Cheniere Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheniere Energy Bundle

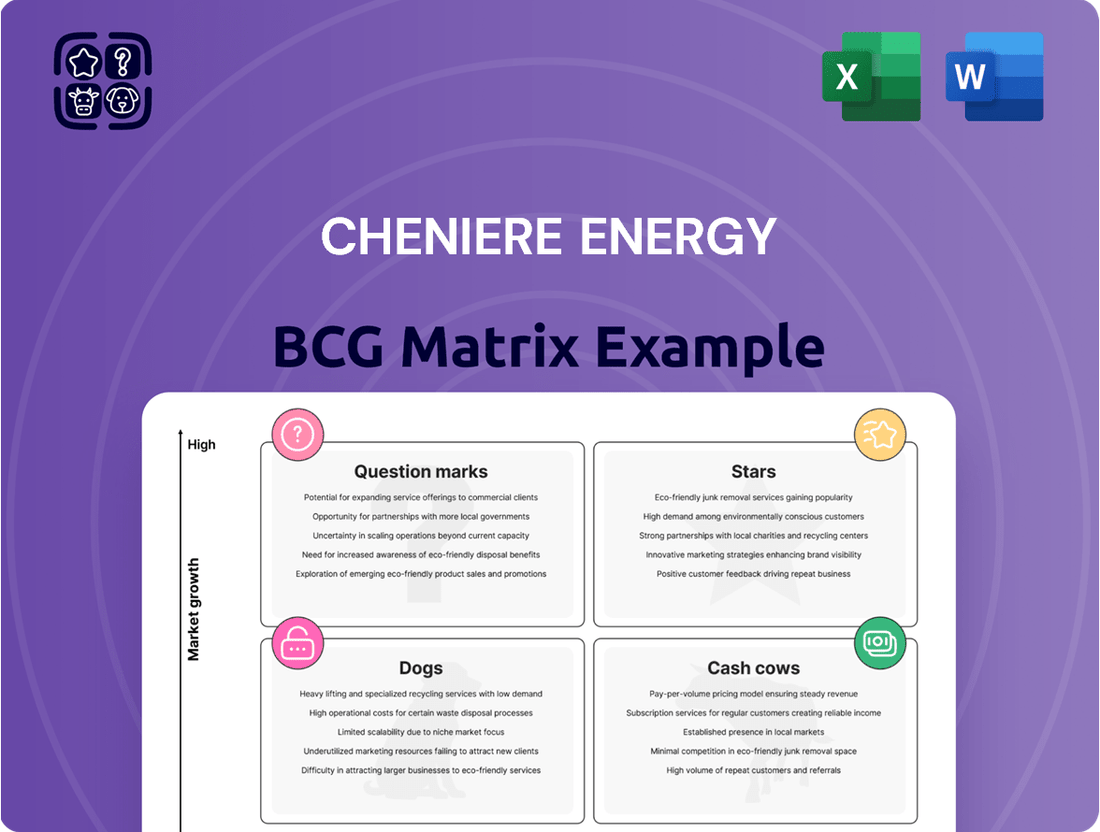

Explore Cheniere Energy's strategic positioning with our BCG Matrix preview, highlighting key product categories and their market dynamics. Understand where their assets fall as Stars, Cash Cows, Dogs, or Question Marks to inform your investment decisions.

Unlock the full potential of this analysis by purchasing the complete Cheniere Energy BCG Matrix. Gain actionable insights, detailed quadrant breakdowns, and a strategic roadmap to navigate the evolving energy landscape with confidence.

Stars

The Corpus Christi Stage 3 Project for Cheniere Energy is a clear Star in the BCG matrix. This massive expansion adds over 10 million tonnes per annum (mtpa) of LNG capacity, tapping into a booming global demand for liquefied natural gas.

The project's success is underscored by its rapid development. The first train reached substantial completion in March 2025, ahead of schedule. Production commenced in December 2024, with the first cargo departing in February 2025, demonstrating efficient execution and market readiness.

This expansion significantly bolsters Cheniere's production capabilities and market presence. By bringing substantial new capacity online, Cheniere is well-positioned to capitalize on the continued growth and strategic importance of the LNG sector in the coming years.

Cheniere Energy stands as the preeminent U.S. LNG exporter, controlling roughly half of the nation's LNG output. This dominant market share is crucial, as the United States has ascended to become the world's leading LNG exporter.

The global LNG market is on a significant growth trajectory, with projections indicating an expansion of approximately 60% by the year 2040. Given its substantial market presence within this rapidly expanding sector, Cheniere's overall export operations are clearly positioned as a Star in the BCG Matrix.

