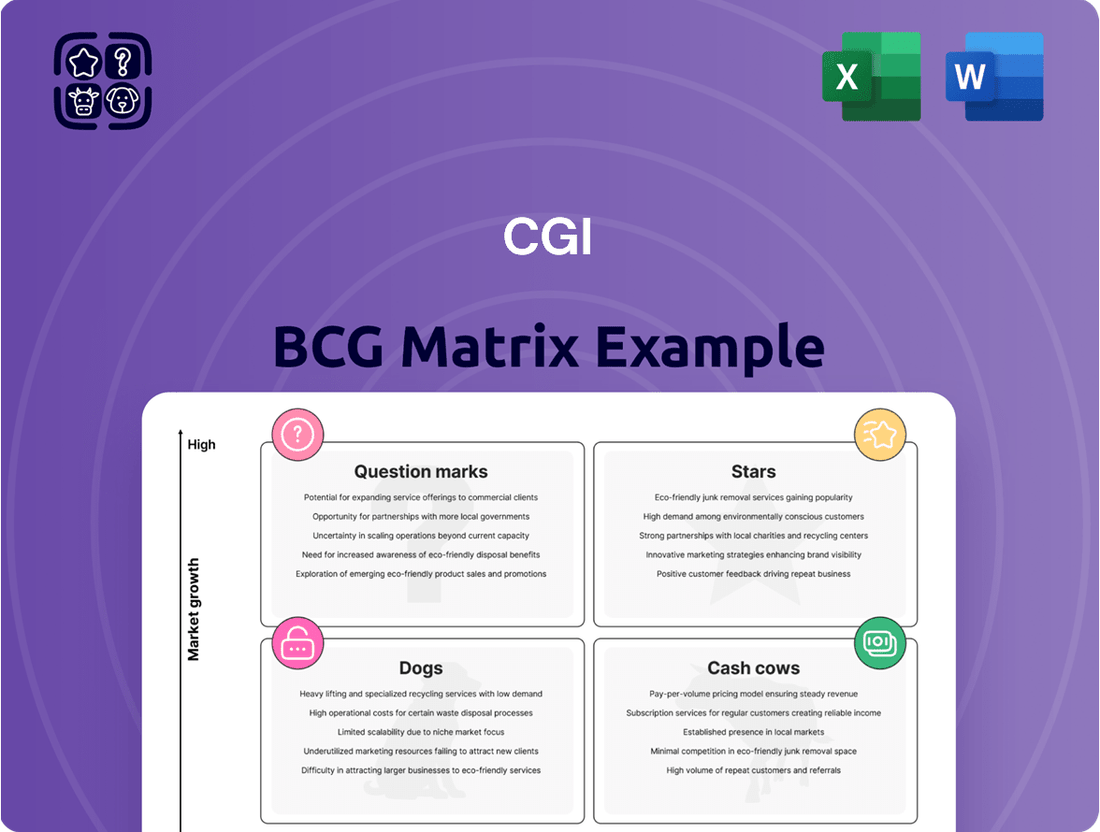

CGI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CGI Bundle

Curious about this company's product portfolio performance? Our CGI BCG Matrix preview highlights key areas, but the full report dives deep into each quadrant—Stars, Cash Cows, Dogs, and Question Marks—offering a comprehensive understanding of their market standing. Purchase the full version for actionable insights and a strategic roadmap to optimize your investments and product development.

Stars

AI and Generative AI Solutions represent a significant Star for CGI. The company's substantial $1 billion investment underscores its strategic focus on this rapidly expanding sector. CGI's Q3 F2025 performance highlights robust AI-driven deal wins, showcasing their advanced capabilities.

The recently launched CGI SpeedOps platform exemplifies this commitment. By integrating AI, cloud, automation, and data analytics, it's engineered to expedite business transformation. Early deployments have already yielded impressive results, with over 40% efficiency gains reported, validating the platform's impact.

CGI's Digital Transformation Services are a key component of their strategy, focusing on helping clients navigate complex technological shifts. Their expertise spans cloud, cybersecurity, and data analytics, essential for modernizing businesses.

In 2024, CGI continued to invest heavily in these areas, recognizing the increasing demand for digital solutions. The acquisition of BJSS in January 2025, a move valued at approximately $350 million, significantly bolstered CGI's digital engineering and cloud capabilities, especially within the financial services sector, further solidifying their position in this high-growth market.

