Commercial Bank of Qatar PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial Bank of Qatar Bundle

Navigate the dynamic landscape of Qatar's financial sector with our comprehensive PESTLE analysis of Commercial Bank of Qatar. Understand how political stability, economic growth, and technological advancements are shaping its strategic direction. Gain a competitive edge by leveraging these expert insights. Download the full version now for actionable intelligence.

Political factors

Qatar's enduring political stability, underscored by its commitment to the Qatar National Vision 2030, offers a predictable framework for the Commercial Bank of Qatar. This long-term vision guides economic diversification, impacting the banking sector's lending opportunities and strategic direction.

Government fiscal policies, including substantial investments in infrastructure and diversification initiatives as outlined in national development plans, directly shape the economic landscape. For instance, ongoing projects within the energy sector and the push towards non-hydrocarbon growth create specific lending avenues and influence credit risk profiles for banks like Commercial Bank of Qatar.

Consistent regulatory oversight, a hallmark of Qatar's stable political environment, minimizes operational uncertainty for financial institutions. This predictability in regulatory frameworks, including capital adequacy requirements and anti-money laundering laws, is crucial for maintaining investor confidence and ensuring sound financial practices.

The Qatar Central Bank (QCB) is the primary architect of the nation's banking regulations, directly influencing Commercial Bank of Qatar's (CBQ) operational landscape. Recent directives, such as the QCB's updated capital adequacy ratios implemented in early 2024, mandate higher buffers, requiring banks like CBQ to maintain robust financial health. These evolving rules, including liquidity management and risk assessment frameworks, necessitate ongoing investment in compliance and strategic adjustments to ensure adherence.

Qatar's proactive foreign policy, particularly its strong diplomatic ties with key global players and its role in regional mediation, significantly bolsters investor confidence. For instance, Qatar's continued engagement in resolving regional disputes in 2024-2025 is expected to foster a more stable economic landscape, directly benefiting the Commercial Bank of Qatar (CBQ) by encouraging cross-border investment and trade.

Regional stability, or lack thereof, directly impacts CBQ’s international operations. In 2024, the ongoing efforts to de-escalate tensions in certain parts of the Middle East are crucial for maintaining predictable trade flows and foreign direct investment into Qatar, which underpins the financial health of CBQ's corporate clientele.

Maintaining robust diplomatic relationships is paramount for Qatar's sustained economic growth, and by extension, for CBQ. The nation’s strategic alliances, evidenced by significant trade agreements signed in late 2023 and early 2024, are projected to create new avenues for international business and financial services, positively impacting CBQ's bottom line.

Fiscal Policy and Public Spending

Government fiscal policy, particularly public spending on major infrastructure and national development, acts as a significant catalyst for economic expansion in Qatar. These substantial expenditures directly translate into heightened demand for a spectrum of banking services, including corporate financing, project finance, and retail banking, benefiting institutions like Commercial Bank of Qatar.

The bank's business pipeline is closely tethered to the rhythm of these government outlays. For instance, Qatar's 2024 budget allocated significant funds towards infrastructure development and diversification efforts, signaling continued opportunities for project finance and corporate lending. Fluctuations in government revenue, primarily driven by hydrocarbon export prices, can directly impact the scale and continuity of these development projects, thereby influencing the bank's forward business projections.

- Public spending on infrastructure projects, such as those related to the National Vision 2030, creates demand for project finance and corporate loans.

- Government revenue, heavily reliant on hydrocarbon prices, directly influences the pace and volume of public spending.

- Commercial Bank of Qatar's growth is supported by increased demand for its lending and financial services stemming from government-led economic initiatives.

- The 2024 Qatari budget emphasized continued investment in non-hydrocarbon sectors, offering diversified opportunities for the banking sector.

Anti-Corruption and Governance Initiatives

Qatar's unwavering commitment to anti-corruption and robust governance significantly bolsters the integrity of its financial sector. This focus is crucial for the Commercial Bank of Qatar (CBQ), as it necessitates strict adherence to international standards for transparency and ethical conduct. For instance, Qatar ranked 31st out of 180 countries in Transparency International's 2023 Corruption Perception Index, reflecting its ongoing efforts to combat corruption.

Adherence to these strengthened governance frameworks, including comprehensive anti-money laundering (AML) protocols, is not merely a regulatory requirement but a strategic imperative for CBQ. These initiatives directly contribute to building and maintaining trust with international investors and financial partners, thereby enhancing the bank's global standing and mitigating the significant risks tied to illicit financial flows.

- Strengthened Regulatory Environment: Qatar's anti-corruption drive reinforces the legal and ethical framework within which CBQ operates, promoting fair competition and investor confidence.

- Enhanced Reputation: Compliance with good governance principles improves CBQ's public image and attractiveness to foreign direct investment, a key driver for economic growth.

