Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses Bundle

Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions businesses face a dynamic competitive landscape. While buyer power might be moderate due to product differentiation, the threat of substitutes in certain applications could exert pressure. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of crucial raw materials, such as petrochemicals for Clariant's emulsions and textile chemicals, or pulp for its paper specialties, hold considerable sway, particularly when prices are volatile. For instance, crude oil prices, a key driver for petrochemicals, saw significant fluctuations in 2024, impacting input costs for many chemical manufacturers.

Global supply-demand dynamics, geopolitical tensions, and even adverse weather events can trigger unexpected surges in raw material expenses. This unpredictability directly affects the cost basis for companies like Clariant, complicating efforts to maintain consistent pricing and healthy profit margins in its textile, paper, and emulsions segments.

The bargaining power of suppliers for Clariant's textile chemicals, paper specialties, and emulsions businesses is significantly influenced by the concentration of specialized inputs. If there are few alternative sources for crucial chemical intermediates or unique pulp types, suppliers gain considerable leverage. For instance, if a specific proprietary chemical component is only available from a handful of manufacturers, those suppliers can dictate higher prices and less favorable contract terms to Clariant, impacting its cost of goods sold.

For manufacturers in the textile, paper, and emulsion sectors, the cost and complexity of switching chemical suppliers are significant. These switching costs can include the substantial investment required for re-formulating products and re-certifying intricate manufacturing processes. For instance, a textile manufacturer might need to conduct extensive trials to ensure new dyes or finishing agents meet performance and regulatory standards, a process that can take months and incur considerable expense.

The need for new equipment or rigorous testing to guarantee compatibility with alternative raw materials further elevates these barriers. Imagine a paper mill needing to adjust its entire chemical treatment system to accommodate a different sizing agent; this could necessitate costly equipment upgrades and prolonged downtime for validation. Such investments effectively lock manufacturers into existing supplier relationships, often regardless of whether the current terms are optimal.

Supplier Forward Integration Potential

Suppliers in the textile chemicals, paper specialties, and emulsions sectors possess increased bargaining power if they can credibly threaten to integrate forward into manufacturing. This means they could start producing the final products themselves, directly competing with their current customers. For instance, a chemical supplier might develop its own line of specialty paper coatings, thereby leveraging its raw material expertise.

The potential for this forward integration can significantly influence negotiations. Manufacturers might be hesitant to push for lower prices or more favorable terms if they believe their suppliers could easily enter their market. This is particularly true when the complexity of the end-product manufacturing is relatively low compared to the production of the specialized raw materials.

- Forward Integration Threat: Suppliers can increase their leverage by threatening to produce textile chemicals, paper specialties, or emulsions directly.

- Deterrent to Aggressive Negotiation: This potential for direct competition discourages manufacturers from demanding lower prices or better terms.

- Complexity Factor: The threat is amplified when the end-product manufacturing is less intricate than the supplier's core raw material production.

- Example Scenario: A raw material provider could enter the market for finished paper coatings, using its existing chemical expertise.

Importance of Supplier's Input to Product Quality

When the quality and performance of Clariant's final chemical products, like those in its Textile Chemicals or Paper Specialties divisions, are intrinsically linked to the specific raw materials sourced from a particular supplier, that supplier's bargaining power increases significantly. Manufacturers in these sectors are often hesitant to substitute inputs for cost savings if it risks compromising the efficacy or reputation of their specialized offerings.

For instance, in the realm of specialty chemicals, where unique performance characteristics are a primary competitive advantage, suppliers of critical, high-purity intermediates hold considerable sway. Clariant's reliance on such suppliers means that disruptions or unfavorable pricing from these sources can directly impact its product quality and market position.

Consider the Emulsions business, where specific polymer chemistries are crucial for achieving desired product attributes like adhesion or stability. If a limited number of suppliers can provide these specialized polymers, their bargaining power is amplified. In 2023, the global specialty chemicals market saw continued demand for high-performance materials, underscoring the importance of reliable, quality-assured sourcing for companies like Clariant.

- Supplier Dependence: Clariant's ability to maintain product quality in its Textile Chemicals and Paper Specialties divisions is heavily reliant on the consistent quality of specific raw materials.

- Performance Differentiation: In specialty chemicals, where performance is key, suppliers of unique or high-purity inputs gain leverage due to the risk of quality degradation.

