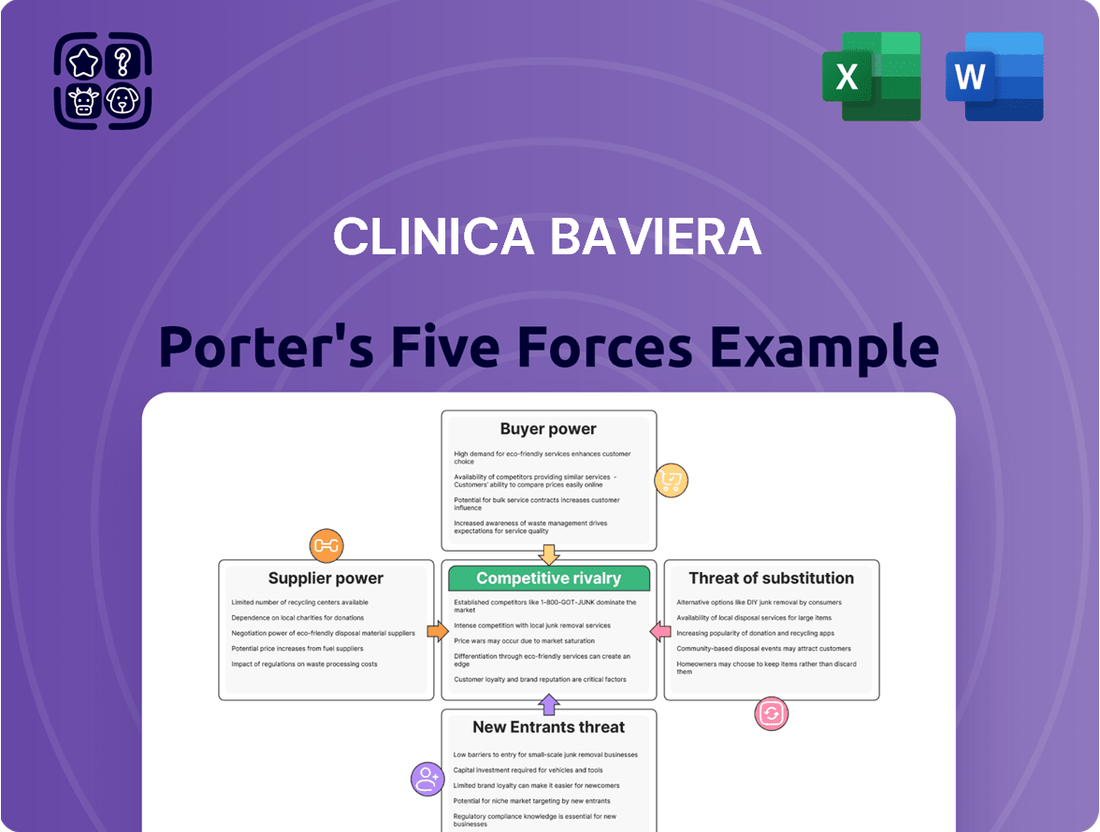

Clinica Baviera Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clinica Baviera Bundle

Clinica Baviera operates in a dynamic market shaped by the intense rivalry among existing players, the significant bargaining power of its customers, and the constant threat of new entrants. Understanding these forces is crucial for navigating the competitive landscape effectively.

The complete report reveals the real forces shaping Clinica Baviera’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized ophthalmic equipment, such as advanced lasers and diagnostic machines, wield considerable bargaining power. This is largely due to the high cost and unique nature of their offerings, with few alternative manufacturers capable of providing cutting-edge technology. Clinica Baviera's dependence on this sophisticated machinery for critical procedures like refractive and cataract surgeries underscores the importance of supplier reliability and performance.

Suppliers of critical components like intraocular lenses and specialized pharmaceuticals hold significant sway over Clínica Baviera. When these products are patented or provide distinct clinical benefits, their bargaining power increases substantially. For instance, while generic medications might offer competition, advanced implants for complex eye surgeries are often sourced from a limited number of manufacturers, potentially driving up costs for the clinic.

