China Galaxy Securities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Galaxy Securities Bundle

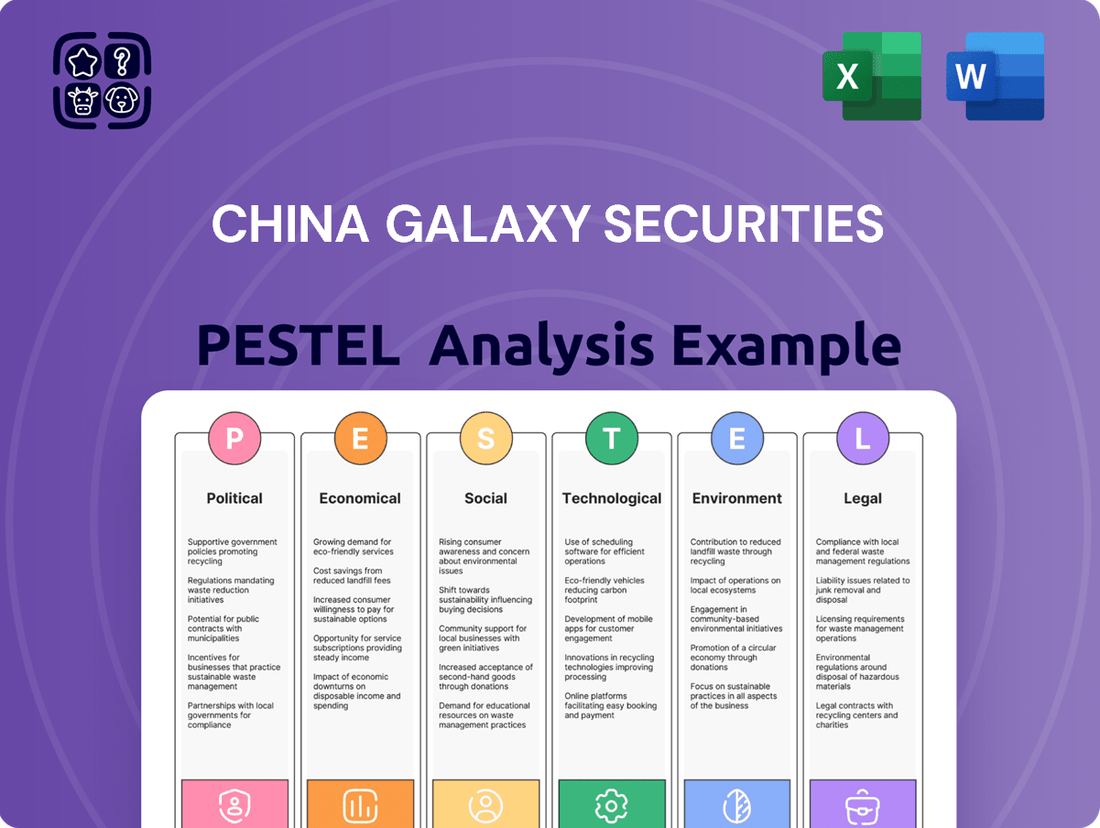

Uncover the critical political, economic, social, technological, legal, and environmental factors influencing China Galaxy Securities's trajectory. This comprehensive PESTLE analysis provides actionable insights to navigate the dynamic Chinese market. Gain a competitive advantage by understanding these external forces—download the full report now!

Political factors

China's government maintains a robust, centralized grip on its financial markets, a key political factor influencing China Galaxy Securities. This control allows for swift policy implementation, shaping the landscape for financial institutions.

Policies enacted in 2024 and 2025 underscore a commitment to deepening capital market reforms and fostering high-quality economic development. For instance, the China Securities Regulatory Commission (CSRC) announced plans in early 2024 to further streamline IPO processes and enhance investor protections, directly impacting the securities sector.

These governmental directives aim to support the real economy, which translates into opportunities for firms like China Galaxy Securities to engage in lending, underwriting, and investment banking activities aligned with national economic priorities. The focus on innovation and technological advancement within these policies also presents avenues for growth.

China's commitment to financial sector reform is evident in its proactive regulatory approach. The 'New National Nine Articles,' introduced in April 2024, aim to bolster capital market development by enhancing supervision and mitigating systemic risks. This policy framework signals a strategic push towards greater market stability and investor protection.

The China Securities Regulatory Commission (CSRC) is at the forefront of these reforms, intensifying oversight of securities and fund management institutions. This heightened scrutiny, coupled with efforts to prevent financial contagion, reflects a broader governmental objective to foster a more resilient and trustworthy financial ecosystem. Such measures are crucial for attracting both domestic and international investment.

