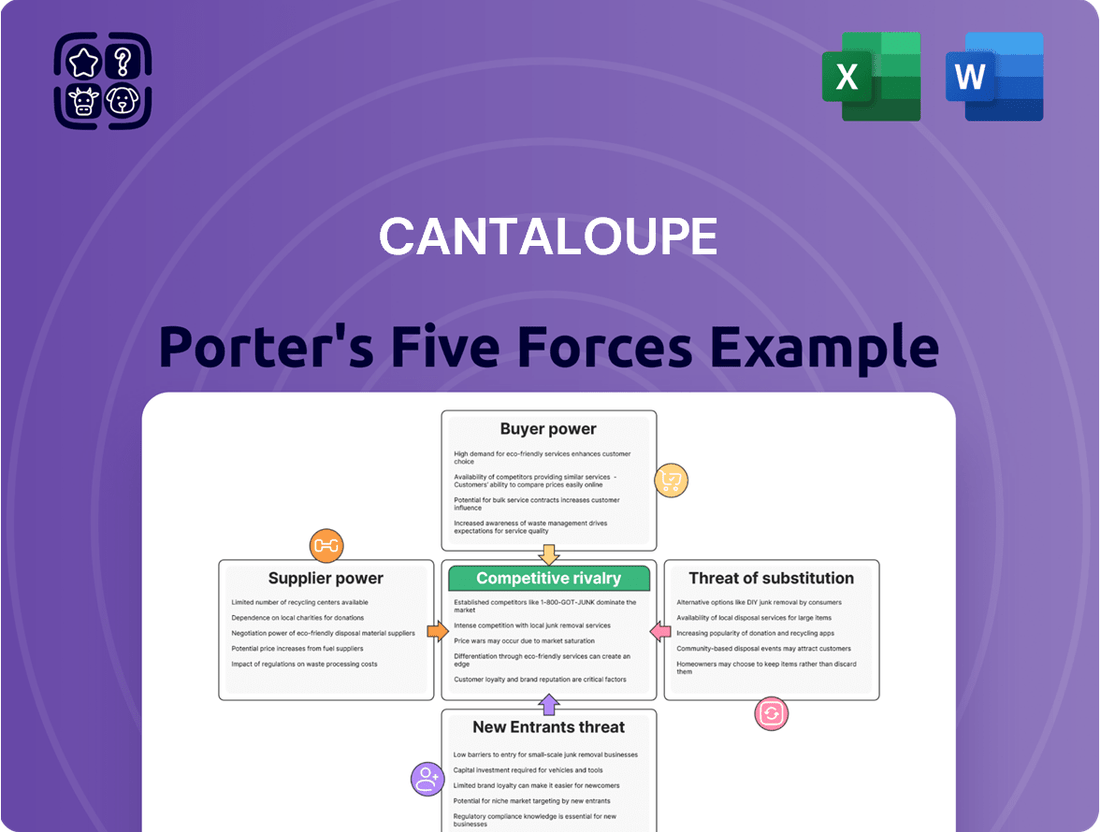

Cantaloupe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

Cantaloupe's industry faces moderate bargaining power from buyers, as switching costs are relatively low, and a significant threat from substitutes like other fruits. The intense competition among existing players also shapes the market landscape.

The complete report reveals the real forces shaping Cantaloupe’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cantaloupe Inc. depends on a limited number of technology providers for crucial components. For instance, if only a few companies offer specialized payment hardware or IoT modules, these suppliers gain significant leverage. This concentration means Cantaloupe might face higher prices or less favorable contract terms, directly impacting its operational costs and profitability.

The cost and complexity for Cantaloupe to switch between different technology suppliers can be significant. This includes integrating new hardware, adapting software, and retraining personnel, which can give existing suppliers more leverage in negotiations.

