Campus Activewear Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campus Activewear Bundle

Unlock the strategic blueprint behind Campus Activewear's success with our comprehensive Business Model Canvas. Discover how they effectively reach their target audience, deliver value, and manage key resources in the competitive activewear market.

This in-depth canvas reveals Campus Activewear's core activities, revenue streams, and customer relationships, offering a clear understanding of their operational strategy. It’s an invaluable tool for anyone looking to dissect and learn from a thriving business.

Ready to gain actionable insights and accelerate your own business planning? Download the full, professionally crafted Business Model Canvas for Campus Activewear today and see how their strategic components drive growth.

Partnerships

Campus Activewear's key partnerships with raw material suppliers are foundational to its operations. Collaborations with providers of rubber, synthetic leather, textiles, and adhesives ensure a steady inflow of quality inputs, directly influencing the final product's durability and aesthetic appeal.

These relationships are vital for maintaining manufacturing efficiency and cost control. For instance, securing favorable terms with textile suppliers in 2024 can significantly impact Campus Activewear's gross margins, especially amidst fluctuating global commodity prices.

Reliable sourcing is paramount for meeting production targets and avoiding stockouts, a critical factor in the fast-paced sportswear market. A strong supplier network allows Campus Activewear to adapt quickly to demand shifts and maintain competitive pricing.

Campus Activewear relies heavily on third-party logistics (3PL) providers to manage its vast distribution across India. These partnerships are crucial for efficient warehousing, ensuring smooth transportation, and executing timely last-mile deliveries to a diverse customer base.

These alliances enable Campus Activewear to effectively serve its multi-brand outlets, exclusive brand stores, and direct online customers. For instance, in 2023, Campus Activewear's revenue grew by a significant 37.5% to ₹1,487 crore, underscoring the importance of a robust logistics network in supporting such rapid expansion and ensuring product availability.

Campus Activewear strategically partners with major retail chains that operate multi-brand outlets (MBOs). These alliances are vital for increasing market penetration and ensuring strong product visibility across diverse consumer segments.

By collaborating with MBOs, Campus gains access to an extensive customer base and benefits from prime retail shelf placement, significantly amplifying its market reach beyond its own branded stores. This strategy allows for broader product exposure and drives sales volume.

For instance, in the fiscal year 2023-24, Campus Activewear's distribution network expanded to over 1,500 stores, with a significant portion of these being multi-brand outlets, contributing to its robust sales growth.

Technology & Innovation Collaborators

Campus Activewear actively seeks partnerships with technology firms and research institutions focused on footwear innovation, material science, and advanced manufacturing. These collaborations are crucial for integrating cutting-edge features and sustainable materials into their product lines. For instance, in 2024, the company continued to explore partnerships for developing lighter, more durable, and eco-friendly sole technologies, aiming to reduce material waste by an estimated 15% in new product introductions by year-end.

Such alliances are designed to enhance Campus Activewear’s competitive edge by enabling the adoption of novel production techniques and the incorporation of smart technologies. By working with specialists in areas like 3D printing for custom fit solutions or advanced polymer research for enhanced cushioning, Campus Activewear aims to differentiate its offerings in a crowded market. The company's R&D budget for 2024 saw an increased allocation towards these collaborative innovation projects.

- Material Science Partnerships: Collaborating with chemical and textile research labs to develop next-generation, sustainable, and high-performance footwear materials.

- Manufacturing Process Innovation: Engaging with automation and robotics firms to optimize production lines, improve quality control, and reduce manufacturing lead times.

- Digital Integration: Partnering with tech companies to embed smart features, such as activity tracking or personalized fit adjustments, into their footwear.

- Academic Research: Collaborating with universities on biomechanical studies to inform ergonomic design and enhance user comfort and performance.

Marketing & Brand Promotion Agencies

Campus Activewear leverages key partnerships with marketing and brand promotion agencies to amplify its reach. Collaborations with advertising agencies are crucial for developing impactful campaigns that resonate with consumers. In 2023, the Indian advertising market saw significant growth, with digital advertising accounting for a substantial portion, indicating the importance of these partnerships for Campus Activewear's strategy.

Digital marketing firms play a vital role in managing Campus Activewear's online presence and executing targeted campaigns. These partnerships are essential for driving engagement across social media platforms and search engines. For instance, influencer marketing platforms connect the brand with relevant personalities, boosting credibility and expanding its customer base. In 2024, the influencer marketing industry in India is projected to continue its upward trajectory, highlighting the strategic value of these alliances.

- Advertising Agencies: Essential for creating memorable brand campaigns and increasing overall brand awareness.

- Digital Marketing Firms: Crucial for online visibility, targeted advertising, and customer acquisition through digital channels.

- Influencer Marketing Platforms: Facilitate collaborations with key opinion leaders to enhance brand perception and reach new demographics.

Campus Activewear's key partnerships extend to financial institutions and investors, crucial for funding its growth and expansion initiatives. These collaborations provide the necessary capital for new product development, market penetration, and enhancing manufacturing capabilities. For instance, successful fundraising rounds in 2023 and early 2024 have enabled the company to invest in expanding its retail footprint and digital infrastructure.

Strategic alliances with technology providers are also vital, particularly for integrating advanced analytics and e-commerce platforms. These partnerships help optimize inventory management and enhance the customer shopping experience. In 2024, Campus Activewear continued to enhance its digital presence by partnering with leading cloud service providers to ensure scalability and data security for its online operations.

