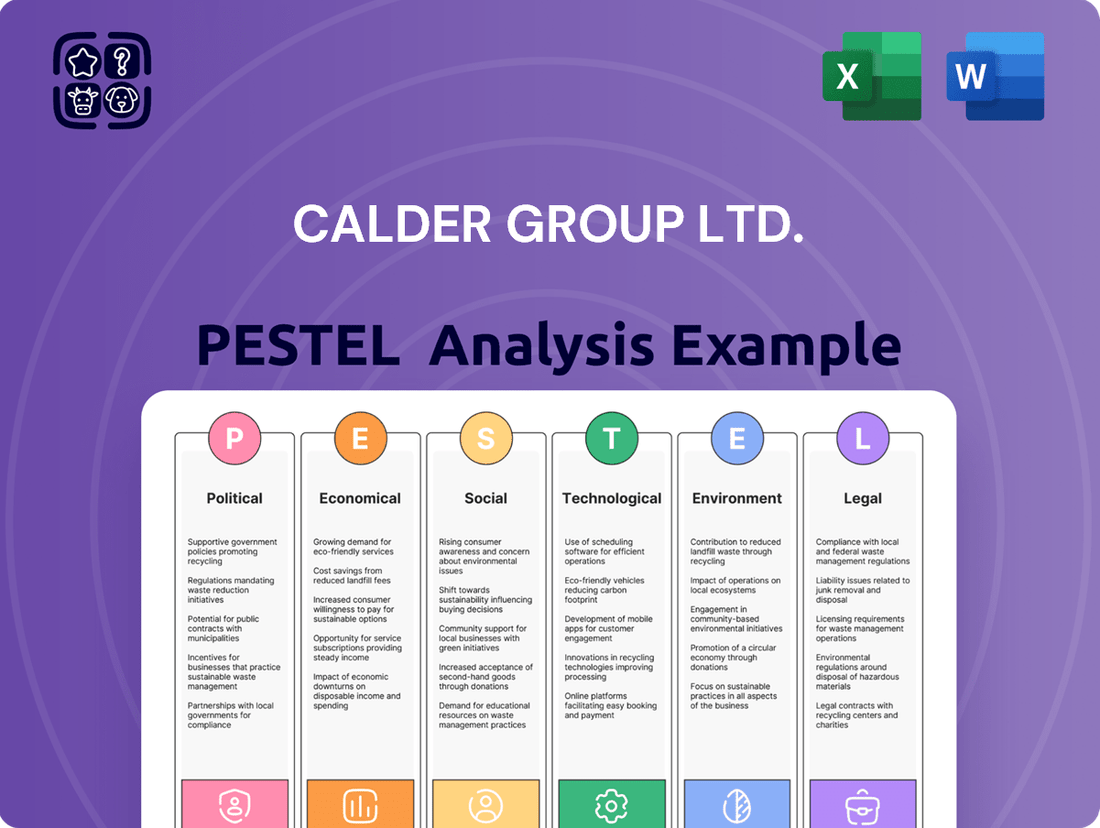

Calder Group Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calder Group Ltd. Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Calder Group Ltd.'s landscape. Our expert-crafted PESTLE analysis offers a clear roadmap to understanding these external influences. Gain a competitive edge by leveraging these deep-dive insights for your strategic planning. Download the full version now and equip yourself with the intelligence to navigate the future.

Political factors

Governments globally are tightening rules around lead use and exposure. California's Cal/OSHA, for example, enacted new lead standards from January 1, 2025, dramatically lowering permissible exposure limits (PELs) and action levels (ALs) for lead in both general industry and construction.

These evolving regulations demand significant adjustments in manufacturing processes and workplace safety procedures for companies like Calder Group Ltd. This shift could impact production costs and require investment in new technologies or materials to meet compliance by 2025.

Trade policies and tariffs significantly influence Calder Group's operational landscape. For instance, changes in import duties on raw lead, a critical component, directly affect production costs. In 2024, the global average tariff on lead ore remained a key consideration, with specific bilateral agreements potentially offering Calder Group advantages or disadvantages depending on their sourcing and sales regions.

