Calian Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calian Bundle

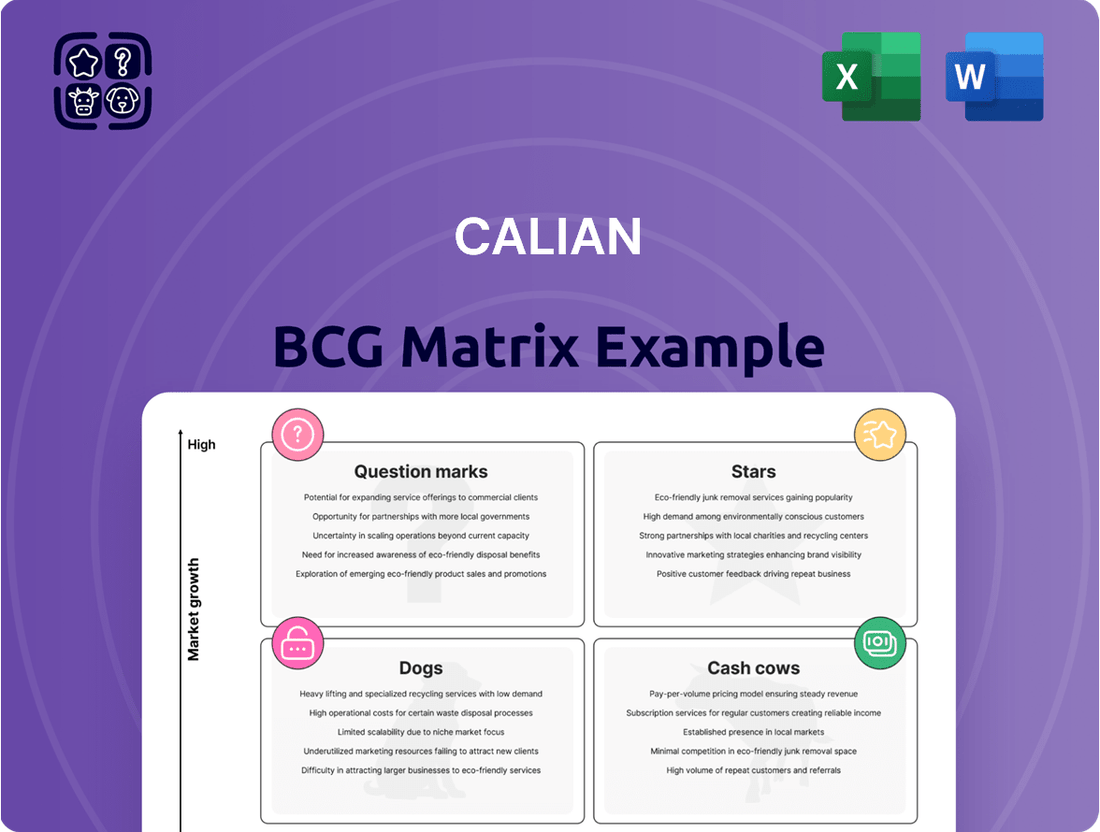

This insight into the Calian BCG Matrix offers a glimpse into their strategic product portfolio. Understand which of Calian's offerings are market leaders, which require nurturing, and which might be holding them back.

To truly unlock the power of this analysis and translate it into actionable growth strategies, dive into the complete Calian BCG Matrix. Purchase the full report for a detailed quadrant breakdown and expert recommendations to optimize your investment and product development decisions.

Stars

Calian's Defence Solutions are a clear Star in the BCG matrix, showing impressive momentum. In Q2 FY25, this segment saw a robust 13% surge, fueled by a worldwide uptick in defense and national security needs.

This strong market performance is bolstered by Calian's strategic expansion, including the establishment of a new U.S. subsidiary specifically targeting government and defense contracts. This proactive approach, combined with heightened military spending and Calian's dedication to national priorities, firmly places Defence Solutions in the Star category, poised for continued success.

Advanced Technologies, encompassing space and satellite communications, represents a significant growth driver for Calian. This segment is characterized by rapid technological advancements, including innovations in satellite communication, earth observation, and deep space connectivity. The satellite industry itself is experiencing accelerated growth, fueled by technological leaps and ongoing consolidation, with projections indicating continued expansion in the coming years.

