Choate Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choate Construction Bundle

Choate Construction operates within a dynamic market, facing pressures from suppliers, buyers, and competitors. Understanding these forces is crucial for navigating the construction landscape effectively. This brief overview hints at the complexities involved.

Ready to move beyond the basics? Get a full strategic breakdown of Choate Construction’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Choate Construction's bargaining power of suppliers is influenced by the availability of specialized materials and equipment. When a project demands unique, custom-fabricated components or advanced technological systems, and only a limited number of suppliers can provide them, those suppliers gain significant leverage. This can lead to higher input costs and less favorable payment terms for Choate.

For instance, in 2024, the construction industry saw continued demand for high-performance concrete and specialized structural steel, with lead times for custom orders often extending. Companies relying on these niche inputs found themselves negotiating with a smaller pool of manufacturers, increasing supplier pricing power. This dynamic directly impacts project budgets and timelines for general contractors like Choate.

The bargaining power of suppliers for Choate Construction is significantly influenced by the availability and demand for specialized skilled labor. Trades like MEP (Mechanical, Electrical, Plumbing) and structural steel erection require a high degree of expertise, and when demand for these skills surges, suppliers of this labor gain considerable leverage. For instance, in 2024, the construction industry faced ongoing challenges with labor shortages, particularly in skilled trades, which drove up wages and made securing qualified teams more competitive.

Choate Construction's reliance on commodity materials like concrete, steel, and lumber exposes it to significant supplier power driven by pricing volatility. Global supply chain disruptions, such as those seen in 2024 impacting lumber availability due to extreme weather events affecting production, can dramatically increase raw material costs. For instance, lumber prices experienced notable fluctuations throughout 2024, directly affecting project bids and material expenses for construction firms.

Proprietary Technology and Software

Suppliers of proprietary construction software, such as Building Information Modeling (BIM) tools and advanced project management platforms, wield significant bargaining power. Choate Construction's reliance on these specialized technologies for operational efficiency and project accuracy means that switching to alternative solutions can involve substantial costs and require specialized training.

This dependence grants technology providers leverage in negotiating pricing and service agreements. For instance, the global construction software market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly, indicating a strong demand for these proprietary solutions. Choate's integration of these tools directly impacts its ability to deliver projects on time and within budget, making the continuity of these services crucial.

- High Switching Costs: Implementing new construction software can involve significant upfront investment in licensing, customization, and employee training, often running into tens of thousands of dollars for large firms like Choate.

- Specialized Knowledge: The expertise required to effectively utilize advanced construction technologies means that suppliers offering these specialized skills and ongoing support hold considerable influence.

- Efficiency and Accuracy: Choate's operational efficiency and accuracy are directly tied to the performance of these proprietary software solutions, giving suppliers leverage in contract negotiations.

- Market Growth: The increasing adoption of digital tools in construction, with the construction technology market expected to reach over $100 billion by 2028, underscores the growing power of these technology providers.

Fuel and Energy Costs

The cost of fuel for construction equipment and transportation, alongside energy for site operations, constitutes a substantial input expense for Choate Construction. In 2024, global crude oil prices, a key driver of fuel costs, experienced volatility, impacting operational budgets.

As these energy markets often behave as commodities, suppliers can wield considerable power, especially during periods of significant price swings. For instance, the average price of West Texas Intermediate (WTI) crude oil fluctuated throughout 2024, impacting fuel procurement costs.

Choate's capacity to manage these rising expenses hinges on its contractual arrangements with clients and its ability to navigate prevailing market conditions. The terms of construction contracts, whether fixed-price or cost-plus, directly influence how fuel cost increases are absorbed or passed on.

- Fuel and energy costs are a major expense for construction firms like Choate.

- Global commodity markets for oil and gas influence supplier power.

- Contractual terms and market dynamics dictate Choate's ability to manage these costs.

Choate Construction faces supplier power from providers of specialized construction materials and advanced technology solutions. When unique components or proprietary software are essential, and few suppliers offer them, those suppliers can dictate terms and pricing. This was evident in 2024 with high demand for specialized concrete and BIM software, where limited availability increased supplier leverage.

Skilled labor shortages in 2024 also amplified the bargaining power of labor suppliers, particularly in trades like MEP and steel erection. Increased demand for these specialized skills drove up wages, making it more competitive for general contractors like Choate to secure qualified teams, impacting project costs and schedules.

