Carlsberg Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlsberg Bundle

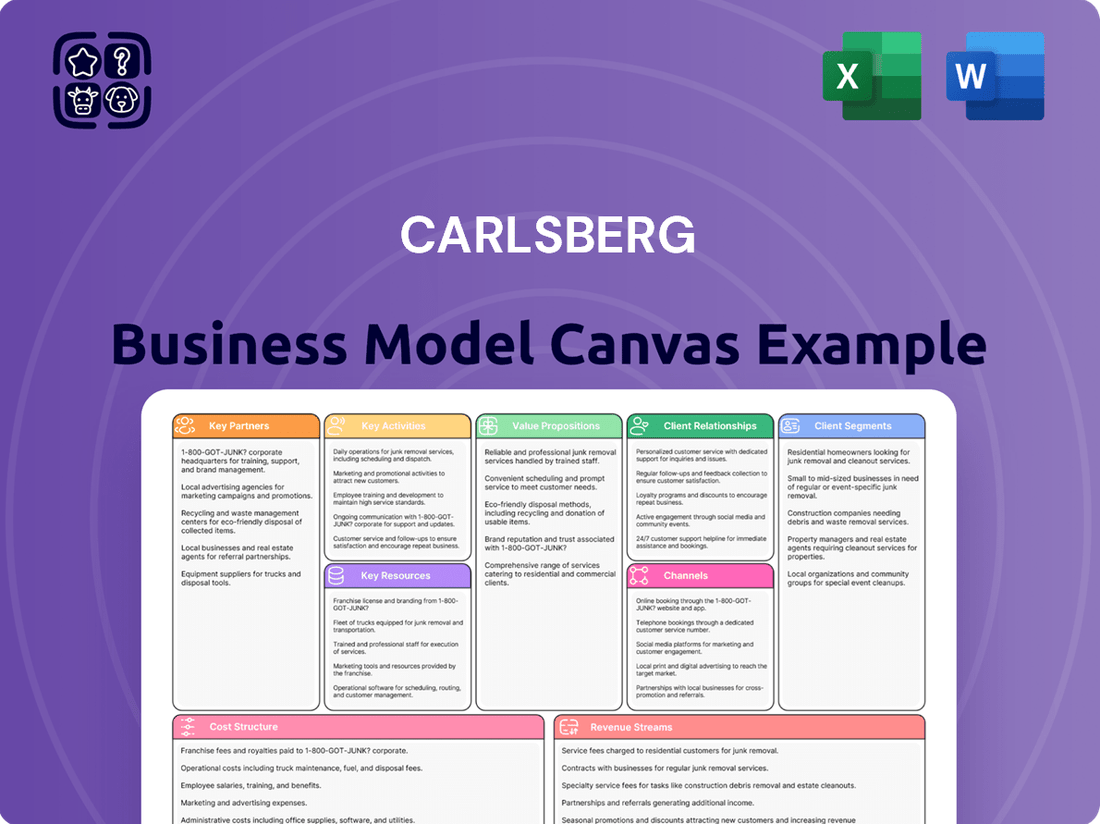

Unlock the strategic blueprint of Carlsberg's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, build partnerships, and generate revenue in the competitive beverage industry. Download the full version to gain actionable insights for your own business strategy.

Partnerships

Carlsberg cultivates strategic alliances with other beverage giants, notably expanding its global partnership with PepsiCo. This collaboration, set to cover bottling franchises in Kazakhstan and Kyrgyzstan from 2026, allows Carlsberg to diversify its offerings beyond beer into soft drinks and other non-alcoholic options, thereby boosting its market reach and realizing supply chain efficiencies.

The acquisition of Britvic plc in the UK is another significant move, positioning Carlsberg as a major multi-beverage supplier. This strengthens its competitive edge by offering a wider range of products to consumers and retailers alike, creating a more robust and diversified business model.

Carlsberg’s distribution and retail partners are the backbone of its market reach. They collaborate with numerous local distributors, ensuring their beverages are available across a vast network of establishments. This includes everything from cozy pubs and restaurants to major supermarket chains.

These partnerships are vital for Carlsberg to achieve broad market penetration. In 2024, Carlsberg continued to leverage its extensive network of over 100,000 retail outlets across its key markets, a testament to the strength of these relationships.

Carlsberg collaborates with logistics and transport providers, like Einride in Sweden, to electrify its fleet, a move critical for achieving its ambitious sustainability targets. This partnership directly supports the reduction of carbon emissions throughout Carlsberg's extensive supply chain.

These strategic alliances are fundamental for optimizing delivery routes and ensuring consistent, timely product distribution. By working with specialized transport companies, Carlsberg aims to minimize its environmental footprint while enhancing operational efficiency.

Raw Material Suppliers (e.g., Barley, Hops, Water)

Carlsberg actively cultivates strong relationships with its raw material suppliers, including those providing barley, hops, and water. These partnerships are fundamental to guaranteeing the consistent quality and sustainable procurement of essential brewing ingredients. For instance, Carlsberg's commitment to reducing its environmental impact is evident in its collaborations on regenerative agriculture pilot projects, aiming to lessen the ecological footprint of its farming practices.

Water stewardship is another area where Carlsberg emphasizes strategic partnerships. The company engages with various entities to implement water replenishment initiatives, particularly in breweries situated in water-stressed regions. This proactive approach ensures responsible water management throughout its operations. In 2023, Carlsberg continued to expand its regenerative agriculture programs, with over 70% of its barley sourced from Western Europe now covered by sustainability programs, a significant increase from previous years.

These key partnerships are vital for Carlsberg's business model, ensuring supply chain resilience and supporting its ambitious sustainability goals. The focus on regenerative agriculture and water stewardship not only mitigates risks but also enhances brand reputation and aligns with growing consumer demand for environmentally conscious products.

- Supplier Collaboration: Partnerships with barley and hop growers are crucial for quality control and innovation in ingredient sourcing.

