CaixaBank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CaixaBank Bundle

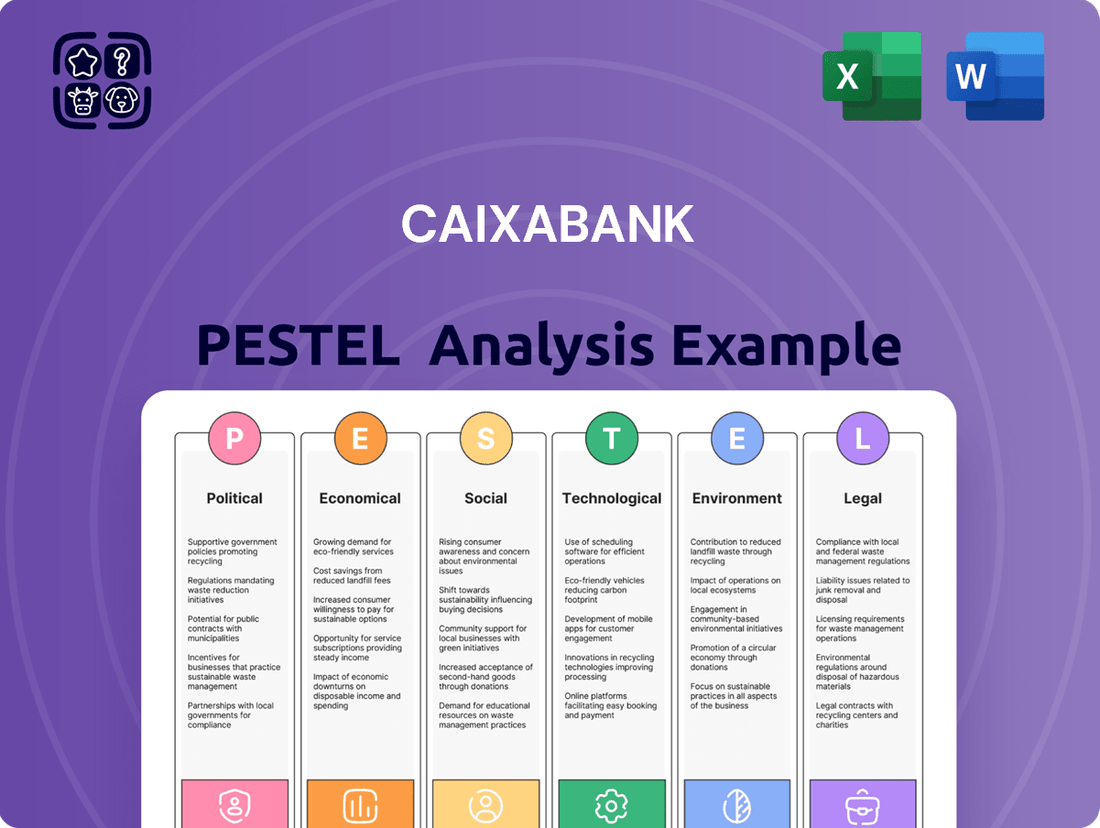

Navigate the complex external forces impacting CaixaBank with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its strategic landscape. Gain the foresight needed to make informed decisions and secure your competitive advantage.

Political factors

The stability of the Spanish government and its economic policies are crucial for CaixaBank's operations. For instance, the Spanish government's commitment to fiscal discipline and its approach to banking regulation directly shape the bank's profitability and strategic planning. A stable political environment fosters investor confidence, which is vital for financial institutions like CaixaBank.

Shifts in political leadership or evolving policy priorities, such as adjustments to corporate tax rates or new regulations on financial services, can significantly alter CaixaBank's financial performance. For example, a potential increase in bank taxes, as debated in various European contexts, could directly impact net interest margins and overall earnings capacity.

Spain's political landscape, which has seen periods of fragmentation, can sometimes lead to a less predictable regulatory environment. This can make it challenging for banks like CaixaBank to formulate long-term strategies, as policy implementation might be subject to frequent changes or delays, impacting the certainty of future returns.

The Spanish government's banking tax, initially introduced in 2021 and potentially extended, directly impacts CaixaBank's profitability. This levy, designed to increase government revenue, adds a direct cost to the bank's operations.

