Cheniere Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheniere Energy Bundle

Navigate the complex external landscape impacting Cheniere Energy with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the LNG market and Cheniere's strategic direction. Gain a critical edge by downloading the full analysis to inform your investment decisions and strategic planning.

Political factors

The U.S. government actively promotes liquefied natural gas (LNG) exports as a cornerstone of its foreign policy, aiming to bolster global energy security and enhance its geopolitical standing, particularly in regions facing energy supply disruptions. This strategic imperative directly benefits companies like Cheniere, a leading U.S. LNG exporter, by creating a supportive policy landscape for its operations and expansion.

Cheniere's position as a significant U.S. LNG producer aligns perfectly with these governmental objectives, translating into robust demand for its export infrastructure and facilitating strategic growth opportunities. This political backing often translates into a more favorable regulatory environment and the continued issuance of export authorizations, crucial for long-term investment and development.

For instance, in 2023, U.S. LNG exports reached record levels, with volumes increasing significantly compared to previous years, underscoring the growing global demand and the success of U.S. export policies. This trend is projected to continue into 2024 and 2025, further solidifying Cheniere's strategic advantage.

U.S. energy policy, informed by Department of Energy studies, increasingly supports LNG exports, acknowledging their limited effect on domestic natural gas prices. This favorable policy landscape streamlines regulatory processes for Cheniere's growth initiatives, like the elimination of the seven-year export limit. The company proactively collaborates with federal bodies to secure ongoing approvals and permits.

Trade negotiations and the imposition of tariffs directly impact LNG demand. For instance, tariffs previously led to a notable decrease in U.S. LNG exports to China. Cheniere's strategy of diversifying its customer base, as demonstrated by its agreement with Canadian Natural Resources in early 2024 for 1.9 million tonnes per annum of LNG, helps buffer against these geopolitical trade shifts.

Government Support for Infrastructure Development

Government recognition of LNG infrastructure as a strategic asset significantly bolsters Cheniere's development and expansion plans. Supportive policies are crucial for navigating the capital-intensive nature of these projects.

Cheniere's substantial capital allocation for liquefaction capacity expansion, estimated at billions of dollars for projects like Corpus Christi Stage 3, is directly influenced by this favorable regulatory climate. The administration's focus on energy security and exports creates a conducive environment for such long-term investments.

- Strategic Asset Recognition: The US government views LNG export terminals as vital for national energy security and foreign policy objectives.

- Policy Support: This translates into streamlined permitting processes and potential incentives for new liquefaction projects.

- Regulatory Environment: Cheniere benefits from a regulatory framework that acknowledges the long-term economic and strategic value of its infrastructure investments, evidenced by timely project approvals.

International Climate Policy and Agreements

International climate policies, such as the Paris Agreement, shape the global perception of natural gas as a transitional fuel. While Cheniere's liquefied natural gas (LNG) exports are significant, evolving regulations can impact long-term demand for fossil fuels, even those considered cleaner alternatives. For instance, the European Union's Fit for 55 package aims to reduce greenhouse gas emissions by 55% by 2030, influencing energy sourcing decisions across member states.

Cheniere is actively addressing these concerns by investing in emissions reduction technologies. Their Sabine Pass and Corpus Christi facilities have implemented projects to lower methane intensity, a key greenhouse gas. This focus on sustainability is crucial for maintaining political goodwill and market access in regions with stringent environmental mandates. In 2023, Cheniere reported a reduction in its Scope 1 and Scope 2 emissions intensity from its liquefaction operations.

- Global Climate Agreements: Policies like the Paris Agreement influence the long-term outlook for natural gas as a bridge fuel.

- Demand Influence: International climate goals can affect the demand for LNG, impacting Cheniere's export markets.

- Emissions Reduction Initiatives: Cheniere's investments in lowering methane intensity align with global climate objectives, enhancing its political standing.

The U.S. government's strong support for LNG exports, driven by energy security and foreign policy, directly benefits Cheniere by fostering a favorable regulatory environment and ensuring continued export authorizations. This policy alignment, evidenced by record U.S. LNG exports in 2023, is projected to persist through 2024 and 2025, bolstering Cheniere's strategic position.

Trade policies and tariffs can significantly impact LNG demand; for example, past tariffs affected U.S. LNG exports to China. Cheniere mitigates this risk by diversifying its customer base, as seen with its 2024 agreement with Canadian Natural Resources, securing 1.9 million tonnes per annum of LNG.

