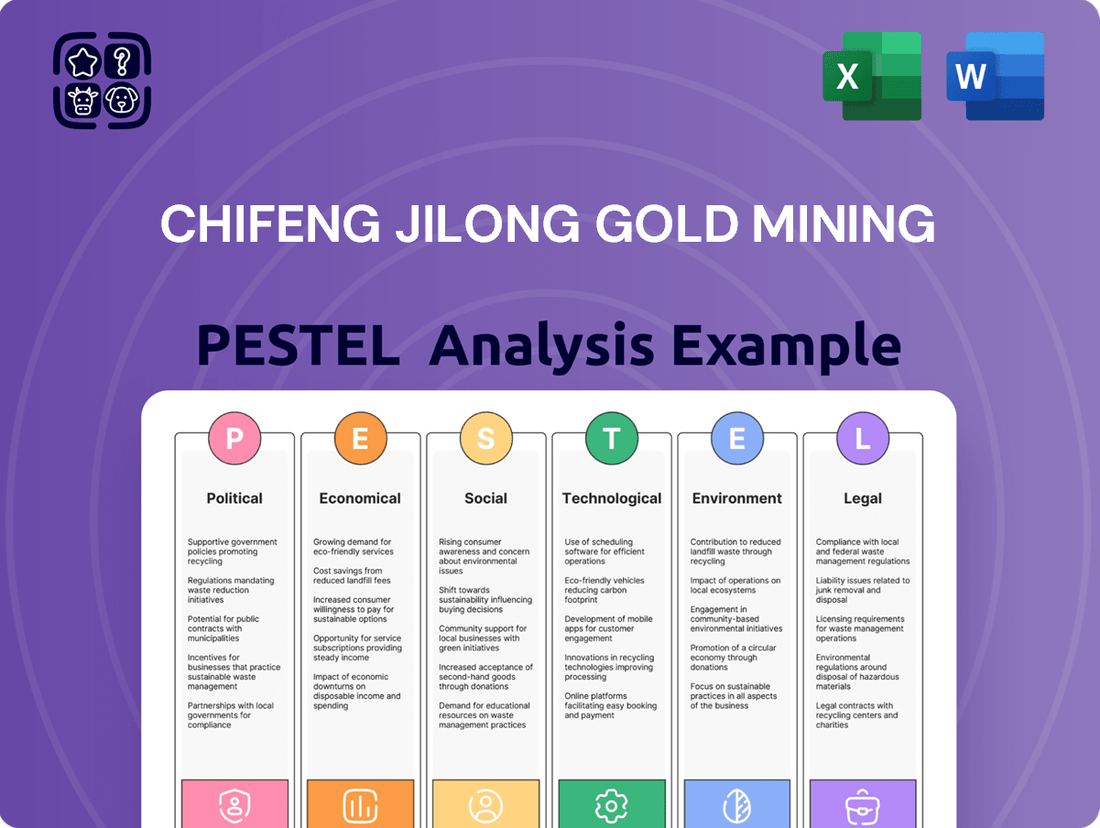

Chifeng Jilong Gold Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chifeng Jilong Gold Mining Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Chifeng Jilong Gold Mining's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate challenges and seize opportunities. Gain a strategic advantage by understanding the complete picture—download the full PESTLE analysis now and make informed decisions for your business.

Political factors

Government policies on resource extraction, including licensing, quotas, and strategic minerals designation, directly impact Chifeng Jilong's operational scope and expansion potential. For instance, China's focus on domestic supply chains for critical minerals, which could include gold in certain contexts, might lead to preferential policies for local producers like Chifeng Jilong.

Changes in these policies, especially concerning gold, can create either significant opportunities or constraints for the company's growth and profitability. In 2024, China continued its efforts to bolster domestic gold production, aiming to meet a significant portion of its consumption needs, which generally benefits established miners.

Political stability in China also plays a crucial role in ensuring a predictable regulatory environment for long-term investments. The stable political climate observed through 2024 provided a consistent framework for mining operations, allowing companies like Chifeng Jilong to plan and invest with greater certainty regarding regulatory frameworks.

International trade relations and potential tariffs on gold or mining equipment significantly impact Chifeng Jilong's global operations. For instance, the US-China trade tensions, ongoing since 2018, have created uncertainty, though direct tariffs on gold itself have been limited. However, tariffs on mining machinery or technology imported from countries like the US or European nations could increase Chifeng Jilong's capital expenditure and operational costs.

Geopolitical instability, such as conflicts in resource-rich regions or broader trade disputes, can disrupt global supply chains for critical mining components. This disruption, coupled with potential shifts in global demand for gold driven by economic uncertainty, directly affects Chifeng Jilong's sales and overall revenue streams. Monitoring these evolving trade dynamics is crucial for risk mitigation.

