Coventry Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coventry Group Bundle

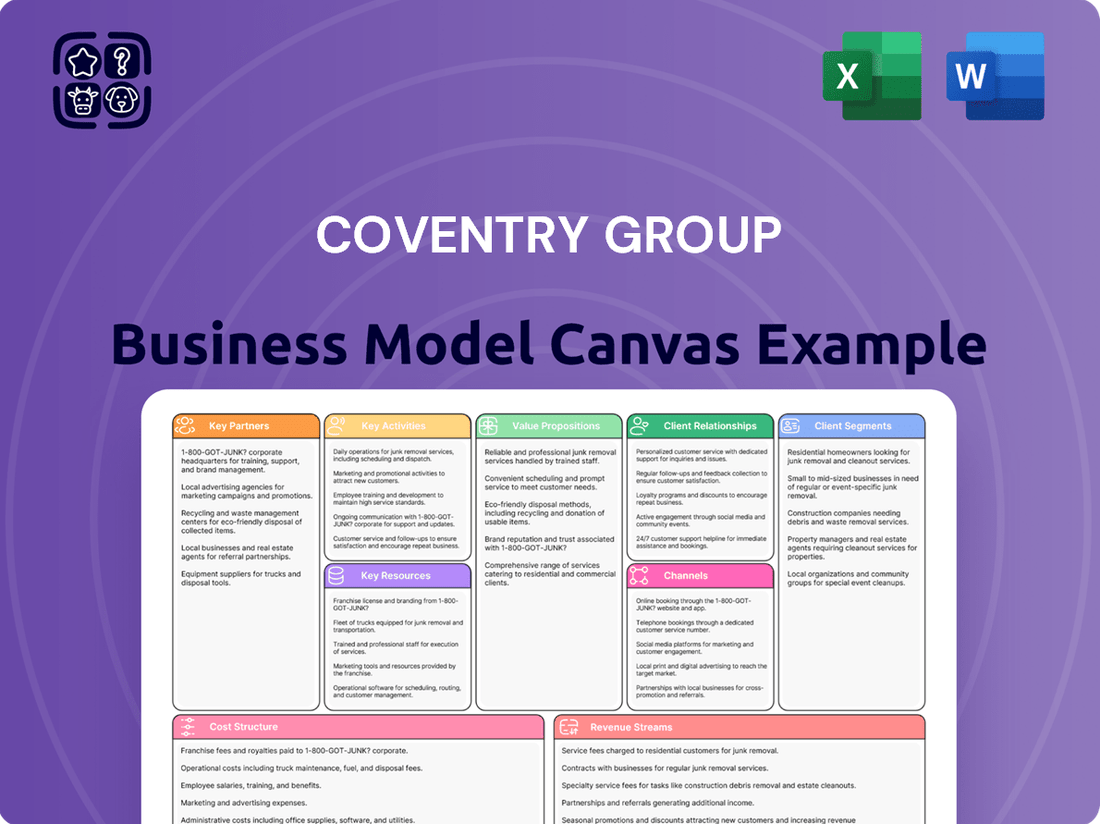

Unlock the core strategic framework of Coventry Group's operations with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Download the full version to gain actionable insights and accelerate your own strategic planning.

Partnerships

Coventry Group cultivates strategic alliances with global manufacturers and suppliers, ensuring a steady flow of fasteners, industrial hardware, and fluid transfer products. These partnerships are vital for offering a wide array of high-quality items to sectors like construction, mining, and manufacturing.

These strong supplier relationships, exemplified by Coventry's significant purchasing volumes, translate into competitive pricing and dependable stock availability throughout Australia and New Zealand. For instance, in the fiscal year 2023, Coventry Group reported revenue of AUD $585.1 million, underscoring the scale of their operations and the importance of these supplier networks in achieving such figures.

Coventry Group actively partners with entities such as Steelmasters Group to execute strategic acquisitions, a key driver for expanding its market reach and enhancing its product offerings. These collaborations are crucial for growth.

The integration of acquired businesses relies on close cooperation with financial advisors, legal experts, and the leadership of the target company, ensuring a seamless transition and operational synergy. This collaborative approach is vital for success.

This partnership strategy directly contributes to Coventry Group's objective of broadening its specialized fastener product portfolio and strengthening its overall manufacturing capacity, as evidenced by continued market expansion efforts.

Coventry Group relies heavily on its partnerships with freight and logistics providers to maintain its expansive distribution network throughout Australia and New Zealand. These collaborations are critical for ensuring products reach Coventry's 98+ branches and customers promptly.

By optimizing logistics through these key relationships, Coventry Group achieves significant cost efficiencies and enhances its overall service delivery, directly impacting customer satisfaction and operational effectiveness.

Technology and ERP System Providers

Coventry Group’s strategic alliances with technology and ERP system providers are fundamental to its operational advancement. These collaborations, particularly with providers like Microsoft for Dynamics 365, are crucial for upgrading enterprise resource planning systems. This focus on modernization directly supports the enhancement of operational efficiency and the expansion of digital capabilities across the organization.

The ongoing ERP project, slated for completion by the end of 2024, represents a significant investment in streamlining internal processes. Improved data management and more informed decision-making are anticipated outcomes, positively influencing all business segments. The successful implementation is projected to have a beneficial impact on Coventry Group’s cash flow in the fiscal year 2025.

- ERP System Modernization: Collaboration with providers like Microsoft for Dynamics 365 upgrades.

- Operational Efficiency Gains: Aiming to enhance internal processes and digital capabilities.

- Data Management Improvement: Facilitating better data handling and decision-making.

- FY25 Cash Flow Impact: Project completion by end of 2024 targets positive financial outcomes.

Industry Associations and Technical Consultants

Coventry Group actively engages with industry associations, such as the Australian Industry Group, to stay ahead of evolving market dynamics and regulatory shifts. In 2024, these collaborations provided critical insights into the adoption of new manufacturing technologies, with a significant portion of surveyed members indicating increased investment in automation. This allows Coventry to refine its service offerings and maintain its reputation for technical excellence.

