China Galaxy Securities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Galaxy Securities Bundle

China Galaxy Securities operates within a dynamic financial landscape, facing significant competitive pressures from rivals and the ever-present threat of new entrants. Understanding the bargaining power of both its suppliers and buyers is crucial for navigating this market effectively.

The complete report reveals the real forces shaping China Galaxy Securities’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Government regulatory bodies, such as the China Securities Regulatory Commission (CSRC), are crucial suppliers of legitimacy and operational scope for China Galaxy Securities. Their influence is immense, as they set the rules for licensing, operational procedures, and compliance, all of which are mandatory for the company's existence. For instance, in 2024, the CSRC continued to refine regulations impacting areas like algorithmic trading and the scope of foreign investment in domestic financial markets, directly shaping China Galaxy Securities' strategic options and market participation.

Technology and software providers hold significant bargaining power in the financial sector, especially for firms like China Galaxy Securities that depend heavily on advanced systems. Their leverage stems from the proprietary nature and essentiality of their solutions, including sophisticated trading platforms, robust data analytics, and critical cybersecurity measures. For instance, specialized fintech solutions that offer a distinct competitive edge can command premium pricing and favorable contract terms.

Information and data providers wield considerable influence over China Galaxy Securities. Access to real-time market data, financial news, and economic research is non-negotiable for a securities firm to function effectively. Major data providers, particularly those offering proprietary data or unique analytical tools, possess significant bargaining power because this information can directly translate into a competitive advantage for China Galaxy Securities in its trading, research, and advisory operations.

Talent Pool

The bargaining power of suppliers, particularly the talent pool, is a significant factor for China Galaxy Securities. Highly skilled financial professionals, such as analysts, traders, and investment bankers, represent critical resources. Their specialized knowledge and the intense competition for these roles within China's rapidly expanding financial sector grant them considerable leverage.

This high bargaining power means that attracting and retaining top talent is not just a strategic goal but a necessity for China Galaxy Securities to maintain its competitive edge. In 2024, the demand for experienced financial professionals in China continued to outstrip supply, driving up compensation packages and benefits.

- Specialized Knowledge: Professionals possess unique skills in areas like quantitative analysis, risk management, and deal structuring.

- Competitive Demand: China's financial services industry is experiencing robust growth, leading to fierce competition for qualified personnel.

- Retention Challenges: High turnover rates among skilled employees can disrupt operations and increase recruitment costs.

- Impact on Costs: Increased salary and benefit demands from this talent pool directly affect China Galaxy Securities' operating expenses.

Interbank and Funding Markets

While not traditional suppliers, entities in the interbank lending market and commercial banks are critical for China Galaxy Securities' liquidity and capital. Their influence stems from prevailing interest rates, overall market liquidity, and regulatory frameworks designed to ensure financial stability. In 2023, benchmark lending rates in China, such as the Loan Prime Rate (LPR), fluctuated, impacting the cost of funds for securities firms.

The bargaining power of these funding sources is directly tied to their ability to provide capital and the prevailing economic conditions. When liquidity is tight or interest rates rise, the cost of borrowing for China Galaxy Securities increases, effectively enhancing the bargaining power of the lenders. For instance, the People's Bank of China's monetary policy adjustments, including changes to reserve requirement ratios and benchmark rates, significantly shape the funding landscape.

- Interbank Market Influence: The cost of borrowing in the interbank market directly impacts China Galaxy Securities' profitability.

- Regulatory Impact: Financial regulations can either increase or decrease the bargaining power of funding providers by altering capital requirements and liquidity rules.

- Liquidity Conditions: Periods of tight market liquidity generally empower banks and other lenders, leading to higher funding costs for securities firms.

Suppliers of essential technology and data providers hold significant sway over China Galaxy Securities due to the critical nature of their offerings. In 2024, the demand for advanced trading platforms and real-time market data remained high, allowing these suppliers to command premium pricing and favorable contract terms, directly impacting China Galaxy Securities' operational costs and competitive capabilities.

