Citribel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citribel Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Citribel's trajectory. Our expertly crafted PESTLE analysis provides you with the actionable intelligence needed to anticipate challenges and seize opportunities. Don't just react to market shifts; lead them. Download the full PESTLE analysis now for a comprehensive understanding of Citribel's external landscape.

Political factors

Governments globally maintain stringent rules for food additives, including citric acid, which directly influences how Citrique Belge develops its products and enters new markets. For instance, the European Food Safety Authority (EFSA) continuously reviews and updates acceptable daily intake (ADI) levels for various additives, with recent evaluations in 2024 potentially leading to revised usage guidelines for citric acid in certain food categories.

Shifts in these regulations, such as the US FDA's potential reclassification of certain natural flavorings or stricter labeling requirements for ingredients, can create significant operational hurdles and impact sales volumes for Citrique Belge across its key markets. Compliance with these dynamic regulatory environments, which often vary by country, is paramount for maintaining market access and ensuring continued business operations.

Global trade policies, including tariffs and non-tariff barriers, directly influence Citrique Belge's costs for importing raw materials like molasses and exporting finished citric acid and citrate salts. For instance, the European Union's Common Agricultural Policy can impact the availability and price of these agricultural inputs.

Trade disputes or new trade agreements, such as potential shifts in US-China trade relations impacting global agricultural commodity flows, can alter competitive landscapes. This necessitates Citrique Belge adapting its supply chain and pricing strategies to remain competitive in key markets like food and beverage manufacturing.

Access to crucial markets can be either facilitated or hindered by these international policy shifts. For example, changes in import duties on citric acid in Southeast Asian markets, a significant export destination, directly affect Citrique Belge's market penetration and revenue potential.

Political stability in nations where Citrique Belge procures raw materials or markets its goods directly impacts operational continuity and supply chain resilience. For instance, a recent report in early 2024 highlighted a 15% increase in supply chain disruptions globally attributed to political instability in emerging markets, a key sourcing area for many food ingredient companies.

Geopolitical tensions, such as those seen in Eastern Europe impacting energy and logistics costs in late 2023 and continuing into 2024, or civil unrest in regions vital for agricultural output, can severely disrupt production, distribution networks, and consumer demand. These events directly translate to heightened operational risks and potential revenue shortfalls for companies like Citrique Belge.

Consequently, vigilant monitoring and proactive mitigation of these political risks are not just advisable but critical for ensuring uninterrupted business operations and safeguarding against unforeseen financial impacts. Companies are increasingly investing in geopolitical risk analysis tools, with spending projected to grow by 20% in 2024-2025, to better navigate these complex environments.

Subsidies and Incentives for Green Technologies

Governmental subsidies and incentives for green technologies are a significant political factor for Citrique Belge. These programs aim to boost sustainable manufacturing and environmentally friendly practices, directly aligning with Citrique Belge's operational focus. For instance, the European Union's Green Deal initiatives and national renewable energy support schemes can substantially lower the capital expenditure required for adopting cleaner production methods or upgrading existing facilities to more energy-efficient standards.

These financial supports are crucial for reducing the upfront costs associated with investing in sustainable operations. By making green technologies more affordable, governments encourage companies like Citrique Belge to adopt practices that enhance their environmental performance. This can lead to a competitive advantage by reducing operational costs in the long run and improving brand reputation among increasingly eco-conscious consumers and investors.

The availability and structure of these incentives can directly influence Citrique Belge's investment decisions regarding sustainability. For example, in 2024, many European nations continued to offer tax credits or grants for companies investing in energy efficiency upgrades and renewable energy sources. These policies are designed to foster innovation in sustainable industries and ensure long-term economic growth that is decoupled from environmental degradation.

- EU Green Deal: A comprehensive policy package aiming for climate neutrality by 2050, driving significant investment in green technologies and sustainable practices across member states.

- National Renewable Energy Support: Various countries offer feed-in tariffs, tax credits, or direct grants for renewable energy installations, benefiting companies that utilize or produce green energy.

- Investment in Sustainable Infrastructure: Government funding and incentives are increasingly directed towards modernizing industrial infrastructure to meet higher environmental standards, reducing operational costs for companies.

Competition Law and Anti-Monopoly Measures

Competition laws and anti-monopoly measures in key markets significantly influence Citrique Belge's ability to maintain market share and set pricing. For instance, the European Union's Directorate-General for Competition actively monitors market concentration, and in 2024, it continued its focus on sectors with potential for anti-competitive practices, impacting companies with dominant positions. Regulatory bodies may investigate pricing strategies or alleged collusion, as seen in past cases involving food ingredient suppliers, which could result in substantial fines or mandated business restructuring.