- Risk Mitigation: Robust AML and counter-terrorism financing (CTF) measures, integral to governance initiatives, reduce the bank's exposure to financial crime and associated penalties.

- International Alignment: Qatar's proactive stance aligns it with global best practices, facilitating smoother international banking relationships and access to capital markets.

Qatar's political stability, anchored by the National Vision 2030, provides a predictable operating environment for Commercial Bank of Qatar (CBQ). This stability fosters investor confidence and supports the bank's long-term strategic planning, particularly as the nation pursues economic diversification away from hydrocarbons.

Government fiscal policies, including significant public spending on infrastructure and development projects as highlighted in the 2024 budget, directly stimulate demand for banking services. For instance, the budget's emphasis on non-hydrocarbon sector growth creates lending opportunities in areas like technology and tourism, benefiting CBQ's corporate banking division.

Regulatory oversight by the Qatar Central Bank (QCB) is a key political factor. The QCB's implementation of updated capital adequacy ratios in early 2024, requiring higher buffers, directly impacts CBQ's financial strategy and risk management. This consistent regulatory framework minimizes operational uncertainty.

Qatar's proactive foreign policy and strong diplomatic ties, evidenced by trade agreements signed in late 2023 and early 2024, enhance its global standing and attract foreign investment. This diplomatic engagement is crucial for CBQ, as it facilitates international business and cross-border financial flows.

What is included in the product

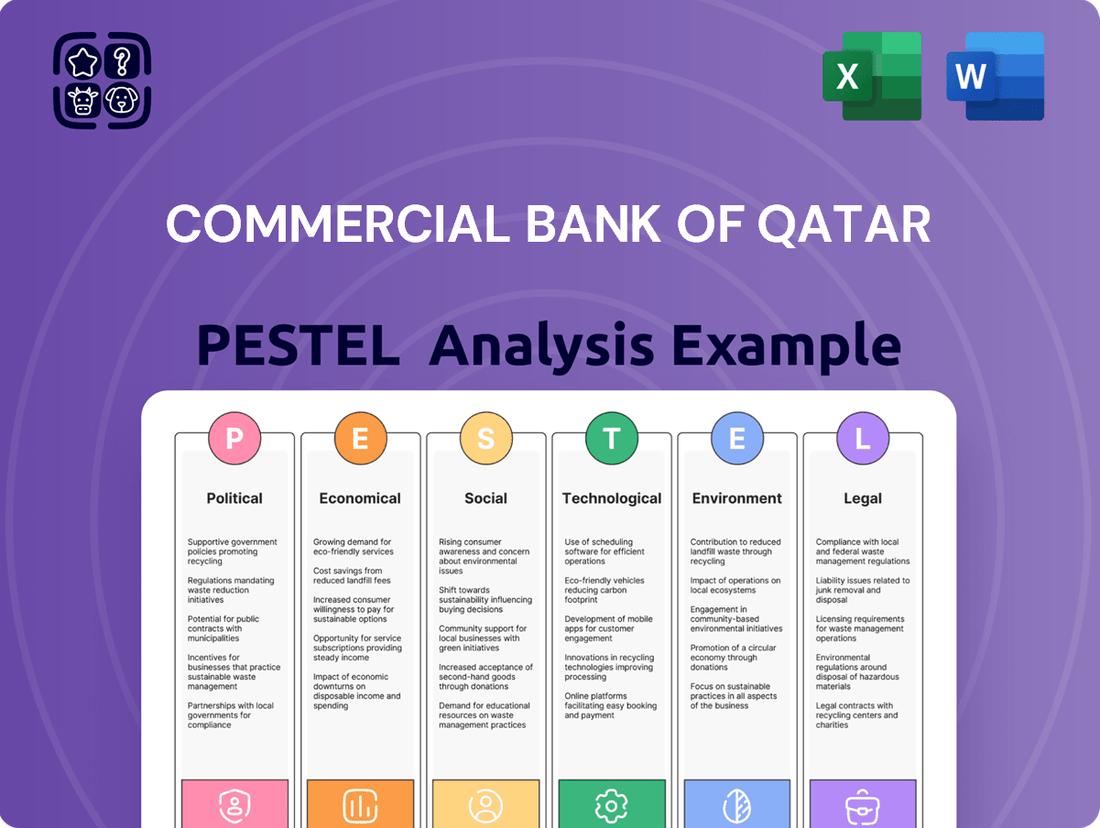

This PESTLE analysis of the Commercial Bank of Qatar examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

It provides actionable insights for stakeholders to navigate the dynamic external landscape and capitalize on emerging opportunities within Qatar's banking sector.

The Commercial Bank of Qatar's PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during meetings and simplifying complex market dynamics for all stakeholders.

Economic factors

Qatar's economy, heavily reliant on hydrocarbons, makes its banking sector, including Commercial Bank of Qatar (CBQ), sensitive to global oil and gas price swings. For instance, while crude oil prices averaged around $80-$90 per barrel for much of 2024, sustained high levels generally translate to robust government revenues, boosting liquidity and lending for CBQ.