- Cost vs. Quality Trade-off: Manufacturers often prioritize input quality over minor cost savings to protect brand reputation and product efficacy.

- Market Dynamics: The limited availability of specialized chemical inputs can grant suppliers substantial bargaining power, impacting Clariant's operational costs and product development.

Suppliers of specialized raw materials for Clariant's textile chemicals, paper specialties, and emulsions businesses wield significant power, especially when few alternatives exist for critical inputs. This leverage is amplified when switching costs for Clariant are high, involving reformulation and re-certification processes that can be time-consuming and expensive.

The threat of forward integration by suppliers, where they might produce finished goods themselves, also bolsters their bargaining position. This is particularly potent if the supplier's core raw material production is more complex than Clariant's end-product manufacturing, making direct competition a credible risk.

Clariant's reliance on suppliers for specific, high-quality inputs crucial for product performance, such as unique polymers for emulsions or specialized dyes for textiles, further strengthens supplier influence. In 2024, the specialty chemicals market continued to emphasize high-performance materials, making reliable sourcing paramount.

| Factor | Impact on Supplier Bargaining Power | Relevance to Clariant's Businesses |

|---|---|---|

| Supplier Concentration | High if few suppliers for critical inputs | Textile Chemicals, Paper Specialties, Emulsions |

| Switching Costs | High if reformulation/re-certification is complex | Textile Chemicals, Paper Specialties |

| Forward Integration Threat | Increases power if credible | All three businesses |

| Product Quality Dependence | High if final product performance relies on specific inputs | Textile Chemicals, Emulsions |

What is included in the product

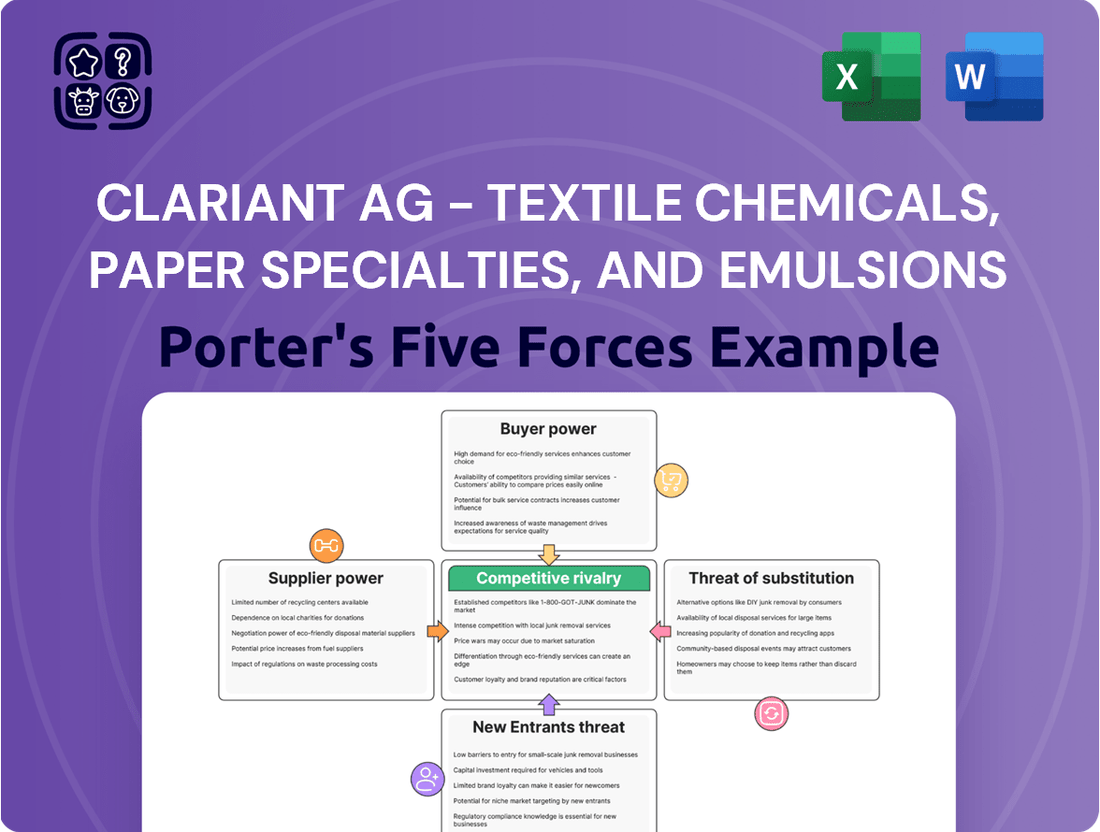

This analysis of Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses reveals that while supplier power is moderate, intense rivalry and the threat of substitutes in these mature markets significantly shape competitive dynamics.

