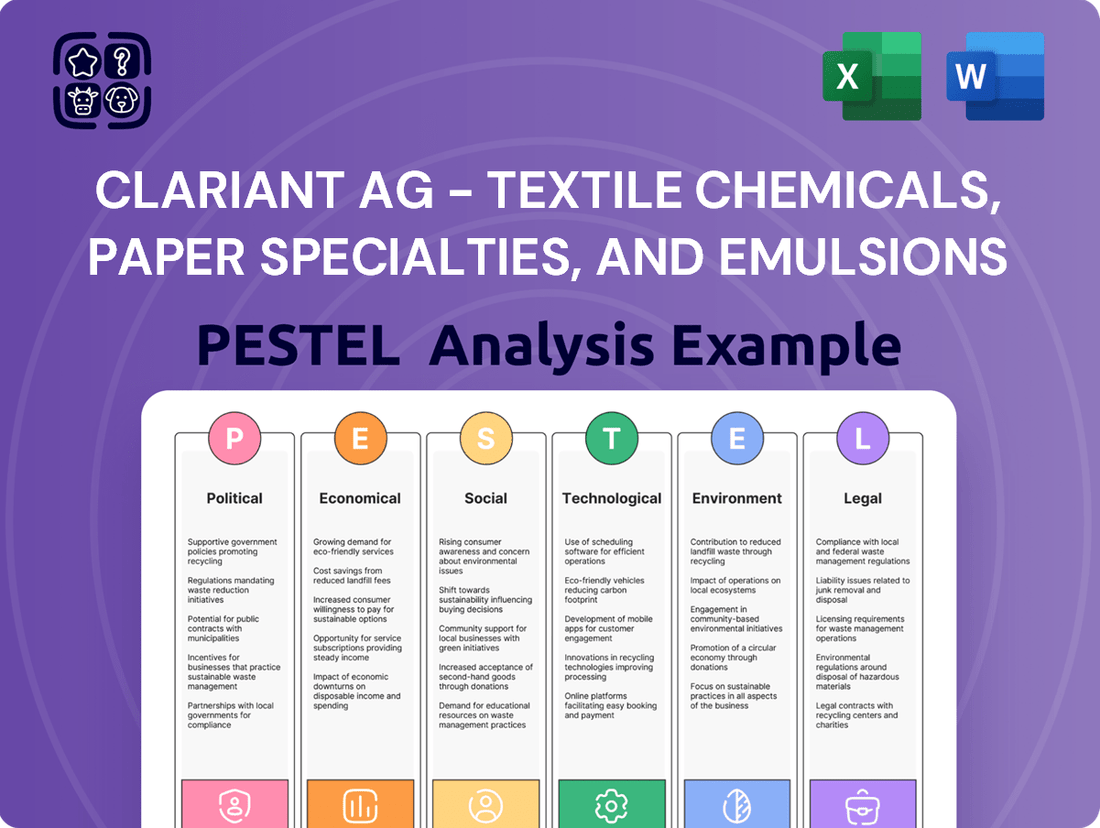

Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses Bundle

Navigate the complex external forces shaping Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses with our comprehensive PESTEL Analysis. Understand how evolving political landscapes, economic shifts, technological advancements, environmental regulations, and social trends are impacting your market. Gain a strategic advantage by unlocking actionable insights to anticipate challenges and capitalize on opportunities. Download the full version now to empower your decision-making.

Political factors

Changes in global trade policies and tariffs directly affect Clariant's textile chemicals, paper specialties, and emulsions businesses by influencing raw material sourcing costs and the competitiveness of exports. For instance, the ongoing trade disputes between major economies in 2024 continue to create uncertainty, potentially increasing duties on key chemical inputs and finished products, impacting profit margins.

Geopolitical tensions, such as those observed in Eastern Europe and Asia throughout 2024, can lead to significant supply chain disruptions. This might force Clariant to seek alternative, potentially more expensive, suppliers for critical components used in its chemical formulations, thereby raising operational costs and affecting pricing strategies for its diverse product portfolio.

Maintaining a global perspective on market access and competitive pricing is crucial for Clariant. As of early 2025, the company must navigate varying trade regulations and tariff structures across its key markets, including Europe, North America, and Asia, to ensure its textile and paper chemical offerings remain attractive and cost-effective against regional competitors.

Governments globally are tightening chemical safety regulations, impacting Clariant's textile, paper, and emulsions businesses. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, with ongoing discussions around restrictions on per- and polyfluoroalkyl substances (PFAS). By 2024, many companies are actively seeking PFAS-free alternatives to meet these stringent requirements.