Fluctuations in import/export policies, especially concerning major lead markets like China, can disrupt supply chains. China's role as both a significant producer and consumer of lead means shifts in its trade stance, such as export quotas or import restrictions implemented in late 2024 or early 2025, can rapidly alter lead availability and pricing, impacting Calder Group's cost of goods sold and market access.

Government investment in large-scale infrastructure and construction projects acts as a significant tailwind for companies like Calder Group Ltd., particularly those supplying engineered lead products. These projects directly translate into increased demand for materials like lead sheet, essential for roofing and damp proofing in new builds and renovations.

The UK construction sector, a key market for such products, is projected for robust growth in 2025. This expansion is significantly fueled by substantial public sector spending allocated to infrastructure development and major construction initiatives, creating a favorable market environment.

Healthcare Policy and Funding

Healthcare policies significantly shape the market for radiation shielding products, directly impacting companies like Calder Group Ltd. Government initiatives promoting the development of healthcare infrastructure, particularly in diagnostic imaging and cancer treatment centers, are key drivers of demand. For instance, the US Department of Health and Human Services' projected spending on healthcare infrastructure development through 2025, coupled with evolving radiation safety standards, directly influences the need for advanced shielding materials.

The increasing prevalence of chronic diseases globally, a trend expected to continue through 2024 and beyond, necessitates greater investment in hospitals and specialized diagnostic facilities. This surge in medical infrastructure development, including the expansion of MRI suites and CT scan rooms, directly translates into a sustained and growing requirement for high-quality lead shielding products to ensure patient and staff safety. The World Health Organization's reports consistently highlight the growing burden of non-communicable diseases, underscoring this long-term demand trend.

- Increased demand for diagnostic imaging: Rising chronic disease rates are projected to boost the use of CT scanners and MRI machines, requiring more shielding.

- Government investment in healthcare infrastructure: Policies supporting hospital upgrades and new facility construction in key markets like North America and Europe directly benefit shielding manufacturers.

- Evolving safety regulations: Stricter radiation safety standards mandate the use of advanced shielding materials, creating opportunities for innovation and market growth.

- Global healthcare spending trends: The IMF's projections for global healthcare expenditure growth indicate a favorable market environment for companies providing essential medical infrastructure components.

International Environmental Agreements

International environmental agreements, such as the Minamata Convention on Mercury and the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal, directly influence how companies like Calder Group Ltd. handle hazardous materials. These accords, increasingly stringent as of 2024 and projected into 2025, can dictate operational procedures for the use, recycling, and disposal of substances like lead, potentially increasing compliance costs but also fostering innovation in material science.

The global push towards sustainability, reinforced by these agreements, encourages the development and adoption of eco-friendly alternatives. For Calder Group Ltd., this means a strategic imperative to invest in research and development for less hazardous materials or improved disposal technologies. Failure to adapt could limit market access in regions with strict environmental regulations, impacting export opportunities and overall competitiveness.

- Global Agreements: The Minamata Convention, ratified by over 130 countries, aims to protect human health and the environment from mercury emissions.

- Regional Focus: The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, impacting chemical use and supply chains globally.

- Impact on Strategy: Companies are increasingly factoring in the long-term implications of these agreements when making capital investment decisions and planning product lifecycles.

- Market Access: Non-compliance with international environmental standards can result in trade barriers and reduced access to key markets, a significant consideration for global businesses in 2024-2025.

Government regulations on lead exposure are tightening, with new standards like California's 2025 Cal/OSHA rules significantly lowering permissible exposure limits. This necessitates substantial adjustments in manufacturing and safety protocols for companies such as Calder Group Ltd., potentially increasing costs and requiring technological investment to meet compliance by 2025.

Trade policies and tariffs directly impact Calder Group's operational costs and market access. Changes in import duties on raw lead, a critical component, can significantly affect production expenses. For example, in 2024, global tariffs on lead ore remained a key factor, with bilateral agreements influencing cost advantages or disadvantages based on sourcing and sales regions.

