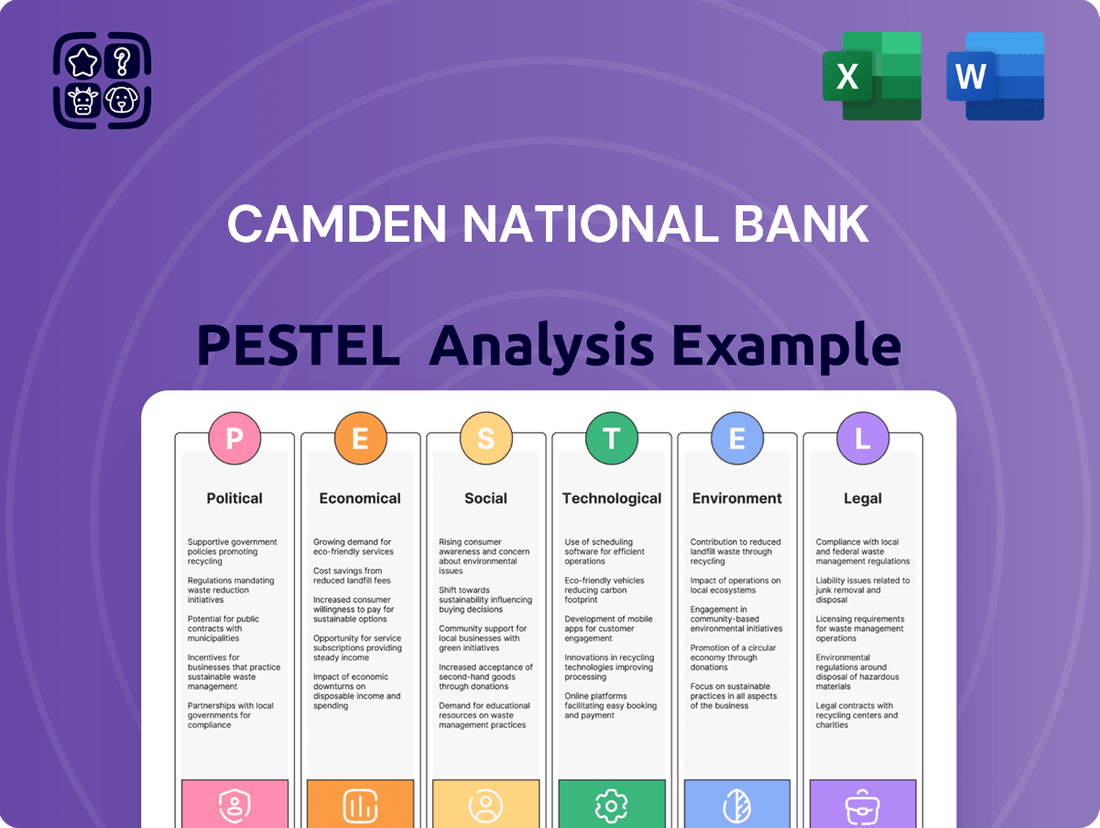

Camden National Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camden National Bank Bundle

Unlock the critical external factors shaping Camden National Bank's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements present both challenges and opportunities for the institution. Equip yourself with actionable intelligence to refine your strategy and secure a competitive advantage. Download the full PESTLE analysis now for immediate, in-depth insights.

Political factors

The U.S. political landscape in 2025 points towards a potentially more favorable regulatory environment for regional banks such as Camden National Bank. This anticipated easing of regulations could translate into lower compliance burdens, freeing up capital and operational capacity for strategic initiatives like expansion or technological investment.

A shift towards a more pro-business administration is anticipated to stimulate greater lending by financial institutions, including regional banks like Camden National Bank. This regulatory climate could see a rise in loan origination as economic confidence grows.

Furthermore, this supportive environment is likely to spur increased merger and acquisition (M&A) activity within the banking sector. For Camden National Bank, this presents potential avenues for strategic growth and consolidation as the market landscape evolves.