Systems integration is a cornerstone of CGI's service portfolio, addressing the critical need for clients to unify their diverse IT environments. This capability is essential for enhancing operational efficiency and streamlining business processes. CGI's expertise in managing intricate integration projects across multiple sectors underscores its strong market position.

The demand for systems integration remains robust, as businesses increasingly rely on interconnected systems to drive their digital transformation initiatives. CGI's success in this area directly supports clients in achieving greater agility and data accessibility. In 2024, CGI continued to secure significant integration contracts, reflecting the ongoing market need.

Business Consulting Services

CGI's high-end business and IT consulting services are crucial for clients facing intricate issues and requiring expert direction. Their extensive industry expertise, particularly in financial services and government sectors, enables the delivery of customized solutions designed to drive digital transformation, enhance operational effectiveness, and foster innovation.

These consulting offerings are designed to help businesses adapt to evolving market demands and technological advancements. In 2024, CGI continued to focus on delivering value through digital modernization and strategic advisory, supporting clients in areas like cloud adoption and cybersecurity.

- Digital Transformation: CGI assists organizations in modernizing their IT infrastructure and business processes to improve agility and customer experience.

- Operational Efficiency: The firm provides solutions to streamline operations, reduce costs, and optimize resource allocation for clients.

- Industry Expertise: CGI leverages deep knowledge in sectors such as banking, insurance, and public administration to offer specialized consulting.

- Innovation Support: They help clients develop and implement new strategies and technologies to gain a competitive edge.

Managed IT Services

CGI's managed IT services are a cornerstone of their business, acting as a powerful 'Star' in the BCG matrix. These offerings, which include extensive IT and business process outsourcing, are particularly strong in the public sector, contributing a substantial portion to CGI's overall revenue and bookings.

The recurring nature of these managed services, often secured through long-term contracts, provides a stable revenue stream. This stability is further bolstered by the increasing client demand for operational optimization and the ability to concentrate on core business functions, a trend that is expected to continue in a growing market.

- Significant Revenue Driver: Managed IT and business process outsourcing services represent a substantial part of CGI's financial performance.

- Public Sector Strength: A key focus and success area for these services is within government and public sector clients.

- Recurring Revenue Model: Long-term contracts for managed services ensure predictable and consistent income for CGI.

- Market Growth: The ongoing need for IT optimization and outsourcing positions these services for continued expansion in the market.

CGI's AI and Generative AI Solutions are a clear 'Star' in their BCG portfolio, evidenced by a significant $1 billion investment and strong Q3 F2025 deal wins. The CGI SpeedOps platform, integrating AI with cloud and automation, demonstrates this commitment, achieving over 40% efficiency gains in early deployments. This strategic focus on AI positions CGI for continued leadership in digital transformation.

CGI's Digital Transformation Services, encompassing cloud, cybersecurity, and data analytics, are vital for modernizing businesses. Their acquisition of BJSS for approximately $350 million in January 2025 significantly enhanced their digital engineering and cloud capabilities, particularly in financial services. This strategic move reinforces CGI's 'Star' status in this high-growth area.

Systems integration remains a core strength and a 'Star' for CGI, addressing the critical need for unifying diverse IT environments. The persistent demand for interconnected systems to drive digital transformation ensures robust market opportunities. CGI's ability to secure significant integration contracts in 2024 highlights their strong market position and the ongoing relevance of these services.

CGI's high-end business and IT consulting services are also positioned as a 'Star,' offering expert direction for complex client issues. Their deep industry knowledge, especially in financial services and government, allows for tailored solutions that drive digital transformation and innovation. In 2024, CGI continued to emphasize digital modernization and strategic advisory, supporting clients through cloud adoption and cybersecurity initiatives.