Conversely, a sharp decline in energy prices, such as a hypothetical drop to $50 per barrel, could contract government spending, reduce overall liquidity in the market, and potentially strain the loan portfolios of banks like CBQ as economic activity slows.

Qatar's strategic push towards economic diversification, moving beyond its heavy reliance on hydrocarbons, is creating significant new opportunities. The nation is actively investing in sectors like infrastructure development, tourism, logistics, and cutting-edge technology. For instance, Qatar's National Vision 2030 outlines ambitious goals for these non-oil sectors, aiming to build a more sustainable and varied economic base.

Commercial Bank of Qatar is well-positioned to capitalize on these diversification efforts. By offering tailored financing solutions for emerging businesses, supporting small and medium-sized enterprises (SMEs) within these new industries, and creating specialized financial products for sectors like technology and tourism, the bank can tap into new revenue streams. This strategic alignment not only fosters economic growth but also enhances the bank's own resilience by reducing its exposure to the volatile energy market.

The interest rate policy set by the Qatar Central Bank, often mirroring global trends and the US Federal Reserve's actions, directly influences Commercial Bank of Qatar's (CBQ) net interest margin (NIM) and overall lending profitability. For instance, if the US Federal Reserve maintains a hawkish stance, it can pressure the Qatar Central Bank to adjust its own rates, impacting CBQ's cost of funds and loan pricing.

Rising interest rates can increase borrowing costs for CBQ's clients, potentially dampening loan demand. However, these higher rates can also improve the bank's NIM if its lending rates adjust upward more quickly than the rates it pays on customer deposits. Conversely, a scenario of falling interest rates might compress margins but could simultaneously stimulate borrowing, boosting loan volumes.

Inflationary Pressures

Inflationary trends in Qatar directly impact the purchasing power of consumers and the operational costs for businesses. This, in turn, influences key banking metrics for Commercial Bank of Qatar, such as deposit growth, loan demand, and overall credit risk. For instance, persistent inflation can erode the real value of savings, potentially affecting deposit inflows.

Higher inflation often leads the Qatar Central Bank to implement tighter monetary policies, including interest rate hikes. These increases can make borrowing more expensive, potentially dampening loan demand and affecting the bank's net interest margin. For example, if inflation significantly outpaces wage growth, consumers may reduce discretionary spending and borrowing.

Managing these inflationary pressures is crucial for maintaining economic stability and bolstering consumer confidence, both of which are vital for the health of the banking sector. In 2023, Qatar's inflation rate averaged around 2.4%, a notable increase from previous years, highlighting the growing importance of this factor for financial institutions like Commercial Bank of Qatar.

- Inflationary pressures affect consumer purchasing power and business operating costs in Qatar.

- Rising inflation can lead to higher interest rates, impacting loan demand and credit risk for Commercial Bank of Qatar.

- Economic stability and consumer confidence, influenced by inflation, are critical for the banking sector.

- Qatar's inflation averaged approximately 2.4% in 2023, a figure that demands careful management by financial institutions.

Foreign Direct Investment (FDI) Inflows

Qatar has been actively pursuing policies to attract foreign direct investment (FDI), aiming to diversify its economy beyond hydrocarbons. These efforts are crucial for economic expansion and generating new avenues for commercial banks like CBQ. For instance, Qatar's FDI inflows reached approximately $3.7 billion in the first half of 2024, signaling continued investor confidence.

Higher FDI typically translates into increased corporate activity, infrastructure projects, and job creation. This heightened economic dynamism directly benefits CBQ by driving demand for a range of banking services. These include essential offerings like trade finance to support import-export activities, corporate lending for business expansion, and wealth management services for a growing affluent population.

The sustained attraction of FDI hinges significantly on a stable and supportive legal and regulatory environment. Qatar's commitment to enhancing its business framework, including streamlined processes for foreign investors, is vital for maintaining these inflows. The World Bank's Ease of Doing Business report consistently ranks Qatar favorably, underscoring these advancements.

- Economic Diversification: Qatar's focus on non-hydrocarbon FDI aims to build a more resilient economy, creating new markets for CBQ.

- Increased Corporate Activity: FDI fuels business growth, leading to higher demand for CBQ's corporate banking and trade finance solutions.

- Infrastructure Development: Significant FDI in infrastructure projects generates opportunities for project finance and related banking services.

- Regulatory Environment: A strong legal framework is paramount for attracting and retaining FDI, ensuring a stable operating environment for CBQ.

Qatar's economic landscape, heavily influenced by hydrocarbon prices, directly impacts Commercial Bank of Qatar (CBQ). Fluctuations in oil and gas prices affect government revenues, liquidity, and lending capacity. Economic diversification efforts, as outlined in Qatar National Vision 2030, are creating new opportunities in sectors like technology and tourism, which CBQ is positioned to support through tailored financing.

