Choice Hotels Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choice Hotels Bundle

Choice Hotels operates in a dynamic lodging landscape, facing moderate threats from new entrants and intense rivalry among existing players. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this competitive arena.

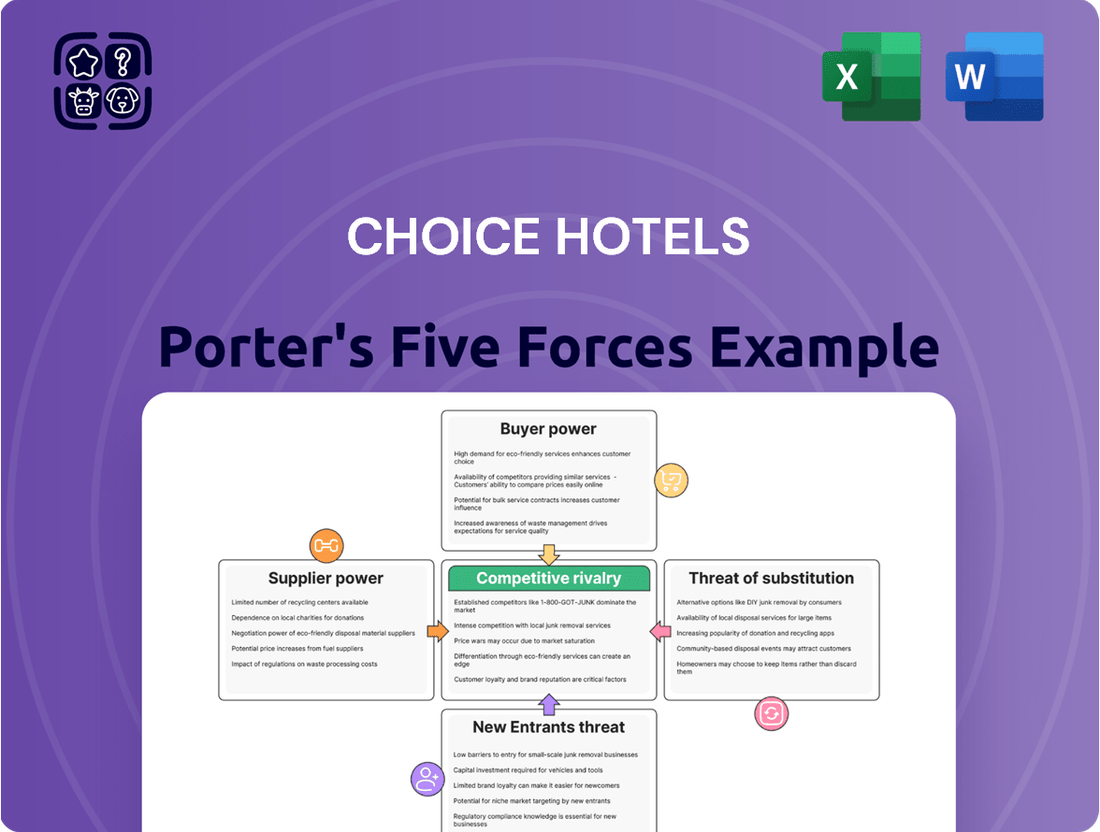

The full Porter's Five Forces analysis reveals the real forces shaping Choice Hotels’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The hospitality sector, including companies like Choice Hotels, depends on numerous suppliers for everything from food and linens to critical technology. When a few major suppliers control a specific market segment, they gain significant leverage. This concentration allows them to potentially dictate terms and increase prices for Choice Hotels and its franchisees, impacting profitability. For instance, in 2024, the global hotel technology market saw consolidation, with a few key players offering integrated property management systems, potentially increasing their bargaining power.

The bargaining power of suppliers for Choice Hotels is significantly influenced by switching costs. If it's difficult or expensive for Choice Hotels or its franchisees to change suppliers, those suppliers gain more leverage. This difficulty can stem from the need for extensive re-training of staff, substantial investment in new technology or reservation systems, or significant operational disruptions during the transition.