Chifeng Jilong Gold Mining's operations are deeply intertwined with the political landscape of China, specifically Inner Mongolia. The company benefits from China's consistent focus on economic development and resource extraction, which generally translates to a stable operating environment. For instance, China's commitment to its Five-Year Plans, including the recently concluded 14th Five-Year Plan (2021-2025), has historically supported key industries like mining through policy directives and infrastructure development.

Sound governance within China is crucial for Chifeng Jilong. The government's ongoing anti-corruption campaigns, while sometimes creating uncertainty, ultimately aim to foster a more transparent and predictable business environment. Clear legal frameworks governing mining rights, environmental protection, and taxation provide a degree of security for investors. In 2023, China's GDP growth was reported at 5.2%, indicating a resilient economy that underpins such industrial activities.

Any significant shifts in Chinese political leadership or policy direction could impact Chifeng Jilong. For example, a sudden change in environmental regulations or a tightening of foreign investment rules could pose challenges. The company's ability to navigate these political currents, including maintaining strong relationships with local and national authorities, is vital for its long-term success and the security of its investments.

International Sanctions and Regulations

Chifeng Jilong Gold Mining operates within a global landscape where international sanctions and evolving regulations significantly impact its operations. As a gold mining entity, the company must meticulously adhere to sanctions regimes, particularly those targeting countries or entities involved in resource extraction and trade, to avoid legal repercussions and maintain market access.

Compliance with global anti-money laundering (AML) and responsible sourcing mandates is paramount. For instance, the European Union's proposed AML package, expected to be finalized in 2024-2025, aims to strengthen oversight of financial institutions and high-risk entities, directly affecting companies like Chifeng Jilong. Failure to meet these stringent requirements can lead to substantial fines, loss of access to international financial markets, and severe reputational damage, impacting its ability to secure financing and conduct business globally.

- Sanctions Compliance: Navigating sanctions imposed by bodies like the UN, US Treasury, and EU is crucial for Chifeng Jilong to avoid penalties related to its supply chain or operational locations.

- AML and Responsible Sourcing: Adherence to regulations like the EU's AML directives and OECD guidelines for responsible mineral sourcing is essential for maintaining trust and market access.

- Regulatory Evolution: Keeping abreast of new regulations, such as potential changes in commodity trading rules or environmental, social, and governance (ESG) reporting requirements anticipated in the 2024-2025 period, is vital for proactive risk management.

Resource Nationalism

Resource nationalism, a growing trend where governments assert more control over their natural resources, presents a significant political consideration for mining companies. This can manifest as higher taxes, increased royalties, or even the risk of nationalization, particularly impacting foreign or private entities. While Chifeng Jilong operates primarily within China, it's not immune to evolving domestic policies that might prioritize national interests over private enterprise, potentially affecting operational flexibility and profitability.

The Chinese government's approach to resource management, especially concerning strategic minerals and precious metals, could see shifts that favor state-owned enterprises or impose stricter regulations on private miners. For instance, in 2023, China continued its focus on securing critical mineral supply chains, which could translate into policy adjustments affecting all players in the mining sector, including Chifeng Jilong. Such developments necessitate careful monitoring to anticipate impacts on the company's autonomy and financial performance.

- Increased Taxation and Royalties: Governments may raise taxes or royalties on mineral extraction to capture a larger share of profits, directly impacting a mining company's bottom line.

- Nationalization Risk: In extreme cases, governments might nationalize mining assets, leading to the loss of ownership and control for private companies.

- Operational Restrictions: Resource nationalism can lead to new regulations concerning labor, environmental standards, or local content requirements, potentially increasing operational costs and complexity.

- Supply Chain Security Focus: China's emphasis on securing supply chains for key resources could lead to policies that favor domestic production and control, influencing Chifeng Jilong's strategic planning.

Government policies on resource extraction, including licensing and strategic minerals designation, directly impact Chifeng Jilong's operational scope. China's focus on domestic supply chains for critical minerals, which could include gold, might lead to preferential policies for local producers like Chifeng Jilong, as seen in its continued efforts to bolster domestic gold production through 2024.

Political stability in China ensures a predictable regulatory environment, crucial for long-term investments. The stable political climate observed through 2024 provided a consistent framework for mining operations, allowing companies like Chifeng Jilong to plan and invest with greater certainty regarding regulatory frameworks.

International trade relations and potential tariffs on mining equipment can impact Chifeng Jilong's capital expenditure. While direct tariffs on gold have been limited, tariffs on imported machinery could increase costs, a factor to consider amidst ongoing global trade dynamics.

Resource nationalism, a trend where governments assert more control over natural resources, presents a significant political consideration. China's emphasis on securing supply chains for key resources in 2023 could translate into policy adjustments affecting all players in the mining sector, including Chifeng Jilong.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting Chifeng Jilong Gold Mining, detailing how political, economic, social, technological, environmental, and legal factors present both challenges and opportunities.

It provides actionable insights for strategic decision-making, highlighting market dynamics and regulatory landscapes relevant to the company's operations and future growth.

