's takeover, remains crucial for market competition in 2024-2025.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Brexit Regulations | Increased compliance costs | 15-20% overhead increase |

| Geopolitical Tensions | Higher fuel/shipping costs | Brent crude $85-$90/barrel (early 2025) |

| Corporate Tax Rate | Affects profitability | 25% (2024) |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Clipper Logistics across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying opportunities and threats within the company's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex PESTLE factors into actionable insights for Clipper Logistics' strategic decision-making.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations, highlighting how understanding external forces can alleviate operational and market-related pain points for Clipper Logistics.

Economic factors

Inflationary pressures significantly impact Clipper Logistics operating expenses, particularly labor and transportation costs. While the UK's CPI inflation eased to 2.0% by May 2024, warehouse labor cost inflation, though showing signs of moderation from 2023 peaks, remains a key factor. Average weekly earnings growth in transportation and storage was around 5.4% in early 2024, influencing pricing strategies and overall profitability. Clipper's ability to manage these pressures through contractual escalations and efficiency gains is critical for maintaining robust financial performance into 2025.

The logistics sector's vitality directly mirrors overall economic health and consumer confidence. Sluggish economic growth, with the UK's GDP growth projected at only 0.7% in 2024 by the Bank of England, and similar trends in Germany, can reduce retail volumes and create fluctuating demand for Clipper Logistics' services. Conversely, a robust recovery in consumer spending, particularly the sustained expansion of e-commerce, which is forecast to grow by 9.4% globally in 2025, significantly boosts demand for warehousing, last-mile delivery, and distribution networks.

The logistics sector, including Clipper Logistics, navigates persistent labor and skills shortages, particularly for warehouse operatives and HGV drivers. Reports from early 2025 indicate driver vacancies remain high, contributing to wage inflation, with average HGV driver pay projected to rise by 4-6% in 2024. This scarcity necessitates significant investment in recruitment and training programs. To mitigate these gaps and boost productivity, companies are increasingly deploying automation and AI solutions, aiming for a 15-20% increase in warehouse efficiency by late 2025 through robotics and intelligent systems.

Fluctuating Demand & Market Volatility

The European logistics market currently navigates fluctuating demand, impacting companies like Clipper Logistics. After a significant post-pandemic surge, freight rates and overall demand have normalized by early 2024, leading to a more cautious investment climate. This shift has resulted in periods of over-capacity across the sector, with average European road freight spot rates decreasing by approximately 6% in Q4 2023 compared to the previous year, requiring flexible resource management.

- European freight rates normalized, with spot rates down around 6% in late 2023.

- Post-pandemic demand has stabilized, leading to over-capacity concerns in 2024.

- This volatility necessitates agile capacity and resource allocation for logistics providers.

Interest Rates and Investment Climate

Changes in central bank interest rates directly influence Clipper Logistics' cost of capital for new facilities and technology. The Bank of England's base rate, held at 5.25% through early 2024, has made borrowing for warehouse development more expensive, potentially constraining new supply. A more stable interest rate environment, with potential cuts anticipated in late 2024 or early 2025, is expected to encourage greater investment in logistics infrastructure. This stability could boost sector development activity, supporting expansion plans.

- Bank of England base rate maintained at 5.25% in early 2024, impacting borrowing costs.

- Higher rates dampen new warehouse development and technology investment.

- Anticipated interest rate cuts in late 2024 or early 2025 could stimulate sector investment.

- A stable rate environment supports long-term strategic investments in logistics.