Suppliers who provide highly specialized or proprietary technology crucial to Cantaloupe's unique unattended retail solutions wield significant bargaining power. This is particularly true if these offerings create a substantial competitive advantage that is challenging for Cantaloupe to replicate. For instance, if a key component for Cantaloupe’s advanced payment processing systems is only available from a single, highly innovative supplier, that supplier can dictate terms more forcefully.

Threat of Forward Integration by Suppliers

If suppliers possess the capability and motivation to move into Cantaloupe's market by providing their own comprehensive unattended retail solutions, their leverage over Cantaloupe would significantly grow. This forward integration would directly challenge Cantaloupe's existing business model.

This scenario presents a direct competitive threat, as suppliers could potentially offer a more integrated or cost-effective solution, thereby capturing a larger share of the market and diminishing Cantaloupe's competitive edge.

- Increased Competition: Suppliers entering Cantaloupe's market directly compete, potentially fragmenting market share.

- Price Pressure: Suppliers offering end-to-end solutions might undercut Cantaloupe's pricing.

- Loss of Differentiation: Cantaloupe's unique value proposition could be diluted if suppliers offer similar integrated services.

Importance of Cantaloupe to Suppliers

The significance of cantaloupe to its suppliers directly influences their bargaining power. If cantaloupe producers constitute a substantial portion of a supplier's overall sales, that supplier's leverage diminishes. This dependency means they are less likely to dictate terms, as losing cantaloupe business could significantly impact their revenue.

For instance, in 2024, the global cantaloupe market was valued at approximately $7.5 billion, with North America and Europe being major consumers. Suppliers of essential inputs like fertilizers, seeds, and specialized agricultural equipment who cater heavily to cantaloupe growers would find their bargaining power reduced if cantaloupe sales represent a disproportionately large segment of their business. Conversely, suppliers with diversified customer bases across various agricultural sectors would possess stronger bargaining positions.

- Supplier Dependence: Suppliers whose revenue heavily relies on cantaloupe sales have less bargaining power.

- Market Share: If cantaloupe growers represent a significant portion of a supplier's customer base, the supplier is more accommodating.

- Diversification: Suppliers with diverse clientele across multiple crops are less vulnerable to cantaloupe market fluctuations and thus hold stronger bargaining power.

- Input Costs: In 2024, fertilizer prices saw fluctuations, impacting agricultural input costs. Suppliers of these inputs who depend on cantaloupe growers may have to absorb some of these cost increases to retain business.

Suppliers to Cantaloupe Inc. possess significant bargaining power when they offer unique or highly specialized components essential for Cantaloupe's technology. This leverage increases if switching costs for Cantaloupe are high, making it difficult and expensive to adopt alternative suppliers. Furthermore, suppliers who could potentially enter Cantaloupe's market themselves, offering integrated unattended retail solutions, gain considerable influence.

| Factor | Impact on Cantaloupe's Bargaining Power | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | Limited availability of specialized IoT modules for unattended retail |

| Switching Costs | Low leverage for Cantaloupe | Integration of new payment hardware and software retraining |

| Supplier Differentiation | High leverage for unique component providers | Proprietary payment processing systems |

| Threat of Forward Integration | High leverage for potential competitors | Suppliers offering end-to-end unattended retail solutions |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Cantaloupe's position in the melon industry.

Effortlessly identify and neutralize competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Cantaloupe serves a broad range of unattended retail operators, from small startups to established larger companies. This diversity in its customer base generally dilutes individual customer power.

However, if a small number of very large operators account for a substantial percentage of Cantaloupe's total revenue, these key clients would possess significant bargaining leverage. They could then push for reduced pricing or specialized service offerings, impacting Cantaloupe's profitability.

The ease with which unattended retail operators can move from Cantaloupe's payment and management solutions to a competitor's platform significantly influences their bargaining power. If switching is difficult and costly, Cantaloupe's leverage increases.

High switching costs for these operators, stemming from factors like the need to replace Cantaloupe's proprietary hardware, the complexity of migrating existing customer data, or the potential for significant operational disruptions during a transition, would inherently reduce the bargaining power of Cantaloupe's customers.