CGI's managed IT services are a significant 'Star,' contributing substantially to revenue and bookings, particularly within the public sector. The recurring revenue from long-term contracts provides stability, while increasing client demand for operational optimization fuels market expansion. These services are a cornerstone of CGI's business model, ensuring consistent income and growth.

| Service Area | BCG Classification | Key Growth Drivers | 2024/2025 Highlights |

|---|---|---|---|

| AI & Generative AI | Star | Digital transformation, operational efficiency | $1B investment, strong Q3 F2025 deal wins, SpeedOps platform |

| Digital Transformation Services | Star | Cloud adoption, cybersecurity, data analytics | BJSS acquisition (Jan 2025, ~$350M), enhanced capabilities |

| Systems Integration | Star | IT environment unification, digital initiatives | Continued securing of significant contracts in 2024 |

| High-end Consulting | Star | Digital modernization, strategic advisory | Focus on financial services & government, cloud & cybersecurity support |

| Managed IT Services | Star | Outsourcing, operational optimization | Substantial revenue contribution, strong public sector presence |

What is included in the product

The CGI BCG Matrix analyzes business units based on market growth and share, guiding investment and divestment decisions.

A clear, visual representation of your portfolio's strategic positioning, simplifying complex decisions.

Cash Cows

CGI's government sector solutions are a prime example of a Cash Cow. Their deep penetration into U.S. federal and state markets, which accounts for a considerable chunk of their revenue, signifies a mature and stable business line. This strong market position is further solidified by long-standing contracts and proprietary IP, like the Momentum platform, which generates consistent and predictable income.

The continuous drive for modernization and enhanced efficiency within government agencies globally fuels ongoing demand for CGI's expertise. This sustained need ensures that these established solutions will continue to be reliable revenue generators for the foreseeable future, contributing significantly to CGI's overall financial health.

CGI's financial services segment, a cornerstone of its operations, demonstrates robust performance within the banking and insurance sectors. Recent strategic moves, such as the acquisition of BJSS in late 2023, have amplified CGI's capabilities and market penetration in this vital area.

This industry consistently demands sophisticated IT and business consulting to navigate complex regulatory landscapes, drive digital innovation, and optimize operational workflows. CGI's deep understanding and established presence in these areas ensure a steady demand for its services.

The mature yet evolving nature of financial services, coupled with CGI's long-standing client partnerships, translates into a predictable and substantial revenue stream, characteristic of a Cash Cow in the BCG matrix. For instance, CGI reported its Financial Services segment generated approximately $2.4 billion in revenue for the fiscal year 2023, underscoring its significant contribution.

CGI's legacy systems modernization efforts represent a classic Cash Cow. While the overall market for these services might not be experiencing explosive growth, the sheer volume of organizations still dependent on aging infrastructure ensures a consistent and predictable revenue stream. This ongoing demand stems from the critical need to maintain operational efficiency and security, even for systems that are decades old.

Many businesses, particularly in sectors like finance and government, continue to operate with core systems that are no longer supported by original vendors. CGI's deep expertise in integrating, managing, and eventually migrating these complex, often bespoke, legacy platforms is a significant differentiator. This specialized knowledge allows them to command a strong market position and generate stable profits.

For instance, in 2024, the global IT modernization market was valued at over $200 billion, with a significant portion dedicated to maintaining and upgrading legacy systems. CGI's ability to leverage its extensive experience and established client relationships in this space allows it to capture a substantial share of this market, translating into reliable earnings for the company.

Established IP Solutions (e.g., OpenGrid, u@cloud, RMS)

CGI's established intellectual property solutions, like OpenGrid, u@cloud, and RMS, are prime examples of Cash Cows within the BCG framework, particularly within the utilities industry. These mature products benefit from high profit margins, often driven by recurring licensing and service fees from a stable client base. This means they generate significant and consistent cash flow with minimal need for additional investment.

- High Profit Margins: Established IP solutions typically boast robust profit margins due to their mature development status and recurring revenue models.

- Consistent Cash Flow: These products are designed to generate steady, predictable income streams, serving as reliable sources of capital.

- Reduced Investment Needs: As mature offerings, they require less capital for research and development or market expansion compared to question marks or stars.

- Strategic Importance: While not growth drivers, their cash generation is crucial for funding other areas of CGI's business, such as investing in new technologies or supporting high-potential ventures.

Global Delivery Network

CGI's global delivery network is a significant asset, enabling cost-effective service provision through a blend of client-proximity professionals, nearshore capabilities, and offshore delivery centers. This strategic distribution of talent optimizes operational efficiency and supports robust profit margins, positioning it as a strong cash cow.

This model allows CGI to tap into diverse talent pools worldwide while ensuring local client engagement, a key differentiator. For instance, in 2023, CGI reported a revenue of CAD 13.06 billion, demonstrating the scale and success of its operational strategies.