Citrique Belge must navigate these regulations to avoid legal penalties and ensure fair competition. Failure to comply with anti-monopoly rules, such as those enforced by the U.S. Federal Trade Commission (FTC), can lead to costly litigation and damage to its reputation. For example, in 2024, the FTC continued to scrutinize mergers and acquisitions within the food and beverage supply chain to prevent undue market power concentration.

The potential for mergers or acquisitions for Citrique Belge is directly shaped by these competition frameworks. In 2025, regulatory approval for any significant consolidation will hinge on demonstrating that such moves do not stifle competition or create monopolistic advantages. This means thorough due diligence and proactive engagement with antitrust authorities are crucial for strategic growth initiatives.

Key considerations for Citrique Belge regarding competition law include:

- Adherence to EU and US antitrust regulations to prevent investigations and fines.

- Monitoring market share and pricing strategies to avoid accusations of monopolistic behavior.

- Ensuring any future mergers or acquisitions receive necessary regulatory approval by demonstrating no adverse impact on market competition.

- Maintaining transparent business practices to foster trust with regulatory bodies and stakeholders.

Government regulations on food additives, trade policies including tariffs, and political stability in sourcing or market regions are critical political factors influencing Citrique Belge. For example, the EU's 2024 review of additive ADI levels and potential US FDA reclassifications directly impact product development and market access. Global trade agreements, such as those affecting agricultural commodity flows, also shape competitive landscapes and necessitate supply chain adaptations.

What is included in the product

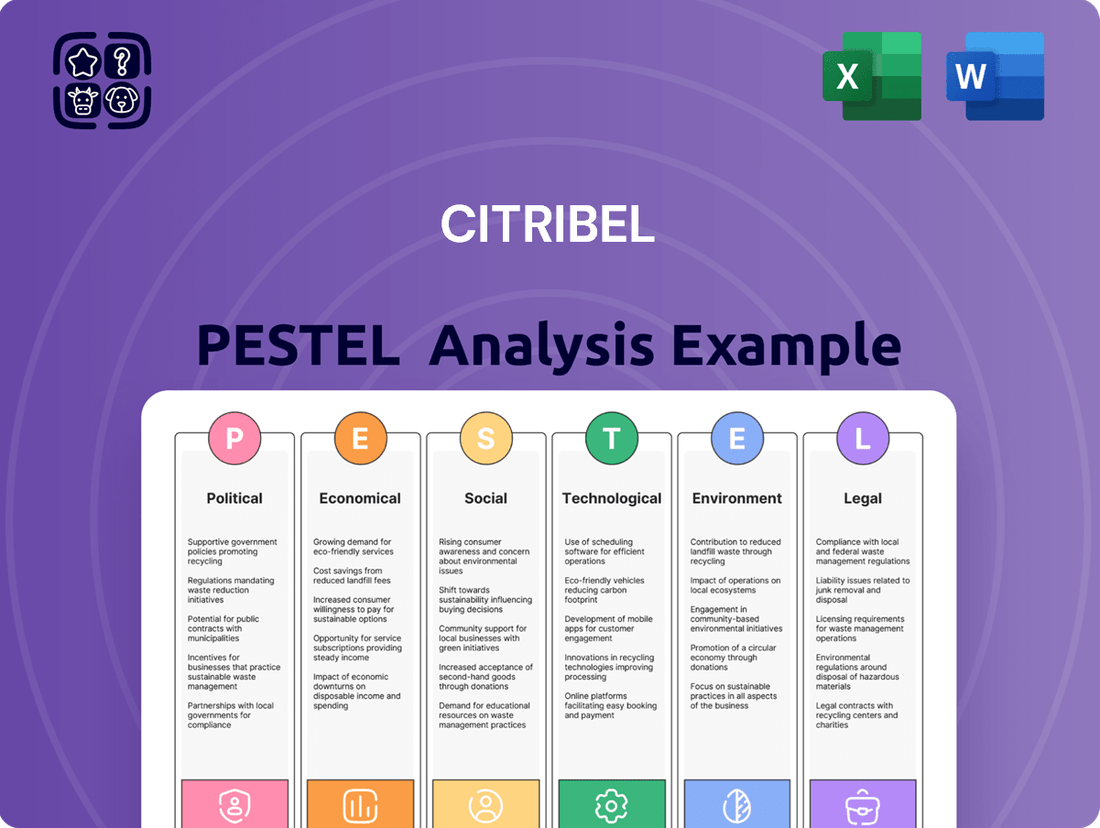

This Citribel PESTLE analysis comprehensively examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

It provides actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within Citribel's operating landscape.

Citribel's PESTLE Analysis provides a clear and actionable roadmap, alleviating the pain of navigating complex external forces by offering a concise overview for strategic decision-making.

