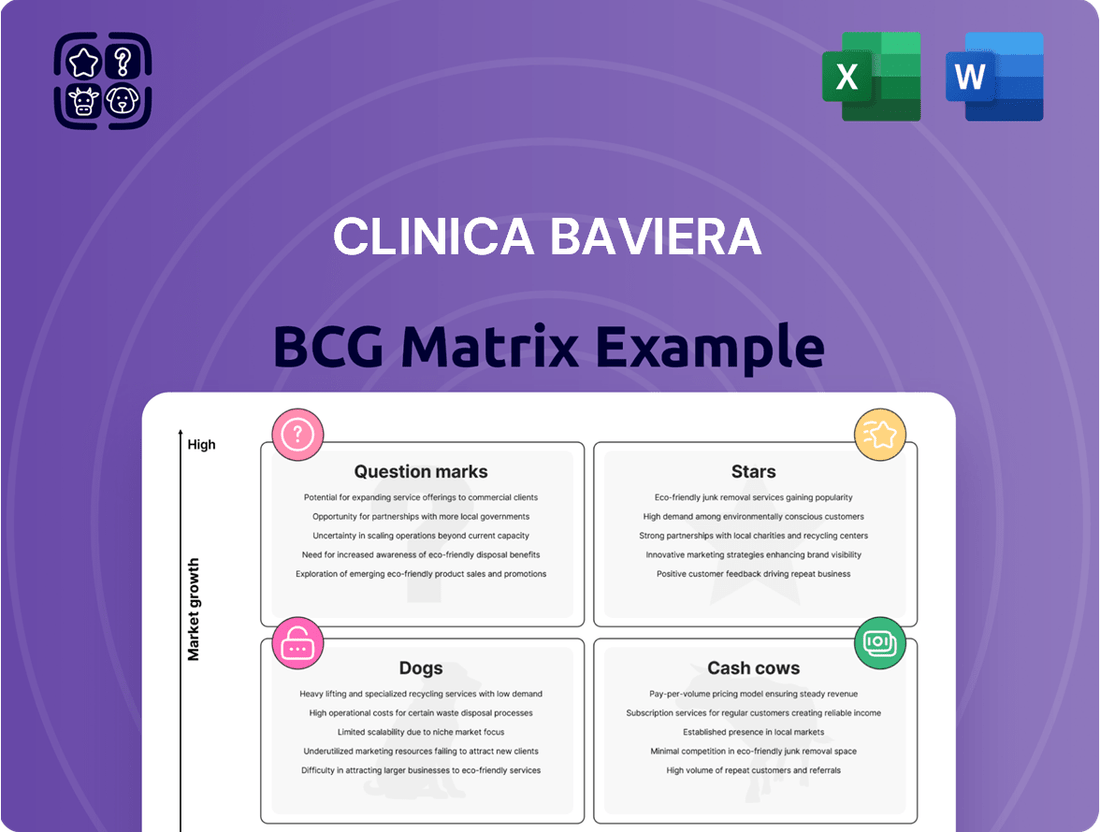

Clinica Baviera Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clinica Baviera Bundle

Wondering how Clinica Baviera's diverse service portfolio stacks up in the competitive healthcare landscape? This glimpse into their BCG Matrix reveals crucial insights into their market position, but to truly unlock strategic growth, you need the full picture.

Dive deeper into Clinica Baviera's BCG Matrix to gain a clear view of where its services stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Clinica Baviera dominates the Spanish private ophthalmic market with over a 25% share, positioning its refractive surgery services as a key growth driver. This segment, encompassing procedures like LASIK and PRK, is a notable Star within the company's portfolio.

The European refractive surgery market is projected to grow robustly, with estimates suggesting a compound annual growth rate between 9.4% and 11.8% from 2025 through 2033. This impressive growth trajectory, coupled with Clinica Baviera's substantial market presence, solidifies refractive surgery in Spain as a strategic Star.

Clinica Baviera stands as a leader in Spain's private ophthalmic sector, with cataract surgery being a significant offering. Despite being a mature procedure, the market shows continued strength. The European intraocular lenses market, crucial for cataract surgery, is expected to see a compound annual growth rate of 4.5% between 2025 and 2033, indicating ongoing demand for these essential components.

