Century Communities Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Century Communities Bundle

Century Communities' BCG Matrix offers a critical lens into their product portfolio's performance and potential. Understand which segments are driving growth and which require strategic re-evaluation. Purchase the full report for a comprehensive breakdown and actionable insights to optimize your investment strategy.

Stars

The Century Complete brand from Century Communities is a prime example of a company's strategic focus on the Stars quadrant of the BCG matrix. This segment targets first-time homebuyers with affordable, move-in-ready homes, a market with substantial growth potential. In 2024, the demand for entry-level housing remained robust, driven by demographic shifts and a persistent need for accessible homeownership.

Century Complete's approach streamlines construction and simplifies mortgage rate locking, directly addressing affordability concerns. This strategy is crucial in the current economic climate, where interest rate sensitivity significantly impacts buyer decisions. The company's commitment to this segment is designed to capture a larger share of a growing buyer demographic.

Century Communities' strategic land-light operating model is a key differentiator, allowing them to navigate housing market fluctuations effectively. By controlling a substantial pipeline of lots without significant upfront capital, the company minimizes its exposure to industry downturns and enhances its flexibility.

This approach is crucial for sustained growth, as it ensures a ready supply of land for future development. For instance, as of the first quarter of 2024, Century Communities reported controlling approximately 47,000 lots, a testament to their land-light strategy. This controlled land inventory provides a buffer against rising land costs and supply chain disruptions.

Century Communities' geographic expansion strategy targets high-growth markets, evidenced by its presence in over 45 markets across 17 states. This includes significant inroads into areas like the greater San Antonio area and North Las Vegas, both experiencing robust population and economic growth. Such diversification across diverse regions helps buffer against localized downturns and captures opportunities in areas with strong demographic tailwinds, aiming to bolster market share in these expanding territories.

Strong Community Count Growth

Century Communities has demonstrated robust expansion in its community count, a key indicator of future growth potential. This strategic development is crucial for its position within the BCG matrix.

- Record Community Expansion: In the second quarter of 2025, Century Communities reached an all-time high of 327 active communities.

- Significant Year-Over-Year Growth: This figure represents a substantial 23% increase compared to the same period in the previous year.

- Foundation for Future Deliveries: The growing number of communities provides a solid platform for increasing home deliveries and driving revenue growth in the coming periods.

- Enhanced Market Penetration: Continued expansion in community count strengthens Century Communities' capacity to capture higher sales volumes and deepen its market penetration.

Integrated Mortgage and Insurance Services (Inspire Home Loans)

Integrated mortgage and insurance services, like those offered by Inspire Home Loans, provide Century Communities a significant edge. This synergy simplifies the home buying journey for customers, often translating into more accessible financing. In 2024, this type of integrated approach has been crucial for builders looking to capture market share in a dynamic housing environment.

- Streamlined Process: Offers a one-stop shop for buyers, reducing complexity.

- Competitive Financing: Subsidiaries can provide advantageous loan terms.

- Enhanced Customer Experience: Simplifies transactions and builds loyalty.

- Additional Revenue: Generates income beyond home sales.

Century Complete, targeting first-time homebuyers, represents Century Communities' Star in the BCG matrix, a segment with strong growth potential. The demand for affordable housing remained high in 2024, fueled by demographics and the ongoing desire for homeownership. This strategic focus aims to capture a significant portion of this expanding buyer base.

The company's land-light strategy, controlling approximately 47,000 lots in Q1 2024, provides crucial flexibility and mitigates risk. This approach is vital for sustained growth, ensuring a ready supply of land for future development and protecting against rising land costs.

Century Communities' expansion into 45 markets across 17 states, including high-growth areas like San Antonio and North Las Vegas, bolsters market penetration and captures opportunities in demographically favorable regions. This geographic diversification is key to its growth trajectory.

