Century Communities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Century Communities Bundle

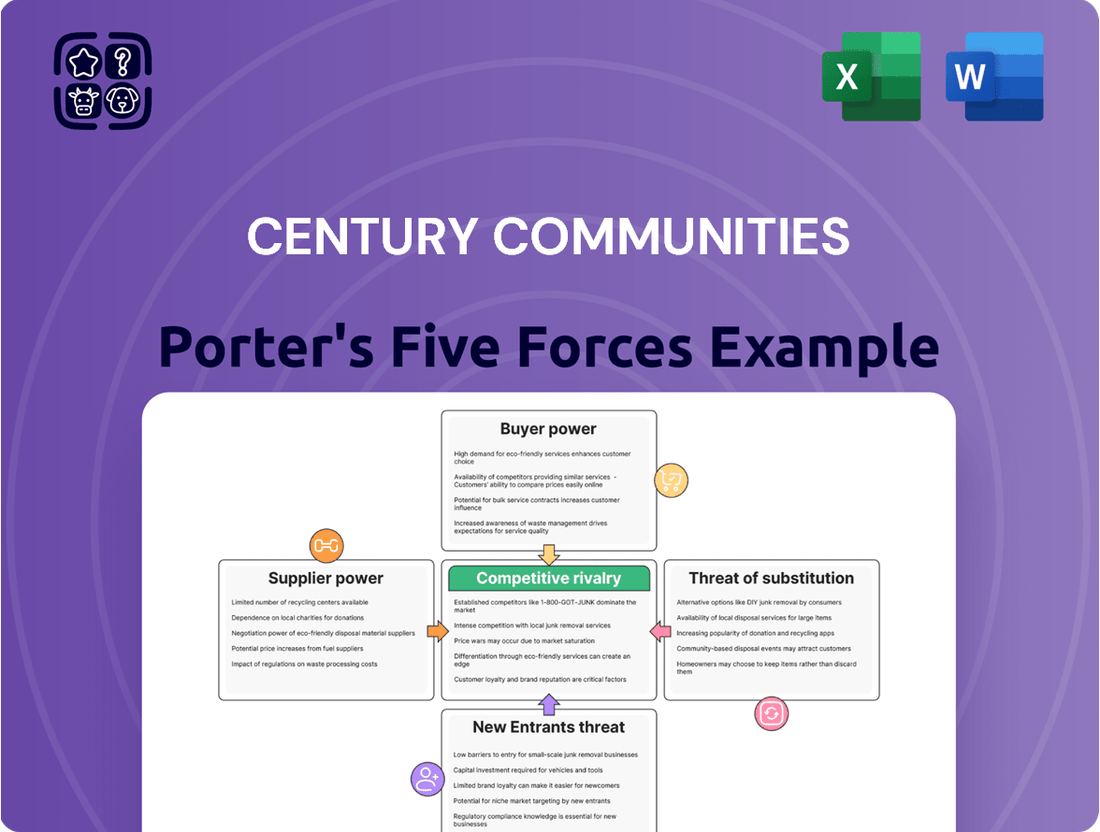

Century Communities operates in a dynamic housing market, facing intense competition and evolving buyer preferences. Understanding the forces of rivalry, new entrants, buyer power, supplier power, and substitutes is crucial for their strategic positioning.

The complete report reveals the real forces shaping Century Communities’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The homebuilding industry, including companies like Century Communities, grapples with persistent skilled labor shortages. This directly impacts construction timelines and inflates carrying costs for builders.

The economic fallout from these delays is substantial, with estimates pointing to an annual impact of $10.806 billion. In 2024 alone, this shortage prevented the construction of approximately 19,000 single-family homes.

While some relief might be felt, the need for more workers remains acute. Projections indicate a demand for around 439,000 additional workers in the construction sector by 2025, underscoring the ongoing bargaining power of labor.

Building material prices are anticipated to climb by 5-7% in 2025. This rise is fueled by persistent inflation, evolving global trade policies, and ongoing supply chain vulnerabilities.

While lumber prices have moderated from their 2020 peaks, other critical components like drywall, siding, and asphalt shingles have experienced substantial cost increases. For instance, the Producer Price Index for asphalt and roofing materials saw a notable year-over-year increase in early 2024.

Furthermore, tariffs imposed on imported building goods directly inflate costs for U.S. homebuilders like Century Communities, thereby strengthening the bargaining power of domestic suppliers who can capitalize on these trade dynamics.