The talent pool, particularly highly skilled financial professionals, represents another key supplier group with considerable bargaining power. China's booming financial sector in 2024 intensified the competition for experienced analysts and traders, driving up compensation packages and making retention a strategic imperative for China Galaxy Securities.

Financial institutions providing liquidity and capital also exert significant influence, with their bargaining power fluctuating based on market conditions and monetary policy. In 2023, changes in benchmark lending rates and liquidity conditions, influenced by the People's Bank of China, directly affected the cost of funds for securities firms like China Galaxy Securities.

| Supplier Type | Bargaining Power Drivers | Impact on China Galaxy Securities | 2023-2024 Trend Example |

|---|---|---|---|

| Technology & Data Providers | Proprietary solutions, essentiality, competitive edge | Higher costs for advanced systems, reliance on data quality | Increased demand for AI-driven analytics |

| Skilled Talent Pool | Specialized knowledge, high demand, retention challenges | Increased personnel costs, need for competitive compensation | Salary growth for financial analysts |

| Funding Sources (Banks, Interbank Market) | Liquidity, interest rates, regulatory framework | Fluctuating cost of capital, impact on profitability | PBOC's LPR adjustments |

What is included in the product

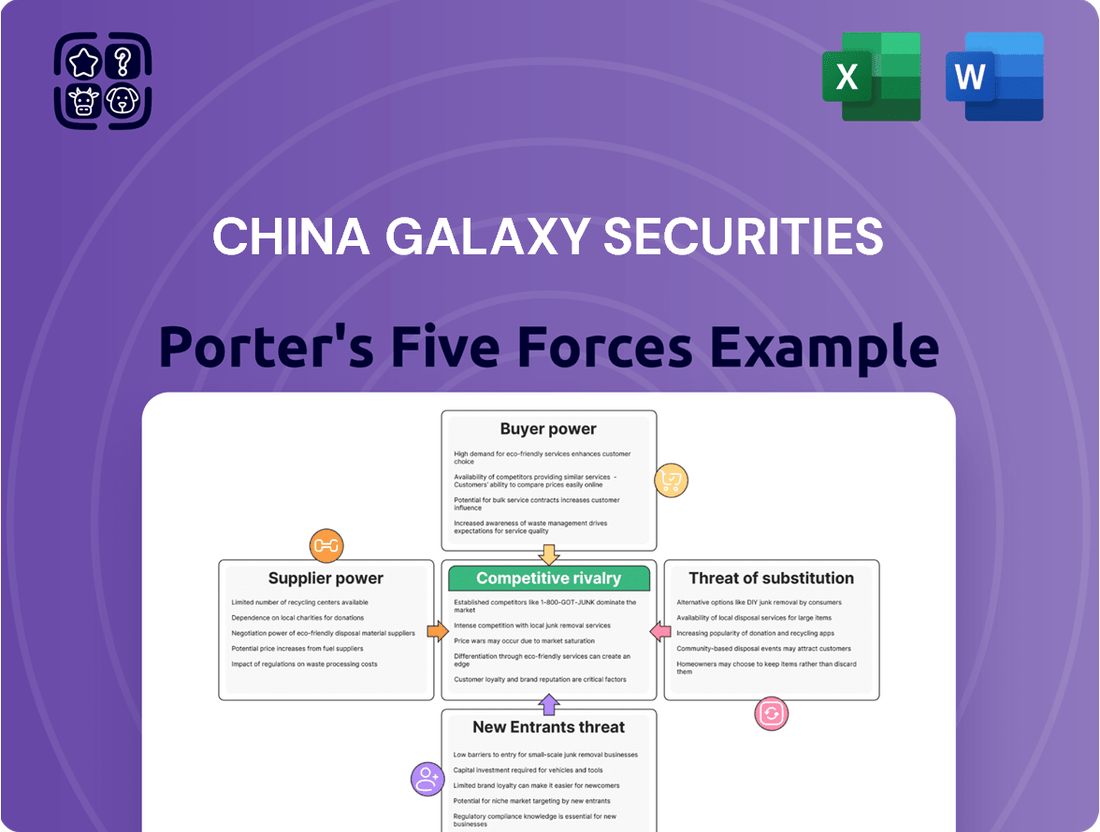

This analysis of China Galaxy Securities dissects the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the securities industry.