For standardized supplies, like basic amenities, switching costs are generally low, limiting supplier power. However, for specialized technology, such as their proprietary reservation and property management systems, the costs and complexity of switching can be considerably higher. For instance, integrating a new central reservation system might require months of development, testing, and franchisee training, creating a strong incentive to stick with existing providers, thereby increasing supplier bargaining power.

Suppliers offering highly differentiated or proprietary products and services can wield significant bargaining power. For Choice Hotels, this could manifest if they rely on unique hotel technology platforms or specialized construction materials that are not easily substituted. For instance, a supplier providing a proprietary property management system that is deeply integrated into Choice Hotels' operations would have more leverage than a provider of generic cleaning supplies.

Choice Hotels' dependence on specific technology providers for its core reservation systems and ongoing operational support can indeed grant those suppliers a degree of leverage. This is particularly true if switching costs are high or if the technology is critical for maintaining brand standards and guest experience across its diverse portfolio of brands, which includes Comfort Inn, Quality Inn, and Sleep Inn.

However, for the majority of its supply needs, Choice Hotels likely encounters fairly commoditized offerings. This means many suppliers provide goods and services that are largely interchangeable, such as standard linens, basic furniture, or widely available food and beverage items. In these instances, the bargaining power of suppliers is considerably diminished, as Choice Hotels can readily switch to alternative providers if prices become unfavorable.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into hotel operations is generally low for Choice Hotels. This is primarily because the capital investment and distinct business model required to run a hotel chain are significant barriers. For instance, a major supplier of hotel amenities or linens would face substantial hurdles in acquiring properties, managing operations, and marketing a hotel brand effectively.

However, if a supplier were to overcome these barriers and successfully launch its own hotel brand, its bargaining power would undoubtedly increase. This would allow them to potentially dictate terms more aggressively to hotel groups like Choice Hotels, or even compete directly for market share.

In 2024, the hospitality industry continued to see consolidation and investment, but the core competencies of suppliers remain focused on their specific product or service lines rather than hotel management. For example, while some large hospitality service providers might offer integrated solutions, a direct move into owning and operating multiple hotel brands by a typical supplier is rare. This limited forward integration capability keeps their bargaining power in check.

- Limited Forward Integration: Most suppliers to the hospitality sector, such as linen providers or food and beverage distributors, lack the capital and expertise to operate hotel chains.

- High Barriers to Entry: Establishing and managing a hotel brand requires significant investment in real estate, marketing, and operational know-how, which are typically outside a supplier's core business.

- Focus on Core Competencies: Suppliers generally concentrate on excelling in their specific product or service offerings, rather than diversifying into the complex hotel management business.

Importance of Choice Hotels to Suppliers

The bargaining power of suppliers for Choice Hotels is influenced by the company's scale. As a major player in the hospitality industry, Choice Hotels, through its extensive network of franchisees, represents a significant customer for many suppliers of goods and services, ranging from linens and toiletries to technology and food supplies. This considerable purchasing volume provides Choice Hotels with leverage, potentially reducing the suppliers' ability to dictate terms and prices.

For example, in 2023, Choice Hotels reported system-wide revenue of approximately $2.2 billion. This substantial financial footprint means that many suppliers rely on Choice Hotels for a significant portion of their business. Consequently, suppliers are often incentivized to offer competitive pricing and favorable contract terms to secure and maintain these valuable relationships, thereby diminishing their individual bargaining power.

- Scale of Operations: Choice Hotels' global presence and the sheer volume of its operations mean it's a critical client for many suppliers.

- Purchasing Power: The collective purchasing power of Choice Hotels and its franchisees allows for negotiation of better terms and prices, reducing supplier leverage.

- Supplier Dependence: For many suppliers, Choice Hotels represents a substantial portion of their revenue, making them more amenable to negotiation.