Gain immediate clarity on competitive pressures within Clariant's Textile Chemicals, Paper Specialties, and Emulsions, allowing for targeted strategic adjustments to mitigate threats and capitalize on opportunities.

Easily visualize the intensity of each of Porter's Five Forces, empowering swift, data-driven decisions to navigate market dynamics and enhance profitability.

Customers Bargaining Power

For certain segments within Clariant's textile chemicals, paper specialties, and emulsions businesses, a highly fragmented customer base significantly dilutes individual customer bargaining power. This means that no single buyer represents a substantial portion of Clariant's sales, allowing the company to retain more control over pricing. For example, in the diverse textile industry, Clariant might serve thousands of smaller apparel manufacturers rather than a few giants, limiting any one customer's ability to demand lower prices.

Customers in commodity-like segments of Clariant's textile chemicals, paper specialties, and emulsions businesses, particularly those with thin profit margins, exhibit high price sensitivity. This means they are very focused on getting the best price for their purchases.

The presence of numerous suppliers offering comparable products naturally fuels intense price competition. This forces manufacturers like Clariant to consider lower margins to win and retain business, a frequent hurdle in markets where product differentiation is minimal and cost is the dominant factor in buying decisions.

For instance, in the paper chemicals market, where many products are seen as interchangeable, a slight price advantage can significantly sway customer choice. This dynamic was evident in 2024, with reports indicating that price negotiations in certain specialty chemical segments saw increases of 3-5% in raw material costs being passed on, but only where product performance truly justified it.

When customers can easily switch between suppliers for chemicals or paper products, their ability to negotiate better deals significantly rises. This is because the effort and expense involved in changing providers are minimal. For instance, if a textile manufacturer finds a competitor offering a similar dye at a lower price with comparable quality, they can switch without much disruption.

This ease of switching forces Clariant AG, particularly in its Textile Chemicals and Paper Specialties segments, to remain highly competitive. In 2024, the specialty chemicals market, where Clariant operates, saw continued price pressure due to global economic conditions and readily available alternatives for many product lines. Companies like Clariant must therefore focus on delivering exceptional value, whether through innovative product development, reliable supply chains, or enhanced technical support, to maintain customer loyalty.

Customer Backward Integration Potential

The potential for customers to integrate backward, meaning they could start producing chemicals or paper products themselves, significantly boosts their bargaining power against Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. This threat is particularly relevant for large-scale textile mills or paper manufacturers who might find it economically viable to produce these inputs in-house if the cost savings are compelling and the necessary technology is readily available.

This customer capability effectively sets a price ceiling for Clariant’s offerings, as customers can always threaten to bring production in-house if prices become too high. For instance, in 2024, the global paper and pulp industry saw significant investment in automation and process efficiency, potentially lowering the barrier to entry for backward integration for major players. This means Clariant must remain competitive on price and value to retain these customers.

- Customer Threat: Large customers can potentially produce chemicals or paper products in-house.

- Cost Savings Incentive: Backward integration is more likely if significant cost reductions are achievable.

- Technology Accessibility: The availability of accessible technology facilitates customer self-production.

- Price Ceiling: This potential limits the pricing power of chemical and paper suppliers like Clariant.

Availability of Substitute Products for Customers

The availability of substitute products significantly impacts Clariant's bargaining power with its customers in the textile, paper, and emulsions sectors. When customers can easily switch to alternative chemicals or entirely different materials that perform similar functions, their reliance on Clariant's offerings diminishes. This is particularly true in industries where technological advancements introduce new solutions, such as innovative textile treatments that might bypass traditional chemical processes.

For example, the rise of sustainable and bio-based materials in textiles can present alternatives to conventional chemical finishes, thereby increasing customer leverage. Similarly, in the paper industry, advancements in paper recycling and alternative fiber sources can reduce the demand for specific specialty chemicals used in virgin paper production. This dynamic empowers customers by providing them with more choices and a stronger negotiating position.