Global geopolitical tensions are expected to remain a significant factor for banks like Camden National Bank through 2025, potentially increasing operational risks. These ongoing conflicts can disrupt supply chains and create volatility in financial markets, requiring robust risk management frameworks.

Regulators are intensifying their focus on Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) programs, with a particular emphasis on sanctions compliance. This is driven by the dynamic nature of international relations and the need to prevent illicit financial flows. For instance, the US Treasury Department's Office of Foreign Assets Control (OFAC) continues to update its sanctions lists, impacting financial institutions globally.

Data Privacy Legislation Development

The landscape of data privacy in the U.S. is evolving, with a growing movement towards unified national standards. This push aims to streamline the patchwork of state-specific privacy laws, creating a more consistent regulatory environment. For financial institutions like Camden National Bank, this means navigating an increasingly complex, yet potentially more predictable, data protection framework.

While financial services are already subject to stringent data privacy rules, such as the Gramm-Leach-Bliley Act (GLBA), new federal legislation is on the horizon. The goal is to move away from the current state-by-state approach, which can lead to compliance challenges and operational inefficiencies. For instance, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), have set a high bar, influencing national discussions.

- Federal Privacy Legislation Momentum: Discussions and proposals for a comprehensive federal data privacy law are intensifying, with bipartisan support emerging for a national standard.

- Harmonization Efforts: Key legislative proposals focus on creating a baseline of privacy rights and obligations that would preempt or harmonize with existing state laws, potentially simplifying compliance for businesses operating nationwide.

- GLBA and Future Compliance: Existing financial sector regulations like GLBA provide a strong foundation, but institutions will need to adapt to any new federal mandates, ensuring alignment with broader consumer data protection principles.

- Impact on Data Handling: The development of national standards could influence how Camden National Bank collects, uses, and secures customer data, necessitating ongoing review and potential updates to internal policies and technological safeguards.

Government Oversight of AI Use

Regulators are intensifying their focus on how banks like Camden National Bank use Artificial Intelligence (AI), particularly concerning ethical practices and managing associated risks. This heightened scrutiny aims to ensure AI applications are fair, transparent, and accountable, with an emphasis on developing robust AI fair use policies. For instance, the U.S. Department of Justice has been actively investigating algorithmic bias in lending, indicating a trend towards stricter enforcement of fair housing and lending laws as they apply to AI-driven decision-making in the financial sector.

This governmental oversight translates into tangible requirements for financial institutions:

- Enhanced AI Risk Management Frameworks: Banks must demonstrate comprehensive strategies for identifying, assessing, and mitigating risks inherent in AI systems, including data privacy and cybersecurity.

- Fairness and Bias Audits: Institutions will likely face mandates to conduct regular audits of AI models to detect and correct potential biases that could lead to discriminatory outcomes.

- Transparency in AI Decision-Making: Regulators are pushing for greater clarity on how AI algorithms arrive at decisions, especially in customer-facing applications like loan approvals or fraud detection.

The U.S. political environment in 2025 suggests a potentially more favorable regulatory climate for regional banks like Camden National Bank, possibly reducing compliance costs and freeing up resources. A pro-business stance is expected to encourage increased lending, boosting loan origination as economic confidence rises. This supportive atmosphere may also foster greater merger and acquisition activity within the banking sector, offering growth opportunities for Camden National Bank.

What is included in the product

This PESTLE analysis of Camden National Bank examines how political, economic, social, technological, environmental, and legal factors create both challenges and avenues for growth.

It provides a comprehensive overview of the external landscape, enabling strategic decision-making and risk mitigation for the bank.

A PESTLE analysis for Camden National Bank offers a clear, summarized version of external factors, simplifying discussions on market positioning and risk management for all stakeholders.

Economic factors

The Federal Reserve's anticipated interest rate cuts in 2025, aiming for a federal funds rate between 3.5% and 3.75%, will make borrowing cheaper for both individuals and companies. This easing of monetary policy is a significant factor for businesses like Camden National Bank.