Quickly identify and mitigate competitive threats within China's securities market by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Individual investors, often referred to as retail clients, typically wield less bargaining power when dealing with large financial institutions like China Galaxy Securities. This is primarily due to their smaller individual transaction volumes and their dependence on the services provided by their brokers. However, the landscape can shift as competition intensifies among brokerages, forcing them to offer more attractive pricing and services to capture this segment.

The collective influence of these individual investors can become a significant factor. For instance, if a substantial number of retail clients begin to shift their business to competitors offering lower fees or superior platforms, it can pressure China Galaxy Securities to adapt its offerings. In 2023, the retail segment accounted for a significant portion of trading volumes on many exchanges, highlighting the importance of this customer base.

Institutional investors like mutual funds and pension funds wield considerable influence over China Galaxy Securities. Their substantial investment size means they can negotiate for lower commission rates and preferential treatment. For instance, a large fund manager placing a significant block trade can command better pricing than a retail investor.

These sophisticated clients often require specialized services, such as customized research reports or access to initial public offerings (IPOs). China Galaxy Securities, by offering investment banking and asset management solutions, caters to these demands, but the sheer volume of business these institutions represent grants them leverage in securing favorable terms and competitive pricing on trading and advisory services.

High-Net-Worth Individuals (HNWIs) in China, especially those looking for wealth management, wield considerable influence. They often demand tailored advice, unique investment opportunities, and competitive pricing, making their bargaining power moderate to high. Their capacity to shift significant capital means financial institutions must cater to their specific needs to retain their business.

Corporate Clients (for Investment Banking)

Corporate clients, particularly those undertaking large-scale transactions like Initial Public Offerings (IPOs) or Mergers and Acquisitions (M&A), wield significant bargaining power when engaging investment banks. This power stems from the substantial fees involved and the competitive nature of the investment banking sector.

These clients can effectively negotiate fees and service terms by leveraging the transaction's complexity and size, as well as the number of investment banks vying for their business. For instance, in 2024, major IPOs often saw multiple banks competing for lead underwriter roles, allowing the issuing corporations to secure more favorable terms.

- Transaction Size: Larger deals, often in the billions of dollars, grant corporations greater leverage in fee negotiations.

- Competitive Landscape: A crowded market of investment banks increases client bargaining power.

- Client Reputation: Well-established and reputable corporations can command better terms due to their deal-making history.

- Deal Urgency: Clients with time-sensitive transactions might have slightly less bargaining power, but still retain considerable influence.

Market Transparency and Digital Platforms

The increasing market transparency, fueled by digital platforms, significantly boosts customer bargaining power. For instance, in China, the growth of online financial comparison sites and mobile banking apps has made it simpler for consumers to evaluate and switch between securities firms. This ease of access to information on fees, services, and performance metrics directly impacts customer price sensitivity and reduces the effort required to change providers.

This heightened transparency translates into tangible benefits for customers. In 2023, China's online brokerage sector saw continued user growth, with platforms offering detailed product comparisons and transparent fee structures. This environment allows customers to readily identify the most cost-effective and feature-rich options, thereby increasing their leverage when negotiating terms or choosing a service provider. The ability to easily compare offerings from various firms, such as China Galaxy Securities, means customers can demand better pricing and service levels.

- Increased Information Access: Digital platforms provide customers with readily available data on financial products and services, enabling informed comparisons.

- Reduced Switching Costs: Online account opening and management processes simplify the transition between financial institutions.

- Enhanced Price Sensitivity: Customers are more aware of pricing differences, leading them to seek out more competitive offerings.

- Greater Negotiation Leverage: The ease of switching and access to comparative data empowers customers to negotiate better terms with their chosen securities firm.