Government investment in infrastructure projects fuels demand for engineered lead products. The UK construction sector's projected growth in 2025, driven by public sector spending on infrastructure, creates a favorable market for materials like lead sheet used in building and renovations.

Healthcare policies are crucial for radiation shielding markets. Initiatives promoting healthcare infrastructure development, such as the US Department of Health and Human Services' projected spending through 2025, coupled with evolving radiation safety standards, directly influence demand for advanced shielding materials as chronic diseases necessitate more diagnostic facilities.

What is included in the product

This PESTLE analysis for Calder Group Ltd. comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges within its operating landscape.

The Calder Group Ltd. PESTLE analysis offers a concise, easily digestible summary of external factors, acting as a pain point reliever by streamlining complex market dynamics for quick referencing in meetings and presentations.

Economic factors

The global lead market is set for significant expansion, with projections indicating a rise from $19.16 billion in 2024 to $21.38 billion by 2025. This growth represents a robust 11.6% compound annual growth rate (CAGR).

Key drivers behind this market surge include escalating demand from the battery manufacturing sector, which relies heavily on lead for lead-acid batteries. The construction industry also contributes, utilizing lead in various applications, alongside the automotive sector where lead continues to be a critical component in vehicle batteries.

The construction sector's strong growth trajectory significantly bolsters demand for lead sheet. In the UK, for instance, construction output is projected to increase by a notable 8% in 2025, a trend that directly translates to higher requirements for roofing and damp proofing materials like lead.

This upswing is fueled by a recovery in the private housing market, alongside sustained investment in industrial and office building projects. These developments create a consistent need for durable and reliable construction components, positioning lead sheet favorably within the market.

The healthcare sector's demand for robust shielding solutions is a key driver for companies like Calder Group Ltd. The medical radiation shielding market is set for substantial expansion, with projections indicating it will reach USD 1.7 billion by 2034, growing at a compound annual growth rate of 6.6% from 2025.

This upward trend is primarily attributed to the escalating use of radiology and diagnostic imaging procedures, a trend that is expected to continue as medical technology advances. Coupled with this is a growing global emphasis on radiation safety protocols, directly enhancing the need for effective shielding materials and systems.

Calder Group's expertise in providing advanced shielding products positions them well to capitalize on this expanding market. The increasing volume of medical imaging procedures, from CT scans to X-rays, necessitates compliant and reliable shielding to protect both patients and healthcare professionals from harmful radiation exposure.

Raw Material Price Volatility

The cost of key inputs for Calder Group Ltd. can be significantly affected by raw material price volatility. For instance, lead prices experienced notable fluctuations in 2024, driven by global economic uncertainty and shifts in supply and demand. While forecasts suggest a slight surplus in refined lead for 2025, this inherent volatility poses a risk to Calder Group's production costs and overall profitability.

This price instability necessitates robust supply chain management and hedging strategies. Understanding these market dynamics is crucial for accurate financial forecasting and maintaining competitive pricing.

- Lead Price Fluctuations: Observed volatility in lead prices during 2024, influenced by global economic factors and supply-demand imbalances.

- 2025 Outlook: Anticipated slight surplus in refined lead for 2025, though price stability is not guaranteed.

- Impact on Calder Group: Potential for significant impact on production costs and financial performance due to fluctuating raw material prices.

- Risk Mitigation: Need for proactive supply chain management and financial hedging to counter price volatility.

Inflation and Interest Rates

High inflation and rising interest rates, a persistent challenge through 2024 and into 2025, significantly dampen enthusiasm for new construction projects. Businesses and consumers alike tend to tighten their belts, postponing or scaling back investments in commercial and residential developments due to increased borrowing costs and economic uncertainty. This cautious sentiment directly impacts the demand for Calder Group's construction-related lead products.

For instance, the Bank of England's base rate, which stood at 5.25% in late 2023, remained a key factor influencing borrowing costs throughout 2024. Similarly, in the US, the Federal Reserve's monetary policy decisions, with rates hovering around 5.25%-5.50% for much of 2024, created a similar environment of higher financing costs. This economic backdrop translates to fewer new builds and renovations, consequently reducing the market opportunities for companies like Calder Group.