The company's commitment to expanding its active communities, reaching a record 327 in Q2 2025, a 23% increase year-over-year, lays a strong foundation for future home deliveries and revenue growth. This expansion deepens market penetration and enhances sales volume potential.

| Metric | 2024 (Approximate) | 2025 (Q2) | Year-over-Year Growth |

|---|---|---|---|

| Active Communities | N/A | 327 | 23% |

| Controlled Lots | ~47,000 (Q1 2024) | N/A | N/A |

| Markets Served | 45+ | N/A | N/A |

What is included in the product

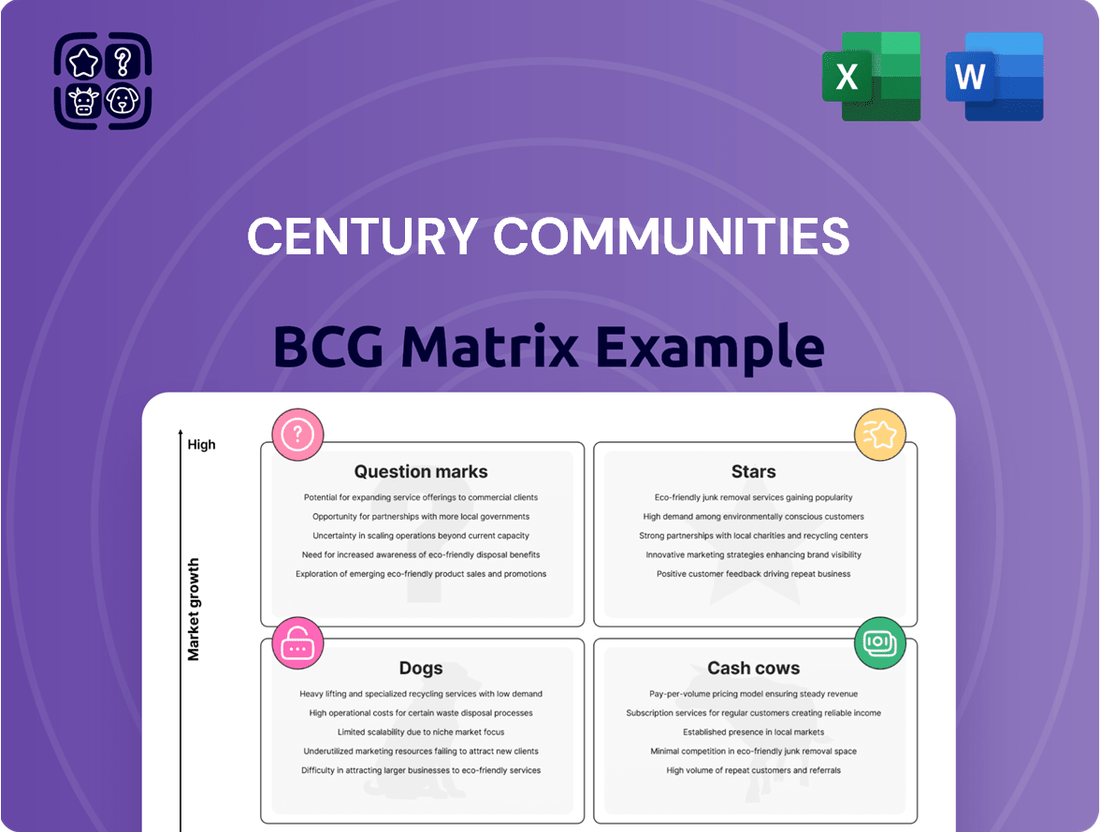

This BCG Matrix analysis highlights Century Communities' business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear BCG Matrix visualizes Century Communities' portfolio, relieving the pain of strategic uncertainty by highlighting growth opportunities and areas needing attention.

Cash Cows

Century Communities' established homebuilding operations function as a classic Cash Cow within its business portfolio. The company's significant market share and consistent delivery volumes, evidenced by a record 11,007 homes delivered in 2024, underscore its maturity and stability.

This mature business segment generates substantial cash flow, with total revenues reaching $4.4 billion in 2024. The scale and operational efficiency of these established operations allow Century Communities to reliably produce strong earnings, funding other strategic initiatives.

Century Communities showcases remarkable financial resilience, boasting 22 consecutive years of profitability. This sustained success is underscored by a net income of $333.8 million reported in 2024, highlighting its status as a cash cow.

The company's robust financial health is further evidenced by its strong balance sheet. As of Q2 2025, Century Communities held $2.6 billion in stockholders' equity and maintained $858 million in liquidity.

This significant financial cushion empowers Century Communities to navigate market volatility and allocate resources effectively towards its core business activities, reinforcing its position as a stable performer.