Cheniere's strategic focus on brownfield expansions at Sabine Pass and Corpus Christi offers a distinct competitive edge. This strategy accelerates project timelines and capitalizes on established infrastructure and operational knowledge, vital for securing market share amid robust global LNG demand.

By prioritizing these expansions, Cheniere is set to significantly boost its production capacity. The company anticipates its combined LNG export capacity to reach between 60 to 63 million tonnes per annum (mtpa) by 2030, demonstrating a clear commitment to leveraging its existing assets for growth.

Long-Term Contracts with High-Growth Regions

Cheniere's strategic focus on long-term sales and purchase agreements (SPAs) in high-growth regions, especially Asia, firmly places its LNG export business within the Star quadrant of the BCG matrix. Asia is projected to account for more than 80% of the global LNG demand growth through 2040, highlighting the immense potential of these markets.

These secured contracts guarantee substantial future volumes for Cheniere in a rapidly expanding market. This not only fortifies its revenue streams but also significantly enhances its market influence and competitive positioning.

- Asia's Dominance: Expected to drive over 80% of global LNG demand growth to 2040.

- Long-Term SPAs: Cheniere secures high future volumes through these agreements.

- Revenue Stability: Contracts ensure predictable and growing revenue streams.

- Market Influence: Solidifies Cheniere's position as a key global LNG supplier.

Methane Emissions Reduction Initiatives

Cheniere Energy is actively pursuing methane emissions reduction, aiming for a methane intensity of 0.03% per tonne of LNG by 2027. This aggressive target underscores their dedication to cleaner energy production. Their robust Quantification, Monitoring, Reporting, and Verification (QMRV) program is central to achieving this goal and demonstrates a commitment to transparency and accountability in their environmental performance.

This strategic focus on reducing methane emissions positions Cheniere favorably in a market that is increasingly prioritizing sustainability. As demand for cleaner energy solutions grows, Cheniere's proactive approach offers a significant competitive advantage and reinforces its leadership in the LNG sector. The company's 2024 initiatives are expected to further solidify this market position.

- Methane Intensity Target: 0.03% per tonne of LNG by 2027.

- Key Program: Quantification, Monitoring, Reporting, and Verification (QMRV).

- Market Driver: Increasing demand for cleaner energy solutions.

- Strategic Benefit: Competitive differentiation and market leadership.

Cheniere's overall export operations, driven by its dominant market share as the preeminent U.S. LNG exporter, are a clear Star in the BCG matrix. The global LNG market is expanding significantly, projected to grow by approximately 60% by 2040, and Cheniere is strategically positioned to capture this growth, especially with its focus on high-demand Asian markets.

The Corpus Christi Stage 3 Project, a significant expansion adding over 10 mtpa of LNG capacity, exemplifies this Star status. Its rapid development, with the first train reaching substantial completion in March 2025, ahead of schedule, and production commencing in December 2024, highlights operational excellence and market responsiveness.

Cheniere's commitment to reducing methane emissions, targeting an intensity of 0.03% by 2027, further solidifies its Star position by aligning with the growing market demand for cleaner energy solutions. This proactive environmental strategy provides a distinct competitive advantage.

| Metric | Value | Year | Significance |

| Global LNG Demand Growth Projection | ~60% | By 2040 | Indicates substantial market expansion |

| Cheniere's Combined LNG Export Capacity Target | 60-63 mtpa | By 2030 | Demonstrates aggressive growth strategy |

| Asian LNG Demand Growth Contribution | >80% | Through 2040 | Highlights key market focus |

| Target Methane Intensity | 0.03% | By 2027 | Reinforces sustainability leadership |

What is included in the product

This BCG Matrix analysis for Cheniere Energy categorizes its LNG export terminals and related businesses.

It highlights which segments are market leaders (Stars/Cash Cows) and which require more investment or divestment.

A Cheniere Energy BCG Matrix provides a clear, visual roadmap for strategic decision-making, alleviating the pain of resource allocation uncertainty.

Cash Cows

The Sabine Pass LNG terminal stands as Cheniere Energy's premier asset, boasting six operational trains with a combined production capacity of roughly 30 million metric tons per annum (mtpa). This facility is a mature, dominant player in the market, consistently delivering thousands of LNG cargoes since 2016.

Its reliable operations translate into substantial and steady cash flow for Cheniere, solidifying its position as a cash cow within the company's portfolio. In 2023, Cheniere reported that Sabine Pass exported approximately 17.4 mtpa of LNG, underscoring its significant contribution to the company's financial performance.