China's government is aggressively pushing green finance, establishing policies to strengthen its green financial system. This includes promoting green bonds, developing carbon markets, and mandating ESG (Environmental, Social, and Governance) disclosures for companies.

These initiatives present significant opportunities for China Galaxy Securities to expand its offerings in green investments and related financial products. For instance, the issuance of green bonds in China reached approximately RMB 660 billion (around $91 billion USD) in 2023, a substantial increase from previous years, indicating a growing market for sustainable finance.

Cross-Border Capital Market Connectivity

China is actively pursuing policies to deepen its capital markets' integration with the global economy, a move that directly benefits entities like China Galaxy Securities. This strategic push involves streamlining regulations for companies seeking to list overseas and fostering greater international collaboration within the financial sector. For instance, by the end of 2023, China had approved over 200 overseas listings for domestic companies, signaling a robust trend in cross-border capital flows.

These initiatives are designed to enhance the accessibility and efficiency of capital markets, creating new avenues for growth. China Galaxy Securities is well-positioned to leverage these developments, potentially expanding its international business operations and client base. The ongoing reforms aim to attract more foreign investment into China's markets while also facilitating Chinese companies' access to global funding sources.

Key aspects of this opening include:

- Streamlined Overseas Listing Procedures: Simplified registration and approval processes for Chinese companies listing abroad.

- Increased Foreign Investment Access: Greater opportunities for international investors to participate in China's domestic stock and bond markets.

- Enhanced Cross-Border Financial Services: Policies encouraging cooperation between domestic and international financial institutions.

Anti-Money Laundering (AML) and Data Security Regulations

China's commitment to combating financial crime is intensifying, with significant updates to Anti-Money Laundering (AML) laws expected to be fully implemented by early 2025. These changes aim to bolster the integrity of the financial system by imposing more stringent requirements on institutions like China Galaxy Securities. The People's Bank of China has been actively refining its regulatory framework, with a particular focus on enhancing the traceability of financial transactions and improving the reporting of suspicious activities.

Alongside AML, data security is a paramount concern. The new Network Data Security Management Regulations, also slated for early 2025, will impose stricter obligations on how financial data is collected, stored, and processed. This means China Galaxy Securities needs to invest heavily in advanced cybersecurity measures and ensure all data handling practices align with these evolving national standards. Failure to comply could result in substantial penalties and reputational damage.

Key compliance areas for China Galaxy Securities include:

- Enhanced Customer Due Diligence (CDD): Implementing more rigorous identity verification and risk assessment processes for all clients.

- Transaction Monitoring: Utilizing sophisticated systems to detect and report unusual or potentially illicit transaction patterns.

- Data Localization and Cross-Border Transfer: Adhering to strict rules regarding where sensitive customer data can be stored and how it can be transferred internationally.

- Cybersecurity Infrastructure: Fortifying systems against data breaches and ensuring the integrity and confidentiality of all information.

China's political landscape significantly shapes the operational environment for China Galaxy Securities, with government policy driving market reforms and economic development. The nation's commitment to deepening capital markets, as exemplified by the 'New National Nine Articles' in April 2024, aims to bolster supervision and reduce systemic risks, directly impacting securities firms.

Government initiatives promoting green finance and ESG disclosures, alongside the expansion of green bond issuance which reached approximately RMB 660 billion in 2023, present growth opportunities. Furthermore, policies facilitating overseas listings, with over 200 approvals by end-2023, and increased foreign investment access are key political factors influencing international integration.

The government's focus on combating financial crime, including enhanced AML laws and data security regulations due in early 2025, necessitates stringent compliance. China Galaxy Securities must adapt to these evolving regulatory demands to maintain operational integrity and trust.

| Policy Area | Key Initiative/Regulation | Impact on China Galaxy Securities | Timeline/Data Point |

|---|---|---|---|

| Capital Markets | 'New National Nine Articles' | Enhanced supervision, risk mitigation | April 2024 |

| Sustainable Finance | Green Bond Market Growth | Opportunities in green investments | RMB 660 billion issued in 2023 |

| Internationalization | Overseas Listing Facilitation | Expansion of cross-border services | Over 200 approvals by end-2023 |

| Compliance | AML & Data Security Laws | Increased focus on due diligence & cybersecurity | Early 2025 implementation |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing China Galaxy Securities, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both threats and opportunities, enabling strategic decision-making for stakeholders.

A concise, PESTLE-driven overview of China Galaxy Securities' external environment, simplifying complex market dynamics for swift strategic decision-making.

