Choice Hotels Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choice Hotels Bundle

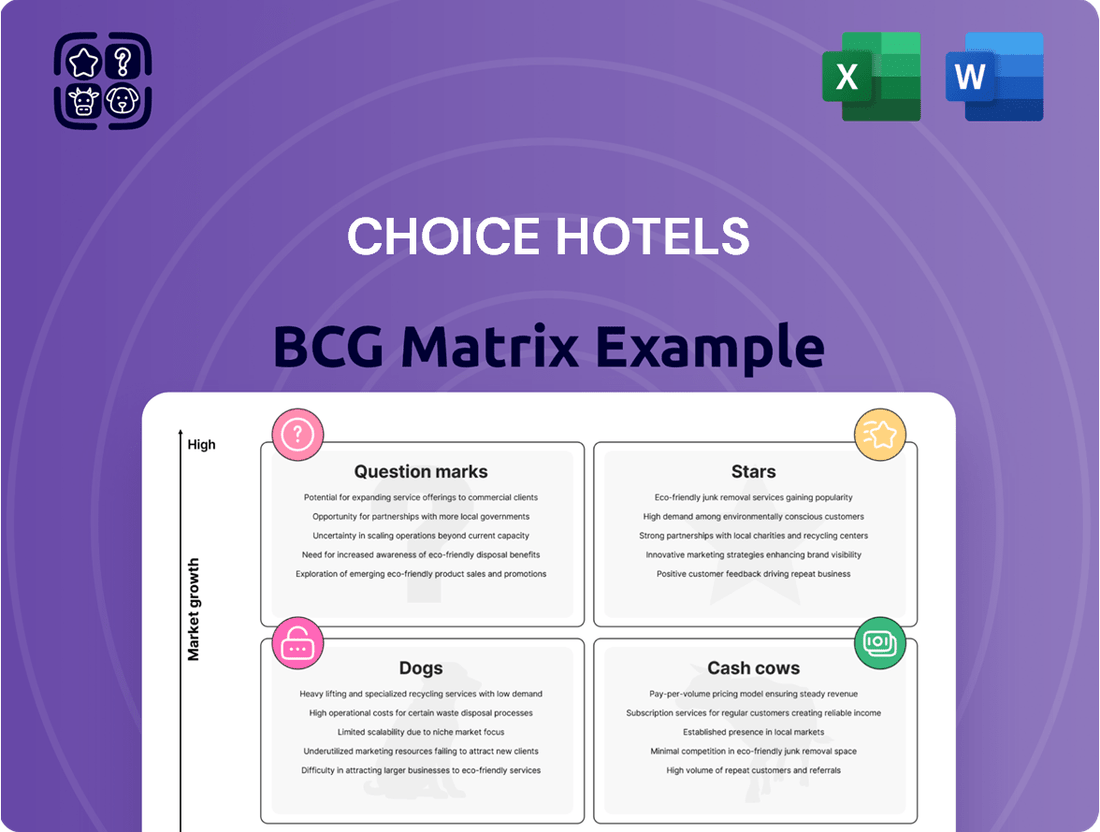

Curious about Choice Hotels' strategic positioning? This preview offers a glimpse into their BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks within their brand portfolio. Understand where each brand contributes to growth and where resources might be better allocated.

To truly unlock the strategic advantage, purchase the full Choice Hotels BCG Matrix report. It provides a comprehensive breakdown of each brand's market share and growth rate, offering actionable insights for optimizing your investment and brand management strategies.

Don't miss out on the complete picture; equip yourself with the detailed analysis and data-backed recommendations needed to navigate the competitive hospitality landscape effectively.

Stars

Everhome Suites, Choice Hotels' new midscale extended-stay offering, is a significant growth driver, with 14 hotels operational and 19 more under construction as of May 2025. Projections indicate nearly 25 Everhome Suites locations will be open by the end of 2025, showcasing its rapid market penetration.

