Cambium Networks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cambium Networks Bundle

Curious about Cambium Networks' product portfolio? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. But to truly unlock strategic advantage, you need the full picture.

Purchase the complete Cambium Networks BCG Matrix for a detailed quadrant breakdown, data-driven insights into market share and growth, and actionable recommendations. Understand where to invest, divest, and nurture for optimal growth and profitability.

Don't just guess; know. Get the full BCG Matrix report and gain the clarity needed to make informed decisions about Cambium Networks' future, ensuring your strategy is built on solid market intelligence.

Stars

Cambium Networks is poised for significant growth with its next-generation Fixed Wireless Access (FWA) solutions, especially following the FCC's approval of 6 GHz spectrum. This development signals a new product cycle for their Point-to-Multi-Point (PMP) offerings, a key driver for their Star position.

The global FWA market is booming, projected to expand from USD 36.54 billion in 2024 to USD 127.57 billion by 2032, with a compound annual growth rate of 17.0%. This robust expansion, combined with Cambium's established leadership in the fixed wireless access point market share, strongly supports its Star classification.

Cambium Networks' Wi-Fi 7 enterprise access points are positioned as a Star in the BCG Matrix, reflecting the high growth of the enterprise WLAN market driven by Wi-Fi 7 adoption. The company's Q1 2024 Wi-Fi 7 product launch allows it to capitalize on this expanding segment.

As Wi-Fi 7 technology matures and becomes more accessible, significant investment will be necessary to sustain Cambium's competitive advantage and market leadership in this key area. This strategic focus is crucial for continued growth and market share capture.

Cambium's cnMaestro X is a powerhouse in their ONE Network strategy, using AI to make managing networks a breeze and performance soar. This platform is key to simplifying operations for their diverse customer base.

The market for cloud management is booming, and cnMaestro X is perfectly positioned. Analysts project cloud infrastructure spending to reach hundreds of billions in 2024, with managed services showing particularly strong growth, making cnMaestro X a significant player in a rapidly expanding sector.

By supporting Cambium's entire product range, cnMaestro X drives efficiency and builds loyalty. This integrated approach is crucial for retaining customers and capturing market share in the increasingly competitive landscape of network management solutions.

Hybrid Fiber and Wireless Access Technologies

Cambium Networks is strategically positioning itself in the hybrid fiber and wireless access market, a growing trend driven by broadband expansion initiatives. This approach blends the strengths of fixed wireless and fiber optics, offering a flexible and cost-effective solution for diverse connectivity needs.

This hybrid strategy is particularly relevant as governments worldwide inject significant funding into broadband deployment. For instance, the US Broadband Equity, Access, and Deployment (BEAD) program, with its substantial allocation, encourages such integrated network designs. Cambium's focus here allows them to address the increasing demand for reliable and affordable internet in both underserved rural regions and densely populated urban areas, aiming to lower the cost per connection while expanding reach.

- Hybrid deployments are becoming mainstream, supported by government broadband funding.

- This strategy enhances coverage and reduces the cost per connection.

- Cambium Networks capitalizes on the demand for diverse and cost-effective broadband solutions.

- The US BEAD program, with billions allocated, exemplifies the financial impetus for these hybrid approaches.

Solutions for Underserved and Expanding Geographic Markets

Cambium Networks is actively pursuing expansion into new geographic markets, with a particular focus on underserved regions and areas experiencing significant growth in demand for high-speed internet. This strategic move capitalizes on their efficient wireless technologies to unlock new revenue opportunities and broaden their customer reach in globally expanding markets.

The company's approach is designed to address the digital divide, bringing essential connectivity to communities that have historically lacked access. This expansion is crucial for Cambium's growth, as it diversifies their revenue streams and positions them to capture market share in high-potential emerging economies. For instance, in 2024, a significant portion of their new customer acquisitions came from developing regions where reliable internet infrastructure is a critical need.

- Targeting Underserved Regions: Cambium is prioritizing markets where internet penetration is low but demand is high, offering cost-effective solutions.

- Leveraging Wireless Expertise: Their robust wireless portfolio is key to quickly deploying infrastructure in challenging or previously unserved areas.

- Driving Revenue Diversification: Expansion into these markets aims to tap into new customer segments and reduce reliance on mature markets.

- Global Growth Opportunities: The strategy is focused on capturing growth in emerging economies and regions experiencing rapid digital transformation.

Cambium Networks' PMP solutions, particularly those leveraging the newly approved 6 GHz spectrum, are positioned as Stars. This segment benefits from a high-growth market, projected to reach USD 127.57 billion by 2032, with Cambium holding a strong market share.

