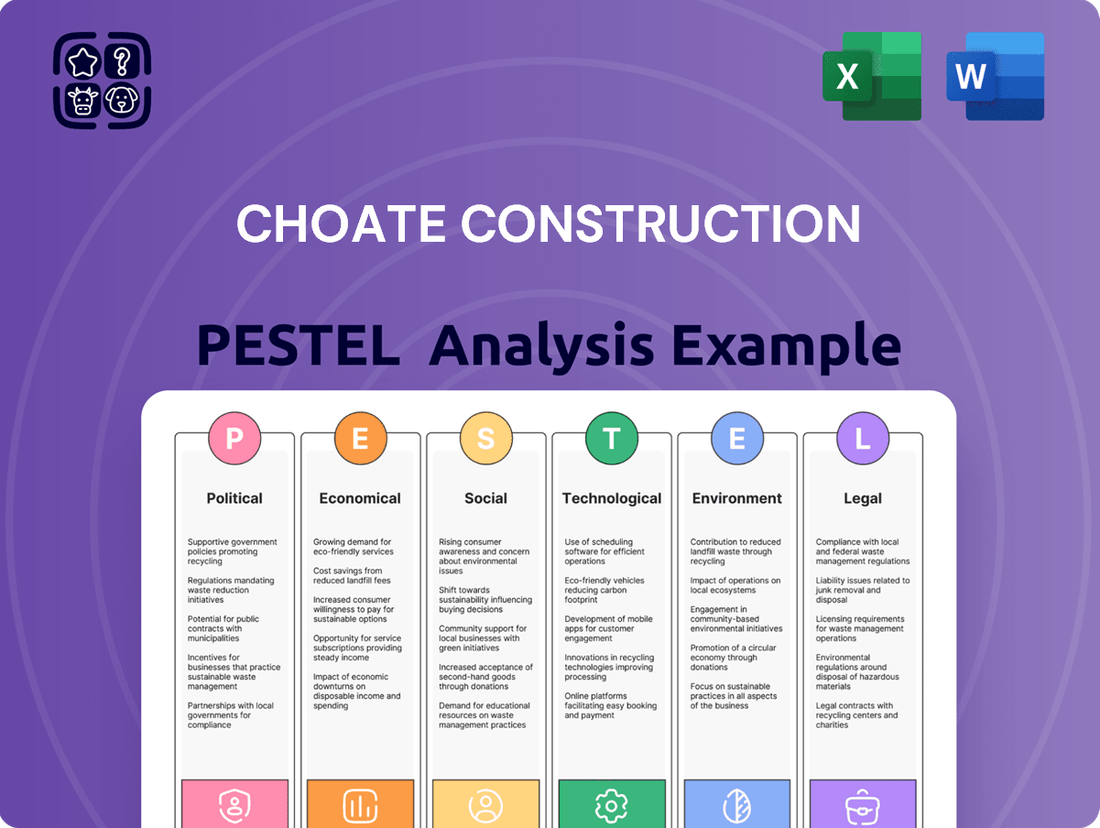

Choate Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choate Construction Bundle

Navigate the complex external landscape affecting Choate Construction with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory and influencing its strategic decisions. Gain a critical advantage by leveraging these expert insights to refine your own market approach and identify potential opportunities.

Ready to make informed decisions about Choate Construction? Our detailed PESTLE analysis provides the crucial context you need, from regulatory shifts to evolving consumer behaviors. Equip yourself with actionable intelligence to anticipate challenges and capitalize on emerging trends. Purchase the full report now for immediate access to this vital market intelligence.

Political factors

The Bipartisan Infrastructure Investment and Jobs Act (IIJA) is a major driver for the US construction industry. It's injecting significant capital into projects like roads, bridges, and public transit, with substantial funding set to continue through 2026. This creates a predictable stream of work for companies like Choate Construction.

Evolving trade policies and the potential for new tariffs on key construction materials such as steel and aluminum present a significant risk to Choate Construction. For instance, in early 2024, the US continued to evaluate Section 232 tariffs on steel imports, which can directly inflate material costs. This volatility necessitates close monitoring to manage project budgets and maintain supply chain stability, as disruptions can lead to project delays and increased expenses.