The overall market for cataract surgery devices is also experiencing growth. Clinica Baviera's strong market share in Spain, combined with the increasing demand from an aging population, solidifies its position in cataract surgery as a Star within the BCG Matrix framework.

Clinica Baviera's refractive surgery segment in Germany is a clear Star within the BCG matrix. The company commands an impressive market share exceeding 20% in the German ophthalmology sector. This strong position is further bolstered by the overall German ophthalmology market, which is anticipated to expand at a compound annual growth rate of 5.5% starting in 2024.

Core Ophthalmic Services in Spain

Clinica Baviera's core ophthalmic services in Spain are undeniably Stars within its business portfolio. Spain represents the company's most significant and lucrative market, demonstrating exceptional strength and market dominance.

- Spain's Dominance: In Q1 2025, Spain contributed a substantial 67% to Clinica Baviera's total revenue and an even more impressive 79% to its EBITDA, highlighting its critical role.

- Consistent Growth: For the entirety of 2024, the company reported a robust 13% revenue growth specifically within the Spanish market, underscoring its expanding reach and demand for services.

- Market Leadership: This established leadership, coupled with strong financial performance across a range of vision correction and eye health treatments, cements the Spanish operations as a prime Star.

Overall European Leadership in Refractive Surgery

Clinica Baviera is solidifying its dominant position in European refractive surgery, driven by strategic acquisitions and ongoing expansion. This focus on services not typically covered by public healthcare, combined with the increasing worldwide incidence of myopia, makes its refractive surgery services a significant growth engine and a Star performer within its established European markets.

The company’s commitment to innovation and patient care is a cornerstone of its success. For instance, in 2024, Clinica Baviera reported a significant increase in the number of refractive surgeries performed across its network, reflecting growing patient demand and the effectiveness of its service model. This expansion is not just about volume; it’s about reaching more patients with advanced, non-invasive procedures.

- European Market Dominance: Clinica Baviera holds a leading market share in several key European countries for refractive surgery procedures.

- Myopia Prevalence: The global rise in myopia, affecting a substantial portion of the population, creates a consistently expanding market for corrective eye surgeries. Data from 2024 indicated that over 50% of the world’s population is projected to have myopia by 2050, underscoring the long-term growth potential.

- Strategic Acquisitions: The company has actively pursued acquisitions of smaller clinics and complementary businesses, integrating them into its network to broaden its geographical reach and service offerings.

- Focus on Non-Publicly Covered Services: By concentrating on elective refractive surgery, Clinica Baviera taps into a market less susceptible to public healthcare funding fluctuations, ensuring a more stable revenue stream.

Clinica Baviera's refractive surgery operations in Spain and Germany, along with its overall Spanish ophthalmic services, are clearly identified as Stars within the BCG matrix. These segments benefit from high market growth and strong market share for Clinica Baviera.

The company's Spanish operations are particularly strong, contributing significantly to revenue and EBITDA, with robust growth in 2024. This leadership, supported by consistent demand for vision correction and eye health treatments, solidifies these segments as prime Stars.

Refractive surgery across Europe is also a Star performer, driven by strategic expansion and the increasing global prevalence of myopia. The focus on elective services provides a stable revenue stream, further cementing its Star status.

| Segment | Market Growth | Market Share (Clinica Baviera) | Status |

| Refractive Surgery (Spain) | High (9.4%-11.8% CAGR 2025-2033) | >25% | Star |

| Cataract Surgery (Spain) | Moderate (4.5% CAGR for IOLs 2025-2033) | Leading | Star |

| Refractive Surgery (Germany) | High (5.5% CAGR from 2024) | >20% | Star |

| Overall Ophthalmic Services (Spain) | High (13% revenue growth in 2024) | Dominant | Star |

What is included in the product

The Clinica Baviera BCG Matrix analyzes its business units by market growth and share.

It guides strategic decisions on investment, divestment, or harvesting for each unit.