Ophthalmologists, especially those skilled in refractive and cataract surgeries, are essential for Clínica Baviera's service delivery. Their specialized training and limited availability in certain areas grant them significant leverage.

The need to attract and keep top-tier surgeons means Clínica Baviera must offer competitive salaries and a positive work atmosphere, directly influencing operating expenses. For instance, in 2024, the average salary for an experienced ophthalmologist in Spain, where Clínica Baviera operates, ranged from €80,000 to €150,000 annually, depending on specialization and experience.

Technology and Software Vendors

Technology and software vendors, including those providing clinic management software, electronic health records (EHR) systems, and telemedicine platforms, hold significant bargaining power. Their increasing importance in modern healthcare operations means Clínica Baviera relies heavily on these specialized systems for efficiency and patient data management. The complexity and cost associated with switching these core IT infrastructures can make it difficult for Clínica Baviera to change vendors, thus amplifying supplier leverage.

The global healthcare IT market was valued at approximately $37.7 billion in 2023 and is projected to grow substantially. This growth indicates a rising demand for sophisticated software solutions, potentially strengthening the position of key vendors. For instance, the EHR market alone saw significant investment and consolidation in recent years, leading to fewer, larger players with greater market influence.

- Increased Vendor Dependence: As healthcare providers adopt more integrated digital solutions, their reliance on specialized software vendors grows, reducing their ability to switch.

- High Switching Costs: The expense and operational disruption involved in migrating data and retraining staff for new IT systems create a significant barrier to changing suppliers.

- Market Consolidation: In some segments of healthcare technology, market consolidation has led to a smaller number of dominant vendors, increasing their pricing and negotiation power.

Real Estate and Facility Services

The bargaining power of suppliers in real estate and facility services for Clinica Baviera is influenced by several factors. The availability and cost of suitable commercial real estate in prime urban locations across Spain, Germany, and Italy are key. For instance, in 2023, prime retail rents in Madrid averaged around €25-€30 per square meter per month, while Milan saw rates between €20-€25 per square meter per month, impacting the cost of clinic expansion or establishment.

Furthermore, specialized facility management, waste disposal, and sterilization services are critical for healthcare operations. While not as directly impactful as medical equipment suppliers, the stringent regulatory requirements and specialized nature of these services can grant these suppliers a degree of leverage. For example, medical waste disposal in Germany is highly regulated, with specialized companies holding significant influence due to the expertise and licensing required.

- Real Estate Costs: Fluctuations in commercial property prices in key European cities directly affect Clinica Baviera's operational costs and expansion plans.

- Specialized Services: The necessity of regulated waste disposal and sterilization services means suppliers in these niches can exert considerable influence.

- Regulatory Compliance: Adherence to strict healthcare facility standards in Spain, Germany, and Italy empowers suppliers who can meet these demands.

Suppliers of specialized ophthalmic equipment, like advanced lasers and diagnostic machines, hold significant power due to the high cost and limited availability of such technology. Clinica Baviera's reliance on these sophisticated tools for critical procedures means supplier reliability is paramount, directly impacting service quality and operational continuity.

The bargaining power of suppliers for Clinica Baviera is considerable, particularly for specialized medical equipment and patented consumables. For example, in 2024, the cost of advanced femtosecond lasers used in eye surgery could range from €200,000 to €500,000, with limited manufacturers controlling the market. Similarly, proprietary intraocular lenses for complex cataract surgeries often come from a few key suppliers, giving them pricing leverage.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Clinica Baviera |

|---|---|---|

| Specialized Ophthalmic Equipment | High cost, unique technology, few alternative manufacturers | Increased reliance, potential for higher equipment procurement costs |

| Critical Consumables (e.g., IOLs) | Patented products, distinct clinical benefits, limited suppliers | Higher material costs for procedures, potential impact on profit margins |

| Technology & Software Vendors | High switching costs, market consolidation, critical for operations | Vendor lock-in, potential for increased software licensing and maintenance fees |

What is included in the product

This analysis unpacks the competitive forces impacting Clinica Baviera, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the eye care sector.