Their Wi-Fi 7 enterprise access points also qualify as Stars due to the rapidly expanding enterprise WLAN market driven by Wi-Fi 7 adoption. Cambium's early product launches in Q1 2024 position them to capture significant share in this high-growth area.

cnMaestro X, their AI-powered network management platform, is another Star. The cloud management market is experiencing robust growth, with projected cloud infrastructure spending in the hundreds of billions for 2024, making cnMaestro X a key player in a booming sector.

The company's strategic focus on hybrid fiber and wireless access, supported by significant government funding like the US BEAD program, also places them in a Star category. This approach addresses the increasing demand for broadband, enhancing coverage and reducing costs.

| Product/Strategy | BCG Matrix Category | Market Growth | Cambium's Position |

|---|---|---|---|

| PMP (6 GHz Spectrum) | Star | High (FWA Market: USD 36.54B in 2024, growing to USD 127.57B by 2032) | Strong market share, new product cycle |

| Wi-Fi 7 Enterprise APs | Star | High (Enterprise WLAN market driven by Wi-Fi 7) | Early mover with Q1 2024 product launch |

| cnMaestro X | Star | High (Cloud Management Market: hundreds of billions in spending in 2024) | Key player in managed services, AI-driven efficiency |

| Hybrid Fiber/Wireless Access | Star | High (Broadband expansion initiatives, government funding) | Capitalizes on demand, cost-effective solutions (e.g., US BEAD program) |

What is included in the product

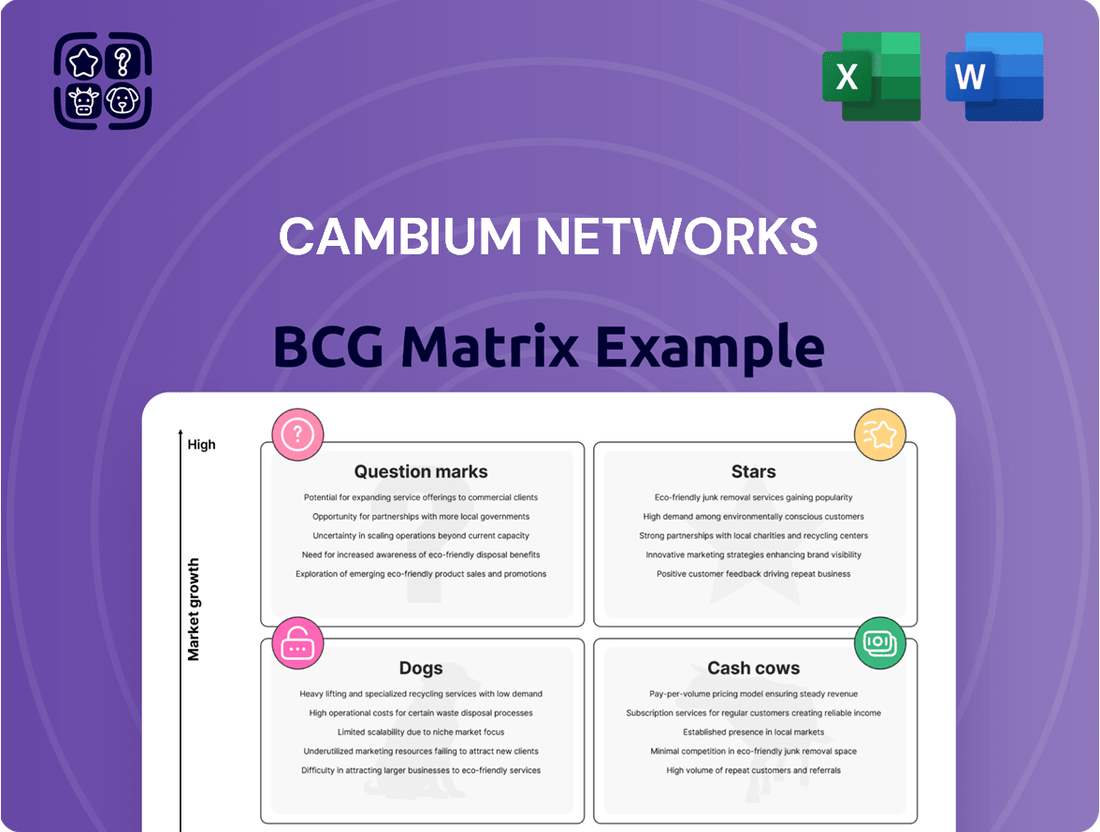

This BCG Matrix overview details Cambium Networks' product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic guidance on investment, divestment, and resource allocation for each product category.