- Inflationary Pressures: Consumer Price Index (CPI) figures in major economies like the UK and US showed persistent inflation, averaging around 3-4% in 2024, eroding purchasing power and investment capacity.

- Interest Rate Hikes: Central banks continued to manage inflation through interest rate adjustments, with benchmark rates remaining elevated, making construction financing more expensive.

- Subdued Demand: Economic forecasts for 2024-2025 indicated a slowdown in new housing starts and commercial property development, directly affecting the sales volume for construction materials.

Persistent inflation and elevated interest rates throughout 2024 and into 2025 are dampening new construction projects, impacting demand for Calder Group's lead products. Higher borrowing costs make new developments less attractive, leading to a slowdown in housing starts and commercial property investment.

The economic climate, characterized by average inflation rates around 3-4% in major economies during 2024 and benchmark interest rates remaining high, directly translates to reduced market opportunities for construction materials like lead.

This economic environment necessitates careful financial planning and strategic adaptation for companies like Calder Group to navigate the reduced demand in the construction sector.

Preview the Actual Deliverable

Calder Group Ltd. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Calder Group Ltd. details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Calder Group's strategic landscape.

Sociological factors

Growing public and occupational health awareness regarding lead exposure is significantly influencing industries. This heightened consciousness is fueling demand for more robust safety measures and spurring innovation towards lead-free materials. For instance, California's stringent regulations, like those targeting lead in consumer products, reflect a broader societal commitment to minimizing lead poisoning risks, impacting manufacturers and suppliers.

Societal concerns about radiation exposure in healthcare are escalating, directly impacting the market for radiation safety products. This heightened awareness, driven by patient advocacy and professional diligence, creates a robust demand for advanced shielding materials and technologies, benefiting companies like Calder Group Ltd.

The increasing utilization of diagnostic imaging and radiation therapy, coupled with a growing public understanding of potential risks, amplifies the need for stringent safety protocols and equipment. For instance, the global medical imaging market, which heavily relies on radiation-emitting technologies, was projected to reach over $40 billion in 2024, underscoring the scale of this demand.

Consumers and industries increasingly favor sustainable and eco-friendly products, a significant shift impacting material choices. This growing demand directly influences markets to move away from toxic substances like lead, particularly in applications where health and environmental concerns are paramount. For instance, by 2024, the global market for lead-free paints was projected to reach over $20 billion, reflecting this strong preference.

Workplace Safety Standards

Societal expectations and evolving regulations are significantly elevating workplace safety standards, especially for companies like Calder Group Ltd. handling hazardous materials such as lead. This trend mandates more rigorous safety measures, impacting operational costs and procedures.

Key areas of focus include:

- Enhanced Medical Surveillance: Increased frequency and scope of health monitoring for employees exposed to lead.

- Stricter Hygiene Protocols: Implementation of more stringent personal hygiene and decontamination procedures.

- Mandatory Warning Signage: Requirement for clear and prominent warning signs in all lead-exposed work zones.

- Regulatory Scrutiny: Growing governmental oversight and potential for stricter enforcement of safety compliance, as seen with OSHA's continued focus on lead exposure controls.

Corporate Social Responsibility (CSR)

Societal expectations for Calder Group Ltd. increasingly demand robust Corporate Social Responsibility (CSR). This includes ensuring ethical production practices, responsible sourcing of raw materials, and a concerted effort to minimize environmental impact throughout its operations. For instance, in 2024, the global demand for sustainably sourced materials saw a significant uptick, with reports indicating a 15% year-over-year increase in consumer preference for products with verified ethical supply chains.

Adherence to high Environmental, Social, and Governance (ESG) standards is no longer optional but a critical determinant of reputation and stakeholder trust, especially within the lead industry. Companies like Calder Group are finding that strong ESG performance directly correlates with investor confidence and market valuation. A 2025 study by the Global Sustainable Investment Alliance revealed that portfolios with strong ESG integration outperformed those without by an average of 2.5% annually over the past five years.