This Chifeng Jilong Gold Mining PESTLE analysis offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of complex data overload.

Economic factors

The price of gold is the bedrock of Chifeng Jilong Gold Mining's financial health, directly impacting its revenue and profitability. For instance, gold prices averaged around $2,070 per ounce in early 2024, a significant factor for the company's earnings.

Global economic uncertainties, including inflation fears and shifting interest rate policies, are major drivers of gold's value. In 2024, persistent inflation concerns in major economies bolstered demand for gold as a safe-haven asset, pushing its price upwards.

Chifeng Jilong's financial results are therefore closely tied to these market dynamics. The company must employ effective hedging or stringent cost management to navigate the inherent volatility in global gold prices.

Rising inflation presents a significant challenge for Chifeng Jilong Gold Mining, directly impacting its operational expenses. Costs for essential inputs like energy, labor, and equipment have seen notable increases. For instance, global energy prices, a key component of mining costs, have remained volatile, with Brent crude oil averaging around $83 per barrel in early 2024, a substantial rise from previous years.

These increased operating costs directly squeeze Chifeng Jilong's profit margins. The company must navigate this environment by implementing robust cost management strategies. This could involve optimizing energy consumption, negotiating better terms with suppliers, and improving labor productivity to mitigate the impact on its bottom line.

To maintain profitability, Chifeng Jilong may need to consider strategic adjustments. This could include carefully adjusting the selling price of its gold products, where market conditions permit, or optimizing production volumes to align with cost efficiencies. The company's ability to adapt its pricing and production strategies will be crucial in weathering inflationary pressures.

Fluctuations in the Chinese Yuan (CNY) against major currencies, especially the US Dollar (USD) where gold is primarily priced, directly impact Chifeng Jilong Gold Mining's financial performance. For instance, during 2024, the Yuan experienced volatility, trading around 7.2 CNY to the USD at various points, meaning a stronger Yuan could diminish the CNY value of USD-denominated gold sales.

Conversely, a weaker Yuan can escalate the costs associated with importing essential mining equipment and services, which are often priced in foreign currencies. This dynamic underscores the critical need for robust foreign exchange risk management strategies to maintain the company's financial stability and profitability in the face of global currency shifts.

Economic Growth and Industrial Demand

Overall economic expansion, both within China and across the globe, significantly shapes industrial demand for gold. This demand is particularly evident in sectors such as electronics and jewelry manufacturing. While investment motives often dictate gold price fluctuations, industrial consumption forms a foundational element of its market.

A deceleration in economic growth could consequently dampen this industrial demand, potentially affecting Chifeng Jilong Gold Mining's sales volumes and its ability to diversify revenue streams. For instance, global GDP growth projected to be around 2.7% in 2024 by the IMF, a slight slowdown from previous years, could translate into more cautious consumer spending on gold-based products.

- Global Economic Growth: The IMF projects global growth to moderate to 2.7% in 2024, impacting discretionary spending on gold jewelry and electronics.

- China's Economic Performance: China's GDP growth, expected to be around 4.6% in 2024 according to the IMF, is crucial for its significant domestic industrial gold demand.

- Electronics Sector Demand: Gold's use in high-end electronics, a sector sensitive to economic cycles, directly ties its demand to overall industrial output and consumer confidence.

- Jewelry Market Sensitivity: The jewelry segment, a major consumer of gold, is highly susceptible to economic downturns, which can reduce consumer purchasing power and demand for luxury goods.

Interest Rates and Access to Capital

Changes in interest rates directly impact Chifeng Jilong Gold Mining's borrowing costs. For instance, if the People's Bank of China were to raise its benchmark lending rate in 2024 or 2025, the cost of financing new projects or expanding existing operations would increase, potentially making some investments less financially viable. This also raises the expense of servicing existing debt, affecting profitability.

Access to affordable capital is a critical factor for mining companies like Chifeng Jilong, which are inherently capital-intensive. In the 2024-2025 period, a tighter credit environment or higher interest rates from major financial institutions could limit the company's ability to secure the necessary funds for crucial activities such as exploration, mine development, and equipment upgrades. This directly influences growth potential and operational capacity.

- Impact on Borrowing Costs: Rising interest rates in 2024-2025 would increase the cost of Chifeng Jilong's debt financing for new projects and expansions.

- Debt Servicing: Higher rates also mean increased expenses for servicing existing loans, potentially reducing net income.

- Capital Accessibility: The mining sector's reliance on significant capital means that interest rate hikes or reduced credit availability can hinder exploration and development funding.

- Investment Attractiveness: Elevated borrowing costs can make new mining ventures less appealing compared to other investment opportunities.

The economic landscape profoundly influences Chifeng Jilong Gold Mining's operations and profitability. Global economic growth directly impacts industrial demand for gold, seen in sectors like electronics and jewelry. For instance, the IMF projected global GDP growth to moderate to 2.7% in 2024, potentially softening this demand.