The bargaining power of suppliers for Choice Hotels is generally moderate, primarily due to the company's significant scale and purchasing volume. While some specialized technology providers may hold more sway, the majority of suppliers deal with commoditized goods, limiting their leverage. For instance, in 2023, Choice Hotels' system-wide revenue of approximately $2.2 billion underscores its importance as a customer, encouraging suppliers to offer competitive terms.

| Factor | Impact on Choice Hotels | Supporting Data (2023/2024) |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized tech; Low for commoditized goods. | Global hotel tech market consolidation in 2024 increased power of key players. |

| Switching Costs | High for proprietary systems; Low for standard supplies. | Integrating new reservation systems can take months and significant investment. |

| Product Differentiation | High for unique tech/materials; Low for standard amenities. | Proprietary property management systems offer suppliers more leverage. |

| Forward Integration Threat | Low due to high barriers to entry in hotel operations. | Suppliers typically focus on core competencies, not hotel management. |

| Purchasing Volume | Lowers supplier power significantly. | $2.2 billion in system-wide revenue in 2023 creates substantial negotiation leverage. |

What is included in the product

This analysis of Choice Hotels' competitive landscape reveals the intense rivalry among existing hotel chains, the significant bargaining power of customers, and the moderate threat posed by new entrants and substitute lodging options.

Instantly visualize the competitive landscape of the hotel industry, identifying key threats and opportunities that impact Choice Hotels' strategic planning.

Customers Bargaining Power

Customers in the hospitality sector, especially those choosing economy and midscale options where Choice Hotels is a major player, are highly attuned to price. This sensitivity means they actively compare rates across different hotel brands and booking platforms, directly impacting Choice Hotels' capacity to increase prices without risking customer loss. For instance, in 2024, the average daily rate (ADR) for economy hotels saw modest growth, but intense competition kept significant hikes in check.

The internet and the proliferation of online travel agencies (OTAs) have dramatically increased the information available to hotel customers. This ease of access allows for effortless comparison of prices, amenities, and reviews across numerous brands, including Choice Hotels.

This transparency directly empowers customers, as they can rapidly identify the most competitive offers and alternative lodging options. For instance, in 2024, platforms like Booking.com and Expedia continue to facilitate this comparison, making it harder for any single hotel chain to command premium pricing without offering superior value.

Switching costs for hotel guests are typically quite low. This means a customer can easily move from one hotel brand to another without facing significant financial penalties or practical hurdles. For instance, a traveler looking for a room in 2024 can readily compare prices and amenities across multiple hotel chains or even consider alternative lodging options like Airbnb with minimal effort.

The ease of comparison and booking through numerous online travel agencies further diminishes any switching friction. A guest might book a room at a Hilton one week and a Marriott the next, with no lingering commitment or loss. This low barrier encourages price sensitivity and a constant search for better value, directly impacting Choice Hotels' ability to retain customers without competitive pricing or superior offerings.

Bargaining Leverage of Large Customer Groups

While individual travelers might have limited sway, large corporate clients, tour operators, and significant group bookings represent substantial revenue streams for Choice Hotels. These larger entities can wield considerable bargaining power, often leading to negotiated rates and customized packages to secure their business. For instance, a major corporation booking hundreds of room nights annually can demand preferential pricing, impacting Choice Hotels' revenue per available room (RevPAR).

The bargaining power of these large customer groups is a critical factor in the hotel industry. Consider that in 2024, corporate travel spending was projected to reach over $1.4 trillion globally, highlighting the significant leverage these clients possess. Choice Hotels, like its competitors, must strategically manage these relationships to balance profitability with client retention.

- Volume-Based Negotiations: Large clients can negotiate lower per-room rates due to the sheer volume of their bookings.

- Package Deals: Offering bundled services like meeting spaces, catering, and accommodation can be a strategy to retain large corporate accounts.

- Loyalty Programs: Tiered loyalty programs can incentivize repeat business from frequent corporate travelers, albeit with associated costs.

- Competitive Bidding: Major clients often engage in competitive bidding processes, forcing hotel chains to offer their best possible rates.

Impact of Loyalty Programs

Choice Hotels' loyalty programs, such as Choice Privileges, are designed to lock in customers and diminish their bargaining power. By offering points for stays and exclusive perks like room upgrades or late checkout, the company aims to increase the cost and inconvenience for guests considering other hotel chains. This strategy directly tackles customer bargaining power by making switching less attractive.