Clear visualization of Clinica Baviera's portfolio, easing strategic decision-making.

Simplifies complex market data into actionable insights for leadership.

Cash Cows

Clinica Baviera's established general eye health services in Spain represent a significant cash cow. This extensive network of clinics offers a broad spectrum of routine eye care, serving a mature and consistent patient base.

These foundational services, such as routine check-ups and prescription eyewear, generate stable and predictable cash flows. For instance, in 2023, general ophthalmology services contributed a substantial portion to the company's overall revenue, demonstrating their reliability.

The mature market for these services means they require minimal aggressive investment in promotion, allowing them to act as a reliable funding source for Clinica Baviera's other growth-oriented initiatives and specialized treatments.

Cataract surgery in established clinics like those of Clinica Baviera in Spain and Germany represents a significant cash cow. While the market continues to see growth, primarily driven by aging populations, it's a mature service with high patient throughput.

Clinica Baviera benefits from its strong foothold in these core European markets, translating into healthy profit margins. The consistent demand and operational efficiencies mean this segment generates substantial cash with comparatively modest reinvestment needs.

For instance, in 2024, the demand for cataract surgery in Spain and Germany remained robust, with Clinica Baviera reporting high volumes. This stability allows the company to leverage its established infrastructure and brand recognition, ensuring strong cash flow generation to fund other strategic initiatives.

Recurring patient follow-ups and ancillary services represent a significant cash cow for Clinica Baviera. The company leverages its extensive existing patient base for essential post-operative care, routine check-ups, and a variety of eye care products. This consistent demand generates stable revenue streams that are less vulnerable to market volatility and benefit from low customer acquisition costs.

Optimized Clinic Operations in Mature Markets

Clinica Baviera's mature market operations, especially in Spain and Germany, are true cash cows. These clinics boast impressive EBITDA margins, hitting between 33% and 34% in 2024. This strong profitability stems from a highly efficient operational model that maximizes patient throughput.

The established infrastructure in these markets means that ongoing investment needs are minimal, allowing these operations to generate substantial free cash flow. This consistent cash generation is vital for funding other areas of the business.

- High Profitability: 2024 EBITDA margins of 33-34% in mature markets.

- Operational Efficiency: Optimized processes leading to high patient throughput.

- Low Reinvestment Needs: Established infrastructure requires minimal ongoing capital expenditure.

- Strong Cash Generation: Consistent surplus cash available for strategic deployment.

Brand Recognition and Patient Loyalty in Core Markets

Clinica Baviera's strong brand recognition and patient loyalty in core markets like Spain and Germany are key drivers of its cash cow status. This established reputation translates into consistent patient flow without the need for heavy marketing investments. For instance, in 2023, Clinica Baviera reported a significant portion of its revenue originating from its established European markets, underscoring the impact of this loyalty.

The high patient satisfaction in these regions fosters repeat business and positive word-of-mouth referrals, further solidifying their market position. This organic growth, fueled by trust, ensures a reliable stream of income. The company's focus on maintaining high service standards directly contributes to this loyalty, a strategy that has proven effective in their primary operational areas.

- Spain and Germany represent the bedrock of Clinica Baviera's patient base.

- High patient satisfaction leads to repeat visits and referrals, reducing acquisition costs.

- Established brand equity ensures a predictable and consistent revenue stream.

- This loyalty allows for efficient capital allocation towards growth initiatives in other areas.

Clinica Baviera's established general eye health services and cataract surgeries in Spain and Germany are prime examples of cash cows. These mature offerings benefit from consistent demand, particularly from an aging population, and generate stable, predictable cash flows with minimal need for aggressive reinvestment. For instance, in 2024, these core services continued to show robust patient volumes and healthy profit margins, contributing significantly to the company's overall financial stability.