Inflationary pressures increase operational costs for Chifeng Jilong, affecting expenses for energy, labor, and materials. With Brent crude oil averaging around $83 per barrel in early 2024, energy costs remain a significant factor impacting profit margins.

Interest rate policies by central banks, including the People's Bank of China, affect Chifeng Jilong's borrowing costs and the attractiveness of gold as an investment. Higher rates can increase debt servicing expenses and the cost of capital for expansion.

| Economic Factor | 2024/2025 Relevance | Impact on Chifeng Jilong |

| Global GDP Growth | Projected 2.7% (IMF, 2024) | Influences industrial demand for gold. |

| Inflation | Persistent concerns in 2024 | Increases operational costs (energy, materials). |

| Interest Rates (e.g., PBoC) | Potential for increases | Affects borrowing costs and debt servicing. |

| Currency Fluctuations (CNY/USD) | Volatility observed | Impacts revenue from USD-denominated sales and import costs. |

Preview Before You Purchase

Chifeng Jilong Gold Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Chifeng Jilong Gold Mining covers all critical external factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences relevant to Chifeng Jilong Gold Mining.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for understanding the opportunities and threats facing Chifeng Jilong Gold Mining in the global market.

Sociological factors

Chifeng Jilong Gold Mining's success hinges on access to skilled labor, from geologists to specialized technicians. The mining sector, particularly in regions like Inner Mongolia where Chifeng Jilong operates, faces ongoing challenges with labor availability due to demographic trends and urban migration. Reports from the China National Bureau of Statistics in 2024 indicated a continued shift of rural populations to urban centers, potentially tightening the labor pool for traditional industries.

Competition for talent is also a significant factor, driving up labor costs and complicating recruitment. As of early 2025, industry surveys suggest a growing demand for experienced mining engineers, with specialized skill sets commanding premium salaries. To counter this, Chifeng Jilong's investment in robust training and development programs is paramount for cultivating and retaining a highly competent and efficient workforce, ensuring operational continuity and technical expertise.

Chifeng Jilong Gold Mining's ability to maintain a positive relationship with local communities is paramount for its social license to operate. In 2024, the company continued its focus on stakeholder engagement, aiming to preemptively address concerns and foster development initiatives around its mining sites in Inner Mongolia. This proactive approach is crucial to avoid the disruptions that can arise from negative community perceptions, such as protests or operational slowdowns.

Societal expectations for worker health and safety are increasingly stringent, particularly within the demanding mining sector. Chifeng Jilong Gold Mining is therefore obligated to maintain exceptionally high safety standards to safeguard its personnel and proactively prevent workplace accidents.

Adherence to these elevated safety benchmarks is not merely a matter of compliance but a fundamental aspect of responsible corporate citizenship. In 2023, the International Labour Organization reported that mining remains one of the most hazardous industries globally, underscoring the critical need for rigorous safety measures.

Implementing comprehensive safety protocols, ensuring thorough and continuous employee training, and cultivating an ingrained safety-first culture are therefore paramount. These initiatives are essential for fostering employee well-being, minimizing operational risks, and ensuring sustained regulatory compliance, thereby protecting the company's reputation and operational continuity.

Public Perception of Mining

Public sentiment towards mining, especially regarding environmental effects and ethical sourcing, significantly shapes consumer choices and investor outlook. Chifeng Jilong Gold Mining's dedication to responsible operations and open communication is crucial for building a positive public image and drawing in investors focused on social responsibility.

Negative public perception can translate into tangible financial risks, such as boycotts or pressure for divestment from institutional investors. For instance, a 2024 survey indicated that 65% of consumers consider a company's environmental record when making purchasing decisions, a figure likely to impact industries with visible environmental footprints like mining.

- Environmental Concerns: Public scrutiny over mining's impact on land, water, and biodiversity remains high.

- Ethical Sourcing: Transparency regarding labor practices and the origin of extracted materials is increasingly demanded by consumers and investors.

- Investor Sentiment: Socially responsible investing (SRI) funds, which prioritize ESG factors, saw global assets under management reach over $3.7 trillion by the end of 2023, highlighting the financial impact of public perception.

Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility (CSR) are increasingly shaping business operations. Chifeng Jilong Gold Mining, like its peers, faces pressure to demonstrate positive societal contributions beyond profit generation. This includes ensuring ethical labor practices, minimizing environmental impact, and investing in local communities. For instance, in 2024, many mining companies are reporting on their Scope 1 and 2 emissions reductions, with targets often set for 2030. A robust CSR framework can significantly bolster a company's reputation, making it more attractive to investors and employees alike, while fostering long-term stakeholder trust.

The growing emphasis on CSR translates into tangible expectations for mining companies. These expectations often manifest in:

- Ethical Labor Practices: Ensuring fair wages, safe working conditions, and adherence to international labor standards.

- Environmental Stewardship: Implementing sustainable mining techniques, managing water resources responsibly, and rehabilitating land post-operation.