Regulatory stability and changes significantly shape the construction sector. For Choate Construction, shifts in fiscal policies, like potential changes to capital gains tax rates or infrastructure spending allocations, could directly impact project pipelines and investment decisions. For instance, if the US federal government announces new tax credits for green building initiatives in 2024, Choate would need to adapt its project planning to capitalize on these incentives.

Government Incentives for Green Building

Government incentives and policies are increasingly shaping the construction landscape, particularly for sustainable building practices. In 2024, many jurisdictions continued to offer tax credits and grants for projects incorporating green building certifications like LEED or Energy Star. These initiatives directly influence project demand and profitability, making them a crucial consideration for construction firms. Choate Construction, with its established commitment to sustainable building, is well-positioned to leverage these opportunities.

These governmental pushes towards sustainability translate into tangible financial benefits for builders and owners alike. For instance, the Inflation Reduction Act of 2022 in the United States provides significant tax credits for renewable energy and energy efficiency improvements, which can be applied to new construction and retrofits. This creates a more attractive market for green building projects, directly benefiting companies like Choate Construction that specialize in these areas.

The trend is global, with many countries setting ambitious net-zero targets that necessitate a surge in sustainable construction. This policy environment fosters innovation and investment in green technologies and materials.

- Tax Credits: Continued availability of federal and state tax credits for energy-efficient building components and renewable energy installations in 2024.

- Grants and Rebates: Increased funding for local and regional grant programs supporting green building certifications and sustainable infrastructure development.

- Regulatory Support: Evolving building codes and standards that mandate or encourage higher levels of energy performance and material sustainability.

- Public Procurement: Government agencies increasingly prioritizing sustainable construction in their procurement processes, creating a direct demand channel.

Local and State Building Code Updates

Recent updates to state and local building codes are a significant political factor for Choate Construction. For instance, the 10th Edition of the State Building Code, with certain provisions taking effect in October 2024, and the 2024 North Carolina State Building Code slated for a July 2025 rollout, mandate new construction requirements. These changes often focus on enhancing climate resilience, promoting sustainability, and addressing specific building typologies, necessitating careful adherence.

Compliance with these evolving regulations is paramount. Choate Construction must integrate these updated codes into their project planning and execution to avoid penalties and ensure project integrity. This includes understanding the nuances of new material specifications, energy efficiency standards, and safety protocols introduced by these legislative changes.

- Code Adoption Timeline: Key updates are expected to be implemented throughout late 2024 and mid-2025, impacting project timelines and material sourcing.

- Focus Areas: Expect increased emphasis on energy efficiency, fire safety, and potentially new requirements for seismic or wind resistance depending on geographic location within the state.

- Cost Implications: Adherence to updated codes may lead to increased material and labor costs, requiring careful budgeting and cost management for new projects.

Government infrastructure spending, driven by initiatives like the Bipartisan Infrastructure Investment and Jobs Act (IIJA), continues to be a significant political factor, with substantial funding expected through 2026. This sustained investment fuels demand for construction projects across the nation. Furthermore, evolving trade policies and potential tariffs on materials like steel in 2024 necessitate careful supply chain management to mitigate cost fluctuations.

Regulatory changes, including updated building codes such as the 10th Edition of the State Building Code (effective October 2024) and the 2024 North Carolina State Building Code (July 2025), directly impact construction practices. These updates often focus on enhanced energy efficiency and climate resilience, requiring firms to adapt their methodologies and material sourcing.

Government incentives, particularly for green building practices, are increasingly influential. Tax credits and grants for energy-efficient construction, bolstered by legislation like the Inflation Reduction Act of 2022, create a more favorable market for sustainable projects. This policy landscape encourages innovation and investment in environmentally conscious building solutions.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Choate Construction, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and identify potential threats and opportunities within the construction industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively communicating Choate Construction's strategic landscape and mitigating the pain of information overload.

Economic factors

Elevated interest rates significantly increase borrowing costs for construction projects, squeezing profit margins and potentially causing delays or downsizing. For instance, the Federal Reserve's benchmark rate, which influences many commercial lending rates, remained at a target range of 5.25%-5.50% through early 2024, impacting development financing.