The scarcity and escalating price of prime land present a significant challenge for homebuilders like Century Communities. Despite efforts to expand its lot inventory, the cost of ready-to-build land can still be subject to inflationary pressures.

Securing desirable land parcels is paramount, and delays in obtaining necessary municipal and utility approvals can further exacerbate costs and extend development timelines. For instance, in 2024, the median price for a single-family home lot in many desirable U.S. markets saw continued increases, reflecting this tight supply dynamic.

Concentration of Key Suppliers

In specialized construction niches, a limited number of suppliers for critical materials or components can grant those suppliers significant leverage. This often translates into less favorable pricing and contract terms for builders like Century Communities.

However, Century Communities' substantial national footprint has been instrumental in amplifying its purchasing power and achieving greater operational efficiencies, thereby mitigating some of this supplier influence.

- Concentration: In specific segments of the construction industry, the availability of specialized materials or components may be restricted to a few key providers.

- Supplier Leverage: This concentration allows these suppliers to exert greater bargaining power, potentially leading to higher costs for homebuilders.

- Century Communities' Mitigation: The company's large-scale operations enhance its purchasing volume, providing a counter-balance to supplier concentration and improving cost-effectiveness.

Switching Costs for Materials and Labor

Switching costs for building materials and labor significantly impact Century Communities' bargaining power with suppliers. Finding and vetting new material suppliers or subcontractors involves considerable time and resources, often leading to project delays and increased upfront expenses. For instance, in 2024, the average lead time for certain specialized construction materials saw an increase of 15-20% compared to previous years, making immediate supplier changes more challenging.

These complexities create a strong incentive for homebuilders like Century Communities to maintain long-term relationships with established suppliers, even if prices rise. The effort required to onboard new partners, ensure consistent quality, and manage new logistical chains can outweigh the potential cost savings. This inherent friction in switching suppliers grants existing vendors greater leverage in price negotiations.

- High Onboarding Costs: Establishing new supplier relationships can involve extensive due diligence, contract negotiation, and initial order adjustments, potentially adding 5-10% to the cost of materials from a new vendor.

- Quality Assurance Challenges: Ensuring the quality and reliability of new materials or labor is paramount in construction; a single substandard delivery or performance issue can lead to costly rework and reputational damage.

- Logistical Integration: Integrating new suppliers into existing supply chain and delivery schedules requires careful planning and coordination, with potential for disruptions if not managed effectively.

- Supplier Dependence: In specialized markets, like custom millwork or specific engineered lumber, the number of qualified suppliers may be limited, further concentrating bargaining power with those few providers.

The bargaining power of suppliers for Century Communities is influenced by the concentration of material providers and the high costs associated with switching vendors. In 2024, the Producer Price Index for asphalt and roofing materials showed a notable year-over-year increase, reflecting supplier leverage. The construction sector faces a projected demand for 439,000 additional workers by 2025, further empowering labor suppliers.

What is included in the product

This analysis dissects the competitive forces impacting Century Communities, evaluating the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly assess competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing Century Communities to pinpoint and mitigate threats proactively.

Customers Bargaining Power

Prospective homebuyers, particularly those entering the market for the first time or looking to upgrade, are acutely aware of pricing. This heightened sensitivity stems from the current economic climate, characterized by elevated mortgage rates and general affordability challenges within the housing sector.

These market conditions compel homebuilders such as Century Communities to actively provide incentives to draw in potential buyers. For instance, Century Communities reported an average sales price of $377,500 for homes delivered in the second quarter of 2025, reflecting the need to remain competitive amidst buyer price consciousness.

The bargaining power of customers is amplified by increased builder incentives, a trend notably seen with Century Communities. In the second quarter of 2025, the company significantly boosted incentives on closed homes, reaching approximately 1,500 basis points, a substantial jump from the roughly 900 basis points offered in the first quarter of 2025. This aggressive incentive strategy directly impacts gross margins.

Across the broader housing market, builders are actively employing substantial incentives, with some offering as much as $60,000 per home, to drive sales and clear inventory. This competitive landscape further empowers buyers, as they can leverage these offerings to negotiate more favorable terms, thereby increasing their bargaining power.

While new homes are currently favored by many, the availability of resale homes, even if limited in certain regions, presents a viable alternative for buyers. This availability, coupled with the option for buyers to postpone their purchase or explore different housing arrangements, strengthens their negotiating position.

However, the strong competition within the housing market can still prompt some buyers to choose new construction. For instance, in early 2024, the U.S. median home price for existing homes hovered around $389,400, while new homes averaged closer to $420,700, showcasing a price difference that can influence buyer decisions, especially when resale inventory is low.