This brand is strategically positioned to capture the robust demand for extended-stay lodging in dynamic, high-growth areas. Its expansion is a testament to Choice Hotels' focus on meeting the evolving needs of travelers seeking longer-term accommodations, supported by developer partnerships and efficient design.

Cambria Hotels represents a significant growth driver for Choice Hotels, positioned within the upscale segment. The brand has seen substantial development, with 18 new properties opening in the past two years alone, underscoring its rapid expansion. This momentum is set to continue with anticipated openings in key locations such as New York Times Square in 2025 and its inaugural Canadian property in 2026.

The strategic expansion of Cambria Hotels into new U.S. markets and internationally targets both business and leisure travelers. It offers a premium select-service experience, emphasizing local character and design. This approach has helped Cambria capture a strong market share within the continually expanding upscale hotel sector.

The Ascend Hotel Collection, a key player in Choice Hotels' portfolio, operates as an upscale soft brand. It has achieved a significant milestone, exceeding 400 open hotels worldwide. This brand is actively growing, particularly in popular leisure and urban destinations, with more than 70 hotels in its development pipeline.

In 2024, Ascend Hotel Collection demonstrated impressive growth, with a global increase of over 40% in its total room count compared to the previous year. This rapid expansion highlights its strong performance and market appeal within the hospitality sector.

Ascend's success is attributed to its adaptable operating model, which caters to independent hotels seeking brand affiliation. This strategy allows it to effectively tap into the expanding upscale segment of the market.

WoodSpring Suites

WoodSpring Suites is a standout performer within Choice Hotels' extended-stay offerings, holding the top spot as the number one economy extended-stay brand. This brand is a significant driver of growth in the extended-stay market, representing a substantial portion of new hotels being built and broken ground on. Its strong market position is further solidified by its efficient operating model, which yields impressive gross operating profits exceeding 55%.

- Dominant Market Share: WoodSpring Suites is the leading economy extended-stay brand, capturing significant market share in a segment experiencing robust growth.

- Development Momentum: The brand leads in new extended-stay hotel construction and groundbreakings, highlighting its expansion and future potential.

- Profitability: With gross operating profits consistently above 55%, WoodSpring Suites demonstrates a highly effective and profitable operating formula.

Radisson Brands (post-acquisition repositioning)

Following Choice Hotels' 2022 acquisition of Radisson Hotels Americas, a strategic repositioning of brands like Radisson, Radisson Blu, and Radisson Individuals is underway. This initiative targets attracting a more upscale clientele and investors, aiming to capture greater market share in the upscale and upper-upscale segments.

The repositioning efforts include updated visual identities and enriched guest experiences. These changes are designed to bolster brand appeal and drive RevPAR growth.

The Radisson brand, in particular, showed promising results in its first full year under Choice Hotels. It achieved a notable 7.5% year-over-year increase in Revenue Per Available Room (RevPAR), signaling strong potential for continued expansion and investor interest.

- Brand Repositioning: Focus on attracting upscale guests and investors for Radisson, Radisson Blu, and Radisson Individuals.

- Market Share Growth: Aiming to significantly increase presence in the upscale and upper-upscale hotel segments.

- Performance Indicator: Radisson brand saw a 7.5% year-over-year RevPAR increase in its first full year post-acquisition.

- Strategic Enhancements: Implementation of new visual identities and improved guest experiences to drive brand value.

WoodSpring Suites is a powerhouse in the economy extended-stay market for Choice Hotels, consistently leading the segment. Its aggressive development pipeline, evidenced by a high volume of new hotel construction and groundbreakings, signals strong future growth. The brand's exceptional profitability, with gross operating profits exceeding 55%, underscores its efficient business model and appeal to both guests and investors.

What is included in the product

This BCG Matrix analysis categorizes Choice Hotels' brands, guiding strategic decisions for investment and resource allocation.

A clear, quadrant-based overview of Choice Hotels' business units, simplifying strategic decisions.

Cash Cows

Comfort Inn, a cornerstone of Choice Hotels' midscale offerings, continues its strong performance, adding 26 new properties in 2024. This expansion underscores its status as a reliable generator of consistent cash flow within the mature midscale segment, where it commands a significant market share.