- Regenerative Agriculture: Carlsberg is investing in pilot projects with farmers to promote soil health and reduce environmental impact, with a goal to have 100% of its barley sourced sustainably by 2030.

- Water Replenishment: Collaborations with local communities and water management organizations are in place to ensure breweries operate with a net positive water impact in high-risk areas.

Industry-Wide Sustainability Collaborations

Carlsberg actively participates in industry-wide collaborations focused on enhancing packaging sustainability and recycling infrastructure. These partnerships are crucial for developing and implementing efficient deposit return schemes and improving overall recycling capabilities for beverage containers.

By working with peers and stakeholders, Carlsberg aims to boost collection and recycling rates for its bottles and cans. For instance, in 2024, the company continued its efforts with initiatives like the Carlsberg Circular Community, which aims to increase the use of recycled materials in its packaging.

- Industry Coalitions: Engaging in groups like the Global Beverage Packaging Coalition to share best practices and drive collective action on recycling targets.

- Deposit Return Schemes: Collaborating with governments and industry partners to optimize and expand deposit return systems, aiming for over 90% collection rates in key markets by 2030.

- Recycling Infrastructure Investment: Jointly investing in advanced recycling technologies and infrastructure to ensure higher quality recyclates and a more robust circular economy for packaging.

- Circular Economy Goals: These partnerships directly support Carlsberg's ambition to achieve zero packaging waste and a fully circular approach to its packaging materials.

Carlsberg's key partnerships extend to raw material suppliers, focusing on quality and sustainability. For example, in 2023, over 70% of its barley sourced from Western Europe was covered by sustainability programs, aiming for 100% by 2030. This commitment is also seen in water stewardship initiatives, with collaborations ensuring net positive water impact in water-stressed regions.

The company also partners with logistics providers like Einride in Sweden to electrify its fleet, crucial for its sustainability targets. These alliances optimize delivery and reduce environmental impact. Furthermore, Carlsberg collaborates with industry peers on packaging sustainability, aiming to increase the use of recycled materials, as seen in its Carlsberg Circular Community initiatives in 2024.

Strategic alliances with other beverage giants, such as the expanded bottling franchise partnership with PepsiCo in Kazakhstan and Kyrgyzstan from 2026, diversify Carlsberg's portfolio and enhance market reach. The acquisition of Britvic plc further solidifies its position as a multi-beverage supplier, strengthening its competitive edge.

What is included in the product

A strategic framework detailing Carlsberg's approach to brewing and distributing its diverse portfolio of beers and beverages, focusing on key partners, core activities, and revenue streams.

This model outlines Carlsberg's customer relationships and channels to market, emphasizing its value propositions centered on quality, innovation, and brand heritage.

Provides a structured framework to identify and address inefficiencies, streamlining complex operations for better decision-making.

Simplifies the strategic overview of Carlsberg's operations, allowing for rapid identification of areas needing improvement and potential cost savings.

Activities

Carlsberg's core activity is the brewing and production of a diverse portfolio of beverages. This includes well-known international brands such as Carlsberg and Tuborg, alongside a growing selection of local and craft beers, and non-alcoholic options. The company manages the entire production chain, from securing high-quality raw materials like barley and hops to the final packaging stages.

The company's global manufacturing footprint is substantial, with numerous breweries strategically located across different regions. This extensive network allows Carlsberg to maintain consistent quality and operational efficiency in its production processes. In 2023, Carlsberg reported a total revenue of DKK 73.5 billion, with a significant portion driven by its brewing operations.

Carlsberg invests heavily in marketing and brand building to enhance its brand equity and connect with consumers worldwide. For instance, their 2024 marketing campaign is set to reach an impressive 120 markets, demonstrating a significant global commitment.

This ongoing investment in advertising and promotional activities is crucial for fostering consumer engagement and growing market share. These efforts aim to solidify Carlsberg's position in a competitive beverage landscape.

Carlsberg actively manages its vast sales and distribution network, a critical activity for reaching consumers. This involves optimizing how products get to market, whether it's through pubs and restaurants (on-trade) or supermarkets and convenience stores (off-trade). In 2024, the company continued to emphasize digital solutions to streamline sales processes and enhance its B2B e-commerce platforms, aiming for greater efficiency and customer accessibility.

Building and maintaining strong relationships with distributors and retailers is paramount to ensuring Carlsberg's brands are readily available to customers. These strategic partnerships are the backbone of their widespread market presence. The company's focus on digital transformation in sales execution aims to provide real-time data and insights, allowing for more agile responses to market demands.

Research and Development (R&D) and Innovation

Carlsberg's commitment to Research and Development (R&D) is primarily channeled through its dedicated Carlsberg Research Laboratory. This facility is the engine for advancements in brewing science, driving the creation of novel beer varieties, including popular alcohol-free and non-alcoholic options, to cater to shifting consumer tastes.

The company’s innovation efforts also extend to crucial sustainability initiatives. This includes the development of plant types that are more resilient to climate change and the exploration of advanced, environmentally friendly packaging solutions.

- Focus Areas: Brewing science, product innovation (new beer types, alcohol-free, non-alcoholic), and sustainability (climate-tolerant plants, packaging).

- Investment: Driven by the Carlsberg Research Laboratory.

- Strategic Importance: Essential for portfolio diversification and meeting evolving consumer preferences.

- 2024 Data Point: Carlsberg has been actively promoting its portfolio of low- and no-alcohol beers, with these products representing a growing segment of their sales, aiming to capture a larger share of the health-conscious market.

Supply Chain and Logistics Optimization

Carlsberg's key activities in supply chain and logistics optimization focus on streamlining operations for cost efficiency and product availability. This involves meticulous management of procurement, value engineering, and the standardization of raw and packaging materials to reduce complexity and waste.

Optimizing logistics is paramount, ensuring efficient transport and timely delivery across its vast distribution network. Carlsberg is actively investing in electrifying its transport fleet, a significant step towards reducing its carbon footprint. In 2023, the company reported that 30% of its delivery fleet was low-emission, with a goal to reach 100% by 2030.