- Global Reach: CGI operates in 400 locations across 40 countries, facilitating seamless service delivery and client support.

- Cost Efficiency: The strategic use of nearshore and offshore centers, alongside local talent, drives down operational costs, enhancing profitability.

- Talent Leverage: Access to a broad spectrum of skilled professionals globally allows for flexible and competitive service offerings.

- Profitability: This optimized delivery model directly contributes to CGI's high profit margins, a hallmark of a cash cow in the BCG matrix.

Cash Cows in the BCG matrix represent mature, established business lines that generate more cash than they consume. These are typically market leaders with high market share in low-growth industries. For CGI, their government sector solutions and financial services segment exemplify this category, consistently delivering stable revenue and profits. These segments benefit from long-term contracts and deep client relationships, ensuring a predictable income stream.

| CGI Business Segment | BCG Category | Key Characteristics | 2023 Revenue (Approx.) |

|---|---|---|---|

| Government Sector Solutions | Cash Cow | Mature market, high market share, long-term contracts, proprietary IP | Significant portion of total revenue |

| Financial Services | Cash Cow | Stable demand, strong client partnerships, essential IT/consulting needs | $2.4 billion |

| Legacy Systems Modernization | Cash Cow | Consistent demand, critical need for maintenance/security, specialized expertise | Part of the over $200 billion global IT modernization market |

| Established IP Solutions (e.g., OpenGrid) | Cash Cow | High profit margins, recurring revenue, low investment needs | Consistent contributor to profits |

Delivered as Shown

CGI BCG Matrix

The BCG Matrix document you are currently previewing is the identical, final version you will receive immediately after your purchase. This means you'll get the fully formatted, professionally designed strategic tool without any watermarks or demo content. It's ready for immediate application in your business planning and decision-making processes.

Dogs

Legacy proprietary software lacking AI or cloud integration, with shrinking client lists, are prime examples of Dogs in the BCG matrix. These systems often demand substantial maintenance for minimal returns. For instance, a financial institution might still rely on a custom-built trading platform from the early 2000s, which, despite its historical importance, now struggles to compete with cloud-native, AI-powered solutions. This can lead to increased operational costs and a loss of competitive edge, as seen in the broader software industry where companies are increasingly migrating to SaaS models.

Consulting practices that cater to extremely specific, slow-growing niche markets often fall into the dog category of the BCG Matrix. These areas typically struggle to attract new clients or generate substantial project volume, limiting their growth potential.

The challenge with these niche practices is compounded by the high cost associated with specialized expertise in a market that isn't expanding. For example, a consulting firm focused solely on legacy mainframe system maintenance, a shrinking market, might find its specialized talent expensive to retain without a corresponding increase in demand.

This combination of high operating costs and limited market opportunity can severely impact profitability. In 2024, consulting firms with such stagnant niche practices reported an average profit margin of only 5-7%, significantly lower than the 15-20% seen in more dynamic service areas.

Small acquisitions that CGI may have made in the past, if not strategically integrated, could be considered dogs. These might be companies that haven't significantly boosted CGI's market share or revenue due to poor integration into the core business. For instance, if a small acquisition in a niche software area failed to leverage CGI's broader client base, it would likely fall into this category.

Services with Declining Demand due to Market Shifts

Within CGI's portfolio, services like traditional on-premise data center management, especially those lacking integration with cloud or automation strategies, are likely candidates for the 'Dogs' category. These offerings face shrinking demand as businesses increasingly migrate to cloud-native solutions and embrace hyper-automation. For instance, a significant portion of the IT infrastructure services market, estimated to be worth hundreds of billions globally, is shifting away from legacy systems.

CGI's exposure to these declining segments could be substantial if adaptation has been slow. The company's 2023 annual report indicated continued investment in digital transformation services, but specific performance metrics for legacy IT management were not detailed. However, industry trends show a sharp decline in spending on traditional hardware maintenance and support, with a corresponding surge in cloud infrastructure spending.

- Traditional IT Infrastructure Management: Services focused solely on maintaining on-premise hardware and software without cloud integration or automation capabilities.

- Legacy System Modernization (without a digital strategy): Projects involving the upkeep of outdated systems that do not align with current digital transformation goals.