Economic factors

China's economic trajectory in 2025 is anticipated to be one of moderate expansion, with forecasts generally falling between 4.0% and 5.0% GDP growth. This steady, albeit not exceptionally rapid, expansion is crucial for China Galaxy Securities, as it directly impacts the overall financial market sentiment and the appetite for investment and financial advisory services.

A stable economic environment fosters greater investor confidence, leading to increased capital flows and a higher demand for the diverse financial products and services China Galaxy Securities provides, from brokerage to wealth management. Conversely, any significant downturn or instability could dampen this demand, affecting the firm's revenue streams and growth prospects.

China's People's Bank of China (PBOC) is maintaining a 'moderately loose' monetary stance heading into 2025. This approach includes the possibility of further interest rate adjustments and reductions in the reserve requirement ratio (RRR) to inject liquidity and stimulate economic activity. For instance, RRR cuts in 2024 have already freed up significant capital for banks to lend.

Fiscal policy is set to remain proactive, with the government likely to increase its spending. This will be supported by increased bond issuance, potentially including special sovereign bonds, to fund infrastructure projects and other growth initiatives. This dual approach aims to create a supportive environment for businesses and consumers.

The Chinese government continues to prioritize real estate market stability, implementing policies aimed at curbing excessive speculation and preventing systemic risk. These efforts are crucial for maintaining broader economic equilibrium, as a healthy property sector underpins consumer confidence and wealth.

China Galaxy Securities, like other financial institutions, faces indirect impacts from real estate market conditions. A downturn can affect asset valuations, loan portfolios, and investor sentiment, influencing the firm's operational environment and strategic planning.

As of early 2024, the property market has shown signs of stabilization, though challenges persist. For instance, the average home price growth in major Chinese cities remained subdued, reflecting ongoing policy adjustments and moderating demand.

Investment Trends and Capital Flow

China's financial landscape is increasingly prioritizing technology finance and direct financing, channeling capital towards high-quality innovative enterprises. This strategic shift is evident in the growing IPO volumes and bond issuances by tech-focused companies. For China Galaxy Securities, this trend signals significant opportunities within its investment banking and asset management divisions, particularly in catering to the burgeoning needs of these dynamic sectors.

Capital flows are actively being redirected to support national strategic industries and technological self-reliance. For instance, in 2024, China's State Council emphasized increased financial support for key technological breakthroughs, a directive that is expected to influence investment banking mandates and asset allocation strategies. This focus creates a fertile ground for China Galaxy Securities to expand its services in areas like venture capital and private equity, specifically targeting advanced manufacturing and digital economy firms.

- Increased investment in strategic sectors: China's commitment to technological advancement is driving substantial capital into areas like artificial intelligence, semiconductors, and renewable energy.

- Shift to direct financing: There's a notable move away from traditional bank lending towards equity and bond markets for corporate fundraising, especially for innovative companies.

- Opportunities for financial institutions: This environment benefits investment banks and asset managers like China Galaxy Securities that can facilitate these direct financing channels and manage specialized tech funds.

- Government support for innovation: Policy initiatives are actively encouraging financial institutions to provide tailored services and capital for high-growth, innovation-driven enterprises.

Inflation and Domestic Demand

China's inflation has been notably subdued, with the Consumer Price Index (CPI) showing a modest increase. For instance, in early 2024, CPI growth hovered around 0.5% year-on-year, prompting concerns about deflationary pressures. This low inflation environment has spurred government initiatives focused on stimulating domestic demand and encouraging consumer spending.

The push to strengthen the domestic market holds significant implications for the financial services sector. A more robust economy, driven by increased household spending and investment, can translate into greater demand for financial products and services. This includes a rise in investment activity, as consumers feel more confident about their financial futures, and potentially increased demand for credit and wealth management solutions.

- Low Inflation Environment: China's CPI growth remained low in early 2024, with figures around 0.5% year-on-year, raising deflationary concerns.

- Policy Focus on Domestic Demand: The government is actively implementing policies to boost consumption and expand domestic demand.

- Financial Sector Benefits: A stronger domestic market can lead to increased household wealth and higher investment activity, benefiting financial services.

- Impact on Investment: Enhanced consumer confidence and spending power are likely to drive greater participation in investment markets.

China's economic growth is projected to be around 4.5% for 2025, a steady pace that supports financial market activity. The People's Bank of China is maintaining a supportive monetary policy, with potential for further liquidity injections. Fiscal policy will remain expansionary, with increased government spending and bond issuance to fuel infrastructure and strategic industries.

The real estate market is a key focus for stability, with policies aimed at preventing systemic risks. While challenges persist, stabilization efforts are underway, impacting investor sentiment and asset valuations. China is also prioritizing technology finance and direct financing, channeling capital towards innovation and strategic sectors.