Inflationary pressures, with UK CPI at 2.0% in May 2024 and transport wage growth around 5.4%, directly impact Clipper's operating costs. UK GDP growth, projected at 0.7% for 2024, alongside 9.4% global e-commerce expansion in 2025, shapes demand for logistics services. High interest rates at 5.25% in early 2024 constrain new investments, while normalized European freight rates and over-capacity necessitate agile resource management.

| Economic Factor | 2024 Data | 2025 Projections |

|---|---|---|

| UK CPI Inflation | 2.0% (May 2024) | Targeting 2.0% |

| UK GDP Growth | 0.7% | Modest recovery |

| Global E-commerce Growth | N/A | 9.4% |

| BoE Base Rate | 5.25% (Early 2024) | Potential cuts |

| European Road Freight Spot Rates | Down ~6% (Q4 2023 YoY) | Stabilization anticipated |

What You See Is What You Get

Clipper Logistics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Clipper Logistics delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the external forces shaping the logistics industry and Clipper's strategic positioning. This detailed report offers valuable insights for informed decision-making.

Sociological factors

The sustained shift towards online shopping fundamentally drives demand for logistics, with global e-commerce sales projected to exceed $7 trillion by 2025. This trend necessitates sophisticated e-fulfillment, efficient last-mile delivery, and robust returns management solutions. As consumer shopping becomes an always-on activity, logistics providers like Clipper Logistics must build highly integrated and responsive networks. For instance, UK online retail penetration remained significant, influencing fulfillment strategies across 2024.

Modern consumers increasingly expect rapid, flexible, and transparent delivery services, a trend intensifying into 2025. This includes a strong demand for next-day or even same-day delivery, with over 70% of UK online shoppers prioritizing delivery speed. The expectation for seamless, free returns also puts significant operational pressure on logistics providers like Clipper Logistics. Meeting these elevated expectations is critical for retaining clients in the competitive retail and e-commerce sectors, directly impacting service contracts and revenue streams. Adapting to these demands ensures a competitive edge and supports client growth.

Consumers and clients are increasingly prioritizing environmentally and socially responsible supply chains, compelling logistics providers like Clipper to adapt. This heightened demand, projected to influence over 60% of procurement decisions by 2025, includes sustainable packaging, low-emission transportation, and ethical labor practices. A strong ESG proposition, evidenced by an estimated 75% of investors considering ESG factors in 2024, is becoming a crucial competitive differentiator for securing new contracts and retaining existing business.

Workforce Well-being and Safety

Attracting and retaining talent, crucial for companies like Clipper Logistics, increasingly hinges on prioritizing employee safety, well-being, and clear career development paths. Organizations are significantly investing in safer work environments, with automation in warehousing projected to grow by over 10% in 2024-2025, and fostering inclusive cultures with defined progression. A positive work environment is essential to combatting persistent labor shortages, which saw some logistics sectors facing over 15% vacancy rates in early 2024, and ensuring a motivated, productive workforce.

- Logistics automation investment is projected to increase by 10%+ by 2025, enhancing safety.

- Labor shortages in logistics saw vacancy rates exceeding 15% in early 2024.

- Prioritizing well-being improves talent retention and reduces turnover costs.

Urbanization and Last-Mile Challenges

Increasing urbanization significantly complicates last-mile delivery, as over 55% of the global population now resides in urban areas, projected to reach 68% by 2050. Delivering goods efficiently in congested urban environments, such as London or New York, demands innovative solutions. Logistics providers like Clipper must adapt strategies to serve these growing urban populations effectively, facing challenges like limited space and traffic congestion.

- Micro-fulfillment centers reduce delivery distances, with investments in this sector projected to exceed $10 billion globally by 2025.

- Optimized routing software can cut fuel consumption and delivery times by up to 20% in dense urban settings.

- Autonomous delivery vehicles are being piloted, with some trials showing up to 90% cost savings per delivery over human couriers.

Sociological shifts, such as the increasing consumer preference for convenience and immediate gratification, significantly shape logistics demand. This includes a growing demand for rapid delivery options, with over 70% of UK online shoppers prioritizing speed in 2024. Furthermore, societal emphasis on ethical consumption drives demand for transparent and sustainable supply chains, influencing over 60% of procurement decisions by 2025. Adapting to these evolving societal values is crucial for Clipper Logistics to maintain relevance and secure new business.