The company's reliance on commodity materials such as lumber also exposes it to supplier power influenced by market volatility. Supply chain disruptions in 2024, affecting lumber availability due to weather, led to significant price fluctuations, directly impacting Choate's material expenses.

| Input Category | Supplier Bargaining Power Drivers | 2024 Impact Example | Choate's Vulnerability |

|---|---|---|---|

| Specialized Materials | Limited suppliers, custom fabrication | High demand for performance concrete | Higher input costs, longer lead times |

| Skilled Labor | Labor shortages, high demand for trades | Increased wages for MEP and steel erectors | Competitive labor acquisition, potential project delays |

| Commodity Materials | Supply chain disruptions, price volatility | Lumber price fluctuations due to weather | Increased raw material expenses, bid uncertainty |

| Proprietary Software | High switching costs, specialized knowledge | Dependence on BIM and project management tools | Contractual leverage for software providers |

What is included in the product

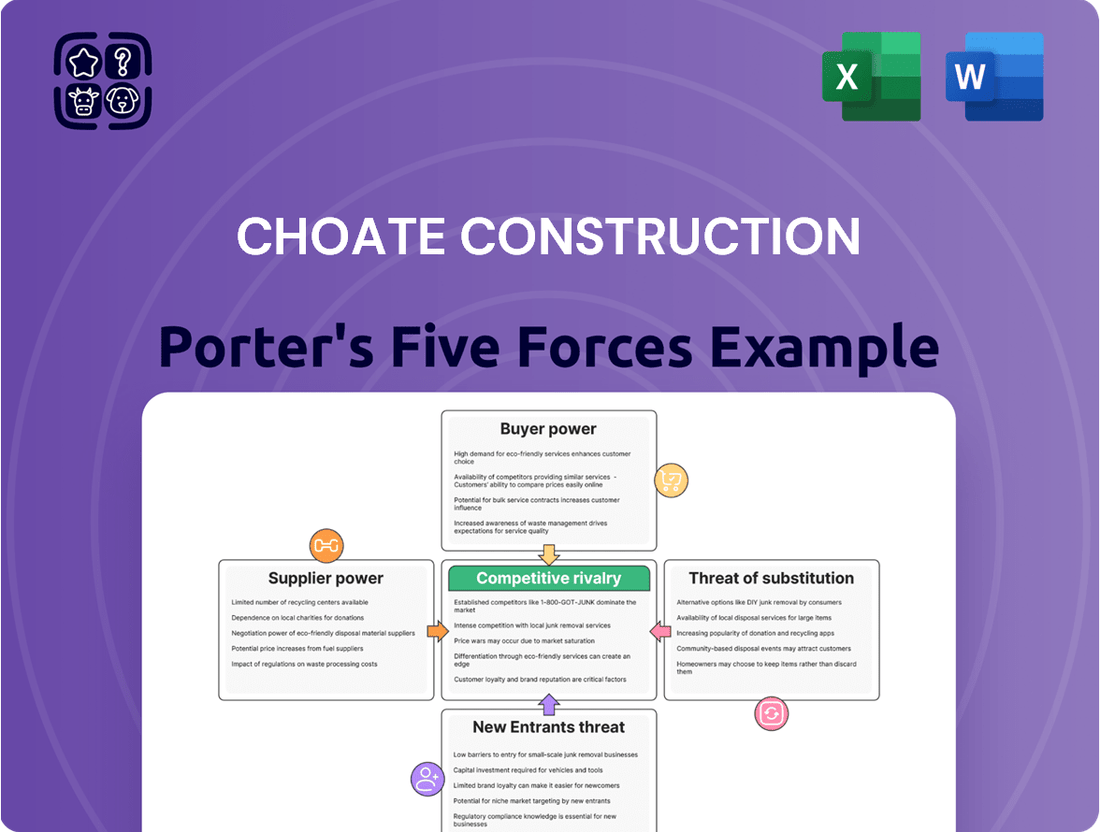

Choate Construction's Porter's Five Forces analysis meticulously examines the competitive intensity within its operating environment, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing firms.

Visualize competitive intensity with a dynamic, customizable dashboard, allowing Choate Construction to proactively address market pressures and identify strategic opportunities.