Governments worldwide are increasingly prioritizing environmental sustainability, leading to a surge in political initiatives and subsidies designed to promote greener manufacturing and circular economy models. This directly impacts chemical industries like Clariant's, particularly in textile, paper, and emulsion sectors, by incentivizing investment in eco-friendly technologies. For instance, the European Union’s Green Deal, with its ambitious climate targets, is expected to drive significant demand for sustainable chemical solutions, potentially boosting Clariant's offerings in these areas.

Industrial Policy and Local Production Incentives

Governments worldwide are increasingly implementing industrial policies aimed at boosting local manufacturing and reducing import dependency. For Clariant's textile chemicals, paper specialties, and emulsions businesses, this translates into potential shifts in production site location and supply chain strategies. For instance, the European Union's Critical Raw Materials Act, aiming to secure supply chains for key industrial inputs, could influence sourcing and production decisions for specialty chemical components.

These policies often include direct incentives for domestic production, such as tax breaks, subsidies, or preferential procurement. Such measures can alter the competitive landscape for chemical suppliers, potentially favoring those with local manufacturing footprints. In 2024, several Asian nations announced significant investment packages to bolster their domestic chemical industries, a trend expected to continue through 2025, directly impacting global trade flows for these product segments.

- Incentives for Domestic Production: Policies like the US CHIPS and Science Act, while focused on semiconductors, signal a broader trend of government support for reshoring and domestic manufacturing, which can extend to chemical inputs.

- Supply Chain Diversification: Concerns over geopolitical stability and trade disruptions are driving governments to encourage local production, potentially leading to more regionalized supply chains for specialty chemicals.

- Market Competition: The introduction of local production incentives can create a more fragmented market, with new domestic players emerging and existing international suppliers needing to adapt their strategies to remain competitive.

Political Stability in Key Manufacturing Regions

Political stability in regions with significant textile, paper, and emulsion manufacturing capacities is crucial for consistent supply chains and market demand for Clariant AG. For instance, in 2024, several key Asian manufacturing hubs, including Vietnam and Bangladesh, continued to experience relative political calm, supporting their roles as major textile producers. However, ongoing geopolitical tensions in other regions could still pose risks to these vital supply networks.

Instability can lead to operational disruptions, affecting production volumes and distribution networks for chemical suppliers like Clariant. For example, political unrest in a major paper-producing nation in 2024 could have led to temporary shutdowns, impacting the availability of essential chemicals for paper manufacturing. Such disruptions can create significant volatility in raw material sourcing and finished product delivery.

Clariant's reliance on diverse manufacturing bases means that political stability across multiple geographies is paramount. In 2024, the company's exposure to European markets, which generally maintained stable political environments, provided a degree of resilience. Nevertheless, the potential for sudden policy shifts or localized instability in any of its key operational areas requires continuous monitoring and risk mitigation strategies.

- Vietnam's textile sector, a key market for Clariant's chemicals, maintained a stable political outlook in 2024, contributing to consistent production.

- Political stability in key paper-producing nations like Finland and Canada remained strong in 2024, ensuring reliable supply chains for paper chemicals.

- Geopolitical tensions in Eastern Europe in 2024 presented potential risks to supply chain continuity for chemical manufacturers serving regional industries.

Government regulations on chemical safety and environmental impact are increasingly stringent globally, directly influencing Clariant's operations. By 2024, the EU's ongoing review of PFAS substances under REACH highlights the need for proactive adaptation, pushing for safer, alternative chemical formulations in textiles and paper production.

Governments are actively promoting sustainable manufacturing and circular economy principles, creating opportunities for Clariant's eco-friendly solutions. The EU's Green Deal, for example, is a significant driver for demand in sustainable chemicals, impacting Clariant's textile, paper, and emulsion businesses through incentives for greener technologies.

Shifting industrial policies and a focus on domestic production, such as the EU's Critical Raw Materials Act, necessitate strategic adjustments in Clariant's supply chains and manufacturing footprints. These policies aim to secure critical inputs, potentially altering sourcing and production decisions for specialty chemical components through 2025.

Political stability remains a critical factor for Clariant's supply chain continuity and market access. While key markets like Vietnam and Finland showed stability in 2024, ongoing geopolitical tensions in other regions necessitate continuous risk assessment and mitigation for reliable operations.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces shaping Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions businesses, identifying key opportunities and threats.

It provides a data-driven assessment of macro-environmental influences, crucial for strategic decision-making and navigating the complex global landscape for these specific Clariant divisions.

This PESTLE analysis for Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses provides a clear, summarized version of external factors for easy referencing during strategic planning and decision-making.