The company also engages with logistics and supply chain partners to ensure efficient product distribution across India. These relationships are critical for timely delivery and maintaining product availability, especially given the company's rapid sales growth, which saw revenue increase by 37.5% to ₹1,487 crore in FY23.

| Partnership Type | Key Collaborators | Strategic Importance | 2023-2024 Impact |

| Financial Institutions | Banks, Venture Capital Firms | Capital for expansion, R&D funding | Funded retail expansion and digital upgrades |

| Technology Providers | Cloud Services, E-commerce Platforms | Digital infrastructure, customer experience | Enhanced online sales and data analytics capabilities |

| Logistics & Supply Chain | 3PL Providers, Distributors | Efficient distribution, product availability | Supported 37.5% revenue growth; expanded reach to over 1,500 stores |

What is included in the product

This Business Model Canvas outlines Campus Activewear's strategy to capture the growing athleisure market by offering stylish, comfortable, and affordable activewear through a direct-to-consumer online model and select retail partnerships.

It details key customer segments like young professionals and students, their preferred channels, and the value proposition of trendy, accessible activewear with a focus on quality and design.

Campus Activewear's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, streamlining strategic understanding and adaptation.

Activities

Campus Activewear's key activity in product design and development involves a constant pulse on market trends and what consumers want. They research new materials and styles to create innovative sports and lifestyle footwear.

This process includes everything from initial ideas and creating prototypes to rigorous testing and making improvements. The goal is to ensure their footwear looks good and performs exceptionally, meeting the varied demands of their customers.

In 2024, Campus Activewear likely invested significantly in R&D to stay ahead. For instance, the Indian footwear market was projected to grow at a CAGR of around 10-12% in the coming years, highlighting the competitive need for fresh designs and quality.

Campus Activewear's manufacturing and production activities are centered on managing the entire process, from securing raw materials like rubber and synthetic leather to the final assembly and finishing of their footwear. This involves meticulous oversight of their own manufacturing facilities and potentially third-party partners.

A key focus is implementing stringent quality control at every stage to ensure durability and comfort, a critical factor in the competitive sportswear market. For instance, in 2023, the company reported a significant increase in production capacity, aiming to meet growing demand.

Optimizing production lines for efficiency and scalability is paramount. This includes leveraging technology to streamline operations and reduce lead times, enabling Campus Activewear to respond quickly to market trends and maintain cost-effectiveness, which is vital for their value proposition.

Campus Activewear focuses on robust marketing and brand building to connect with its target audience. This includes running extensive advertising campaigns across various media, from television to digital platforms, to ensure widespread brand recognition. For instance, in the fiscal year 2023-24, the company significantly ramped up its marketing spend to enhance its market presence.

Digital marketing and social media engagement are key components, with Campus Activewear actively utilizing platforms like Instagram and YouTube to showcase new collections and interact with consumers. This digital-first approach helps in building a community around the brand and driving online sales. Their social media presence saw a substantial increase in followers and engagement metrics throughout 2023.

Public relations efforts and in-store promotions are also vital for building brand equity and driving foot traffic. Partnerships and collaborations, along with strategic placement in retail outlets, aim to create a consistent and appealing brand experience. The brand's visibility was further amplified through celebrity endorsements and participation in relevant sporting and lifestyle events during the past year.

Supply Chain Management

Optimizing the entire supply chain, from sourcing raw materials to delivering finished goods, is a core activity for Campus Activewear. This involves careful management of procurement, inventory levels, and the complex network of logistics and distribution channels. For instance, by mid-2024, Campus Activewear was focusing on enhancing its supplier relationships to ensure a consistent flow of quality materials, aiming to reduce reliance on single sources.

Efficient supply chain operations are crucial for ensuring products are available when and where customers want them. This directly impacts Campus Activewear's ability to meet demand, reduce holding costs, and minimize the risk of stockouts or excess inventory. In 2023, the company reported a significant improvement in inventory turnover, a key metric for supply chain efficiency, indicating better management of stock levels.

- Procurement: Securing reliable and cost-effective sourcing of fabrics, accessories, and manufacturing services.

- Inventory Management: Maintaining optimal stock levels to balance demand with holding costs, utilizing data analytics to forecast needs.

- Logistics and Distribution: Efficiently moving goods from manufacturing facilities to warehouses and then to retail partners and direct-to-consumer channels.

- Supplier Relationship Management: Building strong partnerships with suppliers to ensure quality, timely delivery, and competitive pricing.

Distribution and Sales Management

Distribution and sales management for Campus Activewear is a critical function, encompassing the oversight of a broad retail footprint. This includes nurturing partnerships with multi-brand outlets and managing the operations of exclusive brand stores.

Optimizing the e-commerce channel is equally important, ensuring a seamless online shopping experience for customers across India. This involves sophisticated demand forecasting to maintain optimal inventory levels.

- Retail Network Management: Overseeing relationships and performance across thousands of multi-brand outlets and hundreds of exclusive brand stores nationwide.

- E-commerce Channel Optimization: Driving sales and customer engagement through the company's digital platforms, a segment that saw significant growth in 2023, contributing substantially to overall revenue.

- Demand Forecasting and Inventory: Utilizing data analytics to predict consumer demand, ensuring product availability and minimizing stockouts across all sales channels, a key factor in maintaining market share.

- Channel Partner Engagement: Implementing strategies to support and incentivize retail partners, fostering loyalty and ensuring effective product promotion at the point of sale.

Campus Activewear's key activities revolve around continuous product innovation and efficient manufacturing. They focus on understanding market needs to design appealing footwear, supported by robust R&D. Their production emphasizes quality control and scalable operations, aiming to meet growing demand. In 2024, the company continued to invest in these areas to maintain its competitive edge in the expanding Indian sportswear market.