- Reduced Customer Dependence: The existence of viable substitutes lessens a customer's reliance on a single supplier like Clariant, giving them more freedom to explore alternatives.

- Increased Negotiation Leverage: With multiple options available, customers can more effectively negotiate prices and terms, as they can threaten to switch to a competitor.

- Impact of Innovation: New material science or process innovations can quickly create substitutes, shifting the power balance in favor of customers. For instance, advancements in digital printing for textiles might reduce the need for certain dyeing chemicals.

- Market Responsiveness: Clariant must remain agile and responsive to market shifts driven by substitute availability to maintain its competitive edge and customer relationships.

Customers in Clariant's textile chemicals, paper specialties, and emulsions businesses possess significant bargaining power, primarily driven by a fragmented customer base and high price sensitivity in commodity-like segments. The ease with which customers can switch suppliers, coupled with the potential for backward integration, further amplifies their negotiating leverage. This situation forces Clariant to remain highly competitive on price and value to retain market share.

Preview the Actual Deliverable

Clariant AG - Textile Chemicals, Paper Specialties, and Emulsions Businesses Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis for Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses delves into the competitive landscape, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within these key sectors. The detailed insights provided will equip you with a thorough understanding of the strategic forces shaping these markets.

Rivalry Among Competitors

The specialty chemicals sector, encompassing areas like textile chemicals, paper specialties, and emulsions, is crowded with numerous companies. This high number of competitors means that businesses are constantly vying for market share, particularly in segments that have reached maturity. For instance, in the global textile chemicals market, which was valued at approximately $25 billion in 2023, a substantial portion of this value is held by a multitude of smaller and mid-sized enterprises alongside larger players, intensifying the competitive landscape.

Slower growth in specific areas of textile chemicals, paper specialties, and emulsions can really heat up competition. When the overall market isn't expanding much, companies have to battle harder to win over customers from each other. This is happening even as the broader specialty chemicals sector is expected to see growth, with some parts of Clariant's business facing these slower paces.

For instance, while the global specialty chemicals market was anticipated to grow at a compound annual growth rate (CAGR) of around 4-5% leading up to 2024, certain niche segments within textiles or paper might not be keeping up. This disparity means companies like Clariant must concentrate on gaining market share from competitors rather than simply riding a wave of overall market expansion.

The degree of product differentiation is a key factor in the competitive rivalry within Clariant's textile chemicals, paper specialties, and emulsions sectors. Companies that successfully develop highly specialized or innovative products can command premium pricing and sidestep intense direct competition. For instance, Clariant's focus on sustainable solutions in textiles, such as their advanced dyeing auxiliaries that reduce water and energy consumption, creates a distinct advantage.

Clariant actively pursues innovation to create unique formulations. In the paper specialties segment, this might involve developing functional coatings that enhance paper strength or printability, thereby differentiating their offerings from commodity products. This strategic emphasis on performance and sustainability helps to lessen the impact of price-based competition, allowing them to maintain healthier margins.

High Fixed Costs and Exit Barriers

The specialty chemicals sector, including Clariant's textile chemicals, paper specialties, and emulsions businesses, is characterized by substantial capital outlays for manufacturing facilities and ongoing research and development. These high fixed costs create significant barriers to exiting the market.

Companies are therefore motivated to maintain production even during downturns, often resorting to price reductions to utilize capacity rather than incurring losses from idled operations. This dynamic intensifies competitive rivalry, particularly when market supply outstrips demand.

- High Capital Investment: Industries like specialty chemicals demand significant upfront investment in plants and R&D, leading to high fixed costs.

- Exit Barriers: Once invested, exiting is difficult and costly, compelling firms to stay operational.

- Capacity Utilization Pressure: Companies are driven to operate at full capacity, even at lower margins, to cover fixed costs.

- Intensified Competition: This pressure exacerbates competition, especially during periods of weak demand or oversupply.

Sustainability and Regulatory Pressures

The competitive rivalry in Clariant's textile, paper, and emulsions sectors is intensifying due to a growing global emphasis on sustainability and stricter environmental regulations. This pushes companies to develop and offer greener chemistry and eco-friendly products, making innovation in this area a key differentiator.

Companies that successfully introduce low-VOC (volatile organic compound), bio-based, or PFAS-free chemicals are likely to gain a significant edge. This trend is shifting the competitive landscape from being solely price-driven to one where innovation and sustainability credentials play a crucial role in market positioning.

