Citribel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citribel Bundle

Citribel navigates a competitive landscape shaped by powerful buyer bargaining and the looming threat of substitutes. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Citribel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Citrique Belge's reliance on sugar molasses as a primary input for its fermentation process highlights a key area of supplier bargaining power. If the market for high-quality molasses is dominated by a small number of large suppliers, these entities can exert significant influence over pricing and availability. This concentration of suppliers is particularly impactful for Citrique Belge, given its specialized production method that centers on sugar molasses.

Citrique Belge's reliance on a specialized fermentation process for citric acid production means that changing raw material suppliers or feedstocks would likely involve substantial costs and operational overhauls. These high switching costs for raw materials bolster the bargaining power of current molasses suppliers, making it disruptive and financially burdensome for Citrique Belge to seek alternatives. For instance, in 2024, the global molasses market saw price fluctuations driven by agricultural yields and demand, with prices for some grades reaching upwards of $300 per ton, highlighting the financial impact of sourcing changes.

Citrique Belge's reliance on unique fermentation technology, which involves specialized microbial strains and advanced equipment, places it in a position where the suppliers of these critical inputs hold significant bargaining power. The proprietary nature of these components means that Citrique Belge may not have readily available alternatives, giving these suppliers considerable leverage.

For instance, if a key microbial strain is sourced from a single, highly specialized biotech firm, that firm can dictate terms, potentially increasing prices or limiting supply. This situation is exacerbated if the development and maintenance of these strains are costly and time-consuming, further entrenching the supplier's advantage. In 2024, the global biotechnology market for industrial enzymes, a related field, saw significant growth, with specialized inputs commanding premium pricing due to high R&D costs and intellectual property protection.

Impact of Raw Material Price Volatility

The bargaining power of suppliers is significantly influenced by the volatility of raw material prices. For a company like Citrique Belge, which relies on agricultural commodities, this volatility can directly impact production costs. For instance, the global market for corn, a key commodity that can affect sugar and molasses prices, experienced notable fluctuations throughout 2024. These shifts, often driven by weather patterns and geopolitical events, can create unpredictable cost structures.

This raw material price volatility directly translates into increased bargaining power for suppliers. When the cost of inputs like corn rises, as it did impacting citric acid production in late 2024 and early 2025, suppliers are in a stronger position to demand higher prices from buyers like Citrique Belge. This dynamic forces the company to absorb these increased costs or pass them on to consumers, affecting profitability and competitiveness.

- Corn prices showed significant upward trends in late 2024, impacting related commodity markets.

- Geopolitical tensions and adverse weather events were identified as key drivers of this volatility.

- Citrique Belge's production costs are directly exposed to these fluctuations in agricultural commodity markets.

- Increased input costs can empower suppliers to negotiate more favorable terms, potentially squeezing profit margins.

Supplier Forward Integration Threat

If key suppliers of molasses or other critical fermentation inputs were to integrate forward into citric acid production themselves, they would become direct competitors to Citribel. This potential shift would dramatically enhance their leverage.

The threat of suppliers integrating forward means they could choose to supply Citrique Belge only after fulfilling their own production needs, or at less favorable terms. For instance, a major molasses producer in Brazil, a significant global supplier, could decide to invest in fermentation facilities, directly entering the citric acid market.

- Supplier Forward Integration Threat: Suppliers could become direct competitors by producing citric acid themselves.

- Increased Bargaining Power: This integration would allow suppliers to prioritize their own production, potentially limiting supply to Citrique Belge.

- Market Dynamics: A forward-integrated supplier could dictate terms, impacting Citrique Belge's cost of goods and market positioning.