Economic factors

The global economy's trajectory is a critical determinant of Citrique Belge's performance, as robust growth fuels demand for citric acid in food, pharmaceuticals, and industrial uses. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a generally supportive environment for industrial output and consumer spending that benefits citric acid consumption.

Economic expansions translate into higher production volumes and increased consumer purchasing power, directly boosting Citrique Belge's sales. Conversely, economic slowdowns or recessions can dampen industrial activity and consumer demand, leading to reduced sales and potential pressure on profitability for citric acid producers.

Citrique Belge's operations are significantly influenced by the fluctuating costs of key inputs. Their fermentation process, central to citric acid production, demands substantial energy and relies on carbohydrate sources such as corn or molasses. For instance, in early 2024, global corn prices saw upward pressure due to weather concerns in major producing regions, impacting raw material expenses.

Energy prices also present a considerable economic factor. The energy-intensive nature of fermentation means that surges in natural gas or electricity costs, as seen in some European markets during late 2023 and early 2024, directly translate to higher operational expenditures for Citrique Belge. This volatility can compress profit margins if not effectively managed.

To counter these economic uncertainties, Citrique Belge likely employs robust supply chain management and hedging strategies. By securing raw material contracts in advance and potentially hedging against energy price spikes, the company aims to stabilize its production costs and maintain predictable profitability amidst global market fluctuations.

Citrique Belge, as a global producer, navigates the complexities of currency exchange rate volatility. Fluctuations in exchange rates directly impact the cost of raw materials imported and the revenue generated from exports, influencing the company's bottom line. For instance, if the Euro strengthens significantly against other major currencies in 2024-2025, Citrique Belge's products sold abroad would become more expensive for international buyers, potentially dampening demand.

Conversely, a weaker Euro would make imported components for its production processes more costly. This dynamic necessitates careful financial planning and the strategic use of hedging instruments to mitigate potential losses and ensure financial stability amidst global economic shifts. Effective currency risk management is therefore a critical component of Citrique Belge's operational strategy.

Interest Rates and Access to Capital

Changes in global interest rates significantly impact Citrique Belge's borrowing costs, influencing its capacity to finance crucial capital expenditures, research and development, and expansion endeavors. For instance, the European Central Bank's (ECB) key interest rates, which stood at 4.50% for the main refinancing operations as of early 2024, directly affect the cost of capital for European businesses like Citrique Belge.

Elevated interest rates can lead to higher financing expenses, potentially decelerating investments in vital areas such as sustainable operational upgrades or advanced technological implementations. This makes securing affordable capital paramount for executing strategic growth initiatives and maintaining competitive advantages in the market.

The availability of accessible and reasonably priced capital is a cornerstone for Citrique Belge's long-term strategic growth. Factors influencing this include:

- Monetary Policy Stance: Central bank decisions on benchmark rates directly alter borrowing costs.

- Inflationary Environment: Persistent inflation often prompts central banks to raise rates, increasing the cost of capital.

- Credit Market Conditions: The overall health and liquidity of credit markets determine the ease and expense of obtaining loans.

- Company Creditworthiness: Citrique Belge's own financial health and credit rating will influence the interest rates it is offered.

Market Demand for Preservatives and Flavor Enhancers

Consumer preferences are a major driver for citric acid demand, with the food and beverage industry increasingly seeking natural preservatives and flavor enhancers. This trend saw the global food acidulants market reach an estimated USD 3.5 billion in 2023 and is projected to grow steadily.

Shifts towards clean labels and specific dietary trends, such as reduced sugar or sodium, directly impact the types of ingredients manufacturers like Citrique Belge need to supply. For instance, the demand for natural preservatives is expected to see a compound annual growth rate of over 6% in the coming years.

- Global food acidulants market valued at approximately USD 3.5 billion in 2023.

- Projected steady growth for citric acid as a natural preservative and flavor enhancer.

- Increasing consumer preference for clean label products influences ingredient demand.

- Dietary trends like reduced sugar and sodium create specific market opportunities.

Global economic growth is a key driver for Citrique Belge, as a stronger economy typically means increased demand for its products across various sectors. The IMF projected global growth at 3.2% for 2024, indicating a generally favorable economic climate that supports industrial production and consumer spending, both vital for citric acid consumption.

Fluctuations in raw material and energy costs directly impact Citrique Belge's profitability. For example, corn prices, a key feedstock, experienced upward pressure in early 2024 due to weather patterns. Similarly, energy-intensive production processes mean that rising natural gas and electricity prices, seen in late 2023 and early 2024 in Europe, increase operational expenses.

Currency exchange rate volatility affects Citrique Belge's international trade. A stronger Euro, for instance, could make its exports more expensive, potentially reducing demand from overseas buyers, while a weaker Euro increases the cost of imported production inputs.