A clear BCG Matrix visualizes Cambium's portfolio, easing strategic decision-making pain.

Cash Cows

Cambium Networks' established Fixed Wireless Point-to-Point (PTP) solutions are clear cash cows. These mature products offer high-speed, low-latency wireless links crucial for long-distance connectivity, acting as a dependable backbone for numerous networks. Their proven performance and extensive deployment in challenging environments ensure consistent cash flow with minimal need for further investment in promotion or market placement, leading to robust profit margins.

Cambium Networks' mature Wi-Fi 6/6E enterprise solutions are firmly positioned as Cash Cows. While the industry buzzes about Wi-Fi 7, the proven reliability and cost-effectiveness of Wi-Fi 6 and 6E continue to make them the go-to standard for many large-scale enterprise network deployments. Cambium's extensive range of indoor and outdoor access points consistently delivers dependable performance, securing a substantial market share in this established yet stable segment of the enterprise wireless local area network (WLAN) market.

Cambium Networks holds a significant position in the Point-to-Multi-Point (PMP) access point market, sharing leadership with Ubiquiti. This strong market share in a mature segment highlights their established presence. For instance, in Q1 2024, while North American PMP sales experienced a dip, the overall PMP portfolio remains a core revenue generator for the company.

The PMP solutions, excluding the new 6 GHz band, represent a classic Cash Cow for Cambium. These offerings, though facing slower growth compared to emerging technologies, consistently generate substantial cash flow. This financial stability is crucial for funding innovation in other areas of their business.

cnMaestro Cloud Essentials Management Platform

The core cnMaestro cloud management system, distinct from the more advanced cnMaestro X, serves as a foundational tool for managing Cambium Networks' broad range of products. This platform's widespread adoption is a testament to its user-friendliness and scalability, contributing to efficient network operations for a significant portion of their existing customer base.

cnMaestro's established user base, coupled with its subscription or value-added service model, likely generates a consistent and predictable revenue stream for Cambium Networks. This steady income supports its classification as a cash cow within the BCG matrix.

- Stable Revenue: The recurring subscription model for cnMaestro ensures predictable cash flow.

- Market Penetration: Wide adoption among existing customers signifies a strong market position.

- Operational Efficiency: Its ease-of-use and scalability reduce operational overhead for users.

- Foundation for Growth: Provides a stable base from which to upsell advanced features like cnMaestro X.

Solutions for Government and Public Safety Networks

Cambium Networks has a well-established reputation for delivering secure and dependable wireless broadband solutions tailored for government and military needs. This includes critical applications such as battlefield communications, border surveillance, and garrison infrastructure.

These specialized offerings, frequently secured through lengthy contracts and requiring adherence to stringent security standards like FIPS 140-2, tap into a stable and lucrative market segment. The company's deep roots in these vital sectors indicate a consistent demand and a predictable revenue stream.

- Market Stability: Government and public safety networks represent a consistent revenue source due to the essential nature of their operations and long-term deployment cycles.

- High Value: Solutions for these sectors often command higher margins due to specialized requirements and security certifications.

- Established Trust: Cambium's proven track record in military and government deployments builds significant trust, leading to repeat business and new contract opportunities.

Cambium Networks' legacy Fixed Wireless Broadband (FWB) PMP 450 platform, particularly its earlier iterations, functions as a classic cash cow. These solutions, while not at the forefront of technological advancement, maintain a strong installed base and continue to generate consistent revenue through ongoing support and maintenance contracts. Their reliability and established presence in various utility and rural broadband deployments ensure a steady, predictable income stream for the company.

The PMP 450 platform's mature market position is evident in its consistent contribution to Cambium's revenue, even as newer technologies emerge. For example, in the first quarter of 2024, while new product introductions drive growth, the established PMP portfolio continued to be a significant revenue driver, showcasing its cash cow status. This stability is vital for funding research and development into next-generation solutions.

| Product Category | BCG Matrix Classification | Key Characteristics | Financial Contribution |

| PMP 450 Platform (Legacy) | Cash Cow | Mature technology, strong installed base, reliable performance | Consistent revenue, stable profit margins, low reinvestment needs |

| cnMaestro (Core) | Cash Cow | Widespread adoption, subscription revenue model, operational efficiency | Predictable recurring income, supports other business areas |

What You’re Viewing Is Included

Cambium Networks BCG Matrix

The Cambium Networks BCG Matrix preview you are viewing is the exact, complete document you will receive upon purchase. This means you'll get a fully formatted, professionally analyzed report ready for immediate strategic application, without any watermarks or demo content. It’s designed to provide clear insights into Cambium's product portfolio, enabling informed decision-making for your business planning and competitive strategy.

