Cantaloupe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

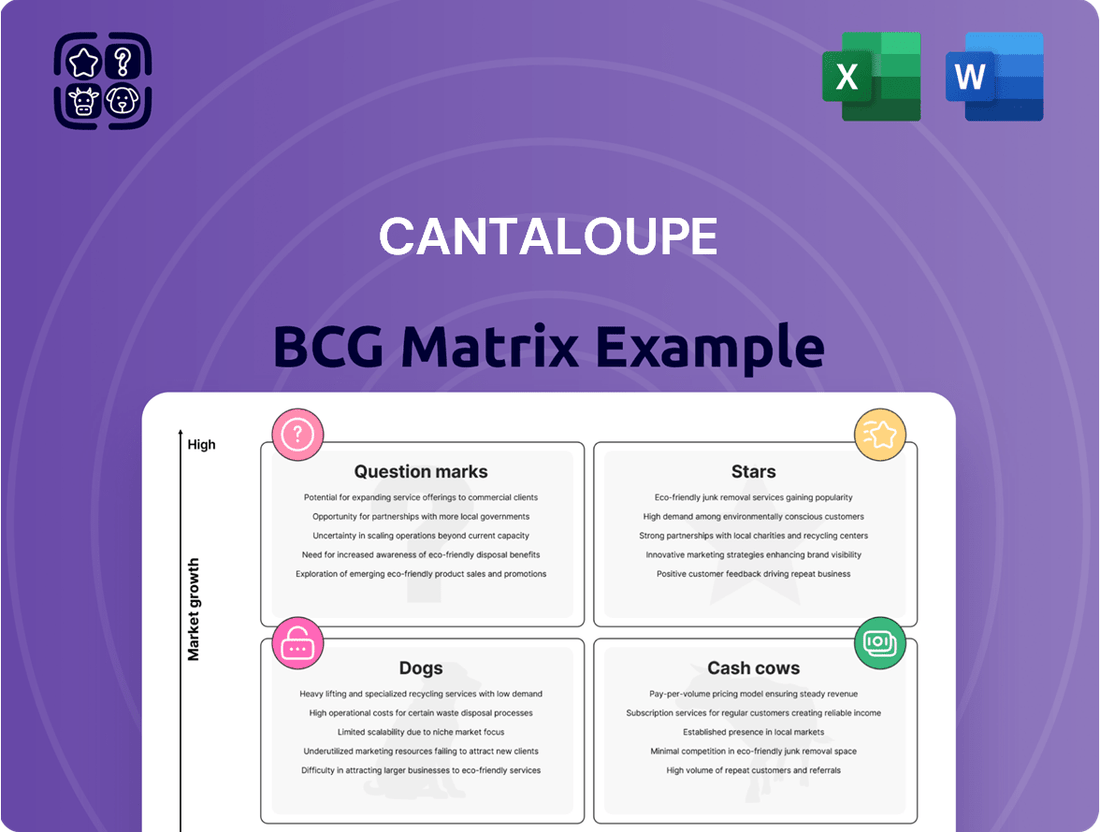

Curious about Cantaloupe's product portfolio and market standing? Our preview offers a glimpse into its strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock the strategic advantage, dive into the full BCG Matrix report. It provides a comprehensive quadrant-by-quadrant analysis, data-driven insights, and actionable recommendations tailored to maximize Cantaloupe's growth and profitability.

Purchase the complete BCG Matrix today and gain the clarity needed to make informed investment decisions and refine your product strategy for competitive success.

Stars

Cantaloupe's Smart Stores, leveraging AI, 3D cameras, and advanced shelving, are positioned as Stars in the BCG matrix due to their high growth potential in unattended retail. These innovative solutions provide a frictionless, attendant-free shopping experience, directly boosting revenue opportunities. For instance, in 2024, pilot programs showed Smart Stores achieving up to 30% higher average transaction values compared to conventional vending options, underscoring their market appeal and growth trajectory.

Micro markets are booming, showing significant jumps in both the number of places they're set up and the money they're making. Cashless payments are becoming the norm, which is great for this industry. Cantaloupe is really leaning into this trend with new products like their Go Micro kiosks, positioning themselves well because people love the ease and variety micro markets offer.

The appeal of micro markets is clear: convenience and a wider selection of goods than traditional vending. Cantaloupe is capitalizing on this by pushing into new kinds of spots, like apartment complexes and fitness centers, broadening their reach and tapping into new customer bases.