The bargaining power of suppliers for Citrique Belge is notably high due to the specialized nature of its key inputs, particularly sugar molasses and proprietary fermentation technology. High switching costs and the potential for supplier forward integration further amplify this power.

| Input Type | Supplier Concentration | Switching Costs | Supplier Bargaining Power |

|---|---|---|---|

| Sugar Molasses | Potentially low (depending on specific grade and region) | Moderate to High (due to quality requirements) | Moderate |

| Proprietary Microbial Strains | Very High (often single source) | Very High (R&D, validation) | Very High |

| Specialized Fermentation Equipment | Moderate to High | High (customization, integration) | High |

What is included in the product

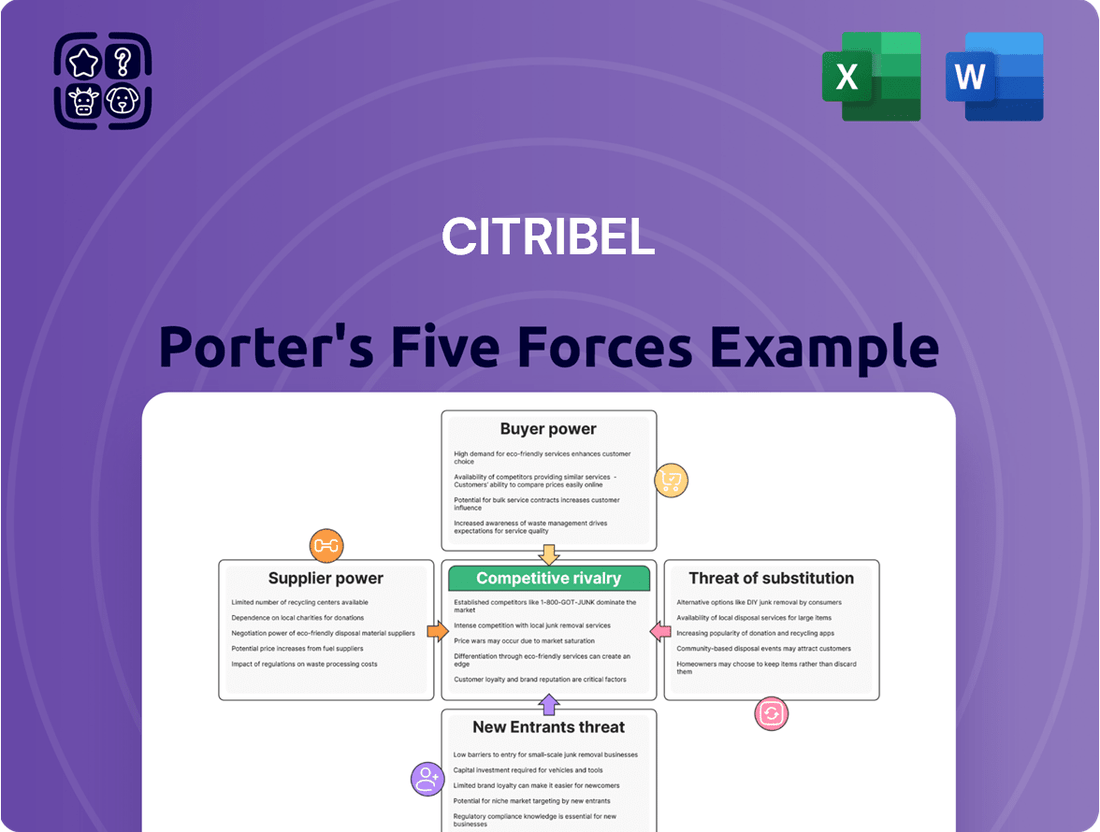

This Citribel Porter's Five Forces analysis meticulously examines the competitive intensity within its industry, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly visualize competitive intensity with a dynamic, interactive Porter's Five Forces model, highlighting key pain points for Citribel.

Customers Bargaining Power

Citrique Belge's diverse customer base, spanning the food and beverage, pharmaceutical, and industrial sectors, significantly moderates customer bargaining power. This broad reach means no single industry segment holds a disproportionate sway over Citrique Belge's revenue streams.

For instance, in 2024, the food and beverage sector likely represented a substantial portion of Citrique Belge's sales, but its diversified industrial and pharmaceutical clients prevented any one group from dictating terms. This wide distribution of sales across various end-markets reduces the company's reliance on any particular customer or industry, thereby diminishing the leverage individual customers can exert.

