Catapult Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Catapult Bundle

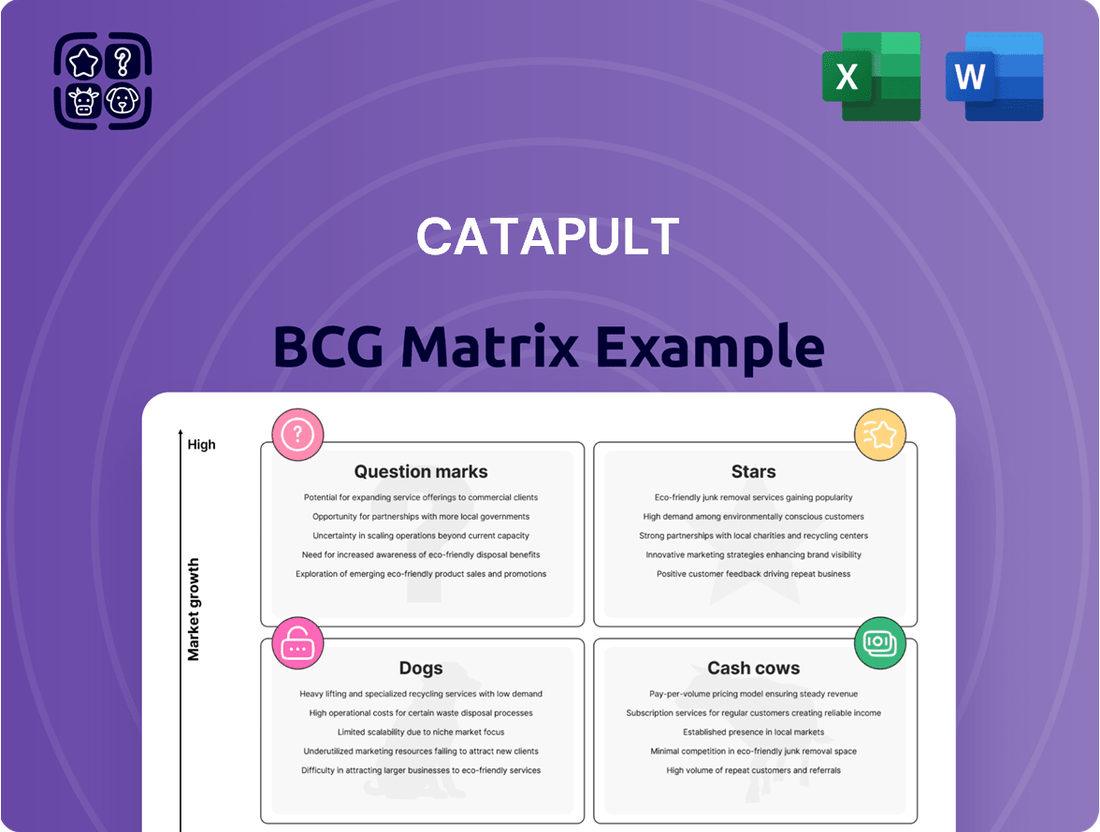

Curious about how a company's product portfolio stacks up? The BCG Matrix is your essential guide, categorizing products into Stars, Cash Cows, Dogs, and Question Marks. Understanding these quadrants is crucial for effective resource allocation and strategic growth. This preview offers a glimpse into that powerful framework.

Ready to unlock actionable insights? Purchase the full BCG Matrix to gain a comprehensive breakdown of each product's position, complete with data-backed recommendations for investment and divestment. Don't just understand the theory; implement it for real-world business impact.

Stars

Catapult's Vector series, spearheaded by the recent Vector 8 launch, stands as their flagship athlete monitoring system, commanding a significant market share in elite professional sports. These devices are indispensable for delivering real-time performance metrics, vital for fine-tuning training regimens and mitigating injury threats across top-tier global sports leagues.

The company's dedication to ongoing innovation, exemplified by advancements like AI-driven analytics and enriched live data experiences, firmly positions them as leaders in the expanding sports technology sector. This commitment ensures their offerings remain highly competitive and relevant in a rapidly evolving market.

Catapult's Pro Video Suite, which includes Focus, Hub, and MatchTracker, is a standout performer in their product lineup. Its recent enhancements, designed to simplify how teams work and better incorporate data from wearable devices, have fueled its growth.

The suite is experiencing robust uptake, particularly within the American football sector. This surge is partly due to new exclusive agreements and collaborations, such as the one with UEFA for Euro 2024. These partnerships highlight Catapult's successful penetration into a dynamic and expanding area of sports analytics.