Monetary policy, particularly interest rate adjustments by the Qatar Central Bank, significantly influences CBQ's net interest margin and profitability. Inflationary pressures, which averaged around 2.4% in 2023, also play a crucial role by affecting consumer spending, business costs, and potentially leading to tighter monetary policies that can dampen loan demand.

Foreign Direct Investment (FDI) is a key driver for Qatar's economic growth and diversification. In the first half of 2024, FDI inflows reached approximately $3.7 billion, signaling continued investor confidence and boosting demand for CBQ's corporate banking and trade finance services. A stable regulatory environment is essential for sustaining these investment trends.

| Economic Factor | Impact on Commercial Bank of Qatar (CBQ) | Key Data/Trend (2023-2024) |

|---|---|---|

| Hydrocarbon Price Sensitivity | Affects government revenue, liquidity, and lending environment. | Crude oil prices averaged $80-$90/barrel in much of 2024. |

| Economic Diversification | Creates new lending and service opportunities in non-oil sectors. | Qatar National Vision 2030 targets growth in technology, tourism, logistics. |

| Monetary Policy & Interest Rates | Influences net interest margin (NIM) and loan demand. | QCB policy often mirrors global trends, impacting borrowing costs. |

| Inflation | Impacts purchasing power, operational costs, and credit risk. | Qatar's inflation averaged ~2.4% in 2023. |

| Foreign Direct Investment (FDI) | Drives corporate activity and demand for banking services. | FDI inflows approximated $3.7 billion in H1 2024. |

What You See Is What You Get

Commercial Bank of Qatar PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Commercial Bank of Qatar delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Qatar's population is experiencing robust growth, projected to reach 3.1 million by the end of 2024, according to recent estimates. This expansion, largely fueled by a significant expatriate workforce, creates substantial demand for a wide array of retail banking products. Commercial Bank of Qatar, like its peers, must adapt its offerings to serve both the established Qatari citizens and the diverse international community.

The demographic makeup, with a substantial proportion of the population under 30, indicates a strong future market for financial services such as savings accounts, investment products, and digital banking solutions. Catering to the unique financial needs and cultural preferences of both Qatari nationals and the large expatriate segment is paramount for effective market segmentation and product innovation. For instance, providing Sharia-compliant banking options alongside conventional services is essential for capturing the local market.

Consumer banking preferences are shifting dramatically, with a strong emphasis on convenience and digital engagement. For instance, a recent survey indicated that over 70% of Qatari banking customers prefer mobile banking for daily transactions by late 2024. This trend necessitates that Commercial Bank of Qatar (CBQ) prioritizes user-friendly digital platforms and personalized service offerings to remain competitive.

Qatar's population is becoming increasingly digitally savvy, with smartphone penetration rates soaring. This heightened digital literacy directly fuels the demand for and use of online and mobile banking services. For Commercial Bank of Qatar, this means a strong push towards digital transformation is essential to meet customer expectations.

The bank is actively enhancing its digital offerings, expanding services available through its online portal and mobile app. This strategic move aims to capitalize on the growing trend of digital adoption, making banking more accessible and convenient for customers.

A higher rate of digital banking adoption promises to streamline operations for Commercial Bank of Qatar, potentially lowering overhead costs. However, this digital shift also underscores the critical need for advanced cybersecurity protocols to protect customer data and maintain trust in an increasingly online financial landscape.

Expatriate Population Dynamics

The significant expatriate demographic in Qatar is a key factor influencing the Commercial Bank of Qatar's (CBQ) operations. This population, constituting a large majority of Qatar's residents, drives demand for specialized banking services. For instance, in 2023, expatriates made up approximately 85% of Qatar's total population, underscoring their economic importance.

CBQ must cater to the unique financial requirements of this segment. These often include robust international remittance services, tailored salary account packages, and accessible short-term credit options. The bank's ability to meet these needs directly impacts its market share and customer loyalty within this crucial demographic.

- Remittance Demand: Expatriates frequently send money home, creating a strong market for remittance services. In 2024, global remittance flows to South Asia, a major origin for Qatar's expatriate workforce, were projected to reach hundreds of billions of dollars.

- Salary Accounts: The majority of Qatar's workforce comprises expatriates, necessitating efficient and user-friendly salary account management.

- Credit Facilities: Short-term credit needs, such as personal loans or overdrafts, are common among expatriates, particularly those new to the country.

- Compliance: Navigating international compliance regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, is paramount when serving a diverse, mobile expatriate customer base.

Wealth Management Trends

Qatar's increasing wealth, especially among its high-net-worth individuals, is significantly boosting the demand for advanced wealth management and investment services. This demographic shift presents a prime opportunity for Commercial Bank of Qatar to enhance its private banking capabilities and offer bespoke investment strategies.