Low inflation, with CPI around 0.5% in early 2024, is a significant factor, prompting government efforts to stimulate domestic demand and consumption. This environment creates opportunities for financial institutions like China Galaxy Securities to support increased investment and wealth management services.

| Economic Factor | 2024/2025 Outlook | Implication for China Galaxy Securities |

| GDP Growth | 4.0%-5.0% (2025 est.) | Supports overall market activity and demand for financial services. |

| Monetary Policy | Moderately loose, potential RRR cuts | Increases liquidity, potentially lowering borrowing costs and boosting investment. |

| Fiscal Policy | Proactive, increased spending and bond issuance | Stimulates economic activity, creating opportunities in project financing and investment banking. |

| Inflation | Subdued (CPI ~0.5% early 2024) | Encourages spending, potentially increasing demand for investment and wealth management products. |

| Real Estate Market | Focus on stability, ongoing policy adjustments | Influences investor sentiment and asset valuations; requires careful risk management. |

| Financing Trends | Shift to direct financing, tech finance focus | Opportunities in IPOs, bond markets, and specialized tech funds. |

Preview the Actual Deliverable

China Galaxy Securities PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of China Galaxy Securities. This detailed report covers political, economic, social, technological, legal, and environmental factors impacting the company. You can trust that the insights and structure you see now are precisely what you'll access immediately after your transaction.

Sociological factors

China's demographic landscape is undergoing a profound transformation, marked by a declining birth rate and a rapidly aging population. By the end of 2023, China's population had fallen for the second consecutive year, with the number of births dropping to 9.02 million, a stark decrease from previous years. This demographic shift directly influences the labor market, potentially leading to labor shortages and increased wage pressures.

The aging population also reshapes consumer behavior, with a growing demand for healthcare, elder care services, and, crucially for financial institutions, wealth management and retirement planning solutions. China Galaxy Securities, like other financial service providers, must adapt its offerings to cater to the increasing needs of an older demographic seeking financial security in their later years.

Despite economic headwinds, China's income growth trajectory continues to fuel an expanding middle class. This demographic is increasingly seeking more complex financial instruments and tailored wealth management services, presenting a significant opportunity for China Galaxy Securities.

By the end of 2023, China's per capita disposable income had risen to ¥39,216, a 6.3% increase year-on-year, underscoring the growing purchasing power and financial sophistication of its citizens. This trend directly translates into a heightened demand for the very services China Galaxy Securities specializes in, from investment advisory to asset management.

As China's capital markets continue to develop, there's a growing emphasis on safeguarding and educating investors. This trend necessitates that China Galaxy Securities refine its offerings and outreach to resonate with a broad spectrum of individuals, from those just beginning their investment journey to seasoned professionals.

The increasing sophistication of Chinese investors is evident, with a significant portion actively seeking financial education resources. By July 2025, it's projected that over 60% of retail investors will engage with online educational platforms, highlighting the need for accessible and tailored content from firms like China Galaxy Securities.

Changing Consumer Preferences for Financial Services

Consumers in China are increasingly seeking digital-first, highly personalized financial experiences. This shift is fueled by the widespread adoption of mobile technology and a growing comfort with online transactions. For China Galaxy Securities, this means a strong emphasis on developing intuitive digital platforms and leveraging data analytics to offer tailored advice and products.

The demand for seamless and secure financial services is paramount. Customers expect integrated experiences across various channels, from mobile apps to online portals, with robust security measures protecting their data and assets. China Galaxy Securities must prioritize investments in cybersecurity and user-friendly interfaces to build trust and meet these evolving expectations.

- Digital Adoption: By the end of 2024, it's projected that over 85% of China's urban population will actively use mobile payment systems, indicating a strong preference for digital financial interactions.

- Personalization Demand: A recent survey revealed that 70% of Chinese consumers are more likely to engage with financial institutions that offer personalized product recommendations and financial planning tools.

- Security Concerns: While embracing digital services, data security remains a top priority, with over 60% of users citing security as the most crucial factor when choosing a financial service provider.

ESG Awareness and Responsible Investment

ESG awareness is rapidly growing in China, with the government actively promoting sustainable development. This shift is directly impacting investment decisions, pushing financial institutions to integrate ESG considerations into their strategies. For China Galaxy Securities, this presents a significant opportunity to align with national priorities and investor demand.

The emphasis on responsible investment is evident in the increasing number of ESG-focused funds and products available. By developing and actively promoting ESG-aligned financial products and services, China Galaxy Securities can tap into this burgeoning market. For instance, China's green bond market experienced substantial growth, with issuance reaching approximately RMB 1.5 trillion (around $210 billion USD) in 2023, indicating strong investor appetite for sustainable finance.