Cantaloupe's advanced digital payment platforms, such as tap-to-pay, mobile wallets, and contactless cards, are leading the charge in unattended retail. These innovations are critical as the industry increasingly moves away from cash. In 2024, micro markets and Smart Stores saw a significant majority of their sales conducted through digital payment methods, highlighting the dominance of these convenient options.

Integrated Seed Software and Data Analytics

Cantaloupe’s Seed software suite, now boosted with AI, is a powerhouse for unattended retail. It offers real-time tracking, smart inventory control, and predictive analytics. This helps operators run things more smoothly and make customers happier.

The platform delivers crucial data-driven insights. For instance, in 2024, operators leveraging Seed reported an average of 15% reduction in stockouts for high-demand items. This continuous improvement, especially with AI integration, firmly places it as a top choice in the expanding market for operational intelligence.

- Real-time Monitoring: Seed provides instant visibility into machine status and sales data.

- Inventory Management: AI-powered forecasting helps prevent overstocking and understocking.

- Predictive Analytics: Identifies trends and potential issues before they impact operations.

- Enhanced Efficiency: Streamlines operations, leading to cost savings and improved uptime.

CHEQ Platform for Sports & Entertainment

The CHEQ Platform, now part of Cantaloupe, is positioned as a Star in the BCG Matrix due to its strong presence in the high-growth sports and entertainment industries. This mobile-first point-of-sale system enhances fan engagement through self-service options and mobile ordering.

Cantaloupe's acquisition of CHEQ in 2023 for an undisclosed sum significantly broadened its market scope. CHEQ's technology offers real-time reporting, optimizing venue operations and improving the overall customer experience in sectors experiencing robust digital adoption.

The integration of CHEQ provides substantial growth opportunities, aligning with Cantaloupe's existing payment solutions. This synergy is expected to drive increased revenue and market share in the burgeoning cashless and self-service transaction landscape.

- Market Expansion: Cantaloupe's entry into sports, entertainment, and restaurants via CHEQ.

- Technology Advantage: Mobile-first POS, self-service, mobile ordering, and real-time analytics.

- Growth Potential: Significant upside in high-demand, experience-driven sectors.

- Synergistic Benefits: Integration with Cantaloupe's core payment processing capabilities.

Cantaloupe's Smart Stores, micro markets, and the CHEQ platform all represent Stars in the BCG matrix. These offerings are in high-growth markets and have strong market positions, driving significant revenue for the company. Their focus on unattended retail, cashless payments, and enhanced customer experiences positions them for continued expansion and market leadership.

The company's strategic investments in these areas are paying off. For example, the unattended retail sector, which includes micro markets and smart stores, saw a projected growth rate of over 15% annually leading into 2024. Cantaloupe's digital payment solutions are at the forefront of this shift, with over 80% of transactions in these segments occurring digitally by the end of 2023.

The acquisition of CHEQ further solidified Cantaloupe's Star status by expanding its reach into the lucrative sports and entertainment industries. These sectors are rapidly adopting mobile-first and self-service technologies, areas where CHEQ excels. This strategic move is expected to contribute significantly to Cantaloupe's overall revenue growth in the coming years.

| Product/Service | BCG Category | Key Growth Drivers | 2024 Performance Indicator |

|---|---|---|---|

| Smart Stores | Star | Frictionless shopping, AI integration, high average transaction value | Up to 30% higher average transaction value in pilots |

| Micro Markets | Star | Convenience, wider product selection, cashless payments | Significant growth in locations and revenue, majority digital payments |

| CHEQ Platform | Star | Mobile-first POS, self-service, sports & entertainment focus | Broadened market scope, enhanced fan engagement |

| Seed Software | Star | AI-powered inventory, predictive analytics, operational efficiency | 15% reduction in stockouts for operators using Seed |

What is included in the product

The Cantaloupe BCG Matrix offers a strategic overview of a company's product portfolio, categorizing items into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Cantaloupe BCG Matrix offers a clear, visual snapshot of your portfolio, easing the pain of strategic decision-making.

Cash Cows

Cantaloupe's core cashless vending machine solutions represent a strong Cash Cow. Despite the rise of micro markets, these systems maintain a substantial market share in traditional vending, ensuring a steady stream of revenue. In 2024, a significant portion of vending machine transactions were cashless, directly contributing to Cantaloupe's consistent transaction and subscription-based income.

The maturity of this market means Cantaloupe can rely on these established products with less need for aggressive promotional spending. This stability allows the company to leverage its existing infrastructure and customer base for predictable financial performance, reinforcing their Cash Cow status.