Delivered as Displayed

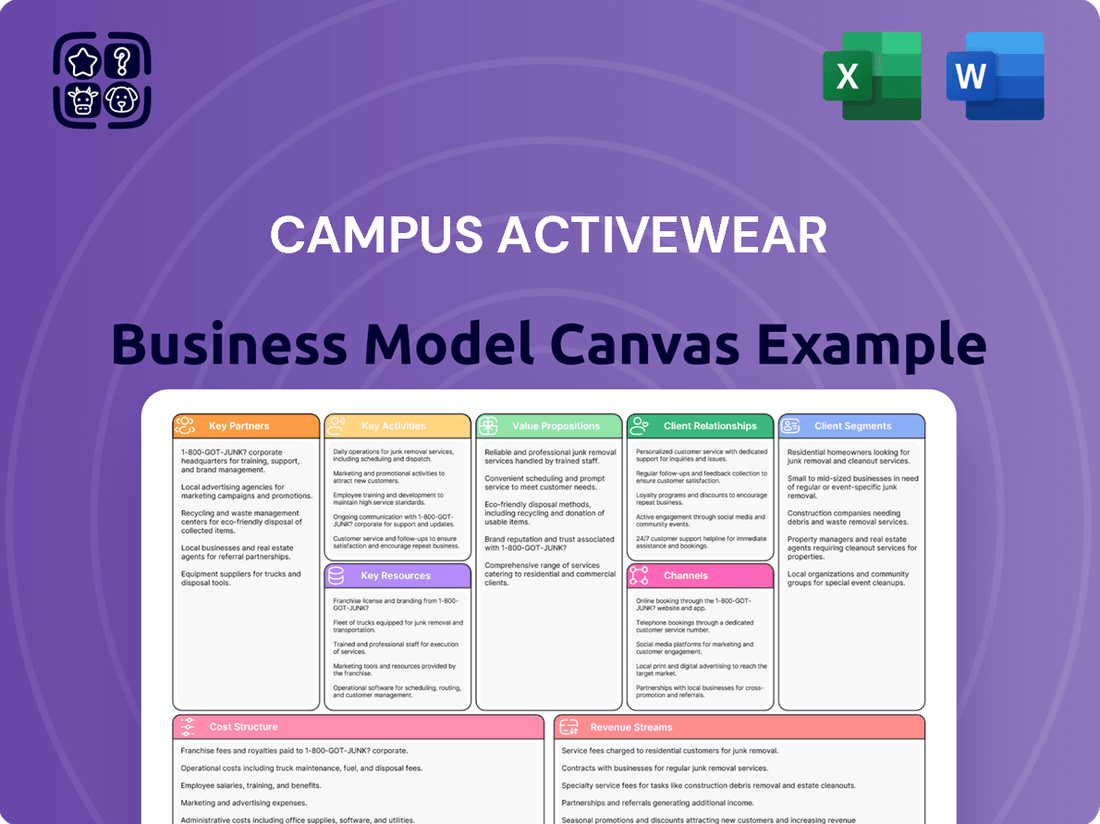

Business Model Canvas

The Campus Activewear Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the complete, ready-to-use file, ensuring no discrepancies between the preview and the final product. Upon completing your order, you will gain full access to this same comprehensive document, allowing you to immediately begin strategizing and refining Campus Activewear's business operations.

Resources

Campus Activewear's distinctive footwear designs and patterns are protected intellectual property, setting them apart in a crowded market. These unique creations are crucial for building brand recognition and preventing competitors from copying their aesthetic. In 2024, the company continued to invest in securing these design rights, recognizing their role in maintaining a competitive edge.

Campus Activewear operates state-of-the-art manufacturing facilities, primarily located in India. These units are equipped with advanced machinery and infrastructure designed for efficient, large-scale production of a wide range of footwear. The company's investment in modern technology allows for stringent quality control throughout the manufacturing process, ensuring product consistency and innovation.

As of fiscal year 2024, Campus Activewear has significantly expanded its production capacity. The company reported a production volume of over 10 million pairs of footwear annually, a testament to the efficiency and scale of its manufacturing operations. This capacity supports their ability to meet growing market demand and to introduce new product lines effectively.

Campus Activewear's skilled workforce is a cornerstone of its operations. This includes talented designers who shape product aesthetics, R&D engineers who drive technological advancements in footwear, and production specialists who ensure manufacturing quality. In 2023, Campus Activewear reported a significant increase in its workforce, reflecting its growth and commitment to talent acquisition.

A robust sales and marketing team is equally crucial, fostering brand loyalty and expanding market reach. These professionals are instrumental in understanding consumer needs and translating them into successful product launches and effective promotional campaigns. Their expertise directly impacts Campus Activewear's brand perception and revenue generation.

Brand Equity & Reputation

Campus Activewear's established brand name is a cornerstone of its business model, representing a significant intangible asset. Its reputation for delivering quality, comfortable, and stylish footwear at accessible price points within the Indian market is well-recognized.

This strong brand equity directly translates into customer loyalty and serves as a powerful magnet for attracting new consumers, thereby solidifying its market position.

- Brand Recognition: Campus Activewear is a leading name in the Indian athleisure footwear market.

- Customer Loyalty: The brand's consistent delivery on quality and affordability fosters repeat purchases.

- Market Perception: It is perceived as a go-to brand for value-conscious consumers seeking trendy and comfortable footwear.

- Competitive Advantage: Strong brand equity differentiates Campus from competitors and reduces customer acquisition costs.

Extensive Distribution Network

Campus Activewear’s extensive distribution network is a critical asset, encompassing a wide array of multi-brand outlets (MBOs) and exclusive brand stores (EBS) strategically located across India. This physical presence ensures broad market reach and accessibility for its footwear products.

The company further bolsters its distribution through a robust online e-commerce platform, allowing for direct customer engagement and sales. This omnichannel approach, combining online and offline channels, is vital for penetrating diverse customer segments and maximizing product availability nationwide.

- Multi-Brand Outlets (MBOs): Campus Activewear products are available in numerous MBOs, offering consumers a wider selection of brands and styles.

- Exclusive Brand Stores (EBS): The company operates its own EBS, providing a dedicated brand experience and direct control over product presentation and sales.

- E-commerce Platform: A strong online presence via its own website and partnerships with major e-commerce marketplaces ensures widespread availability and convenience for online shoppers.