The bargaining power of customers for China Galaxy Securities is influenced by the type of customer and market dynamics. While individual investors have limited power due to smaller transaction sizes, their collective action and the competitive brokerage environment can exert pressure. Institutional investors and high-net-worth individuals, however, possess significant leverage due to their substantial capital and demand for specialized services, enabling them to negotiate favorable terms.

| Customer Segment | Bargaining Power | Key Factors |

|---|---|---|

| Individual Investors | Low to Moderate | Transaction volume, collective action, competition among brokerages |

| Institutional Investors | High | Large transaction size, demand for specialized services, block trading capability |

| High-Net-Worth Individuals (HNWIs) | Moderate to High | Significant capital, demand for tailored advice and unique opportunities |

| Corporate Clients | High | Substantial fees, transaction complexity (IPOs, M&A), competitive banking landscape |

Preview the Actual Deliverable

China Galaxy Securities Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for China Galaxy Securities, detailing the competitive landscape, bargaining power of buyers and suppliers, threat of new entrants and substitutes, and industry rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

China's brokerage sector is a crowded arena, featuring over 140 firms, which fuels fierce competition. This fragmentation means companies like China Galaxy Securities are constantly vying for market share through aggressive pricing and enhanced service offerings.

While there have been moves towards consolidation, the brokerage landscape is anticipated to stay highly competitive for the foreseeable future. This ongoing rivalry directly impacts profit margins and necessitates continuous innovation for firms to stand out.

China's securities regulator, the CSRC, is actively promoting consolidation within the financial sector, aiming to foster larger, more competitive investment banks on a global scale. This strategic push encourages mergers and acquisitions, directly impacting competitive rivalry by increasing the pressure on existing firms to either grow or be acquired.

This regulatory environment intensifies competition as companies seek to gain market share and form strategic partnerships to enhance their capabilities. For instance, in 2023, China saw significant M&A activity in its financial services sector, with several deals aimed at building scale and improving efficiency, reflecting the CSRC's mandate.

Intense competition within China's securities industry, particularly in areas like underwriting and wealth management, has driven significant pricing pressure. Many firms, including China Galaxy Securities, have resorted to aggressive underwriting practices and low fee structures to capture market share. For instance, in 2023, the average underwriting fee for IPOs in China saw a downward trend, forcing companies to compete on more than just price.

To counter this, China Galaxy Securities and its rivals are increasingly focusing on service differentiation. This involves enhancing service quality, introducing innovative financial products, and leveraging technological advancements to improve client experience and operational efficiency. Firms that successfully differentiate are better positioned to maintain profitability and customer loyalty in this highly competitive landscape.

State-Backed and Foreign Competition

China Galaxy Securities faces robust competition from both domestic players and a growing contingent of state-backed and foreign financial institutions. The presence of larger, government-supported entities often means they have preferential access to capital and regulatory advantages, intensifying the rivalry for market share. For instance, by the end of 2023, the total assets of China's top five state-owned commercial banks exceeded 110 trillion yuan, demonstrating their immense scale and influence across the financial sector.

The increasing liberalization of China's financial markets has opened the door wider for foreign firms, bringing new competitive pressures and innovative business models. These international players often possess advanced technological capabilities and established global networks, which they leverage to attract both retail and institutional clients. By the first half of 2024, foreign-invested securities firms had increased their market share in certain segments, such as wealth management and investment banking, signaling a shift in the competitive dynamics.

- State-backed entities benefit from implicit government guarantees, potentially lowering their cost of capital and enabling more aggressive pricing strategies.

- Foreign firms are introducing sophisticated financial products and digital platforms, pushing domestic competitors to innovate and enhance their service offerings.

- The combined force of these diverse competitors necessitates continuous adaptation and strategic investment in technology and talent for China Galaxy Securities to maintain its leading position.

Market Performance and Economic Climate

The performance of China's capital markets and the overall economic climate directly impact competitive intensity within the securities industry. When markets are sluggish, as experienced in recent periods, profitability can shrink, intensifying the battle for market share and new business.

Economic uncertainties often lead to a more aggressive competitive landscape. For instance, during periods of slower economic growth, firms may engage in price wars or offer more aggressive terms to attract clients, thereby increasing rivalry. This dynamic was particularly evident in 2023, where many financial institutions focused on cost management and operational efficiency amidst market volatility.