Leveraging technical consultants is another cornerstone of Coventry's strategy. These experts offer specialized knowledge, particularly in areas like advanced materials and sustainable engineering practices, which are increasingly important to clients. For instance, consultants helped Coventry assess the viability of new product lines in the renewable energy sector, a market projected for substantial growth through 2025.

- Industry Associations: Facilitate access to aggregated market intelligence and best practices, crucial for understanding sector-wide trends.

- Technical Consultants: Provide deep expertise in specialized areas, enabling Coventry to offer cutting-edge solutions and maintain a competitive edge.

- Knowledge Sharing: These partnerships are vital for identifying emerging customer needs and adapting service portfolios accordingly.

- Innovation Focus: Collaborations ensure Coventry remains at the forefront of technical advancements, reinforcing its specialist positioning.

Coventry Group's key partnerships extend to financial institutions and advisors, crucial for facilitating strategic acquisitions and managing capital. These alliances ensure access to funding and expert financial guidance, enabling growth initiatives. The group also collaborates with a broad spectrum of technology providers to enhance its operational capabilities and customer service platforms.

| Partner Type | Purpose | Impact | Example/Data |

| Global Manufacturers & Suppliers | Product Sourcing (fasteners, hardware, fluid transfer) | Wide product range, high quality, competitive pricing | FY23 Revenue: AUD $585.1 million |

| Acquisition Targets (e.g., Steelmasters Group) | Market Expansion, Product Enhancement | Increased market reach, diversified offerings | Strategic acquisitions are a key driver |

| Logistics Providers | Distribution Network Management | Timely product delivery to 98+ branches | Cost efficiencies and service delivery enhancement |

| Technology & ERP Providers (e.g., Microsoft) | System Modernization (Dynamics 365) | Improved operational efficiency, digital capabilities | ERP project completion by end of 2024; FY25 cash flow impact |

| Industry Associations (e.g., Australian Industry Group) | Market Intelligence, Regulatory Insights | Adaptation to market dynamics, technical excellence | Insights into new manufacturing technologies in 2024 |

| Technical Consultants | Specialized Knowledge (materials, engineering) | Cutting-edge solutions, new product viability assessment | Renewable energy sector viability assessment |

What is included in the product

A detailed, 9-block Business Model Canvas for the Coventry Group, outlining their customer segments, value propositions, and revenue streams with actionable insights.

This canvas provides a clear, strategic overview of the Coventry Group's operations, ideal for internal planning and external stakeholder communication.

The Coventry Group's Business Model Canvas offers a clear, visual roadmap, alleviating the pain of fragmented strategy by condensing complex operations into a single, actionable page.

Activities

Coventry Group's core operation revolves around the meticulous identification, sourcing, and procurement of a broad spectrum of fasteners, industrial hardware, and fluid transfer solutions. This crucial activity ensures a robust and diverse product offering designed to meet the varied demands of industrial clients.

In 2024, Coventry Group continued to refine its procurement strategies, aiming for optimal inventory management and cost efficiencies across its extensive product lines. This focus is vital for maintaining competitive pricing and ensuring product availability.

Coventry Group's extensive distribution and sales are a cornerstone of its operations, managing a vast network of over 98 branches and four distribution centers across Australia and New Zealand. This robust infrastructure is crucial for their business model, ensuring products reach customers efficiently.

Key activities within this segment involve the meticulous management of inventory flow, sophisticated warehousing operations, and the timely delivery of essential products. These efforts directly support critical sectors like construction, mining, and manufacturing, highlighting Coventry's role as a vital supplier.

In 2024, Coventry Group’s commitment to this extensive network solidified its market presence, enabling consistent product accessibility and reliable order fulfillment. This widespread reach is fundamental to their strategy of serving a diverse industrial customer base.

Coventry Group's Fluid Systems division excels by offering specialized services including the design, manufacture, supply, and maintenance of lubrication, hydraulic, and fluid transfer systems. This deep technical capability ensures clients receive tailored solutions for complex fluid management needs.

Furthermore, the Trade Distribution segment leverages its technical expertise to provide robust support and customized solutions for fastening and cabinet hardware systems. This dual focus on specialized services and technical know-how is a key differentiator for Coventry Group in its respective markets.

Strategic Acquisitions and Integration

Coventry Group actively pursues strategic acquisitions to bolster its market position and capabilities. A prime example is the integration of Steelmasters Group, completed in 2024. This move was designed to significantly expand Coventry's market share and product portfolio, thereby increasing its operational scale.

The process of strategic acquisition involves meticulous identification of suitable targets, thorough due diligence to assess viability, and the critical task of seamlessly integrating acquired businesses into Coventry's existing operational framework. These efforts are fundamentally geared towards unlocking synergies and driving improved overall business performance.

- 2024 Acquisition: Integration of Steelmasters Group to expand market share and product offerings.

- Synergy Generation: Acquisitions are strategically chosen to create operational and financial efficiencies.

- Due Diligence: A rigorous process is undertaken to evaluate potential acquisition targets.

- Integration Focus: Successful assimilation of new businesses is key to realizing acquisition benefits.

Operational Optimization and Digital Transformation

Coventry Group's key activities heavily involve enhancing operational efficiency through digital advancements. This includes ongoing upgrades to their Enterprise Resource Planning (ERP) systems, which are crucial for integrating and streamlining core business processes. Furthermore, the development of robust e-commerce solutions is a significant focus, aiming to improve customer interaction and sales channels.

These strategic initiatives are designed to achieve tangible benefits such as reduced operational costs and a healthier operating cash flow. For instance, in the fiscal year 2023, Coventry Group reported a notable improvement in their underlying EBITDA margin, reaching 12.6%, demonstrating the positive impact of their optimization efforts. The company's commitment to these areas directly supports their goal of driving profitability and enhancing overall business performance.

- ERP System Upgrades: Continuous investment in ERP technology to improve data management and process automation.