Century Communities' commitment to returning value to shareholders through share repurchases and dividends highlights its position as a Cash Cow. The company's decision to increase its quarterly cash dividend to $0.29 per share in 2025, following consistent growth, signals a business generating substantial free cash flow that exceeds its reinvestment opportunities.

Cost Control and Operational Efficiency

Century Communities' success in managing costs is a key driver for its Cash Cow status. The company has demonstrated a strong capability in controlling direct construction expenses, which is crucial for maintaining healthy profit margins in the homebuilding sector. This focus directly impacts their ability to generate consistent cash flow from their established operations.

- Strong Cost Management: Century Communities has shown a consistent ability to manage direct construction costs effectively.

- Improved Fixed Cost Leverage: The company benefits from improved fixed cost leverage, enhancing profitability.

- Healthy Gross Margins: In 2024, Century Communities reported an adjusted homebuilding gross margin of 23.3%, reflecting their cost discipline.

- Profitability in Challenging Markets: Efficient operations and cost control enable sustained profitability even when market conditions necessitate higher incentives.

Diverse Buyer Segments (First-Time, Move-Up, Active Adult)

Century Communities' strategy of serving diverse buyer segments, including first-time, move-up, and active adult buyers, creates a robust and consistent revenue stream. This broad market approach diversifies risk and taps into different stages of the homeownership lifecycle.

While the affordable housing segment is identified as a Star, the established move-up and active adult markets are likely the Cash Cows for Century Communities. These segments represent mature markets where the company has built a strong reputation and consistent market share, generating reliable cash flow.

In 2024, the housing market continued to see demand across these segments, though affordability remained a key consideration. For instance, data from the National Association of Realtors indicated that existing-home sales in the U.S. experienced fluctuations throughout the year, with price points varying significantly by region and home type, underscoring the importance of a diversified buyer base.

- Diverse Buyer Base: Catering to first-time, move-up, and active adult buyers provides stability.

- Cash Flow Generation: Mature segments like move-up and active adult are key Cash Cows.

- Market Maturity: These established segments require less aggressive investment for growth.

- 2024 Market Context: Housing demand remained across segments, with price variations influencing buyer decisions.

Century Communities' established homebuilding operations are its primary Cash Cows, characterized by high market share and consistent cash generation. The company's ability to deliver a significant volume of homes, as seen with 11,007 deliveries in 2024, and achieve a substantial revenue of $4.4 billion in the same year, solidifies this classification.

These mature business segments, particularly the move-up and active adult markets, require less investment for growth while generating substantial profits. This is further supported by a strong adjusted homebuilding gross margin of 23.3% reported in 2024, demonstrating efficient cost management.

The company's 22 consecutive years of profitability, including a net income of $333.8 million in 2024, and a growing quarterly cash dividend to $0.29 per share in 2025, clearly indicate a business unit that produces more cash than it needs for reinvestment, a hallmark of a Cash Cow.

| Metric | 2024 Value | Significance for Cash Cow Status |

| Homes Delivered | 11,007 | Indicates mature, high-volume operations |

| Total Revenues | $4.4 billion | Demonstrates significant market presence and sales |

| Adjusted Homebuilding Gross Margin | 23.3% | Reflects strong cost control and profitability |

| Net Income | $333.8 million | Highlights consistent earnings generation |

| Quarterly Cash Dividend (2025) | $0.29 per share | Signals excess cash flow returned to shareholders |

What You See Is What You Get

Century Communities BCG Matrix

The BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This ensures you know exactly what you're getting—a professionally analyzed and formatted strategic tool ready for immediate application without any hidden surprises or additional work.

Dogs

Century Communities' underperforming regional markets, particularly in the Mountain West and certain Texas areas, are currently experiencing softness. These markets may represent dogs in the BCG matrix, characterized by low market share and low growth prospects. The company itself noted regional softness in Q2 2025, indicating a recognized challenge in these specific geographies.

Century Communities' focus on a land-light approach is strategic, but legacy land holdings, especially those acquired at elevated prices or in less appealing areas, can represent a challenge. These parcels are essentially the 'Dogs' in the BCG Matrix, demanding careful management due to their potential for low returns and capital immobilization.