However, the influence of these loyalty programs is not absolute. Customers still wield significant power, especially when they can easily compare prices and find deals through Online Travel Agencies (OTAs). In 2024, the competitive landscape for hotel bookings remains dynamic, with OTAs playing a crucial role in price discovery and often offering packages or discounts that can outweigh the benefits of loyalty points for price-sensitive travelers. Furthermore, the rise of alternative accommodations continues to present a compelling choice for consumers, further fragmenting the market and empowering customers to seek value beyond traditional hotel loyalty schemes.

- Loyalty Program Goal: Choice Hotels uses its Choice Privileges program to increase switching costs for customers through points accumulation and exclusive benefits, thereby reducing their bargaining power.

- Customer Bargaining Power Factors: Despite loyalty programs, customers retain significant power due to the ease of price comparison on Online Travel Agencies (OTAs) and the availability of alternative accommodations.

- 2024 Market Dynamics: The hotel market in 2024 continues to see OTAs offering competitive deals that can challenge the value proposition of hotel loyalty programs for price-conscious consumers.

Customers possess considerable bargaining power due to the ease of price comparison across numerous platforms and the low switching costs associated with the hotel industry. This allows them to readily seek out the best value, impacting Choice Hotels' pricing flexibility.

While individual travelers have limited leverage, large corporate clients and group bookings represent a significant force. These entities can negotiate preferential rates, directly influencing Choice Hotels' revenue per available room.

Choice Hotels' loyalty program aims to mitigate customer power by increasing switching costs. However, the prevalence of Online Travel Agencies (OTAs) and alternative accommodations in 2024 continues to empower price-sensitive consumers, presenting a challenge to loyalty-driven retention.

| Factor | Impact on Choice Hotels | 2024 Relevance |

|---|---|---|

| Price Sensitivity | Limits pricing power; necessitates competitive rates. | High, with continued focus on value by travelers. |

| Information Availability (OTAs) | Increases transparency, empowering comparison shopping. | Extremely high; OTAs remain dominant booking channels. |

| Switching Costs | Low, allowing easy movement between brands. | Consistently low, reinforcing price sensitivity. |

| Corporate/Group Buyers | Significant leverage for negotiated discounts. | Crucial for volume; corporate travel spending remains substantial. |

Same Document Delivered

Choice Hotels Porter's Five Forces Analysis

This preview showcases the exact Choice Hotels Porter's Five Forces Analysis you will receive immediately after purchase, providing a comprehensive understanding of competitive forces within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, offering actionable intelligence without any placeholders or surprises.

Rivalry Among Competitors

The hotel industry is incredibly fragmented, featuring a vast array of competitors ranging from global giants to local establishments. Choice Hotels, for instance, contends with major players like Marriott International and Hilton Worldwide, but also with other significant brands such as Wyndham Hotels & Resorts. This broad competitive landscape means Choice must differentiate itself across various market segments.

A slower industry growth rate often fuels more intense competition as companies battle for a larger slice of a limited market. While the global hotel industry anticipates continued growth through 2024 and 2025, with projections suggesting a healthy expansion, this doesn't entirely eliminate competitive pressures. Certain hotel segments or geographic areas might still face significant rivalry, especially if they are mature or experiencing slower localized demand.

The hotel industry, including companies like Choice Hotels, operates with substantial fixed costs. These include expenses for properties, ongoing maintenance, and a core staff that must be maintained regardless of occupancy levels. This inherent cost structure puts significant pressure on hotels to achieve high occupancy rates.

This pressure to cover fixed costs often translates into aggressive pricing strategies. Hotels may lower room rates, especially during off-peak seasons or periods of low demand, to fill rooms. This can intensify competition among brands vying for the same customer base, particularly when demand dips, as seen in the post-pandemic recovery phases where occupancy rates fluctuated.

Brand Identity and Differentiation

Choice Hotels manages a wide array of brands, from budget-friendly options like Comfort Inn to more upscale offerings such as Cambria Hotels. This diversity aims to attract different customer segments, and a strong brand identity can lessen direct competition based solely on price. However, in markets where many hotels offer similar amenities and price points, the competitive landscape often intensifies, leading to price wars.