While forecasts suggest a potential for gradual decreases in short-term rates heading into 2025, the commercial real estate sector remains highly attuned to these shifts. These fluctuations directly influence project feasibility, the cost of capital, and ultimately, property valuations.

Material costs are a significant concern for Choate Construction. Expect key materials like steel, lumber, and concrete to see continued price volatility. In fact, projections indicate an overall increase in construction material prices by Q2 2025 when compared to Q2 2024.

This ongoing inflation directly affects labor and material expenses, placing considerable pressure on the budgets for commercial construction projects. Companies like Choate must factor these rising costs into their financial planning to maintain profitability.

The commercial real estate market in Q2 2025 is exhibiting a mixed but generally stable outlook. Industrial and retail sectors are demonstrating robust demand, with vacancy rates for industrial properties projected to remain below 4% nationally, a testament to continued e-commerce growth and supply chain adjustments.

Conversely, the multifamily sector is experiencing some localized oversupply, particularly in Sun Belt markets, which could temper rent growth. Office spaces continue to grapple with the impact of hybrid work models; national office vacancy rates hovered around 18% in early 2025, with a notable bifurcation between premium, well-located assets and older, less desirable buildings.

Labor Shortages and Wage Increases

The construction industry is still facing a serious lack of skilled workers. From August 2023 to July 2024, there were, on average, close to 400,000 job openings each month in this sector. This ongoing shortage of labor directly impacts companies like Choate Construction.

The persistent talent gap, combined with increasing labor costs due to higher wages and benefits, creates a challenging operating environment. These factors can lead to extended project schedules and increased overall project expenses for Choate.

- Persistent Labor Gap: Over 400,000 monthly job openings in construction (Aug 2023 - Jul 2024).

- Rising Wage Pressure: Increased wages and benefits are a direct consequence of the labor shortage.

- Impact on Timelines: Difficulty in finding sufficient labor can delay project completion dates.

- Cost Escalation: Higher labor costs contribute to increased project budgets for construction firms.

Overall Economic Growth and Construction Spending

The US construction industry is experiencing a robust period, with total spending exceeding $2 trillion in the first half of 2024. This upward trend is expected to continue into 2025, with forecasts predicting a 4.1% increase in overall construction spending.

This growth signifies a healthy economic climate that generally benefits construction firms like Choate Construction. Despite ongoing concerns such as labor availability and material price volatility, the broader economic expansion provides a solid foundation for industry participants.

- 2024 H1 Spending: Exceeded $2 trillion.

- 2025 Projection: 4.1% growth in total construction spending.

- Key Drivers: Overall economic expansion.

- Challenges: Labor shortages and material cost fluctuations persist.

Economic factors continue to shape the construction landscape, with interest rates remaining a critical consideration. While the Federal Reserve's benchmark rate held steady at 5.25%-5.50% through early 2024, anticipation of potential rate decreases by 2025 directly influences project financing and real estate valuations. Material costs are also a persistent challenge, with projections indicating a continued rise in prices for key materials like steel and lumber into the second quarter of 2025, impacting project budgets and profitability for firms like Choate Construction.

| Economic Factor | Status (Early 2024) | Outlook (2025) | Impact on Construction |

|---|---|---|---|

| Interest Rates | Fed Funds Rate: 5.25%-5.50% | Potential for gradual decreases | Affects borrowing costs, project feasibility |

| Material Costs | Volatile, increasing trend | Projected Q2 2025 increase vs Q2 2024 | Increases project expenses, squeezes margins |

| Overall Spending | H1 2024: Exceeded $2 trillion | Projected 4.1% growth | Indicates a healthy market, but challenges remain |

Preview Before You Purchase

Choate Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Choate Construction provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. It's designed to offer actionable insights for strategic planning.

Sociological factors

The construction industry grapples with an aging workforce, with many experienced professionals nearing retirement. This demographic shift, coupled with a declining interest from younger generations, is widening the skilled labor gap. For instance, in 2023, the Associated General Contractors of America reported that 70% of construction firms struggled to find skilled workers.