Citric acid plays a vital role in many customer products, serving as a key ingredient for preservation, flavoring, and acidulation. This essential function means customers often find it difficult and costly to switch to alternative ingredients without impacting their product's quality or stability. For instance, in the beverage industry, citric acid is fundamental for taste profiles and shelf life, making significant price increases a difficult pill to swallow for manufacturers.

For customers, switching from Citrique Belge's acidulants or preservatives often involves significant investment. Reformulating products can incur substantial research and development expenses, alongside the costs of obtaining new regulatory approvals and retooling production lines. These high switching costs effectively lock customers in, diminishing their motivation to explore alternative suppliers and thereby strengthening Citrique Belge's pricing power.

Customer Price Sensitivity in Commodity Segments

In segments where citric acid is a commodity, like many food and beverage applications, customers can be quite sensitive to price. This is often because these customers operate in highly competitive markets themselves, forcing them to scrutinize every cost. For Citrique Belge, this means that for standard grades of citric acid, they might face significant pressure to keep prices low.

The bargaining power of customers is amplified when they purchase in large volumes. For instance, major beverage manufacturers, who might be buying thousands of tons of citric acid annually, have considerable leverage. They can often negotiate better terms or switch suppliers if they find a more cost-effective alternative, directly impacting Citrique Belge’s profit margins.

- Customer Price Sensitivity: High in large-volume commodity applications, particularly in the food and beverage sector.

- Competitive Pressure on Customers: Intense competition in their own markets forces customers to seek lower input costs.

- Impact on Citrique Belge: Potential pressure on pricing for standard grades of citric acid, affecting profitability.

- Leverage of Large Buyers: Major purchasers can negotiate favorable terms or switch suppliers, increasing customer bargaining power.

Threat of Customer Backward Integration

The threat of customer backward integration for citric acid producers like Citribel is generally low, but not entirely absent. Large buyers, particularly in the food, beverage, and pharmaceutical industries, possess the financial muscle to explore producing citric acid themselves if it offers significant cost savings or strategic control. However, the complex fermentation technology and substantial upfront capital needed for efficient citric acid manufacturing act as significant deterrents.

For instance, setting up a modern citric acid fermentation plant can easily cost tens of millions of dollars. This high barrier to entry means that while a large food conglomerate might consider it, the economic viability is often questionable compared to sourcing from established suppliers. The specialized expertise required in biotechnology and chemical engineering further complicates in-house production for many potential customers.

- High Capital Investment: Establishing a citric acid production facility requires substantial capital expenditure, often exceeding $50 million for a medium-sized plant.

- Technological Expertise: The fermentation process for citric acid is scientifically complex, demanding specialized knowledge in microbiology and biochemical engineering.

- Economies of Scale: Existing citric acid manufacturers benefit from economies of scale, making their per-unit production costs lower than what a new entrant, even a large customer, could initially achieve.

- Market Volatility: Fluctuations in raw material prices (like molasses or corn steep liquor) and citric acid market prices can make the economics of backward integration unpredictable.

Customer bargaining power for Citrique Belge is moderated by its diverse client base across food, beverage, pharmaceutical, and industrial sectors. While price sensitivity is high in commodity applications, particularly for large-volume buyers in the food and beverage industry, the essential nature of citric acid and high switching costs for customers limit their leverage. The threat of backward integration is generally low due to the significant capital investment and specialized expertise required for citric acid production.

| Factor | Impact on Citrique Belge | 2024 Data/Trend |

| Customer Price Sensitivity | High for commodity grades, especially in food/beverage. | Global citric acid prices saw moderate fluctuations in 2024, influenced by raw material costs and demand from key sectors. |

| Switching Costs | Significant due to reformulation and regulatory hurdles. | Companies continued to prioritize product stability, making ingredient changes costly and time-consuming. |

| Volume Purchases | Large buyers possess considerable negotiation power. | Major beverage and food manufacturers often secured volume discounts, impacting supplier margins. |

| Backward Integration Threat | Low due to high capital and technical barriers. | No major backward integration events reported by large customers in 2024, with plant setup costs estimated to be $50M+. |

Preview the Actual Deliverable

Citribel Porter's Five Forces Analysis

This preview showcases the complete Citribel Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape that you will receive immediately after purchase. You're looking at the actual document, meaning no placeholder text or missing sections will be present in your downloaded file. This professionally formatted analysis is ready for your immediate use, providing all the insights you need to understand Citribel's market position.