- Growing Investor Demand: A significant portion of institutional investors, particularly in developed markets, are now incorporating ESG criteria into their investment selection processes.

- Policy Support: The Chinese government has been increasingly vocal about environmental protection and sustainable growth, creating a favorable policy environment for ESG initiatives.

- Product Development: China Galaxy Securities can capitalize on this by offering a range of green financial products, sustainable bonds, and ESG-focused investment funds.

- Reputational Advantage: Demonstrating a commitment to ESG principles enhances brand reputation and can attract a broader base of socially conscious investors.

China's evolving social fabric is characterized by a rapidly aging population and a declining birth rate, with the population falling for the second consecutive year by the end of 2023. This demographic shift directly impacts the labor market, potentially leading to shortages and wage pressures, while also reshaping consumer demand towards healthcare and retirement planning services, areas where China Galaxy Securities can tailor its offerings.

The expanding middle class, fueled by continued income growth, is increasingly seeking sophisticated financial instruments and personalized wealth management. With per capita disposable income reaching ¥39,216 in 2023, a 6.3% year-on-year increase, this demographic represents a significant opportunity for firms like China Galaxy Securities to provide advanced investment advisory and asset management services.

Investor education and digital engagement are paramount, with over 60% of retail investors expected to utilize online educational platforms by July 2025. Consumers demand seamless, personalized, and secure digital financial experiences, making intuitive platforms and robust cybersecurity crucial for China Galaxy Securities to build trust and meet evolving expectations.

ESG awareness is a growing force, with government support for sustainable development influencing investment decisions. China's green bond market, reaching approximately RMB 1.5 trillion in 2023, highlights investor appetite for sustainable finance, presenting China Galaxy Securities with an opportunity to develop and promote ESG-aligned products and services.

Technological factors

China's fintech sector is a powerhouse, with mobile payments alone handling trillions of dollars annually, a trend that continued its upward trajectory through 2024. Digital banking and online lending platforms are also seeing significant expansion, offering new avenues for financial services and investment. This rapid digital evolution means China Galaxy Securities needs to aggressively pursue its own digital transformation to stay ahead.

To maintain competitiveness and better serve its clients, China Galaxy Securities must integrate advanced fintech solutions. This includes enhancing its digital platforms for trading, advisory services, and customer engagement. By embracing these technological shifts, the company can streamline operations and unlock new growth opportunities in the dynamic Chinese financial landscape.

China Galaxy Securities is actively integrating artificial intelligence and big data to revolutionize its financial services. This technological push is enabling the company to offer more personalized client solutions, significantly bolster its risk management capabilities, and enhance the intelligence of its security operations.

By leveraging these advanced technologies, China Galaxy Securities aims to gain deeper client insights, allowing for more tailored product offerings and advisory services. This strategic adoption is projected to drive substantial improvements in operational efficiency across the board.

In 2024, the global financial services sector saw significant investment in AI, with reports indicating that AI adoption in finance could boost global GDP by $1.5 trillion by 2030, with China being a major contributor. China Galaxy Securities' investment in this area positions it to capitalize on this growth.

China's advancement with the digital yuan (e-CNY) is a significant technological factor. By the end of 2023, the e-CNY pilot program had expanded to include over 260 million users and facilitated transactions worth trillions of yuan. China Galaxy Securities must closely observe the evolution of e-CNY, particularly its integration into broader financial infrastructure and potential impacts on traditional payment methods.

The increasing adoption of blockchain technology beyond cryptocurrencies presents opportunities and challenges. China is actively exploring blockchain for supply chain management, data security, and interbank settlements. For China Galaxy Securities, understanding these applications is crucial for identifying potential efficiencies and new service offerings, especially as regulatory frameworks around blockchain continue to develop.

Cybersecurity and Data Security Advancements

As digitalization accelerates, cybersecurity and data security are becoming increasingly critical for financial institutions like China Galaxy Securities. The company must prioritize investments in cutting-edge security solutions to safeguard sensitive client information and uphold customer trust. This is particularly important as new data protection regulations, such as those evolving in line with global privacy standards, come into effect, demanding stringent compliance.

China Galaxy Securities faces the imperative to fortify its digital defenses against sophisticated cyber threats. For instance, in 2023, the financial services sector globally experienced a significant rise in ransomware attacks, with average recovery costs exceeding $1 million. Therefore, proactive measures are essential.

Key areas of focus for China Galaxy Securities include:

- Enhanced threat detection and response systems: Implementing AI-powered tools to identify and neutralize threats in real-time.