Access to Information and Digital Tools

Customers today wield significant power due to unprecedented access to information. Online platforms and digital tools provide detailed insights into home prices, builder reputations, and community features, enabling thorough comparisons. This transparency directly translates into more informed negotiation tactics for potential buyers.

Century Communities, recognized for its digital presence and online home sales capabilities, must actively engage with this empowered consumer base. The ability to easily compare Century's offerings against competitors, including pricing and available amenities, strengthens the customer's bargaining position.

For instance, in 2024, the housing market continued to see buyers leveraging online resources like Zillow and Redfin to research comparable sales and builder reviews. This trend means Century Communities faces customers who arrive at the sales table armed with data, expecting competitive pricing and clear value propositions.

- Informed Negotiations: Buyers can easily access data on comparable home sales and builder reviews, strengthening their ability to negotiate pricing and terms.

- Digital Transparency: Online platforms provide visibility into pricing, features, and builder reputations, reducing information asymmetry.

- Competitive Landscape: Century Communities operates in an environment where customers can readily compare its offerings with those of other builders.

Impact of Mortgage Interest Rates

Fluctuations in mortgage interest rates significantly impact buyer affordability, directly affecting their purchasing power. When rates rise, fewer buyers can qualify for mortgages, or they can afford less home, which can pressure builders like Century Communities to negotiate or offer incentives.

For instance, if mortgage rates climb, the demand for new homes can soften, giving potential buyers more leverage to seek price reductions or added features. Conversely, lower rates can boost demand and reduce buyer bargaining power.

- Mortgage Rate Impact: Higher mortgage rates reduce buyer affordability and purchasing power, potentially leading to increased customer bargaining.

- 2025 Outlook: Projections suggest mortgage rates could decline into the mid-5% range by 2025, which is expected to improve affordability for homebuyers.

- Builder Response: When rates are high and demand is low, builders may offer concessions to attract buyers, increasing customer leverage.

Customers today possess considerable bargaining power, largely due to increased access to information and the competitive nature of the housing market. This allows them to compare offerings, negotiate prices, and leverage builder incentives effectively.

For example, Century Communities' significant increase in incentives in Q2 2025, reaching approximately 1,500 basis points on closed homes, directly reflects this customer leverage. Buyers can also find alternatives in the resale market or delay purchases, further strengthening their negotiating position.

The availability of data through online platforms empowers buyers to conduct thorough research, making informed decisions and demanding competitive pricing. This transparency means builders must present clear value propositions to attract and retain customers.

| Builder Incentive Trend (Century Communities) | Q1 2025 | Q2 2025 |

|---|---|---|

| Average Basis Points | ~900 | ~1500 |

Preview the Actual Deliverable

Century Communities Porter's Five Forces Analysis

This preview showcases the complete Century Communities Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the homebuilding industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring transparency and immediate usability for your strategic planning. You can confidently expect this comprehensive report, ready for download and application, to guide your understanding of Century Communities' market position.

Rivalry Among Competitors

The homebuilding sector is crowded, with many national, regional, and local companies all competing for customers. This intense rivalry means that companies like Century Communities must constantly adapt and strategize to stand out.

Century Communities, as a significant player in the U.S. housing market, directly contends with well-established builders such as KB Home and Lennar. For instance, in the first quarter of 2024, KB Home reported a 17% decrease in net orders compared to the previous year, highlighting the challenging market dynamics all builders face.

Century Communities boasts a significant competitive advantage through its extensive geographic footprint, operating in 17 states and over 45 distinct markets. This wide reach allows the company to diversify its revenue streams and buffer against localized economic downturns. The company's commitment to expansion is evident in its record community count of 327 as of Q2 2025, signaling aggressive growth and market penetration.

The homebuilding sector, including Century Communities, is deeply intertwined with the economy. Fluctuations in interest rates, inflation, and consumer sentiment directly affect demand and affordability. For instance, Century Communities adjusted its FY2025 delivery outlook, acknowledging these market headwinds, which underscores the industry's sensitivity to macroeconomic shifts.

Product Differentiation and Innovation

Competitive rivalry in the homebuilding sector is intense, with companies like Century Communities actively differentiating their offerings. They focus on distinct home designs, appealing community amenities, and bundled services to stand out. For instance, Century Communities caters to a broad range of buyers by offering diverse home styles and community developments.