| Sociological Trend | Impact on Logistics | Key Data (2024/2025) |

|---|---|---|

| Consumer Convenience Preference | Increased demand for rapid and flexible delivery. | 70%+ UK shoppers prioritize delivery speed. |

| Ethical Consumption | Demand for sustainable and transparent supply chains. | 60%+ procurement decisions influenced by ESG. |

| Digital Lifestyle Integration | Always-on shopping, necessitating responsive networks. | Global e-commerce sales exceed $7 trillion by 2025. |

Technological factors

Automation in warehousing, exemplified by GXO’s leadership, is crucial for efficiency and safety. The deployment of advanced robotics, including AI-powered picking and automated packaging systems, is addressing critical labor shortages. Projections for 2025 indicate a 15-20% increase in warehouse automation adoption, vital for managing the escalating volume of e-commerce operations. This technological integration enhances productivity and ensures robust supply chain resilience for logistics providers.

Artificial Intelligence and machine learning are increasingly integrated into logistics, enhancing demand forecasting and optimizing delivery routes for companies like Clipper Logistics. These technologies enable smarter, data-driven decisions, projecting up to a 15% efficiency gain in supply chain operations by 2025. AI also significantly improves workforce management and picking productivity, with automated warehouse systems seeing a 20-30% increase in throughput.

The digitalization of logistics, leveraging advanced Warehouse Management Systems (WMS), IoT sensors, and blockchain, significantly enhances supply chain transparency and real-time tracking. This technological integration provides Clipper Logistics' clients with superior visibility and control over their inventory and distribution networks. For instance, GXO Logistics, a key player in contract logistics, reported deploying over 15,000 IoT sensors across its operations by early 2024, substantially improving inventory accuracy and operational efficiency. Such advancements are crucial for meeting evolving client demands for precise, up-to-the-minute supply chain data.

Humanoid Robotics Development

GXO Logistics is actively piloting and developing humanoid robots for warehouse applications, representing a significant technological shift. By partnering with leading robotics firms, the company is testing these humanoids for tasks such as moving totes and picking, aiming to reduce repetitive heavy lifting for employees. This strategic investment in the next generation of warehouse automation is projected to enhance operational efficiency and mitigate labor shortages, with market analysts forecasting substantial growth in the logistics robotics sector through 2025. The global logistics automation market, valued at over $60 billion in 2023, is expanding rapidly.

- GXO pilots humanoid robots for core warehouse tasks.

- Partnerships with robotics firms drive development.

- Focus on reducing repetitive heavy lifting for staff.

- Strategic investment in 2024/2025 automation trends.

Focus on Cybersecurity

As Clipper Logistics' operations become increasingly digitized and interconnected, the threat of cybersecurity breaches escalates significantly. Protecting sensitive company and customer data, including supply chain information, is a critical legal and technological imperative. Significant investment in robust cybersecurity measures is necessary to safeguard against disruptions, maintain operational continuity, and uphold client trust, especially with evolving regulations like DORA impacting financial services clients. Projections indicate global cybersecurity spending will approach $260 billion by 2025, reflecting this urgent need.

- The average cost of a data breach is projected to exceed $4.5 million in 2024.

- Logistics firms face rising ransomware attacks, increasing 20% year-over-year in 2023.

- Regulatory fines for data privacy violations can reach 4% of global annual turnover.

- Investment in AI-driven threat detection is critical for 2024-2025 strategies.

Clipper Logistics is heavily influenced by rapid technological advancements, notably increased automation and AI integration, projected to boost warehouse efficiency by 15-20% by 2025. Digitalization via advanced WMS and IoT sensors, with GXO deploying over 15,000 by early 2024, ensures superior supply chain transparency. Furthermore, the escalating cybersecurity threats necessitate significant investment, as global spending is expected to approach $260 billion by 2025 to mitigate risks like average data breach costs exceeding $4.5 million in 2024.

| Technological Factor | Key Impact | 2024/2025 Data |

|---|---|---|

| Warehouse Automation | Efficiency & Labor Mitigation | 15-20% adoption increase by 2025; Market >$60B (2023) |

| AI & Machine Learning | Optimization & Productivity | Up to 15% efficiency gain by 2025; 20-30% throughput increase |

| Cybersecurity Investment | Risk Mitigation & Data Protection | Global spending ~$260B by 2025; Data breach cost >$4.5M (2024) |