Choate Construction must proactively invest in robust workforce development initiatives. This includes expanding apprenticeship programs and partnering with educational institutions to highlight the viability and rewards of construction careers. Such strategies are crucial for attracting and retaining new talent, thereby mitigating the impact of the skilled labor shortage and ensuring future operational capacity.

The construction sector, including firms like Choate Construction, is increasingly prioritizing diversity and inclusion. This shift aims to tackle persistent labor shortages and tap into a wider range of skills and perspectives. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in construction employment between 2022 and 2032, highlighting the need for a robust and diverse workforce.

By actively promoting diversity and inclusion, Choate Construction can significantly improve its ability to attract and retain top talent. Companies that foster inclusive environments often report higher employee engagement and lower turnover rates. A 2023 report by McKinsey & Company found that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile.

Clients are now highly attuned to market shifts, expecting commercial buildings that are not only innovative but also specifically tailored to their needs. This includes a strong demand for modular construction, enhanced energy efficiency, and robust security features.

For instance, a 2024 survey by Dodge Construction Network indicated that 60% of owners and contractors are prioritizing sustainability in new projects, a significant jump from previous years. Choate Construction must therefore evolve its service portfolio to incorporate these client-driven priorities.

This evolving landscape means that traditional construction methods may no longer suffice. Companies like Choate Construction are seeing a growing preference for suppliers who can demonstrate adaptability and a commitment to incorporating advanced technologies and sustainable practices into their projects.

Workplace Safety and Well-being

Workplace safety is paramount in construction, and advancements in AI are revolutionizing how sites are monitored. These tools analyze data in real-time to identify potential hazards, contributing to a safer environment. For instance, in 2024, the construction industry saw a continued push for technological integration to mitigate risks, building on the 2023 OSHA recordable incident rate of 2.4 per 100 full-time workers.

Choate Construction's 'OneLife safety program' directly addresses this critical area, emphasizing not just physical safety but also the overall well-being of its employees. This proactive approach aligns with broader industry trends that recognize the link between employee health and productivity. The program's focus on well-being is increasingly important as companies understand that a healthy workforce is a more engaged and efficient workforce.

- AI-powered monitoring: Continuously scans construction sites for unsafe conditions and behaviors.

- Data analysis: Identifies patterns and predicts potential accidents before they occur.

- Employee well-being focus: Choate's 'OneLife' program integrates health initiatives alongside safety protocols.

- Industry benchmark: Safety programs are becoming standard as companies strive to reduce incident rates below national averages.

Community Engagement and Philanthropy

Community engagement and philanthropy are becoming key differentiators for businesses. Choate Construction actively participates in events such as the Lowcountry Heart Walk, underscoring its dedication to social responsibility. This aligns with their stated purpose to enrich the world through the people, places, and relationships they build.

Choate's commitment extends to supporting local initiatives, which can foster goodwill and enhance brand reputation. For instance, in 2023, companies across various sectors reported increased employee volunteer hours, with many organizations matching employee donations to charitable causes. This trend suggests a growing expectation for corporate involvement in community betterment.

- Community Impact: Choate Construction's participation in events like the Lowcountry Heart Walk demonstrates a tangible commitment to local well-being.

- Social Responsibility: The company's stated purpose highlights a core value of contributing positively to society.

- Reputational Benefits: Strong community engagement can lead to enhanced brand perception and customer loyalty.

- Employee Morale: Involvement in philanthropic activities often boosts employee morale and a sense of purpose.

Sociological factors significantly influence the construction industry by shaping workforce dynamics and client expectations. An aging workforce, coupled with a declining interest from younger generations, has created a widening skilled labor gap, with 70% of construction firms reporting difficulty finding skilled workers in 2023. Simultaneously, there's a growing emphasis on diversity and inclusion, as companies recognize its benefits for talent acquisition and innovation, with McKinsey reporting in 2023 that gender-diverse companies were 25% more likely to be more profitable.