For instance, in the economy segment, where differentiation can be challenging, Choice Hotels brands like Econo Lodge and Rodeway Inn frequently compete on price against similar offerings from competitors like Wyndham Hotels & Resorts or Super 8. This dynamic is evident in pricing strategies where slight variations in nightly rates can significantly influence booking decisions. In 2024, the average daily rate (ADR) for economy hotels in the US saw fluctuations, with brands needing to carefully manage pricing to remain competitive while maintaining profitability.

- Brand Portfolio: Choice Hotels operates brands across various segments, including economy (Comfort Inn, Quality Inn), midscale (Ascend Hotel Collection, Sleep Inn), and upscale (Cambria Hotels).

- Differentiation Impact: Strong brand identity can reduce price-based rivalry by offering unique value propositions beyond just cost.

- Price Sensitivity: In segments with many similar hotel offerings, competition often shifts to price, impacting profitability.

- 2024 Market Conditions: The hotel industry in 2024 continued to see intense competition, particularly in price-sensitive segments, requiring strategic pricing and operational efficiency.

Exit Barriers

Choice Hotels, like many in the hospitality sector, faces significant exit barriers. These aren't just about closing down; they involve substantial financial and contractual commitments. Imagine the cost of owning or leasing prime real estate, often tied up in long-term agreements. These investments make it incredibly difficult for a hotel owner to simply walk away, even if the business isn't performing well.

These high exit barriers can have a ripple effect, intensifying competition. When hotels are locked into operating due to these barriers, even if they are unprofitable, they continue to compete for the same pool of customers. This can lead to prolonged price wars as hotels try to attract guests, or it might result in an oversupply of rooms in certain markets, further pressuring profitability for everyone involved.

For instance, in 2024, the average hotel development cost per key in the US can range from $150,000 to $300,000 or more, depending on the market and brand. This substantial upfront investment, coupled with franchise agreements that can extend for 15-20 years, creates a strong disincentive to exit, even during economic downturns. This persistence of supply, regardless of demand, is a direct consequence of these exit barriers.

- High Capital Investment: Significant upfront costs for property acquisition, construction, and renovation create a financial anchor.

- Long-Term Franchise Agreements: Contracts often bind franchisees for many years, making early termination costly.

- Brand Reputation and Goodwill: The investment in building a brand's reputation can be lost if operations cease abruptly.

- Operational Commitments: Ongoing leases, employee contracts, and supplier agreements add to the difficulty of exiting.

Choice Hotels operates in a highly competitive environment, facing rivals like Marriott, Hilton, and Wyndham across various market segments. This intense rivalry is amplified by the industry's substantial fixed costs, which necessitate high occupancy rates, often leading to aggressive pricing strategies, especially in price-sensitive segments. The fragmented nature of the industry means that even smaller local competitors can exert pressure, forcing brands to constantly innovate and differentiate to maintain market share.

SSubstitutes Threaten

The most significant threat to Choice Hotels comes from alternative accommodations such as Airbnb, Vrbo, and other short-term rental platforms. These services provide travelers with unique, personalized experiences, often in more spacious settings, directly challenging the traditional hotel model and potentially siphoning off revenue. For instance, by the end of 2023, Airbnb reported over 5.6 million active listings globally, showcasing the vast scale of this competitive landscape.

The proliferation of non-traditional lodging, beyond typical short-term rentals, significantly intensifies the threat of substitutes for hotel chains like Choice Hotels. This diversification now encompasses boutique hotels, glamping experiences, co-living arrangements, and eco-lodges, each appealing to travelers prioritizing unique and experiential stays over standardized accommodations.

Substitutes, like vacation rentals or extended-stay hotels, often present a compelling price-performance trade-off. These alternatives might offer more space or amenities, such as full kitchens, at a price point that appeals to budget-conscious travelers or those seeking longer stays. For instance, platforms like Airbnb saw significant growth, with its revenue reaching an estimated $6.5 billion in 2023, highlighting the strong consumer appeal of alternative lodging options.

This dynamic compels Choice Hotels to constantly assess its pricing strategies and service packages. By understanding how substitutes meet different traveler needs, Choice Hotels can better position its brands, such as Comfort Inn or Quality Inn, to remain competitive. The company must ensure its value proposition, even at lower price tiers, remains attractive compared to the flexibility and potential cost savings offered by substitutes.