Catapult's commitment to integrating AI and machine learning into its sports analytics platforms is a significant driver of its 'Star' status. These technologies offer prescriptive analytics, guiding coaches and athletes with real-time, actionable recommendations for training and performance optimization.

This advanced capability directly addresses the high-growth demand for AI in sports, providing a competitive edge. For instance, Catapult's solutions can analyze vast datasets to predict injury risk or identify subtle biomechanical inefficiencies, leading to more informed and effective decision-making for elite teams.

The enhanced value proposition is clear: deeper insights translate to better performance outcomes. In 2024, Catapult reported continued strong adoption of its AI-powered features, with clients experiencing measurable improvements in athlete load management and tactical planning, underscoring its position as an industry leader.

Strategic Partnerships with Major Leagues/Teams

Catapult's strategic partnerships with major sports leagues and teams are a cornerstone of its market dominance, fitting squarely into the Stars quadrant of the BCG Matrix. These exclusive, multi-year agreements, such as those with the SEC for NCAA football and Rugby Football Union, Rugby Premiership, Premiership Women's Rugby, and UEFA, are crucial. They ensure widespread adoption of Catapult's advanced athlete management technology across lucrative and expanding professional sports ecosystems.

These deep-rooted alliances translate directly into robust, recurring revenue streams. For instance, in 2023, Catapult reported that over 90% of professional football teams in the top European leagues utilized their solutions, highlighting the penetration achieved through these partnerships. Such widespread integration solidifies Catapult's position as the undisputed industry standard, fostering loyalty and creating high switching costs for competitors.

The benefits of these strategic alliances are multifaceted:

- Market Penetration: Exclusive deals grant Catapult access to a significant portion of the professional sports market, ensuring a large and consistent customer base.

- Revenue Growth: Long-term contracts with top-tier organizations provide predictable and growing recurring revenue, a key characteristic of Stars.

- Brand Authority: Association with elite leagues and teams enhances Catapult's brand reputation and perceived value, attracting new customers.

- Technological Advancement: Close collaboration with these partners often drives innovation, keeping Catapult's technology at the forefront of the industry.

SaaS-Based Revenue Model for Elite Clients

Catapult's Software-as-a-Service (SaaS) revenue model is a cornerstone of its success, particularly with its elite client base. This model ensures a steady stream of predictable, high-margin recurring revenue, a hallmark of a Star in the BCG matrix. The company's commitment to this strategy is evident, with over 70% of its revenue derived from recurring sources in FY23.

The strong recurring revenue base signifies deep client integration and sustained demand for Catapult's professional team solutions. This embeddedness translates into significant growth, with a reported 19% increase in revenue for FY25, underscoring its position as a market leader.

- Predictable Revenue: Over 70% of Catapult's revenue was recurring in FY23, providing stability.

- High Margins: The SaaS model for elite clients inherently supports high-margin generation.

- Growth Trajectory: A 19% revenue increase in FY25 highlights strong market performance.

- Client Embeddedness: Solutions are deeply integrated into professional team workflows, ensuring client retention.

Catapult's status as a Star in the BCG Matrix is firmly established by its market leadership in elite athlete monitoring and its robust revenue model. The company's Vector series and Pro Video Suite are highly sought after, driven by continuous innovation like AI integration. Strategic partnerships with major sports organizations further solidify its dominant market position and recurring revenue streams.

The company's focus on AI and machine learning provides prescriptive analytics, directly addressing the growing demand for advanced sports technology. This capability allows for real-time, actionable insights, improving athlete performance and injury prevention, which is crucial for elite teams. In 2024, Catapult saw significant client adoption of these AI features, leading to measurable improvements in load management and tactical planning.

Catapult's SaaS revenue model, with over 70% of its income recurring as of FY23, provides financial stability and predictability. This recurring revenue, coupled with a reported 19% revenue increase in FY25, highlights the company's strong growth trajectory and its deeply embedded position within professional sports teams.

| Metric | Value | Year | Significance |

|---|---|---|---|

| Recurring Revenue Percentage | Over 70% | FY23 | Indicates stable, predictable income |

| Revenue Growth | 19% | FY25 | Demonstrates strong market expansion |

| Professional Football Team Penetration (Top European Leagues) | Over 90% | 2023 | Highlights market dominance and client integration |

What is included in the product

Strategic guidance for managing a portfolio by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

A visual roadmap for strategic investment, the Catapult BCG Matrix eliminates the pain of resource allocation uncertainty.