While CaixaBank has managed this tax, its potential extension poses a risk. Extended application could lead to a reduction in net interest margins, impacting the bank's capacity to lend and potentially affecting broader financial conditions for its customers.

The European Central Bank (ECB) has voiced concerns, warning in its 2024 financial stability review that such taxes can weaken the banking sector's overall resilience. This sentiment underscores the potential for regulatory and fiscal policies to influence financial stability.

As a significant player in the Spanish financial landscape, CaixaBank operates under a comprehensive web of European Union regulations. These directives, covering areas like capital adequacy (e.g., Basel III implementation), consumer protection, and anti-money laundering, necessitate ongoing compliance efforts that impact operational costs and strategic decision-making. For instance, the EU’s Digital Operational Resilience Act (DORA), fully applicable from January 2025, demands significant investment in IT security and risk management.

The European Central Bank’s (ECB) monetary policy decisions and its overarching focus on financial stability directly influence the operating environment for CaixaBank. For example, the ECB's interest rate policies, such as those implemented throughout 2023 and into early 2024, significantly affect net interest margins and lending volumes across the Eurozone, including Spain. The ECB's ongoing supervision, including stress tests, also shapes capital management strategies.

Geopolitical Risks and Trade Tensions

Global geopolitical risks, including escalating trade conflicts and regional instabilities, introduce significant uncertainty into financial markets and can dampen economic growth, directly impacting CaixaBank's operational environment. For instance, ongoing trade disputes between major economic blocs can disrupt supply chains and reduce international investment flows, indirectly affecting Spain's export-driven industries and, consequently, the demand for banking services and the quality of loan portfolios.

While Spain's direct exposure to specific trade tensions, such as those involving the United States, might be limited, broader global economic slowdowns stemming from these conflicts pose a considerable threat. A downturn in export-oriented sectors could lead to increased non-performing loans, while reduced foreign investment might dampen demand for corporate banking and capital markets services. For example, the International Monetary Fund (IMF) projected global growth to be 3.1% in 2024, a slight increase from 3.0% in 2023, but acknowledged that risks remain tilted to the downside due to geopolitical fragmentation and persistent inflation.

- Trade Tensions Impact: Global trade disputes can reduce international investment and disrupt supply chains, affecting Spain's export sectors.

- Economic Slowdown Risk: Broader global economic slowdowns due to geopolitical instability can negatively impact loan quality and demand for banking services.

- IMF Growth Forecast: The IMF's 2024 global growth projection of 3.1% highlights ongoing risks, with geopolitical factors contributing to potential downside.

Public Debt and Fiscal Policy

Spain's public debt remains a significant political and economic consideration. As of the first quarter of 2024, the debt-to-GDP ratio stood at 107.7%, a figure that, while showing a slight decrease from previous periods, still represents a substantial fiscal burden. This level of debt directly impacts the government's ability to implement expansive fiscal policies, potentially limiting its capacity to stimulate economic growth or provide broad support to sectors like banking.

The Spanish government's fiscal policy, therefore, plays a crucial role in shaping the operating environment for institutions like CaixaBank. Decisions regarding taxation, public spending, and debt management have ripple effects on interest rates, inflation, and overall economic stability. For instance, austerity measures aimed at reducing debt could dampen consumer spending and business investment, indirectly affecting CaixaBank's loan demand and asset quality. Conversely, fiscal stimulus, if financed sustainably, could boost economic activity and benefit the bank.

CaixaBank's performance is intrinsically linked to these macroeconomic conditions. A stable fiscal environment fostered by responsible policy can enhance investor confidence, leading to lower borrowing costs for the bank and its clients. Conversely, concerns about Spain's debt sustainability or the effectiveness of fiscal policy can lead to increased market volatility and a more challenging operating landscape for CaixaBank. The bank's strategic planning must account for these political and fiscal dynamics.

- Public Debt to GDP Ratio: Spain's public debt was 107.7% of GDP in Q1 2024.

- Fiscal Policy Impact: Government spending and taxation decisions directly influence economic stability and investor confidence.

- Banking Sector Linkage: CaixaBank's profitability and growth are sensitive to the macroeconomic environment shaped by fiscal policy.