Effortlessly identify and address competitive threats with a visually intuitive breakdown of industry forces, streamlining strategic planning.

Customers Bargaining Power

Patient price sensitivity is a significant factor for Clínica Baviera, particularly for elective procedures like refractive surgery. Many patients in 2024 are carefully considering costs, as these treatments are often out-of-pocket expenses, not covered by standard insurance plans. This means the perceived value of the service directly impacts their decision-making process.

Clínica Baviera needs to strategically position its pricing to remain competitive while upholding its reputation for quality care. For instance, in markets where out-of-pocket healthcare spending is high, offering transparent and competitive pricing can be a key differentiator. In 2023, the global refractive surgery market was valued at approximately USD 4.5 billion, with a significant portion driven by patient choice and affordability.

The bargaining power of customers at Clínica Baviera is significantly influenced by the availability of alternative providers. In 2024, the private ophthalmology sector saw continued growth, with numerous private clinics, hospital-based ophthalmology departments, and independent practitioners offering comparable services across Spain and other European markets where Clínica Baviera operates. This abundance of choice allows patients to readily compare pricing, service quality, and treatment success rates from various sources.

For instance, in major Spanish cities, patients can often find several well-established ophthalmology clinics within a short distance, each vying for market share. This competitive landscape directly pressures Clínica Baviera to not only offer competitive pricing but also to emphasize its unique selling propositions, such as specialized treatments, advanced technology, or superior patient care, to retain and attract customers.

The internet and social media have significantly amplified patient power by providing unprecedented access to information, reviews, and comparative data on clinics and surgeons. Prospective patients can now meticulously research their options through online forums, review sites, and comparison platforms, making informed decisions easier than ever before. For instance, a 2024 study indicated that over 75% of patients consult online reviews before selecting a healthcare provider.

This increased transparency directly translates to greater customer influence. Negative reviews or reports of poor outcomes can rapidly dissuade potential new patients, forcing clinics to prioritize patient satisfaction and quality of care. In 2023, platforms like Trustpilot and Google Reviews saw millions of healthcare-related reviews submitted, highlighting the critical role of online reputation in patient acquisition.

Low Switching Costs for Initial Consultation

The bargaining power of customers is amplified by low switching costs for initial consultations. Patients can easily compare services and prices from different eye care providers, including Clínica Baviera, before committing to a specific treatment. This freedom to "shop around" empowers them to seek the best value and quality for their initial diagnostic needs.

While switching costs do rise once a patient begins a treatment plan or undergoes a procedure, the initial ease of comparison remains a significant factor. For instance, in 2024, many online platforms allowed patients to directly compare pricing for common procedures like LASIK across multiple clinics. This transparency grants patients considerable leverage in their decision-making process.

Consequently, Clínica Baviera faces the challenge of effectively converting these initial inquiries into loyal customers. Success hinges on demonstrating superior value, patient care, and clear communication from the very first point of contact.

- Low Initial Switching Costs: Patients can readily compare prices and services for initial consultations and diagnostic tests without significant financial or time commitment.

- Patient Leverage: This ease of comparison gives patients considerable power to negotiate or choose providers based on perceived value and cost.

- Conversion Imperative: Clínica Baviera must excel at converting initial patient interest into committed clients by highlighting unique selling propositions and competitive offerings.

Patient Expectations and Outcomes

Patients seeking vision correction, like those at Clinica Baviera, often have very high expectations for both the surgical results and their overall experience. This is understandable, as these are elective procedures that can significantly change their lives.

A 2023 survey indicated that over 90% of patients undergoing elective cosmetic surgery considered the outcome and the provider's communication as key factors in their satisfaction. For Clinica Baviera, meeting these elevated patient expectations is crucial for their business. High patient satisfaction can translate directly into repeat business and valuable word-of-mouth referrals, which are often more persuasive than traditional advertising.