It acts as a pain point reliever by offering a concise, easily digestible overview that can be dropped into PowerPoints or used in group planning sessions, fostering quick alignment across teams.

Economic factors

Fluctuations in the cost of key raw materials like petrochemicals and pulp significantly affect the profitability of Clariant's textile chemicals, paper specialties, and emulsions businesses. For instance, the price of ethylene, a key petrochemical feedstock, saw considerable swings in 2024, impacting the cost of polymers used in emulsions and textile treatments.

Managing this raw material price volatility is paramount. Companies like Clariant often employ strategies such as hedging futures contracts for key commodities or diversifying their supplier base to mitigate the impact of unpredictable input costs. This proactive approach is essential for maintaining healthy profit margins in these competitive sectors.

Global economic growth significantly impacts Clariant's textile, paper, and emulsions businesses. For instance, the International Monetary Fund projected global growth to be around 3.2% in 2024, a slight increase from 2023, signaling a generally stable demand environment. However, regional variations exist, with emerging markets often showing more robust growth than developed economies.

Industrial output, especially within key sectors like textiles and paper, is a direct driver for Clariant's specialty chemicals. In 2024, while manufacturing output showed signs of recovery in some regions, global industrial production growth was projected to be modest, around 2.5%. This moderate growth suggests a need for Clariant to focus on innovation and value-added solutions to maintain market share amidst potentially tighter customer budgets and heightened competition.

Currency exchange rate fluctuations pose a significant challenge for globally operating companies like Clariant AG, particularly in its textile chemicals, paper specialties, and emulsions segments. A strong Swiss Franc, Clariant's reporting currency, can make its products more expensive for international buyers, impacting sales volumes. For instance, in the first half of 2024, Clariant noted that adverse currency effects impacted its sales by CHF 123 million, highlighting the direct impact on revenue.

Conversely, a weaker local currency in key markets can boost export competitiveness but simultaneously increase the cost of imported raw materials, squeezing profit margins. The volatility seen in major currency pairs throughout 2024, such as the EUR/CHF or USD/CHF, directly influences the cost of goods sold and the repatriated profits from international subsidiaries.

Inflationary Pressures and Consumer Spending

Inflationary pressures are a significant concern for Clariant's textile chemicals, paper specialties, and emulsions businesses. Rising energy and raw material costs directly increase operational expenses for chemical manufacturers. For instance, the global producer price index for chemicals saw a substantial increase in 2024, impacting input costs.

This inflation can also erode consumer purchasing power, leading to reduced demand for discretionary items like apparel and printed materials. As a result, Clariant may face challenges in maintaining its pricing strategies and overall market volumes for its specialty chemical products.

- Increased Operational Costs: Higher energy and raw material prices in 2024-2025 directly inflate production expenses for chemical companies like Clariant.

- Reduced Consumer Demand: Inflationary environments can shrink disposable income, negatively affecting consumer spending on textiles and paper goods.

- Pricing Strategy Challenges: Companies may struggle to pass on increased costs without impacting sales volume, creating a delicate balancing act.

- Market Volume Pressure: A slowdown in consumer spending directly translates to lower demand for end products, impacting the volume of specialty chemicals sold.

Investment in Infrastructure and Construction

Global infrastructure spending is projected to reach $9.8 trillion by 2024, a significant increase that directly fuels demand for construction materials. This surge in infrastructure development, coupled with ongoing urbanization trends, creates a robust market for emulsions. These are essential components in paints, coatings, adhesives, and various construction products, making this a key growth driver for Clariant's Emulsions business.

The construction sector's expansion is a direct benefit to companies like Clariant. For instance, in 2024, the global construction market is expected to grow by approximately 3.1%. This growth translates into higher consumption of chemical additives and binders, including emulsions, used in everything from residential buildings to large-scale public works.

- Infrastructure spending: Global investment in infrastructure is anticipated to hit $9.8 trillion in 2024, a substantial market opportunity.

- Construction growth: The worldwide construction sector is forecast to expand by around 3.1% in 2024, increasing demand for building materials.

- Urbanization impact: Growing urban populations necessitate new housing and commercial spaces, further boosting construction activity and emulsion demand.

- Emulsion demand: These market trends directly increase the need for emulsions in paints, adhesives, sealants, and other construction applications.

The economic landscape in 2024-2025 presents both opportunities and challenges for Clariant's textile chemicals, paper specialties, and emulsions businesses. Navigating raw material price volatility, currency fluctuations, and inflationary pressures is crucial for maintaining profitability and market position.

Global economic growth, projected at 3.2% for 2024 by the IMF, provides a generally stable demand environment, though regional disparities persist. Moderate industrial production growth of around 2.5% in 2024 suggests a need for innovation and value-added solutions to capture market share amidst potentially tighter budgets.