Government recognition of LNG infrastructure as a strategic asset supports Cheniere's multi-billion dollar capital investments in liquefaction capacity expansion, such as the Corpus Christi Stage 3 project, creating a conducive environment for long-term growth.

| Factor | Impact on Cheniere | Supporting Data/Trend (2023-2025) |

|---|---|---|

| U.S. Export Promotion | Favorable policy, regulatory support, export authorizations | Record U.S. LNG exports in 2023; projected continued growth 2024-2025 |

| Trade Policy & Tariffs | Potential demand fluctuations, need for customer diversification | Diversification strategy via agreements like the 2024 deal with Canadian Natural Resources (1.9 MTPA) |

| Infrastructure as Strategic Asset | Support for capital investment and expansion projects | Billions invested in projects like Corpus Christi Stage 3 |

What is included in the product

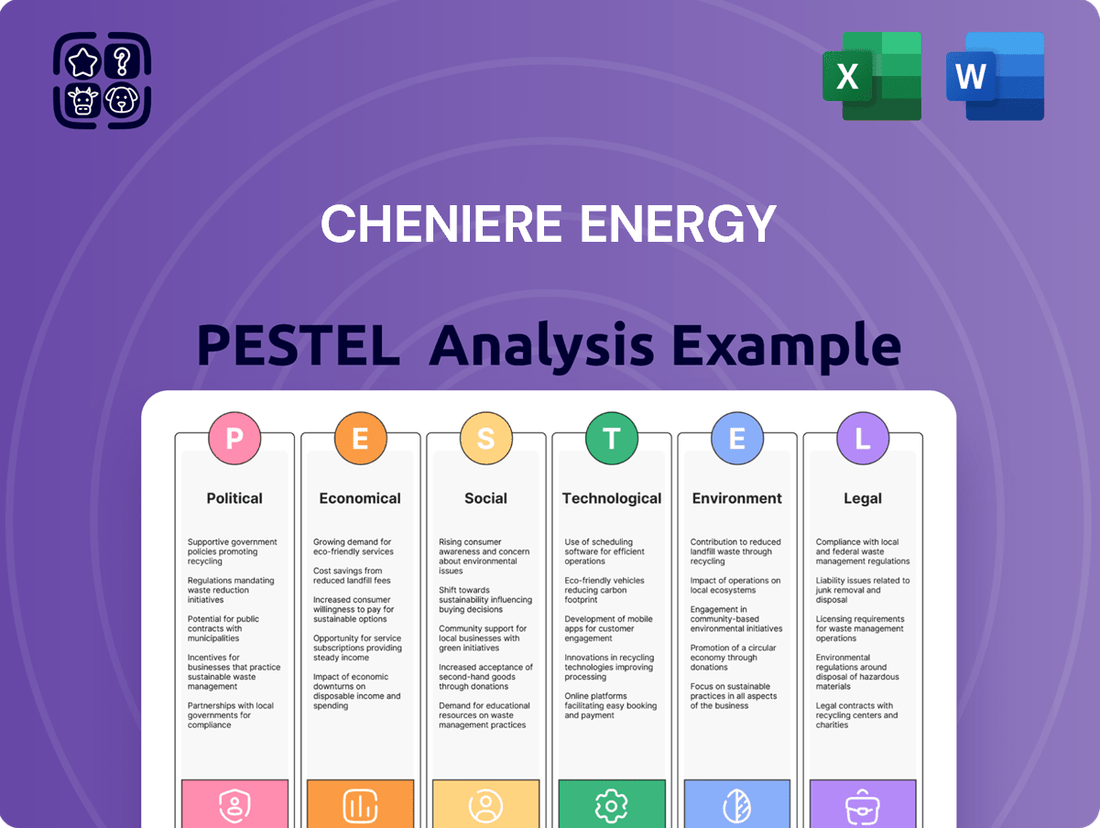

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Cheniere Energy, providing a comprehensive overview of its operating landscape.

It offers forward-looking insights to support strategic decision-making and identify potential threats and opportunities for Cheniere Energy.

A PESTLE analysis for Cheniere Energy provides a clear, summarized view of external factors influencing the company, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global demand for Liquefied Natural Gas (LNG) remains robust, with Asia, particularly China and India, and Europe leading the charge in seeking energy diversification away from traditional sources. This sustained demand is a primary driver for Cheniere Energy's revenue and expansion plans.