Shifting Consumer Preferences

The evolving desires of travelers, especially younger demographics, lean towards unique, local, and tailored experiences. Alternative accommodations, such as vacation rentals and boutique guesthouses, are often more adept at fulfilling these demands. This growing preference for authenticity presents a significant long-term threat to the traditional, standardized hotel model that companies like Choice Hotels have historically relied upon.

This shift is reflected in market trends. For instance, the global vacation rental market was valued at approximately $80 billion in 2023 and is projected to grow substantially. This indicates a tangible movement away from conventional lodging.

- Authenticity Demand: Travelers increasingly seek genuine local experiences over predictable hotel stays.

- Alternative Providers: Vacation rentals and boutique accommodations are well-positioned to offer these personalized options.

- Market Growth: The vacation rental sector's robust growth, projected to reach over $100 billion by 2028, underscores this threat.

Ease of Switching to Substitutes

The threat of substitutes for Choice Hotels is significant, primarily due to the ease with which travelers can opt for alternative accommodations. The rise of online travel agencies (OTAs) and direct booking platforms has dramatically lowered switching costs for consumers. Travelers can effortlessly compare prices, amenities, and locations across a wide range of lodging options, from other major hotel chains to independent hotels and vacation rentals.

This accessibility means that a traveler dissatisfied with Choice Hotels' offerings or pricing can quickly pivot to a competitor with minimal effort or expense. For instance, platforms like Airbnb reported over 1.5 billion guest arrivals globally by early 2024, showcasing the immense scale of alternative accommodation options readily available to consumers. This broad availability and low switching friction empower consumers, intensifying the competitive pressure on Choice Hotels from substitute services.

- Low Switching Costs: Travelers can switch between hotel brands or alternative accommodations with ease, often with just a few clicks online.

- Ubiquitous Online Platforms: Websites and apps like Booking.com, Expedia, and Airbnb provide readily accessible comparisons and booking for a vast array of lodging options.

- Diverse Substitute Offerings: The market includes not only other hotel chains but also vacation rentals, extended-stay properties, and even unique lodging experiences, all serving as viable alternatives.

- Price Sensitivity: Consumers often prioritize price, and the ease of comparison means that even small price differences can drive switching behavior.

The threat of substitutes for Choice Hotels is significant, driven by the growing popularity and accessibility of alternative lodging options. These substitutes, ranging from short-term rentals like Airbnb to unique boutique hotels, offer travelers more personalized and experiential stays. The ease with which consumers can access and compare these alternatives online, coupled with their often competitive pricing and unique value propositions, directly challenges the traditional hotel model.

| Substitute Type | Key Appeal | 2023/2024 Data Point |

|---|---|---|

| Short-Term Rentals (e.g., Airbnb) | Unique experiences, local feel, more space | Airbnb had over 5.6 million active listings globally by end of 2023. |

| Boutique Hotels/Unique Stays | Personalized service, distinct character, experiential focus | The global vacation rental market was valued at approximately $80 billion in 2023. |

| Extended-Stay Properties | Value for longer stays, amenities like kitchens | A significant portion of travelers prioritize value and amenities, making these direct competitors. |

Entrants Threaten

Entering the hotel industry, particularly for those aiming to establish a new brand or construct new properties, demands significant financial outlay. These capital requirements, covering everything from real estate acquisition and construction to the development of operational infrastructure, present a considerable hurdle for aspiring new entrants.

For instance, building a new mid-scale hotel could easily cost tens of millions of dollars. Consider that in 2024, the average cost to build a new hotel in the US can range from $200,000 to $500,000 per room, not including land acquisition. This high initial investment naturally deters many potential competitors from entering the market, thereby protecting existing players like Choice Hotels.

Brand loyalty is a significant barrier for new hotel entrants. Established chains, including Choice Hotels, have cultivated strong brand recognition and customer loyalty through years of service and effective marketing. For example, Choice Hotels’ Choice Privileges loyalty program boasts millions of active members, creating a sticky customer base that is less likely to switch to an unknown brand.

Furthermore, existing players have nurtured deep-seated relationships with franchisees and corporate clients. These established partnerships provide a stable revenue stream and a ready distribution network, which new entrants would struggle to replicate quickly. Building this level of trust and market presence from scratch requires substantial time and investment, making it a formidable hurdle.