Rivalry Among Competitors

The global citric acid market is highly competitive and fragmented, with a substantial share of production originating from Asia-Pacific, especially China. This intense competition puts pressure on pricing and margins for all participants.

Citrique Belge, being one of the few remaining European producers, navigates a landscape populated by both large multinational corporations and smaller regional competitors. In 2024, the global citric acid market was valued at approximately USD 3.8 billion, with Asia-Pacific accounting for over 60% of the production capacity.

Citric acid, particularly in its common granular and anhydrous forms, often behaves like a commodity. This means that when comparing different suppliers, price becomes a primary deciding factor for many buyers. This commodity nature fuels a competitive environment where producers frequently compete on price to attract customers and secure market share.

The intense focus on price can lead to aggressive price wars among citric acid manufacturers. For instance, in 2023, the global citric acid market experienced fluctuations driven by raw material costs and supply chain dynamics, directly impacting pricing strategies. Such price competition can significantly squeeze profit margins for companies within the industry.

The global production capacity for the relevant sector reached approximately 3.0 million tons in 2024. This substantial capacity can lead to intense competition.

The risk of overcapacity, or the addition of new production facilities, directly fuels competitive rivalry. When more product is available than demand can absorb, companies are often forced to lower prices to move inventory.

This downward pressure on pricing directly impacts profit margins for all players in the market. Companies with higher cost structures are particularly vulnerable in such an environment.

Technological Advancements and Differentiation

While fermentation remains the primary production method for citric acid, ongoing leaps in biotechnology and a growing emphasis on sustainable practices are creating significant opportunities for competitive differentiation. Companies that can leverage these advancements can gain a distinct edge.

Citrique Belge, for instance, has carved out a niche through its unique surface fermentation process. This method, coupled with a strong commitment to circular economy principles and waste reduction, allows them to stand out in a market where cost efficiency is often paramount.

The global citric acid market, valued at approximately USD 3.7 billion in 2023, is projected to grow at a CAGR of around 4.5% through 2030. This growth is fueled by increasing demand in the food and beverage, pharmaceutical, and detergent industries.

- Technological Innovation: Investments in advanced fermentation techniques, such as precision fermentation and metabolic engineering, can lead to higher yields and purer products.

- Sustainability Focus: Companies adopting eco-friendly production methods, reducing water usage, and minimizing waste are increasingly favored by environmentally conscious consumers and businesses.

- Product Diversification: Exploring novel applications for citric acid derivatives or offering specialized grades for specific industries can create unique market positions.

- Supply Chain Efficiency: Optimizing logistics and raw material sourcing through technology can reduce costs and improve responsiveness to market demands.

Regional Market Dynamics and Trade Policies

Regional market dynamics, including trade policies, directly shape the competitive landscape for Citrique Belge. For instance, anti-dumping duties imposed on citric acid imports from specific nations can alter sourcing strategies. In 2024, such duties, if implemented, would likely increase the cost of imported raw materials, potentially benefiting domestic producers or those with established supply chains outside the targeted regions.

These policy shifts can lead to a recalibration of production focus and market entry strategies for existing players and new entrants alike. Citrique Belge might see increased competition from local manufacturers who benefit from reduced import pressure, or it might need to adjust its own import strategies. For example, if the European Union were to implement new tariffs on citric acid from China, it could bolster the competitive position of European producers like Citrique Belge within the EU market.

- Trade Policy Impact: Anti-dumping duties can create a more favorable environment for domestic producers by increasing the cost of imported goods.

- Sourcing Adjustments: Companies may need to diversify their raw material suppliers to mitigate the impact of trade barriers.

- Production Shifts: Policies can incentivize companies to shift production to regions with more favorable trade agreements or lower tariffs.

- Competitive Landscape: Changes in trade policies can significantly alter the intensity of competition by affecting price points and market access.