However, the LNG market is inherently volatile. Factors such as fluctuating natural gas prices, influenced by supply and demand dynamics, and geopolitical events, like the ongoing conflict in Eastern Europe, can significantly impact market stability and Cheniere's operational environment.

Cheniere's strategy of securing long-term contracts, often with take-or-pay clauses, provides a crucial buffer against this volatility. These agreements ensure a predictable revenue stream, shielding the company from the immediate impact of short-term price swings and market uncertainties.

Cheniere's financial health hinges on how smoothly its liquefaction plants and logistics operate. Efficiently managing these complex operations directly impacts its ability to generate strong earnings before interest, taxes, depreciation, and amortization (EBITDA).

The company's dedication to boosting operational performance and controlling expenses is vital for sustaining healthy EBITDA margins. For instance, Cheniere reported a significant increase in its adjusted EBITDA for Q4 2024, underscoring the importance of these cost-management strategies.

Cheniere Energy’s capital allocation strategy prioritizes investments in growth projects, debt reduction, and shareholder returns, demonstrating a balanced approach to financial management.

Significant capital is being directed towards expansion projects, such as Corpus Christi Stage 3 and Sabine Pass, which are designed to boost liquefaction capacity. These investments are crucial for securing future revenue streams and are reflected in the company's positive financial outlook for 2025 and beyond.

Long-Term Contracts and Revenue Stability

Cheniere Energy's revenue stream benefits significantly from its long-term sales and purchase agreements (SPAs). These contracts are the bedrock of its financial stability, ensuring a predictable inflow of cash. As of the close of 2024, the weighted average remaining term for these agreements stood at roughly 13 years, offering substantial visibility into future earnings.

This long-term contracting strategy effectively insulates Cheniere from the volatility often seen in the spot market for liquefied natural gas (LNG). By securing these agreements, the company guarantees consistent demand for its exported LNG, thereby smoothing out revenue fluctuations and enhancing its financial resilience.

- Revenue Stability: Long-term SPAs provide a predictable and stable revenue base for Cheniere.

- Contract Duration: The weighted average remaining life of these contracts was approximately 13 years as of December 2024.

- Risk Mitigation: These agreements significantly reduce exposure to short-term market price fluctuations.

- Demand Assurance: SPAs ensure consistent demand for Cheniere's LNG volumes.

Financial Performance and Shareholder Returns

Cheniere Energy's financial performance is a direct driver of shareholder returns. For the first quarter of 2024, the company reported a net income of $526 million, a significant increase from $307 million in the same period of 2023. Consolidated adjusted EBITDA reached $1.3 billion in Q1 2024, demonstrating robust operational cash flow generation.

The company's commitment to shareholder value is evident through its capital allocation strategies. In 2023, Cheniere repurchased approximately $1.1 billion of its stock and paid dividends totaling $1.2 billion. This approach balances returning capital to investors with maintaining financial flexibility for future growth and operational stability.

- Net Income (Q1 2024): $526 million

- Consolidated Adjusted EBITDA (Q1 2024): $1.3 billion

- Share Repurchases (2023): Approximately $1.1 billion

- Dividends Paid (2023): $1.2 billion

Global economic growth directly influences LNG demand, with projections for 2024 and 2025 indicating continued expansion, particularly in emerging markets. However, persistent inflation and rising interest rates in major economies could temper this growth, impacting energy consumption patterns and potentially affecting Cheniere's revenue streams.

Geopolitical stability is a critical economic factor for Cheniere. The ongoing conflict in Eastern Europe and other global tensions continue to create supply chain disruptions and price volatility in the energy markets, underscoring the importance of Cheniere's diversified customer base and long-term contracts.

Cheniere's financial performance is closely tied to global energy prices. For instance, the company reported consolidated adjusted EBITDA of $1.3 billion in Q1 2024, reflecting the impact of market conditions on its operational earnings.

Cheniere's capital allocation strategy, including its 2023 share repurchases totaling approximately $1.1 billion and dividend payments of $1.2 billion, demonstrates a focus on shareholder returns amidst economic uncertainties.

| Financial Metric | Q1 2024 Value | 2023 Value |

|---|---|---|

| Net Income | $526 million | N/A |

| Consolidated Adjusted EBITDA | $1.3 billion | N/A |

| Share Repurchases | N/A | ~$1.1 billion |

| Dividends Paid | N/A | $1.2 billion |

Preview the Actual Deliverable

Cheniere Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cheniere Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. You'll gain a clear understanding of the external forces shaping Cheniere's business landscape.