As a flagship brand, Comfort Inn's substantial and steady revenue streams solidify its position as a cash cow. Its ability to maintain profitability is further enhanced by ongoing investments in new prototypes designed to boost operational efficiency and elevate the guest experience.

Quality Inn, a brand marking its 85th year in 2024, is a well-established player in the midscale hotel segment. Its significant market share is underscored by the addition of 41 new hotels in 2024, demonstrating continued growth and demand.

This brand is a prime example of a Cash Cow within Choice Hotels' portfolio. Its mature status and strong U.S. market presence translate into consistent and substantial cash generation, a hallmark of this BCG matrix category.

Ongoing investments in infrastructure and brand modernization are crucial for Quality Inn. These efforts ensure its efficiency and competitive edge, allowing it to continue its role as a reliable cash flow generator for the company.

Country Inn & Suites by Radisson, now a key part of Choice Hotels following the Radisson Americas acquisition, is a prime example of a Cash Cow. Its impressive 19-point RevPAR Index increase and substantial revenue growth in 2024 highlight its robust performance. This brand consistently generates significant cash flow within the upper midscale segment, requiring less promotional spending due to its established market standing.

MainStay Suites

MainStay Suites, a key player in Choice Hotels' extended-stay offerings, functions as a cash cow due to its stable revenue generation. This brand consistently contributes to the company's financial health, benefiting from the ongoing demand in the extended-stay market. In 2024, Choice Hotels continued to expand MainStay Suites, opening 16 new properties, reinforcing its established market position.

The brand's focus on operational efficiency, exemplified by initiatives like 'Lobby in a Box,' directly supports increased cash flow for its franchisees. This strategic approach helps maintain MainStay Suites' status as a reliable income generator within the Choice Hotels portfolio.

- Brand: MainStay Suites

- Segment: Extended-Stay

- 2024 Performance: 16 new properties opened

- Strategic Initiative: 'Lobby in a Box' for efficiency

Suburban Studios

Suburban Studios represents a significant component of Choice Hotels' extended-stay portfolio, demonstrating consistent performance. In 2024, the brand saw the addition of 14 new properties, reinforcing its position in the market and contributing to a stable market share.

As an economy extended-stay brand, Suburban Studios is positioned as a cash cow. It offers dependable cash generation due to consistent demand, even though its growth prospects are more modest compared to other segments.

The brand benefits from Choice Hotels' robust operational support and ongoing innovation. These efforts are specifically geared towards improving efficiency and maximizing the profitability of its extended-stay offerings, much like the strategy employed for MainStay Suites.

- Brand: Suburban Studios

- Segment: Economy Extended-Stay

- 2024 Performance: 14 new properties opened

- Strategic Role: Cash Cow, stable market share, reliable cash generation

These brands are Choice Hotels' established performers, consistently generating significant revenue with minimal investment. Their mature market position and strong brand recognition allow them to capture a steady stream of customers, translating into reliable cash flow for the company.

Brands like Comfort Inn and Quality Inn, which added a combined 67 new properties in 2024, exemplify this category. Their continued expansion within their respective midscale segments highlights their enduring appeal and ability to generate substantial, predictable earnings.

Country Inn & Suites by Radisson also stands out as a cash cow, demonstrating impressive revenue growth and a strong RevPAR Index increase in 2024. This indicates its efficiency and ability to maximize profitability in the upper midscale market.