Calian is proactively investing in this dynamic market, evidenced by the planned 2025 launch of its Resource Orchestration platform, designed to address the evolving requirements of satellite operators. Furthermore, their established expertise in RF ground stations, coupled with new product introductions within the sat-nms family, reinforces Calian's robust standing in this increasingly vital sector.

Cybersecurity solutions are a prime example of a Star in the BCG matrix, driven by robust market expansion. Global spending is anticipated to climb from an estimated $245 billion in 2024 to $500 billion by 2030, showcasing a compound annual growth rate of 12.9%.

Calian's strategic moves, including acquisitions like Decisive Group and partnerships with Microsoft for cloud-native offerings, underscore its commitment to this high-growth sector. This aggressive market penetration in a rapidly expanding industry solidifies its Star status.

Healthcare (Remote & Emergency Services)

Calian's healthcare division, particularly its remote and emergency services, is poised for substantial growth. The acquisition of Advanced Medical Solutions (AMS) in May 2025 significantly strengthens this segment, adding a key player in Northern Canada's healthcare landscape. This move directly supports Canadian government initiatives focused on the Arctic, highlighting the strategic importance and anticipated expansion of this market.

AMS provides Calian with a robust client base in industrial sectors and enhances its capacity to offer comprehensive healthcare services across a wider geographical area. This expansion is particularly relevant given the increasing demand for accessible healthcare solutions in remote regions.

Key aspects of this strategic positioning include:

- Market Expansion: The acquisition of AMS in May 2025 provides Calian with immediate access to the remote and emergency healthcare services market in Northern Canada.

- Government Alignment: This venture aligns with Canadian government investments and strategies for the Arctic region, signaling a high-priority growth area.

- Synergistic Capabilities: AMS's existing industrial customer base and expertise complement Calian's offerings, enabling integrated healthcare solutions.

- Growth Potential: The combined strengths position Calian to capture a significant share of a critical and expanding niche within the healthcare sector.

Nuclear Services

Calian's Nuclear Services segment is a standout performer, showcasing exceptional growth. In the second quarter of fiscal year 2025, this division achieved an impressive 51% organic growth. This surge is largely attributed to a strategic acquisition that significantly expanded Calian's capabilities.

The acquisition of nuclear assets from MDA Ltd. in March 2024 was a pivotal moment for Calian's nuclear business. This move not only broadened the service offerings but also integrated new expertise, bolstering the company's position in this specialized market. The integration has clearly paid dividends, contributing to the robust financial results.

- Nuclear Services Growth: Achieved 51% organic growth in Q2 FY25.

- Strategic Acquisition: Enhanced capabilities through the acquisition of nuclear assets from MDA Ltd. in March 2024.

- Market Position: Demonstrates a high-growth trajectory and increasing market share within Calian's overall portfolio.

- Capability Expansion: The MDA acquisition added new services and expertise to the existing nuclear business.

Calian's Defence Solutions are a clear Star, demonstrating robust growth and market demand. In Q2 FY25, this segment experienced a significant 13% increase, driven by global defense spending. This upward trend is supported by Calian's strategic expansion, including a new U.S. subsidiary focused on government contracts, solidifying its Star status.

Advanced Technologies, particularly in space and satellite communications, is another Star performer for Calian. The sector is rapidly evolving with innovations in satellite technology and deep space connectivity. Calian's investment in its Resource Orchestration platform, set to launch in 2025, and its established expertise in RF ground stations position it for continued success in this expanding market.

Cybersecurity solutions are a definitive Star for Calian, benefiting from substantial market expansion. Global cybersecurity spending is projected to reach $500 billion by 2030, with a compound annual growth rate of 12.9%. Calian's strategic acquisitions, such as Decisive Group, and its partnership with Microsoft, reinforce its strong position in this high-growth industry.

Calian's Nuclear Services segment is a remarkable Star, achieving an impressive 51% organic growth in Q2 FY25. This exceptional performance is largely due to the strategic acquisition of nuclear assets from MDA Ltd. in March 2024, which significantly broadened Calian's capabilities and market standing.

| Segment | BCG Category | Q2 FY25 Growth | Key Drivers |

| Defence Solutions | Star | 13% | Global defense spending, U.S. subsidiary expansion |

| Advanced Technologies | Star | N/A (Growth Driver) | Satellite industry expansion, Resource Orchestration platform |

| Cybersecurity | Star | N/A (High Growth Market) | Global spending increase, strategic acquisitions, Microsoft partnership |

| Nuclear Services | Star | 51% | MDA Ltd. asset acquisition, expanded capabilities |

What is included in the product

Strategic analysis of products/units based on market share and growth.

Guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Calian BCG Matrix provides a clear, visual snapshot of your portfolio, alleviating the pain of indecision about where to focus resources.

Cash Cows

Calian's Established Healthcare Staffing segment is a prime example of a Cash Cow within the BCG matrix. This division boasts a long and stable history, serving both government and commercial sectors. Its consistent revenue generation, fueled by a significant market share, provides a reliable source of cash flow with minimal need for substantial reinvestment.

Calian's long-term government contracts are a prime example of a cash cow. These agreements, particularly in defense and public service, offer a predictable stream of revenue, bolstering the company's financial stability. For instance, in fiscal year 2024, Calian reported significant contributions from its government sector, highlighting the consistent cash generation from these secured, recurring business relationships.

Calian's traditional learning services act as a classic cash cow within its business portfolio. This segment offers professional training and education, serving a broad range of clients with established programs. While growth might not be explosive, its strength lies in consistent demand and a loyal customer base, ensuring a reliable stream of income.

The focus here is on maintaining existing offerings and optimizing delivery, not on aggressive expansion. This lean operational approach translates into healthy profit margins and a predictable, steady cash flow generation. For instance, in 2024, Calian's learning segment continued to be a significant contributor to overall profitability, demonstrating the enduring value of its mature educational solutions.

Mature IT Infrastructure Services

Mature IT infrastructure services within Calian's ITCS division represent established offerings with a strong client base. These services, while operating in a slower-growth segment, generate consistent revenue due to their essential nature and long-term contracts.

Calian's mature IT infrastructure services likely benefit from high market share owing to deep client integration and the ongoing need for support and maintenance. This stability allows them to act as significant cash generators for the company, requiring limited investment in new development or aggressive marketing campaigns.

For example, in 2024, companies in the IT infrastructure services sector generally saw steady demand, with some reporting revenue growth in the low-to-mid single digits, reflecting the mature nature of the market. Calian's focus on long-term government contracts, a key area for IT infrastructure, often provides predictable revenue streams.

- Stable Revenue: Mature IT infrastructure services provide a reliable income stream, often through multi-year support and maintenance agreements.

- High Market Share: Deeply embedded solutions and established client relationships contribute to a dominant position in their specific market niches.

- Cash Generation: These services are cash cows, requiring minimal reinvestment while contributing significantly to overall profitability.

- Low Growth, High Profitability: While market growth may be modest, the profitability of these established services is typically high due to operational efficiencies and scale.

Core Communications Solutions

Calian's core communications solutions likely function as the company's cash cows. These are established offerings, perhaps supporting critical communication infrastructure or older, but still vital, systems. Their long-standing presence and essential nature mean they probably hold a significant market share.

The stability of these solutions means they generate reliable cash flow without demanding massive reinvestment, unlike newer, high-growth areas. This consistent income stream is crucial for funding other parts of Calian's business, such as those in the question mark or star categories.

- Stable Revenue Generation: Core communications solutions provide a predictable and consistent income stream for Calian.

- High Market Share: Due to their established nature and essential services, these offerings likely command a substantial portion of their respective markets.

- Low Investment Needs: Unlike growth-oriented segments, these mature products require minimal capital expenditure for maintenance and incremental improvements.

- Funding Growth Initiatives: The cash generated by these solutions can be strategically deployed to invest in more dynamic or emerging business areas within Calian.

Calian's established healthcare staffing, long-term government contracts, traditional learning services, mature IT infrastructure, and core communications solutions all exemplify cash cows within the BCG matrix. These segments benefit from high market share in mature, low-growth markets, generating consistent and substantial cash flow with minimal need for reinvestment. In fiscal year 2024, Calian's performance highlighted the stability of these mature segments, with government contracts and established services continuing to be significant contributors to overall profitability and providing the financial foundation for other business units.

What You’re Viewing Is Included

Calian BCG Matrix

The Calian BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete strategic analysis ready for your immediate use. You can confidently use this preview to understand the depth and quality of the insights provided, knowing the purchased version offers the same professional presentation and actionable data. It's designed to be directly integrated into your business planning, providing a clear framework for evaluating your product portfolio's strategic positioning.