Despite these cuts, interest rates are still projected to be higher than the historically low levels seen in recent years. This means that while borrowing becomes more accessible, the cost of capital will remain a consideration for strategic financial planning and investment decisions.

While the U.S. has seen inflation move closer to the Federal Reserve's 2% target, a projected temporary increase in 2025, potentially influenced by tariffs, could alter the trajectory of interest rate adjustments and overall economic expansion.

For instance, the Consumer Price Index (CPI) saw a 3.3% year-over-year increase in May 2024, a slight moderation from earlier peaks, but any resurgence in 2025 could lead the Fed to maintain higher rates for longer, impacting borrowing costs for businesses and consumers alike.

Anticipating a more favorable political landscape, Camden National Bank can expect a surge in loan activity towards the end of 2025 and into 2026. This projected increase in lending, particularly by regional banks, signals a potentially more competitive environment.

This renewed emphasis on lending will likely drive a greater focus on customer experience as banks vie for market share. For instance, in Q1 2024, total commercial and industrial loans held by U.S. commercial banks saw a slight increase, indicating a foundational demand that could accelerate with policy shifts.

Economic Growth Outlook

The U.S. economy is anticipated to see growth of approximately 2% in 2025. However, there's a possibility of inflation and interest rates exceeding expectations in the immediate future.

Looking ahead to the medium term, a deceleration in economic expansion is a possibility. This is largely due to the inherent uncertainties associated with the policy directions of a new administration.

- Projected 2025 U.S. GDP Growth: Around 2%

- Near-Term Risks: Potential for higher inflation and interest rates

- Medium-Term Headwinds: Policy uncertainties from a new administration could dampen growth

Impact of Digitalization on Banking Costs

The increasing digitalization of banking services, while streamlining customer interactions, is also leading to new operational efficiencies. However, this digital transformation comes with significant investment, particularly in areas like artificial intelligence. The cost of AI compliance for banks is anticipated to increase by 15-20% between 2024 and 2025, a crucial factor for institutions like Camden National Bank.

This rise in AI compliance costs directly impacts a bank's bottom line, potentially offsetting some of the efficiency gains from digitalization. Banks must carefully manage these expenditures to ensure a net positive outcome from their digital strategies.

- Digitalization drives operational efficiencies.

- AI compliance costs are projected to rise 15-20% from 2024 to 2025.

- This trend necessitates careful cost management for banks.

Economic factors present a mixed outlook for Camden National Bank in 2025. While anticipated Federal Reserve interest rate cuts, targeting a federal funds rate between 3.5% and 3.75%, are set to lower borrowing costs, inflation might see a temporary uptick, potentially influencing the pace of these cuts.

The U.S. economy is projected to grow around 2% in 2025, but policy uncertainties stemming from a new administration could pose medium-term headwinds to this expansion. This economic backdrop will shape lending activity and overall market demand for banking services.

Digitalization continues to drive operational efficiencies, yet the increasing cost of AI compliance, estimated to rise 15-20% between 2024 and 2025, will demand careful financial management from institutions like Camden National Bank.

| Economic Indicator | 2024 Projection | 2025 Projection | Key Impact on Banking |

|---|---|---|---|

| Federal Funds Rate Target | 4.75%-5.00% (as of mid-2024) | 3.5%-3.75% (anticipated) | Lower borrowing costs, potential for increased loan demand |

| U.S. GDP Growth | ~2.5% | ~2.0% | Moderate economic expansion influencing loan growth and risk appetite |

| Inflation (CPI Year-over-Year) | Slightly above 3% (May 2024: 3.3%) | Potential temporary increase, then moderating | Influences Fed's rate decisions and cost of capital |

| AI Compliance Costs for Banks | Baseline | 15-20% increase (2024-2025) | Increased operational expenses impacting profitability |

Preview the Actual Deliverable

Camden National Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Camden National Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations, providing actionable insights for strategic planning.