Customers Bargaining Power

For large, multi-million dollar construction projects, clients typically wield considerable bargaining power. These substantial contracts represent significant revenue for firms like Choate Construction, allowing clients to negotiate better pricing and more favorable terms. In 2023, the average value of a large commercial construction project in the US exceeded $10 million, highlighting the financial weight these clients carry.

The sheer scale of these projects means clients can often solicit bids from numerous qualified construction companies. This competitive bidding process naturally increases the client's leverage, as they can choose the most advantageous offer. For instance, a single large hospital or infrastructure project might attract bids from over a dozen major construction firms, intensifying the competition for Choate.

The sheer number of commercial general contractors available significantly empowers customers. In 2024, the U.S. construction industry is characterized by a robust market with numerous established and emerging general contractors, many of whom possess strong reputations and extensive portfolios. This abundance of choice means clients can readily compare bids and services, making it easier to switch providers if they feel their needs aren't being met or if a competitor offers a more attractive package.

This competitive landscape directly impacts Choate Construction by increasing customer bargaining power. Clients can leverage the availability of multiple contractors to negotiate more favorable pricing, demand higher quality standards, and seek out enhanced service offerings. For Choate, this necessitates a continuous focus on delivering exceptional value and differentiating itself through superior project execution, client relationships, and innovative solutions to secure and retain business.

If Choate Construction's customer base is heavily concentrated within just a few major industries, such as large-scale commercial real estate or healthcare, those dominant sectors can exert significant leverage. For example, if a handful of major developers or hospital systems represent a substantial portion of Choate's annual revenue, these key clients might be able to negotiate more favorable terms, including pricing and project timelines, due to their substantial and recurring project pipelines.

This concentration of power means that a downturn in a single industry or the loss of a few large clients could disproportionately impact Choate's business. To counter this, maintaining a diverse client portfolio across various industries is a critical strategy for mitigating the bargaining power of concentrated customer bases.

Switching Costs for Customers

While customers can easily choose a different contractor for future projects, the cost of switching during an active construction project is prohibitively high. This involves significant disruption, potential project delays, and the risk of legal complications, effectively neutralizing customer bargaining power once a contract is in place. For instance, a mid-project switch could easily add 15-20% to the overall project cost due to rework and new mobilization.

However, this power shifts dramatically to the customer during the pre-construction and bidding phases. This is where clients evaluate potential partners and negotiate terms. Choate Construction's strong reputation for reliability, evidenced by its consistent on-time and on-budget project completion rates, helps to mitigate this pre-contractual customer leverage. In 2024, Choate reported a 98% client satisfaction rate, reinforcing their ability to command favorable terms even in the early stages.

- High Switching Costs During Projects: Disruptions, delays, and legal issues make switching contractors mid-project extremely costly for clients.

- Increased Power in Bidding Phase: Customers hold significant bargaining power before a contract is awarded, influencing initial terms.

- Choate's Reputation Mitigation: A strong track record of reliability reduces customer power during the pre-contractual negotiation period.

Customer Financial Health and Expertise

Sophisticated clients, especially those with deep pockets and extensive experience in construction, wield significant bargaining power. Their financial robustness means they can often dictate terms, secure better pricing, and demand higher quality. For instance, a large institutional investor undertaking a major commercial development in 2024 might have the leverage to negotiate lower profit margins for contractors like Choate Construction due to the sheer volume and potential for repeat business.

These experienced clients understand the intricacies of construction contracts, market rates, and project timelines. This knowledge allows them to push for more favorable payment schedules, reduced risk allocation, and stringent performance benchmarks. They are less likely to be swayed by standard contract offerings and will actively negotiate clauses that protect their interests, potentially impacting Choate's project profitability.

- Financial Sophistication: Clients with strong financial backing can absorb project risks and negotiate from a position of strength.

- Market Knowledge: Informed clients can compare bids effectively and demand competitive pricing, potentially squeezing contractor margins.

- Project Experience: Repeat clients with a history of successful projects often have established relationships and clear expectations, increasing their leverage.

- Negotiating Prowess: Clients adept at contract negotiation can secure terms that favor them, such as extended payment terms or performance bonuses tied to strict deadlines.