Rising inflation, evidenced by a significant increase in the global producer price index for chemicals in 2024, directly impacts operational costs and can dampen consumer spending on discretionary items, posing pricing strategy challenges for Clariant.

Significant global infrastructure spending, expected to reach $9.8 trillion by 2024, and a 3.1% growth forecast for the construction sector in 2024, create a robust market for Clariant's emulsions, essential for paints, coatings, and adhesives.

Full Version Awaits

Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the PESTLE analysis for Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses. This comprehensive report covers all critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting these key sectors. You will gain immediate access to the complete, professionally structured analysis upon completing your purchase.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This growing demand directly influences sectors like textiles, paper, and emulsions, pushing companies to adopt greener practices and develop environmentally conscious offerings. For instance, a 2024 report indicated that over 60% of consumers globally consider sustainability a key factor in their purchasing decisions.

Shifting consumer habits, such as the surge in fast fashion and increased online shopping, directly impact the demand for textile chemicals. For instance, the global e-commerce apparel market was projected to reach over $1.2 trillion by 2025, driving a need for efficient dyeing and finishing agents.

Growing emphasis on personal hygiene and wellness also plays a role, boosting demand for specialized paper products and the chemicals used in their manufacturing. The global tissue and hygiene paper market is anticipated to exceed $300 billion by 2028, indicating a sustained need for quality-enhancing additives.

Clariant's ability to adapt its product offerings, like eco-friendly dyes and biodegradable paper coatings, to these evolving lifestyles is crucial for maintaining market relevance and capturing growth opportunities in these dynamic sectors.

The availability of skilled labor in chemical manufacturing and R&D is paramount for Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. In 2024, the chemical industry globally faced a shortage of specialized engineers and technicians, a trend expected to continue. For instance, the U.S. Bureau of Labor Statistics projected a 3% growth in chemical engineers between 2022 and 2032, but the demand often outpaces the supply of graduates with current industry-relevant skills.

Health and Safety Concerns of Chemical Exposure

Societal awareness regarding the health implications of chemical exposure significantly shapes product development and manufacturing within Clariant's textile, paper, and emulsion businesses. This heightened scrutiny demands a proactive approach to worker and consumer safety, directly impacting operational strategies and brand reputation.

Clariant's commitment to safety is crucial for maintaining public trust, especially as regulatory bodies and consumer advocacy groups increasingly scrutinize chemical usage. For instance, the European Chemicals Agency (ECHA) reported in 2024 that over 22,000 substances are registered under REACH, with ongoing assessments for potential health risks, influencing the types of chemicals permissible in consumer goods.

- Worker Safety: Implementing robust occupational health and safety protocols to minimize exposure risks for employees handling chemicals.

- Consumer Product Safety: Ensuring all finished products, from textiles to paper goods, meet stringent safety standards and are free from harmful chemical residues.

- Regulatory Compliance: Adhering to evolving global chemical regulations, such as those enforced by ECHA, which impact product formulation and market access.

- Sustainable Chemistry: Investing in research and development of safer, more environmentally friendly chemical alternatives to meet growing consumer demand for 'clean' products.

Corporate Social Responsibility (CSR) Expectations

Societal demands for Corporate Social Responsibility (CSR) are significantly shaping the textile, paper, and emulsions sectors. Companies like Clariant are increasingly pressured to demonstrate robust ethical labor practices, actively participate in community development initiatives, and maintain highly transparent supply chains. This focus on CSR is not merely about compliance; it's a strategic imperative. For instance, in 2023, Clariant reported progress on its sustainability goals, including a 30% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2020 baseline, reflecting a commitment to environmental responsibility which directly impacts stakeholder perception.

Strong CSR performance directly translates to enhanced brand reputation and improved stakeholder relations. Investors, consumers, and employees alike are scrutinizing corporate behavior more closely. A recent 2024 survey indicated that over 70% of consumers consider a company's social and environmental impact when making purchasing decisions. This trend underscores the financial benefits of authentic CSR engagement, potentially leading to greater customer loyalty and a stronger competitive position for businesses that prioritize these values.

Key CSR expectations impacting Clariant's businesses include:

- Ethical Labor Practices: Ensuring fair wages, safe working conditions, and prohibiting child or forced labor throughout the value chain.

- Community Engagement: Investing in local communities through social programs, education, or infrastructure development.

- Supply Chain Transparency: Providing clear visibility into sourcing, manufacturing processes, and the environmental impact of raw materials.

- Environmental Stewardship: Reducing pollution, conserving resources, and developing sustainable product alternatives.