Sociological factors

Cheniere's operations significantly boost local economies, with its Sabine Pass and Corpus Christi facilities creating numerous jobs and contributing through direct financial support and employee volunteerism. For instance, in 2023, Cheniere reported investing millions in community initiatives and logged thousands of volunteer hours, directly impacting local development and social well-being.

Public perception of natural gas as a 'bridge fuel' significantly impacts societal acceptance of Cheniere's LNG infrastructure. This view, positioning it as a cleaner option than coal or oil, can bolster support for projects.

Cheniere highlights LNG's environmental advantages, such as reducing greenhouse gas emissions by over 50% compared to coal for power generation, aiming to cultivate a favorable public image.

Cheniere Energy places a high priority on workforce safety and development, recognizing them as critical sociological elements. A robust safety record, often measured by a low Total Reportable Incident Rate (TRIR), directly reflects the company's dedication to its employees' well-being. For instance, in 2023, Cheniere reported a TRIR of 0.35, significantly below the industry average, underscoring its commitment.

Investing in workforce development is equally vital. This includes providing ongoing training and skill enhancement programs to ensure employees are equipped to handle the complex and evolving demands of the energy sector. Such investments not only bolster operational efficiency and reliability but also foster a positive company culture, which in turn enhances public trust and stakeholder confidence.

Energy Security and Affordability for Consumers

Cheniere's position as a major U.S. liquefied natural gas (LNG) exporter significantly bolsters energy security for numerous importing countries. This reliable supply directly impacts the economic stability and overall well-being of their populations, particularly in regions heavily reliant on imported energy. For instance, in 2023, Cheniere's exports reached over 60 million metric tons of LNG, providing a crucial energy source for Europe and Asia.

By ensuring a consistent and predictable flow of LNG, Cheniere indirectly fuels economic development and contributes to improved living standards in these importing nations. Access to affordable energy is a foundational element for industrial growth and household consumption. The company's operations help stabilize energy prices, offering a degree of predictability that aids in long-term economic planning for these countries.

- Energy Security: Cheniere's LNG exports provide a vital alternative to other energy sources, enhancing energy independence for importing nations.

- Economic Stability: Consistent energy supply supports industrial output and consumer spending, contributing to national economic health.

- Affordability Impact: The availability of U.S. LNG can influence global price benchmarks, potentially leading to more affordable energy options for consumers.

- Living Standards: Reliable and affordable energy access is directly linked to improved quality of life, enabling essential services and economic opportunities.

Social License to Operate and ESG Considerations

Cheniere Energy's social license to operate is increasingly linked to its environmental, social, and governance (ESG) performance, impacting its ability to secure and maintain operations. Stakeholder expectations, particularly regarding environmental stewardship and community engagement, are paramount for sustained business success.

The company's commitment to ESG principles, as detailed in its corporate responsibility reports, directly influences its attractiveness to investors and its capacity to attract and retain a skilled workforce. For instance, Cheniere reported a 21% increase in women in leadership roles between 2022 and 2023, highlighting its focus on diversity, equity, and inclusion (DEI) initiatives.

- Social License: Cheniere's ability to operate hinges on public and community acceptance, heavily influenced by its ESG track record.

- Talent Acquisition: Strong DEI programs and transparent reporting are vital for attracting and retaining top talent in a competitive energy sector.

- Stakeholder Relations: Meeting the evolving expectations of investors, employees, and communities regarding sustainability is crucial for long-term viability.

- ESG Reporting: Continued investment in and transparent disclosure of ESG metrics, such as emissions reduction targets and community investment programs, are key.

Societal views on natural gas, particularly its role as a transitional energy source, directly influence the acceptance of Cheniere's infrastructure and operations. Public perception is shaped by the narrative of LNG as a cleaner alternative to fossil fuels like coal, which can foster broader support for the company's projects.

Cheniere's commitment to community engagement and economic contribution is a significant sociological factor, with its facilities creating jobs and supporting local development. For instance, in 2023, the company reported investing millions in community initiatives, demonstrating a tangible impact on social well-being.

The company's focus on employee safety and development, evidenced by a low Total Reportable Incident Rate (TRIR) of 0.35 in 2023, reflects a dedication to its workforce that resonates positively with society and enhances its reputation.