MainStay Suites and Suburban Studios, both in the extended-stay segment, also contribute significantly as cash cows. With 16 and 14 new properties opened in 2024 respectively, they show consistent demand and operational efficiency, reinforcing their role as stable income generators.

| Brand | Segment | 2024 New Properties | BCG Category | Key Characteristic |

|---|---|---|---|---|

| Comfort Inn | Midscale | 26 | Cash Cow | Reliable cash flow, strong market share |

| Quality Inn | Midscale | 41 | Cash Cow | Mature, consistent revenue generation |

| Country Inn & Suites by Radisson | Upper Midscale | N/A (Acquired) | Cash Cow | Strong revenue growth, high RevPAR Index |

| MainStay Suites | Extended-Stay | 16 | Cash Cow | Stable revenue, operational efficiency |

| Suburban Studios | Economy Extended-Stay | 14 | Cash Cow | Dependable cash generation, consistent demand |

What You See Is What You Get

Choice Hotels BCG Matrix

The Choice Hotels BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This report offers a detailed strategic analysis of Choice Hotels' brand portfolio, categorized according to the Boston Consulting Group matrix. You'll gain immediate access to this professionally formatted, ready-to-use analysis for your business planning and competitive strategy discussions.

Dogs

Older, underperforming economy brands within Choice Hotels, such as Comfort Inn & Suites or Quality Inn, might be classified as Dogs. These brands often face intense competition in mature, slow-growth markets, leading to consistently low market share. For instance, as of late 2023, the U.S. hotel industry saw occupancy rates hovering around 63%, with economy segments often experiencing lower average daily rates (ADR) and revenue per available room (RevPAR) compared to upscale segments.

These brands typically require minimal capital infusion, as significant investments in rebranding or extensive renovations may not yield a profitable return. The strategy often involves managing these assets to generate cash flow with little to no further investment, or considering divestiture if they become a drain on resources. In 2024, the focus for many hotel groups is on optimizing their portfolios, which can include shedding less profitable or stagnant brands.

Individual hotel properties, irrespective of their brand affiliation, that consistently struggle with low occupancy rates and generate insufficient revenue to cover operational expenses are prime examples of "Dogs" within the Choice Hotels portfolio. These underperforming assets can be viewed as cash traps, immobilizing capital without delivering adequate returns, a situation exacerbated by factors like suboptimal locations or outdated amenities.

For instance, if a specific Comfort Inn property in a declining tourist area consistently reports occupancy below 40% and generates only 60% of its operating costs in revenue, it fits the profile. In 2024, the average occupancy rate for hotels in the U.S. hovered around 63%, meaning such a property would be significantly underperforming the national average, signaling a need for strategic intervention.

Outdated or unrenovated hotels within the Choice Hotels portfolio often find themselves categorized as Dogs. These properties typically exhibit low growth and low relative market share, a direct consequence of their aging infrastructure and outdated amenities. For instance, hotels that haven't been updated in over a decade may struggle to attract guests, especially in markets with newer, more appealing competitors.

These Dog properties face significant challenges in competing effectively. Their declining guest satisfaction scores and reduced market appeal translate into a struggle for occupancy and pricing power. In 2024, the hospitality industry saw a strong demand for updated and technologically integrated accommodations, further highlighting the disadvantage faced by unrenovated hotels.

Given their poor performance and the high cost of renovation, significant investment in these Dog hotels might not be financially prudent. Choice Hotels may consider divesting these underperforming assets to redeploy capital towards more promising growth opportunities, such as their Stars or Question Marks segments.

Brands with Declining RevPAR and Unit Growth

Brands exhibiting a consistent decline in Revenue Per Available Room (RevPAR) coupled with stagnant or negative unit growth are prime candidates for the Dogs quadrant in the Choice Hotels BCG Matrix. These brands typically operate in mature or declining markets where their market share is already low, presenting a significant challenge for future growth.

For instance, if a brand like Clarion, historically a midscale option, saw its RevPAR decrease by 5% year-over-year in 2023 and opened only 2 new properties while closing 3, it would strongly indicate Dog status. This situation suggests that the brand is not resonating with consumers in its current form or market positioning. Continued capital allocation to such a brand without a strategic turnaround plan risks diverting resources from more promising segments of the portfolio.

- Declining RevPAR: A consistent year-over-year drop in RevPAR signifies weakening demand or pricing power.

- Stagnant/Negative Unit Growth: Lack of new property openings or net closures points to an inability to attract franchisees or a challenging operating environment.

- Low Market Share in Low-Growth Markets: This combination highlights a brand struggling to gain traction where overall market expansion is limited.