The initial three trains at Cheniere's Corpus Christi LNG terminal, boasting a production capacity of around 15 million tonnes per annum (mtpa), are a significant cash-generating asset. This facility, which began operations in 2018, is a cornerstone of Cheniere's consistent revenue generation and overall financial health.

As of the first quarter of 2024, Cheniere reported that its Corpus Christi operations, including these initial trains, contributed substantially to its adjusted EBITDA. The sustained demand for liquefied natural gas globally solidifies the terminal's position as a reliable income producer for the company.

Cheniere Energy's extensive portfolio of long-term contracts, often lasting 10-20 years with fixed fees, firmly places its liquefaction business in the Cash Cows category of the BCG Matrix. This robust contractual framework, covering over 90% of projected operational volumes, generates highly predictable and stable cash flows.

These agreements effectively shield Cheniere from the unpredictable swings of short-term commodity prices, solidifying its position as a reliable generator of consistent revenue. For instance, as of early 2024, Cheniere's contracted volumes provide a substantial revenue stream that supports ongoing operations and investments.

Integrated LNG Value Chain Services

Cheniere's integrated LNG value chain services position it firmly as a Cash Cow. This comprehensive approach, covering everything from gas sourcing to final delivery, creates significant efficiencies. By controlling each step, Cheniere optimizes operations and consistently generates strong cash flow from its existing, well-established infrastructure.

The company's ability to manage the entire LNG process, including liquefaction at its Sabine Pass and Corpus Christi facilities, underpins its Cash Cow status. This integration allows for predictable revenue streams and high margins. For instance, in 2024, Cheniere's substantial liquefaction capacity, totaling approximately 45 million tonnes per annum (mtpa) across its facilities, was largely utilized, demonstrating the maturity and consistent demand for its services.

- Integrated Operations: Cheniere manages gas procurement, liquefaction, transportation, and delivery, ensuring seamless operations.

- High Utilization: Its existing liquefaction facilities, like Sabine Pass, experienced high utilization rates in 2024, reflecting strong market demand.

- Consistent Cash Generation: The mature and efficient nature of its services results in a reliable and substantial cash flow.

- Market Leadership: As one of the largest LNG exporters globally, Cheniere benefits from established market presence and long-term contracts.

Consistent Shareholder Returns

Cheniere Energy's mature operations are clearly its cash cows, fueling consistent shareholder returns. The company's ability to deploy significant capital towards share repurchases and quarterly dividends is a testament to its robust cash-generating capabilities from these established assets.

In 2024, Cheniere allocated approximately $5.4 billion across growth initiatives, balance sheet management, and shareholder returns. This substantial deployment highlights the strong and reliable cash flow generated by its mature operations.

- Robust Cash Generation: Cheniere's mature assets consistently produce strong cash flow, enabling significant capital deployment.

- Shareholder Returns: The company actively returns capital to shareholders through share buybacks and dividends.

- 2024 Capital Deployment: Approximately $5.4 billion was allocated in 2024 to growth, balance sheet, and shareholder returns, underscoring cash cow strength.

Cheniere's established LNG infrastructure, particularly the Sabine Pass and Corpus Christi terminals, functions as its primary cash cows. These facilities benefit from high utilization rates and long-term contracts, ensuring a consistent and substantial revenue stream. The company's integrated model, managing the entire LNG value chain, further solidifies the predictable cash generation from these mature assets.

In 2024, Cheniere's robust cash flow allowed for significant capital allocation, with approximately $5.4 billion directed towards growth, balance sheet management, and shareholder returns. This financial flexibility demonstrates the strength and reliability of its cash cow operations.

| Metric | Sabine Pass (approx.) | Corpus Christi (initial trains, approx.) | Total Capacity (approx.) |

| Operational Trains | 6 | 3 | 9 |

| Annualized Production Capacity (mtpa) | 30 | 15 | 45 |

| Contracted Volumes (as of early 2024) | >90% of projected operational volumes | >90% of projected operational volumes | >90% of projected operational volumes |

Full Transparency, Always

Cheniere Energy BCG Matrix

The Cheniere Energy BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic overview of Cheniere's business units, enabling informed decision-making. You can confidently download this fully formatted report, ready for direct integration into your business planning and presentations, without any hidden surprises or need for further editing.

Dogs

Within Cheniere Energy's portfolio, underperforming ancillary assets could include smaller, non-core pipeline segments or underutilized terminal infrastructure. These assets might exhibit low revenue generation and high operational expenses, leading to negative or minimal profitability. For instance, if a specific, isolated pipeline segment experiences consistently low throughput and requires significant upkeep, it would fit this category.