Cheniere's role in enhancing energy security for importing nations through its substantial LNG exports, exceeding 60 million metric tons in 2023, directly impacts the economic stability and living standards of populations reliant on these supplies.

| Sociological Factor | Description | 2023 Data/Impact |

|---|---|---|

| Public Perception of Natural Gas | Societal acceptance of LNG as a 'bridge fuel' | Influences support for infrastructure projects. |

| Community Investment | Cheniere's economic contribution to local areas | Millions invested in community initiatives. |

| Workforce Safety | Employee well-being and operational integrity | TRIR of 0.35, significantly below industry average. |

| Energy Security Contribution | Impact of LNG exports on importing nations | Over 60 million metric tons exported, bolstering global energy supply. |

Technological factors

Cheniere Energy leverages cutting-edge liquefaction technologies, notably the Optimized Cascade® process. This advanced system significantly boosts efficiency and curbs emissions during the natural gas liquefaction process, a critical factor in today's environmentally conscious market.

The company's commitment to continuous innovation in liquefaction technology is paramount for sustaining its competitive advantage. This ongoing development is essential for meeting increasingly stringent environmental regulations and for staying ahead in the global energy transition.

Cheniere Energy is actively investing in and deploying advanced Quantification, Monitoring, Reporting, and Verification (QMRV) projects and cutting-edge leak detection technologies. This focus is crucial for accurately measuring and significantly reducing methane emissions throughout its entire supply chain.

These technological advancements are fundamental to Cheniere's overarching sustainability strategy and directly support its ambitious methane intensity reduction targets. For instance, by mid-2024, the company reported a methane intensity of 0.047% for its Sabine Pass operations, demonstrating progress in its mitigation efforts.

Cheniere is increasingly leveraging digitalization to enhance its operations. For instance, the company is investing in advanced analytics and data management systems to optimize production and logistics at its LNG facilities, aiming for greater efficiency and reduced costs.

This focus on data-driven decision-making extends to environmental performance. By analyzing operational data, Cheniere can better monitor and manage its emissions profile, identifying specific areas within its LNG value chain where performance improvements can be made, aligning with sustainability goals.

In 2023, Cheniere reported significant progress in its digital transformation initiatives, with a particular emphasis on improving predictive maintenance and real-time operational monitoring across its Sabine Pass and Corpus Christi terminals. This technological advancement is crucial for maintaining high safety standards and operational reliability.

Carbon Capture and Storage (CCS) Opportunities

Cheniere Energy is actively pursuing opportunities in Carbon Capture and Storage (CCS) as part of its strategic expansion. The company has initiated front-end engineering design (FEED) studies to incorporate CCS capabilities into its future projects, signaling a commitment to addressing greenhouse gas emissions. This proactive stance positions Cheniere to align with the growing global demand for decarbonized energy solutions.

The integration of CCS technology is crucial for the long-term viability of the natural gas sector, especially as regulatory landscapes evolve. Cheniere's investment in CCS research and development reflects an understanding of these shifting market dynamics and the increasing importance of environmental, social, and governance (ESG) factors in investment decisions. For instance, the International Energy Agency (IEA) reported in 2024 that CCS projects are essential for meeting climate targets, with a significant increase in planned capacity globally.

- CCS Integration: Cheniere is undertaking FEED studies for CCS integration in its expansion plans.

- Decarbonization Alignment: This move aligns Cheniere with future decarbonization trends and emissions reduction goals.

- Market Responsiveness: The company is adapting to evolving regulatory and market demands for cleaner energy solutions.

- IEA Projections: CCS is highlighted by the IEA as critical for achieving climate objectives, underscoring the strategic importance of Cheniere's initiatives.

Pipeline Infrastructure and Supply Chain Technology

Cheniere Energy's operations are fundamentally dependent on extensive pipeline networks to move natural gas to its liquefaction facilities. The reliability and capacity of this infrastructure are paramount, directly impacting Cheniere's ability to meet contractual obligations. For instance, in 2023, Cheniere continued to invest in pipeline expansions and upgrades to support its growing export volumes, aiming to enhance the security and efficiency of its supply chain.