These underperforming assets can necessitate substantial price reductions or incentives to move, potentially impacting profitability. For instance, the company reported a $7 million impairment charge in 2023 related to closeout communities in Florida, illustrating the financial impact of such legacy land. This highlights the ongoing risk of inventory impairment charges on these types of holdings.

Older phases within Century Communities' established neighborhoods, particularly those with designs that are no longer as popular or are nearing the end of their sales cycle, often face slower sales and reduced profit margins. These sections can be categorized as question marks or even dogs in a BCG-like analysis, as they may necessitate significant price reductions or aggressive incentives to clear remaining inventory, thereby dampening overall profitability.

Highly Incentivized Home Sales

Highly incentivized home sales, while a strategy to boost volume, can significantly impact profitability. When a substantial portion of sales relies on concessions, it signals potential weakness in demand for specific product types or locations. This can lead to a situation where sales numbers look good, but the actual profit generated is minimal.

For Century Communities, if certain home segments consistently require elevated incentives, these offerings might be classified as Dogs in a BCG Matrix analysis. This implies they operate in a low-growth market and hold a low market share, meaning they don't contribute significantly to overall company growth or profitability. For instance, if a particular community's average incentive jumped by 15% in late 2023 to achieve sales targets, it would highlight this characteristic.

- Erosion of Gross Margins: Over-reliance on incentives directly reduces the profit margin on each home sold.

- Low Net Profitability: High incentives can result in low net profits, even with strong sales volume.

- Dog Classification: Home types or communities needing consistent, high incentives may be categorized as Dogs.

- Indicative of Market Weakness: This strategy often points to low demand or competitive pressures in specific market segments.

Segments Highly Sensitive to Interest Rate Volatility

Segments highly sensitive to interest rate volatility, particularly those reliant on buyers stretching affordability, are likely to be classified as 'Dogs' in Century Communities' BCG Matrix. These areas experience a sharp drop in new home contracts and slower absorption rates when mortgage rates climb. For instance, in early 2024, as mortgage rates hovered around 7%, demand for entry-level homes, often targeted by first-time buyers sensitive to monthly payment increases, saw a noticeable slowdown.

While the broader housing market feels the pinch of higher rates, specific buyer profiles and price points bear the brunt. This disproportionate impact leads to subdued demand and constrained growth in these particular segments. The revised FY25 guidance from Century Communities, which anticipates continued pressure from these factors, underscores the challenges faced by these sensitive market areas.

- Impact on Entry-Level Buyers: First-time homebuyers, often with tighter budgets, are most vulnerable to rising mortgage rates, directly affecting affordability and demand for starter homes.

- Slower Absorption Rates: Higher interest rates can lead to longer selling cycles for new homes in these sensitive segments, increasing inventory holding costs for builders.

- Reduced Contract Growth: A direct consequence of affordability challenges is a decline in the number of new home contracts signed, signaling weak market performance.

- FY25 Guidance Adjustments: Century Communities' updated financial outlook for fiscal year 2025 reflects the anticipated headwinds in these interest-rate-sensitive market segments.

Certain Century Communities' regional markets, like those in the Mountain West and parts of Texas, are experiencing softness. These areas, characterized by low growth and market share, can be viewed as Dogs in the BCG matrix. The company's land-light strategy, while beneficial, means older or less desirable land parcels also fit this 'Dog' category, requiring careful management due to potential low returns.

Question Marks

New geographic markets where Century Communities is just beginning to establish a presence, such as its return to North Las Vegas with new communities, represent question marks in the BCG Matrix. These markets have high growth potential but currently low market share for the company, requiring significant investment in promotion and infrastructure to gain traction. Success hinges on rapid buyer adoption, and in 2024, Century Communities has been actively launching new projects in these emerging areas, aiming to capture early market share.

Century Communities' digital homebuying platform, a key innovation allowing 24/7 online purchases and virtual appointments, positions them as an industry leader. However, the question mark arises from the uncertainty surrounding the complete market adoption and scalability of this digital-first strategy across all geographical areas and buyer segments.

While the platform offers a modern, convenient experience, achieving widespread acceptance and consistent growth in every market remains a challenge. Significant ongoing investment in technology upgrades and targeted marketing campaigns will be crucial to fully capitalize on this digital offering and solidify its market dominance.