- Procurement and Value Engineering: Standardizing materials and optimizing sourcing to lower costs.

- Logistics Optimization: Enhancing transport efficiency and delivery networks.

- Fleet Electrification: Transitioning to low-emission vehicles, with 30% of the fleet electrified by 2023.

- Carbon Footprint Reduction: Aligning logistics with sustainability goals through greener transport solutions.

Carlsberg's key activities revolve around its extensive brewing operations, encompassing product development, manufacturing, and robust marketing efforts. The company also manages a sophisticated sales and distribution network, ensuring its diverse beverage portfolio reaches consumers efficiently. Furthermore, significant investment in research and development drives innovation in both product offerings and sustainable practices.

These activities are supported by a focus on optimizing the supply chain and logistics, including fleet electrification and material standardization. In 2024, Carlsberg's marketing reach extended to 120 markets, underscoring its global brand-building focus. The company's commitment to sustainability is evident in its R&D efforts, such as developing climate-resilient plants and eco-friendly packaging.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Brewing & Production | Manufacturing a diverse beverage portfolio, from core brands to craft and non-alcoholic options. | Total revenue DKK 73.5 billion in 2023. |

| Sales & Distribution | Managing global on-trade and off-trade channels, emphasizing digital B2B platforms. | Continued emphasis on digital solutions for sales processes in 2024. |

| Marketing & Brand Building | Enhancing brand equity and consumer engagement through global campaigns. | 2024 marketing campaigns targeting 120 markets. |

| Research & Development | Innovating brewing science, product varieties (incl. low/no alcohol), and sustainability. | Active promotion of low- and no-alcohol beers in 2024. |

| Supply Chain & Logistics | Optimizing procurement, logistics, and fleet electrification for efficiency and sustainability. | 30% of delivery fleet low-emission in 2023, aiming for 100% by 2030. |

Full Version Awaits

Business Model Canvas

This preview showcases the exact Carlsberg Business Model Canvas you will receive upon purchase. It's a direct, unedited view of the comprehensive document, demonstrating its structure and content. Once your order is complete, you'll gain full access to this identical file, ready for your strategic analysis and planning.

Resources

Carlsberg's global brand portfolio, featuring powerhouses like Carlsberg, Tuborg, and 1664 Blanc, alongside the popular Somersby cider, is a cornerstone of its business. This diverse collection of international and local brands, including a growing number of craft offerings, acts as a significant intangible asset, driving recognition and loyalty.

In 2023, Carlsberg reported that its premium brands, which include many of these key international names, continued to perform strongly, contributing to a healthy revenue stream. The company's strategic focus on these established brands allows for premium pricing and sustained market share in competitive beverage landscapes.

Carlsberg's extensive physical assets include a vast network of over 70 breweries and production facilities strategically located across numerous global regions. This robust infrastructure is fundamental to their ability to manufacture and distribute a wide array of beverages at scale.

These facilities are equipped for comprehensive production processes, encompassing brewing, bottling, and packaging, which are essential for maintaining a consistent supply chain. In 2024, Carlsberg continued to invest in optimizing these sites to enhance efficiency and product quality across its portfolio.

Carlsberg's intellectual property, encompassing unique brewing recipes and proprietary processes, is a cornerstone of its business. This IP, protected by patents, allows for distinct product differentiation in a crowded market. The company's commitment to innovation is evident in its continuous development of new beer varieties and brewing techniques.

The Carlsberg Research Laboratory, established in 1875, is a testament to the company's dedication to brewing science and expertise. This deep knowledge base fuels ongoing product innovation and quality assurance, providing a significant competitive advantage. In 2023, Carlsberg continued to invest in R&D, focusing on sustainable brewing practices and novel flavor profiles.

Human Capital and Talent

Carlsberg's workforce, exceeding 30,000 individuals worldwide, is a cornerstone of its operations. This diverse talent pool includes skilled brewers, innovative scientists, strategic marketing professionals, and dedicated sales teams.

The collective expertise, experience, and dedication of these employees are fundamental to Carlsberg's ability to implement its strategic vision, foster innovation, and ensure consistent operational quality. Their commitment directly impacts the company's success in the competitive beverage market.

- Global Workforce: Over 30,000 employees across various functions.

- Key Roles: Brewers, scientists, marketing, and sales professionals.

- Strategic Importance: Essential for strategy execution, innovation, and operational excellence.

- Talent Value: Skills, experience, and commitment drive business performance.

Robust Distribution Network and Logistics Capabilities

Carlsberg's robust distribution network is a cornerstone of its operations, leveraging extensive logistics infrastructure, dedicated warehousing, and a diverse transportation fleet. This physical resource is critical for ensuring timely and efficient product delivery to both on-trade (bars, restaurants) and off-trade (retail stores) channels across its global markets.

In 2023, Carlsberg's supply chain operations were a significant focus, with investments aimed at enhancing efficiency and sustainability. The company's ability to reach millions of consumers relies heavily on this intricate network, which manages the movement of its beverage portfolio from production to point of sale.

- Extensive Reach: Carlsberg's network allows it to serve a vast number of retail and hospitality outlets, a key enabler of its market penetration.

- Logistical Efficiency: Investments in warehousing and transportation aim to optimize delivery routes and reduce costs, directly impacting profitability.

- Fleet Management: The company operates a significant fleet, crucial for maintaining product freshness and availability, particularly for perishable goods like beer.

- Channel Support: This network is designed to cater to the specific needs of different sales channels, ensuring product is available where and when consumers want it.

Carlsberg's key resources are multifaceted, encompassing its strong brand portfolio, extensive production facilities, valuable intellectual property, and a dedicated global workforce. These assets are crucial for maintaining its market position and driving future growth.