- Need for Strategic Re-evaluation: Brands in this category require a thorough assessment, potentially leading to divestment, repositioning, or significant operational changes.

Non-Core, Niche Brands with Limited Scalability

Non-Core, Niche Brands with Limited Scalability are those within Choice Hotels that serve a very specific, small customer base and struggle to expand their reach. These brands operate in markets with low growth potential, meaning they are unlikely to significantly increase their market share. For instance, a brand focusing on a highly specialized travel niche might represent this category. In 2024, Choice Hotels continued to refine its portfolio, and brands fitting this description would likely see minimal investment, with the strategy focused on managing their existing operations efficiently without significant growth initiatives.

- Limited Market Appeal: These brands target a narrow segment, restricting their overall customer acquisition potential.

- Low Growth Environment: Their operating markets are not expanding, capping any organic growth prospects.

- Resource Management Focus: The strategy prioritizes maintaining profitability and minimizing resource drain rather than aggressive expansion.

- Portfolio Rationalization: Such brands might be candidates for divestiture if they don't align with long-term strategic goals and efficient capital allocation.

Brands exhibiting declining RevPAR and minimal unit growth, often in mature markets with low market share, are classified as Dogs. These typically include older, underperforming economy brands or niche offerings with limited scalability. For example, a brand seeing a 5% RevPAR decrease year-over-year in 2023 and net property closures would fit this profile.

The strategy for these Dog brands focuses on efficient management, minimal capital infusion, or potential divestiture. In 2024, the industry trend emphasizes portfolio optimization, making underperforming assets prime candidates for shedding. This approach frees up capital for more promising segments.

These underperforming assets, like poorly located or unrenovated hotels, are cash traps that immobilize capital. With national occupancy rates around 63% in late 2023, properties consistently below 40% occupancy are significantly underperforming.

Choice Hotels may consider divesting these assets to redeploy capital towards more promising growth opportunities. Brands with limited market appeal and operating in low-growth environments require resource management focus rather than expansion.

Question Marks

Radisson Individuals, relaunched in October 2024, is positioned as a Question Mark within Choice Hotels' portfolio. This upper-upscale soft brand targets a high-growth segment, aiming to onboard distinctive, independent hotels. Its success hinges on capturing market share in a competitive landscape, a move that requires substantial investment to gain traction.

Radisson Blu, now part of Choice Hotels, is being repositioned to capture the upscale market. This involves new visual branding and service improvements aimed at attracting a more discerning clientele.

Operating within the booming upscale and upper-upscale hotel segments, Radisson Blu’s market share under Choice Hotels is still in its nascent stages. This growth phase, coupled with significant investment in brand enhancement, firmly places it in the Question Mark category of the BCG Matrix.

The strategic focus on elevating the guest experience and brand image is critical. Success here will dictate whether Radisson Blu can transition from a developing market share player to a stronger performer within Choice Hotels' portfolio.

Choice Hotels is strategically expanding its Cambria Hotels brand into Canada, with a planned debut by 2026. This move, alongside new openings in France, Spain, and the broader Asia-Pacific region, signals a strong push into potentially high-growth international markets. These new ventures, while promising, currently represent Question Marks in the BCG matrix due to their nascent market share and the significant investment required for brand establishment and market penetration.

Emerging Technology Platforms/Partnerships

Choice Hotels' strategic investments in emerging technology platforms, like the integration of the Mews property management system, and the adoption of AI-powered growth strategies position them within the question mark category of the BCG matrix. These initiatives represent significant future growth potential but also carry inherent uncertainty regarding their market success and eventual return on investment. For instance, Choice Hotels announced in early 2024 a multi-year agreement to adopt Mews' cloud-native property management system across its portfolio, aiming to streamline operations and enhance guest experiences. This move signifies a proactive approach to leveraging technology for competitive advantage.