- China's CSI 300 Index experienced a decline of approximately 11% in 2023, reflecting a challenging market environment.

- The average profit margin for securities firms in China saw a contraction in the first half of 2023 compared to the same period in 2022.

- Increased competition for underwriting fees and wealth management mandates is a direct consequence of a less buoyant economic outlook.

China Galaxy Securities operates in a highly competitive environment with over 140 domestic brokerage firms, driving aggressive pricing and service innovation to capture market share.

The ongoing push for consolidation, encouraged by regulators like the CSRC, intensifies rivalry as firms aim to scale up or face acquisition, impacting profit margins and demanding continuous adaptation.

Both state-backed entities, with their cost of capital advantages, and increasingly sophisticated foreign firms entering the market, present significant competitive challenges, pushing domestic players to enhance their offerings.

Market downturns, such as the CSI 300 Index's 11% decline in 2023, exacerbate competition as firms fight for shrinking profits, leading to price wars and a greater focus on operational efficiency.

| Metric | China Galaxy Securities (Example) | Industry Average (2023 Estimate) | Key Competitors (Example) |

|---|---|---|---|

| Market Share (Brokerage) | ~5-7% | Varies | CITIC Securities, Haitong Securities |

| Underwriting Fees (Average IPO) | ~3-5% | ~2-4% (Declining Trend) | Competitive Pressure |

| Wealth Management Growth | ~10-15% | ~8-12% | Focus on Digital Platforms |

SSubstitutes Threaten

Traditional banks and other financial institutions are increasingly stepping into the direct banking and wealth management space, offering products that can directly substitute for services provided by brokerage firms like China Galaxy Securities. These alternatives often highlight convenience and a broader spectrum of risk-return profiles, potentially drawing away clients seeking different avenues for their investments.

For instance, in 2024, the growth of digital-only banks and fintech platforms offering integrated investment and savings solutions presented a significant competitive challenge. Many of these platforms reported substantial user growth, with some reaching millions of active accounts by mid-2024, indicating a tangible shift in consumer preference towards more consolidated financial offerings.

Fintech platforms and robo-advisors represent a substantial threat of substitutes for traditional brokerage services. These digital solutions, offering lower fees and automated investment management, are increasingly attracting a segment of the market, particularly younger and tech-savvy investors. For instance, by the end of 2023, the global robo-advisory market was valued at over $20 billion and is projected to grow significantly, indicating a clear shift in investor preference towards these more accessible and cost-effective alternatives.

Customers increasingly bypass traditional securities firms by opting for direct investment channels. This trend is especially pronounced among institutional investors and high-net-worth individuals seeking to diversify into private equity, real estate, and other alternative assets. For instance, global alternative asset AUM reached an estimated $13.4 trillion in 2023, demonstrating a significant appetite for direct engagement outside of conventional brokerage services.

Cryptocurrency and Digital Assets

While still undergoing significant development and facing regulatory hurdles in China, the rise of cryptocurrencies and other digital assets presents a potential long-term threat of substitution for traditional financial services offered by firms like China Galaxy Securities. If China's regulatory stance evolves to embrace these digital assets more broadly, they could siphon investment capital away from conventional securities markets, impacting the demand for brokerage and asset management services.

The potential for digital assets to offer alternative investment avenues is a growing concern. For instance, by the end of 2024, the global cryptocurrency market capitalization has seen significant fluctuations, but the underlying technology and the concept of decentralized finance continue to mature. This maturation could lead to wider adoption, especially if traditional markets experience volatility or offer lower returns.

- Evolving Regulatory Landscape: China's approach to digital assets remains a key factor; any shift towards greater acceptance could accelerate substitution.

- Capital Flight Potential: If digital assets offer perceived higher returns or greater accessibility, investment capital could be diverted from traditional stock and bond markets.

- Technological Advancements: The underlying blockchain technology powering digital assets is constantly improving, potentially creating more robust and appealing alternatives to existing financial instruments.

Self-Directed Investment and Financial Literacy

The rise of self-directed investing, fueled by increasing financial literacy, presents a significant threat of substitutes for traditional brokerage services. As more individuals gain the knowledge and confidence to manage their own portfolios, they may bypass firms like China Galaxy Securities.