Clients are increasingly demanding sustainable and technologically advanced buildings, with a 2024 Dodge Construction Network survey showing 60% of owners and contractors prioritizing sustainability. This necessitates adaptability from construction firms like Choate Construction. Furthermore, a strong commitment to community engagement and corporate social responsibility is becoming a key differentiator, fostering goodwill and enhancing brand reputation, as evidenced by increased employee volunteer hours reported across sectors in 2023.

| Sociological Factor | Impact on Construction | Choate Construction Relevance | Supporting Data (2023-2024) |

| Workforce Demographics | Skilled labor shortage due to aging workforce and lower youth interest. | Necessitates investment in training and recruitment. | 70% of firms struggled with skilled labor shortage (AGC of America, 2023). |

| Diversity & Inclusion | Attracts wider talent pool, enhances innovation and profitability. | Improves talent acquisition and retention. | Gender-diverse companies 25% more likely to be profitable (McKinsey, 2023). |

| Client Expectations | Demand for sustainable, technologically advanced, and customized buildings. | Requires adaptation of service offerings and practices. | 60% of owners/contractors prioritize sustainability (Dodge Construction Network, 2024). |

| Community Engagement | Builds brand reputation, fosters goodwill, and boosts employee morale. | Enhances company image and employee engagement. | Increased employee volunteer hours across sectors (various reports, 2023). |

Technological factors

AI and machine learning are fundamentally transforming the construction sector, boosting productivity and precision. These technologies automate routine tasks, enable real-time hazard identification, optimize scheduling, and refine cost projections. For instance, in 2024, construction firms are increasingly adopting AI for predictive maintenance on equipment, potentially reducing downtime by up to 30%.

Choate Construction can harness AI-driven tools to streamline operations and sharpen its decision-making capabilities. By integrating AI for tasks like site analysis and resource allocation, the company can anticipate challenges and improve project outcomes, mirroring industry trends where AI adoption is projected to increase project efficiency by an average of 15% by 2025.

Building Information Modeling (BIM) and digital twins are revolutionizing construction, offering immersive 3D models and real-time data for better project management and collaboration. These technologies allow for early identification of design issues and predictive maintenance, enhancing efficiency throughout a project's lifecycle.

Choate Construction can leverage BIM and digital twins to streamline workflows, improve communication among stakeholders, and optimize building performance. For instance, the global BIM market was valued at approximately $10.2 billion in 2023 and is projected to reach over $30 billion by 2030, highlighting its growing importance.

Robotics and automation are becoming essential tools in construction, helping to combat labor shortages and increase efficiency. For instance, companies are deploying robots for tasks like bricklaying and painting, which are often repetitive or dangerous. This technology not only speeds up projects but also enhances accuracy and worker safety on job sites.

Choate Construction can leverage these advancements to streamline operations and improve project timelines. The global construction robotics market was valued at approximately $1.8 billion in 2023 and is projected to grow significantly, reaching an estimated $4.5 billion by 2028, at a compound annual growth rate of around 20%. This growth highlights the increasing adoption and potential benefits of automation in the sector.

Drones for Site Monitoring and Data Collection

Drones equipped with AI and machine learning are revolutionizing site monitoring by providing real-time aerial imagery, 3D LiDAR scans, and thermal imaging. This technology allows construction managers to track progress, conduct thorough inspections, and identify potential problems with remarkable accuracy. For instance, a 2024 report indicated that drone usage in construction can reduce inspection time by up to 80% and improve data accuracy by 95%.

Choate Construction can leverage drones for various critical functions, including initial site surveys, efficient data collection, and enhancing safety protocols, especially in high-risk environments. The adoption of drone technology aligns with industry trends, with the global construction drone market projected to reach $5.7 billion by 2027, demonstrating significant growth potential.

- Enhanced Site Monitoring: Real-time aerial data provides a comprehensive overview of project status.

- Improved Inspection Capabilities: LiDAR and thermal imaging allow for detailed structural analysis and early issue detection.

- Increased Safety: Drones can access hazardous areas, reducing human risk.

- Data-Driven Decision Making: Accurate, up-to-date information supports better project management.

Cloud-Based Collaboration and Data Analytics

Cloud computing and advanced data analytics are becoming critical for boosting productivity and efficiency in construction. These technologies enable real-time collaboration among geographically dispersed teams, a significant advantage for a company like Choate Construction managing multiple projects. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting its widespread adoption and importance in business operations.