Conversely, failing to meet these expectations can have a detrimental effect. Negative reviews and poor online reputation can quickly deter potential new patients. For instance, a study on healthcare service quality found that a single negative online review could impact a provider's booking rates by as much as 10-15%. This highlights the significant bargaining power patients wield through their ability to influence others' decisions.

- High Expectations: Patients anticipate excellent visual outcomes and a seamless, positive clinic experience.

- Impact of Satisfaction: Positive experiences drive repeat business, referrals, and a strong online reputation.

- Consequences of Dissatisfaction: Unmet expectations can lead to lost customer loyalty and negative publicity.

- Patient Influence: Online reviews and word-of-mouth significantly impact Clinica Baviera's ability to attract new patients.

The bargaining power of customers for Clínica Baviera is substantial, driven by a competitive market and readily available information. In 2024, the abundance of alternative providers, from private clinics to hospital departments, means patients can easily compare pricing, quality, and outcomes. This transparency, amplified by online reviews and comparison platforms, empowers patients to seek the best value and exert significant influence on pricing and service standards.

| Factor | Impact on Clínica Baviera | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High | Continued growth in private ophthalmology sector across Europe. |

| Information Accessibility | High | Over 75% of patients consult online reviews before choosing a provider (2024 study). |

| Switching Costs (Initial) | Low | Easy comparison of prices for consultations and common procedures online. |

| Patient Expectations | High | Over 90% of cosmetic surgery patients prioritize outcomes and communication (2023 survey). |

Preview the Actual Deliverable

Clinica Baviera Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Clinica Baviera, presenting the exact document you will receive immediately after purchase. You're looking at the actual, professionally formatted analysis, ensuring no surprises or placeholders, ready for your strategic decision-making. What you see here is the complete, ready-to-use file, providing an in-depth examination of competitive forces within the ophthalmology sector.

Rivalry Among Competitors

The ophthalmology market in Spain, Germany, and Italy is characterized by a broad spectrum of competitors, ranging from large private clinic chains to smaller, independent practices and even hospital-affiliated departments. This rich diversity fuels a highly competitive environment, driving intense rivalry for patient engagement and market share.

Clínica Baviera navigates this landscape by differentiating itself not solely on pricing strategies but also by emphasizing its brand reputation, the adoption of cutting-edge technological advancements, and a consistent record of positive clinical outcomes. For instance, in 2024, the European ophthalmology market saw continued investment in advanced laser technologies, with companies like Zeiss and Alcon launching new equipment that clinics are pressured to adopt to remain competitive.

The demand for vision correction, including refractive surgery, is generally on an upward trend, driven by an aging global population and heightened patient awareness of available treatments. For instance, the global refractive surgery market was valued at approximately $10.5 billion in 2023 and is projected to reach over $17 billion by 2030, indicating a compound annual growth rate (CAGR) of around 7.2% during this period.

However, the specific growth rate for elective refractive surgery can be subject to fluctuations. In more developed markets, where penetration rates are already high, this slower growth can intensify competitive pressures. Companies then focus more on capturing existing market share rather than benefiting from broad market expansion.

Furthermore, rapid technological advancements in areas like laser vision correction and intraocular lenses continuously introduce new competitive offerings. This innovation cycle can accelerate market growth in certain segments but also creates a dynamic environment where established players must constantly adapt to stay ahead of emerging technologies and new entrants.

Clinics differentiate through specialized procedures, advanced technology, and surgeon expertise. Clínica Baviera's focus on refractive and cataract surgery offers specialization, but rivals may offer similar or broader service portfolios.

For instance, in 2024, competitor Grand Vision reported a 5% year-over-year increase in revenue from its specialized eye care services, highlighting the market's demand for niche offerings. Continuous investment in new techniques and patient experience is vital for Clínica Baviera to maintain its competitive edge against such specialized players.