- Robust data encryption protocols: Ensuring all client data, both in transit and at rest, is securely encrypted.

- Regular security audits and penetration testing: Continuously assessing vulnerabilities to stay ahead of emerging attack vectors.

- Employee training and awareness programs: Educating staff on best practices to prevent human error, a common cause of breaches.

Automation and Operational Efficiency

Technological advancements are significantly boosting automation across financial services, impacting everything from high-frequency trading algorithms to the intricate back-office processes that keep firms running smoothly. For China Galaxy Securities, embracing these tools means a direct path to streamlining operations and reducing manual intervention.

The drive towards automation within China Galaxy Securities is expected to yield substantial cost savings. By automating repetitive tasks and optimizing workflows, the company can reallocate resources more effectively, leading to enhanced operational efficiency. For instance, advancements in Robotic Process Automation (RPA) can handle data entry and reconciliation tasks, freeing up human capital for more strategic roles. In 2024, the global financial services industry saw significant investment in AI and automation, with projections indicating continued growth as firms seek to gain a competitive edge through improved speed and accuracy.

The benefits of automation extend beyond cost reduction, directly impacting China Galaxy Securities' ability to deliver faster, more accurate services to its clients. This technological integration is crucial for maintaining competitiveness in a rapidly evolving market. Key areas of automation focus include:

- Algorithmic Trading: Enhancing trading speed and execution efficiency.

- Robotic Process Automation (RPA): Automating back-office tasks like data processing and compliance checks.

- Artificial Intelligence (AI) & Machine Learning (ML): Improving risk management, fraud detection, and customer service through intelligent systems.

- Digitalization of Customer Onboarding: Streamlining account opening and KYC processes.

China's fintech landscape is a rapidly evolving domain, with mobile payments handling trillions annually and digital banking platforms expanding significantly, a trend that continued strongly through 2024. China Galaxy Securities must embrace these technological shifts, integrating advanced solutions like AI and big data to personalize client services and bolster risk management. The ongoing development of the digital yuan (e-CNY), with hundreds of millions of users and trillions in transactions by late 2023, necessitates close monitoring for potential impacts on payment infrastructure.

The firm's strategic focus on automation, particularly through AI and RPA, is set to drive substantial cost savings and enhance service delivery speed and accuracy. Cybersecurity remains paramount, with investments in threat detection, encryption, and regular audits crucial to protect sensitive data against rising global cyber threats, which saw average recovery costs exceeding $1 million for financial services firms in 2023.

| Technological Factor | Description | Impact on China Galaxy Securities | Key Data Point (2023/2024) |

| Fintech & Digitalization | Growth in mobile payments, digital banking, and online lending. | Need for aggressive digital transformation and integration of advanced platforms. | Mobile payments handling trillions annually; e-CNY pilots with over 260 million users by end-2023. |

| Artificial Intelligence (AI) & Big Data | Application in personalized services, risk management, and security. | Opportunity for deeper client insights, tailored offerings, and operational efficiency gains. | AI adoption in finance could boost global GDP by $1.5 trillion by 2030; significant investment in AI in financial services during 2024. |

| Blockchain Technology | Exploration for supply chain, data security, and settlements. | Potential for identifying efficiencies and new service offerings as regulatory frameworks evolve. | China actively exploring blockchain applications beyond cryptocurrencies. |

| Cybersecurity | Increasing importance due to sophisticated threats and data protection regulations. | Imperative to fortify digital defenses and invest in advanced security solutions to safeguard client data. | Financial services sector saw a significant rise in ransomware attacks in 2023, with average recovery costs exceeding $1 million. |

| Automation | Impact on trading, back-office processes, and customer service. | Path to streamlining operations, reducing manual intervention, and improving speed and accuracy. | Continued growth in automation investment in financial services during 2024. |

Legal factors

The China Securities Regulatory Commission (CSRC) actively refines securities and futures regulations. Recent initiatives in 2024 and early 2025 include tighter IPO oversight, increased scrutiny of listed firms, and updated trading protocols. China Galaxy Securities must maintain rigorous adherence to these dynamic regulatory frameworks to ensure operational integrity and market confidence.

China has significantly bolstered its Anti-Monetary Laundering (AML) and Counter-Terrorist Financing (CTF) legislation, adopting a risk-based methodology and broadening the scope of predicate offenses. This evolution places increased compliance burdens on both financial institutions and designated non-financial businesses and professions.

China Galaxy Securities, like its peers, must therefore invest in and refine its internal compliance systems to meet these escalating regulatory demands. This includes robust customer due diligence, transaction monitoring, and suspicious activity reporting mechanisms to ensure adherence to the People's Bank of China's directives and international Financial Action Task Force (FATF) standards.