Cash Cows

Catapult's older vector models represent established cash cows. These wearable devices, despite being older generations, maintain a strong presence and high market share within professional sports teams, a testament to their enduring reliability and performance.

Their consistent cash flow is driven by widespread adoption and recurring subscription revenue from the essential software that supports them. This predictable income stream means they require considerably less promotional investment than newer, more innovative products in Catapult's portfolio.

As of 2024, the installed base of these older vector models continues to provide a stable revenue foundation for Catapult, underscoring their importance in the company's overall financial strategy.

Catapult's basic athlete monitoring software solutions, which are bundled with their wearable technology, function as a cash cow within the BCG matrix. These foundational tools are crucial for collecting, storing, and generating fundamental reports on athlete performance data.

Thousands of sports teams worldwide rely on this integrated software for their daily operational needs, ensuring a consistent and stable revenue stream with predictable, albeit low, growth. This reliability makes these solutions a vital component of Catapult's financial stability.

Catapult's deeply entrenched presence within traditional, established sports like football, rugby, and American football forms a significant cash cow. Their expansive network, boasting over 4,600 elite teams across more than 100 nations, highlights a dominant market position in these mature sectors.

These enduring client relationships, cultivated over many years, translate into exceptional customer loyalty and predictable revenue streams. The company achieved a remarkable 96.5% Annual Contract Value (ACV) retention rate in Fiscal Year 2024, underscoring the stability and low churn associated with this segment.

The consistent demand for Catapult's performance and athlete management solutions from these well-established sports leagues and teams provides a solid foundation for ongoing profitability. This reliable revenue generation allows Catapult to fund investments in other areas of its business, a hallmark of a strong cash cow.

Basic Video Analysis and Tagging Tools (Legacy)

Certain foundational video analysis and tagging tools within Catapult's offerings, particularly those that have been integral to team workflows for years, function as cash cows. These established solutions, while not necessarily introducing novel features, are critical for day-to-day tactical evaluations and generate predictable income via recurring subscriptions. Their reliability makes them a stable revenue stream, even if their growth potential is limited.

- Consistent Revenue: These tools represent a mature product line with a stable customer base, ensuring a predictable revenue stream for Catapult. For example, as of Q1 2024, Catapult’s subscription-based revenue from its established analytics platforms, which include these foundational video tools, continued to show steady growth, contributing significantly to overall earnings.

- Indispensable for Routine Analysis: Teams rely on these tools for fundamental tasks like player tracking, event tagging, and basic video playback, making them essential rather than discretionary purchases.

- Long-Term Contracts: The sticky nature of these tools, embedded in team workflows, often leads to multi-year contracts, providing revenue visibility.

- Lower R&D Investment: Compared to cutting-edge technologies, these legacy tools typically require less ongoing research and development, leading to higher profit margins.

Data Licensing and Professional Services

Catapult's media licensing and professional services represent a classic cash cow within its business portfolio. This segment capitalizes on the extensive athlete performance data Catapult has meticulously gathered. By licensing this valuable data to media outlets, betting companies, and other sports-related businesses, Catapult generates consistent revenue streams.

The professional services component further solidifies its cash cow status. Catapult leverages its deep expertise in sports science and analytics to offer consulting services to teams and federations. This allows them to monetize their knowledge and insights, providing tailored solutions that enhance athlete performance and strategic decision-making. This segment requires minimal incremental investment as it utilizes existing infrastructure and intellectual capital.

The market for sports data and analytics is mature and stable, with a consistent demand for reliable performance metrics. In 2023, the global sports analytics market was valued at approximately $2.1 billion and is projected to grow steadily. Catapult's established presence and comprehensive dataset give it a significant advantage in this established market.

- Revenue Generation: Licensing athlete performance data provides a steady income stream with high-profit margins.

- Low Investment: Leverages existing data infrastructure and expertise, minimizing the need for new capital expenditure.

- Mature Market: Operates in a stable and established market with consistent demand for sports analytics.

- Expertise Monetization: Professional services allow Catapult to profit from its specialized knowledge and analytical capabilities.

Catapult's established wearable devices, like the older Vector models, are prime examples of cash cows. These products have a substantial market share in professional sports, demonstrating their enduring value and reliability. Their consistent revenue is boosted by widespread adoption and recurring subscription fees for essential software, requiring less marketing spend than newer innovations.

