Carlsberg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlsberg Bundle

Carlsberg's BCG Matrix reveals a fascinating portfolio, with some brands acting as reliable Cash Cows while others are emerging Stars poised for growth. Understanding these dynamics is crucial for strategic resource allocation.

To truly unlock the potential of Carlsberg's product lineup, delve into the full BCG Matrix. Gain a comprehensive view of each brand's market share and growth rate, enabling you to make informed decisions about investment and divestment. Purchase the complete report for actionable insights and a clear path to optimizing Carlsberg's market position.

Stars

Carlsberg's premium beer portfolio is a star performer, showing robust organic growth and representing a major strategic focus. Brands such as Carlsberg, Tuborg, 1664 Blanc, and Brooklyn are driving significant revenue increases, outpacing the company's mainstream offerings.

This segment is a key growth engine for Carlsberg, attracting substantial marketing investments aimed at further accelerating its expansion. In 2024, the premium segment continued to be a critical driver of value, reflecting the company's commitment to this high-potential market.

Asia is a powerhouse for Carlsberg, consistently driving growth. In 2023, the Asia segment, excluding China, achieved a 10.1% organic revenue growth, demonstrating the region's vital contribution to the company's overall performance.

Markets like Vietnam and India are particularly dynamic, with Carlsberg actively pursuing expansion. Vietnam, a key market, saw a 15.1% volume growth in 2023, underlining the success of its strategy to increase market share in high-potential Asian economies.

The premium variant of the Carlsberg brand is a standout performer, showing substantial volume growth. This indicates a strong market share within the expanding premium beer segment.

Carlsberg's premium offering benefits from clever positioning and targeted marketing, reinforcing its position as a star product. In 2023, Carlsberg saw a notable increase in its premium segment sales, contributing significantly to the company's overall revenue growth.

Tuborg Brand

Tuborg is a shining example of a Star in the Carlsberg Group's BCG Matrix. Its impressive international brand volume growth, especially in burgeoning markets across Asia and Central and Eastern Europe (CEEI), underscores its stellar performance. For instance, Carlsberg reported in their 2023 annual report that Tuborg's volume in Asia saw a significant uptick, contributing positively to the group's overall revenue.

The brand's consistent strength within the premium beer segment further solidifies its Star status. Tuborg's ability to maintain and grow its market share in competitive premium categories demonstrates its strong brand equity and consumer appeal. This consistent performance is a key driver for Carlsberg's global strategy.

- Strong International Volume Growth: Tuborg has experienced notable increases in sales volume across key international markets.

- Premium Category Success: The brand consistently performs well within the premium beer segment, indicating strong consumer preference.

- Contribution to Group Performance: Tuborg's growth directly benefits Carlsberg's overall volume and revenue figures.

Alcohol-Free Brews

Alcohol-free brews are a shining example of a Star in Carlsberg's BCG Matrix. This segment is booming worldwide, largely due to people becoming more mindful of their health and seeking lower-alcohol options. Carlsberg is clearly recognizing this trend and putting resources into developing and promoting its alcohol-free beer offerings.

The company has seen impressive organic growth within its alcohol-free portfolio, which indicates strong consumer demand and successful market penetration. This positions Carlsberg favorably in what is undeniably a high-growth market, suggesting continued investment and expansion in this area are likely.

- Market Growth: The global non-alcoholic beer market was valued at approximately $25.5 billion in 2023 and is projected to reach over $40 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 7%.

- Carlsberg's Performance: Carlsberg reported a significant increase in sales for its alcohol-free portfolio in 2023, with specific brands like Carlsberg 0.0 experiencing double-digit growth in key markets.

- Strategic Focus: Carlsberg has explicitly stated its commitment to expanding its presence in the health and wellness beverage category, with alcohol-free options being a primary focus for innovation and marketing efforts through 2025.