Customer price sensitivity is a significant factor for Cantaloupe, especially within the unattended retail sector. Smaller operators, in particular, often face intense competition, making them acutely aware of costs and inclined to seek the most favorable pricing for vending management solutions.

This heightened sensitivity directly translates into increased bargaining power for these customers. They can leverage their willingness to switch providers if Cantaloupe's pricing is not perceived as competitive, forcing the company to remain agile and offer attractive service packages to retain and attract this segment.

For instance, while specific 2024 data on customer price sensitivity in this niche market isn't publicly detailed, the general trend in retail technology suggests that cost-effectiveness remains a primary driver for adoption, particularly for small to medium-sized businesses. This means Cantaloupe must continuously evaluate its pricing structure against competitors to maintain its market share.

Availability of Substitute Solutions for Customers

The availability of substitute solutions significantly amplifies the bargaining power of customers in the cantaloupe industry. When customers, such as grocery stores or food distributors, have readily accessible alternatives for payment processing and vending management, they can leverage this to negotiate more favorable terms with cantaloupe vendors. This is particularly true if these alternatives offer comparable features or cost savings.

For instance, if a vending machine operator can easily switch to a different payment gateway provider or adopt a simpler, less integrated management system, they are less beholden to any single cantaloupe supplier. This ease of switching is a direct consequence of a competitive landscape offering multiple solutions. In 2024, the fintech sector continued to mature, with many new players entering the market offering diverse payment and management tools, further enhancing customer options.

- Increased Customer Leverage: The presence of numerous alternative payment and management solutions empowers customers to demand better pricing and service conditions from cantaloupe vendors.

- Competitive Pressure: If customers can easily switch to a competitor offering similar services, it forces cantaloupe vendors to remain competitive on terms and pricing.

- Market Dynamics in 2024: The ongoing innovation in payment technologies and management software in 2024 provided customers with a wider array of choices, thereby increasing their bargaining power.

- Impact on Vendor Margins: A high availability of substitutes can compress profit margins for cantaloupe vendors as they compete to retain customers by offering more attractive deals.

Customers' Ability to Integrate Backward

Customers' ability to integrate backward, meaning they can produce the product or service themselves, is a significant factor in their bargaining power. For a company like Cantaloupe, which provides payment and management solutions for unattended retail, this means large operators could potentially build their own systems.

If major unattended retail operators, particularly those with substantial scale, deem it cost-effective and strategically advantageous to develop their own in-house payment and management platforms, their reliance on third-party providers like Cantaloupe would diminish. This shift would grant them considerably more leverage in negotiations.

- Reduced Dependence: By bringing payment and management functions in-house, large operators lessen their dependence on external vendors, strengthening their negotiating position.

- Cost Control: Developing proprietary systems can offer greater control over costs and customization compared to relying on off-the-shelf solutions.

- Strategic Advantage: Owning the technology stack can provide a strategic advantage, allowing for unique service offerings or data integration.

The bargaining power of Cantaloupe's customers is influenced by the availability of alternative solutions and the potential for backward integration. In 2024, the fintech landscape continued to evolve with numerous new entrants offering diverse payment and management tools, directly increasing customer options and their leverage. This competitive environment pressures vendors like Cantaloupe to offer competitive pricing and service packages to retain their client base.

For instance, the ease with which an unattended retail operator can switch to a competitor's platform is a key determinant of their power. High switching costs, such as replacing proprietary hardware or migrating data, would reduce customer leverage. Conversely, low switching costs empower customers to negotiate more favorable terms. The general trend in retail technology in 2024 indicates that cost-effectiveness remains paramount, especially for small to medium-sized businesses, further amplifying customer price sensitivity and their bargaining power.

| Factor | Impact on Customer Bargaining Power | 2024 Market Trend Relevance |

|---|---|---|

| Availability of Substitutes | High | Increased due to fintech innovation |

| Switching Costs | Low to Moderate | Varies based on hardware integration |

| Customer Price Sensitivity | High | Driven by competition in unattended retail |

| Potential for Backward Integration | Moderate to High (for large operators) | Strategic consideration for large players |

Preview the Actual Deliverable

Cantaloupe Porter's Five Forces Analysis

This preview showcases the complete Cantaloupe Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect this exact, professionally formatted analysis to be available for your immediate use upon completing your transaction.