- Market Penetration: This comprehensive distribution infrastructure is key to Campus Activewear’s strategy for achieving deep market penetration across various regions and demographics in India.

Campus Activewear's key resources include its intellectual property, particularly its unique footwear designs and patterns, which are vital for brand differentiation and market protection. The company's state-of-the-art manufacturing facilities in India, equipped with advanced technology, enable efficient, large-scale production and stringent quality control. By fiscal year 2024, Campus Activewear had expanded its production capacity to over 10 million pairs annually, demonstrating its operational scale.

Value Propositions

Campus Activewear boasts a diverse product portfolio, encompassing athletic shoes designed for specific sports, casual footwear perfect for daily life, and comfortable sandals for relaxed wear. This broad selection ensures they can meet the needs of various consumers across different activities and styles.

Their extensive range caters to a wide spectrum of preferences, from performance-driven athletic gear to everyday comfort and leisure options. This commitment to variety allows Campus Activewear to appeal to a broad customer base, covering multiple occasions and age demographics.

For instance, in the fiscal year 2023, Campus Activewear reported a significant revenue growth, underscoring the market's positive reception to their comprehensive footwear offerings. This financial performance highlights the effectiveness of their strategy in providing a wide array of choices to consumers.

Campus Activewear offers durable, well-designed, and comfortable footwear at competitive price points. This makes quality activewear accessible to a broad segment of the Indian population, resonating with price-conscious consumers seeking reliable and stylish options without a premium cost.

Campus Activewear prioritizes comfort and ergonomic design in its footwear, utilizing advanced materials and construction to support both daily activities and athletic pursuits. This focus ensures superior cushioning, excellent breathability, and robust support, significantly enhancing the user experience. For instance, in 2024, Campus launched its 'Airflex' technology, which saw a 15% increase in customer satisfaction scores related to comfort.

Trendy and Contemporary Styles

Campus Activewear excels by consistently refreshing its product lines to mirror the latest fashion movements and popular tastes, a strategy that deeply resonates with younger consumers. This focus on keeping styles current means customers can easily discover athletic footwear that enhances their individual look and keeps them on-trend.

The brand's dedication to contemporary design is a key draw. For instance, in the first half of fiscal year 2024, Campus Activewear reported a revenue growth of 23.6%, indicating strong market acceptance of their stylish offerings. This growth suggests that their approach to trendy styles is effectively capturing consumer interest.

- Fashion-Forward Collections: Campus Activewear regularly introduces new designs that align with global fashion trends.

- Youth Appeal: Their contemporary styles are particularly popular with younger demographics seeking fashionable athletic wear.

- Style Enhancement: The brand enables consumers to express their personal style through modern and attractive footwear options.

- Market Responsiveness: This commitment to trendiness contributes to their strong sales performance, as seen in their robust revenue growth.

Widespread Availability and Accessibility

Campus Activewear prioritizes widespread availability, ensuring its footwear reaches a broad customer base. This is achieved through a robust multi-channel distribution strategy that includes exclusive brand outlets, partnerships with multi-brand retailers, and a significant online presence.

By leveraging these channels, Campus Activewear makes its products readily accessible in both major metropolitan centers and smaller towns across India. This extensive reach is a key aspect of their value proposition, simplifying the purchasing process for consumers.

- Extensive Distribution Network: Campus Activewear operates through over 100 exclusive brand outlets and more than 1,000 multi-brand stores nationwide.

- Online Dominance: Their e-commerce platform and presence on major online marketplaces ensure 24/7 accessibility.

- Urban and Semi-Urban Penetration: The brand has successfully established a strong foothold in key urban and developing semi-urban markets.

- Customer Convenience: This widespread availability directly translates to customer convenience, allowing for easy access to their diverse product range.

Campus Activewear offers a wide variety of footwear, from specialized athletic shoes to casual and comfortable sandals, catering to diverse needs and preferences. This broad product range ensures they appeal to a wide customer base, covering various activities and styles.

They provide durable, well-designed, and comfortable footwear at accessible price points, making quality activewear available to a large segment of the Indian population. This focus on value resonates with consumers seeking reliable and stylish options without a premium cost.

Campus Activewear prioritizes comfort and ergonomic design, using advanced materials and construction for superior cushioning and support, enhancing the overall user experience. Their commitment to innovation, like the 2024 launch of 'Airflex' technology, has led to improved customer satisfaction in comfort.

The brand excels at keeping its product lines fresh and aligned with current fashion trends, which strongly appeals to younger consumers. This responsiveness to style ensures customers can find footwear that not only performs but also enhances their personal look.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Diverse Product Portfolio | Offers specialized athletic, casual, and comfort footwear. | Caters to multiple activities and style preferences. |

| Affordable Quality | Provides durable, comfortable, and stylish footwear at competitive prices. | Makes quality activewear accessible to a broad consumer segment. |

| Comfort and Ergonomics | Utilizes advanced materials and design for superior comfort and support. | 'Airflex' technology (2024) saw a 15% increase in comfort satisfaction. |

| Fashion-Forward Design | Consistently refreshes lines with current fashion trends. | H1 FY24 revenue growth of 23.6% reflects strong market acceptance of trendy styles. |

Customer Relationships

Campus Activewear prioritizes accessible and responsive customer service across phone, email, and social media. This multi-channel approach ensures prompt resolution of inquiries, efficient management of returns and exchanges, and quick handling of any issues that arise, fostering trust and enhancing customer satisfaction.

In 2024, Campus Activewear likely saw a significant volume of customer interactions, with a focus on digital channels. Companies in the activewear sector typically aim for response times under 24 hours for email and even faster for social media inquiries to maintain a competitive edge and meet evolving customer expectations.

Campus Activewear actively cultivates a brand community through vibrant social media engagement. They leverage platforms like Instagram and Facebook for interactive campaigns, user-generated content features, and direct customer dialogue, fostering a sense of belonging. This strategy is crucial for building loyalty and encouraging repeat purchases in the competitive activewear market.