Carlsberg's premium beer portfolio, including brands like Carlsberg, Tuborg, and 1664 Blanc, represents a significant Star in their BCG Matrix. These brands are experiencing robust organic growth and are a key strategic focus for the company, driving substantial revenue increases. In 2024, the premium segment continued to be a critical driver of value, reflecting Carlsberg's commitment to this high-potential market.

The success of these premium offerings is further bolstered by strong performance in key Asian markets. For example, Carlsberg's Asia segment, excluding China, achieved 10.1% organic revenue growth in 2023, with Vietnam showing a remarkable 15.1% volume growth in the same year. This indicates a strong market share within the expanding premium beer segment, driven by clever positioning and targeted marketing.

| Brand/Segment | Growth Driver | Market Focus | 2023 Performance Highlight |

|---|---|---|---|

| Carlsberg (Premium) | Brand equity, targeted marketing | Global, strong in Asia | Notable increase in premium segment sales |

| Tuborg | International volume growth | Asia, CEEI | Significant volume uptick in Asia |

| 1664 Blanc | Premium positioning | Global | Contributed to premium segment growth |

| Alcohol-Free Portfolio | Health consciousness, innovation | Global | Double-digit growth for Carlsberg 0.0 in key markets |

What is included in the product

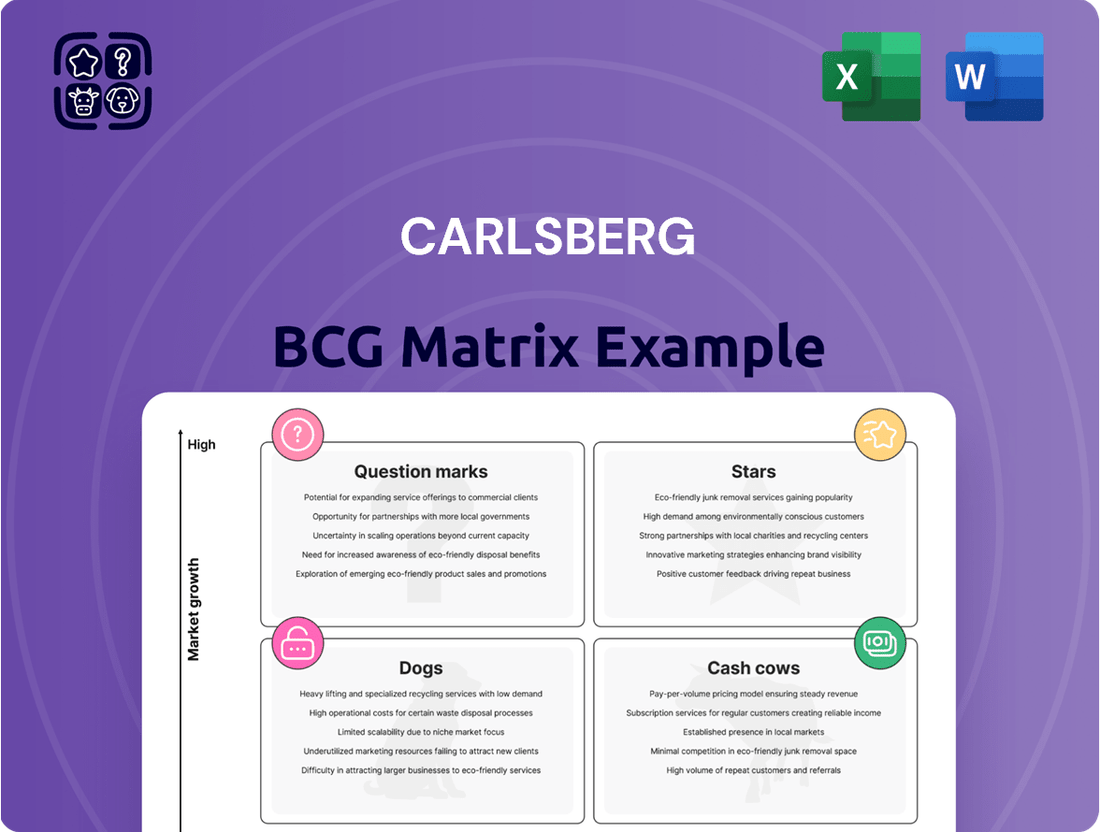

The Carlsberg BCG Matrix analyzes its product portfolio, categorizing brands as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic guidance on resource allocation, highlighting which brands to invest in, maintain, or divest.