Political stability in Spain is paramount for CaixaBank, influencing regulatory frameworks and investor confidence. Government policies on banking taxation, such as the Spanish banking tax, directly affect the bank's profitability, as seen with potential impacts on net interest margins.

Navigating the complex web of EU regulations, including DORA from January 2025, requires significant investment and impacts operational costs for CaixaBank. The ECB's monetary policy, including interest rate decisions throughout 2023-2024, directly shapes the bank's lending environment and profitability.

Spain's public debt, at 107.7% of GDP in Q1 2024, necessitates careful fiscal management, influencing economic stability and CaixaBank's operating conditions. Government fiscal policies, encompassing taxation and spending, create a direct link to the bank's performance and strategic planning.

What is included in the product

This CaixaBank PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the bank's operations and strategic planning.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential impacts for informed decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering quick insights into the external factors affecting CaixaBank.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the political, economic, social, technological, environmental, and legal landscape impacting CaixaBank.

Economic factors

The prevailing interest rate environment is a critical factor for CaixaBank, directly influencing its net interest income (NII), a primary source of revenue. Recent periods of elevated interest rates have bolstered the bank's profitability.

However, forecasts for 2025 suggest a gradual easing of interest rates. This shift is anticipated to compress CaixaBank's net interest margins, potentially impacting earnings.

CaixaBank's strategy to counter this includes active hedging strategies and a focus on driving loan growth, which could help to offset the narrowing margin pressure. For instance, the European Central Bank's key interest rates, which heavily influence CaixaBank's operating environment, are expected to see adjustments throughout 2025.

Spain's economy has shown impressive resilience, with GDP growth consistently outperforming the Eurozone average. For instance, in 2024, Spain's GDP growth was projected to be around 2.0%, significantly higher than the Eurozone's estimated 0.9%. This robust expansion creates a favorable operating landscape for CaixaBank.

This economic strength is underpinned by strong consumer spending, a vital sector for banking. Furthermore, Spain's thriving tourism industry, which saw visitor numbers rebound strongly in 2023 and continue to grow into 2024, injects significant revenue into the economy. A healthy labor market, with unemployment rates gradually declining, also bolsters consumer confidence and borrowing capacity.

These positive economic indicators directly translate into benefits for CaixaBank. Stronger consumer spending and business activity fuel demand for loans, mortgages, and other banking services, thereby increasing the bank's overall business volume. The bank's performance is thus closely tied to Spain's economic health and its capacity for sustained growth.

CaixaBank is seeing a healthy uptick in new loan origination across its core business areas, including mortgages, corporate lending, and consumer finance. This expansion is directly contributing to the growth of its overall credit portfolio.

While the bank's asset quality has generally held up well, a modest rise in non-performing loans (NPLs) is projected for 2025, particularly as consumer and retail lending continues to expand. Despite this anticipated increase, total credit costs are expected to remain largely stable.

Inflation and Consumer Purchasing Power

Inflation’s trajectory remains a key consideration for CaixaBank, directly impacting how much consumers can afford. While overall inflation has eased from its peaks, the stickiness of service sector price increases, coupled with potential government measures like higher taxes on energy and food, could still dampen household spending and reduce savings. This dynamic directly influences the demand for various banking products, from loans to investment vehicles.

For instance, in the Eurozone, inflation averaged 2.4% in April 2024, a notable decrease from previous years, but core inflation, excluding energy and food, remained at 2.7%. This persistent service inflation means that even with lower headline figures, the cost of everyday services continues to rise, squeezing disposable income. Consumers may therefore be more cautious about taking on new debt or making significant investments.

- Inflationary Pressures: While headline inflation in the Eurozone was 2.4% in April 2024, services inflation has shown more resilience, impacting consumer budgets.

- Purchasing Power Squeeze: Potential tax increases on essential goods like energy and food could further reduce household disposable income, affecting consumer confidence and spending.

- Impact on Banking: Reduced consumer spending and savings can lead to lower demand for retail banking services, including mortgages, personal loans, and investment products.

- Savings Behavior: Economic uncertainty and reduced purchasing power may encourage a more conservative savings approach, influencing the deposit base and investment strategies for banks like CaixaBank.