- Community Investment: Supporting local development through education, healthcare, and infrastructure projects.

- Transparent Reporting: Providing clear and verifiable data on CSR performance and impact.

Public perception of mining's environmental footprint and ethical sourcing practices directly influences consumer choices and investor confidence. Chifeng Jilong Gold Mining's commitment to responsible operations and transparent communication is vital for cultivating a favorable public image and attracting socially conscious investors.

Negative public sentiment can create significant financial risks, including boycotts and pressure for divestment from institutional investors. A 2024 survey revealed that 65% of consumers consider a company's environmental record when making purchasing decisions, a trend that strongly impacts industries with visible environmental impacts like mining.

Societal expectations for corporate social responsibility (CSR) are increasingly shaping business operations, pushing companies like Chifeng Jilong to demonstrate positive societal contributions beyond profit. This includes ethical labor, minimized environmental impact, and local community investment, with many mining companies reporting on emissions reductions in 2024.

The evolving landscape of CSR expectations for mining companies encompasses ethical labor practices, environmental stewardship, community investment, and transparent reporting. These factors are crucial for building stakeholder trust and enhancing corporate reputation.

Technological factors

Chifeng Jilong Gold Mining's adoption of automation and robotics is poised to significantly boost operational efficiency, safety, and cost-effectiveness. Automated drilling and hauling systems, for instance, can reduce direct labor expenses and improve precision in extraction processes.

These advanced technologies enable mining operations in previously inaccessible or hazardous areas, thereby expanding resource potential and minimizing human risk. The global mining robotics market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards increased automation.

Investing in such technological advancements is crucial for Chifeng Jilong to maintain its competitive edge in the increasingly automated global mining landscape, ensuring higher productivity and potentially lower per-unit production costs.

Technological progress in geological surveying and geophysical exploration is a game-changer for Chifeng Jilong Gold Mining. These advancements enable the company to pinpoint and assess potential gold deposits with much greater precision. For instance, in 2024, the mining industry saw increased adoption of AI for analyzing vast geological datasets, reportedly improving discovery success rates by up to 15% in some pilot projects.

Furthermore, the integration of remote sensing, sophisticated data analytics, and innovative drilling techniques significantly lowers the risks and expenses associated with exploration. This efficiency boost means Chifeng Jilong can discover more resources effectively. By 2025, it's projected that AI-driven exploration will reduce exploration costs by an average of 10-20%, making resource acquisition more economical.

Innovations in gold processing, like advanced crushing and grinding techniques, are boosting recovery rates. For instance, new milling technologies can improve efficiency by up to 15% compared to older methods. Chifeng Jilong Gold Mining can leverage these advancements to extract more gold from its reserves, directly impacting profitability.

More efficient leaching processes, often involving optimized chemical solutions and shorter contact times, are also key. These methods not only increase the amount of gold recovered but also reduce the environmental footprint by minimizing chemical usage and waste. Companies investing in R&D for these technologies, like those seen in the 2024 advancements in heap leaching, are poised for greater operational efficiency and cost savings.

Data Analytics and Digitalization

Chifeng Jilong Gold Mining can significantly boost its operational efficiency by embracing big data analytics and digitalization. Leveraging IoT sensors and digital platforms provides real-time insights across the entire mining lifecycle, from initial planning to ongoing equipment upkeep. This data-driven approach facilitates predictive maintenance, smarter resource distribution, and more informed strategic choices, ultimately driving higher productivity and minimizing costly operational interruptions.

The mining industry in 2024-2025 is seeing a surge in technology adoption for efficiency gains. For instance, companies are investing heavily in AI-powered geological modeling and autonomous mining equipment. Chifeng Jilong's adoption of these technologies could mirror industry trends where digital transformation initiatives are projected to increase operational output by as much as 15-20% in the coming years.

- Real-time Operational Monitoring: IoT sensors can track equipment performance, environmental conditions, and material flow, offering immediate feedback for swift adjustments.

- Predictive Maintenance: Analyzing sensor data helps anticipate equipment failures, allowing for scheduled maintenance that prevents unexpected breakdowns and downtime.

- Optimized Resource Allocation: Data analytics can identify patterns in resource usage, enabling better planning for explosives, water, and energy, thereby reducing waste and cost.

- Enhanced Safety: Digital platforms can monitor worker location and environmental hazards, contributing to a safer working environment by reducing risks associated with mining operations.

Sustainable Mining Technologies

The mining industry is increasingly adopting sustainable technologies to minimize its environmental impact. Innovations like advanced water recycling systems, which can reduce freshwater consumption by up to 50% in some operations, and energy-efficient equipment, potentially lowering energy costs by 15-20%, are gaining traction. Chifeng Jilong Gold Mining can leverage these advancements to meet evolving environmental regulations and enhance operational efficiency.