In 2024, the installed base of these older Vector models continues to be a bedrock of Catapult's revenue, underlining their strategic financial importance. These stable income streams fund growth in other areas, a classic characteristic of cash cow products in a portfolio.

| Product Segment | Market Position | Revenue Driver | Investment Needs | FY2024 Data Point |

|---|---|---|---|---|

| Older Vector Wearables | High Market Share, Mature | Subscription Revenue, Installed Base | Low (Maintenance) | Stable Revenue Foundation |

| Basic Athlete Monitoring Software | Essential, Widely Adopted | Recurring Subscriptions | Low | Consistent, Predictable Income |

| Foundational Video Analysis Tools | Integral to Workflows | Recurring Subscriptions | Low (Minimal R&D) | High Profit Margins |

| Media Licensing & Professional Services | Mature Market, Data Monetization | Licensing Fees, Consulting Revenue | Minimal (Leverages Existing Assets) | 96.5% ACV Retention (Overall) |

What You See Is What You Get

Catapult BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This comprehensive tool, designed for strategic analysis, contains no watermarks or demo content, ensuring you get a professional and ready-to-use resource for your business planning needs. You can confidently proceed with your purchase, knowing you'll receive the complete, analysis-ready BCG Matrix for immediate application in your strategic decision-making.

Dogs

Discontinued or technologically obsolete hardware models from Catapult would likely be classified as Dogs in the BCG Matrix. These products, while potentially still supported for a select, legacy client base, typically exhibit a low market share within a rapidly declining market. For instance, if Catapult had a sports analytics device released in the early 2010s that is no longer actively developed or marketed, it would fit this category.

These legacy hardware offerings often represent a drain on resources, requiring continued investment in maintenance and support without generating substantial revenue or future growth potential. In 2024, companies often face this challenge with older software-dependent hardware, where the cost of keeping it operational outweighs the perceived value. The focus shifts to migrating clients to newer, more advanced solutions.

Niche or underperforming sport-specific offerings within Catapult's portfolio can be categorized as dogs. These are typically products designed for sports where Catapult hasn't secured substantial market share or where the market itself is experiencing very slow growth. For example, if Catapult invested heavily in a performance tracking solution for a less popular sport like competitive rowing, and adoption has remained minimal beyond a few early test programs, it would likely fall into this category.

These "dog" segments often represent areas where initial investments have not yielded significant returns. Despite the potential for specialized solutions, the lack of widespread adoption means these offerings contribute little to overall revenue and profitability. In 2024, such segments might include specialized wearable technology for niche collegiate sports where budgets are constrained, or advanced analytics platforms for sports with limited professional leagues and thus a smaller addressable market.

If Catapult’s product offerings for the low-tier amateur or youth sports market have seen limited adoption, they would be classified as Dogs within the BCG matrix. Despite the overall growth in youth sports participation, a low market share in this segment indicates a need for significant, likely unprofitable, investment to gain traction against established competitors.

For instance, if Catapult's basic wearable trackers for young athletes, priced below their premium offerings, have only captured a minimal 2% share of the estimated $500 million youth sports technology market by early 2024, this clearly signals a Dog status. Such products would require substantial marketing and product development to even approach breakeven, diverting resources from more promising growth areas.

One-Off Hardware Sales without SaaS Attachment

One-off hardware sales without a SaaS attachment can indeed be classified as Dogs in the Catapult BCG Matrix. This occurs when Catapult sells hardware units, particularly older models, to customers who don't commit to ongoing software subscriptions. This business model struggles with generating predictable recurring revenue and achieving the high-profit margins associated with their preferred SaaS offerings, thus hindering sustainable growth and profitability.

These hardware-only transactions represent a less attractive segment because they lack the sticky customer relationships and predictable income streams that SaaS provides. Without the recurring revenue, the long-term value of these customer relationships is significantly diminished, making them a drain on resources compared to more profitable SaaS-based ventures.

Consider the implications for a company like Catapult (hypothetically, as specific company data for 2024 isn't publicly available for this exact scenario). If, for instance, 20% of their hardware sales in 2024 were one-off transactions without SaaS, and these contributed only 5% to their overall revenue while requiring 15% of their customer support resources, this would clearly indicate a Dog category. This highlights the inefficient allocation of resources.

- Low Market Share: One-off hardware sales typically capture a smaller, less engaged portion of the market compared to bundled SaaS solutions.

- Low Growth Prospects: Without recurring revenue, the potential for future growth from these customers is minimal.