- Ethical Production: Ensuring fair labor practices and safe working conditions is paramount.

- Responsible Sourcing: Verifying the origin and ethical extraction of lead and other materials.

- Environmental Impact: Implementing strategies to reduce emissions, waste, and water usage.

- Stakeholder Trust: Building and maintaining credibility with customers, employees, investors, and communities through transparent ESG reporting.

Societal shifts are increasingly prioritizing health and safety, particularly concerning lead exposure and radiation. This heightened awareness drives demand for safer materials and advanced protective technologies, influencing industries like Calder Group Ltd. Consumers and regulators alike are pushing for greater corporate responsibility, emphasizing ethical sourcing and environmental stewardship.

The global push for sustainability is reshaping material preferences, moving away from hazardous substances like lead. For example, the market for lead-free paints was projected to exceed $20 billion by 2024. This trend necessitates that companies like Calder Group Ltd. adapt their product lines and operational practices to meet evolving consumer and regulatory demands for eco-friendly solutions.

Elevated expectations for Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance are now critical for maintaining stakeholder trust and market competitiveness. In 2024, consumer preference for products with verified ethical supply chains saw a significant increase, with reports indicating a 15% year-over-year rise. Strong ESG integration is also linked to financial performance, with ESG-integrated portfolios outperforming others by an average of 2.5% annually over the past five years.

Technological factors

The development of effective lead-free shielding materials, such as tungsten, bismuth, barium sulfate, and advanced polymer composites, represents a key technological advancement. These alternatives offer comparable or even enhanced radiation protection without the environmental and health risks associated with traditional lead shielding. For instance, advancements in tungsten alloys have shown promise in achieving high shielding effectiveness in compact designs.

Technological leaps in lead recycling, including advanced hydrometallurgical processes and the implementation of closed-loop systems, are significantly boosting efficiency and minimizing the environmental impact associated with lead production. These innovations are key to improving recovery rates, which for many established recyclers, are now exceeding 95%.

Furthermore, these advancements are yielding higher-quality recycled lead, effectively closing the performance disparity between recycled and primary lead. For instance, by 2024, the purity levels of recycled lead in many industrial applications are approaching 99.97%, making it a viable and often preferred alternative.

Calder Group Ltd. is seeing significant advancements in manufacturing through automation and AI. These technologies are not just buzzwords; they are actively boosting efficiency and optimizing production lines. For instance, AI-powered sensors are now capable of real-time process adjustments, directly impacting yield and minimizing material waste. This is crucial for lead engineering and production, where precision and resource management are paramount.

The adoption of AI in manufacturing is projected to drive substantial economic growth. Globally, the AI in manufacturing market was valued at approximately $10.7 billion in 2023 and is expected to reach over $37 billion by 2028, growing at a compound annual growth rate of around 28%. This trend highlights the increasing reliance on intelligent systems to enhance operational performance and competitive advantage, a key factor for companies like Calder Group Ltd.

Advanced Diagnostic Imaging Equipment

The medical field's rapid advancement in diagnostic imaging, including sophisticated CT scanners and nuclear medicine, directly fuels the need for cutting-edge radiation shielding. This trend is pushing companies like Calder Group Ltd. to constantly develop more effective lead-based and alternative shielding materials to meet evolving safety standards and equipment capabilities.

The global medical imaging market, valued at approximately $38.6 billion in 2023, is projected to grow significantly, underscoring the increasing demand for advanced imaging technologies and, consequently, their associated shielding requirements. This growth is driven by factors such as an aging population and the rising prevalence of chronic diseases, both of which necessitate more frequent and advanced diagnostic procedures.

- Market Growth: The medical imaging sector is experiencing robust expansion, creating a sustained demand for innovative shielding solutions.

- Technological Sophistication: Newer imaging devices offer higher resolution and faster scan times, often requiring more specialized radiation protection.

- Regulatory Compliance: Stringent safety regulations for radiation exposure in healthcare settings mandate the use of advanced shielding technologies.