Such assets would likely possess a low market share in their particular niche, with little to no anticipated expansion in demand or utility. Cheniere's 2024 financial reports might highlight specific segments with declining volumes or increased maintenance burdens that don't align with strategic growth objectives.

Legacy IT systems at Cheniere Energy, such as outdated data management platforms or manual operational workflows, could be categorized as question marks or potentially dogs within a BCG matrix framework. These systems often require substantial maintenance costs, consuming resources that could be reinvested in growth areas. For instance, if Cheniere's older accounting software, which cost an estimated $5 million annually to maintain in 2023, struggles to integrate with newer digital platforms, it doesn't contribute to market share expansion.

Cheniere Energy's portfolio might include small, non-core investments with limited scalability, representing ventures outside its primary LNG liquefaction and export operations. These could be past initiatives that didn't achieve significant market traction or growth potential, holding a low market share in their niche areas.

Inefficient Energy Consumption in Older Units

Older operational units within Cheniere's existing terminals, if demonstrably less energy-efficient than contemporary technologies, could be classified as Dogs in a BCG matrix analysis. This inefficiency translates directly to higher operational expenditures without a proportionate increase in production capacity or market dominance.

These less efficient components, while still functional, represent a drain on resources. Their inability to keep pace with technological advancements means they consume more energy per unit of output, impacting overall profitability and competitiveness.

- Higher Fuel Consumption: Older liquefaction trains might require more natural gas for the liquefaction process compared to newer, more advanced designs. For instance, if a 2010-era train consumes 10% more regasification fuel than a 2020-era train, this directly impacts operating costs.

- Increased Maintenance Costs: Aging equipment often necessitates more frequent and costly repairs, diverting capital that could be invested in growth areas.

- Lower Throughput Potential: Inefficient older units may have a lower nameplate capacity or struggle to reach optimal operational speeds, limiting their contribution to overall revenue generation.

Limited Spot Market Exposure During Downturns

Cheniere Energy's limited exposure to the volatile spot LNG market, even with its predominantly contract-based model, could be categorized as a Dog in a BCG matrix analysis. During periods of extreme oversupply, such as those seen in early 2024, spot prices can plummet, potentially leading to minimal or even negative returns on any uncontracted volumes.

This vulnerability, though mitigated by its robust long-term agreements, represents a segment with low market share and profitability when market conditions turn unfavorable. For instance, while Cheniere's contracted volumes provide stability, any spot sales made during the first half of 2024, when global LNG spot prices in Asia dipped below $10 per million British thermal units (MMBtu) at times, would have faced significant margin pressure.

- Spot Market Vulnerability: Any uncontracted LNG volumes sold on the spot market during periods of oversupply, like those experienced in early 2024, can result in low or negative profitability.

- Low Market Share in Downturns: This segment, by definition, represents a smaller portion of Cheniere's overall business due to its strong contract portfolio, and its profitability shrinks further during market slumps.

- Price Sensitivity: Spot LNG prices can be highly volatile; for example, Asian spot LNG prices fell significantly in the first half of 2024, impacting the economics of spot sales.

- Strategic Management Needed: Effective management of these limited spot exposures is crucial to prevent them from becoming a consistent drag on overall financial performance.

Assets classified as Dogs within Cheniere Energy's portfolio are those with low market share and low growth prospects, often representing underperforming or legacy components. These might include older, less efficient operational units or specific, non-core pipeline segments that generate minimal revenue and incur high upkeep costs. For example, an aging liquefaction train from the early 2010s might consume 10% more fuel than newer models, directly impacting profitability.

These segments require significant management attention and resources without contributing substantially to overall growth or market dominance. In 2023, Cheniere's maintenance costs for legacy IT systems alone were estimated at $5 million annually, highlighting the financial drain of such assets.

The limited exposure to the volatile spot LNG market, particularly during periods of oversupply like early 2024 when Asian spot prices dipped below $10/MMBtu, also falls into this category. While Cheniere's contract structure mitigates much of this risk, any uncontracted volumes sold during such downturns face severe margin pressure.

Question Marks

The Sabine Pass expansion project represents a significant Question Mark for Cheniere Energy. This ambitious undertaking aims to boost LNG capacity by approximately 20 million tonnes per annum (mtpa).

While the project targets the burgeoning global LNG market, it remains in the crucial regulatory and development stages. As such, it currently holds no market share and necessitates considerable future capital investment to reach operational status.

The success of this expansion hinges on navigating regulatory hurdles and securing the necessary financing, typical of a Question Mark in the BCG matrix. As of early 2024, the project's FID (Final Investment Decision) was still pending, underscoring its uncertain future.