Pricing Strategies and Promotions

Competitive rivalry in the eye care sector is intense, with rivals frequently employing aggressive pricing tactics, bundled service packages, and promotional offers to draw in patients, particularly for widespread procedures like LASIK surgery. For instance, in 2024, several European competitors were observed offering LASIK packages starting from €1,500, a significant reduction from previous years' averages. This competitive pricing landscape can exert considerable pressure on Clínica Baviera’s profit margins, especially if the company feels compelled to match or even undercut these aggressive price points to remain competitive.

Maintaining a premium pricing strategy, as Clínica Baviera often aims for, necessitates cultivating robust brand loyalty and clearly demonstrating a superior perceived value proposition to patients. Without this, customers may opt for lower-cost alternatives, impacting market share. The company's ability to differentiate itself through service quality, advanced technology, or specialized treatments becomes crucial in justifying higher prices in 2024 and beyond.

- Aggressive Pricing: Competitors commonly use price reductions and package deals to attract patients.

- Promotional Campaigns: Marketing efforts often focus on discounts for common procedures like LASIK.

- Margin Pressure: Price matching or undercutting can directly impact Clínica Baviera's profitability.

- Value Proposition: Premium pricing relies on strong brand perception and demonstrable superior service or outcomes.

Geographic Concentration and Accessibility

Competitive rivalry within the ophthalmology sector, particularly for providers like Clínica Baviera, is often intensely localized. This means that while a large network offers broad reach, the real battle for patients frequently plays out within specific cities or even neighborhoods. For instance, in major metropolitan areas, multiple eye clinics might be clustered together, all vying for the same patient pool.

Clínica Baviera's significant geographic footprint, with numerous locations across Spain and other European countries, offers a distinct advantage in terms of accessibility. However, this doesn't eliminate the threat of direct competition. In 2024, the Spanish healthcare market continued to see a mix of large private groups and smaller, independent clinics operating in close proximity, especially in urban centers. This localized competition means that factors beyond just the number of clinics become crucial.

- Localized Competition: In 2024, urban areas often featured a high density of eye care providers, intensifying rivalry for patients.

- Geographic Advantage: Clínica Baviera's extensive network provides broad accessibility, a key differentiator.

- Accessibility Factors: Convenience, such as easy-to-reach locations and ample parking, became significant competitive elements influencing patient choice.

Competitive rivalry in ophthalmology is fierce, with Clínica Baviera facing numerous competitors, from large chains to independent practices. This intense competition is driven by a growing demand for vision correction services, with the global refractive surgery market projected to exceed $17 billion by 2030. Clinics differentiate through technology, specialization, and patient experience, leading to aggressive pricing strategies, particularly for common procedures like LASIK, where package deals starting around €1,500 were observed in 2024.

Clínica Baviera's broad network offers accessibility, but localized competition in urban centers means proximity and convenience are critical. To maintain its market position, the company must leverage its brand reputation and technological advancements to justify premium pricing against competitors who frequently employ promotional campaigns and bundled offers.

| Key Competitive Factors | 2024 Observations | Impact on Clínica Baviera |

|---|---|---|

| Price Competition | Aggressive pricing, LASIK packages from €1,500 | Potential margin pressure, need for value justification |

| Service Differentiation | Specialized procedures, advanced technology | Necessity to highlight unique offerings and outcomes |

| Market Penetration | High in developed markets | Focus on market share capture and patient retention |

| Brand Reputation | Crucial for premium pricing | Requires consistent positive clinical outcomes and patient experience |

SSubstitutes Threaten

The primary substitutes for surgical vision correction, such as those offered by Clinica Baviera, remain traditional eyeglasses and contact lenses. These options are generally less invasive and have a lower initial cost, making them accessible to a broad consumer base. For instance, the global eyeglasses market was valued at approximately $140 billion in 2023 and is projected to grow steadily.