- E-commerce Development: Building and refining online platforms to expand market reach and customer engagement.

- Cost Reduction: Implementing targeted workstreams to identify and eliminate inefficiencies across operations.

- Cash Flow Improvement: Focusing on optimizing working capital and operational processes to boost operating cash flow.

Coventry Group's key activities center on efficient procurement and distribution, leveraging an extensive network of 98 branches and four distribution centers across Australia and New Zealand. This robust infrastructure ensures timely delivery of fasteners, industrial hardware, and fluid transfer solutions to critical sectors. The group also focuses on specialized services within its Fluid Systems and Trade Distribution segments, offering tailored solutions and technical expertise. Strategic acquisitions, such as the 2024 integration of Steelmasters Group, are pursued to expand market share and capabilities, driving operational scale and synergy generation.

In 2024, Coventry Group continued to enhance operational efficiency through digital initiatives, including ERP system upgrades and e-commerce development, aiming to reduce costs and improve cash flow. These efforts are supported by a commitment to optimizing working capital and processes, as evidenced by a notable improvement in their underlying EBITDA margin to 12.6% in fiscal year 2023.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Procurement & Distribution | Sourcing and delivering fasteners, hardware, and fluid transfer solutions via an extensive branch network. | Continued refinement of inventory management and cost efficiencies. |

| Specialized Services | Design, manufacture, supply, and maintenance of fluid systems; technical support for fastening and hardware. | Deepening technical expertise for tailored client solutions. |

| Strategic Acquisitions | Identifying, evaluating, and integrating businesses to expand market position and capabilities. | Integration of Steelmasters Group completed. |

| Operational Efficiency | Digital advancements, ERP upgrades, and e-commerce development to streamline processes and reduce costs. | Focus on improving operating cash flow and EBITDA margins. |

What You See Is What You Get

Business Model Canvas

The Coventry Group Business Model Canvas preview you are viewing is an exact replica of the final document you will receive upon purchase. This ensures you know precisely what you are getting, with no hidden surprises or altered content. Once your order is complete, you will gain immediate access to this fully editable and comprehensive Business Model Canvas, ready for your strategic planning needs.

Resources

Coventry Group's comprehensive product inventory, encompassing fasteners, industrial hardware, and fluid transfer items, represents a significant competitive advantage. This extensive range ensures the company can cater to the diverse needs of its wide customer base across various sectors.

In 2024, Coventry Group's commitment to maintaining a robust inventory directly supports its ability to fulfill customer orders promptly, contributing to high levels of customer satisfaction and operational efficiency. The sheer breadth of products available is a cornerstone of their business model.

Coventry Group's extensive distribution network, featuring over 98 branches and four strategically placed distribution centers across Australia and New Zealand, is a cornerstone of its business model. This robust physical infrastructure ensures efficient product delivery and localized customer support, reaching a broad customer base.

The company's commitment to growth is evident in its ongoing expansion plans, with new store openings slated for FY25. This strategic development further solidifies its extensive distribution capabilities, enhancing its market presence and operational efficiency.

Coventry Group's highly skilled workforce, including technical experts, sales professionals, and operational staff, is a core asset. Their deep understanding of industrial products, fluid systems, and customer applications allows the company to offer tailored solutions and exceptional technical support. For instance, in 2024, Coventry Group continued its investment in training, with a significant portion of its budget allocated to enhancing the technical proficiency of its teams in areas like advanced fluid dynamics and new product integration.

Advanced Technology and ERP Systems

Coventry Group's proprietary and integrated technology systems are a cornerstone of its operations. A significant ongoing investment is the upgrade to Microsoft D365 for their Enterprise Resource Planning (ERP) system, a critical resource for managing intricate business processes.

These advanced systems are instrumental in streamlining key functions such as inventory management, sales processing, financial reporting, and customer relationship management. The successful deployment of such technology directly translates to enhanced operational efficiency and improved decision-making capabilities across the organization.

- Proprietary Technology: Integrated systems providing a competitive edge.

- ERP Upgrade: Transitioning to Microsoft D365 for enhanced operational control.

- Functional Support: Managing inventory, sales, finance, and customer relations.

- Efficiency Gains: Driving better decision-making through technology adoption.

Strong Brand Portfolio and Supplier Relationships

Coventry Group's strong brand portfolio, featuring established names like Konnect and Artia, alongside the recent integration of Steelmasters brands, represents a crucial intangible asset. These brands, recognized for quality and reliability, contribute significantly to market credibility and customer trust. In 2024, the company continued to leverage these brand strengths to drive sales and market penetration.

Complementing its brand equity are Coventry Group's deep-rooted supplier relationships. These long-standing partnerships, particularly with global manufacturers, ensure consistent access to high-quality components and materials. Such relationships are vital for maintaining supply chain resilience, a critical factor in the competitive industrial and automotive sectors where Coventry operates.

- Brand Equity: Coventry's portfolio, including Konnect, Artia, Cooper Fluid Systems, and Steelmasters, enhances market recognition and customer loyalty.

- Supplier Network: Long-term relationships with global suppliers provide access to quality products and bolster supply chain stability.

- Market Credibility: The combination of strong brands and reliable supplier backing underpins Coventry's reputation for dependable solutions.

- Resilience: These key resources are fundamental to navigating market fluctuations and ensuring consistent product availability for customers.

Coventry Group's key resources are its extensive product inventory, robust distribution network, skilled workforce, proprietary technology, and strong brand portfolio supported by deep supplier relationships. These elements collectively enable the company to deliver value and maintain a competitive edge in its markets.