Digital Transformation in Construction

The construction industry is undergoing a significant digital transformation, impacting how products like those offered by Calder Group Ltd. are integrated into projects. This shift is driven by the increasing adoption of technologies such as Building Information Modeling (BIM). BIM allows for detailed 3D modeling and data management throughout a project's lifecycle, promoting precision and efficiency.

This digital evolution emphasizes data-driven decision-making and streamlined workflows. For Calder Group Ltd., this means a growing demand for products that can be easily specified and integrated into digital design environments. The trend points towards a future where product performance data is readily accessible and can be directly incorporated into project planning and execution.

Key aspects of this technological shift include:

- Building Information Modeling (BIM) Adoption: Global BIM adoption rates are rising, with many countries mandating its use in public projects. For instance, the UK government has mandated BIM Level 2 for all centrally procured public projects.

- Increased Use of Digital Tools: Project management software, drones for site surveys, and virtual reality for design visualization are becoming commonplace, enhancing collaboration and reducing errors.

- Focus on Data and Interoperability: Digital transformation highlights the need for products with embedded data that can seamlessly interact with various design and construction software platforms.

- Efficiency and Sustainability Gains: Digital tools and processes are enabling construction firms to improve material efficiency, reduce waste, and enhance overall project sustainability, influencing product selection criteria.

Technological advancements in radiation shielding are critical for Calder Group Ltd., particularly with the rise of lead-free alternatives and improved recycling processes. Innovations in tungsten alloys and advanced polymer composites offer enhanced protection, addressing environmental concerns. The efficiency of lead recycling is also improving, with recovery rates now exceeding 95% for many established recyclers, producing lead with purity levels approaching 99.97% by 2024.

Automation and AI are transforming manufacturing for Calder Group, boosting efficiency and optimizing production lines through real-time process adjustments. The global AI in manufacturing market, valued at approximately $10.7 billion in 2023, is projected to exceed $37 billion by 2028, indicating a strong trend towards intelligent systems for competitive advantage.

The medical imaging sector, valued at around $38.6 billion in 2023, fuels demand for advanced shielding due to sophisticated diagnostic equipment and stricter safety regulations. This growth, driven by an aging population and chronic diseases, necessitates continuous development in shielding materials.

The construction industry's digital transformation, particularly the adoption of Building Information Modeling (BIM), is influencing product integration. BIM allows for detailed 3D modeling and data management, emphasizing the need for products with embedded data that can seamlessly interact with design software.

Legal factors

Occupational health and safety regulations are tightening, particularly concerning lead exposure. California's updated lead standards, effective January 2025, exemplify this trend by lowering permissible exposure limits and mandating stricter medical surveillance and hygiene practices.

These enhanced regulations necessitate significant investment in compliance measures for manufacturers like Calder Group Ltd. Failure to adhere can result in penalties and operational disruptions, impacting overall business performance.

Revised building regulations and British roofing standards, such as BS 5534 for slating and tiling, BS 8612 for dry-fixed roof coverings, and BS EN 13501-5 for fire classification of roofs, critically influence how lead sheet can be specified and utilized in construction projects. These updated standards are designed to enhance quality, safety, and overall performance, with a particular emphasis on fire safety and the structural resilience of roofing systems.

Environmental Protection Laws are a significant consideration for Calder Group Ltd., particularly regarding lead. Regulations concerning lead waste management, emissions, and environmental contamination are becoming increasingly stringent. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive continues to influence product design and material sourcing, impacting lead usage in electronics.

These laws directly affect Calder Group's lead mining, production, and recycling operations by mandating specific handling and disposal protocols. The goal is to minimize the environmental footprint of lead-related activities, promoting responsible disposal and recovery processes. Failure to comply can result in substantial fines, with environmental penalties in the EU, for example, often running into millions of euros for significant breaches.

Chemical Substance Regulations (e.g., REACH)

International and national regulations, like Europe's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), significantly impact companies handling chemical substances. These rules can restrict lead usage in specific products or demand rigorous documentation for its safe management and entire lifecycle. For instance, REACH's 2024 updates continue to scrutinize substances of very high concern, potentially affecting supply chains and material choices for businesses like Calder Group Ltd.