- Sustainability as a Differentiator: Clariant's competitors are increasingly focusing on developing sustainable alternatives, such as biodegradable or recycled content-based chemicals, to meet evolving market demands.

- Regulatory Compliance Costs: Adhering to new environmental standards, like those concerning water usage or chemical discharge, can lead to increased operational costs for all players in the industry.

- Innovation in Green Chemistry: The race to create novel, eco-friendly formulations is a primary driver of competition, rewarding companies with strong R&D capabilities in areas like bio-based surfactants or formaldehyde-free binders.

- Market Share Shifts: As of early 2024, a noticeable trend shows that companies with a robust portfolio of sustainable products are capturing a larger share of new contracts, particularly with large global brands prioritizing environmental, social, and governance (ESG) criteria.

Competitive rivalry within Clariant's textile chemicals, paper specialties, and emulsions businesses is intense, driven by a fragmented market and varying growth rates across segments. Companies are increasingly differentiating through innovation, particularly in sustainable solutions, as regulatory pressures and customer demand for eco-friendly products rise. This focus on green chemistry is reshaping market share, with firms offering strong ESG credentials gaining an advantage.

| Factor | Impact on Rivalry | Example (Clariant Focus) |

|---|---|---|

| Market Fragmentation | High competition from numerous players, especially in mature segments. | Many smaller and mid-sized enterprises compete alongside larger ones in the global textile chemicals market. |

| Growth Rate Disparities | Intensified competition in slower-growing segments as companies fight for market share. | While the overall specialty chemicals market grows, specific textile or paper segments may see slower expansion, forcing direct competition. |

| Product Differentiation | Innovation in specialized or sustainable products creates competitive advantages. | Clariant's advanced dyeing auxiliaries reduce water and energy use, offering a distinct benefit. |

| Sustainability Focus | Green chemistry and eco-friendly products become key differentiators and market share drivers. | Companies offering bio-based or PFAS-free chemicals are capturing new contracts, especially with ESG-conscious clients. |

SSubstitutes Threaten

The increasing consumer and regulatory pressure for sustainability is a major driver for the threat of substitutes in Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. The growing demand for bio-based and biodegradable materials presents a direct challenge to conventional chemical formulations, especially within the packaging and textile sectors.

For instance, the global biodegradable packaging market was valued at approximately $27.5 billion in 2023 and is projected to grow significantly, indicating a clear shift away from traditional, less sustainable options. This trend directly impacts Clariant's offerings by providing viable, environmentally friendly alternatives that could reduce the need for their current chemical solutions.

Innovations within textile and paper industries pose a significant threat of substitution for Clariant's offerings. For instance, advancements in digital printing directly bypass the need for many traditional textile dyeing and finishing chemicals. Similarly, new paper manufacturing processes that require fewer chemical additives or utilize alternative binding agents can diminish demand for Clariant's paper specialties.

The emergence of novel materials with built-in functionalities, such as advanced polymers or smart textiles, presents a significant threat of substitution to Clariant's textile, paper, and emulsions businesses. These materials can inherently offer properties like water repellency or flame resistance, directly diminishing the demand for chemical additives and treatments that Clariant currently supplies.

Shifting Consumer Preferences

Shifting consumer preferences represent a significant threat of substitutes for Clariant's textile, paper, and emulsions businesses. Growing demand for minimalist products and those with fewer chemical inputs directly challenges traditional chemical-intensive processes. For instance, a strong preference for natural fibers like organic cotton over synthetics, which require extensive chemical treatments for dyeing and finishing, can shrink the market for certain textile chemicals. Similarly, the rise of chemical-free cleaning solutions impacts the demand for specific emulsion-based products.

This trend is not just theoretical; it's reflected in market behavior. By 2024, the global market for sustainable textiles was projected to reach over $10 billion, indicating a substantial consumer pull towards alternatives that minimize chemical footprints. This shift can lead to a reduced overall market size for specific chemical categories within Clariant's portfolio, forcing a re-evaluation of product development and marketing strategies.

- Consumer shift towards natural fibers: This reduces the need for synthetic fiber processing chemicals.

- Demand for chemical-free products: Impacts markets for cleaning agents and certain paper treatments.

- Market growth for sustainable alternatives: The global sustainable textile market is a key indicator of this trend.

- Potential market size reduction: Certain chemical categories may see declining demand due to these preferences.