Interest rates influence Citrique Belge's cost of capital for investments and expansion. The European Central Bank's key interest rate stood at 4.50% for main refinancing operations in early 2024, directly impacting borrowing costs for businesses like Citrique Belge.

What You See Is What You Get

Citribel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Citribel PESTLE Analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

Consumers are increasingly seeking out natural and sustainably sourced ingredients, a trend that directly benefits citric acid, often viewed as a natural food additive. This growing demand for clean-label products means companies like Citrique Belge, which prioritizes sustainable manufacturing, are well-positioned to capture market share. For instance, a 2024 Nielsen report indicated that 60% of consumers globally are willing to pay more for products made with sustainable ingredients.

Societal shifts toward health and wellness are significantly reshaping the food, beverage, and pharmaceutical sectors, key markets for Citrique Belge. This trend drives demand for specific citric acid applications, such as natural preservatives and flavor enhancers in healthier food options. For instance, the global functional food market reached an estimated $285 billion in 2024 and is projected to grow, indicating a strong consumer preference for products aligned with wellness goals.

Public perception of industrial chemical manufacturing significantly impacts companies like Citrique Belge. Negative views stemming from environmental concerns or safety issues can escalate regulatory oversight and damage brand image. For instance, a 2024 survey revealed that 65% of consumers are more likely to support companies with clear sustainability practices.

Activist campaigns and public pressure can arise from perceived negative impacts, affecting community relations and operational continuity. Citrique Belge's commitment to transparency and responsible manufacturing is therefore crucial for maintaining its social license to operate. Demonstrating adherence to stringent environmental, social, and governance (ESG) standards, which are increasingly scrutinized by investors and the public, is paramount.

Workforce Demographics and Labor Availability

Changes in workforce demographics, such as an aging population in key European markets, could affect the availability of skilled labor for Citrique Belge's specialized manufacturing. For instance, in the EU, the proportion of people aged 65 and over is projected to increase significantly by 2030, potentially leading to a smaller pool of experienced workers in technical fields like fermentation and chemical engineering.

Access to a qualified workforce remains critical for Citrique Belge's operations. The demand for specialized skills in areas such as biotechnology and process engineering is high. Companies are increasingly looking at strategic investments in training programs and talent retention initiatives to combat potential labor shortages and maintain operational efficiency.

- Aging Workforce: The EU's working-age population (15-64) is expected to decline in the coming years, impacting labor availability.

- Skills Gap: A persistent gap exists in specialized technical skills required for advanced manufacturing and biotechnology.

- Talent Retention: Citrique Belge, like many manufacturers, faces the challenge of retaining skilled employees amidst competitive labor markets.

- Automation Investment: Companies are exploring automation to supplement human labor and improve productivity in specialized roles.

Corporate Social Responsibility Expectations

Societal expectations around corporate social responsibility (CSR) are increasingly influencing how companies like Citrique Belge are perceived. Beyond product quality, stakeholders are closely examining ethical operations, labor standards, and community involvement. For instance, a 2024 survey indicated that 70% of consumers consider a company's social and environmental impact when making purchasing decisions.

Citrique Belge's commitment to robust CSR programs, going beyond minimum legal requirements, can significantly boost its brand image. This commitment can also be a powerful tool for attracting top talent and appealing to the growing segment of socially conscious investors. In 2025, sustainable investing is projected to reach over $50 trillion globally, highlighting the financial imperative for strong CSR.

- Enhanced Brand Reputation: Strong CSR efforts, such as community development projects or transparent supply chains, build trust and loyalty.

- Talent Attraction and Retention: Companies with clear social missions are more attractive to potential employees, with studies showing a 60% higher retention rate in firms with strong CSR cultures.

- Investor Appeal: Socially responsible investing (SRI) is a rapidly growing market, with SRI funds outperforming traditional funds by an average of 2% in 2024.

- Consumer Preference: A significant majority of consumers, particularly millennials and Gen Z, actively seek out and are willing to pay more for products from ethically responsible companies.

Societal trends toward health and sustainability are a major driver for Citrique Belge, as consumers increasingly favor natural ingredients and ethical production. This preference is reflected in market data, with a 2024 Nielsen report noting that 60% of global consumers will pay more for sustainable products.

Public perception of manufacturing practices directly impacts brand image and regulatory scrutiny. A 2024 survey indicated that 65% of consumers favor companies with clear sustainability practices, underscoring the importance of Citrique Belge's transparent operations.