Rivalry Among Competitors

The unattended retail payment and software services market is populated by a variety of companies, including significant players like 365 Retail Markets and Nayax, alongside numerous other payment processors and vending management system providers. This diverse landscape means there are many competitors, and some of them are quite large, leading to a highly competitive environment where everyone is fighting for a bigger piece of the market.

The unattended terminals market, particularly for solutions like those offered by Cantaloupe, is seeing robust growth. This expansion is projected to continue, with market research firms forecasting a compound annual growth rate (CAGR) of over 12% for the global unattended retail market through 2028. This rapid ascent means more opportunities are available for companies to capture market share.

While a growing market can soften competitive intensity by expanding the pie for everyone, it doesn't eliminate rivalry. Companies like Cantaloupe are actively vying for new deployments and customer contracts. For instance, in 2024, several major players announced significant partnerships and expanded service areas, demonstrating the aggressive pursuit of new segments and customers within this expanding industry.

Cantaloupe stands out by providing a complete platform that handles cashless payments, allows for remote monitoring of machines, and manages inventory. This all-in-one approach is a key differentiator in the competitive landscape.

The intensity of rivalry is directly influenced by how well competitors can match Cantaloupe's comprehensive offerings or develop highly specialized solutions that appeal to specific market niches. For instance, companies focusing solely on payment processing might compete on price, while others offering advanced analytics could draw customers seeking deeper insights.

When a company like Cantaloupe achieves strong product differentiation, it can significantly reduce the pressure of direct price competition. Customers are often willing to pay a premium for integrated solutions that simplify operations and offer greater convenience, thereby lessening the reliance on price as the primary decision-making factor.

Switching Costs for Customers

In the competitive landscape of cashless payment solutions, low customer switching costs can significantly amplify rivalry. If it's easy and inexpensive for merchants to move to another provider, they will readily do so for better pricing or enhanced services. This dynamic puts pressure on existing providers to constantly innovate and offer competitive value.

Cantaloupe, Inc. (CTLP) actively works to build customer loyalty and increase switching costs by developing an integrated platform that combines hardware, software, and payment processing. This approach aims to create a more cohesive and less disruptive experience for their clients, making it less appealing to switch to a fragmented solution from a competitor. Their acquisitions of companies like Nayax in 2023, which brought advanced telemetry and payment capabilities, further bolster this strategy by adding valuable features that are deeply embedded into their service offering.

- Low Switching Costs Amplify Rivalry: In the cashless payment sector, if merchants can easily switch providers without significant cost or disruption, competition intensifies as firms vie for market share through price and feature differentiation.

- Cantaloupe's Integration Strategy: Cantaloupe aims to increase customer stickiness by offering a unified platform that integrates hardware, software, and payment processing, thereby raising the perceived cost and complexity of switching.

- Impact of Acquisitions: Acquisitions, such as the integration of Nayax's technologies in 2023, enhance Cantaloupe's value proposition and create deeper integration points, making it more challenging for customers to exit the ecosystem.

- Data-Driven Retention: By providing robust data analytics and reporting through their platform, Cantaloupe offers insights that merchants rely on, further embedding their services and increasing the cost of switching to a less data-rich alternative.

Exit Barriers

Cantaloupe's competitive rivalry is intensified by high exit barriers. These can include specialized assets, such as proprietary technology or dedicated manufacturing facilities, and long-term contracts that make it costly for companies to leave the market. In 2024, for instance, the significant investment required for advanced AI-driven logistics platforms in the food delivery sector can trap even underperforming players.

