CJ Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ Logistics Bundle

CJ Logistics, a titan in the global logistics arena, boasts impressive strengths like its extensive network and technological innovation, but also faces significant opportunities in emerging markets and e-commerce growth. However, understanding the full scope of its weaknesses, such as reliance on certain key markets, and the threats from intense competition and evolving regulations is crucial for strategic decision-making.

Want the full story behind CJ Logistics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CJ Logistics' global network is a major strength, with operations spanning 34 countries and 271 cities. This extensive reach is crucial for its international freight forwarding capabilities and supports its growing cross-border e-commerce business.

The company is actively expanding in strategic markets like the US, India, and Saudi Arabia, further solidifying its global footprint. This expansion is vital for capturing new growth opportunities and enhancing its service offerings in specialized logistics, including cold chain solutions.

CJ Logistics' commitment to advanced technology, including AI and robotics, significantly boosts operational efficiency and cost reduction across its logistics network. For instance, the company’s investment in smart warehouses powered by automation is designed to streamline sorting and handling processes, aiming for a noticeable decrease in labor costs and an increase in throughput.

The company is strategically investing in cutting-edge areas like autonomous driving and sophisticated data analytics. These advancements are crucial for optimizing route planning and improving demand forecasting accuracy, thereby sharpening CJ Logistics' competitive advantage in the dynamic global logistics market.

CJ Logistics boasts an incredibly broad service offering, encompassing everything from contract logistics, which includes warehousing and transportation, to express delivery, international freight forwarding, and specialized e-fulfillment solutions. This extensive range means they can serve a wide array of customer requirements across many different industries.

Their ability to handle diverse logistics needs, from consumer goods to more specialized sectors like healthcare and defense, highlights the depth of their capabilities. For instance, in 2023, CJ Logistics reported significant growth in its contract logistics segment, driven by increased demand for integrated supply chain solutions.

Commitment to Sustainability and ESG

CJ Logistics demonstrates a robust commitment to sustainability, targeting carbon neutrality by 2050. This focus on environmental, social, and governance (ESG) principles is a significant strength, resonating with a growing market demand for responsible business practices.

Their proactive implementation of eco-friendly transportation, advanced waste recycling systems, and innovative sustainable packaging solutions directly supports this commitment. These initiatives not only reduce environmental impact but also bolster brand reputation, attracting a key demographic of environmentally conscious clients and partners.

- Carbon Neutrality Target: Aiming for carbon neutrality by 2050, aligning with global sustainability goals.

- Eco-Friendly Operations: Actively deploying greener transportation and waste management strategies.

- Sustainable Packaging: Investing in and developing environmentally sound packaging solutions.

- Enhanced Brand Image: Leveraging ESG efforts to improve public perception and attract responsible business partners.

Strategic Investments and Partnerships

CJ Logistics is strategically investing in its infrastructure, notably through the construction of significant distribution centers in the United States. For instance, in 2023, the company announced plans to build a new 1.1 million-square-foot fulfillment center in Texas, a move aimed at bolstering its North American logistics capabilities and catering to the growing e-commerce market.

These investments are complemented by the formation of key partnerships. Collaborations with technology providers are crucial for integrating advanced solutions like AI and automation into their operations, thereby increasing efficiency and reducing costs. By teaming up with other logistics players, CJ Logistics can broaden its service portfolio and gain access to new markets, solidifying its competitive edge.

These strategic moves are designed to enhance CJ Logistics' overall market position and service offerings.

- Expansion in the US: Construction of large distribution centers, like the Texas facility announced in 2023, signifies a commitment to strengthening its North American presence.

- Technological Integration: Partnerships with tech firms are key to adopting AI and automation for operational improvements.

- Service Portfolio Enhancement: Collaborations with other logistics companies allow for broader service offerings and market reach.

CJ Logistics' expansive global network, operating in 34 countries and 271 cities, is a cornerstone of its strength, particularly for international freight forwarding and cross-border e-commerce. The company's strategic market expansions, notably in the US, India, and Saudi Arabia, are solidifying this global presence and opening doors for specialized logistics services like cold chain solutions.