- Profitability Concerns: The profit margins on standalone hardware are generally lower than those from SaaS subscriptions, impacting overall financial health.

- Resource Drain: Supporting these customers can consume valuable resources that could be better allocated to high-growth SaaS products.

Non-Core, Non-Integrated Standalone Software Tools

Non-core, non-integrated standalone software tools within Catapult's portfolio, if they exhibit low market share and minimal growth potential, are categorized as Dogs. These could represent older software acquired by Catapult or new ventures that haven't yet established a solid market position or clear synergy with the company's primary products.

For instance, imagine a legacy CRM tool Catapult acquired in 2020 that has seen a decline in active users by 15% annually since 2022, with its market share now standing at a mere 0.5%. Such a tool, lacking integration with Catapult's flagship analytics suite, would likely be a prime candidate for the Dog quadrant.

- Low Market Share: If a standalone tool captures less than 1% of its addressable market, it often signals limited customer adoption.

- Stagnant or Declining Growth: A year-over-year revenue growth rate below 2% for such tools indicates a lack of market traction.

- Limited Strategic Fit: Tools that do not contribute to or detract from Catapult's core business objectives are prime candidates for divestment or discontinuation.

- High Maintenance Costs: If the cost to maintain a standalone tool exceeds its revenue generation, it further solidifies its Dog status.

Products or services that have a very small slice of their market and aren't expected to grow much are considered Dogs. Think of older technology that few people are buying anymore, or specialized tools for very niche markets that haven't taken off. These often require more money to keep going than they bring in. For example, if Catapult had a specific data analysis tool for a sport with a tiny global following, and its market share remained below 1% throughout 2024, it would be a Dog.

These types of offerings, while potentially serving a small group, tend to be resource drains. Companies often look to phase them out or find ways to minimize the costs associated with them. In 2024, many businesses are assessing their portfolios for such underperformers. For instance, a company might find that a particular software module, representing only 0.2% of its total revenue in 2024 and costing 1.5% of its R&D budget for maintenance, fits the Dog profile.

Consider a scenario where Catapult offered a basic video analysis tool for amateur cycling clubs in 2024. If this tool only captured 0.5% of the estimated $20 million amateur cycling tech market and had a declining user base, it would be a clear Dog. This would mean it's not generating significant revenue and has little prospect for future growth.

These products often require more investment in customer support and maintenance than they generate in sales. Their low market share and lack of growth potential mean they don't contribute meaningfully to the company's overall financial health. In 2024, many businesses are actively trying to divest or discontinue such assets to focus on more profitable ventures.

Question Marks

Catapult's strategic push into emerging geographic markets, particularly those with nascent sports technology adoption, positions these regions as question marks within its growth matrix. These areas, while presenting substantial long-term growth prospects, currently represent a low market share for Catapult, necessitating considerable investment.

Significant capital will be directed towards establishing local partnerships and building the necessary infrastructure to cultivate a presence. The objective is to effectively transition these markets from question marks to stars, mirroring the success seen in more developed territories, potentially unlocking new revenue streams.

For instance, by 2024, the global sports technology market was projected to reach over $40 billion, with emerging markets expected to contribute a growing percentage of this figure. Catapult's expansion strategy aims to capitalize on this trend, although the initial return on investment in these nascent markets may be slower.

Advanced AI-powered predictive analytics for injury prevention represent a significant question mark within the Catapult BCG matrix. While the potential for these sophisticated models to forecast and mitigate injuries is immense, their current market penetration and widespread adoption are still developing.

These solutions offer a compelling value proposition, promising substantial cost savings and performance improvements by proactively identifying at-risk athletes or employees. However, their nascent stage means substantial investment in research and development is ongoing, with many platforms still undergoing rigorous validation and refinement.

The market education required for these advanced AI tools is also a key factor. Organizations need to understand the capabilities and limitations, necessitating a significant effort to build trust and demonstrate efficacy. This educational hurdle, coupled with the R&D investment, positions these technologies as high-potential but not yet dominant players.

For instance, while specific market share data for highly advanced, yet-to-be-proven AI injury prediction models is scarce, the broader sports analytics market is projected to reach over $6 billion by 2027. This growth indicates a strong underlying demand that these advanced AI solutions are poised to tap into, provided they can overcome their current question mark status through continued innovation and market outreach.

Catapult's foray into Virtual Reality (VR) for athlete training represents a significant question mark on its BCG matrix. While the sports technology market for VR is projected for substantial growth, with industry analysts predicting it could reach billions by 2027, its current adoption by Catapult is minimal.