Customers possess substantial bargaining power, particularly for large-scale projects where their financial commitment is significant. This leverage is amplified by the competitive landscape of the construction industry, where numerous qualified contractors vie for business. In 2024, the U.S. construction market features a robust supply of general contractors, enabling clients to readily compare bids and services, thereby increasing their ability to negotiate favorable terms and pricing from firms like Choate Construction.

| Factor | Impact on Customer Bargaining Power | Choate Construction's Mitigation Strategy |

| Project Size & Value | High for multi-million dollar projects | Focus on value, quality, and client relationships |

| Number of Competitors | High due to abundant contractors | Differentiate through superior execution and innovation |

| Switching Costs (Mid-Project) | Very High | Maintain strong project management and client satisfaction |

| Client Sophistication & Market Knowledge | High for experienced clients | Demonstrate reliability and competitive pricing |

Full Version Awaits

Choate Construction Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Choate Construction's competitive landscape through a detailed examination of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. This analysis is meticulously crafted to provide actionable insights for strategic decision-making.

Rivalry Among Competitors

The commercial construction landscape is quite crowded, featuring a wide array of regional and national companies. Choate Construction finds itself in direct competition with a diverse group, ranging from smaller, localized contractors to much larger, established national firms.

This extensive number of participants significantly heats up the competition, especially when companies are vying for projects in the same market segments or geographic areas. For instance, in 2024, the U.S. Census Bureau reported over 350,000 establishments primarily engaged in heavy and civil engineering construction, illustrating the sheer density of players.

The construction industry's growth rate directly fuels competitive rivalry. During periods of slower economic expansion, such as the projected moderate growth in commercial construction for 2024, competition for projects becomes fierce. Contractors often resort to aggressive bidding, driving down prices and squeezing profit margins as they vie for limited opportunities.

Conversely, when the industry experiences robust growth, like the anticipated surge in infrastructure spending in 2025, the intensity of rivalry can diminish. With a greater volume of available work, established players may find it easier to secure contracts without the same level of price pressure, allowing for healthier profit margins.

While general contracting might seem like a uniform offering, firms like Choate Construction actively differentiate. They achieve this through deep expertise in specific sectors such as healthcare or industrial projects, and by adopting innovative approaches like design-build. A strong emphasis on safety and client satisfaction further sets them apart, mitigating the tendency towards pure price competition.

High Exit Barriers

The commercial construction sector, where Choate Construction operates, is characterized by substantial exit barriers. These include the considerable capital tied up in specialized equipment, such as cranes and earthmovers, and long-term commitments to leases for facilities and land. Furthermore, the need for a highly skilled and specialized workforce, often with certifications and extensive experience, makes it difficult for firms to simply shut down operations without significant loss.

These high exit barriers mean that even companies facing financial difficulties may persist in the market. Instead of ceasing operations, they might continue to bid on projects, even at reduced profit margins or for less desirable work, to cover fixed costs and retain their workforce. This dynamic contributes to sustained and often intense competition among existing players, as no one wants to be the first to leave the arena.

For instance, in 2024, the average construction company might have millions of dollars invested in heavy machinery, with depreciation and maintenance costs continuing even during periods of low activity. Leased office and yard space can represent ongoing monthly expenses that a company must attempt to cover. The inability to easily divest these assets or redeploy specialized labor forces compels many firms to remain active, thus intensifying the competitive rivalry for Choate Construction and its peers.

- Significant Capital Investment: Construction firms often have millions invested in heavy machinery, which is difficult to liquidate quickly.

- Long-Term Lease Obligations: Commitments to facilities and land leases continue regardless of project volume.

- Specialized Workforce Retention: The cost and difficulty of maintaining a skilled labor force encourage continued operation.

- Persistence of Struggling Firms: High exit barriers lead to companies operating at lower margins rather than exiting, increasing rivalry.

Project Bidding and Tendering Process

The construction industry's project bidding and tendering process is a major driver of competitive rivalry. Contractors frequently find themselves bidding against numerous other firms for the same projects, which naturally intensifies competition. This often results in contractors submitting increasingly aggressive pricing to secure work, sometimes even operating on thin margins.

The inherent transparency of the bidding process means that participants are acutely aware of their competitors. They can see who else is bidding and often gain insights into their pricing strategies. This awareness fuels a continuous cycle of competitive pressure, as firms adjust their approaches to stay ahead.

- Intense Bid Competition: In 2024, the average number of bids submitted per public construction project often exceeded 10, highlighting the crowded competitive landscape.