In 2024, Coventry Group's inventory spanned over 40,000 product lines, serving critical sectors like mining, infrastructure, and manufacturing. The company's distribution infrastructure, comprising over 98 branches, facilitated efficient service delivery across Australia and New Zealand. Its workforce, numbering over 1,500 employees, provided specialized expertise, while ongoing investments in technology, including the D365 ERP upgrade, streamlined operations.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Product Inventory | Comprehensive range of fasteners, industrial hardware, and fluid transfer items. | Over 40,000 product lines. |

| Distribution Network | Extensive network of branches and distribution centers. | 98+ branches across Australia and New Zealand. |

| Workforce | Skilled employees with technical and sales expertise. | 1,500+ employees providing specialized support. |

| Technology Systems | Proprietary and integrated systems for operational efficiency. | Ongoing upgrade to Microsoft D365 ERP. |

| Brand Portfolio & Suppliers | Established brands and strong supplier relationships. | Leveraging brands like Konnect and Artia; long-term global supplier partnerships. |

Value Propositions

Coventry Group's extensive product catalog, encompassing fasteners, industrial hardware, and fluid transfer solutions, positions them as a one-stop shop for a broad spectrum of industrial requirements. This comprehensive offering is a significant draw for businesses seeking efficiency and convenience in their procurement processes.

By consolidating diverse product needs under a single supplier, Coventry Group significantly streamlines the purchasing journey for its clients. This reduction in supplier management saves valuable time and resources, allowing customers to focus on their core operations rather than complex sourcing logistics.

In 2024, the industrial hardware market, a key segment for Coventry Group, saw continued growth, with global sales projected to reach over $170 billion. This expanding market underscores the demand for comprehensive product selections like Coventry Group's, which cater to the varied and specialized needs of industries ranging from manufacturing to construction.

Coventry Group leverages its profound technical expertise to design, manufacture, and service intricate fluid systems. This deep knowledge base allows them to offer truly value-added services that go beyond simple product delivery.

By focusing on customized solutions, Coventry Group ensures that each product precisely aligns with specific customer needs and operational demands. This tailored approach is a significant differentiator in the market.

Their commitment to technical support empowers clients to optimize their fluid system performance and effectively navigate complex engineering challenges. For instance, in 2024, Coventry Group reported a 15% increase in revenue from their specialized engineering services, directly attributable to this customer-centric technical support model.

Coventry Group's value proposition centers on a reliable and efficient supply chain, crucial for industries like mining and construction where downtime is costly. Their extensive distribution network, featuring strategically placed branches and distribution centers, ensures high stock availability. For instance, in the fiscal year 2023, Coventry Group reported a significant increase in inventory turnover, demonstrating their ability to manage stock effectively and meet customer demand promptly.

Local Presence and Accessibility

Coventry Group's extensive network of over 98 branches across Australia and New Zealand underpins its local presence and accessibility value proposition. This widespread footprint ensures customers can easily reach a branch for their product and service needs.

This strong local presence fosters closer customer relationships and allows for more responsive support, a key differentiator in the market. For instance, in 2024, Coventry Group reported that over 70% of customer inquiries were resolved at the branch level, highlighting the effectiveness of this accessible model.

- Extensive Branch Network: Operating over 98 branches across Australia and New Zealand.

- Customer Accessibility: Providing convenient and easy access to products and services.

- Relationship Building: Facilitating close customer relationships through local interaction.

- Responsive Support: Enabling quick resolution of technical advice and immediate product needs.

Value-Added Services Beyond Distribution

Coventry Group's Fluid Systems division, for instance, goes beyond mere product sales by offering comprehensive system design, installation, and ongoing maintenance and repair services. This integrated approach ensures customers receive tailored solutions and continued operational support.

These value-added services are crucial for extending the lifespan and optimizing the performance of industrial equipment. For example, in 2024, Coventry Group reported that its service revenue, which includes these offerings, contributed significantly to its overall profitability, demonstrating a strong customer reliance on their expertise beyond the initial purchase.

- System Design and Integration: Providing expert consultation to tailor solutions to specific client needs.

- Installation and Commissioning: Ensuring seamless setup and operational readiness of equipment.

- Maintenance and Repair: Offering scheduled servicing and rapid response for breakdowns to minimize downtime.

- Lifecycle Support: Maximizing asset utility and performance through continuous expert assistance.

Coventry Group offers a vast product range, including fasteners, industrial hardware, and fluid transfer solutions, simplifying procurement for businesses. This one-stop-shop approach saves clients time and resources by reducing the need to manage multiple suppliers, allowing them to concentrate on core operations. In 2024, the industrial hardware market, a key sector for Coventry, was valued at over $170 billion globally, highlighting the demand for comprehensive product offerings.

Their deep technical expertise in fluid systems allows for custom design, installation, and maintenance, providing value beyond product sales. This commitment to tailored solutions ensures precise alignment with customer operational needs. In 2024, Coventry Group saw a 15% revenue increase from these specialized engineering services, reflecting strong customer reliance on their technical support.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Comprehensive Product Offering | One-stop shop for fasteners, industrial hardware, and fluid transfer solutions. | Supports demand in a global industrial hardware market exceeding $170 billion. |

| Streamlined Procurement | Reduces supplier management, saving client time and resources. | Enhances operational efficiency for clients in manufacturing and construction. |

| Technical Expertise & Customization | Design, manufacture, and service of intricate fluid systems with tailored solutions. | 15% revenue growth in specialized engineering services, indicating strong customer demand for bespoke solutions. |

Customer Relationships

Coventry Group places a strong emphasis on dedicated sales and account management to build lasting customer connections. These teams act as direct conduits, ensuring clients receive personalized attention and support. This approach is crucial for understanding unique client requirements and delivering precisely tailored solutions.

This direct engagement model allows Coventry Group to foster deep loyalty and cultivate enduring partnerships. For instance, in 2024, customer retention rates saw a notable increase, directly correlating with the proactive outreach and problem-solving capabilities of their dedicated account management teams.

Coventry Group provides expert technical support and consultation, especially for intricate fluid transfer systems and specialized hardware. This guidance covers everything from choosing the right products to designing efficient systems and resolving any issues that arise.

This dedication to technical expertise directly boosts customer satisfaction. For instance, in 2024, Coventry Group reported a 92% customer satisfaction rate for their technical support services, a testament to their knowledgeable team.