By leveraging cloud-based platforms, Choate Construction can streamline project management, allowing for seamless sharing of blueprints, schedules, and progress reports. Furthermore, sophisticated data analytics tools can provide actionable insights into project performance, helping to identify potential risks early and optimize resource allocation. In 2023, construction firms utilizing data analytics reported an average of 15% improvement in project delivery times, demonstrating a tangible benefit to adopting these technologies.

- Enhanced Collaboration: Cloud platforms facilitate simultaneous access and editing of project documents by all stakeholders, regardless of location.

- Data-Driven Decision Making: Analytics provide insights into cost overruns, schedule delays, and resource utilization, enabling proactive problem-solving.

- Risk Management: Predictive analytics can forecast potential issues, such as material shortages or weather impacts, allowing for mitigation strategies.

- Operational Efficiency: Streamlined workflows and better resource management contribute to reduced waste and improved project profitability.

Technological advancements are reshaping the construction landscape, with AI and machine learning driving significant productivity gains and precision. These tools automate tasks, identify hazards in real-time, optimize schedules, and improve cost estimations. For instance, in 2024, construction firms are increasingly using AI for predictive equipment maintenance, aiming to cut downtime by up to 30%.

Choate Construction can integrate AI to streamline operations and enhance decision-making. By applying AI to site analysis and resource management, the company can proactively address challenges and improve project outcomes, mirroring industry trends where AI adoption is expected to boost project efficiency by an average of 15% by 2025.

The adoption of advanced technologies like Building Information Modeling (BIM) and digital twins is revolutionizing construction project management and collaboration. These digital tools provide immersive 3D models and real-time data, enabling early detection of design flaws and facilitating predictive maintenance, thereby boosting efficiency across a project's entire lifecycle. The global BIM market, valued at approximately $10.2 billion in 2023, is anticipated to exceed $30 billion by 2030, underscoring its growing significance.

Choate Construction can leverage these technologies to optimize workflows, enhance stakeholder communication, and improve building performance. Robotics and automation are also becoming crucial for addressing labor shortages and increasing efficiency, with robots being deployed for tasks like bricklaying and painting, enhancing both speed and safety. The global construction robotics market, valued at around $1.8 billion in 2023, is projected to reach $4.5 billion by 2028, growing at a compound annual rate of approximately 20%.

Legal factors

The adoption of updated building codes, such as the 2024 International Building Code (IBC) and various state-specific codes effective in 2025, introduces new requirements for construction. These include provisions for climate resilience, enhanced flood protection, and the integration of energy storage systems. Choate Construction must ensure strict adherence to these evolving legal frameworks to maintain compliance and operational integrity.

Environmental regulations are becoming more stringent, impacting construction projects. For instance, in 2024, the EPA continued to enforce stricter standards on construction site runoff, requiring enhanced erosion and sediment control measures. This means Choate Construction must invest more in compliant practices and potentially specialized materials to meet these evolving requirements.

Compliance with these environmental laws often translates to increased operational costs. For example, the adoption of sustainable building materials, mandated in many new developments by 2025, can be more expensive upfront than traditional options. Choate Construction will need to factor these higher material and system costs into project bids and budgets to remain competitive while adhering to legal mandates.

Health and safety regulations, such as the Construction (Design and Management) Regulations, are crucial in the construction industry, mandating careful environmental considerations throughout project planning and execution. These legal frameworks are designed to protect workers and the public, ensuring that construction activities minimize risks and environmental impact.

Choate Construction actively maintains robust safety programs that are meticulously aligned with these legal mandates. For instance, in 2024, the company reported a lost-time injury frequency rate (LTIFR) of 0.8, significantly below the industry average, demonstrating their commitment to workforce protection and regulatory compliance.

Contract Law and Dispute Resolution

Large construction projects, like those Choate Construction undertakes, inherently involve complex contracts. These agreements govern everything from scope and timelines to payment schedules and dispute resolution mechanisms. Navigating these can be challenging, and a misstep can lead to costly legal battles.

Choate Construction's history, including involvement in legal proceedings like property foreclosure, underscores the critical need for strong legal expertise and meticulous contract management. This ensures compliance and mitigates risks associated with project execution and financial obligations.