Cost-Effectiveness of Alternatives

The cost-effectiveness of alternative materials and processes presents a significant threat to Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses. If these alternatives become cheaper to produce or use, they can lure customers away from traditional specialty chemicals.

For instance, advancements in bio-based dyes or water-saving dyeing techniques could offer a more economical and environmentally friendly solution for textile manufacturers. Similarly, in the paper industry, innovations in pulp processing or digital printing technologies might reduce the reliance on chemical additives. The economic viability of these substitutes is paramount; if they offer a lower total cost of ownership, the substitution threat intensifies. This is particularly true as regulatory pressures on chemical usage, such as those concerning environmental impact or worker safety, continue to rise, potentially increasing the cost of traditional chemical inputs.

- Rising environmental regulations could increase compliance costs for traditional chemical users.

- Innovations in bio-based materials and digital technologies offer potentially lower-cost alternatives.

- The economic viability of substitutes is a primary driver of customer adoption.

The threat of substitutes for Clariant's Textile Chemicals, Paper Specialties, and Emulsions businesses is amplified by the increasing availability and cost-competitiveness of alternative solutions. Innovations in bio-based materials, digital technologies, and natural fiber processing are presenting viable, and often more economical, options for customers. For example, the global market for bio-based chemicals, a key substitute category, was projected to reach over $400 billion by 2024, demonstrating a significant shift in material sourcing and processing.

These substitutes often come with enhanced sustainability profiles, aligning with growing consumer and regulatory demands. For instance, advancements in waterless dyeing technologies for textiles can significantly reduce operational costs and environmental impact compared to traditional chemical-intensive methods. Similarly, the paper industry is seeing a rise in recycled content and alternative fiber sources that require fewer chemical treatments, directly challenging the market for conventional paper specialties.

The economic viability of these substitutes is a crucial factor. As production scales increase and technological efficiencies improve, the cost advantage of alternatives becomes more pronounced. This can lead to a direct erosion of market share for incumbent chemical providers like Clariant if they cannot match the value proposition of these emerging substitutes. The total cost of ownership, including regulatory compliance and waste disposal, is increasingly favoring these newer, greener alternatives.

| Substitute Category | Key Drivers | Market Trend Example (2024 Projections) | Impact on Clariant |

|---|---|---|---|

| Bio-based Chemicals | Sustainability, regulatory push, cost reduction | Global Bio-based Chemicals Market: ~$400 billion | Direct competition for chemical inputs |

| Digital Textile Printing | Reduced water/chemical usage, customization | Global Digital Textile Printing Market: ~$5.5 billion | Reduced demand for traditional dyes/finishes |

| Recycled Paper & Alternative Fibers | Resource efficiency, lower chemical needs | Global Recycled Paper Market: ~$130 billion | Reduced demand for paper specialty chemicals |

| Waterless/Low-Water Dyeing | Environmental compliance, cost savings | Growing adoption in textile manufacturing | Potential decline in demand for conventional dyeing chemicals |

Entrants Threaten

The specialty chemical sectors Clariant operates in, such as textile chemicals, paper specialties, and emulsions, demand significant upfront capital. Companies need to invest heavily in research and development to innovate, build state-of-the-art manufacturing plants, and ensure adherence to stringent environmental and safety regulations. This financial hurdle naturally discourages many aspiring competitors from entering the market.

The necessity for advanced, specialized machinery and the economies of scale achieved through large-scale production further amplify the financial burden of market entry. For instance, setting up a new emulsion production line can easily run into tens of millions of dollars, making it a challenging proposition for smaller firms without substantial backing.

The extensive research and development (R&D) and technological expertise required to innovate in specialty chemicals present a substantial barrier to entry for new players in Clariant's textile, paper, and emulsions markets. Developing novel and high-performing chemical solutions necessitates significant upfront investment in R&D facilities and highly skilled scientific talent, a considerable undertaking for any aspiring competitor.

Established companies like Clariant benefit from decades of accumulated knowledge, proprietary formulations, and a robust patent portfolio, which are difficult and time-consuming for newcomers to replicate. For instance, Clariant's commitment to innovation is reflected in its significant R&D spending; in 2023, the company invested CHF 215 million in research and development, underscoring the capital-intensive nature of staying competitive in this sector.