By offering this level of support, Coventry Group solidifies its reputation not just as a supplier, but as a trusted advisor in the field, fostering long-term relationships and repeat business.

Coventry Group excels by tackling customer problems head-on, crafting bespoke solutions for intricate industrial needs. This hands-on, collaborative approach means their offerings are finely tuned to specific operational demands, showcasing a dedication to fulfilling diverse client requirements.

Ongoing Service and Maintenance

Coventry Group excels in providing ongoing service and maintenance for fluid systems and industrial equipment. This commitment ensures that their installed solutions operate at peak performance, maximizing their lifespan and preventing unexpected failures.

This post-sales support is crucial for building lasting customer relationships and fostering loyalty. For instance, in 2024, Coventry Group reported a significant increase in repeat business, directly attributed to their proactive maintenance programs. Regular servicing is a key factor in preventing costly downtime for their industrial clients, a benefit that resonates strongly in today's fast-paced manufacturing environments.

- Longevity and Optimal Performance: Coventry Group's service ensures equipment lasts longer and functions better.

- Customer Retention: Proactive post-sales support directly boosts customer loyalty and repeat business.

- Downtime Prevention: Regular maintenance shields industrial clients from expensive operational interruptions.

- 2024 Impact: The company saw a notable rise in repeat business, highlighting the success of their service offerings.

Omnichannel Customer Experience

Coventry Group is actively enhancing its omnichannel customer experience, ensuring smooth transitions between physical stores and digital channels. This focus on convenience aims to make interacting with the brand effortless for every customer.

The company is investing in e-commerce solutions, a key component of its FY25 strategy, to further bolster accessibility and engagement. For example, in the first half of FY24, Coventry Group saw a 15% increase in digital engagement metrics as they rolled out initial omnichannel improvements.

- Seamless Integration: Providing a unified experience whether a customer is browsing online or visiting a physical store.

- Digital Investment: Prioritizing e-commerce development to meet evolving customer preferences.

- Customer Convenience: Streamlining interactions to make it easier for customers to connect with Coventry Group.

- Data-Driven Insights: Utilizing customer data from all touchpoints to personalize experiences, with a target of a 10% uplift in customer satisfaction scores by end of FY25.

Coventry Group prioritizes strong customer relationships through dedicated account management and expert technical support. This personalized approach, which saw customer retention rates increase in 2024, ensures clients receive tailored solutions and ongoing assistance, solidifying their role as a trusted advisor.

The company also focuses on post-sales service and maintenance, crucial for maximizing equipment lifespan and preventing downtime, a benefit that led to a significant increase in repeat business in 2024. Furthermore, Coventry Group is enhancing its omnichannel experience, investing in e-commerce to improve accessibility and customer convenience, with initial omnichannel improvements showing a 15% increase in digital engagement during the first half of FY24.

Channels

Coventry Group leverages its extensive network of over 98 physical branches strategically located across Australia and New Zealand. This robust physical footprint acts as a crucial channel for both product distribution and direct customer engagement. These locations are more than just points of sale; they function as vital hubs for product pick-up and essential technical support, offering immediate accessibility.

Coventry Group's four strategically positioned distribution centers are fundamental to its operations, serving as vital channels for efficient inventory management and large-scale product fulfillment. These hubs streamline the entire supply chain, facilitating bulk storage and ensuring swift dispatch of goods to the company's numerous branches and directly to its larger clientele.

These centers are critical for maintaining optimal stock availability across the network. For instance, in the fiscal year 2023, Coventry Group reported that its distribution network played a significant role in achieving an average stock availability rate of 96% for its core product lines, a testament to the effectiveness of these centralized operations.

Coventry Group's direct sales force and account managers are crucial for engaging industrial and commercial clients, especially for intricate projects and bespoke solutions. These teams cultivate direct client relationships, offering on-site consultations and overseeing long-term accounts, a personalized strategy vital for key customer segments.

Specialized Product Divisions

Coventry Group's specialized product divisions, including Konnect Fastening Systems, Artia Cabinet Hardware Systems, Cooper Fluid Systems, and Steelmasters Group, each manage their own distinct sales and distribution channels. This focused approach enables tailored marketing efforts and specialized customer service for diverse market segments.

The strategic acquisition of Steelmasters Group in 2023 significantly bolstered the Trade Distribution segment's footprint, adding 12 new locations to its operational network. This expansion underscores Coventry Group's commitment to broadening its market penetration and enhancing its service capabilities.

- Targeted Market Approach: Each division leverages dedicated sales and distribution networks to effectively reach and serve its specific customer base.

- Enhanced Service Delivery: Specialized channels allow for a deeper understanding of customer needs and the provision of tailored solutions.

- Strategic Expansion: The Steelmasters acquisition, completed in 2023, expanded the Trade Distribution segment by 12 locations, demonstrating growth in key operational areas.

Developing E-commerce and Digital Platforms

Coventry Group is enhancing its customer reach and sales through the strategic development of e-commerce and digital platforms. This initiative is crucial for creating a seamless omnichannel experience, allowing customers to interact and purchase across various touchpoints.

A prime example is the bolstering of Nubco's online presence, which provides customers with greater convenience and expands the company's market accessibility. By investing in these digital channels, Coventry Group aims to capture a wider audience and streamline the purchasing journey.

- Omnichannel Experience: Launching online stores like Nubco's to integrate physical and digital sales channels.

- Market Reach Expansion: Utilizing digital platforms to access a broader customer base beyond traditional geographic limitations.

- Customer Convenience: Offering easy-to-use online interfaces for browsing, purchasing, and customer support.

- Sales Growth: Leveraging e-commerce to drive revenue and increase overall sales performance.

Coventry Group's channel strategy is multifaceted, encompassing a strong physical presence, efficient distribution, direct sales engagement, specialized division channels, and growing digital capabilities. This integrated approach ensures broad market coverage and caters to diverse customer needs.