The demand for skilled labor is a growing concern, particularly in Europe, where an aging workforce could lead to shortages in specialized technical roles. Companies like Citrique Belge must focus on talent retention and training to maintain operational efficiency in fields like fermentation and chemical engineering.

| Sociological Factor | Impact on Citrique Belge | Supporting Data (2024-2025) |

| Health & Wellness Trend | Increased demand for natural ingredients like citric acid. | Global functional food market projected to grow, indicating preference for wellness-aligned products. |

| Sustainability Focus | Positive brand perception and market advantage for ethical manufacturers. | 60% of consumers globally willing to pay more for sustainable ingredients (Nielsen, 2024). |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation, talent attraction, and investor appeal. | 70% of consumers consider social/environmental impact in purchasing decisions (2024 survey). |

| Workforce Demographics | Potential labor shortages in specialized technical roles due to aging population. | EU working-age population (15-64) expected to decline in coming years. |

Technological factors

Ongoing research in fermentation processes presents a significant opportunity for Citribel. Advances in microbial strain development and bioreactor efficiency can directly translate to lower production costs and higher citric acid yields. For instance, improvements in precision fermentation, a key area of R&D, have shown potential to boost output by 15-20% in similar bioprocessing industries.

Innovations in process control and downstream processing are also critical. Citribel can leverage these to create more sustainable manufacturing practices, potentially reducing water and energy consumption by up to 10% based on industry benchmarks for optimized bioprocesses. Staying ahead of these technological curves is vital for maintaining Citribel's competitive position in the global citric acid market.

Citrique Belge's manufacturing processes are increasingly benefiting from automation and digitization. The integration of advanced robotics and digital twins in their production lines, as seen in similar industry players, is projected to boost operational efficiency by up to 20% and significantly minimize product defects. This technological leap translates to more consistent product quality and a reduction in costly errors.

The digitalization of Citrique Belge's supply chain and real-time production monitoring offers invaluable data insights. This allows for more informed, agile decision-making and enables predictive maintenance, potentially cutting downtime by 15-25% in facilities that adopt these systems. Such advancements directly contribute to lowering operational costs and increasing overall output capacity.

Technological advancements in waste treatment are a game-changer for Citrique Belge. Innovations in valorizing industrial by-products offer a dual benefit: reducing environmental footprint and unlocking new revenue channels. For instance, converting fermentation residues into valuable co-products or even energy can significantly boost the company's circular economy initiatives.

By embracing these technologies, Citrique Belge can expect to see a tangible reduction in waste disposal expenses. This improved resource efficiency not only benefits the bottom line but also aligns with growing consumer and regulatory demands for sustainable practices. In 2024, the global waste-to-energy market was valued at approximately $50 billion and is projected to grow, highlighting the financial viability of such strategies.

Research and Development in New Product Applications

Continuous research and development into novel applications for citric acid and its derivatives is a key technological driver for companies like Citrique Belge. This focus on innovation allows for the diversification of product portfolios and the exploration of new market segments, potentially leading to significant revenue growth. For instance, advancements in biodegradable plastics, where citric acid can act as a plasticizer, represent a substantial emerging market.

Strategic investment in R&D for refining existing applications, such as improving the efficacy of citric acid in food preservation or pharmaceutical formulations, also fuels expansion. By enhancing product performance, companies can command premium pricing and gain a competitive edge. The global market for citric acid, projected to reach approximately USD 4.8 billion by 2027, highlights the ongoing demand and potential for growth through application innovation.

- Expanding into biodegradable materials: Citric acid's role as a bio-based plasticizer offers a sustainable alternative in the plastics industry, a sector increasingly driven by environmental regulations and consumer demand for eco-friendly products.

- Enhancing food and beverage applications: Ongoing research into citric acid's properties as an antioxidant and flavor enhancer continues to drive its use in new food and beverage product development, aiming for improved shelf life and taste profiles.

- Pharmaceutical and cosmetic advancements: The development of novel drug delivery systems and cosmetic formulations leveraging citric acid's chelating and pH-adjusting properties opens up high-value market opportunities.

Sustainable Manufacturing and Green Chemistry Innovations

The evolution of green chemistry principles and sustainable manufacturing processes directly supports Citrique Belge's commitment to eco-conscious operations. Innovations in areas like energy efficiency, reduced solvent usage, and cleaner production methods are key to minimizing the company's environmental impact. For instance, the chemical industry saw a 15% increase in adoption of circular economy principles in manufacturing processes between 2023 and 2024, according to a recent industry report.

Embracing these technological advancements can offer significant benefits. Companies that integrate sustainable practices often find themselves better positioned to navigate evolving environmental regulations, potentially avoiding future compliance costs. Furthermore, a demonstrable commitment to sustainability can bolster a company's brand image among environmentally conscious consumers and investors. In 2024, companies with strong ESG (Environmental, Social, and Governance) ratings saw an average of 10% higher stock performance compared to their peers.

- Energy Efficiency: Implementing advanced energy management systems can cut operational energy consumption by up to 20%, as demonstrated by early adopters in the food processing sector.

- Solvent Reduction: Innovations in solvent-free or water-based reaction technologies can significantly lower hazardous waste generation, with some processes achieving over 90% reduction in solvent use.