- Price Sensitivity: Contractors frequently report that winning bids are often decided by the lowest price, with bid price being the primary factor in over 70% of public sector awards.

- Awareness of Competitors: Industry surveys indicate that over 85% of construction firms regularly monitor the bidding activity and project wins of their direct competitors.

The commercial construction sector is highly competitive, with numerous firms vying for projects, often leading to aggressive pricing strategies. This intense rivalry is exacerbated by the transparency of the bidding process, where competitors are aware of each other's pricing, driving down margins.

In 2024, the sheer volume of construction firms, exceeding 350,000 in heavy and civil engineering alone, ensures a crowded marketplace. This density means companies like Choate Construction must differentiate through specialization and innovation to avoid being solely price-takers.

High exit barriers, such as significant investments in machinery and skilled labor, compel even struggling firms to remain active, thus perpetuating fierce competition. This persistence means Choate Construction consistently faces a broad spectrum of competitors, from small local outfits to large national players, all seeking to secure limited project opportunities.

| Factor | Description | 2024 Data/Trend |

|---|---|---|

| Number of Competitors | Many regional and national construction companies | Over 350,000 establishments in heavy/civil engineering alone in the US |

| Bidding Intensity | Aggressive pricing due to frequent bidding against multiple firms | Average of 10+ bids per public project; price is the primary award factor in >70% of public sector deals |

| Competitive Awareness | Firms monitor competitor activity and pricing | >85% of firms track competitor bidding and project wins |

| Differentiation | Specialization, innovation (e.g., design-build), client service | Key strategies to mitigate pure price competition |

SSubstitutes Threaten

Large corporations or institutions with substantial and ongoing construction projects may choose to build their own in-house construction capabilities. This directly substitutes the need for external general contractors like Choate Construction, especially for clients with predictable, continuous facility expansion or maintenance needs.

For example, a major retail chain with a consistent rollout of new stores or a large university system managing regular campus upgrades could find it more cost-effective in the long run to manage these projects internally. In 2024, many large enterprises are re-evaluating their operational efficiencies, and this could lead to a greater investment in internal project management and construction oversight.

The rise of modular and prefabricated construction presents a significant threat of substitutes for traditional general contracting services. These off-site construction methods can deliver projects faster and often at a lower cost due to efficiencies in labor and material management. For instance, the global modular construction market was valued at approximately $150 billion in 2023 and is projected to grow substantially, indicating a clear shift towards alternative building solutions.

Clients may opt for specialized design firms or independent project management consultants to oversee construction projects. This approach bypasses the need for a comprehensive general contractor, thereby fragmenting the construction service offering. For instance, in 2024, the global construction project management software market was valued at approximately $3.5 billion, indicating a significant demand for specialized project oversight solutions.

Alternative Building Materials and Technologies

Innovations in construction are rapidly introducing substitutes that can bypass traditional methods. For instance, 3D-printed buildings, a growing sector, offer faster construction times and potentially lower labor costs, directly challenging conventional brick-and-mortar approaches. In 2023, the global 3D printing construction market was valued at approximately $1.5 billion and is projected to grow significantly.

Advanced material composites also represent a substantial threat. These materials can simplify installation, reduce the need for specialized trades, and offer enhanced performance characteristics. For example, pre-fabricated modular building components, which saw a surge in demand during labor shortages in 2024, can significantly cut down on-site assembly time and complexity.

- 3D Printing: Offers speed and reduced labor dependency, with the global market expected to reach over $10 billion by 2030.

- Modular Construction: Utilizes off-site prefabrication, leading to faster project completion and improved quality control.

- Advanced Composites: Lighter, stronger, and easier to install than traditional materials, reducing overall construction time and cost.

- Sustainable Materials: Innovations like cross-laminated timber (CLT) provide alternatives to concrete and steel, offering environmental benefits and faster assembly.

Renovation vs. New Construction

For construction firms like Choate Construction, renovating or repurposing existing buildings can act as a significant substitute for new ground-up construction. This trend is particularly noticeable as clients weigh the benefits of cost savings, prime existing locations, or the imperative of historical preservation against the prospect of entirely new builds. For instance, the U.S. construction market saw a notable increase in renovation and repair spending, with the U.S. Census Bureau reporting approximately $150 billion in residential improvements and alterations in 2023 alone, indicating a strong preference for upgrading existing structures in many scenarios.