A clear visual of Carlsberg's portfolio, identifying Stars and Cash Cows, alleviates the pain of resource allocation uncertainty.

Cash Cows

In mature markets such as the UK and Malaysia, the core Carlsberg brand acts as a reliable cash cow. It holds a significant market share in these low-growth environments, consistently delivering stable revenue and volume. This strong position allows for efficient operations and predictable cash generation, often requiring less intensive promotional spending compared to brands in high-growth sectors.

Carlsberg's Nordic markets, particularly Denmark, represent its cash cows. The company enjoys a dominant position here, leveraging its established brands and extensive distribution. These mature markets provide a steady stream of reliable revenue, underpinning Carlsberg's financial stability.

Kronenbourg 1664, positioned as a mature premium beer, has solidified its presence in the super-premium category globally. Its consistent performance in key markets like Asia and Western Europe generates reliable cash flow for Carlsberg.

While not experiencing explosive growth, the brand's established market share ensures it acts as a significant cash cow. In 2024, premium and super-premium beer segments continued to show resilience, with brands like Kronenbourg 1664 benefiting from consumer demand for higher-quality offerings.

Somersby Cider (Established Markets)

Somersby Cider, a prominent player in the 'Beyond Beer' category, has solidified its position in established markets. Its extensive distribution and strong brand recall translate into a substantial market share, consistently generating significant revenue for Carlsberg.

While recent performance might show some volume shifts, Somersby's core strength lies in its mature market presence. This stability means it requires less aggressive investment for growth, allowing it to function as a reliable cash generator within Carlsberg's portfolio.

- Market Position: Somersby is a leading cider brand in numerous European markets, benefiting from established distribution networks.

- Revenue Generation: In 2023, Carlsberg reported that its cider portfolio, including Somersby, contributed positively to overall sales growth, with cider volumes showing resilience.

- Investment Needs: As a mature product, Somersby's capital expenditure requirements are primarily focused on maintaining market share and operational efficiency rather than rapid expansion.

- Brand Equity: The brand benefits from high consumer awareness and a strong association with refreshment, underpinning its steady sales performance.

Existing Soft Drinks Partnerships

Before the substantial Britvic acquisition, Carlsberg had established several key partnerships for distributing and selling soft drinks from other companies. These arrangements, such as the one with Pepsi in specific regions, provided consistent and reliable sources of income, contributing predictable cash flows to the company's operations.

These existing soft drink partnerships functioned as Cash Cows within Carlsberg's portfolio. They represented mature markets with established demand, allowing for efficient operations and steady profit generation without requiring significant investment for growth. For example, in 2023, Carlsberg's non-beer portfolio, which includes these soft drink arrangements, showed continued resilience, contributing to overall revenue stability.

- Stable Revenue Streams: Partnerships like the one with Pepsi generated predictable income through established distribution agreements.

- Mature Market Presence: These brands held strong positions in their respective markets, ensuring consistent sales volume.

- Limited Investment Needs: As mature products, they required minimal capital expenditure for maintenance or expansion, maximizing cash generation.

- Contribution to Profitability: These Cash Cows played a vital role in funding other strategic initiatives and investments within Carlsberg's broader business.

Carlsberg's established beer brands in mature markets like Denmark and the UK are prime examples of cash cows. These brands, such as the core Carlsberg lager, benefit from high market share and consistent consumer demand, requiring minimal investment to maintain their position. For instance, in 2023, Carlsberg's Western European markets, characterized by maturity, continued to be significant contributors to the company's profitability, reflecting the stable cash generation from these established brands.