Dogs

Older, legacy wireless broadband equipment likely falls into the Dogs category of the BCG Matrix. Cambium Networks' Q1 2024 revenue decline of 45% year-over-year across all product families points to segments struggling with demand. This older equipment, with limited upgrade paths, is probably experiencing low market share and declining sales, tying up valuable capital.

Cambium Networks' enterprise WLAN products were significantly impacted by the 2024 drawdown of supply chain backlogs. This influx of previously delayed inventory, a lingering effect of COVID-19 era disruptions, led to market saturation for certain offerings.

Products caught in this inventory glut, coupled with intensified competition during the backlog period, may now exhibit low market share and diminished growth potential. These particular WLAN solutions could be categorized as cash traps within Cambium's portfolio, requiring careful management.

Cambium Networks operates in a fiercely competitive wireless market, facing rivals like Ubiquiti, Airspan, Radwin, and MikroTik, particularly in the crowded unlicensed sub-6 GHz spectrum. This intense price competition can put significant pressure on profit margins for products in these segments. For Cambium, offerings that are losing ground in market share and struggling with profitability due to this price erosion could be classified as Dogs in the BCG matrix.

Certain Regional or Niche Market Offerings

Cambium Networks’ strategy involves expanding its reach globally, but it also navigates certain regional or niche markets that might show slower growth. These segments, potentially facing intense local competition or market saturation, could be utilizing resources without generating substantial returns. For instance, if a specific geographic area has established players with deep roots, Cambium might find it challenging to gain significant traction, impacting its market share in that particular territory.

These areas, while perhaps historically important, may not align with the company's current high-growth objectives. The challenge lies in identifying whether these niche offerings represent a potential turnaround opportunity or a drain on valuable capital and operational focus. In 2024, companies often reassess their portfolio to ensure resources are allocated to segments with the highest potential for future revenue and profit growth, a principle applicable to Cambium's market positioning.

- Low Growth Potential: Some regional markets might exhibit single-digit annual growth rates, significantly below the industry average for wireless networking solutions.

- Niche Market Saturation: Highly specialized segments could be dominated by a few entrenched competitors, limiting Cambium's ability to capture substantial market share.

- Resource Allocation Dilemma: Continued investment in these areas might divert funds from more promising high-growth opportunities, impacting overall financial performance.

- Strategic Re-evaluation: Companies like Cambium often conduct periodic reviews to determine if divesting or reducing focus on underperforming niche markets is a viable strategy.

Underperforming Point-to-Multi-Point (PMP) in Specific Regions

While Cambium Networks has seen overall strength in its Fixed Wireless Access (FWA) segment, its Point-to-Multi-Point (PMP) business in North America experienced a notable downturn. Specifically, this segment saw a 14% decrease in performance during the first quarter of 2024. This regional underperformance in a core product line raises concerns.

If this trend continues and is not counteracted by the introduction of new, innovative product cycles, it could signal that this particular geographic segment, or indeed older PMP models operating within North America, are entering a 'dog' status within Cambium's portfolio. This classification implies low market share and low growth potential.

- Regional Decline: Cambium's PMP business in North America declined by 14% in Q1 2024.

- Potential 'Dog' Status: Persistent underperformance in this core segment could indicate a 'dog' status for older PMP models in the region.

- Impact of New Products: The ability of new product cycles to offset this decline is a key factor in determining the future trajectory of this segment.

Cambium's older wireless broadband equipment, particularly legacy PMP models in North America which saw a 14% revenue decline in Q1 2024, likely fit the Dogs category. These products face limited upgrade paths and are probably experiencing low market share and declining sales, tying up capital. The influx of inventory for enterprise WLAN products due to supply chain backlog clearings in 2024 also pushed some offerings into a dog-like status, characterized by market saturation and diminished growth potential.

| Product Segment | BCG Category (Likely) | Key Indicators |

|---|---|---|

| Legacy Wireless Broadband Equipment | Dogs | Limited upgrade paths, declining sales |

| Enterprise WLAN (Post-Backlog Influx) | Dogs | Market saturation, intensified competition |

| PMP in North America (Q1 2024) | Dogs | 14% revenue decline, potential for low market share/growth |

Question Marks

The Industrial IoT market is booming, with spending expected to hit $500 billion by 2025. Cambium's cnReach IIoT solutions are positioned within this dynamic space.