This shift directly impacts the demand for new construction projects, which is a core service for companies like Choate. When clients opt for renovation, it means fewer opportunities for new foundations, framing, and roofing contracts. The economic climate often amplifies this substitution effect; in times of economic uncertainty, the upfront cost of new construction can be prohibitive, making the more budget-friendly option of renovation highly attractive. This dynamic can limit the growth potential for new construction services.

Consider these factors driving the substitution:

- Cost-Effectiveness: Renovations often present a lower overall cost compared to the complete expense of acquiring land, designing, and building a new structure.

- Location Advantage: Existing buildings are frequently situated in established, desirable areas, bypassing the need for new land acquisition and development in potentially less accessible or more expensive locations.

- Historical or Environmental Preservation: Client mandates or public sentiment may favor preserving historical architectural integrity or reducing environmental impact by reusing existing materials and structures.

- Reduced Lead Times: Renovation projects can sometimes offer quicker completion timelines than ground-up construction, especially when dealing with complex permitting and site preparation for new builds.

The threat of substitutes for general contractors like Choate Construction is multifaceted, encompassing alternative construction methods and client-led strategic shifts. Innovations such as 3D printing and modular construction offer faster, often cheaper, alternatives to traditional building. For instance, the global modular construction market was valued at approximately $150 billion in 2023, highlighting a significant shift towards these methods.

Furthermore, clients increasingly opt for in-house capabilities or specialized project management firms, bypassing the need for a full-service general contractor. This trend is supported by the growth in construction project management software, valued at around $3.5 billion globally in 2024, indicating a demand for specialized oversight.

Renovating existing structures also serves as a powerful substitute for new construction. In 2023, U.S. residential improvements and alterations alone reached roughly $150 billion, demonstrating a strong client preference for upgrades due to cost, location, or preservation factors.

| Substitute Type | Key Characteristics | Market Indicator (2023/2024 Data) |

|---|---|---|

| Modular Construction | Off-site prefabrication, faster completion, quality control | Global Market Valued at ~$150 Billion (2023) |

| 3D Printing Construction | Speed, reduced labor dependency | Global Market Valued at ~$1.5 Billion (2023), projected growth |

| In-house Construction Teams | Cost-effectiveness for large, ongoing projects | Increasing enterprise re-evaluation of operational efficiencies (2024) |

| Specialized Project Management | Focus on oversight, potentially bypassing GC | Global Construction PM Software Market Valued at ~$3.5 Billion (2024) |

| Renovation/Repurposing | Cost savings, location advantage, preservation | U.S. Residential Improvements & Alterations: ~$150 Billion (2023) |

Entrants Threaten

The commercial general contracting sector, where Choate Construction operates, presents a formidable threat of new entrants primarily due to high capital requirements. Launching a new firm necessitates significant upfront investment in essential equipment, securing substantial bonding capacity to bid on projects, obtaining comprehensive insurance coverage, and covering initial operating expenses. For instance, in 2024, many regional general contractors reported needing upwards of $5 million in bonding capacity to even be considered for mid-sized commercial projects.

These considerable financial barriers effectively limit the number of new players capable of entering the market and competing on an equal footing with established entities like Choate. Companies with deep financial reserves and proven track records, such as Choate, are better positioned to absorb these costs and leverage their financial strength to secure lucrative contracts, making it challenging for nascent competitors to gain traction.

Choate Construction's deep-rooted reputation for exceptional quality, unwavering safety standards, and consistent client satisfaction acts as a formidable barrier. This hard-won trust, built over years of successful project delivery, makes it difficult for newcomers to compete.

Furthermore, Choate benefits from a robust network of established relationships with key industry players, including developers, architects, and subcontractors. New entrants simply do not possess this vital network, hindering their ability to secure initial projects and gain market credibility.

The commercial construction sector is burdened by substantial regulatory and licensing requirements. New companies must secure numerous permits and licenses, and strictly adhere to intricate building codes and safety regulations. For instance, in 2024, the average time to obtain a major building permit in large U.S. cities could extend from several months to over a year, with associated fees often reaching tens of thousands of dollars.