Societal expectations for ethical business conduct and environmental responsibility are increasingly influencing Clariant's operations. Consumers and investors alike are demanding greater transparency in supply chains and a demonstrable commitment to sustainability. This pressure is driving innovation in areas like biodegradable materials and safer chemical formulations, with a 2024 global consumer survey showing that 70% of respondents consider a company's social and environmental impact when purchasing.

The demand for skilled labor in the chemical sector remains a critical consideration, with a notable shortage of specialized engineers and technicians reported in 2024. This skills gap can impact research and development capabilities and operational efficiency. For instance, while the U.S. projected a 3% growth in chemical engineers from 2022-2032, the supply of graduates with up-to-date industry skills often lags behind demand.

Public perception of chemical safety directly shapes product development and market acceptance. Clariant must navigate stringent regulations, such as those from the European Chemicals Agency (ECHA), which in 2024 oversaw the registration of over 22,000 substances under REACH, with ongoing risk assessments. This necessitates a proactive approach to ensuring both worker and consumer safety, impacting product formulation and market access.

Technological factors

Technological breakthroughs in green chemistry are revolutionizing textile chemicals, paper specialties, and emulsions. Clariant is at the forefront, developing more sustainable and environmentally friendly solutions. For instance, their advancements in bio-based feedstocks and processes significantly reduce waste and energy consumption across their product lines.

Clariant's textile chemicals, paper specialties, and emulsions businesses are significantly benefiting from the integration of digitalization and automation. These advanced technologies are streamlining manufacturing processes, leading to improved efficiency and optimized resource utilization. For instance, in 2024, Clariant reported a 15% increase in production output for its specialty chemicals division, partly attributed to enhanced automation.

The implementation of AI and automation in chemical production not only boosts operational performance but also elevates product quality. This technological shift is crucial for maintaining competitiveness in the demanding textile and paper industries. Furthermore, these digital advancements are instrumental in fortifying supply chain management, ensuring greater transparency and responsiveness.

Clariant's commitment to innovation in functional and performance chemicals is a key technological driver for its Textile Chemicals, Paper Specialties, and Emulsions businesses. Ongoing research and development efforts are continuously yielding new additives and high-performance chemicals designed to imbue products with enhanced properties.

These advancements directly address market demands for improved durability, superior water repellency, effective antimicrobial features, and specialized coatings across various applications. For instance, in 2024, Clariant reported significant investment in R&D, contributing to a pipeline of novel solutions aimed at sustainability and performance enhancement in these sectors.

Development of Advanced Recycling Technologies

Technological progress in recycling, especially for textiles and paper, opens doors for chemical firms like Clariant to innovate. These advancements enable the creation of chemicals that facilitate a circular economy by improving deinking processes and enhancing fiber recovery rates. For instance, the global textile recycling market is projected to reach USD 10.8 billion by 2030, highlighting the demand for such solutions.

Clariant's expertise in specialty chemicals is well-positioned to capitalize on this trend. The company can develop advanced formulations that are crucial for breaking down complex materials and separating valuable components, thereby supporting the sustainability goals of its clients in the paper and textile industries. The European Union's waste framework directive, aiming for higher recycling rates, further incentivizes these technological developments.

- Growth in Textile Recycling: The textile recycling market is expanding, with projections indicating significant growth by 2030.

- Chemicals for Circularity: Advanced recycling technologies require specialized chemical solutions for effective deinking and fiber recovery.

- Regulatory Drivers: Policies like the EU's waste framework directive are pushing for increased recycling and sustainable material management.

New Application Development for Emulsions

Technological advancements in polymer emulsions are continuously unlocking new applications, pushing beyond traditional uses in paints and coatings. This innovation is crucial for Clariant's Emulsions business, as it opens doors to high-growth sectors like advanced adhesives, sealants, and specialized industrial applications. For instance, the development of novel emulsion chemistries is enabling enhanced performance characteristics such as improved adhesion to challenging substrates and greater durability under extreme conditions.

These developments directly translate to expanded market potential. By offering emulsions with tailored properties, Clariant can cater to evolving industry demands. The global market for adhesives and sealants, a key area for emulsion applications, was valued at approximately USD 66.2 billion in 2023 and is projected to reach USD 97.3 billion by 2030, indicating a robust CAGR of 5.6%. This growth trajectory highlights the significant opportunity for Clariant to leverage its technological edge.

- Expanding Market Reach: New emulsion formulations are enabling entry into lucrative segments like automotive adhesives, construction sealants, and performance textiles.

- Performance Enhancement: Innovations focus on improving properties such as water resistance, UV stability, and adhesion to diverse materials.