A significant competitive advantage stems from CJ Logistics' deep commitment to technological advancement, integrating AI and robotics to drive operational efficiency and cost savings, exemplified by its smart warehouse automation initiatives. Further investments in autonomous driving and data analytics are crucial for optimizing routes and improving demand forecasting accuracy.

The company offers a comprehensive suite of logistics services, from contract logistics and express delivery to international freight forwarding and e-fulfillment, catering to diverse industry needs. This broad capability was underscored in 2023 by strong growth in contract logistics, driven by demand for integrated supply chain solutions.

CJ Logistics' dedication to sustainability, with a target of carbon neutrality by 2050, enhances its brand image and appeals to environmentally conscious clients. Proactive eco-friendly transportation, advanced waste management, and sustainable packaging solutions are key components of this ESG focus.

| Strength Area | Key Initiatives/Data | Impact |

|---|---|---|

| Global Network | Operations in 34 countries, 271 cities. Expansion in US, India, Saudi Arabia. | Enhanced international freight forwarding and cross-border e-commerce capabilities. |

| Technology Adoption | AI, robotics, smart warehouses, autonomous driving, data analytics. | Improved operational efficiency, cost reduction, optimized routing, better demand forecasting. |

| Service Breadth | Contract logistics, express delivery, freight forwarding, e-fulfillment. | Ability to serve diverse customer needs across multiple industries. |

| Sustainability | Carbon neutrality target by 2050, eco-friendly transport, waste management. | Improved brand image, attraction of ESG-conscious partners and clients. |

What is included in the product

Analyzes CJ Logistics’s competitive position through key internal and external factors, detailing its strengths in global networks and technology, weaknesses in certain regional markets, opportunities in e-commerce growth, and threats from intense competition and regulatory changes.

Offers a clear, actionable framework to identify and address CJ Logistics' core challenges and opportunities, alleviating strategic planning bottlenecks.

Weaknesses

CJ Logistics saw its operating profit fall by 15.2% in the first quarter of 2025, reaching KRW 105.3 billion. This decline was largely driven by higher expenses related to securing new parcel and e-commerce orders, alongside investments in new growth strategies. Such figures highlight a key weakness in cost control during expansion phases.

CJ Logistics has experienced a noticeable downturn in its domestic parcel delivery market share within South Korea. This trend indicates that the competitive landscape is becoming more crowded, with rivals actively challenging CJ Logistics' established position.

While specific 2024 or early 2025 market share figures are still emerging, industry analysts noted in late 2023 that the gap between CJ Logistics and its closest competitors was narrowing. For instance, reports suggested that while CJ Logistics held a significant portion of the market, its growth rate was slower compared to some emerging players who were rapidly expanding their operations and customer base through aggressive pricing and service enhancements. This suggests a need for strategic adjustments to counter the increasing competitive pressures and retain its leadership.

CJ Logistics' parcel and e-commerce operations are particularly vulnerable to shifts in consumer sentiment, which often deteriorates during economic downturns. This sensitivity means that a weakening economy can directly translate to lower cargo volumes and, consequently, reduced revenue for the company, making sustained growth a challenge.

Operational Ramp-up Costs for New Initiatives

CJ Logistics' expansion into new markets and the launch of innovative services, while promising for revenue growth, come with substantial upfront operational costs. These ramp-up expenses, covering everything from new facility setup to technology integration and staff training, can temporarily suppress profit margins. For instance, the company's significant investments in expanding its electric vehicle fleet and smart logistics infrastructure in 2024, estimated to be in the hundreds of millions of dollars, are expected to weigh on short-term profitability.

Effectively managing these initial outlays is paramount. Failing to control these costs can hinder the long-term financial viability of new ventures and delay the realization of their full potential. CJ Logistics must closely monitor expenditure during these critical phases to ensure a smooth and financially sound integration of its strategic initiatives, aiming to achieve profitability within a reasonable timeframe.