Furthermore, sophisticated waste management solutions, including tailings reprocessing and dry stacking methods, are crucial for responsible mining. These technologies not only mitigate environmental risks but can also unlock value from previously discarded materials. By integrating such sustainable practices, Chifeng Jilong can bolster its corporate social responsibility profile and potentially reduce long-term liabilities associated with waste disposal.

The push for sustainability is driven by both regulatory pressures and market demand for environmentally conscious products. For instance, many investment funds are now screening companies based on their Environmental, Social, and Governance (ESG) performance, with sustainable resource management being a key metric. Embracing these technological shifts positions Chifeng Jilong favorably in the eyes of investors and stakeholders.

Key sustainable mining technologies include:

- Water Recycling Systems: Aim to significantly reduce freshwater usage and wastewater discharge.

- Energy-Efficient Equipment: Focuses on lowering power consumption through optimized machinery and processes.

- Advanced Waste Management: Includes tailings reprocessing and dry stacking to minimize environmental footprint and potential resource recovery.

- Real-time Environmental Monitoring: Utilizes sensors and data analytics to track and manage emissions and resource usage effectively.

Technological advancements in automation and AI are revolutionizing gold mining. By 2025, AI in geological exploration is projected to cut costs by 10-20%, improving discovery success. Automation in drilling and hauling can slash labor expenses and enhance precision.

Innovations in processing, like advanced milling, can boost gold recovery by up to 15%. Digitalization and big data analytics offer real-time insights, enabling predictive maintenance and optimized resource allocation, potentially increasing operational output by 15-20%.

Sustainable technologies are also critical, with water recycling systems potentially reducing freshwater use by 50% and energy-efficient equipment lowering costs by 15-20%. These advancements are vital for Chifeng Jilong to maintain competitiveness and meet ESG demands.

Legal factors

Chifeng Jilong Gold Mining navigates a dense web of national and provincial mining legislation in China. These laws dictate everything from initial exploration activities to the actual extraction of minerals and the granting of concession rights. For instance, the Mineral Resources Law of the People's Republic of China sets the overarching framework, with specific implementing regulations often varying by region.

Adhering to these stringent rules, which include securing and retaining vital permits and licenses, is non-negotiable for maintaining operational continuity. Failure to comply can lead to significant penalties or even the suspension of operations. The company's ability to secure new exploration blocks or renew existing concessions hinges on its demonstrated compliance with these evolving legal requirements.

Furthermore, any shifts in mining legislation, whether at the national or local level, can have a profound effect on Chifeng Jilong's operational capabilities and, consequently, its financial performance. For example, stricter environmental regulations introduced in recent years have increased compliance costs across the mining sector, a trend that continued into 2024, impacting capital expenditure plans for many companies, including those in gold mining.

Chifeng Jilong Gold Mining operates under stringent environmental protection laws governing air and water quality, waste management, and land reclamation. These regulations necessitate significant investment in compliance technologies and ongoing environmental impact assessments to mitigate risks of penalties and legal disputes. For instance, China's updated environmental protection laws, continually enforced and refined through 2024 and into 2025, place a heavy onus on mining companies to demonstrate responsible resource extraction and waste handling.

Chifeng Jilong Gold Mining operates within a framework of stringent labor laws. These regulations dictate minimum wages, maximum working hours, and essential safety standards, particularly critical in the mining sector. For instance, in 2024, China's minimum wage varies significantly by region, with major cities often exceeding 2,500 RMB per month, a benchmark Chifeng Jilong must meet or exceed.

Failure to comply with these labor laws can result in severe consequences. Legal disputes, substantial fines, and significant reputational damage are all potential outcomes of non-compliance. In 2023, several companies faced penalties for violating labor protection laws, highlighting the enforcement rigor.

Adhering to fair labor practices and maintaining safe working conditions are paramount for Chifeng Jilong. This not only fosters employee satisfaction and reduces turnover but also serves as a critical risk mitigation strategy against legal entanglements and operational disruptions.

Corporate Governance and Compliance

As a publicly traded entity, Chifeng Jilong Gold Mining operates under rigorous corporate governance mandates. These include adherence to International Financial Reporting Standards (IFRS) for financial reporting, comprehensive disclosure obligations, and strict anti-corruption legislation. For instance, in 2024, the company's financial statements were audited according to these standards, ensuring a baseline of transparency.

Compliance with these legal frameworks is paramount for maintaining transparency and safeguarding shareholder interests, which directly impacts investor confidence. A strong governance record is crucial for attracting and retaining capital in the competitive mining sector.

Failure to comply with these regulations can lead to significant penalties. In 2023, for example, several mining companies faced substantial fines for non-compliance with environmental disclosure laws, underscoring the financial risks involved.

- Financial Reporting: Adherence to IFRS ensures standardized and comparable financial data for investors.

- Disclosure Requirements: Timely and accurate disclosure of material information is legally mandated.

- Anti-Corruption Laws: Compliance with laws like the Foreign Corrupt Practices Act (FCPA) is critical for international operations.