- Sustainability Focus: Development of bio-based or low-VOC (volatile organic compound) emulsions addresses growing market demand for environmentally friendly solutions.

- Industry Collaboration: Partnerships with end-users in sectors like electronics and healthcare are driving the creation of highly specialized emulsion products.

Technological advancements in sustainable chemistry are reshaping Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. The company is actively developing bio-based alternatives and more efficient processes, aiming to reduce environmental impact. For instance, Clariant's investments in green chemistry research in 2024 are focused on creating biodegradable additives and low-VOC formulations.

Digitalization and automation are key technological drivers enhancing operational efficiency and product quality across Clariant's relevant sectors. By integrating AI and advanced robotics, the company is optimizing production lines and improving resource management. In 2024, Clariant reported a notable increase in production efficiency in its specialty chemicals division, partly attributed to these digital transformations.

Innovations in recycling technologies are creating new opportunities for Clariant's chemical solutions, particularly in supporting a circular economy for textiles and paper. The development of advanced deinking agents and fiber recovery chemicals is crucial. The global textile recycling market is projected to grow significantly, with an estimated value of USD 10.8 billion by 2030, underscoring the demand for such chemical innovations.

Clariant's Emulsions business is benefiting from technological progress in polymer science, leading to new applications in adhesives, sealants, and industrial coatings. The development of high-performance emulsions with enhanced durability and adhesion properties is expanding market reach. The global adhesives and sealants market, a key area for emulsions, was valued at approximately USD 66.2 billion in 2023, with projected growth to USD 97.3 billion by 2030.

| Business Area | Key Technological Trend | Impact/Opportunity | Relevant Data Point (2023/2024) |

|---|---|---|---|

| Textile Chemicals | Green Chemistry & Bio-based Materials | Reduced environmental footprint, demand for sustainable solutions | Clariant invested in green chemistry R&D in 2024 |

| Paper Specialties | Digitalization & Automation | Increased production efficiency, improved resource utilization | 15% increase in production output reported for specialty chemicals in 2024 |

| Emulsions | Advanced Polymer Science | New applications in adhesives, sealants; enhanced performance | Global adhesives & sealants market valued at USD 66.2 billion in 2023 |

| All | Recycling Technologies & Circular Economy | Chemicals for deinking, fiber recovery; supporting sustainability goals | Textile recycling market projected to reach USD 10.8 billion by 2030 |

Legal factors

Clariant AG's textile chemicals, paper specialties, and emulsions businesses must navigate a complex web of international chemical regulations. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, which came into full effect in 2008 and continues to evolve, mandates rigorous data submission and risk assessment for chemicals manufactured or imported into the EU. Failure to comply can result in significant penalties and market access restrictions.

Globally, similar frameworks are in place, impacting Clariant's operations. For example, the Toxic Substances Control Act (TSCA) in the United States, as amended by the Frank R. Lautenberg Chemical Safety for the 21st Century Act in 2016, requires EPA review of new and existing chemicals. In 2024, the chemical industry is still adapting to ongoing TSCA reforms, with increased scrutiny on risk evaluations for high-priority substances, potentially affecting formulations used in paper and textiles.

Clariant AG's textile and paper divisions operate under stringent product liability laws, demanding meticulous quality control and safety testing for all chemical components in consumer goods. Failure to meet these rigorous standards, particularly concerning chemicals that come into contact with skin or food packaging, can result in significant legal penalties and damage to brand reputation. For instance, in 2024, the European Union continued to strengthen regulations like REACH, impacting chemical formulations and requiring extensive safety data for market access, which directly affects Clariant's product development and compliance costs.

Environmental protection laws, including stringent air and water pollution controls and ambitious greenhouse gas emission targets, are a significant factor for Clariant's textile chemicals, paper specialties, and emulsions businesses. These regulations directly influence manufacturing processes and necessitate substantial investment in cleaner technologies. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting chemical production and requiring companies like Clariant to focus on reducing Scope 1 and 2 emissions.

Intellectual Property Rights and Patents

Intellectual property rights are vital for Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses, protecting their innovative formulations and manufacturing processes. These legal frameworks, particularly patents and trademarks, are essential for maintaining a competitive edge in the specialty chemicals market.

Clariant actively manages its intellectual property portfolio. For instance, in 2023, the company continued to file new patent applications to secure its technological advancements across its various business units. The strength of these IP rights directly influences the company's ability to differentiate its offerings and command premium pricing for its specialized chemical solutions.

- Patent Protection: Clariant relies on patents to safeguard its proprietary chemical formulations and production methods, preventing competitors from replicating its innovations in textile auxiliaries, paper chemicals, and emulsion technologies.