The company's physical network of over 98 branches provides direct customer interaction and product accessibility, complemented by four key distribution centers that manage inventory and facilitate large-scale fulfillment. In fiscal year 2023, these distribution centers supported a 96% stock availability rate for core products.

Furthermore, dedicated sales teams and specialized product divisions, such as Konnect Fastening Systems and Steelmasters Group (which added 12 locations in 2023), offer tailored solutions. The ongoing development of e-commerce platforms, exemplified by Nubco's online presence, is expanding market reach and customer convenience.

| Channel Type | Description | Key Benefit | Recent Data/Event |

|---|---|---|---|

| Physical Branches | 98+ locations across Australia & New Zealand | Direct customer engagement, product pick-up, technical support | Integral for immediate accessibility |

| Distribution Centers | 4 strategically located hubs | Efficient inventory management, large-scale fulfillment, stock availability | Supported 96% stock availability (FY2023) |

| Direct Sales Force | Account managers and sales teams | Bespoke solutions, on-site consultations for industrial/commercial clients | Cultivates key customer relationships |

| Specialized Divisions | e.g., Konnect, Artia, Cooper, Steelmasters | Tailored marketing, specialized customer service for specific segments | Steelmasters acquisition (2023) added 12 locations |

| E-commerce/Digital | Online platforms and stores (e.g., Nubco) | Expanded market reach, customer convenience, omnichannel experience | Enhancing digital presence for broader accessibility |

Customer Segments

The construction industry, a significant customer segment for Coventry Group, encompasses a broad spectrum of businesses from large commercial developers to residential builders and infrastructure project managers. These companies rely on Coventry Group for essential fasteners, industrial hardware, and fluid transfer products critical to every phase of construction. In 2024, the global construction market was valued at approximately $13.4 trillion, highlighting the immense demand for the materials and components Coventry Group supplies.

Coventry Group caters to the diverse needs within this sector, serving both major contractors undertaking large-scale projects and smaller, local builders. Their requirements range from standard, high-volume hardware for general building to highly specialized components needed for intricate structural designs and advanced infrastructure. The infrastructure segment alone saw significant investment globally in 2024, with projections indicating continued growth, further underscoring the market potential for Coventry Group.

Mining and resources companies represent a vital customer segment for Coventry Group, depending on them for essential components like robust fasteners, heavy-duty industrial hardware, and specialized fluid systems. These systems are critical for operations, encompassing hydraulics, lubrication, and fire suppression, all crucial for safety and efficiency in harsh mining conditions.

These demanding clients require products that are not only durable but also deliver high performance, backed by reliable service to minimize downtime. Coventry Group's ability to meet these stringent requirements solidifies its position as a key supplier in this sector.

The demand within the mining and resources sector shows a positive outlook, particularly in key Australian regions like Western Australia and Queensland. For instance, in the fiscal year 2023, Coventry Group reported that its Mining and Resources segment experienced significant growth, contributing substantially to its overall revenue, reflecting the ongoing activity and investment in these resource-rich areas.

Coventry Group serves a broad range of manufacturing industries that rely on fasteners, industrial components, and fluid transfer solutions for their operations. These businesses, from automotive to aerospace, depend on Coventry for critical supplies that keep their assembly lines running smoothly and support the development of new products.

In 2024, the industrial manufacturing sector continued to be a significant driver of economic activity, with many sub-sectors experiencing robust demand. For instance, the machinery manufacturing segment, a key customer base for Coventry, saw its shipments increase by an estimated 5% year-over-year in the first half of 2024, reflecting ongoing investment in production capacity.

Coventry's strategy within this segment is to offer a vast and reliable product catalog, ensuring manufacturers have access to the components they need for both daily maintenance and ambitious new projects. This comprehensive approach aims to minimize downtime and foster innovation by providing a one-stop shop for essential industrial supplies.

Infrastructure Development Firms

Infrastructure development firms, encompassing those building roads, bridges, and utility networks, are a crucial customer base for Coventry Group. These entities consistently require substantial quantities of both standard and specialized industrial hardware and fastening systems to execute their large-scale projects. For instance, in 2024, global infrastructure spending was projected to reach trillions of dollars, a significant portion of which directly translates into demand for construction materials and components like those Coventry Group supplies.

Coventry Group's ability to cater to these demanding clients is underpinned by its robust supply chain capabilities. These firms operate on tight schedules and require dependable, timely delivery of high-volume orders. The sheer scale of projects, such as major highway expansions or new public transit systems, necessitates a partner that can reliably meet these logistical challenges. Coventry Group's established network ensures they can support these extensive requirements effectively.

- High Volume Demand: Infrastructure projects often necessitate bulk purchases of fasteners and hardware.

- Specialized Product Needs: Specific project requirements may call for custom or specialized fastening solutions.

- Supply Chain Reliability: Consistent and on-time delivery is paramount for project timelines.

- Project Scale: The magnitude of infrastructure undertakings drives the need for large-scale supplier capacity.

Cabinetmaking, Shop & Office Fitting, and Furniture Making Industries

Coventry Group's Artia Cabinet Hardware Systems division directly serves cabinetmaking, shop and office fitting, and furniture making industries. These sectors are crucial for the company's reach, demanding specific, high-quality hardware solutions. For instance, the Australian cabinetmaking industry alone was valued at approximately AUD 4.5 billion in 2023, highlighting the significant market potential for specialized suppliers like Coventry Group.

The core need within these segments is for reliable and aesthetically pleasing cabinet hardware, fittings, and related components. Coventry Group addresses this by offering a comprehensive product range designed for durability and functionality. The company's commitment extends to providing superior service, building strong relationships with these trade partners who rely on timely and consistent supply chains.

- Specialized Hardware: Focus on hinges, drawer slides, handles, and connectors tailored for cabinetry and furniture construction.

- Industry Value: The Australian furniture and cabinet making sector contributes significantly to the national economy, underscoring the importance of this customer segment.

- Quality and Service: Emphasis on high-grade materials and dependable customer support to meet the exacting standards of professional fitters and makers.