The bank should focus on expanding its suite of tailored investment solutions and providing expert financial advisory. This includes adapting to a growing client preference for sustainable and ESG (Environmental, Social, and Governance) focused investments, a trend that gained considerable traction globally through 2024 and is projected to continue its upward trajectory into 2025.

- Growing Affluence: Qatar's GDP per capita was estimated to be around $82,000 in 2024, indicating a strong economic base supporting wealth accumulation.

- Demand for Sophistication: Surveys from 2024 showed a marked increase in Qatari investors seeking personalized financial planning and access to global markets.

- ESG Investment Growth: Global sustainable investment assets were projected to exceed $50 trillion by the end of 2025, a trend mirrored in the Middle East.

- Digital Expectations: Clients increasingly expect seamless digital platforms for managing their wealth, a key area for banks to invest in for 2025.

The sociological landscape in Qatar is characterized by a young, growing, and increasingly digital population, with expatriates forming a significant majority. This demographic reality shapes banking needs, emphasizing accessible digital platforms and tailored services for both local and international customers. The rising affluence also drives demand for sophisticated wealth management, including a growing interest in ESG-compliant investments.

| Sociological Factor | Description | Impact on Commercial Bank of Qatar | 2024/2025 Data/Projections |

|---|---|---|---|

| Population Growth & Demographics | Rapid population expansion, high proportion of youth, significant expatriate majority. | Drives demand for diverse retail and digital banking products; need for culturally sensitive services. | Population projected to reach 3.1 million by end of 2024; expatriates approx. 85% of residents in 2023. |

| Digital Savviness & Adoption | Increasingly tech-literate population with high smartphone penetration. | Necessitates investment in user-friendly digital platforms and mobile banking to meet customer expectations. | Over 70% of Qatari banking customers prefer mobile banking for daily transactions by late 2024. |

| Consumer Preferences | Shift towards convenience, digital engagement, and specialized services. | Requires innovation in product offerings, particularly for remittances and salary accounts for expatriates. | Global remittance flows to South Asia projected in hundreds of billions in 2024. |

| Wealth Accumulation & Investment Trends | Growing high-net-worth individuals seeking advanced financial solutions. | Opportunity to expand private banking and wealth management, catering to demand for personalized and ESG investments. | Global sustainable investment assets projected to exceed $50 trillion by end of 2025. |

Technological factors

The burgeoning FinTech sector in Qatar presents a dynamic landscape for Commercial Bank of Qatar (CBQ). Globally, FinTech adoption is soaring, with reports indicating that over 75% of consumers in emerging markets have used at least one FinTech service in 2024. This rapid growth means FinTechs are increasingly offering specialized services like digital wallets and streamlined lending, directly challenging traditional banking models.

CBQ faces a critical juncture: either innovate internally or partner with these agile FinTech players. For instance, the increasing demand for digital payment solutions, which saw a significant surge in transaction volumes in Qatar during 2024, necessitates a robust response. By developing its own digital platforms or integrating with existing FinTech solutions, CBQ can enhance customer experience and retain its competitive edge in a rapidly evolving financial ecosystem.

Commercial Bank of Qatar (CBQ) is navigating a significant digital banking transformation, a crucial move to stay competitive. This involves digitizing everything from core banking operations to how customers sign up and receive services. For instance, by the end of 2023, CBQ reported a substantial increase in digital transactions, with over 70% of retail transactions conducted through digital channels, showcasing the growing reliance on these platforms.

Investing in advanced digital platforms, user-friendly mobile apps, and robust online portals is paramount. This not only elevates the customer experience but also streamlines operations and lessens the need for extensive physical branch networks. CBQ's commitment to this digital shift is evident in its continued investment in technology, aiming to meet the evolving expectations of a digitally fluent customer base.

As Commercial Bank of Qatar (CBQ) expands its digital footprint, sophisticated cybersecurity threats like ransomware and phishing pose significant risks. In 2024, global financial institutions reported an average of 30% increase in cyberattack attempts, highlighting the escalating challenge. Protecting sensitive customer information and financial assets requires continuous investment in advanced security measures and proactive threat intelligence.

Maintaining customer trust hinges on CBQ's ability to safeguard against data breaches and financial fraud. A robust cybersecurity infrastructure, including multi-factor authentication and real-time anomaly detection, is essential. Employee training programs are critical to foster a security-aware culture, as human error remains a significant vulnerability in cyber defense.

Compliance with stringent data protection regulations, such as those evolving globally and within Qatar, is paramount. Failure to adhere to these mandates can result in substantial fines and severe reputational damage. CBQ must stay abreast of these regulatory shifts to mitigate legal and operational risks stemming from cyber incidents.

Artificial Intelligence and Automation

The integration of Artificial Intelligence (AI) and automation presents a significant opportunity for the Commercial Bank of Qatar (CBQ) to boost its operational efficiency, refine risk management, and elevate customer service. These technologies are instrumental in areas like advanced fraud detection, more accurate credit scoring models, and the delivery of highly personalized marketing campaigns. Furthermore, automating repetitive tasks allows CBQ to redeploy its valuable human capital towards more strategic and client-facing responsibilities.