Competitive rivalry in the citric acid market is fierce, driven by a fragmented supplier base and the commodity-like nature of the product, especially in its common forms. This leads to a strong emphasis on price as a key differentiator, often resulting in price wars that compress profit margins for all participants.

With a global production capacity of around 3.0 million tons in 2024 and over 60% of production capacity concentrated in Asia-Pacific, particularly China, Citrique Belge, a European producer, faces significant competition. The market, valued at approximately USD 3.8 billion in 2024, sees intense pressure from both large multinationals and smaller regional players, exacerbated by the risk of overcapacity.

Technological advancements and a growing demand for sustainable practices offer avenues for differentiation, allowing companies like Citrique Belge to distinguish themselves through unique production methods and eco-friendly commitments, thereby navigating the price-sensitive landscape.

Trade policies, such as anti-dumping duties, can significantly alter the competitive dynamics by influencing import costs and market access, potentially benefiting domestic producers and requiring strategic adjustments from companies like Citrique Belge.

| Metric | 2023 Data | 2024 Projection/Data | Key Trend |

|---|---|---|---|

| Global Citric Acid Market Value | USD 3.7 billion | USD 3.8 billion | Steady growth driven by demand in food, beverage, and pharmaceuticals. |

| Asia-Pacific Production Capacity Share | Over 60% | Over 60% | Dominance of Asian producers, particularly China, influencing global pricing. |

| Global Production Capacity | ~2.9 million tons | ~3.0 million tons | High capacity can lead to oversupply and intensified price competition. |

| Projected CAGR (2023-2030) | ~4.5% | ~4.5% | Consistent demand growth expected across key end-use industries. |

SSubstitutes Threaten

The threat of substitutes for citric acid is moderate. For many food and beverage applications, other organic acids like lactic acid and acetic acid, or even inorganic acids, can function as alternatives. For instance, in confectionery or dairy products, lactic acid might be chosen for its specific flavor profile or buffering capabilities. The decision often hinges on a balance between functional efficacy, cost-effectiveness, and the desired sensory outcome for the final product.

The growing consumer demand for 'clean label' products and natural ingredients directly fuels the market for natural preservatives, including citric acid. This trend presents a significant threat as consumers actively seek out products with fewer artificial additives.

However, this same trend also opens the door for alternative natural preservatives. Ingredients such as vinegar, rosemary extract, and various fruit extracts are increasingly being adopted, particularly within the food and beverage industry, directly competing with citric acid's market share.

For instance, the global natural preservatives market was valued at approximately USD 3.5 billion in 2023 and is projected to grow substantially, indicating a robust demand for these alternatives. This growth highlights the competitive pressure citric acid faces from a widening array of natural solutions.

In industrial settings, such as cleaning products or metal finishing, citric acid faces substitution threats from other chelating agents and descalers. While citric acid's biodegradability and non-toxic profile are advantageous, chemical alternatives are readily available, potentially impacting demand.

Technological Advancements in Formulation

Technological advancements in food formulation present a significant threat of substitutes for citric acid. Innovations in food technology could introduce novel ingredients or processes that reduce or entirely eliminate the need for citric acid in various applications. For instance, ongoing research into alternative food ingredients and preservation methods, such as natural antimicrobials or advanced processing techniques, could offer viable substitutes. In 2024, the global food ingredients market saw continued growth, with a particular focus on clean-label and natural alternatives, indicating a fertile ground for substitute development.

These evolving technologies directly impact citric acid demand by offering functional replacements. For example, the development of new acidity regulators or flavor enhancers that are not derived from fermentation processes could displace citric acid in beverages and confectionery. The market for natural preservatives is also expanding, potentially offering alternatives to citric acid's role in extending shelf life. This trend is supported by consumer demand for fewer artificial ingredients, pushing manufacturers to explore new formulation avenues.

- Emerging Natural Acidity Regulators: Research into plant-derived acids and fermentation byproducts offers potential replacements for citric acid in pH control and flavor enhancement.

- Advanced Preservation Technologies: Innovations in high-pressure processing and pulsed electric fields may reduce reliance on traditional acidulants like citric acid for microbial control.