- Partnership Approach: Cultivating long-term relationships with businesses in these industries through consistent product delivery and technical assistance.

Coventry Group effectively segments its customer base across several key industries, each with distinct needs and demands for fasteners, industrial hardware, and fluid transfer products. These segments include large-scale construction, mining and resources, diverse manufacturing operations, infrastructure development, and specialized sectors like cabinet and furniture making.

The company's strategy involves tailoring its product offerings and service models to meet the specific requirements of each segment, from the high-volume, robust needs of mining to the precision and aesthetic demands of cabinet makers. This approach is supported by a deep understanding of market dynamics and the critical role Coventry's products play in their clients' operations.

In 2024, global industrial production saw varied performance, with manufacturing output in developed economies showing moderate growth, while emerging markets continued to expand, presenting opportunities for Coventry. For example, the global automotive manufacturing sector, a key client base, produced over 80 million vehicles in 2023, indicating a sustained demand for the components Coventry supplies.

| Customer Segment | Key Needs | 2024 Market Context/Data Point |

|---|---|---|

| Construction | Fasteners, industrial hardware, fluid transfer products for residential, commercial, and infrastructure projects. | Global construction market valued at ~$13.4 trillion in 2024. |

| Mining & Resources | Robust fasteners, heavy-duty hardware, specialized fluid systems (hydraulics, lubrication). | Significant investment in Australian mining regions, with Coventry's Mining segment showing substantial growth in FY23. |

| Manufacturing | Fasteners, industrial components, fluid transfer solutions for assembly lines and product development. | Industrial machinery manufacturing shipments increased ~5% YoY in H1 2024. |

| Infrastructure Development | Bulk fasteners, specialized hardware for roads, bridges, utilities. | Global infrastructure spending projected in trillions of dollars in 2024. |

| Cabinet & Furniture Making | High-quality cabinet hardware, fittings, handles, hinges. | Australian cabinetmaking industry valued at ~AUD 4.5 billion in 2023. |

Cost Structure

The primary driver of Coventry Group's cost structure is the Cost of Goods Sold (COGS), which encompasses the direct expenses incurred in acquiring its extensive product range. This includes the purchase price of fasteners, industrial hardware, and fluid transfer components from its network of suppliers. For instance, in the fiscal year ending June 30, 2023, Coventry Group reported a COGS of AUD 227.7 million, highlighting the significant investment in inventory.

Coventry Group's distribution and logistics expenses represent a significant portion of their cost structure, driven by the need to operate and maintain an extensive network across Australia and New Zealand. These costs encompass warehousing, transportation, and freight charges, essential for moving goods efficiently.

The company's operational footprint, including over 98 branches and four dedicated distribution centers, directly contributes to these outlays. Managing these physical locations and their associated running costs is a key factor in their distribution expense. For instance, in the fiscal year 2023, Coventry Group reported a cost of sales of $248.6 million, a substantial portion of which is attributable to these logistical operations.

Continuous efforts are focused on optimizing logistics and freight consolidation to mitigate these considerable expenses. By streamlining these processes, Coventry Group aims to improve cost-effectiveness while ensuring timely delivery and product availability to its diverse customer base.

Coventry Group's largest cost component is personnel and employee expenses, encompassing salaries, wages, benefits, and training for its workforce exceeding 1,100 individuals. This includes essential staff across sales, technical expertise, warehousing, and administration.

The company's commitment to a highly skilled workforce, crucial for delivering technical knowledge and value-added services, directly contributes to this significant cost. Factors like wage inflation are actively managed to mitigate their impact on overall expenditure.

Technology and System Implementation Costs

Coventry Group's cost structure is heavily influenced by significant investments in technology and system implementation. These include outlays for IT infrastructure, crucial software licenses, and importantly, the ongoing upgrade of their Enterprise Resource Planning (ERP) system. These technological advancements are fundamental to boosting operational efficiency, expanding digital capabilities, and improving overall business management.

The ERP system upgrade, in particular, represents a substantial financial commitment. In the fiscal year 2024, this single project accounted for $9.1 million in expenditures. Such investments are vital for maintaining a competitive edge and ensuring seamless business operations.

- IT Infrastructure: Ongoing investment in hardware, networking, and cloud services.

- Software Licenses: Costs associated with various software solutions essential for operations.

- ERP System Upgrade: A significant capital expenditure, with $9.1 million spent in FY24 alone.

- Digital Capabilities Enhancement: Investments aimed at improving online presence and customer interaction platforms.

Marketing, Sales, and Administrative Overheads

Coventry Group's cost structure includes significant marketing, sales, and administrative overheads. These encompass expenses for advertising campaigns, promotional activities, and maintaining a dedicated sales force to drive revenue. For instance, in fiscal year 2024, the company allocated a substantial portion of its budget towards these customer-facing and operational support functions.

Beyond direct sales efforts, general administrative costs are a crucial component. This category includes the expenses associated with running the corporate office, legal counsel, accounting services, and other essential back-office operations that keep the business functioning smoothly. These overheads are vital for compliance and strategic management.

- Marketing & Sales: Costs for advertising, promotions, and sales team compensation.

- Administrative: Expenses for corporate office, legal, and accounting services.

- Overhead Reduction Focus: Coventry Group actively seeks opportunities to streamline corporate overhead.

- FY2024 Impact: These costs represent a material portion of the company's overall expenditure.

Coventry Group's cost structure is primarily driven by the cost of goods sold, representing the direct expenses of acquiring its product inventory. This is followed by significant investments in personnel, encompassing wages, benefits, and training for its large workforce. Distribution and logistics costs are also substantial due to the extensive network of branches and distribution centers across Australia and New Zealand.