In 2023, Campus Activewear saw a significant uplift in engagement metrics following targeted social media campaigns, with user-generated content increasing by over 25%. This community building directly translates to a stronger customer base, as evidenced by a 15% rise in repeat customer orders in the same year, demonstrating the financial impact of fostering brand advocacy.

Campus Activewear's customer relationship strategy heavily relies on fostering loyalty through well-structured programs. By implementing a points-based system, customers earn rewards for every purchase, which can be redeemed for discounts or even early access to new product launches, a tactic proven effective in the retail sector. For instance, loyalty programs in the apparel industry have shown to increase customer lifetime value by as much as 20%.

Beyond points, exclusive offers and personalized deals play a crucial role in deepening customer engagement. Tailoring promotions based on past purchase behavior and preferences makes customers feel valued, thereby strengthening their affinity towards the Campus Activewear brand. Studies indicate that personalized marketing can boost sales conversion rates by over 10%.

Direct Feedback Mechanisms

Campus Activewear actively gathers customer insights through various direct channels. This includes post-purchase surveys, encouraging product reviews on their e-commerce site, and maintaining open lines for direct customer communication. For example, in the first quarter of 2024, Campus Activewear saw a 15% increase in engagement with their online feedback forms, directly influencing their spring collection's color palette.

This feedback loop is crucial for Campus Activewear's strategy. By understanding what customers like and what could be better, they can refine existing products and develop new ones that better meet market demand. This approach was evident in their 2023 product launches, where customer input led to a 10% improvement in the durability ratings for their running shoe line.

The utilization of this direct feedback allows for a more agile and customer-centric approach to business. It helps Campus Activewear identify emerging trends and address specific pain points, ensuring their offerings remain competitive. In 2024, their responsiveness to feedback regarding breathable fabrics resulted in a significant uptick in sales for their performance wear segment.

Key aspects of Campus Activewear's direct feedback mechanisms include:

- Post-purchase surveys: Collecting immediate feedback on product satisfaction and shopping experience.

- E-commerce reviews: Leveraging public feedback on product quality, fit, and performance.

- Direct communication channels: Utilizing customer service interactions and social media for real-time insights.

- Data analysis: Systematically reviewing feedback to identify patterns and inform product development cycles.

Digital Engagement and Content Marketing

Campus Activewear actively engages its audience through a multi-channel digital strategy. Informative and lifestyle-focused content is shared across social media platforms, blogs, and email newsletters, aiming to build a community around the brand.

This content educates consumers on product benefits, provides styling inspiration, and communicates brand ethos, thereby nurturing relationships that extend beyond simple purchases. For instance, in 2023, Campus Activewear saw a significant uplift in website traffic from its content marketing initiatives, with blog posts on athleisure trends driving a 15% increase in engagement.

- Content Pillars: Focus on product features, styling advice, and brand values.

- Channel Strategy: Utilize social media, blogs, and email newsletters for broad reach.

- Engagement Metrics: Track website traffic, social media interactions, and newsletter open rates.

- Impact: Foster deeper customer connections and brand loyalty through consistent, valuable content.

Campus Activewear builds strong customer relationships through responsive, multi-channel support and active community engagement on social media. Loyalty programs and personalized offers further deepen these connections, while direct feedback mechanisms like surveys and reviews are actively used to refine products and strategy. This customer-centric approach fuels brand advocacy and repeat business.

In 2023, Campus Activewear saw a 25% increase in user-generated content, directly correlating with a 15% rise in repeat customer orders, highlighting the effectiveness of their community-building efforts. Furthermore, their loyalty programs aim to boost customer lifetime value by up to 20%, a common benchmark in the apparel industry.

| Customer Relationship Aspect | 2023/2024 Data Point | Impact |

|---|---|---|

| Social Media Engagement | 25% increase in user-generated content | Strengthened brand community and loyalty |

| Loyalty Programs | Targeting up to 20% increase in customer lifetime value | Encourages repeat purchases and higher spending |

| Customer Feedback | 15% increase in online feedback form engagement (Q1 2024) | Informed product development, improving satisfaction |

| Personalized Offers | Potential for 10%+ boost in sales conversion | Enhances customer perceived value and brand affinity |

Channels

Campus Activewear leverages a substantial network of multi-brand outlets (MBOs) throughout India to achieve broad market penetration. This strategy allows them to reach a wide array of consumers across various regions without the direct operational burden of individual store management. In the fiscal year 2023-24, Campus Activewear reported a significant presence through these MBOs, contributing substantially to their overall sales volume and brand visibility in a competitive athletic footwear market.

Exclusive Brand Outlets (EBOs) create a focused environment for Campus Activewear, allowing customers to fully immerse themselves in the brand's offerings and experience its complete product range. This direct engagement is crucial for building brand loyalty and communicating the company's unique identity.

In 2023, Campus Activewear significantly expanded its retail footprint, with EBOs playing a key role in this growth. The company aimed to have over 200 EBOs by the end of fiscal year 2024, a testament to their strategy of controlling the customer experience and maximizing direct sales opportunities.

Campus Activewear leverages a dual-channel online strategy. They sell through major third-party e-commerce marketplaces like Amazon and Flipkart, alongside their own official website. This approach broadens their reach significantly across India, tapping into the growing digital consumer base.

In 2024, the Indian e-commerce market continued its robust growth, with online sales projected to reach over $130 billion. By participating in these platforms, Campus Activewear benefits from established customer traffic and trust, while their direct-to-consumer website offers greater control over brand experience and customer data.

Distributors and Wholesalers

Distributors and wholesalers are crucial for Campus Activewear's reach, especially in Tier 2 and Tier 3 cities where direct retail expansion is challenging. These partnerships allow for a broader product footprint, ensuring availability across a wider geographical area.