- High initial investment in new technology and infrastructure for service expansion.

- Increased labor and training costs associated with onboarding new operational capabilities.

- Potential for temporary dips in profitability due to unrecovered ramp-up expenses.

Vulnerability to Sluggish Retail Sales

CJ Logistics' reliance on the health of the retail sector presents a notable weakness. When consumer spending slows, it directly impacts the volume of e-commerce and parcel deliveries the company handles. This can create significant headwinds, particularly during economic downturns.

For instance, during the first half of 2024, global retail sales growth has shown signs of moderation compared to previous periods, influenced by persistent inflation and interest rate concerns. This trend directly translates to potentially lower parcel volumes for logistics providers like CJ Logistics.

- Dependence on Consumer Spending: A significant portion of CJ Logistics' revenue is directly linked to the volume of goods purchased by consumers.

- Economic Sensitivity: Sluggish retail sales, often a symptom of broader economic slowdowns, can lead to reduced demand for logistics services.

- E-commerce Volatility: While e-commerce is a growth area, its performance is still tethered to consumer confidence and disposable income.

CJ Logistics faces challenges with rising operational costs, particularly in securing new orders and investing in growth. This was evident in the first quarter of 2025, where operating profit declined by 15.2% to KRW 105.3 billion due to these increased expenses.

The company is also experiencing a narrowing gap in its domestic parcel delivery market share, indicating intensified competition. While specific 2024 market share data is still solidifying, reports from late 2023 showed a slowdown in CJ Logistics' growth rate compared to emerging rivals employing aggressive strategies.

Furthermore, CJ Logistics' business is highly sensitive to consumer spending patterns, making it vulnerable during economic downturns. Moderating global retail sales growth in early 2024, influenced by inflation and interest rates, directly impacts parcel volumes and revenue.

Significant upfront investments in new technologies and infrastructure, such as its electric vehicle fleet and smart logistics expansion in 2024, are expected to temporarily suppress profit margins, with these outlays estimated in the hundreds of millions of dollars.