Dogs

Calian's ITCS segment experienced a challenging environment in Q2 FY25, marked by slower customer demand. This situation prompted one-time investments aimed at repositioning its offerings for future growth, suggesting that certain ITCS products or services may have low market share within slow-growing or declining sub-markets.

These underperforming legacy ITCS offerings, if not successfully revitalized through strategic repositioning, risk becoming significant cash drains for the company. The need for these specific investments highlights a strategic imperative to either innovate or divest from these less competitive areas within the ITCS portfolio.

Calian's operation in highly commoditized IT services, where differentiation is minimal and profit margins are squeezed, would place these offerings squarely in the 'Dogs' quadrant of the BCG Matrix. These services, often characterized by low investment requirements, also deliver low returns, consuming valuable resources without offering substantial growth potential.

The 'challenging environment' noted within Calian's ITCS segment could indeed point to pressure on these commoditized services. For instance, basic IT support or managed services, once lucrative, now face intense competition, driving down prices. In 2024, the global IT services market, while growing, sees intense price competition in areas like help desk support and basic cloud management, with average margins often falling below 10% for these standardized offerings.

Non-strategic, low-margin contracts represent a category within Calian's business that doesn't align with its core focus on high-value, innovative solutions. These might be projects in mature or declining markets, consuming valuable resources and management bandwidth without generating substantial profits or contributing to future growth. For instance, if Calian's strategic shift targets cloud solutions and cybersecurity, older, fixed-price IT maintenance contracts in legacy systems might fall into this 'dog' quadrant.

Outdated or Less Relevant Training Programs

Calian's learning segment, while generally robust, faces challenges with outdated or less relevant training programs. These programs, failing to align with current industry needs or technological shifts, could be categorized as Dogs in the BCG Matrix. Such offerings might see a drop in enrollment and a diminished market presence, struggling for growth.

The issue stems from a lack of continuous investment to update curricula, making these programs less appealing. For instance, if a cybersecurity training module still focuses on 2020 threats without incorporating advancements in AI-driven security or quantum computing's impact, its relevance plummets. This necessitates strategic decisions on whether to revitalize or divest these underperforming assets.

- Declining Relevance: Training content that doesn't reflect current industry standards or emerging technologies.

- Low Market Share & Growth: Programs with fewer participants and minimal expansion potential.

- Investment Dilemma: The need for costly updates versus the potential for low returns.

- Strategic Review: Decisions on whether to refresh, reposition, or discontinue these offerings.

Non-core, Low-performing Legacy Assets

Within Calian's strategic framework, non-core, low-performing legacy assets represent businesses or product lines that may no longer align with the company's primary growth objectives. These could be smaller entities acquired in earlier expansion phases or inherited through mergers, now finding themselves in mature or declining markets with limited competitive standing.

These assets often require ongoing investment for maintenance or regulatory compliance but yield minimal returns, acting as a drag on overall profitability. For instance, if a legacy software division, acquired in 2020, now holds less than a 2% market share in a market projected to grow at only 1% annually, it would fit this category.

- Resource Drain: These assets consume valuable capital and management attention that could be better allocated to high-growth opportunities.

- Low Profitability: Their contribution to overall earnings is negligible, potentially even negative when considering associated costs.

- Strategic Misfit: They do not leverage Calian's core competencies or contribute to its future market positioning.

- Divestiture Potential: Such assets are prime candidates for divestiture, allowing Calian to streamline operations and reinvest proceeds into more promising ventures.

Calian's "Dogs" represent business units or offerings with low market share in slow-growing or declining markets. These segments, like certain commoditized IT services or outdated training programs, consume resources without generating significant returns. For example, a legacy IT maintenance contract in a shrinking market might fit this description, demanding investment for upkeep but yielding minimal profit.

The company's ITCS segment's challenges in Q2 FY25, including slower customer demand, suggest some offerings are indeed in this "Dog" category. These underperforming assets require careful management, potentially through revitalization or divestiture, to free up capital for more promising ventures. In 2024, the global IT services market sees intense price competition in basic support, often with margins below 10% for standardized offerings.

Calian's learning segment might also have "Dogs" in the form of training programs lacking current industry relevance. If a cybersecurity module, for instance, doesn't incorporate AI advancements, its market appeal diminishes. Such programs require strategic decisions on whether to invest in updates or discontinue them to focus on growth areas.