The Corpus Christi Midscale Trains 8 & 9 project, with its recent June 2025 Final Investment Decision (FID) and ongoing construction, fits squarely into the Question Mark quadrant of the BCG Matrix. This project aims to boost Cheniere's LNG capacity by approximately 3 million tonnes per annum (mtpa), a significant expansion that requires substantial upfront capital.

As these trains are not yet operational, their current market share is effectively zero, necessitating considerable investment to bring them online and capture future demand. The success of this venture hinges on its ability to transition from a high-investment, low-market-share position to a high-growth, high-market-share Star, or risk becoming a Dog if market conditions or execution falter.

Cheniere Energy could strategically explore new market entry into frontier LNG import markets, which are characterized by low current consumption but significant projected growth. These ventures would be considered question marks within a BCG Matrix framework, demanding considerable upfront capital for market development and essential infrastructure. The potential for high future returns, though uncertain, justifies the risk associated with these nascent markets.

Advanced Carbon Capture and Storage (CCS) Integration

While Cheniere Energy is actively pursuing methane reduction, a strategic expansion into advanced, large-scale carbon capture and storage (CCS) for its facilities presents a compelling opportunity. This aligns with the high-growth, high-potential market for decarbonization solutions, even though current commercial deployment remains limited and necessitates substantial research and development investment alongside significant capital expenditure.

The integration of advanced CCS technologies would position Cheniere to capitalize on the increasing demand for lower-carbon energy infrastructure. For instance, the global CCS market is projected to reach hundreds of billions of dollars by 2030, driven by regulatory pressures and corporate sustainability goals. Cheniere's existing infrastructure could serve as a valuable platform for piloting and scaling these emerging technologies.

- Strategic Fit: Advanced CCS complements Cheniere's existing operations, offering a pathway to significantly reduce Scope 1 and Scope 2 emissions from its liquefaction facilities.

- Market Potential: The growing global emphasis on decarbonization creates a substantial market for entities capable of offering integrated CCS solutions with LNG exports.

- Technological Advancement: Investing in advanced CCS, such as direct air capture or point-source capture with enhanced storage, could provide Cheniere with a competitive edge.

- Investment Needs: Significant upfront capital and ongoing R&D are required, reflecting the current stage of technological maturity and the scale of deployment needed.

Integrated Production Marketing (IPM) Agreements for Future Supply

Cheniere Energy's 15-year Integrated Production Marketing (IPM) agreement with Canadian Natural Resources, commencing in 2030, is classified as a Question Mark within the BCG Matrix. This strategic arrangement is designed to secure future natural gas supply, addressing the anticipated high demand in a growing market. However, its forward-looking nature means it does not currently contribute to Cheniere's existing market share or revenue streams.

The classification as a Question Mark stems from its dependence on critical future developments. Specifically, the agreement is contingent upon Cheniere achieving a Final Investment Decision (FID) for its Sabine Pass Liquefaction (SPL) Expansion Project. This FID represents a significant hurdle, requiring substantial capital commitment and a successful execution strategy for the expansion to materialize.

- Future Growth Potential: The IPM agreement targets a high-growth market for LNG, aligning with global energy transition trends.

- Uncertainty of FID: The SPL Expansion Project's FID is a key determinant of the agreement's realization, introducing significant risk.

- No Current Market Share Impact: The agreement's 2030 start date means it has no immediate effect on Cheniere's current market position.

- Strategic Feed Gas Security: It provides a crucial long-term solution for securing the necessary feed gas for future LNG export capacity.

Cheniere's Sabine Pass expansion and Corpus Christi Midscale Trains 8 & 9 are prime examples of Question Marks. These projects require substantial capital investment without current market share, hinging on regulatory approvals and future market demand for their success. The 15-year IPM agreement with Canadian Natural Resources, also a Question Mark, is tied to the FID of the Sabine Pass expansion, highlighting its future-oriented, uncertain nature.

| Project/Agreement | BCG Quadrant | Capacity (mtpa) | Status | Key Uncertainty |

|---|---|---|---|---|

| Sabine Pass Expansion | Question Mark | ~20 | Regulatory/Development Stage | Final Investment Decision (FID) |

| Corpus Christi Midscale Trains 8 & 9 | Question Mark | ~3 | FID (June 2025), Construction | Market Capture, Execution |

| IPM with Canadian Natural Resources | Question Mark | N/A (Feedstock for future capacity) | Contingent on SPL Expansion FID | SPL Expansion FID |

BCG Matrix Data Sources

Our Cheniere Energy BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.