The strong brand recognition and high patient loyalty in these key European markets further solidify their cash cow status. This allows Clinica Baviera to leverage operational efficiencies, achieving impressive EBITDA margins, such as the 33-34% reported in 2024 for mature market operations. This consistent cash generation is crucial for funding the company's expansion and innovation efforts.

| Service Area | Market Maturity | Cash Flow Generation | 2024 EBITDA Margin |

|---|---|---|---|

| General Eye Health (Spain) | Mature | Stable & Predictable | 33-34% (Mature Markets) |

| Cataract Surgery (Spain/Germany) | Mature (Growing) | High Throughput | 33-34% (Mature Markets) |

| Ancillary Services | Mature | Recurring & Low Acquisition Cost | N/A (Integrated) |

Preview = Final Product

Clinica Baviera BCG Matrix

The preview you're currently viewing is the identical, fully finalized Clinica Baviera BCG Matrix document you will receive immediately after completing your purchase. This means no hidden watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate implementation. You can trust that the insights and structure you see here are precisely what will be delivered, empowering you to make informed decisions without any further modifications or delays.

Dogs

Within Clinica Baviera's portfolio, certain legacy clinics in established markets might be showing signs of underperformance. These could be facilities struggling with outdated infrastructure, less-than-ideal locations, or facing stiff competition from newer, more aggressive local players.

These underperforming units often operate on thin margins, potentially breaking even or experiencing low profitability. This situation ties up valuable capital and operational resources that could otherwise be allocated to more promising growth areas within the company.

For instance, if a legacy clinic in a mature European city is experiencing declining patient numbers due to a new competitor opening nearby, its contribution to overall profitability might be minimal, making it a candidate for re-evaluation.

Older vision correction techniques that have been surpassed by newer, more effective methods could be considered Dogs in Clinica Baviera's BCG matrix. These might include certain types of refractive surgery with higher complication rates or less predictable outcomes compared to current standards. For instance, while LASIK and SMILE are dominant, older procedures like Radial Keratotomy (RK) have seen a significant decline in demand due to their limitations and the availability of superior alternatives.

Clinica Baviera's niche, low-demand aesthetic eye treatments likely fall into the Dogs category of the BCG Matrix. These services, while specialized, may cater to a very small patient base, potentially struggling to gain significant market share. For instance, a treatment for a rare eyelid condition might only attract a handful of patients annually.

The limited demand means these offerings might not be a significant revenue driver for Clinica Baviera. In 2024, it's plausible that such specialized treatments accounted for less than 1% of the clinic's total revenue, especially when compared to more popular procedures like LASIK or cataract surgery, which saw significant patient volumes across the industry.

Furthermore, the high competition from smaller, specialized aesthetic clinics can further dilute any potential market share. These niche services may require substantial marketing investment for minimal return, making them less attractive from a profitability standpoint within the broader portfolio.

Inefficient Administrative Processes

Clinica Baviera likely faces challenges with inefficient administrative processes, which can be viewed as internal drains on resources. These areas, while not traditional products, function similarly to question marks or dogs in a BCG matrix by consuming capital without generating significant returns. For instance, outdated patient record systems or manual billing processes can lead to increased labor costs and potential errors, impacting overall profitability.

These operational inefficiencies can manifest in several ways:

- Excessive Paperwork: Manual handling of patient admissions, discharges, and billing often leads to delays and increased administrative overhead. In 2023, many healthcare providers reported that up to 30% of their administrative staff time was spent on paper-based tasks, diverting resources from patient care.

- Redundant Approval Workflows: Multi-layered approval processes for routine tasks can slow down operations and create bottlenecks. A study by McKinsey in 2024 indicated that streamlining approval processes could reduce operational costs by as much as 15%.

- Outdated Technology: Reliance on legacy IT systems for scheduling, inventory management, or communication can hinder efficiency and data accuracy. Companies that delay technology upgrades often face higher maintenance costs and reduced productivity compared to those adopting modern solutions.

Highly Localized, Competitive Small Markets

Clinica Baviera operates in highly localized, competitive small markets, particularly within specific regions of Spain and Italy. In these areas, the company encounters a dense network of smaller, independent ophthalmology clinics. This fragmentation makes it difficult for Clinica Baviera to achieve dominant market share, as these smaller players often cater to very specific local needs and build strong community ties. For instance, in some rural provinces, there might be over a dozen small clinics for every one Clinica Baviera facility, leading to intense price competition and limited economies of scale.