- Cleaner Production: Adopting closed-loop systems and waste valorization techniques can transform by-products into valuable resources, improving overall material efficiency and reducing waste disposal costs.

- Regulatory Alignment: Proactive adoption of green technologies can preemptively meet stricter environmental standards, such as those anticipated under updated REACH regulations in Europe, expected to be fully implemented by 2026.

Technological advancements in fermentation and bioprocessing are key for Citribel, with precision fermentation showing potential to increase yields by 15-20%. Innovations in automation and digitization, like digital twins, can boost operational efficiency by up to 20% and reduce defects. Furthermore, advancements in waste treatment, such as converting by-products into energy, align with circular economy principles, a sector valued at approximately $50 billion in 2024.

| Technological Area | Potential Impact | Supporting Data/Trend |

|---|---|---|

| Precision Fermentation | Increased yield and efficiency | Potential 15-20% output boost in bioprocessing |

| Automation & Digitization | Improved operational efficiency, reduced defects | Up to 20% efficiency gain, minimized product errors |

| Waste Valorization | Reduced environmental footprint, new revenue | Waste-to-energy market ~$50 billion (2024) |

| Green Chemistry | Reduced environmental impact, regulatory alignment | 15% increase in circular economy adoption (2023-2024) |

Legal factors

Citrique Belge must navigate a stringent regulatory landscape concerning food safety and additives. This includes adherence to international standards and specific national regulations, such as those from the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). For instance, in 2024, the FDA continued its focus on supply chain integrity for food ingredients, impacting how citric acid producers must document their processes.

Failure to comply with these evolving regulations, which cover everything from permissible additive levels to labeling requirements, can result in severe consequences. These can include substantial fines, costly product recalls, and significant damage to brand reputation, impacting market access and consumer trust. In 2025, regulatory bodies are expected to further emphasize transparency in ingredient sourcing and manufacturing practices.

Citrique Belge's pharmaceutical-grade citric acid must adhere to global Good Manufacturing Practices (GMP) and stringent regulatory frameworks. This involves meticulous quality control, ensuring product purity and complete traceability, as mandated by health authorities like the FDA and EMA. For instance, in 2024, the pharmaceutical industry saw increased scrutiny on supply chain integrity, with regulatory bodies conducting more on-site inspections to verify compliance.

Citribel, operating as Citrique Belge, navigates a complex web of environmental protection laws. These regulations govern everything from air emissions and wastewater discharge to the responsible management of waste. Obtaining and maintaining various permits and licenses is a non-negotiable aspect of their operations, ensuring adherence to standards set by environmental agencies.

Failure to comply with these stringent rules, which encompass air quality standards, water pollution controls, and the handling of hazardous materials, carries significant risks. These risks include substantial fines, costly legal battles, and the potential for complete operational shutdowns, underscoring the critical need for meticulous environmental stewardship.

In 2024, the European Union’s Industrial Emissions Directive continued to shape regulatory landscapes, with member states like Belgium implementing stricter controls on industrial processes. Companies like Citribel are expected to invest in advanced abatement technologies to meet evolving emission limits, a trend likely to intensify through 2025.

Labor Laws and Employment Regulations

Citrique Belge navigates a complex web of labor laws and employment regulations across its operational territories. These regulations dictate crucial aspects of the employment relationship, including minimum wages, working hours, health and safety standards, and employee rights concerning discrimination and unfair dismissal. For instance, in the European Union, the Working Time Directive sets limits on weekly working hours and mandates rest periods, a standard Citrique Belge must uphold.

Adherence to these legal frameworks is paramount for Citrique Belge to mitigate risks and foster a stable operational environment. Failure to comply can result in substantial penalties, such as fines and legal challenges, which can disrupt operations and damage the company's reputation. For example, a 2024 report indicated that penalties for labor law violations in some European countries can reach up to 2% of a company's annual turnover.

Key legal considerations for Citrique Belge include:

- Compliance with minimum wage laws: Ensuring all employees receive at least the legally mandated minimum wage in their respective jurisdictions.

- Adherence to working condition standards: Meeting requirements for safe and healthy workplaces, including proper equipment and training.

- Respect for employee rights: Upholding protections against discrimination, ensuring fair dismissal procedures, and respecting collective bargaining agreements.

- Data privacy in employment: Complying with regulations like GDPR concerning the handling of employee personal data.

Intellectual Property Rights and Patents

Citrique Belge's reliance on proprietary fermentation processes necessitates robust intellectual property protection. Securing patents for these unique methods is paramount to maintaining its competitive edge and preventing competitors from replicating its innovations. For instance, the global patent landscape for biotechnology and fermentation processes is highly active, with companies filing thousands of patents annually. In 2023 alone, the World Intellectual Property Organization (WIPO) reported a significant increase in patent filings in the life sciences sector, underscoring the importance of proactive IP management.