The company’s brand equity, built over decades, allows for premium pricing and consumer loyalty, a vital intangible asset. In 2023, Carlsberg continued to leverage its portfolio, with premium brands showing robust performance, contributing significantly to revenue.

Intellectual property, including proprietary brewing techniques and research from the Carlsberg Research Laboratory, provides a distinct competitive edge. This commitment to innovation ensures product quality and differentiation in the market.

Carlsberg's operational infrastructure, featuring over 70 breweries worldwide, ensures efficient production and distribution. In 2024, investments focused on optimizing these facilities for enhanced efficiency and sustainability.

| Resource Category | Description | 2023/2024 Data/Impact |

|---|---|---|

| Brand Portfolio | Power brands like Carlsberg, Tuborg, 1664 Blanc, Somersby | Premium brands drove strong revenue performance in 2023. |

| Physical Assets | Over 70 breweries and production facilities globally | Continued investment in 2024 to optimize efficiency and quality. |

| Intellectual Property | Unique brewing recipes, proprietary processes, R&D expertise | Carlsberg Research Laboratory (est. 1875) fuels innovation and quality assurance. |

| Human Capital | Global workforce exceeding 30,000 employees | Essential for strategy execution, innovation, and operational excellence. |

Value Propositions

Carlsberg’s commitment to a diverse portfolio is a cornerstone of its value proposition, offering consumers a wide array of high-quality alcoholic and non-alcoholic beverages. This variety spans premium lagers, popular local brews, and emerging craft beers, alongside a growing selection of alcohol-free alternatives and soft drinks. For instance, in 2023, Carlsberg's beer volumes saw a slight increase, demonstrating continued consumer demand for its core offerings.

The strategic acquisition of Britvic in July 2024 significantly bolstered Carlsberg's soft drinks segment, adding established brands like Robinsons and J2O to its portfolio. This move not only broadens consumer choice but also positions Carlsberg to capitalize on the expanding non-alcoholic beverage market, which is projected to see continued growth in the coming years.

Carlsberg's heritage, stretching back to 1847, is a cornerstone of its value proposition, fostering deep consumer trust through a long-standing reputation for quality and innovation. This historical foundation, coupled with its iconic 'Probably the best beer in the world' tagline, reinforces a reliable and enduring brand image that resonates with customers globally.

Carlsberg's 'Together Towards ZERO and Beyond' program is a cornerstone of its value proposition, demonstrating a deep commitment to environmental, social, and governance (ESG) principles. This initiative directly addresses growing consumer and investor demand for sustainable business practices.

The program focuses on tangible goals, including significant reductions in carbon emissions and water usage across its operations. For instance, Carlsberg aims for zero carbon emissions at its breweries by 2030, a target that is crucial for mitigating climate change and appeals to a broad range of stakeholders.

Furthermore, Carlsberg actively promotes responsible consumption and champions sustainable packaging solutions, such as exploring fiber-based bottles. These efforts not only reduce environmental impact but also enhance brand reputation and foster loyalty among increasingly eco-aware consumers, contributing to long-term brand value.

Global Accessibility and Local Relevance

Carlsberg's global reach, spanning over 150 brands in more than 140 markets, ensures wide product accessibility. This extensive distribution network means consumers worldwide can readily find Carlsberg products.

Crucially, Carlsberg balances this global presence with a commitment to local relevance. By nurturing strong local partnerships and acquiring regional breweries, the company offers a portfolio that resonates with diverse tastes and cultural preferences.

For example, in 2024, Carlsberg continued to emphasize its strategy of acquiring and integrating local breweries, a move that strengthens its foothold in specific markets and allows for tailored product offerings. This approach directly addresses varied consumer demands, ensuring both international appeal and deep local connection.

This dual focus on global accessibility and local relevance is a cornerstone of Carlsberg's business model, enabling it to effectively serve a broad customer base with a nuanced understanding of individual market needs.

Innovation in Product and Experience

Carlsberg's commitment to innovation shines through in its product development, notably the expansion of its alcohol-free beer portfolio. In 2024, the company continued to invest in this growing segment, aiming to capture a larger share of the health-conscious consumer market.

Beyond traditional beer, Carlsberg is actively exploring 'Beyond Beer' categories, diversifying its offerings to cater to evolving consumer preferences. This strategic move reflects a broader industry trend towards more varied beverage options.

- Product Innovation: Continued expansion of alcohol-free brews and 'Beyond Beer' categories.

- Consumer Experience: Enhanced through targeted marketing campaigns and experiential activations.

- Market Relevance: Focus on new offerings and engaging experiences maintains brand appeal.

- Growth Areas: Investment in alcohol-free and diversified beverage segments drives future growth.

Carlsberg's value proposition centers on offering a diverse, high-quality beverage portfolio, from premium lagers to alcohol-free options, catering to a wide range of consumer tastes. The acquisition of Britvic in July 2024 significantly expanded its non-alcoholic offerings, aligning with market growth trends.

Leveraging its rich heritage since 1847, Carlsberg builds consumer trust through consistent quality and iconic branding, reinforced by its 'Together Towards ZERO and Beyond' sustainability program. This ESG focus addresses growing demand for responsible business practices, with targets like zero carbon emissions at breweries by 2030.

The company ensures broad product accessibility through its global reach across 140 markets while maintaining local relevance by acquiring regional breweries and tailoring offerings to diverse tastes. This strategy, exemplified by continued local brewery integration in 2024, balances international appeal with deep market connections.