Technological advancements in pipeline monitoring and maintenance are critical for ensuring operational integrity and minimizing downtime. Innovations in areas like leak detection and predictive maintenance help safeguard against disruptions. Cheniere's commitment to these technologies supports its ongoing projects, such as the Corpus Christi Stage 3 expansion, which will add significant liquefaction capacity and require corresponding pipeline support.

- Pipeline Capacity: Cheniere's ability to secure sufficient natural gas volumes hinges on the capacity of the pipelines connecting to its Sabine Pass and Corpus Christi terminals.

- Supply Chain Technology: Investments in advanced logistics and tracking technologies improve the efficiency and transparency of the natural gas supply chain feeding its facilities.

- Infrastructure Integrity: Ongoing maintenance and technological upgrades to existing pipelines are essential for preventing service interruptions and ensuring a consistent supply of feedgas.

- Expansion Support: The development of new liquefaction trains necessitates corresponding investments in pipeline infrastructure to handle increased throughput.

Cheniere's technological edge is evident in its Optimized Cascade® liquefaction process, enhancing efficiency and reducing emissions. The company's proactive investment in advanced monitoring technologies, like those for methane emissions, is crucial. For example, by mid-2024, Sabine Pass operations achieved a methane intensity of 0.047%, showcasing tangible progress.

Digitalization is a key focus, with investments in data analytics and management systems to optimize production and logistics. This data-driven approach extends to environmental performance, allowing for better emissions monitoring and management across its LNG value chain.

Furthermore, Cheniere is exploring Carbon Capture and Storage (CCS) integration, initiating FEED studies for future projects. This strategic move aligns with global decarbonization efforts, as highlighted by the IEA in 2024, which emphasized CCS's role in meeting climate targets.

Technological advancements in pipeline monitoring and maintenance are vital for Cheniere's operational integrity, ensuring a consistent supply of feedgas to its facilities. These upgrades are essential for supporting ongoing expansions, like the Corpus Christi Stage 3 project.

| Technology Area | Cheniere's Application | Impact/Goal | Data Point (2023-2025) |

|---|---|---|---|

| Liquefaction Process | Optimized Cascade® | Efficiency, Emission Reduction | N/A (Proprietary) |

| Emissions Monitoring | QMRV Projects, Leak Detection | Methane Intensity Reduction | 0.047% (Mid-2024, Sabine Pass) |

| Digitalization | Advanced Analytics, Data Management | Operational Optimization, Cost Reduction | Investment in predictive maintenance (2023) |

| Decarbonization | Carbon Capture and Storage (CCS) | Greenhouse Gas Reduction, Market Alignment | FEED studies initiated for CCS integration |

| Infrastructure | Pipeline Monitoring & Maintenance Tech | Reliability, Supply Chain Integrity | Pipeline expansion and upgrade investments (2023) |

Legal factors

Cheniere's operations, particularly its liquefied natural gas (LNG) export terminals, are intrinsically tied to securing and upholding regulatory approvals from key U.S. government bodies like the Department of Energy (DOE) and the Federal Energy Regulatory Commission (FERC). These approvals are critical for the construction and ongoing operation of its significant expansion projects, such as the Corpus Christi Stage 3 project, which aims to add substantial export capacity.

Any unforeseen delays or shifts in these regulatory requirements can directly affect project timelines and, consequently, Cheniere's ability to bring new capacity online, impacting its projected revenue streams and market position. For instance, the permitting process for major infrastructure projects can often span several years, with potential for public comment periods and environmental reviews that could introduce uncertainty.

Cheniere Energy operates under a stringent environmental regulatory framework, encompassing greenhouse gas emissions, waste disposal, and biodiversity protection. Compliance with regulations like the Resource Conservation and Recovery Act (RCRA) is a significant factor, impacting operational costs and necessitating ongoing monitoring and reporting.

International trade laws and agreements directly influence Cheniere Energy's global LNG exports, with potential tariffs or trade disputes posing significant risks. For instance, changes in import duties in key markets like China or Japan could impact the landed cost of Cheniere's LNG, affecting demand and pricing. The company's strategy of diversifying its customer base across multiple countries, including those in Asia and Europe, helps mitigate some of these geopolitical trade risks.

Contractual Obligations and Long-Term Sales Agreements

Cheniere Energy's financial stability hinges significantly on its long-term sales and purchase agreements (SPAs). These contracts, which are legally binding, represent a substantial portion of its revenue. The enforceability and consistent adherence to the terms within these SPAs are crucial for ensuring predictable cash flows and overall financial resilience for the company.