The premiumization trend also benefits certain Carlsberg brands, like Kronenbourg 1664, which acts as a cash cow by commanding a strong presence in the super-premium segment. Its consistent sales in key regions, including Asia and Western Europe, generate reliable cash flow. In 2024, the super-premium beer category demonstrated resilience, with brands like Kronenbourg 1664 continuing to benefit from consumer preference for higher-quality products, solidifying their cash cow status.

Somersby Cider, a leading brand in its category, also functions as a cash cow for Carlsberg. Its strong market share in established cider markets, coupled with high brand recognition, ensures consistent revenue generation. While growth might be moderate, its low investment needs for maintenance and its steady contribution to cash flow make it a vital part of Carlsberg's portfolio. Carlsberg's 2023 financial reports indicated continued resilience in its 'Beyond Beer' segment, where Somersby plays a key role.

| Brand/Category | Market Status | Cash Flow Contribution | Investment Needs |

| Carlsberg Core Brand (UK, DK) | Mature, High Market Share | Stable, Predictable | Low (Maintenance) |

| Kronenbourg 1664 | Mature, Premium Segment | Consistent, Reliable | Low to Moderate |

| Somersby Cider | Mature, Leading Cider Brand | Significant, Steady | Low (Maintenance) |

Delivered as Shown

Carlsberg BCG Matrix

The Carlsberg BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means you can confidently assess the strategic insights and professional presentation of the report, knowing that no watermarks or demo content will obscure the analysis. Upon completion of your purchase, this comprehensive BCG Matrix will be instantly accessible, ready for immediate application in your business strategy discussions and decision-making processes.

Dogs

Carlsberg's divestment of its Russian operations in December 2024 exemplifies the strategic removal of a 'dog' from its business portfolio. This market, once a significant contributor, had become a liability due to geopolitical factors and operational challenges, prompting a decisive exit.

The sale of Baltika Breweries, Carlsberg's Russian subsidiary, marked a complete withdrawal from a market that no longer aligned with the company's global strategy. This move underscores a commitment to shedding underperforming or problematic assets to focus on core, high-growth areas.

Underperforming local mainstream brands within Carlsberg's portfolio, particularly those in mature or declining markets with limited market share, would be classified as Dogs. These brands typically generate minimal revenue and often operate at a loss or break-even point, consuming valuable resources without contributing significantly to overall growth or profitability. For instance, if a local mainstream brand in a market like France, where Carlsberg's market share is relatively smaller compared to core markets, isn't gaining traction or is facing intense competition from premium imports or craft beers, it would likely fit this category.

Certain legacy craft beer ventures within Carlsberg's portfolio might be classified as Dogs in the BCG Matrix. These are typically smaller operations that haven't achieved significant scale or market penetration, potentially struggling in saturated local markets.

These ventures could be consuming resources without generating substantial returns. For instance, if a legacy craft brand, despite Carlsberg's investment, saw its market share decline by 5% in 2024 and its revenue growth stagnate at 1% compared to the overall craft beer market's 8% expansion, it would fit this category.

Segments Impacted by Weak Consumer Sentiment/Weather

Carlsberg's Q2 2024 performance highlighted the impact of external pressures on specific business segments. Unfavorable weather conditions across multiple European markets, coupled with subdued consumer sentiment in certain Asian regions, directly affected sales volumes, causing them to fall short of projections. This situation particularly impacted segments or micro-markets where Carlsberg already held a smaller market share.

These challenged segments, experiencing temporary setbacks due to factors like adverse weather or economic headwinds, can be viewed as potential 'Dogs' within the BCG Matrix framework. For instance, if a particular beer category or a specific regional market within Asia saw a notable sales decline in Q2 2024 due to these issues, and Carlsberg's presence there was already limited, it would fit this description.

The company's reporting indicated that these external factors led to sales lagging forecasts, underscoring the vulnerability of certain product lines or geographical areas. The persistence of weak consumer sentiment in some Asian markets, for example, would directly translate into lower demand for Carlsberg's offerings in those specific locations.

- Impact of Weather: Q2 2024 volumes were negatively affected by poor weather in several key markets.