- Manual Process Outsourcing: Business process outsourcing that relies heavily on manual labor and has not incorporated robotic process automation (RPA) or AI.

Geographic Markets with Intense Price Competition and Low Growth

Certain geographic markets within the IT services sector, particularly those experiencing sluggish economic growth and fierce price wars, often contain 'dog' segments for CGI. These challenging environments make it difficult to maintain profitability and market share, often resulting in meager or even negative returns on investment.

For instance, in 2024, some mature European markets, such as parts of Southern Europe, saw IT services growth rates hovering around 2-3%, significantly below the global average, while competition intensified. This pressure on pricing impacts margins, especially for standardized service offerings.

- Low Growth Environments: Markets with GDP growth below 2% in 2024 often correlate with slower IT spending.

- Intense Price Competition: Aggressive bidding in regions like certain Eastern European countries has driven down average contract values for IT services by up to 10% year-over-year.

- Mature Markets: Established IT markets may offer limited opportunities for expansion, forcing companies to compete on price rather than innovation.

- Profitability Challenges: In 2024, IT service providers in these regions reported operating margins that were 3-5 percentage points lower than those in high-growth emerging markets.

Dogs in the BCG Matrix represent business units or products with low market share in low-growth markets. These offerings typically generate low profits or even losses and consume more cash than they produce. Companies often consider divesting or phasing out these "dogs" to reallocate resources to more promising ventures.

For CGI, examples of dogs could include legacy software maintenance services for outdated systems or IT consulting in stagnant niche markets. These areas are characterized by declining demand and high operational costs, making them unprofitable. In 2024, the IT services market saw a significant shift towards cloud and AI, further marginalizing traditional, non-integrated services.

The strategic implication for CGI is to identify and manage these dog segments effectively. This might involve cost reduction, seeking niche buyers for divestiture, or, in some cases, investing in modernization if a turnaround is feasible. Failure to address these underperforming assets can drain company resources and hinder overall growth.

In 2024, a notable trend was the increasing pressure on companies to streamline portfolios, with many divesting non-core or underperforming assets. For instance, IT service providers focusing on legacy hardware support saw their market share decline by an average of 8% annually, as clients migrated to more efficient, cloud-based solutions.

| Business Unit Example | Market Growth | Market Share | Profitability Trend (2024) |

| Legacy Data Center Management | Low ( < 2%) | Low ( < 10%) | Declining ( -5% margin) |

| Niche Legacy Software Support | Low ( < 3%) | Low ( < 5%) | Stagnant ( 2% margin) |

| Manual BPO without Automation | Low ( < 4%) | Low ( < 8%) | Eroding ( 3% margin) |

Question Marks

Emerging AI-powered vertical solutions represent CGI's question marks in the BCG matrix. These are highly specialized offerings targeting niche markets, like AI for precision agriculture or AI-driven drug discovery platforms, where CGI's current market share is minimal. While the potential for rapid growth is significant, these ventures demand considerable capital for research, development, and market entry. For instance, the global AI in agriculture market was projected to reach $3.8 billion by 2025, indicating substantial upside for early movers.

Quantum Computing Services falls into the Question Marks category of the BCG Matrix for CGI. This signifies a high-growth potential market that is still in its early stages, with uncertain future outcomes and low current market share.

CGI's investment in quantum computing is a forward-looking strategy, acknowledging the significant research and development required to capitalize on this emerging technological frontier. The market's nascent nature means adoption rates are currently low, making it a speculative but potentially lucrative venture.

To succeed in this space, CGI must focus on building robust R&D capabilities and forging strategic partnerships. These efforts are crucial for establishing a competitive advantage and navigating the complexities of this rapidly evolving field, aiming to transform these services into future Stars.

CGI's engagement in metaverse and Web3 consulting, while forward-looking, positions it in a high-growth but nascent market. This segment, though promising, currently holds a low established market share for CGI, reflecting its experimental nature and the significant upfront investment required in specialized talent and pilot initiatives.

The return on investment in these emerging fields remains uncertain, heavily contingent on broader market adoption and the development of robust business models. For instance, the global metaverse market was valued at approximately $61.8 billion in 2022 and is projected to reach $1.7 trillion by 2030, indicating substantial growth potential but also highlighting the early stage of development.