These extensive compliance demands create a significant barrier to entry. Navigating this complex landscape requires considerable expertise and financial resources, making it challenging for new entrants to compete effectively with established firms like Choate Construction, which possess the experience and infrastructure to manage these processes efficiently.

Access to Skilled Labor and Subcontractors

The threat of new entrants concerning access to skilled labor and subcontractors is moderate for construction firms like Choate. New companies often face significant hurdles in attracting and retaining experienced project managers, superintendents, and skilled tradespeople. Furthermore, building a reliable network of quality subcontractors, essential for project success, takes time and a proven track record.

Established companies, such as Choate Construction, benefit from existing relationships and a reputation that makes them more attractive to both skilled labor and subcontractors. This deep-rooted network is a significant competitive advantage, enabling smoother project execution and more competitive bidding processes.

- Labor Shortages: The construction industry continues to grapple with skilled labor shortages. For instance, a 2024 Associated General Contractors of America (AGC) survey indicated that over 70% of construction firms reported difficulty finding qualified workers. This makes it challenging for new entrants to staff projects adequately.

- Subcontractor Reliability: New firms may struggle to secure reliable subcontractors, especially for specialized trades. Established firms often have long-standing partnerships with subcontractors who prioritize their work due to consistent business and timely payments, a factor that can be difficult for newcomers to replicate.

- Experience Premium: Experienced project managers and superintendents command higher salaries and are often loyal to established firms that offer stability and challenging projects. New entrants must offer a significant premium to lure this talent away.

Experience and Project Complexity

The commercial construction sector, especially for intricate projects in healthcare or industrial fields, demands significant experience. Newcomers often struggle with the sheer complexity of project management, risk evaluation, and the practical problem-solving needed for large-scale endeavors. This lack of a proven track record and specialized expertise inherently limits the competitive threat they pose to established firms like Choate Construction.

For instance, a 2024 report indicated that over 70% of major healthcare construction projects experienced delays or cost overruns due to unforeseen complexities, highlighting the critical role of seasoned project management. New entrants are unlikely to possess the established systems and experienced personnel to navigate these challenges effectively.

- Experience Barrier: New firms lack the deep operational knowledge and historical data crucial for successful execution of complex projects.

- Risk Management Gap: Established companies have refined risk assessment and mitigation strategies developed over years of handling diverse project types.

- Reputation and Trust: Clients often prioritize proven performance and reliability, which new entrants have yet to build in specialized construction niches.

- Capital Intensity: The high upfront investment in equipment, technology, and skilled labor creates a substantial financial hurdle for new market participants.

The threat of new entrants in commercial construction, impacting firms like Choate Construction, is significantly mitigated by high capital requirements, regulatory hurdles, and the need for established reputations. New companies face substantial upfront investments in equipment and bonding, often exceeding $5 million for mid-sized projects in 2024. Navigating complex regulations and licensing further complicates entry, with permit acquisition alone sometimes taking over a year and costing tens of thousands of dollars in 2024.

Furthermore, the industry's reliance on skilled labor and trusted subcontractors presents a challenge for newcomers. In 2024, over 70% of construction firms reported difficulty finding qualified workers, and new entrants struggle to build the reliable subcontractor networks that established firms like Choate leverage. This, combined with the experience premium for seasoned professionals, creates a steep climb for new competitors.

| Barrier Type | Description | Impact on New Entrants | 2024 Data Point Example |

| Capital Requirements | Investment in equipment, bonding, insurance | High hurdle, limits number of viable entrants | $5M+ bonding capacity needed for mid-sized projects |

| Regulatory Compliance | Permits, licenses, building codes, safety | Time-consuming and costly to navigate | 12+ months for major permits, $10k+ in fees |

| Reputation & Relationships | Client trust, developer/architect/subcontractor networks | Difficult to replicate, essential for securing work | Established firms benefit from long-term partnerships |

| Skilled Labor Access | Attracting and retaining experienced personnel | Challenging due to industry-wide shortages | 70%+ firms report difficulty finding qualified workers |

| Project Experience | Managing complex projects, risk assessment | New entrants lack proven track record and specialized knowledge | 70%+ major healthcare projects faced delays/overruns in 2024 |

Porter's Five Forces Analysis Data Sources

Our Choate Construction Porter's Five Forces analysis leverages data from industry-specific trade publications, government economic reports, and publicly available financial statements of competitors to provide a comprehensive view of the construction landscape.