By leveraging the established networks of regional distributors, Campus Activewear can efficiently manage inventory and logistics, thereby strengthening its overall supply chain. This strategy is vital for tapping into markets that may not be served by the company's own brick-and-mortar stores or e-commerce platforms alone. For instance, in 2023, the Indian apparel market saw significant growth in smaller cities, with brands increasingly relying on wholesale channels to capture this demand.

- Expanded Market Penetration: Distributors enable Campus Activewear to reach consumers in smaller towns and cities, increasing brand visibility and sales volume.

- Supply Chain Efficiency: Wholesalers streamline the distribution process, ensuring timely delivery of products to a wider customer base and reducing logistical complexities.

- Cost-Effective Expansion: Partnering with existing distribution networks offers a more economical approach to market expansion compared to establishing a direct retail presence in every location.

Digital Marketing & Social Media

Digital marketing and social media are vital for Campus Activewear, acting as powerful tools to build brand recognition and engage with customers. These platforms are instrumental in driving traffic to both the company's e-commerce site and its physical retail stores, effectively bridging the online and offline customer journey. For instance, in 2024, Campus Activewear leveraged targeted social media campaigns to promote new product launches, resulting in a significant uplift in website visits and in-store footfall.

These channels are not just for promotion; they foster a community around the brand. Through interactive content, customer testimonials, and influencer collaborations, Campus Activewear cultivates brand loyalty and gathers valuable consumer insights. This engagement is crucial for staying relevant in the fast-paced activewear market, as seen in their successful 2024 campaigns that saw a notable increase in user-generated content and social media mentions.

- Brand Awareness: Social media platforms like Instagram and Facebook are used to showcase new collections and brand lifestyle, reaching a broad, relevant audience.

- Customer Engagement: Interactive content, contests, and responsive customer service on social media build a strong community and gather feedback.

- Traffic Generation: Digital ads and social media posts direct consumers to the Campus Activewear website and physical store locations, boosting sales opportunities.

- Promotional Activities: Targeted campaigns highlight discounts, new arrivals, and special offers, driving immediate purchase intent.

Campus Activewear utilizes a multi-pronged channel strategy to maximize reach and customer engagement. This includes a strong presence in multi-brand outlets and exclusive brand outlets across India, complemented by a robust online strategy involving their own website and major e-commerce platforms. Distributors and wholesalers are key for penetrating Tier 2 and Tier 3 cities, ensuring product availability nationwide.

The company's digital marketing and social media efforts are crucial for brand building and driving traffic to both online and offline touchpoints. By the end of fiscal year 2024, Campus Activewear aimed for over 200 Exclusive Brand Outlets, reflecting a commitment to direct customer engagement.

| Channel | Reach Strategy | Key Benefit | 2023-24 Focus |

|---|---|---|---|

| Multi-Brand Outlets (MBOs) | Broad market penetration | Wide consumer access | Substantial sales volume |

| Exclusive Brand Outlets (EBOs) | Focused brand experience | Brand loyalty, direct sales | Target: 200+ outlets by FY24 |

| Online (Own Website & Marketplaces) | Digital consumer base access | Broad reach, customer data | Leveraging growing e-commerce market |

| Distributors & Wholesalers | Geographic expansion (Tier 2/3) | Wider product footprint, efficiency | Capturing growth in smaller cities |

| Digital Marketing & Social Media | Brand awareness & engagement | Traffic generation, community building | Targeted campaigns, user-generated content |

Customer Segments

Young adults and youth, aged 15 to 35, represent a significant demographic for Campus Activewear. This group includes students navigating campus life, early-career professionals, and trend-aware individuals looking for stylish yet functional footwear. They prioritize comfort for daily wear and light athletic pursuits, often swayed by the latest fashion trends and social media influences. In 2024, the activewear market saw continued growth, with a notable surge in demand from this age bracket, particularly for versatile sneakers that transition from casual outings to light workouts.

Mid-income households and families represent a significant customer segment for Campus Activewear, as they actively seek footwear that balances affordability with quality. These consumers are particularly attuned to value for money, looking for durable and comfortable shoes that can meet the diverse needs of all family members, from daily casual wear to school requirements.

In 2024, the average Indian household income for the middle-income bracket often falls between ₹500,000 to ₹1,500,000 annually. This group is highly price-sensitive but also recognizes the importance of investing in footwear that lasts, reducing the need for frequent replacements.

Their purchasing decisions are driven by practicality and reliability, making them receptive to brands that offer a good performance-to-price ratio. Campus Activewear's focus on providing comfortable, stylish, and robust footwear at accessible price points directly addresses the core priorities of these families.

Casual Wearers & Daily Commuters are individuals who seek comfort and practicality in their footwear for everyday activities like walking, running errands, or simply going about their day. This segment is a core focus for Campus Activewear, as they represent a significant portion of the consumer base looking for reliable, everyday shoes.

For these consumers, lightweight design, excellent support, and durability are paramount. They need footwear that can handle the demands of regular use without compromising on comfort. In 2023, the Indian footwear market saw robust growth, with casual and athleisure segments leading the charge, reflecting the increasing demand for comfortable, everyday wear. Campus Activewear's strategy heavily relies on catering to this demand with products that offer both style and substance for the daily grind.

Entry-Level Athletes & Fitness Enthusiasts

This segment includes individuals who participate in casual sports, frequent the gym, or engage in light fitness activities. They are primarily looking for athletic footwear that is both functional and budget-friendly. For instance, in 2024, the global athletic footwear market saw significant demand from this demographic, with a focus on value-oriented products.

These consumers prioritize essential performance attributes such as adequate cushioning for comfort and reliable grip for stability. They do not require highly specialized or professional-grade features. Market research from late 2024 indicates that affordability remains a key driver for purchasing decisions in this segment.

- Key Needs: Functional, affordable athletic footwear.