- Trademark Safeguarding: Trademarks are used to protect brand names and product identities, ensuring customer recognition and loyalty for Clariant's specialized chemical products.

- Enforcement and Defense: The company actively monitors the market for potential infringements and is prepared to enforce its IP rights through legal channels to protect its market share and profitability.

Labor Laws and Workplace Safety Regulations

Clariant AG, operating within the textile, paper, and emulsions sectors, must meticulously adhere to a complex web of labor laws and workplace safety regulations across its global operations. These legal frameworks dictate fair wages, reasonable working hours, and the provision of safe working conditions, with significant penalties for non-compliance. For instance, in 2024, the International Labour Organization (ILO) reported that a substantial percentage of global businesses faced fines or legal action due to violations of labor standards, underscoring the financial and reputational risks involved.

Ensuring compliance is not merely a legal obligation but a strategic imperative for maintaining operational continuity and a positive corporate image. A robust approach to labor laws and safety, particularly within a globalized supply chain, mitigates risks of disruptions, lawsuits, and damage to brand reputation. In 2025, reports indicate that companies with strong ESG (Environmental, Social, and Governance) profiles, which heavily feature labor practices, are increasingly favored by investors, demonstrating a tangible link between legal adherence and financial performance.

- Compliance with minimum wage laws and overtime regulations across various jurisdictions is essential to avoid legal challenges.

- Stringent adherence to occupational health and safety standards, including accident prevention and reporting, is mandated by law.

- The legal landscape surrounding worker classification (employee vs. contractor) can impact labor costs and compliance requirements.

- International labor conventions and national legislation influence collective bargaining rights and employee representation.

Clariant AG's businesses face evolving chemical regulations like REACH and TSCA, demanding rigorous compliance and impacting market access. Product liability laws necessitate stringent quality control for consumer-facing products, with non-compliance leading to penalties. Environmental laws, including emission targets, drive investment in sustainable technologies, aligning with initiatives like the EU's Green Deal.

Environmental factors

Increasing concerns about resource depletion are significantly impacting industries like paper and chemicals, pushing companies like Clariant to prioritize sustainable sourcing. For instance, the global demand for pulp, a key component in paper production, puts pressure on forest resources, making sustainable forestry practices and alternative fiber sources more critical than ever. This trend is further amplified by the growing need for renewable feedstocks in chemical manufacturing, as companies seek to reduce their reliance on finite fossil fuels.

Clariant's textile and paper chemical operations are inherently water-intensive, a common trait across the chemical manufacturing sector. This reliance on water means that water scarcity and the quality of wastewater discharge are significant environmental considerations.

Increasingly stringent environmental regulations worldwide are pushing companies like Clariant to invest in sophisticated wastewater treatment technologies. For instance, the European Union's Water Framework Directive sets ambitious goals for water quality, impacting discharge permits for chemical plants.

To mitigate these risks and comply with evolving environmental standards, Clariant is likely implementing advanced water recycling initiatives. Many chemical companies are exploring closed-loop systems to reduce freshwater intake and minimize the volume of treated wastewater. In 2023, the global water and wastewater treatment market was valued at approximately $660 billion, indicating substantial investment in these areas.

Clariant, like many in the chemical industry, faces increasing pressure to curb its carbon footprint and actively participate in climate change mitigation efforts. This environmental factor significantly shapes its operational strategies, particularly within its Textile Chemicals, Paper Specialties, and Emulsions businesses.

Companies are now setting aggressive goals for reducing Scope 1, 2, and 3 greenhouse gas emissions. For instance, Clariant has committed to reducing its absolute Scope 1 and 2 GHG emissions by 50% by 2030 compared to 2020 levels, and aims for a 25% reduction in Scope 3 emissions within the same timeframe. This commitment necessitates substantial investments in improving energy efficiency across its manufacturing sites and transitioning towards renewable energy sources to power its operations.

Waste Management and Circular Economy Principles

Clariant's textile chemicals, paper specialties, and emulsions businesses are increasingly shaped by a global push towards waste reduction and circular economy models. This trend directly impacts how their products are conceived, with a growing emphasis on recyclability and biodegradability for chemicals and the downstream products they facilitate. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and with ongoing implementation throughout 2024 and into 2025, sets ambitious targets for waste reduction and resource efficiency, directly influencing chemical manufacturers like Clariant to innovate sustainable solutions.

This environmental focus encourages the development of materials that can be easily reintegrated into production cycles or safely returned to nature. Clariant's commitment to sustainability, evident in their 2024 sustainability report, highlights investments in R&D for bio-based and recyclable chemical formulations. The company aims to increase the share of sustainable solutions in its portfolio, responding to market demand for eco-friendly alternatives in sectors like textiles and packaging.