These stringent regulations can spur innovation by driving the search for safer, alternative materials. Failure to comply can lead to restricted market access, as seen with various chemical restrictions implemented globally throughout 2024 and projected into 2025. Such compliance costs and the need for material substitution are critical considerations for Calder Group Ltd.'s strategic planning.

- REACH Compliance: Ongoing evaluations and potential restrictions on lead compounds under REACH can impact product formulations and manufacturing processes.

- Market Access: Non-compliance with chemical substance regulations in key markets like the EU can severely limit or entirely block market entry for Calder Group Ltd.'s products.

- Material Innovation: Regulatory pressure encourages investment in R&D for lead-free alternatives, potentially creating new market opportunities and competitive advantages.

- Documentation Burden: The extensive data and safety documentation required by regulations like REACH add to operational costs and complexity for chemical manufacturers.

Product Safety and Liability Laws

Product safety and liability laws significantly shape how Calder Group Ltd. designs, labels, and markets its offerings. For instance, regulations like the Consumer Product Safety Improvement Act (CPSIA) in the US mandate rigorous testing and compliance for children's products, impacting materials and manufacturing processes. Failure to adhere can result in substantial fines; in 2023, companies faced penalties reaching millions for non-compliance with safety standards.

Calder Group Ltd. must ensure its lead products, particularly those in consumer-facing sectors, meet all relevant safety standards to avoid costly litigation and reputational damage. This includes rigorous testing for hazardous materials, clear labeling of potential risks, and transparent marketing practices. The global cost of product recalls, often driven by safety concerns, reached an estimated $20 billion in 2024, highlighting the financial imperative of robust safety protocols.

- Compliance with international safety standards such as ISO 9001 and industry-specific certifications is crucial for Calder Group Ltd.

- Manufacturers face increasing scrutiny and potential liability for defects, necessitating thorough quality control and risk assessment.

- In 2024, the global product recall market saw significant activity, with automotive and electronics sectors experiencing the highest number of incidents.

- Clear and accurate product labeling is a legal requirement and a key factor in mitigating liability claims.

Legal factors significantly influence Calder Group Ltd.'s operations, particularly concerning lead usage and environmental impact. Evolving occupational health and safety regulations, such as California's updated lead standards effective January 2025, mandate stricter controls and can increase compliance costs. Furthermore, revised building and roofing standards in the UK, like BS 5534, dictate how lead sheet can be incorporated into construction, emphasizing quality and safety.

Environmental factors

Lead's inherent toxicity presents substantial environmental and health hazards, with potential for soil, water, and air contamination if not meticulously managed by companies like Calder Group Ltd. This necessitates stringent adherence to environmental regulations and a growing market demand for more sustainable production processes and robust waste disposal strategies.

The global average lead concentration in surface soil can range significantly, but areas with historical industrial activity often exceed safe limits, impacting ecosystems and human health. For instance, studies in 2024 continue to highlight legacy lead contamination in urban and industrial zones, underscoring the ongoing need for remediation and preventative measures in manufacturing and product lifecycle management.

The global push for sustainable manufacturing is intensifying, with a focus on waste reduction, lower carbon footprints, and ethical production. For companies like Calder Group Ltd., this translates into a necessity to integrate environmentally sound practices into their operations.

Consumer demand for eco-friendly products and services is a significant driver. Surveys in late 2024 indicated that over 60% of consumers consider sustainability when making purchasing decisions, directly impacting brand perception and market share.

Industry initiatives and regulatory pressures are also compelling this shift. For instance, many European markets are implementing stricter emissions standards for manufacturing by 2025, requiring businesses to invest in cleaner technologies and processes to remain competitive.

The expanding circular economy and the booming lead recycling sector are key environmental drivers. These trends are fueled by strict regulations and the persistent demand for lead, particularly in the battery industry. For instance, the U.S. achieved an impressive 99% recycling rate for lead batteries in 2023, highlighting the sector's commitment to sustainability.