Sociological factors

Consumers are increasingly expecting seamless digital banking experiences, favoring online and mobile platforms for everyday transactions. This shift is evident with a significant portion of banking activities now conducted digitally, with many customers preferring these channels for their convenience and accessibility.

Banks are responding by investing heavily in user-friendly mobile apps and online portals, aiming to provide intuitive navigation and robust security features. The demand for real-time transactions and personalized services, often powered by artificial intelligence, is a key driver in this evolution.

For instance, by the end of 2024, it's projected that over 80% of banking interactions for many institutions will occur through digital channels, highlighting the critical need for banks like Camden National to maintain and enhance their digital offerings to meet these evolving consumer expectations.

Customers increasingly expect banks like Camden National Bank to offer more than just transactional services; they're looking for deep, personalized financial guidance. This includes detailed insights into their spending patterns and advice on better money management. For instance, a 2024 survey indicated that 65% of banking customers would be more loyal to a bank that provided tailored financial advice.

The rise of AI is poised to revolutionize this customer experience. AI-powered financial assistants can provide proactive, customized guidance and suggest products that genuinely fit individual needs, moving beyond generic offers. By 2025, it's projected that over 70% of customer interactions with financial institutions will involve some form of AI, highlighting the growing demand for intelligent, personalized support.

Camden National Bank must navigate a landscape where digital payment adoption, especially via mobile apps, is rapidly expanding. For instance, a 2024 survey indicated that over 60% of consumers under 40 regularly use mobile payment solutions.

However, a significant portion of the population, particularly older demographics, still prefers and relies on cash for transactions. This preference was highlighted in a late 2024 report showing that individuals aged 65 and above still conduct nearly 30% of their daily transactions using physical currency.

Consequently, banks like Camden National need to offer a robust suite of payment options that accommodate both technologically inclined younger consumers and those who remain loyal to traditional cash-based methods, ensuring accessibility and customer satisfaction across all age groups.

Financial Literacy and Inclusivity

Camden National Bank, like many institutions, is increasingly focused on financial literacy and inclusivity. This commitment translates into efforts to reach underserved populations, such as the unbanked, by offering accessible and affordable banking products. For instance, by June 2024, approximately 4.5% of U.S. households remained unbanked, highlighting a significant market opportunity and social imperative.

These initiatives often include tailored financial education programs designed to empower individuals with the knowledge to manage their money effectively. The banking sector's push for inclusivity is not just about social responsibility; it's also a strategic move to expand customer bases and foster long-term loyalty.

- Expanding Access: Offering low-fee checking accounts and mobile banking solutions to attract individuals previously excluded from traditional banking.

- Financial Education: Implementing workshops and online resources covering budgeting, saving, and credit building.

- Community Partnerships: Collaborating with local non-profits to deliver financial literacy programs to diverse communities.

- Data-Driven Outreach: Utilizing demographic data to identify and target areas with high concentrations of unbanked or underbanked individuals.

Ethical Consumerism and ESG Preferences

Consumers increasingly prioritize Environmental, Social, and Governance (ESG) criteria when making financial choices. This trend is driving demand for banking products that align with sustainable and ethical principles. For instance, a 2024 survey indicated that over 60% of millennials and Gen Z consider ESG factors when choosing financial institutions.

In response, financial institutions like Camden National Bank are integrating ESG considerations into their core offerings and operational transparency. This includes developing green loan products and increasing disclosure on their social impact. By 2025, it's projected that ESG-themed investment funds will continue to see substantial growth, reflecting this consumer shift.

- Growing Consumer Demand: A significant percentage of consumers, particularly younger demographics, actively seek out financial products that reflect their ethical values.

- Banker Adaptation: Financial institutions are evolving their services to meet this demand, offering more sustainable and transparent banking solutions.

- Market Impact: The focus on ESG is reshaping the financial landscape, with a notable increase in the popularity and availability of ethically aligned investment and banking options.