- Clean-Label Ingredient Trends: Consumer preference for recognizable and natural ingredients fuels the search for substitutes that align with clean-label formulations.

- Enzyme-Based Solutions: Development in enzyme technology could lead to new methods for achieving desired flavor profiles and shelf stability, bypassing the need for citric acid.

Cost-Benefit Analysis of Substitutes

The threat of substitutes for Citribel is largely dictated by customers evaluating the cost-benefit trade-off. If alternative products offer similar functionality at a reduced price, or provide added advantages like simpler ingredient lists or more convenient preparation, consumers might shift their preferences. This is particularly true even when there are minor costs associated with switching.

For instance, in the beverage industry, consumers might consider switching from citric acid-based products to natural alternatives like lemon juice or vinegar if the perceived health benefits or cleaner labeling outweigh the slightly higher cost or potential processing adjustments. In 2024, the global market for natural food additives saw significant growth, with some segments expanding by over 6% year-over-year, indicating a growing consumer preference for such substitutes.

- Cost-Effectiveness: Customers will compare the price of Citribel against other acidulants or flavor enhancers. For example, if the price of citric acid rises significantly, consumers might look at malic acid or lactic acid, which can be cheaper in certain applications.

- Performance and Functionality: Substitutes are evaluated on how well they perform the same function, such as pH control, preservation, or flavor enhancement. A substitute that performs equally well or better, even at a similar price point, poses a threat.

- Consumer Preferences and Trends: Shifting consumer demand towards natural, organic, or 'clean label' products can drive the adoption of substitutes. For instance, the demand for beverages with fewer artificial ingredients might lead to a preference for natural acids over synthetic ones.

- Switching Costs: The ease or difficulty for a customer to switch to a substitute is crucial. If changing requires significant reformulation, new equipment, or retraining staff, the threat of that particular substitute is lower.

The threat of substitutes for citric acid is moderate, influenced by its versatile functionality and established use across industries. While direct replacements offering identical performance are few, a range of alternatives exist, particularly driven by clean-label trends and cost considerations.

In 2024, the global food additives market, a key sector for citric acid, continued to see innovation. For instance, the market for natural preservatives, a direct substitute category, was projected to reach over USD 5 billion by 2025, indicating a growing competitive landscape. This growth underscores the increasing adoption of alternatives like vinegar extracts and rosemary derivatives in food and beverage applications.

| Substitute Category | Key Function | Example Substitutes | Market Trend Impact |

|---|---|---|---|

| Organic Acids | Acidity regulation, flavor enhancement | Lactic acid, Malic acid, Acetic acid | Growing demand for natural alternatives |

| Natural Preservatives | Antimicrobial, shelf-life extension | Rosemary extract, Vinegar, Fruit extracts | Strong growth driven by clean-label demand |

| Industrial Chelating Agents | Metal ion sequestration, cleaning | EDTA, Gluconic acid | Availability of cost-effective chemical options |

Entrants Threaten

Establishing a large-scale citric acid production facility, particularly one employing advanced fermentation techniques similar to those used by major players, demands a significant upfront capital outlay. This includes substantial investment in land, specialized fermentation tanks, purification systems, and robust quality control equipment.

For instance, building a modern, efficient citric acid plant can easily cost tens of millions of dollars, with some estimates placing the figure for a world-scale facility well over $100 million. This high barrier to entry deters many potential new competitors from entering the market.

The need for specialized, high-capacity machinery and adherence to stringent environmental and safety regulations further inflates these initial costs. Consequently, only well-funded organizations or those with access to significant financial backing can realistically consider entering the citric acid production arena.

The intricate nature of citric acid production, especially through advanced fermentation techniques like surface fermentation employed by Citrique Belge, presents a significant hurdle for newcomers. This process demands a deep understanding of biochemical pathways, substantial investment in specialized research and development, and years of honed operational experience. For instance, the global citric acid market, valued at approximately USD 4.2 billion in 2023, is dominated by established players who have mastered these complex processes, making it difficult for new entrants to compete on cost and quality.