For certain eye conditions, non-surgical management through medications, lifestyle adjustments, or therapeutic interventions can serve as a viable alternative to surgical procedures. This presents a significant threat as patients may choose these less invasive options, impacting Clínica Baviera's surgical revenue. For example, advancements in pharmaceutical treatments for conditions like glaucoma or dry eye syndrome offer effective management without surgery, potentially diverting patients who might otherwise seek surgical correction.

Emerging non-surgical or minimally invasive technologies for vision correction and eye disease treatment represent a significant future threat of substitutes for Clínica Baviera. For instance, advancements in refractive lens exchange or implantable contact lenses could offer alternatives to traditional LASIK or cataract surgery. The global ophthalmology market, valued at approximately $25 billion in 2023, is expected to see substantial growth in these less invasive segments.

Breakthroughs in pharmaceuticals, particularly gene therapy and novel drug delivery systems for conditions like macular degeneration, could also reduce the need for surgical interventions. The gene therapy market alone is projected to reach over $10 billion by 2025, indicating a rapid pace of innovation. Clínica Baviera needs to actively track these developments, as they could fundamentally alter patient choices and demand for their current surgical services.

To effectively mitigate this substitution threat, Clínica Baviera must remain agile and consider integrating these emerging technologies into their service offerings. This proactive approach, perhaps through strategic partnerships or internal R&D, will be crucial for maintaining market share and relevance in the evolving landscape of eye care. The company's 2023 revenue of €188 million highlights its current market position, but future success hinges on adapting to these technological shifts.

Public Healthcare Provision

The presence of robust public healthcare systems, particularly in countries like Spain and Germany, presents a significant threat of substitutes for private eye care providers such as Clinica Baviera. These public systems often cover essential procedures like cataract surgery, making them a cost-effective alternative for a segment of the population. For instance, in 2024, national health services in many European countries continued to be the primary provider for age-related eye conditions, diverting patients who might otherwise seek private care for these specific treatments.

While elective procedures like refractive surgery are less frequently subsidized, the public healthcare sector's coverage of basic eye care still influences patient decision-making and overall market dynamics. Patients prioritizing affordability over immediate appointment availability or specific advanced technologies may opt for public services, thereby reducing the potential customer base for private clinics. This can particularly impact the volume of patients seeking treatment for conditions that have both public and private provision options.

- Public healthcare systems in Spain and Germany offer cataract surgery as a substitute for private clinics.

- Cost-conscious patients may opt for public healthcare due to lower out-of-pocket expenses.

- The public system's coverage of essential eye treatments influences patient flow for other services.

- Elective refractive surgery is less commonly covered by public healthcare, but the overall public provision impacts market choice.

Preventative Eye Care and Health Awareness

The increasing public awareness regarding eye health, bolstered by advancements in preventative care and early diagnosis, presents a potential threat to surgical providers like Clinica Baviera. As people become more proactive about their vision, the incidence and severity of certain eye conditions that might otherwise necessitate surgery could decrease. For instance, improved management of conditions like diabetic retinopathy through regular screenings and lifestyle changes can delay or prevent the need for laser surgery or vitrectomy.

This long-term trend towards a healthier population, particularly concerning chronic diseases affecting vision, could gradually reduce the overall demand for some surgical interventions. By 2024, global spending on eye care was projected to reach over $100 billion, with a significant portion attributed to surgical procedures. However, a sustained focus on prevention could temper the growth rate of this surgical segment over time, impacting market size for providers reliant on these procedures.

- Increased Public Awareness: Growing understanding of eye health leads to more proactive management of conditions.

- Preventative Care Advancements: Innovations in diagnostics and treatments for conditions like glaucoma and macular degeneration reduce surgical necessity.

- Early Diagnosis Impact: Earlier detection allows for non-surgical interventions, potentially delaying or eliminating the need for surgery.

- Long-Term Demand Shift: A healthier population may lead to a reduced overall demand for certain types of eye surgeries.

Traditional eyeglasses and contact lenses remain significant substitutes for surgical vision correction offered by Clinica Baviera. These alternatives are often more affordable upfront and less invasive, appealing to a broad range of consumers. For example, the global eyeglasses market was valued at approximately $140 billion in 2023, demonstrating its substantial presence.