These agreements often span 15 to 20 years, providing a solid revenue foundation. For instance, as of early 2024, Cheniere had secured SPAs for a significant majority of its liquefaction capacity. These contracts are critical for securing financing for its large-scale projects, as they demonstrate a committed buyer base and predictable revenue streams to lenders.

- Contractual Foundation: Cheniere's business model is built upon long-term contracts, which are legally enforceable commitments for the sale and purchase of liquefied natural gas (LNG).

- Revenue Predictability: These SPAs provide a high degree of revenue predictability, essential for long-term financial planning and investment.

- Financial Health: The stability and enforceability of these contracts directly impact Cheniere's creditworthiness and ability to secure capital for expansion projects.

- Risk Mitigation: Long-term agreements help mitigate the volatility associated with spot market LNG prices, offering a more stable financial outlook.

Antitrust and Competition Laws

Cheniere Energy, as a significant force in the global liquefied natural gas (LNG) sector, operates under a complex web of antitrust and competition laws across various operating regions. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants.

The increasing number of new LNG projects worldwide, particularly in North America and the Middle East, intensifies the competitive landscape. Cheniere must diligently comply with these legal frameworks to maintain fair market practices and avoid potential penalties or market access restrictions. For instance, in 2023, the U.S. Federal Trade Commission (FTC) continued its scrutiny of energy markets, including LNG, to identify and address any anti-competitive behavior.

Navigating these legal requirements is crucial for Cheniere’s ongoing operations and future expansion plans. Failure to comply could result in significant fines, legal challenges, and damage to its reputation, impacting its ability to secure contracts and attract investment.

- Global Scrutiny: Antitrust authorities globally, including the European Commission and the U.S. FTC, actively monitor the energy sector for potential anti-competitive conduct.

- Merger & Acquisition Oversight: Any significant mergers or acquisitions undertaken by Cheniere would be subject to rigorous antitrust review in relevant jurisdictions to assess their impact on market competition.

- Contractual Compliance: Cheniere's long-term supply agreements and customer contracts must be structured to comply with competition laws, avoiding clauses that could be deemed restrictive.

- Market Dominance Concerns: As a major exporter, Cheniere must be mindful of regulations concerning market dominance and ensure its pricing and supply strategies do not stifle competition.

Cheniere's operations depend heavily on regulatory approvals from bodies like the DOE and FERC for its export terminals, including the Corpus Christi Stage 3 project. Delays in these processes, which can take years due to reviews and public input, directly impact project timelines and revenue forecasts.

The company must also adhere to strict environmental laws, such as those governing emissions and waste, which add to operational costs through compliance monitoring and reporting. International trade laws and potential tariffs in key markets like China and Japan can affect LNG demand and pricing, although Cheniere mitigates this by diversifying its customer base.

Antitrust laws globally scrutinize energy markets, requiring Cheniere to ensure fair practices and avoid anti-competitive behavior, especially as new LNG projects emerge. Compliance with these regulations is vital to prevent fines, legal challenges, and reputational damage that could hinder future growth and investment.

| Regulatory Body | Key Approval Area | Impact on Cheniere |

|---|---|---|

| Department of Energy (DOE) | LNG Export Authorization | Crucial for project development and export capacity expansion. |

| Federal Energy Regulatory Commission (FERC) | Pipeline and Terminal Siting/Operation | Ensures safe and compliant infrastructure operation; impacts expansion timelines. |

| Environmental Protection Agency (EPA) | Emissions and Waste Management | Dictates operational standards and compliance costs; influences project permitting. |

| International Trade Commissions | Tariffs and Trade Agreements | Affects the competitiveness and demand for Cheniere's LNG exports. |

Environmental factors

Cheniere Energy recognizes the critical need to address greenhouse gas (GHG) emissions, integrating a comprehensive climate strategy focused on both measurement and reduction. This commitment is underscored by their voluntary target to achieve a methane emissions intensity of 0.03% per tonne of LNG produced by 2027.

This ambitious goal aligns with global efforts, specifically referencing the United Nations Environment Programme's (UNEP) Oil and Gas Methane Partnership 2.0 (OGMP 2.0), demonstrating Cheniere's proactive stance in mitigating environmental impact within the energy sector.