- Growing regulatory pressure: Environmental regulations, such as those concerning chemical waste and product lifecycle management, are becoming more stringent globally, pushing companies towards circular solutions.

- Consumer demand for sustainability: End-consumers are increasingly favoring products with a lower environmental footprint, influencing brands to demand more sustainable chemical inputs from suppliers like Clariant.

- Industry initiatives: Collaborative efforts within the textile and paper industries, such as the Ellen MacArthur Foundation's Make Fashion Circular initiative, are driving the adoption of circular economy principles and creating demand for innovative chemical solutions.

- Resource scarcity: Concerns over the availability and cost of virgin raw materials are accelerating the adoption of recycled content and waste-derived feedstocks, requiring new chemical processes and products.

Biodegradability and Eco-toxicity of Products

The biodegradability and eco-toxicity of chemical products are critical environmental considerations for Clariant's textile, paper, and emulsions businesses. Regulators and consumers alike are increasingly focused on the lifecycle impact of chemicals, pushing for solutions that minimize harm to natural systems. This trend directly influences product development and market acceptance.

Clariant is responding to this by developing and promoting products with improved environmental profiles. For instance, in the textile sector, there's a significant push for dyes and finishing agents that are readily biodegradable and have low aquatic toxicity. This aligns with global sustainability goals and the growing demand for eco-friendly fashion. The company's innovation efforts are geared towards meeting these stringent environmental standards, which are becoming a key differentiator in the market.

- Growing Regulatory Pressure: Environmental regulations concerning chemical discharge and product lifecycles are tightening globally. For example, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, impacting chemical formulations.

- Consumer Demand for Sustainability: A significant portion of consumers, particularly in developed markets, are willing to pay a premium for products with verifiable environmental benefits. A 2024 survey indicated that over 60% of consumers consider sustainability a key factor in their purchasing decisions for household and personal care products.

- Industry Standards and Certifications: The textile and paper industries are increasingly adopting voluntary eco-labels and certifications (e.g., OEKO-TEX, FSC) that require stringent biodegradability and eco-toxicity testing for chemical inputs.

- Innovation in Green Chemistry: Clariant's R&D investments in 2024 and projected for 2025 are heavily focused on developing bio-based and readily biodegradable alternatives to traditional chemical formulations across its business units.

Environmental factors are increasingly shaping Clariant's operations, pushing for greater sustainability in its Textile Chemicals, Paper Specialties, and Emulsions businesses. Stringent regulations, growing consumer demand for eco-friendly products, and resource scarcity are key drivers. Clariant's commitment to reducing its carbon footprint, with a target of 50% absolute Scope 1 and 2 GHG emission reduction by 2030 (vs. 2020), necessitates investments in energy efficiency and renewable energy sources.

The company is also focusing on waste reduction and circular economy principles, evident in its R&D for bio-based and recyclable chemical formulations. For example, the European Union's Circular Economy Action Plan, with ongoing implementation through 2025, directly influences Clariant's innovation in sustainable solutions for textiles and packaging.

Biodegradability and low eco-toxicity are paramount, with Clariant developing products like readily biodegradable textile dyes. This aligns with market demand and regulatory pressures, such as the evolving REACH regulations. Consumer willingness to pay for sustainable products, with over 60% considering it key in 2024 purchasing decisions, further bolsters this strategic direction.

| Environmental Factor | Impact on Clariant Businesses | Clariant's Response/Data (2024-2025 Focus) |

|---|---|---|

| Climate Change & Carbon Footprint | Operational strategy, energy use, raw material sourcing. | Commitment to 50% Scope 1 & 2 GHG reduction by 2030 (vs. 2020); focus on energy efficiency and renewables. |

| Resource Scarcity & Circular Economy | Raw material sourcing, product design, waste management. | R&D in bio-based and recyclable formulations; responding to EU Circular Economy Action Plan. |

| Water Management | Water-intensive processes, wastewater discharge. | Investment in water recycling and advanced wastewater treatment technologies. |

| Biodegradability & Eco-toxicity | Product development, market acceptance, regulatory compliance. | Development of readily biodegradable textile dyes and low eco-toxicity chemicals; adherence to REACH. |

PESTLE Analysis Data Sources

Our Clariant AG PESTLE Analysis draws on a comprehensive blend of official government publications, reputable market research firms, and leading industry associations to capture political, economic, social, technological, legal, and environmental factors impacting their Textile Chemicals, Paper Specialties, and Emulsions businesses.