Societal shifts are profoundly influencing banking preferences, with a strong emphasis on digital convenience and personalized financial guidance. By late 2024, over 80% of banking interactions are expected to be digital, underscoring the need for robust mobile and online platforms. Furthermore, 65% of customers in 2024 indicated a preference for banks offering tailored financial advice, a trend likely to be amplified by AI-driven services by 2025.

Technological factors

Camden National Bank, like all financial institutions, faces escalating cybersecurity threats, from ransomware to sophisticated phishing schemes. The banking sector is a constant target for cybercriminals seeking to exploit vulnerabilities. In 2024, the financial services industry reported a significant increase in cyber incidents, with costs averaging over $10 million per breach, highlighting the critical need for robust defenses.

To combat these advanced threats, Camden National Bank must prioritize investment in cutting-edge cybersecurity infrastructure. This includes AI-powered threat detection systems and continuous, scenario-based training for all employees to recognize and report potential breaches. The bank's proactive approach to cybersecurity is essential for maintaining customer trust and safeguarding sensitive financial data in an increasingly digital landscape.

Camden National Bank is increasingly integrating AI and machine learning to refine its customer interactions and streamline internal processes. For instance, AI-powered chatbots are handling a growing volume of customer inquiries, freeing up human staff for more complex tasks. This technology is also crucial for automating regulatory compliance checks, a significant operational burden for financial institutions.

The bank is also leveraging AI to bolster its cybersecurity defenses, with machine learning algorithms identifying and flagging suspicious activities at an unprecedented speed. However, this technological advancement isn't without its risks. The rise of sophisticated AI-driven phishing attacks presents a new frontier of threats that require constant vigilance and adaptation.

Furthermore, Camden National Bank must develop and enforce clear policies regarding the fair and ethical use of AI. This includes addressing potential biases in algorithms and ensuring transparency in how AI systems make decisions, especially those impacting customer service or loan applications. By mid-2025, financial institutions are expected to have robust AI governance frameworks in place to mitigate these emerging challenges.

Camden National Bank, like many financial institutions, is navigating a significant digital transformation, with cloud adoption accelerating. This shift allows for greater agility and scalability in service delivery, but it also introduces heightened cybersecurity imperatives. For instance, a 2024 report indicated that over 70% of financial services firms were increasing their cloud spending, underscoring the trend.

Securing these expanding digital footprints is paramount. Robust encryption, multi-factor authentication, and frequent security audits are no longer optional but essential components of operational integrity. Failure to implement these measures can expose sensitive customer data and critical banking systems to significant risk, impacting trust and regulatory compliance.

Real-Time Payments and Digital Wallets

Real-time payment (RTP) technology is increasingly vital, with consumers and businesses expecting faster, more secure transactions. By 2025, digital wallets are anticipated to evolve into comprehensive financial hubs, incorporating services like Buy Now, Pay Later (BNPL) and cryptocurrency management.

These advancements are reshaping how financial institutions operate and interact with customers. For instance, the global digital wallet market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $4.5 trillion by 2028, demonstrating significant growth driven by these technological shifts.

- Consumer Demand: Growing expectation for instant fund availability and transaction completion.

- Digital Wallet Evolution: Projections indicate wallets will offer integrated BNPL and crypto services by 2025.

- Market Growth: The digital wallet market is experiencing substantial expansion, driven by these technological integrations.

RegTech and Compliance Automation

RegTech adoption is a significant technological factor for Camden National Bank, as it streamlines complex compliance processes and bolsters due diligence. This technology helps financial institutions like Camden National Bank stay ahead of ever-changing regulatory landscapes, which is crucial for maintaining operational integrity. For instance, the global RegTech market was valued at approximately $11.7 billion in 2023 and is projected to reach $34.9 billion by 2028, showcasing rapid industry growth and investment.

While RegTech offers substantial benefits in automating adherence to regulations, its successful implementation requires careful planning and ongoing oversight. Without proper integration and monitoring, there remains a risk of compliance failures, despite the technology's potential. This highlights the need for robust internal controls and skilled personnel to manage these advanced systems effectively.