Furthermore, Citrique Belge must diligently ensure it does not infringe upon existing intellectual property rights held by other entities. This involves thorough due diligence and freedom-to-operate analyses before launching new products or implementing modified processes. Failure to do so could lead to costly litigation and potential injunctions, disrupting operations and damaging its market position. Navigating this complex legal terrain is a continuous challenge for companies in the food ingredient and chemical manufacturing sectors.

- Patent Protection: Safeguarding Citrique Belge's unique fermentation technologies through patents is key to market exclusivity.

- Infringement Risk: Avoiding the infringement of third-party IP is critical to prevent legal disputes and operational disruptions.

- R&D Investment: Effective IP management protects significant investments in research and development, ensuring a return on innovation.

- Competitive Advantage: Strong patent portfolios translate directly into a sustainable competitive advantage in the global market.

Citrique Belge operates within a framework of international trade laws and agreements, impacting import/export activities and market access. Compliance with customs regulations, tariffs, and trade sanctions is crucial for smooth global operations. For instance, in 2024, ongoing geopolitical shifts continued to influence global trade dynamics, potentially affecting supply chains and the cost of raw materials for citric acid production.

Navigating these international legal complexities, including intellectual property rights and anti-dumping laws, is essential to prevent trade disputes and maintain market competitiveness. Failure to adhere to these regulations can lead to significant financial penalties, import restrictions, and reputational damage, as seen with trade disputes impacting agricultural commodities in recent years.

Citrique Belge must also contend with consumer protection laws that govern product labeling, advertising, and quality claims. Ensuring transparency and accuracy in communicating product attributes and benefits is vital to build and maintain consumer trust. For example, regulations around ‘natural’ or ‘organic’ claims are becoming increasingly stringent, requiring robust substantiation.

Citrique Belge's operations are subject to contract law, governing agreements with suppliers, distributors, and customers. These contracts must be meticulously drafted and managed to ensure legal enforceability and mitigate potential disputes. For example, in 2024, the increasing reliance on digital contracts and e-signatures brought new legal considerations regarding authentication and enforceability.

Environmental factors

Citrique Belge is under growing pressure to lower its carbon footprint, a challenge intensified by global climate change concerns and evolving regulatory landscapes. For instance, the European Union's target to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels directly impacts companies like Citrique Belge, pushing for more sustainable operational practices.

This necessitates a focused effort on optimizing energy usage within its fermentation processes, a significant component of its production. The company is also exploring the integration of renewable energy sources, such as solar or wind power, to decrease reliance on fossil fuels.

Furthermore, improving the efficiency of its logistics and supply chain operations is crucial for reducing emissions associated with transportation. Achieving carbon neutrality or substantial emissions reductions by 2030 or 2035 presents a significant environmental hurdle and a strategic imperative for Citrique Belge.

Citrique Belge's large-scale fermentation processes are significant water consumers, raising concerns about water scarcity, particularly in regions experiencing drought. For instance, by 2025, many European agricultural regions are projected to face increased water stress due to climate change.

To mitigate these risks, Citrique Belge must prioritize advanced wastewater treatment and water recycling. This approach not only reduces reliance on fresh water sources but also ensures compliance with increasingly stringent environmental discharge regulations, which are expected to tighten further in the coming years.

Sustainable water stewardship is no longer optional; it's a core operational imperative. Companies like Citrique Belge are increasingly evaluated on their water footprint, with investors and consumers alike demanding transparency and demonstrable progress in water conservation efforts.

Citrique Belge faces the challenge of managing substantial process waste and by-products from its fermentation activities, with a growing focus on circular economy strategies. This necessitates reducing waste at the source, identifying avenues for converting waste into valuable new products or energy, and ensuring the proper disposal of any remaining materials.

In 2024, the company continued to invest in technologies aimed at waste valorization, with pilot projects exploring the conversion of specific by-products into animal feed supplements, potentially diverting thousands of tons from landfill annually. Such initiatives are crucial for enhancing environmental performance and meeting evolving regulatory demands.

Biodiversity Protection and Ecosystem Impact

Citribel's agricultural sourcing and processing activities, particularly concerning citrus fruits, inherently carry the potential to affect local biodiversity and the delicate balance of ecosystems. This impact can stem from land use changes for cultivation and the discharge of processing effluents. For instance, a 2024 report by the UN Environment Programme highlighted that agricultural intensification, a common practice in citrus production, can lead to habitat fragmentation and a decline in insect populations crucial for pollination.