Major hotel companies, including Choice Hotels, command sophisticated global distribution systems and established online booking platforms. These systems are critical for reaching a broad customer base and managing reservations efficiently. For instance, Choice Hotels' proprietary booking engine and partnerships with online travel agencies (OTAs) are significant assets.

New entrants face a substantial hurdle in replicating these established distribution networks. Building comparable infrastructure requires immense capital investment. Alternatively, relying on existing third-party channels, while quicker, often comes with substantial commission fees, directly impacting a new player's profitability and competitive pricing.

Regulatory and Legal Barriers

The hotel industry faces significant regulatory and legal barriers that can deter new entrants. These include stringent zoning laws, which dictate where hotels can be built and operated, and complex licensing requirements that vary by municipality and state. For instance, obtaining necessary permits and approvals can be a time-consuming and costly process, requiring substantial upfront investment and expertise in navigating bureaucratic procedures.

Health and safety standards are also paramount, with regular inspections and compliance mandates adding to the operational burden for any new hotel. Failure to meet these standards can result in fines or even closure, making adherence a critical factor for survival. In 2024, the hospitality sector continued to grapple with evolving regulations around data privacy and accessibility, further increasing the compliance landscape for newcomers.

- Zoning Laws: Restrictive land-use regulations can limit available locations for new hotel development.

- Licensing: Obtaining operational licenses often requires extensive paperwork and adherence to specific criteria.

- Health & Safety: Strict compliance with health codes and safety regulations is non-negotiable.

- Evolving Compliance: New regulations, such as those concerning data privacy, add layers of complexity for new businesses.

Franchise Model as a Barrier to Entry

Choice Hotels International's reliance on a franchise model significantly deters new entrants. Building a comparable network of branded hotels requires substantial capital investment and time to establish brand recognition and operational consistency. This existing infrastructure makes it difficult for independent or newly franchised properties to gain market traction and compete effectively against established Choice Hotels brands.

The established franchise system, with its proven operational standards and marketing reach, presents a formidable hurdle for newcomers. For instance, as of the end of 2023, Choice Hotels operated over 6,400 hotels across more than 20 brands. This scale provides significant advantages in purchasing power and brand visibility that are challenging for new entrants to replicate quickly.

- Established Brand Recognition: New entrants struggle to match the brand awareness and customer loyalty enjoyed by Choice Hotels' existing portfolio.

- Economies of Scale: The sheer size of Choice Hotels' franchise network allows for greater purchasing power and operational efficiencies, which are difficult for new entrants to achieve.

- Capital Requirements: Establishing a competitive hotel network requires substantial upfront capital for property acquisition, development, and marketing, a barrier that the franchise model helps new entrants overcome but makes it harder for those trying to build independently.

The threat of new entrants for Choice Hotels is generally moderate. While the capital intensity of building new hotels is high, deterring many, the franchise model itself can lower the barrier for some new operators seeking to join an established brand. Established players like Choice Hotels benefit from brand recognition, loyalty programs, and extensive distribution systems, which new independent entrants would find difficult and costly to replicate. For example, Choice Hotels' extensive portfolio of over 6,400 hotels as of late 2023 provides significant economies of scale and market presence.

| Barrier to Entry | Impact on New Entrants | Relevance to Choice Hotels |

|---|---|---|

| Capital Requirements | High (e.g., $200k-$500k per room in 2024) | Deters independent construction, but franchise model can mitigate for new operators |

| Brand Loyalty & Recognition | Significant hurdle for unknown brands | Strong advantage for Choice Hotels (e.g., millions of Choice Privileges members) |

| Distribution Systems | Costly to build or high commission fees with third parties | Established advantage for Choice Hotels' booking platforms |

| Franchise Network Scale | Difficult to match existing scale and purchasing power | Major competitive advantage for Choice Hotels (over 6,400 hotels) |

Porter's Five Forces Analysis Data Sources

Our Choice Hotels Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Choice Hotels' annual reports and SEC filings, alongside industry-specific market research from firms like Statista and IBISWorld.