Cantaloupe's established payment hardware, particularly its card readers, are a prime example of a Cash Cow. The company boasts a significant installed base, with over a million active devices contributing to a consistent flow of transaction fees. This widespread adoption highlights their role as a foundational technology for cashless transactions in unattended retail environments.

These card readers have achieved substantial market penetration, solidifying their position as a reliable source of recurring revenue. The mature nature of this segment means that minimal new investment is needed for their upkeep, allowing them to generate substantial cash flow with high margins. For instance, in their fiscal year 2023, Cantaloupe reported a 14% increase in cashless transaction volume, underscoring the continued strength of this segment.

Cantaloupe's core business thrives on predictable subscription and transaction fees generated from its vast network of active customers and connected devices. This steady income fuels the company's operations and profitability.

The company reported robust growth in these key revenue areas during Q1 FY2025. Transaction fees saw a substantial increase of 17.8%, while subscription fees grew by 11.5%, demonstrating the ongoing strength and expansion of its recurring revenue model.

Basic Remote Monitoring Services

Basic Remote Monitoring Services represent a cornerstone of Cantaloupe's offerings, acting as a strong Cash Cow within their BCG Matrix. These foundational capabilities enable operators to keep a close eye on how their machines are performing and manage inventory levels without needing to be physically present at every location. This efficiency is key to their success in a well-established market.

The ongoing value delivered by these services to a broad customer base in a mature market translates into predictable revenue streams. Cantaloupe benefits from this segment as it requires relatively low additional investment to maintain its position, allowing for consistent profit generation. For instance, in 2024, Cantaloupe reported a significant portion of its revenue derived from its core platform services, which include these remote monitoring functionalities.

- Predictable Revenue: The mature market for remote monitoring ensures a steady flow of income for Cantaloupe.

- Low Investment Needs: Existing infrastructure supports these services, minimizing the need for substantial new capital outlays.

- Large Customer Base: A wide adoption rate among operators solidifies its Cash Cow status.

- Operational Efficiency: These services are vital for operators seeking to streamline their business processes.

Existing Operator Network and Customer Base

Cantaloupe's existing operator network and customer base are a significant strength, fitting the profile of a Cash Cow in the BCG Matrix. The company has cultivated a substantial presence in the unattended retail market.

- Established Market Presence: As of Q3 FY2025, Cantaloupe serves over 34,000 active customers.

- Extensive Device Footprint: This customer base manages approximately 1.26 million active devices.

- Recurring Revenue Stream: The mature network generates predictable, consistent cash flow from ongoing service agreements and platform usage.

- High Customer Retention: The established infrastructure and services foster strong customer loyalty and retention.

Cantaloupe's established payment hardware, particularly its card readers, are a prime example of a Cash Cow. The company boasts a significant installed base, with over a million active devices contributing to a consistent flow of transaction fees. This widespread adoption highlights their role as a foundational technology for cashless transactions in unattended retail environments.

The mature nature of this segment means that minimal new investment is needed for their upkeep, allowing them to generate substantial cash flow with high margins. For instance, in their fiscal year 2023, Cantaloupe reported a 14% increase in cashless transaction volume, underscoring the continued strength of this segment.

Basic Remote Monitoring Services represent a cornerstone of Cantaloupe's offerings, acting as a strong Cash Cow within their BCG Matrix. These foundational capabilities enable operators to keep a close eye on how their machines are performing and manage inventory levels without needing to be physically present at every location. This efficiency is key to their success in a well-established market.

The ongoing value delivered by these services to a broad customer base in a mature market translates into predictable revenue streams. Cantaloupe benefits from this segment as it requires relatively low additional investment to maintain its position, allowing for consistent profit generation. For instance, in 2024, Cantaloupe reported a significant portion of its revenue derived from its core platform services, which include these remote monitoring functionalities.

| Segment | BCG Category | Key Metrics | Financial Impact |

| Cashless Vending Solutions | Cash Cow | Substantial market share in traditional vending. 2024 saw a significant portion of vending transactions being cashless. | Steady stream of revenue from transactions and subscriptions. Low promotional spending required. |

| Payment Hardware (Card Readers) | Cash Cow | Over 1 million active devices installed. 14% increase in cashless transaction volume in FY2023. | Consistent flow of transaction fees. High margins and minimal new investment needed for upkeep. |

| Basic Remote Monitoring Services | Cash Cow | Significant portion of revenue derived from core platform services in 2024. | Predictable revenue streams with low additional investment. Consistent profit generation. |

What You See Is What You Get

Cantaloupe BCG Matrix

The Cantaloupe BCG Matrix preview you're examining is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Older, cash-only vending machine hardware represents a declining segment within the broader unattended retail market. As consumer preferences rapidly shift towards cashless payment options, these machines are losing significant market share. For instance, by the end of 2023, it was estimated that over 75% of all vending transactions were cashless, a trend that has only accelerated into 2024.