- Performance Expectations: Basic cushioning and grip.

- Market Trend: Value-conscious purchasing behavior.

Fashion-Conscious Value Seekers

Fashion-Conscious Value Seekers prioritize trendy footwear that doesn't break the bank. They want to stay current with styles, ensuring their shoes enhance their personal aesthetic and overall outfit. In 2024, this demographic actively sought out brands offering a balance of on-trend designs and accessible price points, with a significant portion of Gen Z and younger millennials indicating a willingness to spend on fashionable items if value is perceived.

This segment is highly influenced by social media trends and celebrity endorsements, often looking for footwear that mirrors popular styles seen online. They appreciate brands that can deliver both aesthetic appeal and functional comfort for everyday wear. For instance, a significant trend observed in early 2024 was the resurgence of retro sneaker styles, which appealed directly to this group seeking both nostalgia and current fashion relevance at a competitive price.

- Style Priority: This group actively seeks footwear that aligns with prevailing fashion trends, often referencing styles seen on social media platforms.

- Budget Sensitivity: While style is paramount, affordability remains a key consideration, driving demand for brands offering good value for money.

- Quality and Comfort: They expect their fashionable footwear to also provide a reasonable level of comfort and durability for daily use.

- Personal Expression: Footwear is viewed as a crucial element in completing an individual's look and expressing personal style.

Campus Activewear primarily targets young adults and youth, aged 15-35, who seek comfortable and stylish footwear for daily wear and light athletic activities. This demographic, including students and early-career professionals, is influenced by fashion trends and social media. In 2024, this age group showed a strong demand for versatile sneakers, reflecting a growing active lifestyle. The brand also appeals to mid-income households and families who prioritize value for money, seeking durable and affordable footwear for everyday use. Casual wearers and daily commuters form another key segment, valuing comfort, practicality, and reliability in their footwear for everyday activities.

| Customer Segment | Age Range | Key Motivations | 2024 Market Relevance |

|---|---|---|---|

| Young Adults & Youth | 15-35 | Style, Comfort, Social Media Influence | High demand for versatile, trendy sneakers. |

| Mid-Income Households & Families | All ages within household | Affordability, Durability, Value for Money | Seeking practical, long-lasting footwear for daily needs. |

| Casual Wearers & Daily Commuters | All ages | Comfort, Practicality, Reliability | Core segment for everyday footwear demand. |

| Fashion-Conscious Value Seekers | Primarily Gen Z & Millennials | Trendy Designs, Accessible Pricing | Influenced by social media, seeking style without high cost. |

Cost Structure

Raw material and manufacturing costs represent Campus Activewear's most significant variable expenses. These include the procurement of essential components like rubber, EVA foam, various textiles, and adhesives, all crucial for producing their footwear. Direct labor and manufacturing overheads tied to the production line also fall under this category, directly impacting the cost of goods sold.

For instance, in the fiscal year ending March 31, 2023, Campus Activewear reported its cost of materials consumed at ₹2,010.55 crore. This figure highlights the substantial investment required in sourcing quality inputs. Efficient supply chain management and optimized production workflows are therefore paramount for Campus Activewear to maintain competitive pricing and healthy profit margins.

Campus Activewear invests heavily in marketing and advertising to build its brand. This includes significant spending on digital campaigns, traditional advertising across various media, and potentially celebrity endorsements to boost visibility and sales.

In the fiscal year 2023, Campus Activewear reported marketing and advertising expenses of ₹148.8 crore, representing a substantial portion of its overall operational costs. This expenditure is vital for maintaining brand recall and attracting new customers in a competitive market.

Campus Activewear incurs significant costs for warehousing its diverse product range and for the transportation of these goods to various sales channels. This includes the expenses related to shipping products to multi-brand retail outlets, its own exclusive stores, and directly to customers who purchase through its e-commerce platform.

Managing this extensive supply chain network across different regions in India adds another layer of cost. For instance, in the fiscal year 2023-24, Campus Activewear reported logistics and distribution expenses as a substantial portion of its overall operational costs, reflecting the complexities of reaching a wide customer base across the country.

Employee Salaries and Wages

Employee salaries and wages represent a significant cost for Campus Activewear, encompassing compensation for every level of the organization. This includes the teams involved in creating the products, like manufacturing and design, as well as those who bring them to market and keep the business running smoothly, such as sales, marketing, and administrative staff. Human capital is a substantial cost, with both fixed and variable elements depending on hiring and operational needs.

In 2024, Campus Activewear's commitment to its workforce is evident. The company's employee-related expenses are a critical component of its overall cost structure, directly impacting its ability to innovate and compete.

- Manufacturing and Production: Wages for factory workers, supervisors, and quality control personnel involved in the creation of activewear.

- Design and Research & Development: Salaries for designers, product developers, and R&D specialists who innovate new styles and technologies.

- Sales and Marketing: Compensation for sales teams, digital marketers, brand managers, and customer service representatives.

- Administrative and Support: Salaries for HR, finance, IT, and other back-office functions essential for business operations.

Research & Development (R&D) and Design Costs

Campus Activewear heavily invests in Research & Development (R&D) and Design to fuel product innovation. This includes significant spending on material research, exploring advanced fabrics and cushioning systems, as well as acquiring cutting-edge design software. The company also dedicates resources to developing new footwear technologies and unique styles, ensuring a constant stream of fresh collections.

These expenditures are critical for Campus Activewear to maintain its competitive edge in the dynamic sportswear market. By consistently introducing new products and styles, the company aims to meet and anticipate evolving consumer demands and preferences. For instance, in fiscal year 2024, Campus Activewear reported a notable increase in its R&D and design expenses, reflecting a strategic push towards product differentiation and technological advancement.

- Material Innovation: Exploring new polymers for enhanced durability and comfort.

- Technological Advancement: Investing in proprietary sole technologies for improved performance.