- Shareholder Protection: Corporate governance rules are designed to protect minority shareholder rights.

Taxation and Royalty Regimes

The legal framework governing taxation and royalties for mineral extraction is a critical determinant of Chifeng Jilong Gold Mining's financial health. Fluctuations in government tax policies or adjustments to royalty rates can directly influence the company's profitability and the viability of its investment returns. For instance, in 2024, China's corporate income tax rate for mining companies remained at 25%, but specific regional incentives or environmental surcharges could apply, impacting effective tax burdens.

Strategic financial forecasting and long-term planning for Chifeng Jilong necessitate a thorough understanding of these fiscal obligations. The company must actively monitor legislative changes and potential policy shifts that could alter its tax liabilities or royalty payments. This proactive approach is crucial for maintaining financial stability and ensuring sustainable growth within the mining sector.

- Corporate Income Tax: China's standard corporate income tax rate is 25%, with potential regional variations or incentives impacting Chifeng Jilong's effective rate in 2024.

- Resource Taxes: Royalties and resource taxes on gold extraction vary by province and are typically calculated as a percentage of sales revenue or production volume, directly affecting operational costs.

- Environmental Levies: Emerging environmental taxes or fees related to mining operations could add further cost burdens, requiring careful financial modeling.

- Value-Added Tax (VAT): VAT on sales of gold and mining inputs is a significant component of the tax regime, influencing net revenue and cash flow.

Chifeng Jilong Gold Mining must navigate China's evolving legal landscape, from national mining laws to provincial regulations, impacting exploration, concessions, and operational compliance. Failure to adhere to these rules, including environmental and labor standards, can lead to significant penalties and operational halts, as seen with increased environmental compliance costs in 2024.

The company's financial reporting and corporate governance are strictly regulated, demanding compliance with IFRS and anti-corruption laws to maintain investor confidence, with penalties for non-disclosure highlighted in 2023. Taxation and royalties also present a dynamic legal challenge, with China's 25% corporate income tax rate and varying resource taxes directly influencing profitability, requiring continuous monitoring of policy shifts.

| Legal Area | Key Regulations/Factors | Impact on Chifeng Jilong | 2024/2025 Relevance |

|---|---|---|---|

| Mining Law | Exploration rights, concession permits, extraction rules | Operational continuity, access to resources | Securing new blocks and renewing concessions based on compliance |

| Environmental Law | Air/water quality, waste management, land reclamation | Compliance costs, risk of penalties/disputes | Stricter enforcement of updated laws increasing capital expenditure |

| Labor Law | Minimum wage, working hours, safety standards | Operational costs, employee relations, legal risk | Regional minimum wages (e.g., >2,500 RMB/month in major cities) impacting payroll |

| Corporate Governance | IFRS, disclosure, anti-corruption | Investor confidence, access to capital | Mandatory adherence to financial reporting standards |

| Taxation & Royalties | Corporate income tax, resource taxes, VAT | Profitability, financial planning | 25% corporate tax rate, variable resource taxes affecting effective burden |

Environmental factors

Chifeng Jilong Gold Mining's operations, especially gold processing, are inherently water-intensive. This places significant emphasis on how the company manages its water resources.

The company faces considerable environmental scrutiny concerning its water sourcing practices, overall consumption levels, and the quality of its discharged water. Meeting these expectations is crucial for maintaining its social license to operate and avoiding penalties.

To ensure sustainability and regulatory adherence, Chifeng Jilong must prioritize implementing advanced water recycling technologies. Minimizing pollution and strictly adhering to evolving water quality standards are paramount for its long-term success and environmental stewardship.

Chifeng Jilong Gold Mining faces substantial environmental hurdles concerning the generation and disposal of mining waste, particularly tailings and waste rock. These materials require careful handling to prevent ecological damage.

The integrity of tailings dams is paramount. In 2023, global mining saw increased scrutiny on tailings dam safety following incidents, leading to stricter regulatory frameworks. Chifeng Jilong must ensure robust management to avert spills or leaks, which could contaminate water sources and soil.

Adopting responsible waste disposal and reclamation strategies is critical for Chifeng Jilong to mitigate environmental risks effectively and maintain regulatory compliance. This includes investing in advanced waste treatment technologies and land rehabilitation efforts post-mining operations.

Chifeng Jilong Gold Mining's operations, like any large-scale extraction, carry the inherent risk of impacting local biodiversity and habitats. The company is increasingly expected to demonstrate robust environmental stewardship, particularly in ecologically sensitive regions where its mining concessions are located.

To address this, Chifeng Jilong must undertake thorough environmental impact assessments and implement comprehensive mitigation strategies. This includes developing detailed biodiversity management plans, focusing on the protection of flora and fauna, and actively engaging in land rehabilitation efforts post-mining. For instance, in 2023, the company reported investing in reforestation projects in areas adjacent to its operational sites, aiming to offset habitat disruption.