The company's focus on AI-powered growth strategies, including personalized marketing and revenue management optimization, further underscores their pursuit of future revenue streams. While these technologies are designed to improve operational efficiency and drive incremental revenue, their long-term impact and market adoption remain subjects of ongoing evaluation. For example, AI-driven pricing strategies, if successful, could lead to significant revenue uplifts, but the competitive landscape and guest response are key variables. Choice Hotels reported a 6.7% increase in revenue per available room (RevPAR) for the first quarter of 2024, indicating positive momentum that these technological investments aim to sustain and accelerate.

- Mews Integration: Choice Hotels' partnership with Mews aims to modernize property management systems, enhancing operational efficiency and guest service capabilities.

- AI-Powered Growth: Investments in AI are focused on optimizing revenue management, personalizing guest experiences, and driving marketing effectiveness.

- Uncertainty and Potential: While these technologies offer significant future growth prospects, their ultimate market impact and ROI are still being realized, placing them in the question mark quadrant.

- Strategic Importance: Continued investment and adaptation in these technological areas are crucial for Choice Hotels to maintain competitiveness in a rapidly evolving industry landscape.

New, Innovative Design Concepts (e.g., 'Lobby in a Box')

Choice Hotels' introduction of modular design concepts like 'Lobby in a Box' and 'Kitchen in a Box' for its extended-stay and conversion brands positions these initiatives as Question Marks within the BCG Matrix. These innovations are designed to streamline the process for new franchisees and accelerate property conversions by lowering upfront costs and reducing the time needed for renovations. For instance, the 'Lobby in a Box' concept aims to simplify and expedite the modernization of hotel common areas, a critical factor in attracting and retaining guests.

The primary goal is to make it easier and more cost-effective for hotel owners to join or update their properties under the Choice Hotels umbrella, thereby potentially increasing market share. As of early 2024, Choice Hotels has been actively promoting these solutions, particularly to its Comfort and Quality Inn brands, which often undergo renovations. The success of these concepts hinges on their ability to deliver tangible cost savings and faster ROI for franchisees, encouraging wider adoption.

- Attracting New Franchisees: The modular designs aim to lower the barrier to entry for new hotel owners by reducing initial investment and build-out timelines.

- Facilitating Conversions: These concepts are specifically targeted at speeding up the conversion of existing hotels to Choice Hotels brands, a key growth strategy.

- Market Share Potential: While promising, the actual impact on increasing Choice Hotels' market share is still being assessed as adoption rates are in the early stages.

- Cost and Time Savings: The core value proposition revolves around significant reductions in both the financial outlay and the duration required for property upgrades.

Choice Hotels' strategic investments in emerging technology platforms, such as the integration of the Mews property management system and AI-powered growth strategies, position these initiatives as Question Marks. These ventures hold significant future growth potential but also carry inherent uncertainty regarding market success and return on investment.

For instance, Choice Hotels announced in early 2024 a multi-year agreement to adopt Mews' cloud-native property management system across its portfolio. This move aims to streamline operations and enhance guest experiences, reflecting a proactive approach to leveraging technology. Choice Hotels reported a 6.7% increase in revenue per available room (RevPAR) for the first quarter of 2024, indicating positive momentum that these technological investments aim to sustain and accelerate.

The company's focus on AI-powered growth strategies, including personalized marketing and revenue management optimization, further underscores their pursuit of future revenue streams. While these technologies are designed to improve operational efficiency and drive incremental revenue, their long-term impact and market adoption remain subjects of ongoing evaluation.

| Initiative | Category | Rationale | Investment Focus | Potential Impact |

|---|---|---|---|---|

| Mews PMS Integration | Question Mark | Modernizing operations, enhancing guest service | Multi-year agreement, portfolio-wide adoption | Streamlined operations, improved guest experience |

| AI-Powered Growth Strategies | Question Mark | Optimizing revenue, personalizing marketing | Revenue management, marketing effectiveness | Increased efficiency, incremental revenue |

BCG Matrix Data Sources

The Choice Hotels BCG Matrix is constructed using a blend of financial disclosures, industry growth forecasts, and competitive performance data, ensuring a robust strategic foundation.