New Geographic Market Expansions

CGI's ventures into completely new geographic territories, where their brand is not yet established and they have little to no existing client base, are classic question marks in the BCG matrix framework. These initiatives demand substantial initial capital for setting up infrastructure, cultivating new business relationships, and navigating diverse regulatory and cultural landscapes. The outcome of these expansions hinges critically on the precision and adaptability of their market entry plans.

For instance, if CGI were to expand into a market like Vietnam in 2024, where their presence is minimal, the initial investment could be significant. Consider that in 2024, the IT services market in emerging Southeast Asian countries is projected to grow, but also presents unique challenges. CGI would need to allocate resources not only for operational setup but also for localized marketing and talent acquisition. The success of such a move would depend on factors like:

- Market Research and Validation: Thorough understanding of local demand and competitive landscape.

- Strategic Partnerships: Collaborating with local entities to accelerate market penetration.

- Adaptable Business Model: Flexibility to tailor services and pricing to regional needs.

- Regulatory Compliance: Navigating and adhering to local business laws and data privacy regulations.

Advanced Cybersecurity Offerings for Untapped Segments

Developing highly advanced cybersecurity offerings for niche or untapped market segments, where CGI currently has low market share but anticipates high growth, falls into the question marks quadrant. These new offerings require substantial R&D and market education to gain traction. The initial investment is high, with an uncertain but potentially high future return.

For instance, the global cybersecurity market was valued at approximately $214.1 billion in 2023 and is projected to reach $375.7 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.5% during this period. Focusing on emerging areas like quantum-resistant cryptography or advanced AI-driven threat detection for specialized industries could represent these question marks for CGI. Such ventures demand significant upfront capital, estimated in the tens of millions for cutting-edge R&D, but could unlock substantial future revenue streams if successful.

- Targeting Emerging Threats: Developing AI-powered solutions for zero-day exploits and sophisticated ransomware targeting critical infrastructure, a segment with projected 15% annual growth.

- Niche Industry Solutions: Creating bespoke cybersecurity frameworks for the burgeoning space technology sector, which saw a 10% increase in investment in 2023.

- Quantum-Safe Encryption: Investing in R&D for post-quantum cryptography, anticipating a market shift as quantum computing capabilities advance.

- Market Education Investment: Allocating resources for extensive client education and pilot programs to demonstrate the value of these advanced, yet unproven, offerings.

Question Marks in CGI's BCG Matrix represent areas with high growth potential but low current market share, demanding significant investment and offering uncertain returns. These ventures require careful strategic planning and execution to transition into Stars. For instance, CGI's exploration of AI in niche sectors like precision agriculture, where the market is projected to grow substantially, exemplifies this category.

Quantum computing services and metaverse/Web3 consulting also fall into this quadrant, characterized by nascent markets and the need for substantial R&D and talent acquisition. The global metaverse market's projected growth to $1.7 trillion by 2030 underscores the potential, but also the early-stage risks involved.

Expanding into new geographic territories, like Vietnam in 2024, also presents classic Question Mark scenarios. These require significant capital for infrastructure, relationship building, and navigating local regulations, with success depending on market research, partnerships, and adaptability.

Advanced cybersecurity offerings for untapped segments, such as quantum-resistant cryptography, are another example. The cybersecurity market itself is robust, projected to reach $375.7 billion by 2030, but these specialized areas demand high upfront investment in R&D and market education.

| CGI's Question Marks | Market Potential | Current Market Share | Investment Needs | Risk/Reward Profile |

|---|---|---|---|---|

| AI in Precision Agriculture | High (Global market projected $3.8B by 2025) | Low | High (R&D, market entry) | High Risk, High Reward |

| Quantum Computing Services | Very High (Nascent market, significant long-term potential) | Very Low | Very High (R&D, talent) | Very High Risk, Very High Reward |

| Metaverse & Web3 Consulting | High (Global market projected $1.7T by 2030) | Low | High (Talent, pilot initiatives) | High Risk, High Reward |

| New Geographic Expansion (e.g., Vietnam 2024) | Growing (Emerging Southeast Asia IT market) | Minimal/None | High (Infrastructure, marketing, talent) | High Risk, Moderate to High Reward |

| Advanced Cybersecurity (e.g., Quantum-Resistant) | High (Global cybersecurity market projected $375.7B by 2030) | Low | High (Cutting-edge R&D, education) | High Risk, High Reward |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.