Carlsberg's innovation is evident in its growing alcohol-free beer segment and exploration of 'Beyond Beer' categories, reflecting evolving consumer preferences. This commitment to new offerings and engaging experiences, including targeted marketing, ensures continued market relevance and drives growth in key areas.

| Value Proposition Element | Description | Key Initiatives/Data |

|---|---|---|

| Diverse Beverage Portfolio | Wide array of alcoholic and non-alcoholic drinks. | Acquisition of Britvic (July 2024) expanded soft drinks. 2023 beer volumes saw a slight increase. |

| Heritage and Trust | Long-standing reputation for quality and innovation. | Founded in 1847, iconic 'Probably the best beer' tagline. |

| Sustainability (ESG) | Commitment to environmental and social responsibility. | 'Together Towards ZERO and Beyond' program. Aim for zero carbon emissions at breweries by 2030. Exploring fiber-based bottles. |

| Global Reach & Local Relevance | Accessibility in 140+ markets with tailored local offerings. | Continued acquisition of local breweries in 2024 to strengthen market presence. |

| Product Innovation | Expansion of alcohol-free and 'Beyond Beer' categories. | Increased investment in alcohol-free segment in 2024. |

Customer Relationships

Carlsberg actively cultivates customer connections through direct engagement, utilizing a blend of marketing efforts across social media, online video, and its e-commerce channels. This integrated approach ensures a consistent brand presence and facilitates immediate interaction with consumers.

The company is also strategically enhancing its B2B e-commerce initiatives. These programs are designed to fundamentally transform how Carlsberg interacts with and gains deeper insights into its business customers, aiming for more personalized and efficient relationships.

Carlsberg likely implements loyalty programs and promotions to foster customer retention and attract new patrons. These could include tiered rewards for frequent buyers or limited-time offers on popular brands, aiming to deepen consumer engagement. For instance, in 2023, the beer industry saw significant marketing spend on promotions to drive sales amidst evolving consumer preferences.

Carlsberg actively supports its on-trade and off-trade partners to drive sales and brand presence. This involves providing tailored customer service and efficient supply chain solutions, ensuring products are well-represented and readily available in venues like pubs and supermarkets.

Community and Sponsorship Engagement

Carlsberg actively fosters consumer relationships through community involvement and strategic sponsorships. A prime example is their enduring partnership with Liverpool FC, which resonates deeply with football enthusiasts, particularly in Asia, creating shared experiences and strengthening brand loyalty.

These initiatives go beyond simple brand visibility; they aim to forge genuine emotional connections. By associating with popular sports teams and community events, Carlsberg cultivates a sense of belonging and shared passion among its consumers, leading to increased brand affinity and repeat engagement.

- Community Initiatives: Carlsberg supports local communities through various programs, enhancing brand perception and goodwill.

- Sponsorships: Long-term partnerships, like the one with Liverpool FC, generate significant brand exposure and fan engagement, especially in key markets. In 2024, this partnership continued to be a cornerstone of their marketing efforts, driving sales and brand recall.

- Emotional Connection: By aligning with popular cultural events and sports, Carlsberg builds emotional bonds with consumers, fostering loyalty that translates into sustained business.

Customer Service and Feedback Mechanisms

Carlsberg actively engages customers through multiple service channels, offering avenues for inquiries, issue resolution, and idea submission. This commitment to customer interaction helps them understand and respond to evolving consumer preferences.

- Customer Support Channels: Carlsberg likely operates dedicated customer service lines, email support, and potentially social media engagement to address customer queries and concerns promptly.

- Feedback Collection: The company probably utilizes surveys, online feedback forms, and direct communication to gather valuable insights into customer satisfaction and areas for improvement.

- Issue Resolution: Efficient complaint handling and problem-solving are crucial for maintaining customer loyalty, with Carlsberg aiming to resolve issues effectively and promptly.

- Data-Driven Improvement: Feedback gathered is analyzed to inform product development, marketing strategies, and overall service enhancements, ensuring a customer-centric approach.

Carlsberg nurtures customer relationships through a multi-faceted approach, blending digital interaction with tangible community engagement. Their B2B e-commerce platforms are being refined for deeper business customer insights and personalized service.

The company leverages sponsorships, like its ongoing partnership with Liverpool FC, to build emotional connections and brand loyalty, particularly noted for its impact in Asian markets throughout 2024. They also invest in community initiatives to foster goodwill.

Carlsberg maintains open communication channels for customer support and feedback, using this input to drive service and product improvements. This focus on customer interaction is key to adapting to evolving market demands.

Carlsberg's customer relationship strategy emphasizes active engagement and support for both consumers and business partners. This includes digital outreach, loyalty programs, and dedicated support for on-trade and off-trade channels.

| Customer Relationship Aspect | Carlsberg's Approach | Impact/Data Point |

| Digital Engagement | Social media, online video, e-commerce channels | Consistent brand presence and direct consumer interaction. |

| B2B E-commerce | Enhancing platforms for business customers | Deeper insights and personalized interactions with business partners. |

| Loyalty & Promotions | Customer retention programs and offers | Aimed at increasing consumer engagement and repeat purchases. |

| Partnership Support | Tailored service for on-trade/off-trade partners | Ensuring product availability and brand representation in retail venues. |

| Sponsorships & Community | Liverpool FC partnership, local programs | Fostering emotional connections and brand affinity, with significant impact in Asia in 2024. |

Channels

Carlsberg's on-trade channels, encompassing bars, restaurants, and hotels, are vital for showcasing its brands and facilitating immediate consumption. These venues offer a social setting where consumers can experience Carlsberg products directly. In 2024, the on-trade sector continued to be a significant driver for beverage sales, with many establishments focusing on premium offerings and customer experience to boost revenue.

Carlsberg's business model heavily leans on off-trade channels, encompassing supermarkets, hypermarkets, convenience stores, and dedicated liquor stores. This strategy ensures broad retail accessibility, making their beverages readily available for consumers to purchase and enjoy at home, which is a substantial driver of their overall sales volume.

Carlsberg actively utilizes e-commerce platforms, both its proprietary B2B portals and collaborations with major online retailers, to directly connect with consumers. This strategic channel is crucial for enhancing convenience and expanding direct market access.

In 2024, the online alcohol sales market continued its upward trajectory, with e-commerce platforms playing a pivotal role in driving this growth. Carlsberg's investment in these channels positions it to capture a significant share of this expanding digital marketplace.