A significant aspect of this rivalry is innovation, particularly in how homes are purchased and experienced. Century Communities has been a pioneer in making home buying more accessible and streamlined, notably through their online platforms.

Furthermore, integrated services such as mortgage and insurance offerings provide additional layers of differentiation. This approach not only adds value for the customer but also strengthens Century Communities' competitive position by capturing more of the home buying transaction. Their strategic focus on affordable housing segments also carves out a distinct market niche.

- Product Differentiation: Century Communities offers a wide array of home designs and community types to appeal to various buyer preferences.

- Integrated Services: The company provides in-house mortgage and insurance services, creating a one-stop shop for buyers.

- Affordable Housing Focus: A key strategy involves targeting the affordable housing market, a segment with consistent demand.

- Online Innovation: Century Communities has invested in pioneering online home buying experiences, simplifying the purchasing process.

Aggressive Pricing and Incentives

The homebuilding industry is intensely competitive, often forcing companies like Century Communities to engage in aggressive pricing and offer substantial incentives to capture market share and close sales. These concessions, such as price reductions or included upgrades, directly impact profitability.

Century Communities itself has highlighted that the level of incentives offered is the primary factor influencing fluctuations in its gross margins. For instance, in the first quarter of 2024, the company reported a homebuilding gross margin of 19.7%, a figure that can be significantly influenced by the need to provide buyer incentives in a competitive environment.

- Aggressive Pricing: Competitors frequently lower prices to attract buyers, especially in slower market conditions.

- Incentive Impact: Incentives, like closing cost assistance or included upgrades, are major drivers of gross margin changes for builders.

- Margin Erosion: The pressure to offer these concessions can lead to reduced profitability across the entire sector.

- 2024 Data: In Q1 2024, Century Communities' homebuilding gross margin stood at 19.7%, illustrating the delicate balance between sales volume and profitability.

The homebuilding industry is characterized by fierce competition, forcing companies like Century Communities to employ various strategies to gain an edge. This rivalry often translates into aggressive pricing and the offering of buyer incentives, which directly impact profit margins.

For example, Century Communities' homebuilding gross margin was 19.7% in the first quarter of 2024, a figure heavily influenced by the need to provide concessions in a crowded market. Competitors frequently adjust pricing and offer incentives such as included upgrades or closing cost assistance to attract buyers, particularly when market conditions slow down.

Century Communities differentiates itself through product diversity, offering a wide range of home designs and community types to appeal to different buyer segments. They also provide integrated services, including in-house mortgage and insurance, creating a more convenient customer experience and capturing additional revenue streams.

Furthermore, the company's focus on the affordable housing segment carves out a distinct niche with consistent demand, and their investment in online platforms aims to simplify the home buying process. This multi-faceted approach is crucial for navigating the intense competitive landscape.

| Metric | Q1 2024 | Significance |

|---|---|---|

| Homebuilding Gross Margin | 19.7% | Indicates the impact of pricing and incentives on profitability. |

| Geographic Footprint | 17 states, 45+ markets | Diversifies revenue and reduces reliance on single markets. |

| Community Count (Q2 2025 est.) | 327 | Demonstrates aggressive growth and market penetration efforts. |

SSubstitutes Threaten

The most direct substitute for a new Century Communities home is an existing resale home. While buyers often show a preference for the features and customization options of new construction, the resale market's dynamics can significantly sway decisions. For instance, in early 2024, while resale inventory saw an uptick, it remained historically low, potentially making new homes more attractive by comparison.

For consumers seeking custom builds or specific design elements, traditional construction methods, distinct from large-scale builders like Century Communities, can act as a viable substitute. Many buyers are comfortable with established building techniques, and these options may be attractive to those prioritizing upfront affordability over the potentially longer-term operational savings associated with more sustainable, modern construction.

For individuals or families seeking housing solutions without the commitment of homeownership, the rental market presents a powerful substitute. This is particularly true for younger demographics or those prioritizing flexibility. In 2024, the demand for rental units remained robust, with multifamily housing starts showing continued strength, indicating a persistent alternative to buying.

The appeal of renting lies in its avoidance of large upfront investments like down payments and closing costs, as well as the reduced responsibility for maintenance and repairs. This flexibility can divert a significant portion of potential homebuyers away from the purchase market, especially when interest rates are elevated or economic uncertainty prevails.

Alternative Housing Solutions

Emerging housing solutions like prefabricated, modular, and tiny homes represent a growing, though still relatively small, threat of substitutes for traditional homebuilders such as Century Communities. These alternatives often attract buyers prioritizing lower costs or faster construction timelines. For instance, the prefabricated home market saw significant growth, with some projections indicating a compound annual growth rate of over 6% leading up to 2024, driven by affordability and efficiency.