Key aspects of RegTech implementation for Camden National Bank include:

- Streamlined Compliance: Automating tasks like KYC (Know Your Customer) and AML (Anti-Money Laundering) checks.

- Enhanced Due Diligence: Improving the accuracy and speed of risk assessments and customer vetting.

- Regulatory Adherence: Ensuring continuous compliance with evolving financial regulations.

- Risk Mitigation: Reducing the likelihood of penalties and reputational damage from non-compliance.

Technological advancements are reshaping Camden National Bank's operational landscape, necessitating continuous adaptation. The increasing sophistication of cybersecurity threats, with financial services reporting over $10 million in breach costs in 2024, demands robust AI-powered defenses and employee training.

AI and machine learning are being integrated to enhance customer service and automate compliance, though the emergence of AI-driven phishing attacks presents new challenges. By mid-2025, financial institutions are expected to have strong AI governance frameworks to manage ethical considerations and potential biases.

Cloud adoption is accelerating, with over 70% of financial firms increasing cloud spending in 2024, requiring enhanced security measures like encryption and multi-factor authentication. Real-time payment technology and evolving digital wallets, projected to manage over $4.5 trillion by 2028, underscore the demand for faster, integrated financial services.

RegTech adoption, with the market projected to reach $34.9 billion by 2028, is crucial for streamlining compliance, enhancing due diligence, and mitigating risks associated with evolving regulations.

| Technology Area | Key Trend/Impact | 2024/2025 Data/Projection |

|---|---|---|

| Cybersecurity | Escalating threats, need for advanced defenses | Financial services breach costs averaged >$10M in 2024 |

| AI & Machine Learning | Customer service, compliance automation, new attack vectors | AI governance frameworks expected by mid-2025 |

| Cloud Computing | Agility, scalability, increased security imperatives | >70% of financial firms increased cloud spending in 2024 |

| Real-Time Payments & Digital Wallets | Faster transactions, integrated financial services | Digital wallet market projected to reach >$4.5T by 2028 |

| RegTech | Streamlined compliance, enhanced due diligence | RegTech market projected to reach $34.9B by 2028 |

Legal factors

Camden National Bank must navigate evolving Anti-Money Laundering (AML) and sanctions compliance, a landscape seeing significant global shifts in 2024 and 2025. These changes emphasize refinement, harmonization, and adaptation to new financial crime threats.

Institutions like Camden National are under increased scrutiny regarding customer due diligence processes, the accuracy of beneficial ownership information, and the effectiveness of sanctions screening. For instance, the Financial Crimes Enforcement Network (FinCEN) in the US continues to update its guidance and enforcement priorities, impacting reporting requirements and risk assessments for banks.

Camden National Bank, like all financial institutions, faces a dynamic legal environment concerning data privacy and security. New state-level regulations are emerging, mirroring the complexity of existing frameworks like the California Consumer Privacy Act (CCPA), and the potential for federal legislation continues to shape compliance strategies. For instance, as of early 2024, several US states have enacted comprehensive data privacy laws, increasing the compliance burden.

Navigating these stringent requirements for customer data handling is paramount. Banks must ensure robust data protection measures are in place, addressing consumer concerns about security breaches and the responsible use of personal information. Failure to comply can result in significant penalties, underscoring the critical need for ongoing vigilance and adaptation to evolving legal standards.

Federal regulators, including the Consumer Financial Protection Bureau (CFPB), are set to maintain a strong supervisory approach in 2025, with a keen eye on consumer protection. Key areas of focus include overdraft fees and the accuracy of representment processing, aiming to safeguard consumer interests.

New regulations are being implemented to bolster consumer rights and enhance the security of their financial data. For instance, the CFPB's ongoing scrutiny of overdraft practices is designed to ensure transparency and fairness for account holders. This regulatory environment directly impacts how banks like Camden National Bank manage customer accounts and fee structures.