Wholesalers and Distributors

Carlsberg relies on a robust network of wholesalers and independent distributors to ensure its diverse beverage portfolio reaches consumers efficiently. These partners are crucial for navigating local market complexities and reaching a wide array of retail and on-trade establishments, from small convenience stores to large restaurant chains.

In 2024, Carlsberg's distribution strategy continued to emphasize strong relationships with these intermediaries. For instance, in key European markets, a significant portion of Carlsberg's sales volume is channeled through established wholesale networks that handle logistics, warehousing, and last-mile delivery. This model allows Carlsberg to maintain a broad market presence without the extensive capital investment required for direct distribution in every single location.

- Extensive Reach: Wholesalers and distributors enable Carlsberg to access a vast number of on-trade (bars, restaurants) and off-trade (retail stores) outlets, amplifying its market penetration.

- Logistical Efficiency: These partners manage the complexities of warehousing, transportation, and inventory management, reducing operational burdens for Carlsberg.

- Market Expertise: Local distributors often possess deep knowledge of regional consumer preferences and regulatory landscapes, facilitating tailored market strategies.

- Sales Volume Contribution: In 2023, for example, the company reported that over 70% of its total sales volume in certain Western European markets was managed through its distributor network.

Direct Sales and Licensing

Direct sales and licensing are crucial channels for Carlsberg's global reach and revenue. In certain markets, Carlsberg utilizes direct sales, targeting large commercial accounts or operating its own managed retail locations to maintain brand control and capture full value. This approach allows for a more tailored customer experience and direct feedback.

Licensing is another key strategy, enabling Carlsberg to extend its brand presence into new territories and product categories without the significant capital investment of establishing full brewing operations. This is particularly effective in regions where local partnerships can navigate regulatory landscapes and consumer preferences more efficiently.

- Direct Sales: Carlsberg may engage in direct sales to major hospitality chains or through its own branded retail outlets in specific markets to enhance customer engagement and control the brand experience.

- Licensing Agreements: The company licenses its popular brands, such as Carlsberg and Tuborg, to local brewers and distributors in numerous countries, facilitating market penetration and revenue generation. For example, in 2024, licensing contributed to Carlsberg's presence in over 150 markets worldwide, with significant growth anticipated in Asia through such partnerships.

Carlsberg's channel strategy is multifaceted, blending on-trade and off-trade engagements with a growing digital presence. This approach ensures brand visibility and accessibility across diverse consumer touchpoints.

The company leverages both its own e-commerce platforms and partnerships with online retailers, a strategy that proved particularly effective in 2024 as online alcohol sales continued their robust growth. This digital push complements its extensive network of wholesalers and distributors, which remain critical for efficient market penetration and logistical management.

Direct sales and licensing agreements further broaden Carlsberg's global footprint, allowing for brand control in key accounts and market expansion through local expertise. In 2024, licensing contributed to Carlsberg's presence in over 150 markets, with significant growth anticipated in Asia.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| On-Trade | Bars, restaurants, hotels for immediate consumption. | Continued focus on premiumization and customer experience drove sales. |

| Off-Trade | Supermarkets, convenience stores for home consumption. | Ensures broad retail accessibility and drives significant sales volume. |

| E-commerce | Proprietary B2B portals and online retailer collaborations. | Capturing share of a growing digital marketplace; vital for convenience. |

| Wholesalers/Distributors | Navigating local markets and reaching diverse retail/on-trade. | Over 70% of sales volume in some Western European markets managed via distributors in 2023. |

| Direct Sales/Licensing | Targeting large accounts, own retail, or brand licensing to local partners. | Licensing present in over 150 markets in 2024; key for expansion. |

Customer Segments

Adult beer consumers, encompassing those of legal drinking age, represent a vast and varied market for Carlsberg. This segment enjoys everything from classic lagers to more sophisticated premium and craft brews.

Carlsberg's extensive brand portfolio, including its flagship Carlsberg Pilsner and Tuborg, along with craft offerings, effectively addresses the diverse tastes within this broad demographic. In 2023, the global beer market was valued at over $750 billion, with a significant portion attributed to these adult consumers.

This segment is increasingly important, with a growing number of consumers actively seeking out low-alcohol or alcohol-free beverage choices. Carlsberg is responding to this trend by expanding its portfolio of alcohol-free beers, which have experienced notable growth in recent years. For instance, in 2024, Carlsberg's alcohol-free portfolio continued to see robust sales, contributing significantly to the company's overall volume growth in key markets.

Carlsberg's customer base now significantly includes soft drink consumers, a segment broadened considerably by its acquisition of Britvic. This move, alongside strategic partnerships with PepsiCo, allows Carlsberg to tap into the vast market for carbonated drinks, juices, and other non-alcoholic beverages, diversifying its appeal beyond its core beer offerings.

On-Premise Establishments (Bars, Restaurants)

Carlsberg's on-premise establishments segment encompasses a wide array of hospitality businesses, including pubs, bars, restaurants, and hotels. These venues are vital as they directly serve Carlsberg's beverages to end consumers, making strong B2B relationships essential for driving on-trade sales volume.

In 2024, the hospitality sector continued its recovery, with many establishments focusing on premiumization and unique beverage offerings to attract customers. Carlsberg actively engages with these partners through various support programs, ranging from marketing assistance to product training, ensuring their portfolio remains appealing to the on-premise market.

- B2B Customer Base: Pubs, bars, restaurants, hotels, and other hospitality venues.

- Key Relationship Driver: Direct sales to end consumers, necessitating strong partnerships.

- Strategic Focus: Supporting on-trade sales through marketing and product engagement.

Retailers and Supermarkets

Carlsberg's retail and supermarket segment is a cornerstone of its distribution strategy, reaching consumers through a vast network of physical stores. This includes major grocery chains and smaller convenience stores that act as direct sales channels.

For Carlsberg, ensuring these retailers have consistent stock and attractive product placement is crucial. In 2024, the company continued to invest in point-of-sale materials and promotional activities to boost visibility and sales within these high-traffic environments.