Stringent regulatory compliance presents a significant threat of new entrants for Clariant's textile chemicals, paper specialties, and emulsions businesses. The chemical industry is heavily regulated, with complex and ever-changing environmental, health, and safety standards. New companies must invest heavily in understanding and meeting these requirements, including obtaining numerous permits and adhering to strict manufacturing protocols.

For example, in 2024, the European Chemicals Agency (ECHA) continued to enforce REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, which require extensive data submission and risk assessment for chemical substances. This process can be costly and time-consuming, creating a substantial barrier for smaller or less capitalized new entrants aiming to compete with established players like Clariant who already have robust compliance systems in place.

Established Customer Relationships and Brand Loyalty

Established customer relationships and brand loyalty present a significant barrier for new entrants in Clariant's textile chemicals, paper specialties, and emulsions markets. Existing players have cultivated trust over years, often through consistent product performance and reliable supply chains. For instance, in the specialty chemicals sector, a 2024 market report indicated that over 60% of purchasing decisions were influenced by supplier reliability and existing relationships, rather than solely by price.

Newcomers must invest heavily to disrupt these entrenched connections. They would need to offer demonstrably superior products, employ aggressive pricing strategies, or provide exceptional customer support to even begin chipping away at market share. This difficulty in rapidly acquiring customers means that new entrants face a prolonged and costly battle for market acceptance.

- Customer Retention Rates: Specialty chemical companies often boast customer retention rates exceeding 90%, highlighting the stickiness of existing relationships.

- Brand Equity Value: The intangible value of established brands in these sectors can be substantial, requiring significant marketing investment to counter.

- Switching Costs: For customers, switching chemical suppliers can involve costly re-qualification processes and potential disruptions to their own production lines.

- Supplier Integration: Many clients integrate their suppliers' products deeply into their manufacturing processes, making a change complex and risky.

Supply Chain Complexity and Distribution Networks

New entrants face significant hurdles in replicating the intricate supply chain and distribution networks that established players like Clariant have cultivated. Building robust relationships with raw material suppliers and developing efficient logistics for diverse product lines, such as textile chemicals and paper specialties, requires substantial investment and time. For instance, in 2024, the global chemical logistics market was valued at over $150 billion, highlighting the scale of infrastructure and expertise needed.

Existing companies benefit from years of optimizing their supply chains, securing favorable terms with suppliers, and establishing broad customer reach. This optimization translates into cost efficiencies and reliability that are difficult for newcomers to match quickly. A new entrant would likely struggle to achieve the same economies of scale in procurement or the widespread market penetration that Clariant enjoys, potentially leading to higher operational costs and slower market acceptance.

- Supply Chain Investment: New entrants need to invest heavily in securing reliable raw material sources, a process that can take years to optimize for cost and consistency.

- Distribution Network Development: Establishing comprehensive distribution channels to reach a diverse customer base across various industries, like textiles and paper, is a significant logistical challenge.

- Economies of Scale: Incumbent firms leverage existing scale in purchasing and logistics to achieve lower per-unit costs, a benefit not readily available to new market entrants.

- Customer Access: Existing players have pre-existing relationships and established delivery mechanisms, making it harder for new companies to gain immediate traction with key customers.

The threat of new entrants in Clariant's textile chemicals, paper specialties, and emulsions businesses is moderate to low, primarily due to substantial capital requirements for R&D, manufacturing, and regulatory compliance. Significant investment in specialized equipment and achieving economies of scale are also major deterrents. For instance, in 2023, the specialty chemicals market saw new product development cycles averaging 18-24 months, requiring continuous R&D investment.

Furthermore, established players benefit from strong brand loyalty and intricate supply chain networks, making it difficult for newcomers to gain market traction. Customer switching costs, often involving re-qualification of materials and potential production line disruptions, can be substantial. By 2024, many B2B customers in these sectors prioritized supplier reliability, with over 60% of purchasing decisions influenced by existing relationships.

The complex regulatory landscape, exemplified by ongoing REACH compliance in Europe, adds another layer of difficulty. New entrants must navigate these stringent environmental, health, and safety standards, a process that demands significant financial and time investment. This regulatory burden, coupled with the need for advanced technological expertise, creates a formidable barrier to entry.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Clariant AG's Textile Chemicals, Paper Specialties, and Emulsions Businesses is built upon a foundation of comprehensive data, including Clariant's annual reports, industry-specific market research from firms like IHS Markit, and publicly available competitor financial disclosures.