This trend is evident in the growing adoption of online trading platforms and robo-advisors. For instance, in 2024, the number of retail investors actively managing their own accounts through digital channels continued to climb, with many citing cost savings and greater control as key motivators.

- Increased Access to Information: Online educational resources, financial news sites, and market analysis tools are readily available, empowering individuals to make informed decisions without professional guidance.

- Lower Transaction Costs: Many online brokerages offer commission-free trading, making it more cost-effective for individual investors to execute trades themselves compared to paying fees to a full-service broker.

- User-Friendly Technology: Sophisticated yet intuitive trading platforms and mobile applications have lowered the barrier to entry for self-directed investing, simplifying the process for novice investors.

- Growth of Robo-Advisors: Automated investment platforms provide diversified portfolios and rebalancing services at a fraction of the cost of traditional financial advisors, acting as a direct substitute for some of the services offered by full-service firms.

The threat of substitutes for China Galaxy Securities is substantial, stemming from a variety of financial products and services that fulfill similar customer needs. Traditional banks and fintech platforms are increasingly offering integrated wealth management and investment solutions, often emphasizing convenience and broader risk-return profiles. By mid-2024, many digital banks and fintech platforms reported millions of active accounts, showcasing a tangible shift in consumer preference towards consolidated financial offerings.

Fintech and robo-advisors directly compete by providing lower fees and automated investment management, attracting tech-savvy investors. The global robo-advisory market, valued over $20 billion by the end of 2023, highlights this trend. Furthermore, institutional investors and high-net-worth individuals are increasingly seeking direct access to alternative assets like private equity and real estate, bypassing traditional brokerage services. Global alternative asset AUM reached an estimated $13.4 trillion in 2023, underscoring this movement.

| Substitute Category | Key Features | Impact on Brokerage Firms | 2024 Market Trend Example |

| Digital Banks & Fintech Platforms | Integrated banking, savings, and investment; Convenience | Client attrition, reduced fee-based income | Significant user growth reported by platforms reaching millions of accounts |

| Robo-Advisors | Automated management, lower fees | Competition for retail and mass affluent segments | Global market projected for significant growth from $20B (end 2023) |

| Direct Alternative Asset Investment | Private equity, real estate, direct market access | Loss of AUM from traditional securities | Global AUM in alternatives reached $13.4 trillion (2023) |

| Cryptocurrencies & Digital Assets | Decentralized finance, potential high returns | Long-term capital flight risk, regulatory dependent | Maturing technology and increasing adoption potential |

Entrants Threaten

The financial services sector in China presents significant hurdles for new entrants due to robust regulatory oversight. The China Securities Regulatory Commission (CSRC) and other governing bodies enforce rigorous licensing procedures and substantial capital requirements, effectively limiting the number of new players that can establish a foothold in the market.

These stringent entry conditions, including capital adequacy ratios and compliance mandates, mean that aspiring firms need considerable financial resources and a deep understanding of complex regulations. For instance, obtaining a securities firm license in China can involve a lengthy approval process and significant upfront investment, deterring many potential competitors.

Establishing a comprehensive financial services firm like China Galaxy Securities demands immense capital. Think about the costs for state-of-the-art trading platforms, robust cybersecurity, and maintaining sufficient liquidity to handle market fluctuations. For instance, as of the end of 2023, China Galaxy Securities reported total assets of approximately RMB 750 billion (roughly $104 billion USD), illustrating the scale of investment needed.

This significant capital requirement acts as a powerful deterrent for new entrants. Smaller firms or startups would struggle to match the financial muscle of established players, making it incredibly difficult to compete effectively from the outset. The sheer financial barrier to entry effectively limits the number of new competitors that can realistically challenge established entities in this sector.

Established brand reputation and trust represent a formidable barrier for new entrants looking to challenge incumbent firms like China Galaxy Securities. Major players have cultivated deep-seated client relationships and a history of reliability, making it difficult for newcomers to gain traction. For instance, in 2024, China Galaxy Securities reported a net profit of RMB 10.2 billion, demonstrating its continued financial strength and market presence, which further solidifies its trusted status among investors.