- Consumer Sentiment: Weak consumer sentiment in some Asian markets also contributed to sales underperformance.

- Sales Lag: The combination of these factors resulted in sales lagging behind company forecasts for the period.

- Market Share Context: Segments with low market share facing these challenges are candidates for the 'Dog' category.

Divested Stake in Carlsberg Marston's Joint Venture

Carlsberg's acquisition of Marston's plc's 40% shareholding in their joint venture, Carlsberg Marston's, in July 2024, signifies a strategic shift. This move, giving Carlsberg full control, indicates the joint venture might not have met expectations or no longer aligned with Carlsberg's core strategy as a shared entity.

Within the BCG Matrix framework, if Carlsberg's stake in this venture was characterized by low market share and low growth potential, it would indeed be classified as a 'Dog'. This consolidation suggests Carlsberg opted to streamline operations and absorb the underperforming asset rather than continuing with a separate, less productive structure.

- Carlsberg's Full Acquisition: Carlsberg completed the purchase of Marston's 40% stake in their joint venture in July 2024.

- Strategic Rationale: This consolidation implies the joint venture was not performing optimally or had become less strategically important as a separate entity.

- BCG 'Dog' Classification: A low market share and low growth profile within the joint venture would place it in the 'Dog' category of the BCG Matrix.

- Streamlining Operations: Carlsberg's decision suggests a move towards simplifying its portfolio and focusing resources on more promising ventures.

Dogs in Carlsberg's portfolio represent brands or business units with low market share in slow-growing or declining industries. These entities typically generate minimal profits and may even incur losses, requiring significant management attention and resources without commensurate returns. For instance, a legacy local beer brand in a mature European market with declining consumption and intense competition would fit this description.

Carlsberg's divestment of its Russian operations in December 2024, specifically the sale of Baltika Breweries, is a prime example of shedding a 'dog.' This move, driven by geopolitical instability and operational challenges, aimed to remove a significant liability and refocus resources on more promising markets.

The acquisition of Marston's 40% stake in their joint venture in July 2024 also hints at potential 'dog' assets. If this venture had low growth and market share, full control could precede a divestment or restructuring to mitigate resource drain.

Segments experiencing temporary setbacks, such as those impacted by adverse weather or weak consumer sentiment in specific Asian markets during Q2 2024, can also be viewed as potential 'dogs.' These situations, leading to sales lagging forecasts, highlight the vulnerability of smaller market share segments.

| Category | Description | Carlsberg Example | 2024 Data Impact |

| Dogs | Low market share, low growth | Underperforming local brands, divested Russian operations | Q2 2024 sales lagged forecasts due to weather and consumer sentiment in certain markets. Divestment of Russian assets completed December 2024. |

Question Marks

Carlsberg's acquisition of Britvic plc in January 2025 firmly places Britvic in the Question Mark category of the BCG Matrix. This move dramatically boosts Carlsberg's presence in the high-growth soft drinks sector, effectively doubling its volume contribution from this segment.

While the soft drinks market offers significant growth potential, Carlsberg's market share within this newly expanded portfolio is still nascent. This necessitates considerable investment to capture market share and achieve profitability, a hallmark of Question Mark assets.

Carlsberg's acquisition of the Pepsi bottling franchise in Kazakhstan and Kyrgyzstan, effective Q1 2026, signifies a strategic move into developing markets. This expansion leverages PepsiCo's established brand presence while introducing Carlsberg to a new beverage category within these Central Asian nations.

The soft drink market in both Kazakhstan and Kyrgyzstan exhibits strong growth potential, fueled by increasing disposable incomes and a growing consumer base. However, Carlsberg's current market share in these regions for beverages, beyond its core beer offerings, is minimal, positioning this venture as a classic 'Question Mark' in the BCG matrix.

Significant investment will be required to build out bottling infrastructure, distribution networks, and marketing campaigns to compete effectively. Success hinges on Carlsberg's ability to leverage PepsiCo's brand equity and operational expertise, transforming this new venture into a future 'Star' performer.