However, Cambium faces stiff competition from established giants like GE MDS and Freewave. This intense rivalry suggests cnReach likely holds a modest market share in this rapidly expanding sector.

Significant strategic investment is crucial for cnReach to carve out a substantial presence. Without it, these IIoT offerings could potentially transition into a 'dog' category, requiring careful consideration of future resource allocation.

Cambium Networks' high-performance fiber solutions, now integrated into their ONE Network platform, cater to the burgeoning demand for scalable, low-latency connectivity. This expansion positions them in a rapidly growing market segment crucial for broadband expansion, especially in hybrid network architectures.

While the fiber infrastructure market is experiencing significant growth, with global fiber optic market size projected to reach $138.5 billion by 2028 according to Precedence Research, Cambium is likely a relatively newer player compared to established fiber infrastructure providers. This places their fiber offerings in a high-growth category but potentially with a lower current market share.

Consequently, Cambium's fiber infrastructure solutions can be viewed as question marks within the BCG Matrix. They operate in a dynamic, high-growth market, but significant investment will be necessary to capture market share and transition these offerings into star performers.

Cambium Networks offers integrated security and SD-WAN solutions like cnMatrix switches and Network Security Edge (NSE) to enhance network management and security. The growing demand for robust network security, fueled by hybrid work trends, positions these offerings favorably in the enterprise networking space.

While the market for these solutions is expanding, it's also highly competitive. Cambium's current market share in specialized security and SD-WAN segments may be modest, indicating a need for significant investment to carve out a stronger competitive position and drive growth.

New Vertical Market Solutions (e.g., Multi-Dwelling Units)

Cambium Networks is strategically entering new vertical markets, like multi-dwelling units (MDUs), to capture growth. Their November 2024 partnership with ROVR highlights this focus on tailored solutions for sectors such as hospitality and MDUs.

These new ventures represent significant growth opportunities, but they are still in their early stages for Cambium. Substantial investment in marketing and product development is necessary to build a solid market presence.

- Targeted Vertical Expansion: Cambium is focusing on specific sectors like MDUs, aiming to provide specialized network solutions.

- Strategic Partnerships: The collaboration with ROVR in November 2024 underscores their commitment to developing these niche market offerings.

- Investment and Growth Potential: While these markets offer high growth potential, they require considerable investment to establish market share.

- Nascent Stage: These vertical solutions are new for Cambium, indicating a need for continued development and market penetration efforts.

Emerging Technologies and AI Integration

Cambium Networks is actively investing in emerging technologies, notably enhancing AI integration within its network management platforms. This focus on AI is crucial for optimizing network performance and offering advanced analytics, a key driver in the evolving connectivity landscape.

The company is also exploring the expansion of Wi-Fi 7 technology, a move that positions them for future growth in high-speed wireless solutions. While these advanced technologies represent significant long-term potential, their immediate market share impact may be limited as the industry adopts these innovations.

These investments align with a strategy to capture future market share in rapidly advancing technological sectors. For instance, the AI in networking market was projected to reach over $10 billion by 2024, highlighting the substantial growth opportunity Cambium is targeting.

- AI Integration: Cambium is enhancing AI capabilities in network management for improved automation and predictive maintenance.

- Wi-Fi 7 Exploration: The company is investigating the rollout of Wi-Fi 7 to offer next-generation wireless speeds and capacity.

- High-Growth Potential: These technologies are in high-growth segments, but immediate market share contribution may be modest due to adoption curves.

- R&D Investment: Continuous research and development are vital to maintain competitiveness and avoid technological obsolescence in these dynamic fields.

Cambium's focus on emerging technologies like AI integration and Wi-Fi 7 positions them in high-growth markets. While these areas offer substantial future potential, their current market share might be limited as the industry adopts these innovations.

Significant investment in research and development is crucial for Cambium to capitalize on these advancements and secure a competitive edge. Without this, these forward-looking initiatives could struggle to gain traction against more established players.

The AI in networking market, for example, was projected to exceed $10 billion in 2024, underscoring the lucrative opportunity Cambium is pursuing. Their strategic alignment with these trends is a key factor in assessing their long-term growth trajectory.

| Cambium Offering | Market Growth | Current Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| AI Integration in Network Management | High | Modest | High | Question Mark |

| Wi-Fi 7 Solutions | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Cambium Networks BCG Matrix leverages a blend of financial statements, market research reports, and competitive analysis to accurately position products.