New regulations, such as the Network Data Security Management Regulations effective January 2025, are significantly tightening controls around personal data protection and how data crosses China's borders. This means financial institutions like China Galaxy Securities must prioritize strong data governance to ensure compliance and safeguard sensitive client information.

These evolving legal landscapes necessitate substantial investment in cybersecurity infrastructure and data handling protocols. For instance, the Cybersecurity Review Measures, updated in 2023, require critical information infrastructure operators to undergo security reviews before listing overseas, impacting potential international expansion strategies for firms like China Galaxy Securities.

ESG Disclosure Requirements

2024 marked a significant shift in China's environmental, social, and governance (ESG) landscape, with the introduction of new, more stringent reporting guidelines from key regulatory bodies. These directives, issued by entities such as the Shanghai and Shenzhen Stock Exchanges, along with the Ministry of Finance, are designed to enhance transparency and accountability in corporate sustainability practices.

China Galaxy Securities, like many other listed companies, will be subject to mandatory ESG data disclosure requirements starting in 2026. This upcoming mandate underscores the growing importance of integrating ESG considerations into core business operations and reporting frameworks. Companies are now focused on building robust systems to collect, verify, and report ESG data accurately.

The evolving regulatory environment necessitates that companies like China Galaxy Securities proactively adapt their disclosure strategies. This includes:

- Developing comprehensive ESG data collection mechanisms to meet upcoming mandatory reporting standards.

- Enhancing internal controls and assurance processes for ESG information to ensure accuracy and reliability.

- Investing in technology and expertise to manage and report on a wider range of ESG metrics effectively.

- Aligning reporting practices with international best practices to attract global investors and maintain competitiveness.

Company Law and Corporate Governance Reforms

China's ongoing company law and corporate governance reforms are pivotal for financial institutions like China Galaxy Securities. These amendments are designed to refine corporate structures and bolster internal oversight mechanisms. For instance, the 2023 revisions to China's Company Law, effective July 1, 2024, emphasize enhanced shareholder rights and improved corporate governance, directly impacting how listed companies, including securities firms, operate and are supervised.

China Galaxy Securities must proactively adapt its governance frameworks to align with these evolving legal landscapes. Staying abreast of regulatory updates is crucial for maintaining compliance and operational integrity. This includes ensuring that internal policies and procedures reflect the latest requirements for transparency, accountability, and risk management within the financial sector.

- Enhanced Shareholder Rights: Recent legal amendments are strengthening the voice and protections afforded to shareholders in Chinese corporations.

- Improved Internal Supervision: New regulations place a greater emphasis on robust internal control systems and independent board oversight.

- Regulatory Alignment: China Galaxy Securities needs to ensure its corporate governance practices are fully compliant with the latest iterations of the Company Law and related financial regulations.

- Risk Mitigation: Adherence to updated governance standards helps mitigate legal and reputational risks associated with non-compliance.

China's legal framework continues to evolve, impacting financial institutions like China Galaxy Securities. The 2023 revisions to the Company Law, effective July 1, 2024, bolster shareholder rights and internal oversight, necessitating proactive adaptation of corporate governance. Furthermore, new data security regulations, such as the Network Data Security Management Regulations effective January 2025, impose stricter controls on data handling and cross-border transfers, requiring robust data governance and cybersecurity investments.

Environmental factors

China's ambitious environmental goals, including reaching peak carbon emissions before 2030 and achieving carbon neutrality by 2060, are significantly shaping its financial landscape. This national drive translates into robust green finance policies and targets, creating a fertile ground for sustainable investment growth.

These policies actively promote green financial instruments such as green loans and bonds, alongside the development of burgeoning carbon markets. For China Galaxy Securities, this presents substantial opportunities to expand its offerings in sustainable investment products and services, aligning with both national objectives and growing investor demand for ESG-aligned assets.

Environmental, Social, and Governance (ESG) factors are now critical considerations in global investment strategies. By 2024, sustainable investing assets under management reached an estimated $37.7 trillion globally, highlighting a significant shift in investor priorities. China Galaxy Securities can leverage this trend by creating and marketing financial products and advisory services that align with ESG principles, thereby attracting a growing segment of environmentally and socially conscious capital.

China Galaxy Securities, like all financial institutions, is under growing scrutiny to address climate change impacts. This includes both physical risks, like extreme weather events damaging assets, and transition risks, stemming from the shift to a low-carbon economy. For instance, the People's Bank of China has been actively promoting green finance, with outstanding green loans reaching RMB 32.35 trillion by the end of 2023, indicating a significant market shift towards sustainability that affects investment portfolios.