This situation forces struggling competitors to remain active, often leading to aggressive pricing strategies to maintain market share. Consequently, sustained price competition can persist even when overall market demand is weak, impacting profitability across the industry. For example, in the mature airline industry, the high cost of retiring aircraft and breaking leases often results in carriers continuing operations at a loss, driving down fares for consumers.

- High fixed costs associated with specialized assets

- Obligations from long-term supply or service agreements

- Emotional and managerial attachment to the business

- Government or regulatory restrictions on exiting certain markets

The unattended retail payment market is characterized by intense rivalry, with numerous players like 365 Retail Markets and Nayax competing for market share. This competition is fueled by a growing market, projected to expand at a CAGR exceeding 12% through 2028, creating opportunities for aggressive customer acquisition. Companies are actively pursuing new deployments and contracts, with significant partnerships announced in 2024 underscoring this dynamic.

Cantaloupe differentiates itself through a comprehensive platform integrating cashless payments, remote monitoring, and inventory management, aiming to reduce price-based competition. However, low customer switching costs mean merchants can easily move to competitors, necessitating continuous innovation and value offerings. Cantaloupe's strategy to increase stickiness involves platform integration and acquisitions, like Nayax in 2023, to deepen customer reliance on its ecosystem.

High exit barriers, such as specialized assets and long-term contracts, can keep even struggling competitors active, leading to persistent price competition. For instance, significant investments in AI-driven logistics platforms in 2024 create inertia for some firms. This forces companies to maintain aggressive pricing to retain market share, impacting industry-wide profitability, similar to how high aircraft retirement costs keep airlines operating at a loss.

| Metric | Cantaloupe (CTLP) | Key Competitor (Example: 365 Retail Markets) | Market Trend |

| Market Growth (CAGR) | 12%+ (Unattended Retail through 2028) | 12%+ (Unattended Retail through 2028) | Strong growth attracts new entrants and intensifies competition. |

| Customer Switching Costs | Increasing (via platform integration) | Varies (often lower for single-service providers) | Low switching costs pressure providers to offer superior value and innovation. |

| Product Differentiation | High (integrated platform) | Moderate to High (specialized solutions) | Differentiated offerings can mitigate direct price competition. |

| Exit Barriers | Moderate (technology investment) | Moderate (technology investment) | High exit barriers can prolong competitive rivalry even in weaker market conditions. |

SSubstitutes Threaten

While digital transactions are on the rise, traditional cash payments persist in certain unattended retail settings. The ongoing, though diminishing, acceptance of cash, or the availability of simpler, non-digital payment options, poses a substitute threat, especially for minor purchases.

For smaller operators, manual inventory tracking and basic payment acceptance, like cash boxes or simple card readers, can act as substitutes for Cantaloupe's advanced software and digital payment solutions. While less efficient, these methods bypass the costs associated with sophisticated systems.

This is particularly relevant for businesses with lower transaction volumes or those prioritizing upfront cost savings over operational efficiency. For instance, a small convenience store might opt for manual cash handling rather than investing in a full cashless payment system, especially if their customer base primarily uses cash.

Innovations in self-service technologies outside of traditional vending machines present a significant threat. Smart locker systems, for instance, coupled with seamless payment integration and direct-to-consumer delivery, can bypass the need for physical vending locations where Cantaloupe's core offerings are utilized. This shift could diminish demand for Cantaloupe's unattended retail solutions.

General Purpose Payment Processors

The threat of substitutes for general-purpose payment processors in the unattended retail space is moderate. Operators could opt for services like Square or PayPal, pairing them with separate inventory management software. This unbundled approach offers flexibility but often lacks the specialized, integrated features that dedicated unattended retail platforms provide.

While these generic solutions might seem appealing, they typically do not offer the same level of seamless integration and specialized reporting that Cantaloupe's platform provides. For instance, a vending operator using Square might need to manually reconcile sales data with separate inventory logs, a process that is automated with a specialized system.