The construction industry saw a significant number of contract disputes in recent years. For example, in 2023, the U.S. construction industry experienced an increase in litigation, with payment disputes and delays being primary drivers. This highlights the ongoing importance of Choate's focus on robust legal frameworks.

- Contract Complexity: Construction contracts, especially for large-scale projects, can be extensive and require specialized legal understanding.

- Dispute Potential: Issues like scope changes, unforeseen site conditions, and payment delays frequently lead to legal disagreements.

- Legal Vigilance: Choate's proactive approach to legal counsel and contract oversight is essential for minimizing risk and ensuring project success.

- Industry Trends: The prevalence of construction litigation, often stemming from contractual disagreements, reinforces the need for meticulous legal management.

Data Security and Privacy Laws

As construction firms like Choate Construction increasingly rely on digital tools for project management and data sharing, safeguarding sensitive information from cyber threats becomes paramount. Growing concerns around data security and privacy necessitate robust measures to protect project data and ensure compliance with evolving regulations.

Compliance with data protection laws, such as GDPR and various state-level privacy acts, is crucial. For instance, the number of data breaches reported globally continues to rise, with the cybersecurity landscape constantly evolving. In 2023, the average cost of a data breach reached $4.45 million, a significant increase that highlights the financial implications of inadequate security.

- Increased reliance on digital platforms in construction: Project management software, BIM, and cloud storage solutions are becoming standard, creating more digital touchpoints for data.

- Growing threat landscape: Cyberattacks targeting businesses, including those in the construction sector, are becoming more sophisticated and frequent.

- Regulatory compliance: Adherence to data privacy laws is not optional; non-compliance can lead to substantial fines and reputational damage.

- Investment in cybersecurity: Choate Construction must allocate resources for advanced security software, employee training, and regular security audits to mitigate risks.

Legal factors significantly shape Choate Construction's operational landscape, demanding strict adherence to evolving building codes and environmental regulations. For instance, updated codes effective in 2025, like the International Building Code, mandate enhanced climate resilience and energy storage integration, requiring careful compliance. Furthermore, increasingly stringent environmental laws, such as those enforced by the EPA in 2024 concerning construction site runoff, necessitate investment in compliant practices and potentially specialized materials, impacting project costs.

Environmental factors

The demand for sustainable construction is rapidly increasing, with clients increasingly prioritizing green building certifications such as LEED and WELL. This shift is driven by a growing awareness of environmental impact and a desire for energy-efficient buildings. In 2024, the global green building materials market was valued at approximately $320 billion and is projected to grow significantly.

Choate Construction, with its established reputation in sustainable building, is well-positioned to leverage this trend. By continuing to implement eco-friendly practices and actively pursuing certifications like LEED Platinum, which saw a 15% increase in projects seeking certification in 2024, Choate can attract environmentally conscious clients and secure a competitive edge.

The construction industry is increasingly pressured by evolving environmental regulations aimed at reducing carbon footprints. New standards are emerging that mandate the use of low-carbon materials and enhanced energy efficiency in buildings, directly impacting project costs and feasibility as companies strive to meet net-zero carbon emissions targets.

Choate Construction must proactively address both operational carbon generated during a building's use and embodied carbon inherent in materials and construction processes. For instance, the UK government has set a legally binding target to achieve net-zero greenhouse gas emissions by 2050, with interim goals influencing construction practices now.

The rising cost of carbon emissions, often through carbon taxes or trading schemes, directly affects project budgets. Mandatory Environmental, Social, and Governance (ESG) reporting further necessitates transparent tracking and reduction of emissions, making sustainability a critical business imperative for firms like Choate Construction.

The construction sector's substantial environmental impact, particularly concerning waste generation, is driving a stronger emphasis on sustainable practices. Globally, construction and demolition waste accounts for a significant portion of total waste streams, prompting greater scrutiny and regulation. For instance, in 2023, the EU reported that construction and demolition waste represented over 37% of all waste generated within the bloc, highlighting the scale of the challenge.

Choate Construction's commitment to waste prevention, robust recycling programs, and efficient waste disposal methods is crucial for mitigating its environmental footprint and complying with evolving regulations. The adoption of recycled and reclaimed materials not only reduces landfill burden but also often lowers the embodied carbon of projects. This focus is becoming increasingly important as waste management levies and environmental performance standards become more stringent across various jurisdictions.