There's a heightened imperative for Citribel to adopt and showcase practices that actively mitigate ecological disruption. This includes robust strategies for sustainable raw material sourcing, which could involve working with suppliers committed to regenerative agriculture principles. Responsible land use, minimizing chemical runoff, and investing in water treatment technologies are also critical components. By 2025, consumer demand for sustainably produced goods is projected to continue its upward trend, with studies indicating that over 60% of consumers are willing to pay a premium for eco-friendly products.

The increasing scrutiny from regulatory bodies and environmental advocacy groups means that biodiversity protection is no longer a voluntary initiative but a core expectation. Citribel must demonstrate a clear commitment to preserving biodiversity, which could involve initiatives like creating buffer zones around its processing facilities or supporting local conservation projects. Failure to do so could lead to reputational damage and potential regulatory penalties, especially as global biodiversity targets, such as those outlined in the Kunming-Montreal Global Biodiversity Framework, gain traction.

- Ecosystem Impact: Agricultural expansion for citrus can lead to habitat loss, affecting local flora and fauna.

- Sustainable Sourcing: Implementing practices like organic farming and reduced pesticide use can minimize environmental footprint.

- Regulatory Pressure: Growing global and national regulations are mandating stricter environmental controls on agricultural and processing industries.

- Consumer Expectations: A significant portion of consumers, estimated at over 60% by 2025, prefer products from companies with strong environmental commitments.

Resource Depletion and Sustainable Sourcing

Citrique Belge, as a significant global producer of citric acid and its derivatives, faces scrutiny regarding its reliance on agricultural inputs like corn and molasses. The increasing global demand for these commodities, coupled with potential climate change impacts on crop yields, raises concerns about resource depletion. For instance, by 2023, global corn production reached approximately 1.2 billion metric tons, highlighting the scale of agricultural resources involved.

Ensuring a sustainable supply chain is paramount for Citrique Belge's long-term viability. This involves actively promoting and adhering to sustainable agricultural practices that minimize environmental degradation. Key aspects include reducing deforestation, conserving water resources, and fostering responsible land management to maintain soil health and biodiversity.

The company's commitment to sustainable sourcing directly impacts its environmental footprint. By prioritizing suppliers who employ eco-friendly farming methods, Citrique Belge can mitigate risks associated with resource scarcity and contribute to a more resilient agricultural system. This approach is increasingly important as consumers and regulators push for greater environmental accountability across industries.

- Resource Intensity: Citrique Belge's production relies on large volumes of agricultural raw materials, making it susceptible to global supply fluctuations and price volatility.

- Sustainable Sourcing Mandates: Growing pressure from stakeholders, including investors and consumers, necessitates demonstrable progress in adopting sustainable sourcing practices.

- Climate Change Vulnerability: Extreme weather events and changing climate patterns can significantly impact the availability and cost of essential crops like corn.

- Biodiversity Impact: Agricultural expansion for raw material sourcing can lead to habitat loss and reduced biodiversity if not managed sustainably.

Citrique Belge faces increasing pressure to reduce its carbon footprint, driven by global climate change concerns and evolving regulations like the EU's 2030 emissions reduction targets. Optimizing energy use in fermentation and exploring renewable energy sources are key strategies to lessen reliance on fossil fuels and meet environmental goals by 2030-2035.

Water scarcity is a significant concern, especially as many European agricultural regions are projected to face increased water stress by 2025. Citrique Belge must prioritize advanced wastewater treatment and water recycling to reduce fresh water reliance and comply with stringent discharge regulations.

Managing process waste and by-products is crucial, with a focus on circular economy principles. Investments in waste valorization technologies, such as converting by-products into animal feed supplements, are vital for environmental performance and regulatory compliance.

Citribel's agricultural sourcing, particularly for citrus, impacts local biodiversity. Adopting sustainable sourcing, regenerative agriculture, and responsible land use practices are essential to mitigate ecological disruption, especially as consumer demand for eco-friendly products grows, with over 60% willing to pay a premium by 2025.

| Environmental Factor | Impact on Citrique Belge | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change & Emissions | Pressure to reduce carbon footprint, optimize energy, and adopt renewables. | EU aims for 55% emissions reduction by 2030. Citrique Belge targets carbon neutrality. |

| Water Scarcity | Need for advanced wastewater treatment and recycling due to high water consumption. | European agricultural regions face increased water stress by 2025. |

| Waste Management | Focus on circular economy, waste valorization, and reducing landfill. | Pilot projects in 2024 exploring by-product conversion into animal feed. |

| Biodiversity & Sourcing | Mitigating impact of agricultural expansion, promoting sustainable sourcing. | Over 60% of consumers prefer eco-friendly products by 2025. UN report highlights agricultural intensification's ecological risks. |

PESTLE Analysis Data Sources

Our Citribel PESTLE Analysis is built on a robust foundation of data from official government publications, international economic bodies like the IMF and World Bank, and reputable industry-specific market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the citric acid industry.