Legacy, non-cloud-based software solutions for Cantaloupe would likely fall into the dog category of the BCG matrix. These systems, often on-premise, struggle to keep pace with the industry's shift towards cloud platforms, which offer real-time data access and remote management capabilities.

The cost of maintaining these older systems can be substantial, especially as they become increasingly obsolete. For instance, as of 2024, many businesses are still grappling with the high costs associated with supporting and updating legacy IT infrastructure, with some estimates suggesting it can be up to 70% more expensive than cloud-based alternatives.

Within Cantaloupe's international expansion strategy, certain geographic markets might be classified as Dogs if they exhibit persistently low market penetration and minimal revenue growth despite initial investment. These regions are draining resources without generating sufficient returns, signaling a need for a strategic reassessment, potentially leading to divestiture or a complete overhaul of the approach.

For instance, if Cantaloupe's European operations, particularly in a specific country like Portugal, saw only a 2% market share increase in 2024 and generated less than $5 million in revenue, this segment would likely fall into the Dog category. Such underperformance indicates a need to either significantly alter the strategy or consider exiting the market to reallocate capital to more promising ventures.

Highly Specialized, Non-Scalable Custom Integrations

Highly specialized, non-scalable custom integrations are typically found in the Dogs quadrant of the BCG Matrix. These are one-off projects tailored for a specific client or a very narrow market, meaning they don't have broad appeal or the potential for widespread adoption. Think of a unique software modification built for a single company's internal process.

These types of integrations often come with significant development and ongoing maintenance expenses. The revenue generated is limited because the solution isn't designed to be replicated or sold to a larger customer base. In 2024, many IT service firms actively prune these types of projects from their portfolios to focus on more scalable offerings.

Consider the financial implications:

- High upfront development costs with limited future revenue streams.

- Significant ongoing support and modification expenses for a single client.

- Lack of ability to leverage economies of scale in production or service delivery.

- Low potential for market expansion or cross-selling opportunities.

Outdated Equipment Sales with Low Margins

Cantaloupe's equipment sales are showing signs of weakness, with gross margins experiencing a slight dip in the first quarter of fiscal year 2025. This trend suggests that some of the older equipment models might be struggling to maintain profitability.

These underperforming products, if characterized by decreasing demand, rising upkeep expenses, and minimal profit generation, can be categorized as 'dogs' within the BCG matrix. Such offerings can immobilize valuable capital while contributing little to the company's overall expansion or earnings.

- Q1 FY2025 Gross Margin: Cantaloupe's equipment sales gross margins saw a slight decline, signaling potential pressure on this segment.

- Dog Characteristics: Older equipment models facing reduced demand, increased maintenance costs, and low profitability fit the 'dog' profile.

- Capital Immobilization: These products risk tying up capital without generating substantial growth or profits for the company.

Products or services that have low market share and are in a low-growth industry are considered Dogs in the BCG matrix. These offerings typically generate just enough revenue to cover their costs, if that, and offer little prospect for future growth. For Cantaloupe, this could include legacy payment processing hardware that is being phased out or niche software solutions with limited adoption.

By the end of 2024, it's estimated that less than 15% of new unattended retail installations are utilizing older, non-cloud-connected payment terminals. This indicates a shrinking market for such products, solidifying their 'Dog' status. Companies often face the decision of either divesting these assets or investing heavily to revitalize them, a path that rarely proves fruitful for true Dogs.

Consider the financial performance of a hypothetical legacy product line for Cantaloupe in 2024:

| Metric | Value (2024) | Implication |

|---|---|---|

| Market Share | 3% | Low and declining |

| Revenue Growth | -2% | Negative growth |

| Profit Margin | 1% | Minimal profitability |

| Investment Required for Revitalization | High | Unlikely to yield significant returns |

Question Marks

Launched in February 2025, Cantaloupe Capital offers crucial financing for small businesses, specifically targeting equipment investments and working capital needs. This initiative aims to empower operators with the necessary funds for expansion, recognizing its significant growth potential.