Climate-Related Financial Risk Disclosure

Regulatory bodies globally are intensifying their scrutiny of financial institutions regarding climate-related financial risks. For instance, the U.S. Securities and Exchange Commission (SEC) proposed rules in 2022 mandating climate-related disclosures, though the final version has seen adjustments. This evolving landscape requires institutions like Camden National Bank to embed climate considerations into their core business strategies, risk management frameworks, and long-term planning. The use of scenario analysis to understand potential future impacts is becoming a critical component of compliance and strategic foresight.

The pressure to disclose extends to integrating these risks into existing enterprise risk management systems. This means not just identifying physical risks from climate events but also transition risks associated with the shift to a lower-carbon economy. Financial institutions are increasingly expected to demonstrate how they are assessing and managing these multifaceted risks across their portfolios and operations. For example, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, widely adopted by regulators, provide a framework for this enhanced disclosure.

- Increased Regulatory Scrutiny: Regulators worldwide, including those in the US and EU, are mandating or strongly encouraging climate-related financial risk disclosures.

- Integration into Strategy and Risk Management: Financial institutions are required to integrate climate risks into their business strategy, risk management processes, and strategic planning.

- Scenario Analysis Mandate: The use of scenario analysis to assess forward-looking climate impacts is becoming a standard expectation for evaluating financial resilience.

- TCFD Adoption: The framework provided by the Task Force on Climate-related Financial Disclosures (TCFD) is a key driver for many of these disclosure requirements, influencing how banks approach reporting.

AI Regulation and Ethical Guidelines

The financial sector's adoption of artificial intelligence is prompting significant regulatory evolution. The EU AI Act, for instance, directly impacts financial institutions leveraging AI, mandating compliance with its provisions. This legislation aims to ensure AI systems are safe, transparent, and non-discriminatory, particularly in high-risk areas like finance.

Regulators worldwide are focusing on embedding robust security and compliance frameworks within AI deployments. Key concerns include algorithmic fairness, bias mitigation, and ensuring transparency in AI decision-making processes. For institutions like Camden National Bank, this means rigorous testing and validation of AI models to prevent unintended consequences and maintain customer trust.

The push for ethical AI in banking is gaining momentum, with a growing emphasis on accountability and explainability. Financial regulators are scrutinizing how AI is used for credit scoring, fraud detection, and customer service to ensure these applications adhere to principles of fairness and do not perpetuate existing societal biases. For example, by 2025, financial firms are expected to demonstrate clear audit trails for AI-driven decisions.

- EU AI Act: Sets comprehensive rules for AI, impacting financial services.

- Fairness and Transparency: Regulators demand explainable AI and bias mitigation.

- Security and Compliance: Emphasis on robust data protection and adherence to evolving standards.

- Ethical AI Deployment: Focus on accountability in AI-driven financial decisions.

Camden National Bank must adhere to stringent data privacy laws, with an increasing number of US states enacting comprehensive regulations in 2024. These laws, similar to the CCPA, expand consumer rights regarding personal information and necessitate robust data protection measures. Failure to comply can lead to significant penalties, underscoring the need for continuous adaptation to evolving legal standards.

Environmental factors

Camden National Bank, like many leading financial institutions, is increasingly weaving Environmental, Social, and Governance (ESG) factors into its core risk management frameworks. This strategic shift acknowledges the tangible financial implications of climate-related events and societal shifts, aiming to build a more resilient and sustainable financial future.

By integrating ESG, banks are better positioned to identify and mitigate risks such as physical climate impacts on assets or reputational damage from social missteps. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework, widely adopted by banks, guides this integration, with many reporting on climate risks as of 2024.

Camden National Bank, like other financial institutions, faces increasing pressure to manage climate-related risks. This involves robust identification and measurement of physical and transition risks, ensuring they are integrated into strategic planning and capital allocation. For instance, by the end of 2024, many banks are expected to have climate risk frameworks in place, driven by regulatory bodies like the Federal Reserve, which is emphasizing climate scenario analysis.