| Financial Metric | Q1 2025 (KRW Billion) | Year-over-Year Change |

|---|---|---|

| Operating Profit | 105.3 | -15.2% |

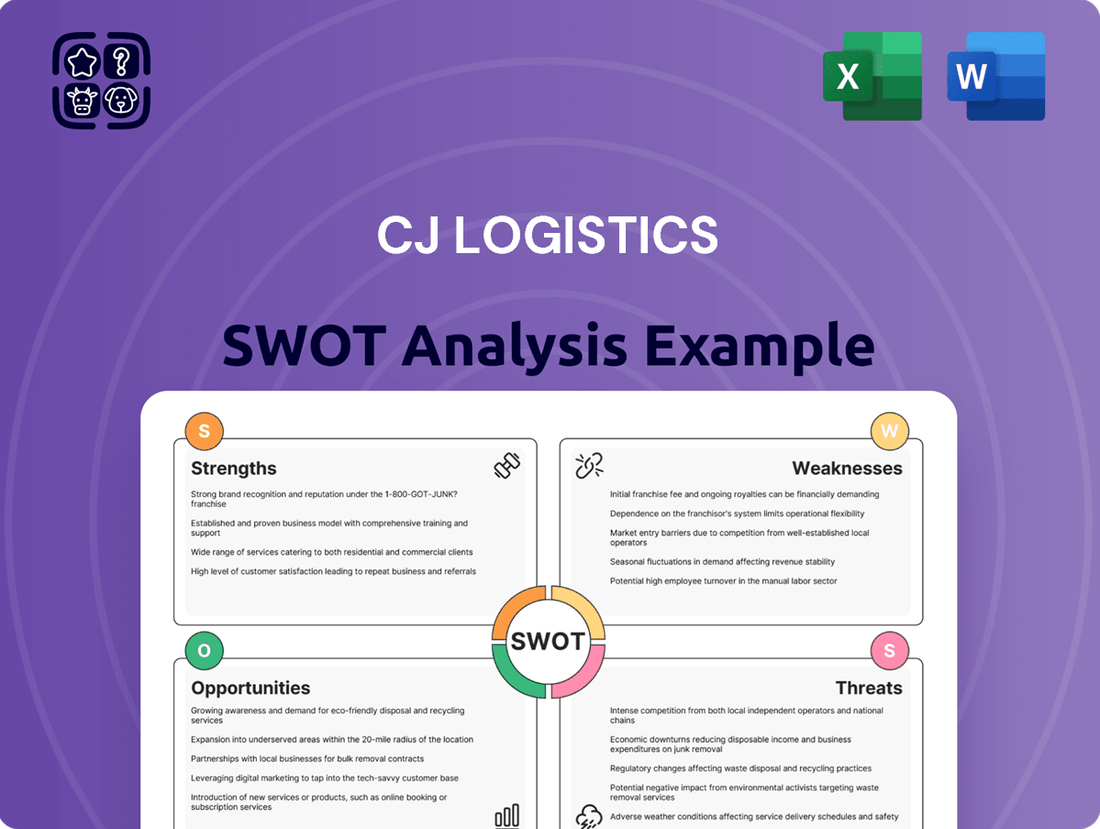

Preview the Actual Deliverable

CJ Logistics SWOT Analysis

This is the actual CJ Logistics SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full CJ Logistics SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This preview reflects the real CJ Logistics document you'll receive—professional, structured, and ready to use. It details key factors influencing the company's market position and future growth.

Opportunities

The e-commerce boom, especially across international borders, is a prime opportunity for CJ Logistics. Global e-commerce sales are projected to reach $7.7 trillion by 2025, a significant increase from previous years. This trend directly benefits logistics providers capable of handling complex cross-border shipments efficiently.

CJ Logistics' strategic investments in advanced e-fulfillment solutions and its continually expanding global network are well-positioned to leverage this growth. The company's focus on providing integrated logistics services for online retailers allows them to capture a larger share of the market driven by increasing consumer demand for fast and reliable international deliveries.

CJ Logistics sees significant opportunities in expanding into key global markets. Strategic entry into high-growth regions such as the United States, India, and Saudi Arabia presents a clear path to boosting revenue and capturing greater market share. For instance, the US logistics market alone was projected to reach over $2 trillion in 2024, offering substantial room for growth.

The company's plan to establish new distribution centers and e-commerce hubs in these target areas is crucial for solidifying its international presence. India's e-commerce market, expected to grow rapidly, and Saudi Arabia's Vision 2030 initiatives, which prioritize logistics infrastructure, are particularly attractive. This expansion directly supports their goal of becoming a leading global logistics provider.

CJ Logistics can significantly boost efficiency by embracing advanced technologies like AI and automation. For instance, implementing AI-powered route optimization in 2024 could slash fuel costs by an estimated 10-15%, a crucial saving in today's volatile energy market. This also translates to faster delivery times, a key differentiator for customers.

Further integration of automated sorting systems in warehouses, a trend gaining momentum in 2025, promises to reduce labor costs and minimize errors. By automating repetitive tasks, CJ Logistics can reallocate human resources to more value-added activities, improving overall service quality and customer satisfaction.

Data analytics plays a vital role in demand forecasting, allowing for better inventory management and resource allocation. Accurate forecasting, refined through machine learning models in 2024, can prevent stockouts and reduce waste, directly impacting profitability and enhancing the company's competitive edge in the logistics sector.

Demand for Specialized Logistics and Cold Chain

The growing need for specialized logistics, particularly cold chain solutions for pharmaceuticals and other temperature-sensitive products, presents a significant opportunity. This niche market is expanding rapidly, driven by advancements in healthcare and the global food supply chain.

CJ Logistics is well-positioned to capitalize on this trend due to its existing investments and capabilities in specialized logistics. The company has been actively developing its cold chain infrastructure and expertise.

For instance, the global cold chain market was valued at an estimated $200 billion in 2023 and is projected to reach over $350 billion by 2030, showing a compound annual growth rate of approximately 8.5%. This growth is fueled by increasing pharmaceutical exports and the demand for frozen foods.