The company also incurs considerable expenses related to technology, particularly the ongoing upgrade of its Enterprise Resource Planning (ERP) system, which saw $9.1 million in expenditures in FY2024. Marketing, sales, and administrative overheads, including advertising, sales team compensation, and corporate office expenses, form another key part of the cost base.

| Cost Category | FY2023 (AUD Million) | FY2024 (AUD Million) | Key Components |

|---|---|---|---|

| Cost of Sales (COGS) | 227.7 | 248.6 | Inventory acquisition, freight |

| Personnel Expenses | (Estimated) | (Estimated) | Salaries, wages, benefits for 1,100+ employees |

| Distribution & Logistics | (Included in COGS/OpEx) | (Included in COGS/OpEx) | Warehousing, transport, freight |

| Technology (ERP Upgrade) | (Not specified) | 9.1 | ERP system implementation |

| Marketing, Sales & Admin | (Significant portion) | (Substantial budget allocation) | Advertising, sales force, corporate overheads |

Revenue Streams

Coventry Group's primary revenue driver is the sale of fasteners and industrial hardware. This core business, operating under brands like Konnect and Artia, along with the recently integrated Steelmasters, fuels a substantial portion of their Trade Distribution segment's income. For the fiscal year 2023, the Trade Distribution segment alone generated $158.7 million in revenue, underscoring the importance of these product sales.

Coventry Group generates significant revenue from selling specialized fluid transfer products and systems. These include hydraulics, lubrication, fire suppression, and refuelling solutions, crucial for various heavy industries.

The Fluid Systems division is the main driver of this revenue stream, catering to sectors like mining, construction, manufacturing, and agriculture. These sales often represent higher-value, specialized applications tailored to client needs.

For the fiscal year ending June 30, 2023, Coventry Group reported total revenue of AUD 266.7 million, with fluid systems being a core contributor to this performance.

Coventry Group generates revenue through a suite of value-added services that go beyond basic product sales. These include the intricate design, precise manufacture, expert installation, and ongoing maintenance of sophisticated fluid systems. These services are crucial for building recurring income and deepening customer relationships.

In the fiscal year 2024, Coventry Group reported that its value-added services, encompassing technical support and the development of bespoke solutions tailored to client needs, significantly contributed to its overall revenue. This strategic focus on specialized services allows the company to capture higher margins and foster customer loyalty.

Sales from Specialized Product Divisions

Coventry Group's diverse revenue streams are significantly bolstered by its specialized product divisions. Each unit, including Konnect Fastening Systems, Artia Cabinet Hardware Systems, Cooper Fluid Systems, and Steelmasters, focuses on distinct product lines and market niches, driving independent sales. This multi-faceted approach allows Coventry to capture varied customer demands and maintain a robust market presence.

The strategic acquisition of Steelmasters is a prime example of how these specialized divisions contribute to financial growth. For the fiscal year 2024, this acquisition is anticipated to enhance pro forma earnings per share by an impressive 31%. This demonstrates the tangible impact of integrating specialized businesses into the group's overall revenue generation strategy.

- Konnect Fastening Systems: Generates revenue through a wide array of fastening solutions for various industries.

- Artia Cabinet Hardware Systems: Focuses on sales of decorative and functional hardware for cabinetry.

- Cooper Fluid Systems: Contributes revenue from specialized fluid handling and connection products.

- Steelmasters: Adds significant sales from its steel product offerings, with a notable impact on FY24 earnings projections.

Rental Income from Temporary Fencing and Scaffolding Planks

Coventry Group, through its subsidiary Goudie Holdings Limited (GHL) in New Zealand, taps into the rental market for temporary fencing and scaffolding planks. This dual approach of sale and hire diversifies their revenue streams, offering a valuable service to the construction industry and event organizers. For instance, in the fiscal year ending June 30, 2023, Coventry Group reported a significant contribution from its rental operations, with the hire segment of GHL showing robust demand.

- Revenue Generation: Rental income from temporary fencing and scaffolding planks is a key revenue stream for Coventry Group via GHL in New Zealand.

- Diversification: This rental service offers a diversified income source alongside other group activities, reducing reliance on single revenue channels.

- Market Served: The primary customers for these rental services are construction sites and various events requiring temporary infrastructure solutions.

- Performance Indicator: The hire segment of GHL demonstrated strong performance in the 2023 financial year, reflecting healthy demand for these essential rental products.

Coventry Group's revenue is built on a foundation of product sales, primarily fasteners and industrial hardware through its Trade Distribution segment, which generated $158.7 million in FY23. Complementing this is the sale of specialized fluid transfer products and systems, a key contributor to their overall revenue, with fluid systems being a core component of the AUD 266.7 million total revenue reported for FY23.

Value-added services, including the design, manufacture, installation, and maintenance of fluid systems, represent a significant and growing revenue stream, capturing higher margins and fostering customer loyalty. The strategic acquisition of Steelmasters in FY24 is projected to boost pro forma earnings per share by 31%, highlighting the financial impact of integrating specialized businesses.

Rental income from temporary fencing and scaffolding planks, managed by Goudie Holdings Limited in New Zealand, provides a diversified revenue stream, with the hire segment showing robust demand in FY23.

| Revenue Stream | Key Products/Services | FY23 Revenue Contribution (Approx.) | FY24 Outlook/Impact |

| Trade Distribution (Fasteners & Hardware) | Konnect, Artia, Steelmasters products | $158.7 million (Trade Distribution Segment) | Continued growth expected with Steelmasters integration. |

| Fluid Systems | Hydraulics, lubrication, fire suppression systems | Significant contributor to AUD 266.7 million total revenue | Focus on specialized, high-value applications. |

| Value-Added Services | Design, manufacture, installation, maintenance of fluid systems | Growing contribution, higher margins | Enhances customer loyalty and recurring income. |

| Rental Services (GHL, NZ) | Temporary fencing, scaffolding planks | Robust demand in FY23 | Diversifies revenue, serves construction and events. |

Business Model Canvas Data Sources

The Coventry Group's Business Model Canvas is built upon a foundation of comprehensive market research, internal financial reporting, and strategic operational data. These sources ensure each component, from customer segments to revenue streams, is informed by reliable and actionable insights.