The liquefaction and export of natural gas, while offering a cleaner alternative to other fossil fuels, do involve environmental considerations such as energy consumption during processing and potential for greenhouse gas emissions. Cheniere strategically markets its LNG as a key contributor to improved global air quality and a facilitator of a lower-carbon energy future.

In 2023, Cheniere's Sabine Pass facility, a major export terminal, processed approximately 1.99 trillion cubic feet of natural gas, highlighting the scale of operations and the associated energy demands. The company emphasizes its role in displacing coal in power generation, a transition that can significantly reduce CO2 emissions per unit of energy produced.

Cheniere's industrial operations, particularly its liquefied natural gas (LNG) facilities, are substantial consumers of water for processes like cooling and vaporizing. Effective water management is crucial for minimizing environmental impact and adhering to stringent regulations. For instance, in 2023, Cheniere reported its water withdrawal and discharge data as part of its sustainability reporting, highlighting efforts to optimize usage and manage wastewater responsibly.

Biodiversity and Ecosystem Protection

The construction and operation of Cheniere Energy's significant industrial infrastructure, such as its liquefied natural gas (LNG) terminals, inherently carry the potential to affect local ecosystems and the biodiversity within them. These impacts can range from habitat disruption during construction to potential effects on marine life during terminal operations.

Cheniere's commitment to environmental stewardship is demonstrated through its compliance with stringent environmental regulations and its proactive corporate responsibility initiatives. These efforts are designed to minimize ecological footprints and safeguard adjacent natural environments. For instance, the company has invested in programs aimed at protecting coastal habitats and marine species impacted by its operations.

Specific actions taken by Cheniere to address biodiversity concerns include:

- Habitat Restoration Projects: Implementing and supporting projects focused on restoring or enhancing natural habitats in areas surrounding its facilities.

- Marine Life Monitoring: Conducting ongoing studies and implementing mitigation strategies to minimize the impact of terminal operations on marine species, such as marine mammals and sea turtles.

- Compliance with Permitting: Adhering to all environmental permits and regulatory requirements, which often include specific mandates for biodiversity protection and impact mitigation.

Adaptation to Climate Change Impacts

Cheniere, as a major operator of coastal liquefied natural gas (LNG) facilities, faces significant risks from the physical impacts of climate change. Rising sea levels and increasingly frequent extreme weather events, such as hurricanes, pose direct threats to its infrastructure and operations. For instance, the company's Sabine Pass terminal in Louisiana is situated in a low-lying coastal area highly vulnerable to storm surges and flooding.

To ensure long-term stability and business continuity, Cheniere must integrate climate resilience into its infrastructure planning and ongoing operations. This involves investing in protective measures, such as reinforcing sea walls and elevating critical equipment, to mitigate the effects of these environmental shifts. The company's capital expenditure plans for 2024 and beyond will likely reflect these adaptation strategies.

The company's commitment to adaptation is crucial for maintaining its operational integrity and investor confidence. Key considerations include:

- Infrastructure Hardening: Implementing upgrades to protect facilities against higher storm surges and increased wind speeds.

- Operational Adjustments: Developing robust emergency response plans and protocols for extreme weather events, including potential facility shutdowns and evacuations.

- Supply Chain Resilience: Assessing and mitigating climate-related risks within its broader supply chain, from feedstock sourcing to transportation.

- Regulatory Compliance: Staying ahead of evolving environmental regulations and reporting requirements related to climate change adaptation and emissions.

Cheniere's environmental strategy includes a target of 0.03% methane emissions intensity per tonne of LNG by 2027, aligning with global initiatives like the OGMP 2.0. The company's large-scale operations, such as processing nearly 2 trillion cubic feet of natural gas at Sabine Pass in 2023, necessitate careful water management and consideration of ecosystem impacts.

Cheniere actively engages in habitat restoration and marine life monitoring to mitigate operational effects on biodiversity, adhering to stringent environmental permits. The company is also focused on climate resilience, investing in infrastructure hardening and operational adjustments to counter risks from rising sea levels and extreme weather events, particularly for its coastal facilities.

| Metric | 2023 Data | Target |

|---|---|---|

| Methane Emissions Intensity | N/A (Reporting ongoing) | 0.03% by 2027 |

| Natural Gas Processed (Sabine Pass) | 1.99 trillion cubic feet | N/A |

PESTLE Analysis Data Sources

Our Cheniere Energy PESTLE Analysis is built on a robust foundation of data, drawing from official government reports, regulatory filings, and leading energy industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.