Economies of Scale and Scope

China Galaxy Securities, like many established players in the financial services sector, benefits significantly from economies of scale and scope. This allows them to spread fixed costs over a larger output, leading to lower per-unit costs for services like investment banking, wealth management, and brokerage. For instance, in 2023, China Galaxy Securities reported total operating income of RMB 33.7 billion, reflecting a substantial operational base that new entrants would find difficult to match immediately.

New entrants face a considerable hurdle in achieving comparable cost efficiencies. They must invest heavily to build the infrastructure, technology, and brand recognition necessary to compete, often starting at a cost disadvantage. This makes it challenging for them to offer competitive pricing or a similarly broad suite of services. The sheer size of incumbent operations means they can absorb market fluctuations more readily.

The ability of firms like China Galaxy Securities to leverage economies of scope, offering a diverse range of integrated financial products and services, further solidifies their competitive position. This integrated approach creates a stickier customer base and cross-selling opportunities that are difficult for specialized new entrants to replicate. For example, offering both retail brokerage and institutional asset management allows for greater operational synergy and client retention.

- Economies of Scale: Incumbents like China Galaxy Securities can spread substantial fixed costs (technology, compliance, personnel) across a vast client base and transaction volume, reducing average costs.

- Economies of Scope: Offering a wide array of financial services (e.g., brokerage, wealth management, investment banking) allows for shared resources and expertise, creating cost efficiencies and bundled value for customers.

- Barriers to Entry: New entrants must overcome significant capital requirements and operational complexities to achieve similar cost structures, making it difficult to compete on price or service breadth.

- Competitive Landscape: In 2023, China Galaxy Securities' total operating income of RMB 33.7 billion underscores the scale advantage incumbents possess against smaller, emerging firms.

Technological Advancements by Incumbents

While FinTech innovations can lower barriers for new entrants, established players like China Galaxy Securities are also aggressively investing in technology. Their substantial capital allows for significant spending on digital transformation and AI, creating a competitive edge.

These investments by incumbents can erect new barriers for startups. For instance, China Galaxy Securities' focus on AI-driven analytics and enhanced customer platforms requires considerable R&D and infrastructure, resources often beyond the reach of nascent firms.

- Incumbent Tech Investment: China Galaxy Securities is actively integrating AI and digital solutions to enhance its services and operational efficiency.

- Barrier Creation: The scale of investment in advanced technology by established firms can make it difficult for smaller, new entrants to compete on a technological level.

- Resource Disparity: Startups often lack the financial capacity to match the R&D and implementation budgets of large, incumbent financial institutions.

The threat of new entrants in China's financial services sector, particularly for firms like China Galaxy Securities, is significantly mitigated by high capital requirements and stringent regulatory hurdles. Obtaining necessary licenses and establishing the required infrastructure demands substantial financial backing, making it difficult for smaller entities to enter. For example, China Galaxy Securities' total assets of approximately RMB 750 billion (around $104 billion USD) at the close of 2023 highlight the immense scale of investment needed to compete effectively.

Established players benefit from strong brand loyalty and economies of scale, further deterring new competition. China Galaxy Securities' 2023 total operating income of RMB 33.7 billion demonstrates its significant market presence and operational efficiency, which new entrants would struggle to replicate. Moreover, incumbents’ continuous investment in technology, such as AI-driven analytics, creates an additional layer of difficulty for startups seeking to gain market share.

| Metric | China Galaxy Securities (2023) | Implication for New Entrants |

|---|---|---|

| Total Assets | ~RMB 750 billion (~$104 billion USD) | High capital barrier to entry |

| Total Operating Income | RMB 33.7 billion | Demonstrates scale advantage and cost efficiencies |

| Net Profit | RMB 10.2 billion (2024 projection/reported) | Indicates financial strength and market trust |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Galaxy Securities is built upon comprehensive data from industry-specific research reports, financial statements, and publicly available regulatory filings. We also incorporate insights from reputable financial news outlets and market intelligence platforms to capture current competitive dynamics.