To navigate this evolving landscape, China Galaxy Securities must integrate robust climate risk analysis into its core operations and investment decision-making processes. This means evaluating how climate-related factors might affect the value of its investments and its own operational resilience. The firm's strategies need to reflect the increasing regulatory and market demand for climate-conscious financial products and services, aligning with China's national goals for carbon neutrality by 2060.

Carbon Market Development and Carbon Accounting

China's commitment to carbon neutrality is driving significant developments in its carbon market. By 2025, the national carbon market is slated to expand beyond the power sector to encompass major industrial emitters such as steel, cement, and aluminum. This expansion is creating substantial opportunities for carbon finance, as companies will need to navigate emissions trading and invest in decarbonization strategies.

The growing emphasis on carbon accounting and transition planning is also a key environmental factor. Financial institutions are increasingly being called upon to provide expertise in these areas, helping businesses measure, report, and manage their carbon footprints. This trend underscores the financial sector's evolving role in facilitating the transition to a low-carbon economy.

- Market Expansion: China's national carbon market is set to include steel, cement, and aluminum industries by 2025, broadening its scope beyond the power sector.

- Carbon Finance Opportunities: The market's growth is expected to unlock new avenues for carbon finance, supporting investment in emission reduction technologies and projects.

- Demand for Expertise: There's a rising need for specialized knowledge in carbon accounting and transition planning, creating a demand for financial institutions with these capabilities.

- Regulatory Drivers: These developments are underpinned by China's national environmental policies and its commitment to achieving carbon peak before 2030 and carbon neutrality before 2060.

Biodiversity Conservation and Green Taxonomy

China's commitment to biodiversity conservation, exemplified by policies like the China Biodiversity Conservation Strategy and Action Plan, directly influences financial institutions. This strategy encourages integrating biodiversity considerations into financing and investment decisions, pushing firms like China Galaxy Securities to adapt.

China Galaxy Securities can proactively align with these environmental directives by weaving biodiversity factors into its green finance product suite. This includes developing investment products that specifically support biodiversity-friendly projects and ensuring adherence to evolving green taxonomies, such as those being developed by the People's Bank of China.

By embracing biodiversity conservation, China Galaxy Securities not only meets regulatory expectations but also taps into a growing market for sustainable investments. For instance, the global sustainable finance market reached an estimated $35.3 trillion in 2024, with China playing an increasingly significant role.

- Policy Alignment: Adherence to the China Biodiversity Conservation Strategy and Action Plan.

- Green Finance Integration: Incorporating biodiversity factors into investment and financing offerings.

- Taxonomy Compliance: Following national and international green taxonomy guidelines.

- Market Opportunity: Capitalizing on the expanding global sustainable finance market.

China's environmental regulations are increasingly stringent, pushing industries towards greener practices and impacting investment strategies. The nation's commitment to carbon neutrality by 2060, coupled with the expansion of its national carbon market to include key sectors like steel and cement by 2025, creates significant opportunities and risks for financial institutions.

These environmental shifts necessitate a focus on climate risk assessment and the development of sustainable financial products. China Galaxy Securities can leverage the growing demand for ESG-aligned investments, which saw global sustainable investing assets reach an estimated $37.7 trillion in 2024, by offering specialized green finance solutions.

The integration of biodiversity considerations into financial decision-making, driven by policies like the China Biodiversity Conservation Strategy and Action Plan, further shapes the market. By aligning with these environmental directives, China Galaxy Securities can tap into the expanding sustainable finance market, estimated at $35.3 trillion globally in 2024.

| Environmental Factor | China's Policy/Goal | Impact on Financial Sector | Opportunity for China Galaxy Securities |

|---|---|---|---|

| Carbon Neutrality | Target by 2060; Peak emissions before 2030 | Increased demand for green finance, carbon trading | Develop green bonds, carbon-related investment products |

| Carbon Market Expansion | Include steel, cement, aluminum by 2025 | Growth in carbon finance, need for emissions management expertise | Offer advisory on carbon trading and compliance |

| Biodiversity Conservation | China Biodiversity Conservation Strategy and Action Plan | Integration of biodiversity into investment decisions | Create biodiversity-focused investment funds |

| Green Finance Growth | Outstanding green loans reached RMB 32.35 trillion by end of 2023 | Market shift towards sustainable assets | Expand ESG-compliant product offerings |

PESTLE Analysis Data Sources

Our China Galaxy Securities PESTLE analysis is built on a comprehensive review of official government publications, economic data from leading international organizations like the IMF and World Bank, and reputable industry-specific reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the Chinese securities market.