The citric acid market faces significant barriers to entry due to rigorous regulatory requirements, particularly for food and pharmaceutical grades. Obtaining approvals like Generally Recognized As Safe (GRAS) status in the United States or quantum satis in the European Union involves extensive testing and documentation, which can be a lengthy and expensive process for newcomers. For example, the FDA's GRAS notification process can take months to years and involve substantial investment in scientific studies and legal review, deterring potential entrants who lack the resources or expertise to navigate these complexities.

Established Distribution Channels and Customer Relationships

Established players like Citrique Belge benefit from deeply entrenched distribution channels and strong, long-standing customer relationships across a wide array of industries. This makes it incredibly difficult for newcomers to gain a foothold.

For instance, in 2024, the global citric acid market, where Citribel operates, saw major players leverage extensive distribution networks that took years, even decades, to build. New entrants would need to invest heavily and patiently to replicate this reach and secure comparable customer loyalty.

Building these essential customer relationships and distribution networks from the ground up is a time-consuming and resource-intensive endeavor for any potential new entrant. This barrier significantly deters new competition.

Consider the following challenges for new entrants:

- Established Distribution Networks: Accessing efficient logistics and warehousing infrastructure, often secured through long-term contracts by incumbents.

- Customer Loyalty: Overcoming existing supplier relationships built on trust, reliability, and tailored solutions, which are hard to displace.

- Market Penetration Costs: The significant financial outlay required to establish brand recognition and secure initial market share against established brands.

- Regulatory Hurdles: Navigating complex food and beverage industry regulations and certifications, which incumbents have already mastered.

Economies of Scale and Cost Advantages of Incumbents

Major global producers of citric acid, such as ADM and Cargill, leverage significant economies of scale, resulting in substantially lower per-unit production costs. For instance, in 2023, these large players operated vast production facilities, allowing them to spread fixed costs over higher output volumes, a feat difficult for new entrants to replicate quickly.

Citrique Belge, with its extensive operational history spanning over a century, has undoubtedly refined its processes to achieve considerable cost advantages. This long-standing optimization, coupled with established supply chain efficiencies, creates a high barrier to entry, making it challenging for nascent companies to compete on price against Citrique Belge's established cost structure.

New entrants face the daunting task of matching the cost efficiencies derived from established players' scale and experience. For example, the capital investment required to build a citric acid production facility comparable in scale to those of major incumbents can easily run into hundreds of millions of dollars, a significant hurdle for any new competitor.

The threat of new entrants is therefore moderated by the substantial cost advantages enjoyed by existing, large-scale producers. These advantages are not easily overcome, requiring new companies to secure massive upfront investment and achieve rapid production scaling to even approach competitive cost levels.

The citric acid market presents a formidable challenge for new entrants due to the immense capital required for establishing production facilities, often exceeding $100 million for world-scale plants. This high initial investment, coupled with the need for specialized equipment and adherence to stringent regulations, significantly limits the pool of potential competitors.

Furthermore, navigating complex regulatory landscapes, such as obtaining GRAS status, demands extensive resources and expertise, creating a substantial barrier for newcomers. Established players also benefit from deeply entrenched distribution networks and customer loyalty, making market penetration a costly and time-consuming endeavor for any new entrant aiming to compete with firms like Citrique Belge.

| Barrier | Description | Estimated Cost/Time Impact |

|---|---|---|

| Capital Investment | Building a modern citric acid plant | $100+ million for a world-scale facility |

| Regulatory Compliance | Obtaining food/pharma grade certifications (e.g., GRAS) | Months to years, significant scientific/legal costs |

| Distribution & Relationships | Establishing logistics and customer loyalty | Years of investment and effort |

| Economies of Scale | Matching per-unit production costs of incumbents | Requires massive upfront investment and rapid scaling |

Porter's Five Forces Analysis Data Sources

Our Citribel Porter's Five Forces analysis is built upon a foundation of data from industry-specific market research reports, financial statements of key players, and public company filings. We also incorporate insights from trade publications and expert interviews to provide a comprehensive view of the competitive landscape.