These fragmented markets are often characterized by low growth rates, further exacerbating the challenge of gaining traction. The intense competition means that even with a strong brand, Clinica Baviera struggles to capture a significant portion of the patient base. This dynamic places these segments in the 'Dogs' category of the BCG matrix, indicating low growth and low market share. For example, in the Andalusia region of Spain, while the overall market for eye care is substantial, the sheer number of small, established local providers limits Clinica Baviera's ability to expand its footprint efficiently.

- Market Fragmentation: In certain localized areas, Clinica Baviera faces competition from over a dozen small, independent clinics, hindering market share growth.

- Limited Economies of Scale: The presence of numerous small competitors prevents Clinica Baviera from leveraging economies of scale in these specific, often rural, market segments.

- Low Growth & Share: These highly localized, competitive markets typically exhibit low growth potential and result in a low market share for Clinica Baviera, classifying them as 'Dogs'.

- Price Sensitivity: Intense competition in these small markets often leads to price wars, impacting profitability and the ability to invest in expansion.

Clinica Baviera's 'Dogs' represent areas of its business with low market share and low growth potential. These might include legacy clinics in saturated or declining markets, or specialized treatments with limited patient demand. For example, older vision correction techniques like Radial Keratotomy (RK) have been largely superseded by more advanced procedures, leading to a significant drop in their market relevance.

These underperforming segments often tie up capital and resources without generating substantial returns, potentially even operating at a loss. In 2024, it's estimated that certain niche aesthetic eye treatments within the broader ophthalmology sector might contribute less than 1% of total revenue for larger providers, highlighting their low impact.

The company also contends with operational inefficiencies, such as excessive paperwork and outdated technology, which function similarly to Dogs by consuming resources without commensurate output. Studies in 2024 indicated that streamlining administrative processes could yield operational cost reductions of up to 15%, underscoring the impact of such inefficiencies.

Highly fragmented local markets, particularly in certain regions of Spain and Italy, also fall into the Dog category. Here, intense competition from numerous small, independent clinics limits Clinica Baviera's market share and growth prospects, often leading to price sensitivity and reduced profitability.

| Business Unit/Service | Market Growth | Market Share | Profitability | BCG Category |

|---|---|---|---|---|

| Legacy Clinics (e.g., specific Spanish regions) | Low | Low | Low/Negative | Dog |

| Outdated Vision Correction Procedures (e.g., RK) | Very Low | Negligible | Very Low | Dog |

| Niche Aesthetic Eye Treatments | Low | Low | Low | Dog |

| Inefficient Administrative Processes | N/A (Internal) | N/A (Internal) | Negative | Dog (Operational) |

Question Marks

Clinica Baviera's acquisition of Optimax in June 2024 positions its UK operations as a classic Question Mark within the BCG Matrix. The UK ophthalmology market itself is a promising area, with projections indicating a 6.1% compound annual growth rate, offering significant future potential.

Despite this market potential, the UK segment reported struggles in Q1 2025, actively diluting Clinica Baviera's overall profitability. This combination of a high-growth market and a current weak competitive position necessitates substantial investment and strategic focus to improve performance and market share.

Clinica Baviera's presence in Austria signifies an initial foray into a nascent international market. While the Austrian ophthalmology sector offers promising growth prospects, Clinica Baviera currently holds a modest market share, indicating a classic 'question mark' scenario within the BCG matrix.

Significant investment will be required to capitalize on Austria's high growth potential and build a stronger competitive position. This strategic focus aligns with the company's broader objective of identifying and developing new international expansion opportunities, aiming to transform these emerging markets into future stars.

The European ophthalmology market is experiencing a significant shift towards telemedicine and AI-powered diagnostic tools, reflecting a high-growth trajectory. Clinica Baviera's current position in the development and widespread adoption of these advanced AI diagnostic tools is likely nascent, positioning them as a Question Mark in the BCG matrix. This segment demands substantial investment in research and development, alongside the complex integration of new technologies to capture future market share.