- Growing Pharmaceutical Sector: Increased production and global distribution of vaccines, biologics, and other temperature-sensitive medications require robust cold chain capabilities.

- Food Industry Demand: The expansion of the frozen food market and the need to maintain freshness and safety in perishable goods logistics are key drivers.

- Technological Advancements: Innovations in temperature monitoring, reefer containers, and warehouse management systems enhance the efficiency and reliability of cold chain operations.

- Regulatory Compliance: Stringent regulations governing the transport of pharmaceuticals and food products necessitate specialized logistics providers like CJ Logistics.

Sustainability-Driven Business Development

The increasing global focus on sustainability and the circular economy presents a significant opportunity for CJ Logistics to pioneer new business ventures. This includes developing specialized logistics solutions for emerging sectors like battery recycling, a critical component of the electric vehicle ecosystem. Furthermore, the transportation of hydrogen energy, a key element in decarbonization efforts, offers another avenue for growth.

CJ Logistics' existing commitment to achieving carbon neutrality by 2050 positions the company favorably to capitalize on these trends. This strategic alignment with environmental, social, and governance (ESG) principles can attract environmentally conscious customers and investors.

- Expansion into Battery Recycling Logistics: The global battery recycling market is projected to reach $15.7 billion by 2030, according to market research firm Precedence Research, offering a substantial opportunity for specialized logistics providers.

- Hydrogen Energy Transportation Services: As nations invest in hydrogen infrastructure, the demand for safe and efficient transportation of hydrogen is expected to surge. For instance, South Korea aims to increase its hydrogen production capacity significantly by 2030, creating a domestic market for related logistics.

- Leveraging Carbon Neutrality Commitment: CJ Logistics' dedication to carbon neutrality can serve as a competitive differentiator, attracting businesses seeking to reduce their own carbon footprints through their supply chain partners.

CJ Logistics is strategically positioned to benefit from the burgeoning global e-commerce market, with sales expected to hit $7.7 trillion by 2025. By expanding its international network and investing in e-fulfillment, the company can capture significant growth from cross-border online shopping. Furthermore, targeting high-growth regions like the US, with its logistics market exceeding $2 trillion in 2024, and India, alongside Saudi Arabia's infrastructure development, provides clear avenues for market share expansion.

Threats

CJ Logistics is navigating an increasingly competitive landscape, facing significant pressure from both established domestic players and emerging global logistics powerhouses. This intensified rivalry, particularly in the fast-paced e-commerce sector, threatens to dilute market share and squeeze profit margins through aggressive pricing strategies. For instance, the rise of rapid delivery services by competitors like Coupang in South Korea, which aims for same-day or next-day delivery for a vast array of goods, forces CJ Logistics to constantly invest in its own network and technology to remain relevant and maintain customer loyalty.

Global supply chains remain vulnerable, with ongoing geopolitical tensions and economic uncertainty posing significant threats. For instance, the Red Sea shipping disruptions in early 2024 led to rerouting and increased transit times, directly impacting logistics costs and delivery schedules for companies like CJ Logistics. These events can inflate operational expenses due to longer routes and higher insurance premiums, alongside potential delays that damage customer trust and business continuity.

A prolonged economic downturn, potentially extending through 2025, could significantly curb consumer spending, directly impacting parcel delivery volumes. For instance, if global GDP growth forecasts for 2025, projected by many institutions to be around 2.5-3%, falter due to recessionary pressures, CJ Logistics would likely see a reduction in e-commerce shipments, a key revenue driver.

Fluctuating consumer sentiment, often tied to inflation and job security concerns, can lead to unpredictable demand patterns. Should consumer confidence indices, which have shown volatility in recent years, continue to decline, it would make forecasting and resource allocation more challenging for CJ Logistics, potentially increasing operational inefficiencies and impacting profitability.