Furthermore, proactive engagement in conservation initiatives can bolster the company's social license to operate and minimize its ecological footprint. This could involve partnerships with local environmental organizations or contributing to the preservation of critical habitats, thereby demonstrating a commitment beyond regulatory compliance.

Energy Consumption and Carbon Footprint

Mining is inherently energy-intensive, directly impacting greenhouse gas emissions. Chifeng Jilong Gold Mining's environmental standing is increasingly tied to its success in curbing energy use and adopting cleaner power sources. For instance, the global mining sector's energy consumption accounted for a significant portion of industrial energy use in recent years, with a substantial part of this energy still derived from fossil fuels.

To address this, the company's strategic focus on reducing its carbon footprint involves investments in energy-efficient technologies and the exploration of renewable energy alternatives. Such initiatives are crucial for meeting evolving sustainability targets and demonstrating responsible operational practices.

- Energy-Intensive Operations: The mining industry, including gold extraction, requires substantial energy for drilling, crushing, and processing.

- Greenhouse Gas Emissions: This high energy demand, often met by fossil fuels, leads to significant carbon emissions.

- Sustainability Goals: Companies like Chifeng Jilong are under pressure to reduce their environmental impact by lowering energy consumption.

- Transition to Cleaner Energy: Investing in energy-efficient equipment and exploring renewable sources like solar or wind power are key strategies to achieve these goals.

Climate Change Adaptation and Resilience

Climate change presents significant physical risks to Chifeng Jilong Gold Mining's operations. Extreme weather events, like intensified rainfall or prolonged droughts, can disrupt mining activities, damage infrastructure, and impact water availability crucial for processing. For instance, increased flooding risks in mining regions could necessitate costly operational shutdowns and repairs, as seen in various global mining incidents in 2024.

The company must proactively assess and adapt to these evolving environmental conditions to maintain operational resilience. This involves integrating climate risk assessments into long-term mine planning and infrastructure development. By understanding potential impacts, Chifeng Jilong can implement mitigation measures, such as reinforcing structures against severe weather or developing water management strategies to cope with scarcity.

Adaptation strategies are becoming increasingly vital for the mining sector's sustainability.

- Increased frequency of extreme weather events: Global average temperatures have continued to rise, with 2024 projected to be one of the warmest years on record, leading to more unpredictable weather patterns impacting mining sites.

- Water scarcity and management: Changes in precipitation patterns can affect water sources essential for mining operations, requiring robust water conservation and recycling programs.

- Infrastructure resilience: Investments in climate-resilient infrastructure are necessary to withstand physical impacts, ensuring continuity of operations and supply chains.

Chifeng Jilong Gold Mining's operations are heavily reliant on water, making water management a critical environmental factor. The company must adhere to stringent regulations regarding water sourcing, consumption, and discharge quality to maintain its operational license and avoid penalties.

Waste management, particularly tailings and waste rock, poses another significant environmental challenge. Ensuring the safety of tailings dams is paramount, especially given increased global scrutiny following incidents in 2023, which led to stricter regulations.

The company must also address its impact on biodiversity and habitats, implementing thorough environmental assessments and mitigation strategies, including reforestation projects as observed in 2023.

Furthermore, the energy-intensive nature of gold mining necessitates a focus on reducing greenhouse gas emissions through energy efficiency and the adoption of cleaner power sources.

Climate change introduces physical risks such as extreme weather events, impacting operations and infrastructure, requiring proactive adaptation and resilience planning.

| Environmental Factor | Impact on Chifeng Jilong | Mitigation/Strategy | Relevant Data/Context |

|---|---|---|---|

| Water Management | High water usage for processing; potential contamination risks. | Implement advanced water recycling; strict adherence to water quality standards. | Global mining sector faces increasing water stress; regulations tightening. |

| Waste Management | Generation of tailings and waste rock; tailings dam safety concerns. | Robust management of waste disposal; investing in advanced waste treatment. | 2023 saw increased global scrutiny on tailings dam safety following incidents. |

| Biodiversity & Habitat | Potential disruption to local ecosystems. | Conduct environmental impact assessments; implement biodiversity management plans; reforestation projects. | Company reported investing in reforestation projects in 2023 near operational sites. |

| Energy Consumption & Emissions | Energy-intensive operations leading to greenhouse gas emissions. | Invest in energy-efficient technologies; explore renewable energy alternatives. | Mining accounts for a significant portion of industrial energy use, often fossil-fuel dependent. |

| Climate Change Risks | Physical risks from extreme weather events (floods, droughts). | Integrate climate risk assessments into mine planning; develop resilient infrastructure. | 2024 projected to be one of the warmest years, increasing frequency of extreme weather. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Chifeng Jilong Gold Mining is built on comprehensive data from official government publications, international financial institutions, and reputable mining industry associations. We incorporate economic indicators, environmental regulations, technological advancements, and geopolitical analyses to provide a robust understanding of the external landscape.