Climate Change Adaptation and Resilience

The construction sector faces increasing pressure to integrate climate change adaptation into its practices. This means building with features that can withstand extreme weather events, such as enhanced flood defenses and more robust structural designs. Choate Construction must prioritize these resilient elements to ensure project longevity and mitigate future damage, especially as climate-related events become more frequent and severe.

For instance, the increasing frequency of intense rainfall events, as highlighted by recent meteorological data, necessitates stronger stormwater management systems in new constructions. Choate Construction’s strategic planning should therefore account for the rising costs associated with climate-induced disruptions and the potential for increased insurance premiums in vulnerable areas.

- Climate Risk Assessment: Integrating thorough assessments of climate risks, such as rising sea levels and increased storm intensity, into every project phase.

- Resilient Design Standards: Adopting and exceeding current building codes to incorporate advanced flood protection, wind resistance, and heat-mitigation strategies.

- Material Innovation: Exploring and utilizing construction materials that offer greater durability and lower environmental impact in the face of changing climate conditions.

- Supply Chain Resilience: Evaluating and diversifying supply chains to ensure continued access to materials and labor amidst potential climate-related disruptions.

Water and Energy Efficiency

There's a significant push in the construction industry, including for companies like Choate Construction, to minimize water usage. This is often achieved by integrating low-flow fixtures and water-efficient landscaping in new builds and during renovations. For instance, the U.S. Green Building Council reported that LEED-certified buildings can reduce water consumption by an average of 20% to 40% compared to conventional buildings.

Optimizing energy consumption is another key environmental consideration. Choate Construction frequently incorporates energy-efficient systems, such as high-performance insulation, efficient HVAC units, and LED lighting, into their projects. These features not only reduce a building's environmental footprint but also translate into substantial long-term operational cost savings for the owners. The U.S. Department of Energy estimates that energy-efficient buildings can lower energy bills by up to 30%.

- Water Reduction: Low-flow fixtures and water-wise landscaping are standard in many modern construction projects, aiming for significant water savings.

- Energy Efficiency: Implementation of advanced insulation, HVAC, and lighting systems leads to reduced energy consumption and lower utility costs.

- Cost Savings: Both water and energy efficiency measures contribute to long-term operational cost reductions for building owners.

- Environmental Benefits: These practices directly support sustainability goals by conserving natural resources and lowering greenhouse gas emissions.

The growing demand for green building certifications like LEED and WELL, with the global green building materials market valued at around $320 billion in 2024, positions Choate Construction to capitalize on this trend. The industry faces increasing regulatory pressure to reduce carbon footprints, with new standards mandating low-carbon materials and energy efficiency, impacting project costs as companies aim for net-zero emissions.

The construction sector’s significant waste generation, accounting for over 37% of total waste in the EU in 2023, drives a focus on sustainable practices like recycling and waste prevention. Furthermore, the need to integrate climate change adaptation into construction, such as building for extreme weather resilience, is becoming critical as climate-related events increase in frequency and severity.

| Environmental Factor | Impact on Construction | Choate Construction Relevance | Data Point/Example |

|---|---|---|---|

| Sustainable Demand | Increased client preference for eco-friendly buildings | Leverage existing reputation in sustainable building, pursue certifications like LEED Platinum | Global green building materials market valued at ~$320 billion (2024) |

| Carbon Emissions Regulations | Mandates for low-carbon materials and energy efficiency | Address operational and embodied carbon, meet net-zero targets | UK target: net-zero by 2050 |

| Waste Management | Scrutiny and regulation on construction waste | Implement waste prevention, recycling programs, use recycled materials | Construction & Demolition waste ~37% of EU total waste (2023) |

| Climate Change Adaptation | Need for resilient building designs against extreme weather | Prioritize flood defenses, robust structures, climate-resilient materials | Increased frequency of intense rainfall events |

PESTLE Analysis Data Sources

Our Choate Construction PESTLE Analysis is grounded in a robust blend of public and proprietary data, encompassing government reports, industry-specific market research, and economic indicators. This ensures our insights reflect current business conditions and emerging trends impacting the construction sector.