The cost savings inherent in these alternative methods, stemming from reduced labor and material waste, make them appealing. Buyers might find that a modular home, for example, can be up to 20% less expensive than a site-built equivalent, depending on customization and location. This cost advantage is a key factor for a segment of the housing market.

These niche solutions cater to specific buyer needs, offering unique living arrangements and potentially faster occupancy. The appeal lies not just in price but also in the innovative design and reduced environmental impact that some of these newer housing models offer, challenging traditional construction paradigms.

- Prefabricated homes offer cost savings through factory production.

- Modular homes can be up to 20% cheaper than site-built homes.

- Tiny houses appeal to a segment seeking affordability and minimalist living.

- The market for off-site construction is expanding, driven by demand for efficiency and cost reduction.

Do-It-Yourself (DIY) Homebuilding

For a niche segment of the housing market, particularly those with construction expertise or a keen desire for unique design and budget control, the do-it-yourself (DIY) homebuilding approach presents a viable substitute to engaging professional builders like Century Communities. This trend is amplified by the growing DIY culture and the increased availability of online resources and pre-fabricated components, enabling more individuals to consider self-construction.

DIY homebuilding can offer significant cost savings, primarily by eliminating labor expenses, which can represent a substantial portion of a new home's total cost. For instance, in 2024, labor costs in residential construction could range from 20% to 40% of the total project budget, depending on the complexity and location.

- DIY homebuilding offers potential cost savings by bypassing professional labor.

- The growth of DIY culture and online resources facilitates self-construction.

- This substitute is most attractive to individuals with construction skills or a strong customization need.

- Labor costs in 2024 could account for 20-40% of a new home's total construction expenses.

The threat of substitutes for Century Communities is moderate, primarily stemming from the resale housing market and the rental sector. While new construction offers customization, the resale market provides immediate availability and potentially lower price points, especially when inventory rises. In early 2024, despite low historical inventory, a slight uptick made resales a more competitive alternative.

The rental market remains a significant substitute, particularly for younger demographics or those prioritizing flexibility over ownership. Robust demand for rental units in 2024, evidenced by strong multifamily housing starts, highlights this persistent alternative, especially when factors like high interest rates or economic uncertainty make purchasing less appealing.

| Substitute Type | Key Appeal | Market Trend (2024 Focus) | Impact on New Homes |

| Resale Homes | Availability, potential lower price | Historically low inventory, slight uptick | Competes on price and speed |

| Rental Market | Flexibility, lower upfront cost | Strong demand, robust multifamily starts | Diverts potential buyers |

| Prefab/Modular Homes | Affordability, faster build times | Growing market, >6% CAGR projections | Niche competition on cost efficiency |

| DIY Building | Cost savings (labor), customization | Growing DIY culture, online resources | Appeals to skilled buyers |

Entrants Threaten

Entering the homebuilding sector, where Century Communities operates, demands a significant upfront capital infusion. This includes costs for acquiring land, preparing it for construction, building homes, and marketing them to buyers. For instance, in 2023, the median cost of a new single-family home in the U.S. was $415,800, illustrating the substantial financial commitment involved in producing even a single unit, let alone an entire development.

Established players like Century Communities can leverage their substantial financial liquidity and achieve economies of scale, which makes it difficult for smaller, less capitalized newcomers to compete effectively. This high capital requirement acts as a formidable barrier, deterring many potential entrants from even attempting to enter the market.

Securing desirable land parcels and navigating complex zoning, permitting, and entitlement processes acts as a substantial barrier for new entrants in the homebuilding industry. These hurdles require significant time, capital, and local knowledge that emerging companies often lack.

Established builders, such as Century Communities, benefit from pre-existing relationships with local authorities and a proven track record in land acquisition and development. This deep-rooted expertise and established network are difficult for new players to quickly replicate, giving incumbents a distinct advantage in accessing prime development opportunities.

New entrants into the homebuilding sector, like Century Communities, grapple with securing a skilled workforce. The construction industry, particularly in 2024, continues to experience significant labor shortages. This scarcity drives up labor costs and can delay project timelines, posing a substantial barrier for newcomers trying to establish a foothold.

Accessing reliable supply chains for building materials presents another hurdle. Established builders often benefit from long-standing relationships with suppliers, granting them better pricing and priority access to essential components. For instance, lumber prices, while fluctuating, remain a key cost driver, and new entrants may not command the same bulk purchasing power as incumbents.