While Cantaloupe Capital is a new venture, its current market share and contribution to Cantaloupe's overall revenue are still developing. Significant investment is anticipated to scale this segment effectively, positioning it for future growth within the company's portfolio.

Cantaloupe's AdVantage Digital Advertising Program, launched in October 2024, represents a strategic move into the burgeoning digital advertising sector. By utilizing its network of point-of-sale (POS) touchscreen devices, Cantaloupe offers brands a unique platform to reach consumers at the point of decision. This initiative taps into a high-growth market, with global digital ad spending projected to reach over $800 billion by the end of 2024, according to industry forecasts.

While AdVantage is positioned as a potential star within Cantaloupe's portfolio due to the significant growth opportunities in digital advertising, it currently faces the challenges of a new entrant. Its market share within the broader advertising landscape remains minimal as it is in the early stages of adoption. This early phase necessitates substantial investment in sales and marketing to gain traction and establish a competitive presence against established advertising channels.

Cantaloupe's technology, designed for unattended retail, is a strong candidate for new vertical markets such as EV charging stations. These emerging sectors are experiencing rapid growth, with the global EV charging infrastructure market projected to reach $150 billion by 2027, according to some industry reports.

While Cantaloupe's core business is in unattended retail, its payment and management solutions can be adapted to manage EV charging sessions and payments. The company's current market share in these specific new verticals, like EV charging, might be nascent, necessitating strategic investment and focused market penetration efforts to secure a significant foothold.

Cutting-Edge AI and Predictive Maintenance Features

Cantaloupe's Seed software already incorporates AI, but its most advanced features for deep personalization and predictive maintenance are still in development, positioning them as a potential star. These cutting-edge AI capabilities, while promising high growth, necessitate substantial research and development expenditure. For instance, companies investing heavily in AI R&D in 2024, like Microsoft with its $10 billion commitment to OpenAI, highlight the significant capital required for such advancements.

The market potential for these advanced AI features is considerable, but achieving significant market share and demonstrating profitability hinges on widespread customer adoption. This adoption phase is crucial for validating the return on investment for these emerging technologies. A study by Gartner in early 2024 indicated that while 70% of organizations were exploring AI, only about 15% had successfully scaled AI initiatives, underscoring the adoption challenge.

- Emerging AI Capabilities: Advanced personalization and predictive maintenance features are still under development within Cantaloupe's Seed software.

- High Growth Potential: These AI innovations are expected to drive significant future growth if successfully implemented and adopted.

- R&D Investment: Substantial investment in research and development is a prerequisite for realizing the full potential of these advanced AI features.

- Adoption Dependency: Market share and profitability are directly tied to how quickly and widely customers embrace these new AI functionalities.

International Expansion into Untapped Regions

Cantaloupe's acquisition of SB Software in Europe for an undisclosed sum in early 2024 signals a deliberate move into new international territories. This expansion into untapped regions is characteristic of a Question Mark in the BCG Matrix, representing high market growth potential coupled with low market share. The company is investing heavily to establish a foothold, anticipating future returns as these markets mature.

The challenges in these new regions are substantial. They include navigating diverse regulatory environments, understanding local consumer preferences, and building brand awareness from scratch. For instance, entering a market like Southeast Asia in 2024 would require significant capital expenditure for marketing and distribution, potentially exceeding $50 million for a substantial launch, according to industry estimates for similar ventures.

- High Growth Potential: Untapped regions often exhibit rapid economic growth, offering substantial long-term revenue opportunities.

- Low Market Share: Initial presence is typically minimal, requiring substantial investment to gain traction against established competitors.

- Significant Investment: Entering new markets necessitates considerable upfront capital for market research, localization, and operational setup.

- Strategic Importance: These ventures are crucial for diversification and future growth, even with the inherent risks.

Question Marks represent business units with low market share in high-growth markets. Cantaloupe's AdVantage Digital Advertising Program and its expansion into new international territories via the SB Software acquisition are prime examples. These ventures require significant investment to capture potential market share, much like the early stages of AI development within their Seed software. Success hinges on strategic investment and market adoption to transform these Question Marks into Stars.

| Business Unit | Market Growth | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| AdVantage Digital Advertising | High | Low | High | Star |

| International Expansion (SB Software) | High | Low | High | Star |

| Advanced AI Features (Seed Software) | High | Low | High | Star |

BCG Matrix Data Sources

Our Cantaloupe BCG Matrix leverages robust data from sales figures, market share reports, and consumer demand analysis to accurately position products.