This strategic area demands considerable upfront investment in research and development to create effective VR training modules and hardware. Catapult must navigate the high costs associated with VR technology and content creation to establish a strong market presence in this nascent but promising sector.

Targeting Broader 'Prosumer' or Athlete-Direct Market

Catapult's expansion into the 'prosumer' or athlete-direct market presents a potential question mark within its BCG matrix. This segment, comprising serious amateur athletes, offers substantial growth opportunities, but Catapult likely faces a lower market share compared to established consumer wearable brands.

Successfully capturing this market will necessitate a distinct go-to-market strategy, likely involving increased marketing expenditure. For instance, the global sports wearable market was valued at approximately $35.1 billion in 2023 and is projected to reach $100.2 billion by 2030, indicating significant untapped potential.

- Market Opportunity: The 'prosumer' segment represents a large and growing market, with amateur athletes increasingly seeking advanced performance tracking tools.

- Competitive Landscape: Catapult faces intense competition from consumer-focused wearable companies that often have broader brand recognition and lower price points.

- Strategic Shift: Targeting prosumers requires a different approach than serving elite teams, demanding new marketing channels and potentially product adaptations.

- Investment Needs: A successful penetration into this market will likely require significant investment in marketing, sales infrastructure, and potentially R&D to cater to this audience.

New Sport-Specific Solutions (e.g., for niche but growing sports)

Catapult's exploration into new sport-specific solutions for niche but growing sports falls squarely into the question mark category of the BCG matrix. These ventures, targeting markets like esports or women's professional lacrosse where Catapult's current market share is minimal, represent significant potential upside. For instance, the global esports market was projected to reach over $2.1 billion in 2024, showcasing a rapidly expanding revenue stream.

The success of these specialized offerings hinges on two critical factors: the continued substantial growth of these niche sports and Catapult's ability to secure early market leadership. If these sports achieve widespread adoption and Catapult can effectively capture a dominant position, these question marks could indeed transition into stars, generating substantial future revenue. However, the inherent risks are considerable, demanding focused investment and strategic execution to overcome established competitors or build brand awareness from the ground up.

- Targeting High-Growth Niche Sports: Focus on sports experiencing rapid expansion, like pickleball, which saw a 300% growth in participation in the US between 2019 and 2022.

- Developing Specialized Solutions: Create tailored performance tracking and analysis tools that address the unique demands of these emerging sports.

- Strategic Investment and Risk Mitigation: Allocate resources judiciously, acknowledging the uncertainty and potential for low returns if market growth falters or competitive barriers prove too high.

- Establishing Early Market Dominance: Aim to become the go-to technology provider in these nascent markets to capitalize on future growth trajectories.

Emerging geographic markets represent a key question mark for Catapult. While these regions offer substantial long-term growth potential, Catapult currently holds a low market share, requiring significant investment to build infrastructure and partnerships. The aim is to transform these markets into stars, mirroring successes in more developed territories.

Advanced AI-powered predictive analytics for injury prevention is another question mark. These sophisticated models have immense potential to forecast and mitigate injuries, but their market penetration and adoption are still developing, necessitating ongoing R&D investment and market education.

Catapult's investment in Virtual Reality (VR) for athlete training also falls into the question mark category. Despite the sports VR market's projected substantial growth, Catapult's current adoption is minimal, requiring significant upfront investment in R&D for effective VR modules and hardware.

The prosumer or athlete-direct market is a potential question mark for Catapult. This segment of serious amateur athletes presents significant growth opportunities, but Catapult faces intense competition from established consumer wearable brands and will need a distinct go-to-market strategy.

New sport-specific solutions for niche markets, such as esports, are also question marks. The success of these specialized offerings depends on the continued growth of these niche sports and Catapult's ability to secure early market leadership, demanding focused investment and strategic execution.

| Category | Market Share | Market Growth | Investment Required | Potential |

|---|---|---|---|---|

| Emerging Geographic Markets | Low | High | High | Star (Long-term) |

| Advanced AI Injury Prediction | Developing | High | High | Star (Long-term) |

| Virtual Reality (VR) Training | Minimal | High | High | Star (Long-term) |

| Prosumer Market | Low | High | High | Star (Long-term) |

| Niche Sport Solutions | Minimal | High | High | Star (Long-term) |

BCG Matrix Data Sources

Our BCG Matrix is informed by a blend of internal financial data, encompassing sales figures and profitability, alongside external market research reports and competitor analysis to provide a comprehensive view.