Brand Recognition and Customer Trust

Existing homebuilders, including Century Communities, possess a significant advantage through their established brand recognition and deep-rooted customer trust. This trust is built over years of delivering quality homes and reliable customer service, a reputation that is difficult and costly for newcomers to replicate. For instance, in 2024, major homebuilders continued to leverage their brand equity to attract buyers, often commanding premium pricing in competitive markets.

The considerable time and financial investment required to cultivate brand loyalty and a proven track record present a substantial barrier to entry for new competitors. Potential buyers often gravitate towards builders with a history of positive reviews and a strong market presence, making it challenging for nascent companies to gain immediate traction and market share. This was evident in 2024 as the housing market saw consolidation, with established players often acquiring smaller, less capitalized firms.

New entrants must overcome the hurdle of demonstrating reliability and quality to an audience accustomed to established brands. This often necessitates extensive marketing campaigns and potentially lower initial pricing to attract early adopters. In 2024, the cost of building materials and labor remained a significant factor, further increasing the capital requirements for new entrants aiming to compete on quality and price.

- Brand equity is a significant deterrent for new homebuilders.

- Customer loyalty to established brands reduces the appeal of new entrants.

- Marketing and advertising costs to build brand recognition are substantial.

- Demonstrating a track record of quality and service takes time and investment.

Regulatory and Environmental Hurdles

The homebuilding sector faces significant regulatory and environmental hurdles that act as a barrier to new entrants. Compliance with evolving building codes, stringent environmental regulations, and diverse local ordinances requires substantial investment and expertise. For instance, in 2024, the average cost to obtain building permits and navigate zoning approvals can add a considerable percentage to a project's overall budget, making it challenging for smaller, less capitalized companies to enter the market.

Newcomers must dedicate resources to understanding and adhering to these complex rules, which directly impacts project timelines and increases upfront costs. This complexity can deter potential competitors who lack the established infrastructure and experience to manage these requirements efficiently.

These regulatory demands mean that new entrants to the homebuilding market, like Century Communities, must be prepared for significant capital outlay not just for land and construction, but also for legal, compliance, and permitting processes.

- Regulatory Compliance Costs: New entrants must factor in substantial costs for permits, inspections, and adherence to zoning laws.

- Environmental Standards: Meeting evolving environmental regulations, such as those related to energy efficiency and sustainable materials, adds complexity and expense.

- Local Ordinances: Navigating a patchwork of local building codes and land-use regulations requires specialized knowledge and can lead to project delays.

- Capital Investment: The need for significant upfront investment in understanding and complying with these frameworks deters many potential new competitors.

The threat of new entrants in the homebuilding industry, where Century Communities operates, is generally considered low due to several significant barriers. The substantial capital required for land acquisition, construction, and marketing, often running into hundreds of thousands of dollars per unit, acts as a primary deterrent. For instance, the median cost of a new single-family home in the U.S. was around $415,800 in 2023, highlighting the immense financial commitment.

Established players like Century Communities benefit from economies of scale and strong financial liquidity, making it difficult for less capitalized newcomers to compete. Furthermore, securing prime land parcels and navigating complex, time-consuming zoning and permitting processes demand local expertise and significant upfront investment, which emerging companies often lack. Established builders also possess an advantage through their brand recognition and customer loyalty, built over years of delivering quality, a factor that is costly and time-consuming for new entrants to replicate. In 2024, the ongoing labor shortages and fluctuating material costs further amplified these entry barriers.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for land, construction, and marketing. (e.g., $415,800 median home cost in 2023) | Significant financial hurdle, limiting the number of potential entrants. |

| Economies of Scale & Liquidity | Established builders have cost advantages and access to capital. | Newcomers struggle to match pricing and production efficiency. |

| Land Acquisition & Entitlements | Difficulty in securing desirable land and navigating complex regulations. | Requires significant time, capital, and local expertise, which new firms may lack. |

| Brand Recognition & Customer Loyalty | Established trust and reputation are hard to build quickly. | New entrants face challenges in attracting buyers without a proven track record. |

| Skilled Labor & Supply Chains | Shortages in skilled labor and established supplier relationships create advantages for incumbents. | New entrants face higher labor costs and potential material access issues. |

Porter's Five Forces Analysis Data Sources

Our Century Communities Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, investor presentations, and industry-specific market research reports from leading firms. We also incorporate insights from regulatory filings and macroeconomic data to provide a comprehensive view of the competitive landscape.