Legal factors

Navigating the evolving UK-EU regulatory landscape presents a significant legal challenge for Clipper Logistics. Compliance with the UK Border Target Operating Model, fully implemented by late 2024, necessitates new safety and security declarations, akin to the EU's ICS2 Phase 3 requirements for air and maritime cargo. Meticulous adherence to these changing customs documentation requirements is critical. Failure to comply can lead to substantial operational delays and financial penalties, potentially impacting profitability by 5-10% on affected routes due to increased administrative burdens and potential fines.

Logistics operators like Clipper Logistics must strictly adhere to evolving employment laws, including the UK National Living Wage, which rose to £11.44 per hour for over 21s from April 2024, alongside working hour regulations and robust employee safety standards. The ongoing legal status debates surrounding gig economy workers, as seen in various 2024 court cases, present significant compliance challenges for flexible staffing models. Ensuring full adherence to these complex labor regulations demands substantial expenditure on HR systems, legal counsel, and continuous training. This sustained investment is crucial for mitigating legal risks and maintaining operational integrity within the 2024-2025 regulatory landscape.

Governments are implementing stricter environmental laws, including the UK's net-zero target by 2050 and the EU's Fit for 55 package, demanding significant carbon emission reductions from logistics. The expansion of Low Emission Zones, like London's ULEZ, directly impacts Clipper's fleet operations, necessitating investment in electric or hydrogen vehicles to avoid daily charges, which can reach £12.50 for non-compliant vans. Compliance with these evolving regulations is essential for maintaining operational licenses and aligning with corporate sustainability goals, impacting fleet renewal budgets and strategic planning through 2025.

Health and Safety Legislation

Health and safety legislation significantly impacts Clipper Logistics operations, mandating stringent standards across its warehousing and transportation networks. This includes strict adherence to regulations for manual handling, safe machinery operation, and comprehensive workplace safety protocols to protect all employees. Companies like GXO, which acquired Clipper, exemplify this commitment with initiatives like their 'Road to Zero' program, aiming for zero occupational injuries and illnesses by prioritizing safety culture and continuous improvement. Such compliance is crucial for maintaining operational licenses and avoiding substantial penalties, which can exceed millions of GBP for severe breaches.

- Regulatory compliance: Essential for all logistics operations in 2024/2025.

- Injury prevention: Focus on reducing incidents through strict protocols.

- Financial impact: Non-compliance can lead to significant fines and reputational damage.

- Industry standard: Programs like GXO's 'Road to Zero' set benchmarks for safety aspiration.

Data Protection and Privacy Laws

Clipper Logistics, handling extensive data, faces critical compliance with data protection laws like GDPR. This necessitates legally sound management of customer, client, and employee information, especially as global data privacy regulations continue to tighten in 2024. Significant investment in robust cybersecurity measures and legal compliance frameworks is essential to safeguard this sensitive data. Failure to comply can result in substantial penalties, with GDPR fines reaching up to €20 million or 4% of global annual turnover, whichever is higher, impacting profitability and reputation.

- GDPR fines collectively exceeded €2 billion in 2023, underscoring ongoing regulatory enforcement.

- The average cost of a data breach globally was $4.45 million in 2023, highlighting financial risks.

- Robust cybersecurity spending is crucial to mitigate breaches and avoid reputational damage.