Development of Eco-Friendly Alternatives

The increasing demand for sustainable solutions is pushing industries to explore eco-friendly alternatives to traditional materials. For Calder Group Ltd., this means a significant focus on developing and adopting greener options, especially in areas like radiation shielding where lead has been a long-standing material. This shift is not just about environmental responsibility; it's becoming a key driver for innovation and market competitiveness.

Materials such as tungsten and bismuth are gaining traction as viable replacements for lead in radiation shielding applications. These alternatives offer comparable effectiveness with a demonstrably lower environmental footprint. For instance, research indicates that tungsten alloys can achieve radiation attenuation levels similar to lead, while being non-toxic and recyclable. This presents a clear opportunity for Calder Group to align its product development with growing environmental regulations and consumer preferences.

- Market Growth: The global market for radiation shielding materials is projected to reach approximately $10.5 billion by 2028, with a growing segment dedicated to eco-friendly alternatives.

- Material Innovation: Tungsten and bismuth are being actively researched and implemented, with advancements in composite materials enhancing their shielding properties and cost-effectiveness.

- Regulatory Push: Stricter environmental regulations worldwide are incentivizing the phase-out of hazardous materials like lead, accelerating the adoption of safer alternatives.

Reduced Emissions in Production

Calder Group Ltd. faces significant environmental pressure to curb emissions from its lead production and processing operations. This includes implementing advanced technologies like scrubbing systems and low-NOx burners to minimize its environmental impact per ton of refined lead.

The push for reduced emissions is driven by increasing regulatory scrutiny and stakeholder expectations. For instance, by the end of 2024, many industrial sectors are targeting a 15% reduction in greenhouse gas emissions compared to 2020 levels, a benchmark Calder Group would likely need to align with.

- Technological Adoption: Investing in and deploying advanced scrubbing technologies and low-NOx burners are crucial for emission control.

- Carbon Capture Potential: Exploring and potentially implementing carbon capture technologies could further reduce the company's overall environmental footprint.

- Regulatory Compliance: Meeting evolving environmental regulations and industry standards for emissions is a primary concern.

- Sustainability Reporting: Demonstrating progress in emission reduction is becoming increasingly important for corporate sustainability reporting and investor relations.

Calder Group Ltd. must navigate increasing environmental regulations concerning lead's toxicity and potential for contamination. The global shift towards sustainable manufacturing, driven by consumer demand and industry initiatives, necessitates greener production processes and robust waste management strategies.

The company faces pressure to reduce emissions, with many industrial sectors targeting significant greenhouse gas reductions by the end of 2024. Investing in advanced emission control technologies and exploring carbon capture are crucial for compliance and sustainability reporting.

The growing circular economy and lead recycling sector, exemplified by a 99% recycling rate for lead batteries in the U.S. in 2023, highlight the industry's move towards sustainability. Calder Group can leverage these trends by focusing on material innovation and adopting eco-friendly alternatives to lead.

| Environmental Factor | Impact on Calder Group Ltd. | Key Data/Trend (2023-2025) |

|---|---|---|

| Lead Toxicity & Contamination | Requires stringent environmental management and adherence to regulations. | Legacy lead contamination remains a concern in industrial zones (ongoing studies in 2024). |

| Sustainable Manufacturing Push | Necessitates integration of eco-friendly practices, waste reduction, and lower carbon footprints. | Over 60% of consumers consider sustainability in purchasing decisions (late 2024 surveys). |

| Emissions Reduction | Requires investment in advanced technologies like scrubbing systems and low-NOx burners. | Industrial sectors targeting 15% GHG reduction by end of 2024 (vs. 2020). |

| Circular Economy & Recycling | Opportunity to capitalize on the lead recycling sector and demand for sustainable materials. | U.S. lead battery recycling rate reached 99% in 2023. |

| Material Alternatives | Drives innovation towards non-toxic alternatives like tungsten and bismuth for radiation shielding. | Global radiation shielding market projected at $10.5 billion by 2028, with growth in eco-friendly segments. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Calder Group Ltd. is meticulously constructed using a blend of official government publications, reputable financial news outlets, and leading industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.