Non-surgical treatments for eye conditions, including pharmaceuticals and lifestyle changes, also pose a threat. Patients might opt for these less invasive methods, impacting Clinica Baviera's surgical revenue streams. Advancements in drug therapies for conditions like glaucoma offer effective management without surgery, potentially diverting patients.

Emerging technologies like implantable contact lenses and less invasive refractive procedures represent future substitution threats. The ophthalmology market, valued at around $25 billion in 2023, is seeing growth in these less invasive segments, which could alter patient choices away from traditional surgeries.

| Substitute Type | Market Value (2023 Est.) | Key Characteristic | Impact on Clinica Baviera |

|---|---|---|---|

| Eyeglasses & Contact Lenses | $140 Billion (Eyeglasses) | Lower initial cost, less invasive | Reduces demand for elective refractive surgery |

| Non-Surgical Treatments | N/A (Specific to condition) | Pharmaceuticals, lifestyle changes | Diverts patients from surgical interventions for manageable conditions |

| Emerging Technologies | $25 Billion (Ophthalmology Market) | Minimally invasive, novel approaches | Potential to replace traditional surgical methods |

Entrants Threaten

Establishing a state-of-the-art ophthalmology clinic, particularly one geared towards advanced procedures like refractive and cataract surgery, demands a considerable financial outlay. This includes investing in cutting-edge lasers, sophisticated diagnostic tools, and the necessary clinic facilities. For instance, a femtosecond laser system, crucial for LASIK surgery, can cost upwards of $300,000 to $500,000, with ongoing maintenance contracts adding to the expense. This substantial barrier to entry significantly deters new players from easily entering the market.

Clínica Baviera, with its established network of clinics and significant asset base, already possesses the infrastructure and equipment needed to operate efficiently and at scale. This existing advantage allows them to spread fixed costs over a larger patient volume, creating economies of scale that new entrants would struggle to match initially. This financial muscle and operational scale provide a competitive buffer against potential new competitors.

The need for specialized medical expertise presents a substantial barrier to new entrants in the ophthalmology sector, particularly for advanced surgical services. New clinics must contend with the significant challenge of attracting and retaining highly qualified ophthalmologists, especially those with expertise in intricate procedures like refractive surgery or complex cataract operations. Building a team of reputable and experienced surgeons takes considerable time and investment, making it difficult for newcomers to compete with established players.

Clínica Baviera benefits from its long-standing reputation and established network of skilled surgeons, many of whom have extensive experience and specialized training. This deep pool of talent is not easily replicated by new entrants, who face the arduous task of recruiting and developing similar levels of proficiency. For instance, a recent report indicated that the demand for specialized ophthalmic surgeons outstripped supply in many European markets throughout 2023, further exacerbating this entry barrier.

The healthcare industry, where Clinica Baviera operates, is characterized by significant regulatory and licensing barriers. New entrants must contend with stringent requirements for medical facilities, equipment, and the qualifications of their medical staff. These hurdles are not uniform; for instance, obtaining the necessary certifications in Spain, Germany, and Italy, key markets for eye care, involves navigating distinct and often lengthy approval processes.

These compliance procedures are not merely bureaucratic; they translate into substantial costs and prolonged timelines for market entry. For example, the initial investment in meeting regulatory standards and the ongoing expenses associated with maintaining compliance can deter potential competitors. In 2024, the average time to secure all required healthcare licenses in the EU could extend over a year, with associated costs often reaching tens of thousands of euros per jurisdiction, significantly raising the barrier to entry for smaller or less capitalized firms.

Brand Reputation and Patient Trust

In the healthcare sector, particularly for specialized clinics like Clínica Baviera, brand reputation and patient trust are incredibly high barriers to entry. Years of successful treatments and consistent patient care have cultivated a loyal customer base that is hesitant to switch providers. For instance, in 2024, the healthcare industry continued to see patients prioritizing established reputations, with a significant portion of new patient acquisition for established providers stemming from referrals, a direct indicator of trust.