Clipper Logistics navigates a complex legal landscape in 2024/2025, from stringent UK-EU trade compliance, including the Border Target Operating Model, to evolving employment laws like the £11.44 National Living Wage. Adherence to data protection, specifically GDPR, is critical, with fines potentially reaching €20 million or 4% of global turnover. Non-compliance across these areas can lead to significant operational delays, substantial penalties, and reputational damage.

| Legal Area | Key Requirement (2024/2025) | Potential Impact of Non-Compliance |

|---|---|---|

| Trade & Customs | UK Border Target Operating Model | 5-10% profitability impact on affected routes |

| Employment | National Living Wage (£11.44/hr from April 2024) | Increased HR costs, legal challenges |

| Data Protection | GDPR compliance | Fines up to €20M or 4% global turnover |

Environmental factors

GXO, having acquired Clipper Logistics, is committed to ambitious, science-based targets for carbon emission reduction. The company aims for a 30% reduction in Scope 1 and 2 emissions by 2030, striving for carbon neutrality by 2040. This commitment drives significant investment in energy-efficient technologies and renewable energy sources across its global operations. A key strategy involves transitioning to electrified, battery-powered fleets, though this remains a considerable challenge for widespread adoption. Such environmental initiatives are crucial for long-term sustainability and regulatory compliance in the logistics sector.

Clipper Logistics prioritizes waste reduction, aiming for an 80% global waste diversion rate from landfills by 2025.

This commitment is underpinned by robust reverse logistics and recycling initiatives, central to their circular economy model.

These services not only significantly reduce environmental impact but also provide a distinct competitive advantage in the market.

In 2024, their advanced returns management systems continued to optimize resource recovery, aligning with sustainability goals and operational efficiency.

The logistics sector, including GXO which acquired Clipper, is heavily focused on green logistics, aiming to reduce environmental impact. This involves optimizing delivery routes to cut fuel consumption, with projections for 2025 showing continued advancements in fleet efficiency. GXO actively partners with clients to design sustainable packaging, utilizing automated machines that significantly reduce cardboard waste, aligning with European Union directives on packaging and packaging waste expected by late 2024. A core strategy is the rapid adoption of electric and alternative fuel vehicles, with major investments planned for 2024-2025 to transition fleets towards net-zero emissions.

Energy Consumption in Facilities

Clipper Logistics prioritizes reducing energy consumption across its extensive warehouse network. A key environmental objective for 2025 is to achieve 80% energy-efficient LED lighting across its global operations. The company is also strategically working towards sourcing 50% of its global electricity from renewable energy sources by 2030, enhancing its sustainability profile.

- By 2025: 80% of global operations to use LED lighting.

- By 2030: 50% of global electricity from renewable sources.

Climate Change Resilience

Clipper Logistics must enhance climate change resilience as extreme weather events, projected to intensify into 2025, increasingly disrupt logistics networks. Building resilient supply chains is crucial for ensuring service continuity, especially with a 2024 report indicating a 15% rise in weather-related supply chain disruptions across Europe. This involves strategic network design and risk management to mitigate impacts from environmental challenges.

- Logistics firms are investing over 7% of their annual infrastructure budget into climate adaptation by 2025.

- Supply chain re-routing due to weather events saw a 20% increase in 2024 in key European corridors.

- The cost of climate-related disruptions for European logistics is estimated to reach €3 billion annually by 2025.

GXO, having acquired Clipper Logistics, targets an 80% global waste diversion rate from landfills by 2025 and 80% LED lighting across operations by 2025. Significant investments are planned for 2024-2025 to transition fleets toward net-zero emissions. Climate change resilience is critical, with a 15% rise in weather-related disruptions in Europe noted in 2024. Logistics firms are investing over 7% of their infrastructure budget into climate adaptation by 2025, addressing an estimated €3 billion annual cost of disruptions by 2025.

| Environmental Metric | Target/Trend | Year |

|---|---|---|

| Global Waste Diversion | 80% from landfills | 2025 |

| LED Lighting Coverage | 80% of global operations | 2025 |

| Weather-Related Disruptions | 15% rise in Europe | 2024 |

| Climate Adaptation Investment | >7% of infrastructure budget | 2025 |

| Cost of Climate Disruptions | €3 billion annually | 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Clipper Logistics is meticulously crafted using a blend of official government publications, reputable market research reports, and expert industry analysis. We draw upon economic indicators, legislative updates, environmental impact assessments, and technological trend forecasts to provide a comprehensive view.