- Key Retail Partners: Carlsberg collaborates with major supermarket groups like Tesco, Sainsbury's, and Asda in the UK, and similar large chains across its European markets.

- Sales Contribution: Retail and supermarket channels typically represent a significant portion of Carlsberg's total sales volume, often exceeding 60% in mature markets.

- Merchandising Focus: The company provides retailers with data-driven insights and support for optimal shelf space allocation and in-store promotions, aiming to maximize product turnover.

- Supply Chain Efficiency: Maintaining a robust and efficient supply chain is paramount to ensure timely deliveries and product availability, especially for high-demand seasonal products.

Carlsberg's customer segments are diverse, ranging from adult beer enthusiasts to a growing base of consumers seeking non-alcoholic options. The company also serves the crucial on-premise sector, including pubs and restaurants, and a broad retail network of supermarkets and convenience stores.

The acquisition of Britvic in 2023 significantly expanded Carlsberg's reach into the soft drink market, broadening its customer base beyond traditional beer drinkers. This strategic move, coupled with ongoing efforts to grow its alcohol-free portfolio, reflects a commitment to catering to evolving consumer preferences. In 2024, the company observed continued strong demand for its low and no-alcohol offerings across key European markets.

| Customer Segment | Key Characteristics | 2024 Focus/Data Point |

| Adult Beer Consumers | Legal drinking age, diverse taste preferences (lager, premium, craft) | Continued innovation in craft and premium segments. |

| Alcohol-Free/Low-Alcohol Consumers | Health-conscious, seeking alternatives to traditional beer | Robust sales growth in alcohol-free portfolio, contributing to volume. |

| Soft Drink Consumers | Broad demographic, acquired through Britvic acquisition | Integration of Britvic brands into distribution channels. |

| On-Premise (Pubs, Restaurants) | Hospitality venues, direct consumer interface | Support programs for partners, focus on premiumization trends. |

| Retail (Supermarkets, Convenience Stores) | Wide distribution network, high sales volume | Investment in point-of-sale and promotions to enhance visibility. |

Cost Structure

Carlsberg's cost structure heavily relies on raw materials like barley and hops, alongside packaging essentials such as glass bottles and aluminum cans. In 2024, global commodity markets experienced volatility, directly influencing the price Carlsberg pays for these key inputs. For instance, disruptions in agricultural supply chains can lead to increased barley prices, a fundamental ingredient in beer production.

Carlsberg's production and manufacturing expenses are significant, encompassing costs like energy for brewery operations, wages for production workers, and upkeep of brewing equipment. For instance, in 2023, the company reported a substantial portion of its operating expenses tied to these production activities, reflecting the capital-intensive nature of the brewing industry.

The company actively pursues operational efficiencies to mitigate these costs. This includes investing in newer, more energy-efficient brewing technologies and optimizing supply chain logistics to reduce transportation and warehousing expenses. Carlsberg's commitment to sustainability also plays a role, as reducing energy and water consumption directly lowers operational expenditures.

Carlsberg dedicates substantial resources to marketing and sales, recognizing their vital role in brand building and sales generation. These efforts encompass large-scale global advertising campaigns, strategic sponsorships, and robust investments in digital marketing channels to reach a broad consumer base. For instance, in 2023, Carlsberg's marketing and sales expenses amounted to DKK 9,387 million, reflecting a significant commitment to these activities.

Distribution and Logistics Costs

Distribution and logistics represent a significant portion of Carlsberg's operational expenses. These costs encompass the complex network required to move products from breweries to consumers worldwide. In 2024, Carlsberg continued to invest in optimizing its supply chain to manage these expenditures effectively.

Key cost drivers include transportation, warehousing, and managing the vast distribution infrastructure. This involves expenses like fleet maintenance, fuel consumption, and engaging third-party logistics providers to ensure timely delivery across diverse markets.

Carlsberg's strategic initiatives to electrify its transport fleet are a notable effort to mitigate long-term costs associated with fuel price volatility and reduce the environmental footprint of its logistics operations.

- Transportation Expenses: Costs related to shipping finished goods to distributors and retailers.

- Warehousing Costs: Expenses for storing inventory in strategically located facilities.

- Fleet Management: Costs associated with maintaining and operating delivery vehicles, including fuel and repairs.

- Third-Party Logistics (3PL) Fees: Payments made to external companies for warehousing, transportation, and other supply chain services.

General and Administrative (SG&A) Expenses

General and Administrative (SG&A) expenses for Carlsberg encompass essential overheads like administrative staff salaries, office operations, and IT infrastructure. These costs also include significant investments in research and development, crucial for product innovation and market competitiveness, alongside vital legal and compliance expenditures to ensure adherence to global regulations.

Carlsberg actively pursues rigorous cost control within its SG&A functions. This is achieved through robust operating cost management frameworks designed to optimize efficiency and reduce waste across administrative and support activities.

- SG&A components: Salaries for administrative personnel, office leases, IT systems, R&D initiatives, and legal/compliance fees.

- Cost control focus: Carlsberg prioritizes tight management of these overheads.

- Enabling framework: Operating cost management strategies are key to SG&A efficiency.

- 2024 Outlook: While specific 2024 SG&A figures are not yet fully disclosed, previous trends suggest continued emphasis on efficiency gains. For instance, in 2023, Carlsberg reported a significant focus on streamlining operations, which directly impacts SG&A.