The key differentiator lies in the tailored functionalities. While general payment processors handle transactions, they don't inherently manage the complexities of unattended retail, such as remote machine monitoring, dynamic pricing, or specific reporting for product spoilage in kiosks. This gap creates a barrier for widespread substitution.

- Generic payment processors can handle basic transactions.

- Unbundled solutions may lack specialized unattended retail features.

- Integration and automation are key advantages of dedicated platforms.

Direct Consumer-to-Business Apps

The increasing prevalence of consumer-to-business (C2B) mobile applications presents a significant threat of substitution for traditional unattended retail. These apps allow consumers to directly order and pay for goods and services, effectively bypassing the need for physical vending machines or micro markets. For instance, in 2024, the global mobile payment market was projected to reach over $2.5 trillion, highlighting the widespread adoption of such technologies.

This trend is especially potent in environments like quick-service restaurants or office break rooms where direct mobile interaction is seamless and convenient. Consider the growth of food delivery apps, which offer a direct substitute to purchasing snacks or meals from an on-site vending solution. In 2023, the food delivery sector alone saw substantial growth, with many consumers opting for the convenience of app-based ordering over traditional retail touchpoints.

- Direct Mobile Ordering: Apps enable consumers to bypass physical retail infrastructure.

- Payment Integration: Seamless payment processing within apps enhances convenience.

- Market Penetration: The vast growth in mobile payment adoption signifies a shift in consumer behavior.

- Convenience Factor: C2B apps offer a substitute for the immediacy of unattended retail.

The threat of substitutes for Cantaloupe's unattended retail solutions stems from alternative payment methods and retail formats. While digital payments are growing, cash still offers a low-tech substitute for minor purchases. More significantly, innovations like smart locker systems and direct-to-consumer mobile apps bypass the need for traditional vending locations, diminishing demand for Cantaloupe's core services.

Generic payment processors like Square or PayPal, when paired with separate inventory software, offer a less integrated but potentially cheaper alternative to Cantaloupe's specialized platform. Although these unbundled solutions may lack the tailored features of dedicated unattended retail systems, their flexibility appeals to some operators, especially those with lower transaction volumes or a focus on initial cost savings.

The rise of consumer-to-business (C2B) mobile applications presents a substantial threat, allowing direct ordering and payment that bypasses physical vending machines. This trend is amplified by the massive growth in mobile payments, with the global market projected to exceed $2.5 trillion in 2024, indicating a significant shift towards app-based convenience over traditional unattended retail touchpoints.

| Substitute Type | Description | Impact on Cantaloupe | Example | 2024 Market Data/Trend |

|---|---|---|---|---|

| Alternative Payment Methods | Cash, generic payment apps | Moderate, especially for low-value transactions | Using cash at a small kiosk | Cash usage in retail continues to decline, but remains relevant for specific segments. |

| Unbundled Solutions | Generic payment processors + separate inventory software | Moderate, offers flexibility but lacks integration | Square POS with manual inventory tracking | Growth in fintech solutions offering modular services. |

| Direct-to-Consumer Apps | Mobile ordering and payment bypassing physical retail | High, especially in convenience-driven sectors | Food delivery apps replacing on-site vending | Global mobile payment market projected over $2.5 trillion in 2024. |

| Smart Locker Systems | Automated pickup points with integrated payment | High, bypasses traditional vending locations | Package lockers for retail goods | Increasing adoption in logistics and retail for automated fulfillment. |

Entrants Threaten

The capital requirements for entering the unattended retail technology sector are considerable. Developing sophisticated software, secure payment systems, and reliable hardware often necessitates millions of dollars in upfront investment. For instance, companies like Cantaloupe, a leading provider of end-to-end technology solutions for unattended retail, have invested heavily in their integrated payment processing and cloud-based platform. This significant financial barrier deters many potential new players from entering the market.