Diversifying into entirely new home product types, such as innovative modular or 3D-printed homes, would position Century Communities as a potential 'Question Mark' in the BCG Matrix. These ventures tap into a high-growth market driven by technological advancements and evolving consumer preferences.

Initially, these new product lines would likely have a low market share due to their novelty and the need to establish brand recognition and distribution channels. Century Communities would need to invest heavily in research and development, marketing, and sales to capture a significant portion of this emerging market.

For instance, if the market for prefabricated smart homes is growing at an estimated 15% annually, and Century Communities captures only 2% of it, this segment would clearly fit the Question Mark category. Such a strategy aims to transform these low-share, high-growth products into future Stars or Cash Cows.

Strategic Acquisitions in Untapped Niches

Strategic acquisitions in untapped niches represent a potential growth avenue for Century Communities, aiming to bolster its position within the BCG matrix. While past acquisitions like Landmark Homes of Tennessee and Anglia Homes have broadened its footprint, future moves into less explored segments require careful consideration of integration costs and scaling efforts to gain significant market share.

For instance, if Century Communities were to acquire a builder specializing in a niche like sustainable or modular housing, the initial investment in understanding and adapting to that specific market would be substantial. The company's 2024 performance, with a reported revenue of $4.7 billion, provides a solid financial base for such strategic ventures. However, achieving a high market share in a new niche would necessitate not only capital but also a robust integration strategy to ensure operational efficiency and brand alignment.

- Future acquisitions in niche markets could diversify Century Communities' portfolio.

- Integration and scaling in new segments demand significant investment and strategic planning.

- Century Communities' 2024 revenue of $4.7 billion offers a foundation for strategic expansion.

- Success in untapped niches hinges on effective integration to achieve market leadership.

Advanced Smart Home Technology Integration

Century Communities' investment in advanced smart home technology integration could be classified as a Question Mark within the BCG Matrix. While they offer smart home packages, positioning these as a core differentiator requires a deeper commitment. The market for sophisticated smart home systems is growing, with projections indicating continued expansion in the coming years, potentially reaching billions in value by the late 2020s.

This area presents significant growth opportunities as consumer demand for connected living increases. However, the success of this segment hinges on Century Communities' ability to not only invest in cutting-edge technology but also to effectively market its unique value proposition against competitors. The company's strategic focus and resource allocation will be crucial in determining whether this becomes a Stars or remains a Question Mark.

- Market Growth: The global smart home market is anticipated to see robust growth, with estimates suggesting a compound annual growth rate (CAGR) of over 10% leading up to 2028.

- Competitive Landscape: Other home builders are also enhancing their smart home offerings, making it essential for Century Communities to innovate and establish a distinct advantage.

- Investment & Innovation: Continued investment in research and development for advanced features like AI-powered home management and enhanced security protocols will be vital for market penetration.

- Consumer Adoption: Understanding and catering to evolving consumer preferences for seamless integration and user-friendly smart home experiences is key to driving adoption.

New geographic markets represent question marks as Century Communities builds its presence, requiring significant investment to gain market share in these high-growth areas. Their digital homebuying platform, while innovative, faces uncertainty in widespread adoption across all markets, necessitating ongoing tech investment and marketing. Exploring new product types like modular homes also fits the question mark category, demanding substantial R&D and marketing to establish brand recognition in these emerging, high-growth segments.

| BCG Category | Century Communities Examples | Market Characteristics | Strategic Focus |

| Question Marks | Emerging Geographic Markets | High Growth, Low Market Share | Investment in infrastructure, promotion, rapid buyer adoption |

| Question Marks | Digital Homebuying Platform Adoption | High Growth Potential (digital services), Uncertain Market Share | Technology upgrades, targeted marketing, scalability |

| Question Marks | New Product Types (e.g., Modular Homes) | High Growth (technology-driven), Low Initial Market Share | R&D, marketing, sales investment, brand establishment |

| Question Marks | Niche Market Acquisitions | Potentially High Growth, Low Existing Share | Integration strategy, capital investment, operational efficiency |

| Question Marks | Smart Home Technology Integration | Growing Market Demand, Uncertain Market Share | Investment in advanced features, marketing unique value proposition |

BCG Matrix Data Sources

Our Century Communities BCG Matrix leverages a blend of internal financial reports, public company filings, and comprehensive market research to accurately assess product performance and market share.