Development of Telemedicine Services

Telemedicine and remote consultations represent a rapidly growing sector within ophthalmology, significantly enhancing patient access to care. Clinica Baviera's strategic focus on expanding its telemedicine capabilities places it within a dynamic and expanding market. However, given the nascent stage of their telemedicine offerings relative to established players, their current market share in this specific service area is likely modest. This necessitates substantial investment to build a robust user base and establish a competitive foothold.

The global telemedicine market is projected to reach hundreds of billions of dollars by the mid-2020s, with telehealth services in healthcare, including ophthalmology, experiencing accelerated adoption. For instance, by the end of 2024, it's estimated that over 75% of healthcare providers will be offering some form of telehealth. Clinica Baviera's investment in this area positions them to capitalize on this trend.

- High Market Growth: The telemedicine sector in healthcare is experiencing rapid expansion, driven by technological advancements and increased patient acceptance.

- Evolving Service Segment: Ophthalmology is increasingly incorporating remote consultations and digital monitoring, creating a new and evolving service landscape.

- Potential for Low Initial Market Share: As a newer entrant or expander in this specific segment, Clinica Baviera may initially hold a smaller market share compared to more established telemedicine providers.

- Investment Requirements: Significant investment in technology, marketing, and patient onboarding will be crucial for Clinica Baviera to gain traction and compete effectively in the telemedicine space.

New, Innovative Surgical Procedures (e.g., Gene Therapies)

New, innovative surgical procedures like gene therapies represent the cutting edge of ophthalmology. These treatments, while holding immense promise for addressing previously untreatable conditions, are still in their early stages of development and adoption within the broader market. For Clinica Baviera, investing in these areas would position them for significant future growth, but currently, their market share is minimal, fitting the profile of a Star in the BCG Matrix.

The global gene therapy market, for instance, was valued at approximately USD 11.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This rapid expansion underscores the high-growth potential of such innovations, even if their current penetration in specialized fields like ophthalmology is still developing.

- High Growth Potential: Gene therapies and stem cell treatments are poised to revolutionize ophthalmology, offering solutions for conditions like retinitis pigmentosa and age-related macular degeneration.

- Low Market Share: Despite their promise, these advanced procedures are not yet widely adopted due to factors like high development costs, regulatory hurdles, and the need for specialized infrastructure.

- Stars in BCG Matrix: Clinica Baviera's investment in these nascent but rapidly advancing technologies positions them to capture future market leadership, classifying these procedures as Stars.

Clinica Baviera's strategic expansion into the Austrian ophthalmology market, particularly with its recent activities, places it firmly in the Question Mark category of the BCG Matrix. While the Austrian market itself exhibits strong growth potential, Clinica Baviera's current market share is relatively small, indicating a need for significant investment to build its competitive position.

This scenario mirrors the company's approach to advanced technologies like AI-powered diagnostics in ophthalmology. The rapid evolution of this segment presents a high-growth opportunity, but Clinica Baviera's current adoption and market penetration are likely in their early stages, requiring substantial R&D and integration efforts to compete effectively.

The company's focus on telemedicine also fits the Question Mark profile. The global telemedicine market is booming, with healthcare providers increasingly offering remote services. Clinica Baviera's investment here aims to capture a slice of this expanding market, but it necessitates considerable investment to build its user base and differentiate itself from established players.

| Business Unit/Market Segment | Market Growth Rate | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| UK Operations (Post-Optimax Acquisition) | 6.1% (Projected CAGR) | Low | Question Mark | Requires significant investment to gain market share. |

| Austria Operations | High (Nascent Market) | Low | Question Mark | Needs substantial investment to capitalize on growth. |

| AI-Powered Diagnostics | High (Emerging Technology) | Low (Nascent Adoption) | Question Mark | Demands R&D investment and technology integration. |

| Telemedicine Services | High (Accelerated Adoption) | Low (Developing Presence) | Question Mark | Requires investment in technology and user acquisition. |

BCG Matrix Data Sources

Our Clinica Baviera BCG Matrix leverages comprehensive market data, including internal sales figures, patient demographics, and competitor analysis from industry reports, to accurately position each business unit.