By embracing AI, CBQ can streamline processes, reduce operational costs, and gain a competitive edge. For instance, AI-powered chatbots can handle a substantial volume of customer inquiries, improving response times and availability. The bank is likely investing in AI capabilities, with global financial institutions reporting significant ROI from AI adoption. For example, a 2024 report indicated that financial services firms using AI saw an average cost reduction of 15% in operational expenses.

- Enhanced Operational Efficiency: AI automates routine tasks, speeding up processing times and reducing manual errors.

- Improved Risk Management: AI algorithms can analyze vast datasets to identify potential fraud and assess credit risk more effectively.

- Personalized Customer Experiences: AI enables tailored product offerings and communication, increasing customer satisfaction and loyalty.

- Investment Requirements: Successful AI implementation necessitates substantial investment in robust data infrastructure, advanced analytics platforms, and specialized talent.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) are emerging forces with the potential to reshape financial services. While widespread adoption in banking is still developing, these technologies offer significant promise for improving cross-border payments, streamlining trade finance processes, and bolstering digital identity verification. For Commercial Bank of Qatar, staying abreast of these advancements and engaging in pilot projects is crucial for understanding how DLT can ultimately lower transaction expenses, boost transparency, and fortify security in its future operations.

The global market for blockchain in financial services was projected to reach approximately $10 billion by 2024, with significant growth anticipated in the coming years. This indicates a strong trend towards exploring and implementing DLT solutions. Commercial Bank of Qatar should consider these market dynamics as it evaluates the strategic integration of blockchain for enhanced efficiency and competitive advantage.

- Potential for Cost Reduction: DLT can significantly reduce intermediary fees and processing times in cross-border transactions, potentially saving banks millions annually.

- Enhanced Transparency and Security: The immutable nature of blockchain records offers a higher degree of transparency and security compared to traditional systems, mitigating fraud risks.

- Trade Finance Transformation: DLT can digitize and automate complex trade finance workflows, improving speed and reducing the risk of errors and disputes.

- Digital Identity Solutions: Blockchain-based identity management can provide secure and verifiable digital identities for customers, simplifying onboarding and KYC processes.

The technological landscape is rapidly evolving, with advancements like AI and blockchain offering significant opportunities for Commercial Bank of Qatar (CBQ). These technologies are crucial for enhancing operational efficiency, improving risk management, and personalizing customer experiences. For instance, AI adoption in financial services is projected to yield substantial cost reductions, with some institutions seeing up to a 15% decrease in operational expenses by 2024.

CBQ's digital transformation, marked by a significant increase in digital transactions—over 70% of retail transactions were digital by end-2023—underscores the growing reliance on technology. This shift necessitates continuous investment in user-friendly mobile apps and secure online portals to meet customer expectations and maintain a competitive edge.

However, this digital push also amplifies cybersecurity risks, with global financial institutions experiencing a 30% increase in cyberattack attempts in 2024. Safeguarding customer data through robust security measures and employee training is paramount to maintaining trust and complying with stringent data protection regulations.

Blockchain technology also presents avenues for CBQ to streamline processes like cross-border payments and trade finance, potentially reducing costs and increasing transparency. The global market for blockchain in financial services was estimated to reach $10 billion by 2024, highlighting its growing importance.

Legal factors

Commercial Bank of Qatar is deeply embedded within the Qatar Central Bank's (QCB) regulatory ecosystem, which dictates everything from licensing and capital requirements to liquidity management and operational procedures. This robust oversight ensures financial stability and consumer protection across the sector.

Maintaining strict compliance with QCB directives is paramount for the bank's continued operation, safeguarding its banking license and avoiding costly penalties. This necessitates ongoing vigilance and swift adaptation to evolving regulatory landscapes.

For instance, QCB's ongoing efforts to strengthen anti-money laundering (AML) and counter-terrorism financing (CTF) frameworks, as evidenced by enhanced reporting requirements and stricter due diligence protocols introduced in late 2023 and early 2024, directly influence operational workflows and technology investments for banks like Commercial Bank of Qatar.

Commercial Bank of Qatar (CBQ) operates under strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations, aligning with global best practices. These laws mandate comprehensive customer due diligence, robust transaction monitoring, and timely suspicious activity reporting to combat financial crime.

Failure to comply with these stringent requirements can result in substantial financial penalties and significant reputational harm. For instance, in 2023, global financial institutions faced billions in AML-related fines, underscoring the critical need for CBQ to maintain advanced compliance infrastructure and ongoing staff training to mitigate these risks.

The Commercial Bank of Qatar (CBQ) operates in an environment where data protection and privacy laws are increasingly stringent, especially with its growing digital footprint. Adherence to regulations like Qatar's Data Protection Law is paramount, given the sensitive nature of customer financial information handled by the bank.