Transition planning towards net-zero emissions is becoming a critical component of climate risk management. This means evaluating how to finance the transition to a low-carbon economy while mitigating potential stranded assets within their portfolios. In 2025, expect to see more concrete targets for emissions reduction from financial institutions, aligning with global initiatives such as the Paris Agreement.

Camden National Bank, like many in the financial sector, is navigating the growing imperative of net-zero commitments. Major banks are increasingly setting ambitious targets for reducing financed emissions, channeling significant capital into sustainable finance. For instance, by the end of 2023, several leading global banks had announced plans to phase out financing for coal power by 2030 and oil sands by 2030, demonstrating a tangible shift in investment strategy.

However, the path to achieving these goals is fraught with challenges, particularly concerning data transparency and the complex process of divesting from existing fossil fuel assets. The lack of standardized reporting frameworks for financed emissions continues to be a hurdle, making it difficult to accurately track progress and compare performance across institutions. This necessitates robust internal data collection and verification processes for banks like Camden National.

Impact of Climate Change on Asset Values

Climate change poses significant threats to asset values. Physical risks like extreme weather events can directly damage property and infrastructure, leading to costly repairs and business interruptions. For instance, the increasing frequency and intensity of hurricanes and floods in coastal regions could devalue real estate holdings and disrupt supply chains, impacting companies like those Camden National Bank might lend to.

Transition risks, stemming from the shift to a lower-carbon economy, also affect asset values. Companies heavily reliant on fossil fuels may see their valuations decline as regulations tighten and consumer preferences shift towards sustainable alternatives. This can impact their ability to repay loans, thereby influencing the financial health of institutions like Camden National Bank.

Financial institutions must actively assess and manage both physical and transition climate risks. Failure to do so could lead to substantial financial losses. For example, a report by the Network for Greening the Financial System (NGFS) in 2024 highlighted that climate-related financial risks could lead to significant macroeconomic impacts, including potential GDP contractions.

- Physical Risks: Direct damage to assets from extreme weather events, leading to repair costs and operational downtime.

- Transition Risks: Devaluation of assets tied to carbon-intensive industries due to policy changes and market shifts.

- Financial Impact: Reduced cash flows, impaired debt repayment capacity, and lower company valuations.

- Institutional Response: The necessity for financial institutions to integrate climate risk assessment into their lending and investment strategies.

Greenwashing and ESG Reporting Standards

The financial sector is grappling with increased scrutiny over environmental, social, and governance (ESG) claims, particularly concerning 'greenwashing.' Regulatory bodies are implementing stricter guidelines on ESG-related fund names to ensure transparency and verifiability of these claims. For instance, in late 2024, the SEC continued its focus on clear disclosures for funds marketing ESG strategies.

This heightened awareness is driving a significant push for standardized ESG metrics and reporting regulations. The goal is to create consistency and comparability across different financial institutions and investment products. By 2025, many expect further harmonization of ESG reporting frameworks, potentially aligning with global standards to facilitate more accurate investor decision-making.

- Stricter Guidelines: Financial regulators are tightening rules on ESG fund naming conventions to prevent misleading claims.

- Transparency Demand: Investors and regulators alike are demanding verifiable data to back ESG assertions.

- Standardization Push: There's a growing consensus on the need for uniform ESG metrics for better comparison.

- Regulatory Evolution: Expect ongoing development of regulations to ensure robust and reliable ESG reporting by 2025.

Camden National Bank faces evolving environmental regulations impacting its operations and lending practices. Increased focus on climate risk disclosure, as mandated by bodies like the Federal Reserve by the end of 2024, requires robust scenario analysis. The global push for net-zero emissions by 2050 influences lending portfolios, encouraging investment in sustainable sectors while managing risks associated with carbon-intensive industries.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Camden National Bank is grounded in data from reputable financial news outlets, government economic reports, and industry-specific research. We incorporate insights from regulatory bodies and market analysis firms to ensure a comprehensive understanding of the macro-environment.