These non-core, low-performing legacy assets, such as a niche software division acquired in 2020 with less than a 2% market share in a 1% growth market, are prime candidates for divestiture. They drain capital and management attention, offering negligible profitability and a strategic misfit with Calian's core competencies.

| Category | Characteristics | Examples within Calian (Hypothetical) | Market Dynamics (2024 Data) | Strategic Implication |

| Dogs | Low Market Share, Low Growth | Commoditized IT support services, Outdated training modules | IT Services: Intense price competition, margins <10% for basic support. | Divest or Revitalize |

| Resource Drain | Legacy software maintenance contracts | |||

| Low Profitability | Non-strategic, low-margin contracts |

Question Marks

Calian US, Inc., launched in December 2024, is positioned as a new entrant targeting the U.S. government and defense sector. This strategic move leverages the high-growth potential of the U.S. defense market, which saw an estimated increase in spending in 2024, driven by evolving geopolitical landscapes. Despite the market's promise, Calian US, Inc. currently holds a low market share and necessitates significant capital infusion for certifications and market penetration.

Calian's new Resource Orchestration platform, launching in 2025, is poised to revolutionize satellite communications by autonomously managing flexible satellites and gateways. This innovative product is strategically positioned to capitalize on the dynamic and expanding satellite communications market, which is projected to reach over $50 billion by 2030.

Currently, this platform represents a Question Mark in the BCG Matrix for Calian. Its market share is nascent due to its recent introduction, necessitating substantial investment in market penetration and customer adoption. The success of this platform hinges on its ability to gain traction and evolve into a market leader.

Calian's agreement to license its NexiTM digital health platform to Walmart Canada for specialty pharmacy expansion signifies a strategic move into a burgeoning healthcare market. This initiative leverages a digital solution to tap into the growing demand for advanced pharmacy services.

As a new licensing model and market entry, NexiTM currently holds a nascent market share. However, its potential for significant growth is high, contingent on successful adoption and scalability within the retail pharmacy sector.

The digital health market is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond, driven by increased digitalization and patient demand for accessible healthcare solutions.

Advanced AI/ML Integrated Cybersecurity Solutions

Calian's strategic collaboration with Microsoft to deliver cloud-native cybersecurity solutions, powered by advanced AI and machine learning, positions them firmly within a high-growth market segment. This integration of cutting-edge technologies addresses the evolving threat landscape, making their offerings highly relevant.

Within the Calian BCG Matrix, these advanced AI/ML integrated cybersecurity solutions would be classified as a Star. The cybersecurity market itself is experiencing robust growth, with global spending projected to reach $268.1 billion in 2024, according to Gartner. Calian's focus on cloud-native and AI-driven solutions taps directly into this expansion.

- High Market Growth: The cybersecurity sector continues its upward trajectory, driven by increasing digital transformation and sophisticated cyber threats.

- Strong Technology Integration: Calian's partnership with Microsoft and its focus on AI/ML for cybersecurity are key differentiators in a competitive market.

- Investment Required: Despite the Star status, continued investment in research, development, and market penetration is crucial to solidify and expand market share.

- Future Potential: The demand for intelligent, automated cybersecurity solutions is expected to surge, offering significant long-term potential for Calian's advanced offerings.

Specific New Product Developments in SatService

Calian's German SatService branch is actively engaged in developing new products within its sat-nms line, aiming to adapt to the evolving satellite ground segment landscape by 2025. This strategic focus targets a rapidly expanding market, fueled by the significant growth observed in the satellite industry.

These new product developments are characterized by an initial low market share, necessitating substantial investment in research and development (R&D) and market penetration strategies. The objective is to secure a leading position in this dynamic sector.

- Focus on sat-nms enhancements: SatService is prioritizing improvements and new product introductions for its sat-nms product family.

- Addressing market shifts: Developments are designed to meet technological changes in the satellite ground segment.

- High-growth market: The initiatives are positioned within a market experiencing accelerated growth due to the booming satellite sector.

- Investment for market leadership: New products start with low market share, requiring R&D and market penetration investments to achieve a leading position.

Question Marks represent new ventures or products with low market share in high-growth markets. These require significant investment to capture potential market leadership. Calian's Resource Orchestration platform and its NexiTM digital health platform, both launched recently, fit this description. They are in nascent stages, demanding capital for development, market entry, and customer acquisition to achieve future growth.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market research reports, and competitive analysis, to accurately position business units.