CBQ must ensure robust data security measures are in place to safeguard customer data from breaches, a critical concern in the financial sector. For instance, in 2023, global financial institutions reported significant investments in cybersecurity, with the average cost of a data breach reaching millions of dollars, underscoring the financial and reputational risks involved.

Maintaining transparent policies regarding data usage and ensuring secure data storage, processing, and transfer are vital for preserving customer trust and avoiding potential legal penalties. Failure to comply can lead to substantial fines and damage to the bank's reputation.

Consumer Protection Legislation

Consumer protection legislation in Qatar is robust, aiming to shield banking customers from unfair practices. These laws dictate fair lending, clear fee disclosures, and effective dispute resolution processes, ensuring transparency in the financial sector. For Commercial Bank of Qatar, adherence to these regulations is paramount for maintaining customer confidence and preventing potential legal repercussions.

In 2024, Qatar's financial regulators continued to emphasize consumer rights. For instance, the Qatar Central Bank (QCB) has been active in updating guidelines related to digital banking services, ensuring that customer data protection and transaction transparency are upheld. This focus directly impacts how banks like Commercial Bank of Qatar must structure their online offerings and customer agreements.

- Fair Lending: Commercial Bank of Qatar must ensure loan application processes are unbiased and clearly communicate all terms and conditions.

- Transparent Fees: All charges associated with banking products, from account maintenance to transaction fees, must be clearly disclosed upfront.

- Dispute Resolution: The bank needs efficient and accessible channels for customers to raise grievances and seek resolutions.

- Responsible Marketing: Advertising and promotional materials must be truthful and not misleading regarding product features or benefits.

International Sanctions Compliance

Commercial Bank of Qatar (CBQ), due to its extensive international operations, faces significant legal obligations regarding international sanctions compliance. This requires rigorous adherence to sanctions regimes established by entities such as the United Nations, the U.S. Office of Foreign Assets Control (OFAC), and the European Union (EU).

CBQ must implement robust systems for screening all transactions, clients, and counterparties against evolving sanctions lists. This proactive approach is crucial to avoid any dealings with individuals or entities that are subject to international sanctions. For instance, OFAC's Specially Designated Nationals (SDN) List is a critical reference point, and banks globally, including CBQ, dedicate substantial resources to maintaining compliance with its updates.

Failure to comply with these international sanctions can result in severe repercussions. These penalties may include substantial financial fines, the potential loss of vital correspondent banking relationships essential for international transactions, and significant damage to the bank's reputation. In 2023, financial institutions worldwide faced billions in sanctions-related penalties, highlighting the gravity of non-compliance.

- Sanctions Screening: CBQ must continuously screen transactions and client data against UN, OFAC, and EU sanctions lists.

- Regulatory Scrutiny: International financial regulators are increasingly focused on sanctions enforcement, with significant penalties for breaches.

- Reputational Risk: Non-compliance can severely damage CBQ's standing in the global financial community, impacting partnerships and client trust.

- Operational Impact: Maintaining compliance requires ongoing investment in technology and personnel to manage complex regulatory requirements.

Commercial Bank of Qatar operates under a stringent legal framework overseen by the Qatar Central Bank (QCB), which mandates compliance with capital adequacy, liquidity, and operational standards. Adherence to QCB regulations, including those updated in 2024 regarding digital banking services, is critical for maintaining its license and avoiding penalties.

The bank must also navigate robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) laws, aligning with global standards and facing significant fines, as seen with billions in global AML penalties in 2023, for non-compliance.

Furthermore, Qatar's data protection laws, emphasized by increased digital transactions in 2024, require CBQ to implement strong cybersecurity measures, as data breaches cost millions globally in 2023.

International sanctions compliance, particularly with UN, OFAC, and EU lists, is also a major legal factor, with non-compliance risking substantial fines and reputational damage, as evidenced by global sanctions penalties in 2023.

Environmental factors

The global emphasis on climate change and Environmental, Social, and Governance (ESG) principles is significantly reshaping Qatar's banking sector. Commercial Bank of Qatar is experiencing heightened expectations from regulators, investors, and the public to embed ESG considerations across its operations, from strategic planning to lending practices.

This translates into a need for robust assessment of the environmental footprint of financed projects and the proactive development of green finance solutions. For instance, Qatar National Bank, a major player, reported significant growth in its sustainable finance portfolio in 2023, indicating a market trend towards environmentally conscious lending.

Qatar's ambitious sustainability agenda, exemplified by its National Vision 2030, strongly supports the growth of green finance. This commitment translates into significant opportunities for Commercial Bank of Qatar (CBQ) to finance renewable energy initiatives, such as solar power projects, and to invest in sustainable infrastructure development. For instance, Qatar aims to generate 8 GW of solar power by 2030, presenting a substantial pipeline for green financing.