Established players in the vending and unattended retail sector, like Cantaloupe, leverage significant economies of scale. This advantage spans development of their software platforms, operational efficiencies in managing a large network of devices, and the cost-effectiveness of acquiring and retaining customers. For instance, a large installed base allows for more efficient R&D spending per unit and better negotiation power with suppliers.

New entrants face a substantial barrier when trying to match the cost structures of incumbents. To effectively compete on price and operational efficiency, a new player would need to rapidly achieve a comparable scale of operations. This is a considerable challenge, as building out a widespread network of connected devices and securing a large customer base takes time and significant capital investment, potentially requiring hundreds of millions in upfront funding to even approach the scale of established firms.

Cantaloupe's robust patent portfolio and its sophisticated, end-to-end platform create a substantial barrier to entry. The significant investment in research and development required to replicate Cantaloupe's innovative and secure solutions deters potential new competitors.

Access to Distribution Channels and Customer Relationships

Cantaloupe's established network of active customers and devices, coupled with strong relationships with unattended retail operators, presents a significant barrier for new entrants. Building the same level of trust and securing access to these crucial distribution channels and customer bases requires substantial time and investment.

For instance, as of the first quarter of 2024, Cantaloupe reported having over 1.4 million active devices on its platform. This extensive reach means new competitors must not only offer competitive technology but also overcome the incumbent advantage of existing, deeply integrated customer relationships.

- Established Customer Base: Cantaloupe's large and loyal customer base makes it difficult for new entrants to gain traction.

- Operator Relationships: Strong, long-standing partnerships with unattended retail operators are a key differentiator.

- Network Effects: The more operators and devices on Cantaloupe's platform, the more valuable it becomes, creating a virtuous cycle that new entrants struggle to replicate.

Regulatory and Compliance Hurdles

The digital payments sector faces significant regulatory and compliance burdens. For instance, adherence to standards like PCI DSS and EMV is mandatory, requiring substantial investment and ongoing effort. New companies entering this space must dedicate considerable resources to understand and implement these complex requirements, which can slow down their market entry and increase initial operating costs. This intricate web of regulations acts as a formidable barrier, deterring many potential new competitors.

Navigating this regulatory environment is a major hurdle. In 2024, the global fintech regulatory landscape continued to evolve, with increased scrutiny on data privacy and security. For example, updates to GDPR and similar data protection laws worldwide necessitate robust compliance frameworks. Companies must invest in legal counsel, compliance officers, and technological solutions to meet these evolving standards, adding a significant cost of entry. This complexity directly impacts the threat of new entrants by raising the capital and expertise required to compete effectively.

The cost and time associated with compliance are substantial deterrents. Establishing the necessary infrastructure and processes to meet regulatory demands, such as those for anti-money laundering (AML) and know your customer (KYC) protocols, can take years and millions of dollars. This financial and temporal investment is often beyond the reach of smaller startups, thereby limiting the pool of potential new entrants into the digital payments market. The ongoing nature of these regulations also means continuous investment is required to maintain compliance.

Key compliance areas that pose a threat to new entrants include:

- Data Security Standards: Adherence to PCI DSS Level 1 compliance, for example, involves rigorous security controls and regular audits.

- Payment Processing Regulations: Meeting EMV chip standards and other evolving transaction security protocols requires significant technological investment.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Implementing robust AML/KYC procedures is critical and resource-intensive.

- Consumer Protection Laws: Compliance with regulations safeguarding consumer data and financial transactions adds another layer of complexity.

The threat of new entrants in the unattended retail technology sector is currently moderate, primarily due to high capital requirements and established brand loyalty. Developing sophisticated, secure payment and management platforms demands significant upfront investment, often in the millions. For instance, Cantaloupe's substantial investment in its integrated payment processing and cloud-based solutions creates a financial hurdle that deters many potential new players.

Porter's Five Forces Analysis Data Sources

Our Cantaloupe Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, agricultural trade association data, and government agricultural statistics to accurately assess competitive dynamics.