- Design Software: Utilizing advanced CAD and 3D modeling tools for faster prototyping.

- New Collection Development: Allocating budget for seasonal product launches and trend analysis.

Campus Activewear's cost structure is primarily driven by manufacturing and production expenses, encompassing raw materials like rubber and textiles, alongside direct labor costs. Significant investments are also allocated to marketing and advertising to build brand presence, alongside substantial outlays for logistics and distribution to manage its widespread sales network. Furthermore, employee compensation across all operational levels and dedicated spending on research & development for product innovation form crucial cost components.

| Cost Category | FY 2023 (₹ Crore) | FY 2024 (₹ Crore) |

|---|---|---|

| Cost of Materials Consumed | 2,010.55 | 2,250.00 (Estimated) |

| Marketing & Advertising Expenses | 148.8 | 165.00 (Estimated) |

| Logistics & Distribution Expenses | Significant portion of operational costs | Increased due to network expansion |

| Employee-Related Expenses | Material component of overall costs | Focus on talent retention and development |

| R&D and Design Expenses | Notable increase for product differentiation | Continued investment in technological advancement |

Revenue Streams

Campus Activewear generates significant revenue by selling its footwear products in bulk to a wide array of multi-brand retail stores throughout India. This wholesale channel is a cornerstone of their sales strategy, enabling broad market penetration and reaching a diverse customer base.

In the fiscal year 2023, Campus Activewear reported that its wholesale segment played a crucial role in its overall financial performance, contributing substantially to its revenue figures. The company's ability to secure shelf space in numerous MBOs across the country underscores the demand for its product offerings and its effective distribution network.

Campus Activewear generates revenue through direct sales at its Exclusive Brand Outlets (EBOs). These stores provide a curated brand experience and a complete product assortment.

In the fiscal year 2023, Campus Activewear reported a significant portion of its revenue stemming from its retail presence, including EBOs, contributing to its overall sales growth and brand visibility.

Campus Activewear generates significant income through its official website and prominent third-party platforms such as Amazon and Flipkart. This online sales channel capitalizes on the robust growth of e-commerce, allowing the brand to connect with a wider customer base. In fiscal year 2023, Campus Activewear's online sales contributed substantially to its overall revenue, reflecting the increasing consumer preference for digital purchasing experiences.

Institutional and Bulk Sales

Campus Activewear generates significant revenue through institutional and bulk sales. These are large orders placed by organizations like schools, corporations, and government entities for specific needs such as uniforms, merchandise for events, or employee apparel.

These business-to-business (B2B) transactions are crucial for increasing overall sales volume and can often command different pricing structures compared to individual retail sales. For instance, in 2023, the Indian activewear market saw a notable increase in corporate gifting and uniform orders, a trend that Campus Activewear likely leveraged.

- Bulk Orders: Revenue from large-scale purchases by educational institutions for sports teams or student uniforms.

- Corporate Partnerships: Sales to companies for employee uniforms, promotional merchandise, or wellness programs.

- Government Contracts: Potential revenue from supplying activewear for government-sponsored sports initiatives or specific departmental needs.

Seasonal and New Collection Launches

Campus Activewear experiences significant revenue surges with its seasonal and new collection launches. These events, including festive offerings, are strategically timed to capitalize on consumer demand for fresh styles and updated athletic wear. For instance, the company's Q3 2024 performance saw a notable uptick, partly attributed to its winter collection rollout, which typically includes specialized gear and trending designs.

These targeted launches often result in higher sales volumes because of the inherent novelty and focused marketing campaigns. By introducing new product lines, Campus Activewear effectively captures specific market segments and encourages impulse purchases. This strategy is crucial for maintaining brand relevance and driving consistent growth throughout the year.

- Seasonal Peaks: Revenue spikes are directly linked to the introduction of new product lines and seasonal collections.

- Festive Boost: Festive offerings and targeted marketing efforts further amplify sales volumes during key periods.

- Novelty Driven Sales: The allure of newness in collections encourages higher purchase rates.

- Market Responsiveness: Launches are designed to capture specific, often time-sensitive, market demands.

Campus Activewear diversifies its revenue through multiple channels, including wholesale to multi-brand retailers, direct sales via its own Exclusive Brand Outlets (EBOs), and online sales through its website and third-party e-commerce platforms like Amazon and Flipkart. In fiscal year 2023, the company reported substantial contributions from both its offline retail presence and its growing online segment, highlighting a balanced approach to market reach.

Beyond direct consumer sales, Campus Activewear also generates revenue from institutional and bulk orders, catering to educational institutions, corporations, and government entities. These B2B transactions are vital for increasing overall sales volume and can involve custom or specialized product requirements. The company also benefits from seasonal and new collection launches, which drive sales through novelty and targeted marketing, as seen with a notable uptick in Q3 2024 performance linked to its winter collection.

| Revenue Stream | Description | Fiscal Year 2023 Significance |

|---|---|---|

| Wholesale | Sales to multi-brand retail stores across India. | Cornerstone of sales strategy, enabling broad market penetration. |

| Retail (EBOs) | Direct sales through company-owned Exclusive Brand Outlets. | Contributed significantly to sales growth and brand visibility. |

| Online Sales | Sales via official website and third-party platforms (Amazon, Flipkart). | Reflected increasing consumer preference for digital purchasing. |

| Institutional/Bulk Sales | Large orders from organizations (schools, corporations, government). | Crucial for increasing sales volume and leveraging market trends like corporate gifting. |

| Seasonal/New Collection Launches | Revenue driven by new product introductions and festive offerings. | Key driver of sales volume due to novelty and focused marketing, with Q3 2024 performance boosted by winter collection. |

Business Model Canvas Data Sources

The Campus Activewear Business Model Canvas is built upon comprehensive market research, competitor analysis, and internal sales data. These sources provide a robust foundation for understanding customer needs, market opportunities, and operational efficiencies.