New entrants face a substantial challenge in replicating this deep-seated trust. They often need to invest heavily in marketing and demonstrate a proven track record over time to even begin to compete with the established credibility of a brand like Clínica Baviera. This lengthy process of building patient confidence means that the threat of new entrants, while present, is significantly mitigated by the intrinsic value of established reputation and the patient's inherent need for reliable, trustworthy healthcare providers.

- Brand Equity: Established clinics benefit from years of positive patient experiences, translating into strong brand recognition and loyalty.

- Patient Referrals: Trust is often built through word-of-mouth, with a significant percentage of new patients in 2024 coming from trusted recommendations.

- Time to Credibility: New entrants require substantial time and investment to build a comparable level of patient trust and a solid reputation.

- Risk Aversion: Patients undergoing medical procedures, especially elective ones, tend to be risk-averse, favoring providers with a proven history of success.

Economies of Scale and Network Effects

Large clinic groups, such as Clínica Baviera, achieve significant cost advantages through economies of scale. This allows them to negotiate better prices for medical equipment, supplies, and even marketing campaigns. For instance, in 2024, major healthcare providers often secured discounts of 10-15% on bulk purchases of essential medical consumables compared to smaller, independent practices.

Furthermore, network effects play a crucial role in strengthening the position of established players. Centralized administrative services, shared IT infrastructure, and the dissemination of best practices across a network of clinics enhance operational efficiency and reduce overheads for companies like Clínica Baviera. This creates a barrier for new entrants who lack the existing infrastructure and patient base to replicate these efficiencies.

Consequently, new, smaller competitors face considerable hurdles in matching the cost-effectiveness and operational agility of larger, established entities. Without the benefit of scale, they struggle to compete on price or offer the same level of service efficiency, making market entry and sustained growth more challenging.

- Economies of Scale: Bulk purchasing power leading to lower unit costs for equipment and consumables.

- Network Effects: Centralized administration and shared best practices improving overall efficiency.

- Competitive Disadvantage for New Entrants: Difficulty in matching cost structures and operational efficiencies of larger, established players.

The threat of new entrants in the ophthalmology market, particularly for specialized clinics like Clínica Baviera, is significantly dampened by substantial capital requirements. Establishing a state-of-the-art facility with advanced surgical equipment, such as a femtosecond laser system which can cost upwards of $300,000 to $500,000, demands considerable upfront investment. This high initial cost, coupled with ongoing maintenance, creates a formidable financial barrier for potential newcomers.

Furthermore, the need for highly specialized medical expertise is a critical deterrent. Attracting and retaining experienced ophthalmologists, especially those skilled in complex procedures, is a time-consuming and costly endeavor. In 2023, the demand for such specialists often outpaced supply in key European markets, making it difficult for new clinics to build a competitive team.

| Barrier Type | Description | Estimated Cost/Time (Illustrative) |

|---|---|---|

| Capital Requirements | Investment in advanced medical equipment and clinic facilities | Femtosecond Laser: $300,000 - $500,000+ |

| Specialized Expertise | Recruitment and retention of qualified ophthalmologists | Time to build a reputable team: Years; Market trend: High demand, limited supply (2023) |

| Regulatory Compliance | Navigating licensing and certification processes | Time to secure licenses: 1+ year (EU, 2024); Costs: Tens of thousands of euros per jurisdiction |

| Brand Reputation & Trust | Building patient confidence and loyalty | Time to establish credibility: Significant investment in marketing and consistent care |

| Economies of Scale | Cost advantages from large-scale operations | Bulk purchasing discounts: 10-15% on consumables (2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Clinica Baviera is built upon a foundation of comprehensive data, including public financial statements, industry-specific market research reports, and competitor announcements.

We also leverage insights from regulatory filings and expert commentary from healthcare industry analysts to provide a robust understanding of the competitive landscape.