Carlsberg Malaysia's introduction of Sapporo and 1664 BRUT into the premium lager market is a strategic move to tap into a burgeoning segment. These brands are positioned as Stars in the BCG matrix, characterized by high market growth and currently low market share.

The company is investing heavily in marketing and distribution for these new entrants to build brand awareness and secure shelf space. This focus is crucial for converting their high growth potential into sustained market penetration and future cash cows.

Strategic Investments in Digital Tools and Capabilities

Carlsberg's Accelerate SAIL strategy places a significant emphasis on enhancing digital tools and capabilities, recognizing them as crucial drivers for future growth. These investments are earmarked for improving operational efficiency and expanding market reach, aligning with the characteristics of a question mark in the BCG matrix.

While these digital initiatives represent high-growth potential, their direct impact on market share and profitability is still developing. Carlsberg's commitment to continued funding in these areas is essential to nurture their growth and ultimately determine their long-term success and position within the portfolio. For instance, in 2024, Carlsberg continued to invest in its digital transformation, aiming to leverage data analytics for more targeted marketing campaigns and supply chain optimization.

- Focus on Digital Transformation: Carlsberg is actively investing in digital tools and capabilities as part of its Accelerate SAIL strategy.

- High-Growth Potential: These investments target areas with high growth potential, particularly in operational efficiency and market reach.

- Early Stage of Development: The direct contribution of these digital investments to market share and profitability is still in its nascent stages.

- Continued Funding Required: Sustained financial commitment is necessary to validate the value and long-term success of these digital capabilities.

Minority Stake in Craft Brewer Mikkeller

Carlsberg's acquisition of a 20% stake in Danish craft brewer Mikkeller in early 2020 positions Mikkeller as a potential 'Question Mark' within the BCG Matrix. This classification stems from Mikkeller's operation in the rapidly growing craft beer market, which offers high potential for future growth, yet currently demands significant investment to maintain or increase market share.

Mikkeller, known for its innovative and diverse beer portfolio, represents a strategic move by Carlsberg to tap into the premium and niche segments of the beverage industry. While the craft beer market experienced substantial growth in recent years, its fragmentation and evolving consumer preferences mean that Mikkeller's future success, and thus its position in Carlsberg's portfolio, is not yet guaranteed.

- Market Growth: The global craft beer market has seen robust expansion, with projections indicating continued growth driven by consumer demand for unique and high-quality beverages.

- Investment Needs: To capitalize on this growth and compete effectively, Mikkeller requires ongoing investment in brewing capacity, distribution, and marketing, characteristic of a Question Mark.

- Uncertainty: The ultimate success of Mikkeller in solidifying its market position and achieving profitability for Carlsberg remains uncertain, necessitating careful strategic management.

- Strategic Importance: This stake allows Carlsberg to gain valuable insights and experience in the dynamic craft beer sector, potentially leading to future expansion or integration.

Carlsberg's strategic investments in emerging markets, such as the Pepsi bottling franchise in Kazakhstan and Kyrgyzstan initiated in Q1 2026, represent classic Question Marks. These ventures operate in high-growth sectors but require substantial capital for infrastructure, distribution, and marketing to establish significant market share.

The acquisition of Britvic plc in early 2025 also places its soft drink portfolio firmly in the Question Mark category. While the market itself is expanding, Carlsberg's share within this segment is new and requires considerable investment to achieve profitability and competitive standing.

Carlsberg's focus on digital transformation, highlighted in its Accelerate SAIL strategy, also aligns with Question Mark characteristics. These initiatives offer high growth potential but are still in early development stages, necessitating continued funding to prove their long-term value and impact on market share.

The stake in Mikkeller, acquired in 2020, exemplifies a Question Mark due to its operation in the dynamic craft beer market. This sector offers growth but demands ongoing investment to navigate evolving consumer tastes and maintain market position.

BCG Matrix Data Sources

Our Carlsberg BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market research, and industry growth forecasts to provide a clear strategic overview.