CBQ can strategically position itself by offering innovative green financial products like green bonds and loans specifically for eco-friendly businesses. The bank's development of such instruments would not only cater to a growing segment of environmentally conscious investors but also directly contribute to Qatar's broader economic diversification and its transition towards a low-carbon economy, aligning perfectly with national sustainability targets.

Financial institutions like Commercial Bank of Qatar are increasingly expected to be transparent about their environmental and sustainability initiatives. This includes detailed reporting on their carbon footprint and energy usage.

In 2024, global financial regulators are pushing for more robust ESG (Environmental, Social, and Governance) disclosures. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming a de facto standard, impacting how banks like Commercial Bank of Qatar must report on climate risks and opportunities.

Investor demand for this data is also significant. A 2024 survey indicated that over 70% of institutional investors consider ESG factors when making investment decisions, directly influencing how Commercial Bank of Qatar communicates its sustainability performance.

Resource Management Pressures

Qatar faces considerable environmental pressures, particularly concerning water scarcity and energy consumption. These factors directly influence the operational costs and sustainability efforts of institutions like the Commercial Bank of Qatar (CBQ).

CBQ can mitigate these pressures and foster environmental responsibility through strategic lending. By supporting businesses that prioritize resource efficiency and investing in green technologies, the bank can align its portfolio with sustainability goals. For instance, in 2023, Qatar's per capita water consumption remained high, underscoring the need for innovative solutions that CBQ can help finance.

The bank's own operational footprint is also subject to these environmental concerns. Implementing energy-efficient technologies within its branches and offices, and reducing waste, are crucial steps. This proactive approach not only addresses direct environmental impacts but also enhances the bank's reputation as a responsible corporate citizen.

- Water Scarcity: Qatar's reliance on desalination makes water a costly and energy-intensive resource.

- Energy Consumption: High energy demand, particularly for cooling, presents a significant environmental challenge.

- Sustainable Lending: CBQ can finance projects focused on water conservation and renewable energy.

- Operational Efficiency: The bank can reduce its environmental impact through internal resource management initiatives.

Environmental Risk Management

Commercial Bank of Qatar (CBQ) must embed environmental risk evaluation into its credit assessment processes. This involves scrutinizing borrowers for environmental liabilities and their susceptibility to climate change, particularly those in carbon-intensive sectors or regions prone to climate impacts. For instance, as of 2024, Qatar's commitment to reducing emissions by 25% by 2030 under its National Climate Change Action Plan necessitates a closer look at the environmental footprint of its industrial partners.

By proactively managing these environmental risks, CBQ can significantly reduce the likelihood of loan defaults stemming from environmental non-compliance or climate-related disruptions. Furthermore, it shields the bank from potential reputational harm associated with funding projects that are environmentally unsound, aligning with growing investor and regulatory expectations for sustainable finance practices.

- Credit Risk Integration: CBQ's credit risk framework should incorporate detailed environmental due diligence for all new and existing loans.

- Climate Vulnerability Assessment: Evaluating borrower exposure to physical climate risks, such as rising sea levels or extreme weather events, is crucial.

- Industry Sector Focus: Particular attention should be paid to sectors like oil and gas, construction, and heavy industry, which often have higher environmental footprints.

- Reputational Safeguard: Demonstrating robust environmental risk management enhances CBQ's standing as a responsible financial institution.

Qatar's environmental landscape presents both challenges and opportunities for Commercial Bank of Qatar (CBQ). Water scarcity and high energy consumption, particularly for cooling, directly impact operational costs and necessitate sustainable practices.

CBQ can leverage its financing capabilities to support water conservation and renewable energy projects, aligning with Qatar's National Vision 2030. For instance, the nation's goal of 8 GW of solar power by 2030 offers a significant market for green financing.

The bank must also integrate environmental risk into its credit assessments, evaluating borrower exposure to climate impacts and environmental liabilities, especially within carbon-intensive sectors. This proactive approach mitigates financial and reputational risks.

| Environmental Factor | Impact on CBQ | Opportunity for CBQ | Relevant Data/Initiative |

|---|---|---|---|

| Water Scarcity | Increased operational costs due to desalination reliance | Finance water conservation technologies and projects | Qatar's per capita water consumption remains high as of 2023. |

| Energy Consumption | Higher energy bills, particularly for cooling | Finance renewable energy projects, promote energy efficiency | Qatar aims for 8 GW of solar power by 2030. |

| Climate Change Risks | Potential for loan defaults from climate-vulnerable borrowers | Integrate environmental risk into credit assessment, support climate adaptation | Qatar's National Climate Change Action Plan targets a 25% emissions reduction by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Commercial Bank of Qatar is built on a robust foundation of data from official Qatari government ministries, the Qatar Central Bank, and reputable international financial institutions like the IMF and World Bank. We also incorporate insights from leading financial news outlets and industry-specific market research reports to ensure comprehensive coverage of all relevant factors.