Carlsberg's cost structure is dominated by key operational expenses, including the procurement of raw materials like barley and hops, and significant manufacturing costs such as energy and labor. Marketing and distribution also represent substantial outlays, reflecting the company's global reach and brand-building efforts. General and administrative expenses, encompassing R&D and overheads, are managed through rigorous cost control measures.

| Cost Category | Key Components | 2023 Data (DKK million) |

|---|---|---|

| Raw Materials & Packaging | Barley, hops, glass bottles, aluminum cans | Not specified separately, but a major cost driver. |

| Production & Manufacturing | Energy, labor, equipment maintenance | Significant portion of operating expenses. |

| Marketing & Sales | Advertising, sponsorships, digital marketing | 9,387 |

| Distribution & Logistics | Transportation, warehousing, fleet management | Significant operational expenditure. |

| General & Administrative (SG&A) | Salaries, IT, R&D, legal/compliance | Managed via cost control frameworks. |

Revenue Streams

Carlsberg's main income comes from selling beer. They produce and market a wide range of beers, from global names like Carlsberg and Tuborg to local favorites and craft options. This beer sales segment is the backbone of their revenue.

In 2023, Carlsberg reported net sales of DKK 73.7 billion, with beer and beverages forming the overwhelming majority of this figure. The company's vast distribution network ensures these products reach consumers worldwide, driving consistent sales volume.

Carlsberg's revenue is increasingly bolstered by its non-alcoholic beverage segment. This includes sales of soft drinks, alcohol-free beers, and other related products.

The strategic acquisition of Britvic in 2024, a major player in the beverage industry, significantly expanded Carlsberg's footprint in this market. This move is expected to contribute substantially to the growth of its non-alcoholic portfolio.

Furthermore, existing partnerships, such as the one with PepsiCo, continue to play a vital role in diversifying and strengthening this revenue stream, offering a broader range of products to consumers.

Carlsberg earns income by licensing its well-known beer brands to third-party brewers and distributors across various international markets. This allows for wider product availability without direct manufacturing investment in every region.

Beyond brand licensing, Carlsberg also capitalizes on its deep brewing knowledge by offering consulting and expertise services. These fees are generated from partners seeking to leverage Carlsberg's operational and product development know-how, contributing to a diversified revenue stream.

Premiumization and Higher Margin Products

Carlsberg's strategy hinges on premiumization, pushing higher-margin specialty and craft beers. This focus directly boosts revenue per hectoliter, enhancing overall profitability. For instance, in 2023, Carlsberg's premium beer portfolio, including brands like Grimbergen and Tuborg, showed robust growth, contributing significantly to the company's improved financial performance as they continue to expand their premium offerings.

This premiumization effort also extends to their non-alcoholic beverage range. By developing and promoting high-quality, premium non-alcoholic options, Carlsberg taps into a growing consumer demand for healthier choices without compromising on taste or brand experience. This dual approach to premiumization across alcoholic and non-alcoholic segments is a key driver for their revenue streams.

- Strategic Focus on Premium Brands: Introduction and promotion of specialty and craft beers.

- Increased Revenue per Hectoliter: Higher pricing power for premium products.

- Enhanced Profitability: Specialty and craft beers typically carry higher profit margins.

- Growth in Premium Non-Alcoholic: Catering to evolving consumer preferences for healthier options.

Geographical Diversification

Carlsberg's revenue streams benefit significantly from geographical diversification. The company operates in a wide array of markets, balancing mature Western European economies with high-growth regions in Asia and Eastern Europe. This spread helps smooth out performance, as a downturn in one region can be offset by growth elsewhere.

For instance, in 2023, Carlsberg reported that Western Europe accounted for a substantial portion of its sales, but the growth in Asia, particularly in markets like Vietnam, was a key driver. This strategy reduces reliance on any single market, making the overall business more resilient to local economic fluctuations or regulatory changes.

- Revenue Mix: Western Europe remains a core market, but Asian markets are increasingly important for growth.

- Risk Mitigation: Diversification across different economic cycles and consumer preferences reduces overall business risk.

- Growth Capture: Emerging markets in Asia and Eastern Europe offer higher potential for volume and value growth.

- Market Presence: Carlsberg's operations span over 150 markets, providing broad exposure to global consumer trends.

Carlsberg's revenue is primarily generated from the sale of beer and beverages, encompassing a vast portfolio from global brands like Carlsberg and Tuborg to local specialties. This core business segment is supported by a robust global distribution network, ensuring consistent sales volumes. In 2023, net sales reached DKK 73.7 billion, with beer and beverages constituting the majority.

The company is actively expanding its non-alcoholic beverage segment, which includes alcohol-free beers and soft drinks. The acquisition of Britvic in 2024 significantly bolstered this area, and existing partnerships, such as with PepsiCo, continue to diversify this revenue stream. This strategic move caters to growing consumer demand for healthier options.

Carlsberg also capitalizes on its brand equity through licensing agreements with third-party brewers and distributors worldwide. Furthermore, it leverages its expertise by offering consulting services, sharing its brewing knowledge and operational know-how for fees. This diversification strategy enhances overall revenue resilience.

A key revenue driver is the company's focus on premiumization, pushing higher-margin specialty and craft beers. This strategy, evident in the strong performance of brands like Grimbergen and Tuborg in 2023, increases revenue per hectoliter and overall profitability. This premiumization extends to their non-alcoholic offerings, tapping into evolving consumer preferences.

| Revenue Stream | Description | Key Brands/Activities | 2023 Impact (Illustrative) |

| Beer & Beverage Sales | Core business of selling alcoholic and non-alcoholic drinks. | Carlsberg, Tuborg, Grimbergen, Craft Beers, Soft Drinks | Net sales DKK 73.7 billion (overall) |

| Non-Alcoholic Beverages | Expansion into alcohol-free beers and other beverages. | Britvic portfolio, PepsiCo partnership | Growing contribution, boosted by 2024 Britvic acquisition |

| Brand Licensing & Consulting | Monetizing brand equity and brewing expertise. | Global brand licensing, operational consulting | Diversifies income, expands market reach |

| Premiumization | Focus on higher-margin specialty and craft products. | Grimbergen, Tuborg premium lines, premium non-alcoholic | Increased revenue per hectoliter, enhanced profitability |

Business Model Canvas Data Sources

The Carlsberg Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer preferences and competitive landscapes, and strategic insights derived from operational performance data.