Rising Operational Costs and Inflationary Pressures

CJ Logistics faces significant threats from rising operational costs and persistent inflationary pressures. The price of fuel, a critical component of logistics, has seen considerable volatility. For instance, global average diesel prices, a key indicator for the industry, remained elevated throughout much of 2024, impacting transportation expenses. Similarly, labor costs are on an upward trend due to a tight labor market and demands for higher wages, which directly affects warehousing and delivery personnel expenses. Furthermore, the investment required for adopting new technologies, such as automation and advanced tracking systems, adds to the capital expenditure burden.

These increasing costs, combined with broader economic inflation, directly squeeze profit margins. Companies like CJ Logistics must navigate the delicate balance between expanding their service offerings and maintaining cost control. This challenge is particularly acute in a competitive market where price sensitivity is high among clients. The ongoing need to absorb or pass on these higher expenses while remaining competitive presents a continuous operational hurdle.

Specific cost pressures include:

- Fuel: Global oil prices, which directly influence diesel costs, have experienced fluctuations, with Brent crude oil averaging around $80-$85 per barrel in early 2024, impacting freight rates.

- Labor: Wage growth in the logistics sector has been observed across many regions, driven by a shortage of skilled drivers and warehouse staff.

- Technology Investment: The push for efficiency necessitates investment in areas like AI-powered route optimization and automated warehousing, which carry substantial upfront and ongoing costs.

- Inflation: Broader inflationary trends in 2024 have increased the cost of goods and services across the supply chain, from packaging materials to facility maintenance.

Cybersecurity Risks and Data Integrity

CJ Logistics' growing dependence on digital infrastructure, including cloud services and sophisticated logistics management systems, significantly elevates its exposure to cybersecurity threats. A successful cyberattack could lead to substantial operational disruptions, impacting delivery schedules and supply chain efficiency. For example, in 2023, the global logistics sector saw a notable increase in ransomware attacks, with some incidents causing multi-day service interruptions.

The integrity of the vast amounts of data handled by CJ Logistics, from customer information to shipment tracking, is also a critical concern. Data breaches not only pose privacy risks but can also lead to financial losses through regulatory fines and reputational damage. The estimated cost of a data breach for companies globally averaged $4.35 million in 2023, according to IBM's Cost of a Data Breach Report.

- Increased Vulnerability: As digital transformation accelerates, the attack surface for cyber threats expands.

- Operational Disruption: System outages or ransomware attacks can halt critical logistics operations.

- Data Breach Impact: Compromised sensitive data can result in significant financial penalties and loss of customer trust.

- Reputational Damage: Security incidents can severely tarnish CJ Logistics' brand image in the competitive market.

Intensified competition, especially from e-commerce giants like Coupang, forces continuous investment to maintain market share and customer loyalty, potentially squeezing profit margins. Global supply chain disruptions, exemplified by the Red Sea shipping issues in early 2024, increase operational costs and delivery times. Economic downturns and fluctuating consumer sentiment, linked to inflation and job security, can reduce parcel volumes and create forecasting challenges.

Rising operational costs, including volatile fuel prices and increasing labor wages, directly impact profitability, requiring careful cost management. Furthermore, significant cybersecurity threats to digital infrastructure and data integrity pose risks of operational disruption, financial penalties, and reputational damage, with the global average cost of a data breach reaching $4.35 million in 2023.

| Threat Category | Specific Example/Impact | Relevant Data Point (2023-2025) |

| Competition | E-commerce rivalry | Coupang's aggressive expansion in South Korea |

| Supply Chain Disruption | Geopolitical tensions | Red Sea shipping delays (early 2024) |

| Economic Factors | Recessionary pressures | Projected global GDP growth around 2.5-3% for 2025 (subject to downturns) |

| Operational Costs | Fuel and labor inflation | Brent crude oil averaging $80-$85/barrel (early 2024); observed wage growth in logistics |

| Cybersecurity | Data breaches and ransomware | Global average data breach cost: $4.35 million (2023) |

SWOT Analysis Data Sources

This CJ Logistics SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and data-driven understanding of the company's strategic position.