Competitive Landscape in Spanish Banking

The Spanish banking sector is navigating a period of significant competitive shifts. The potential consolidation, notably the proposed acquisition of Sabadell by BBVA, introduces uncertainty and could reshape market dynamics. This proposed merger, valued at approximately €12.2 billion as of mid-2024, aims to create Spain's largest bank by assets, intensifying competition.

This heightened competition is likely to manifest in key areas such as consumer and small and medium-sized enterprise (SME) lending. Banks may adopt more aggressive pricing strategies to capture market share, potentially leading to compressed profit margins for all players, including CaixaBank, as they focus on increasing lending volumes to maintain profitability.

- Market Concentration: A successful BBVA-Sabadell merger would significantly increase market concentration in Spain, potentially reducing the number of major players.

- Lending Margins: Increased competition in lending could lead to tighter net interest margins (NIMs) for banks.

- Consumer Finance: Profitable segments like consumer credit are expected to see intensified competition.

- SME Banking: Small and medium-sized businesses may benefit from more competitive loan offerings.

The economic outlook for Spain remains robust, with GDP growth projected to outpace the Eurozone average in 2024 and 2025, creating a favorable environment for CaixaBank. This growth is supported by strong consumer spending and a recovering tourism sector, which directly translates into increased demand for banking services and loan origination.

However, CaixaBank faces headwinds from a projected easing of interest rates in 2025, which could compress net interest margins. The bank is actively employing hedging strategies and focusing on loan growth to mitigate this pressure. While asset quality has been stable, a slight increase in non-performing loans is anticipated in 2025, though total credit costs are expected to remain manageable.

Inflation, particularly in services, continues to impact consumer purchasing power, potentially dampening demand for retail banking products. Furthermore, the proposed merger of BBVA and Sabadell, valued at approximately €12.2 billion in mid-2024, signals increased market concentration and intensified competition, especially in consumer and SME lending, which could affect profit margins.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on CaixaBank |

|---|---|---|---|

| Spain GDP Growth | ~2.0% | ~1.8% | Favorable for loan demand and business volume |

| Eurozone GDP Growth | ~0.9% | ~1.1% | Highlights Spain's relative economic strength |

| ECB Key Interest Rates | Decreasing trend | Continued easing | Pressure on Net Interest Margins (NIMs) |

| Eurozone Services Inflation | Resilient | Persistent | Reduces consumer purchasing power |

| Spain Unemployment Rate | Declining | Further decline | Boosts consumer confidence and borrowing capacity |

Full Version Awaits

CaixaBank PESTLE Analysis

The preview shown here is the exact CaixaBank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, providing a comprehensive look at CaixaBank's Political, Economic, Social, Technological, Legal, and Environmental landscape.

The content and structure shown in this preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Spain's demographic landscape is characterized by an aging population, a trend that significantly shapes consumer needs. This shift directly impacts the demand for financial products like robust pension plans, specialized savings accounts for older individuals, and comprehensive wealth management services. As more people enter their retirement years, the focus on securing their financial future becomes paramount, creating opportunities for financial institutions.

CaixaBank recognizes these demographic realities. Their 2025-2027 Sustainability Plan highlights a commitment to enhancing financial services specifically for seniors, aiming to provide greater security and accessibility. This strategic focus also extends to broader financial inclusion initiatives for vulnerable populations, acknowledging the diverse needs within the Spanish community.

CaixaBank is committed to boosting financial inclusion, offering specialized products and support for vulnerable populations and new businesses. This focus is evident in their initiatives aimed at improving access to financial services for underserved communities.

The growing digital literacy across Spain directly fuels demand for user-friendly online and mobile banking solutions. CaixaBank's substantial investments in technology are designed to meet this evolving customer preference for digital engagement.

Consumer behavior is increasingly shaped by digital adoption, compelling CaixaBank to prioritize its digital transformation. In 2024, a significant portion of banking transactions, estimated to be over 70% for leading European banks, are expected to occur through digital channels, highlighting the need for robust online platforms.

CaixaBank's strategy to enhance digital self-service options and seamlessly integrate physical, remote, and digital touchpoints directly addresses this trend. This approach caters to the growing demand for convenient and accessible banking, as evidenced by the rising use of mobile banking apps, which saw a 15% year-over-year increase in active users across the sector in 2023.

Social Impact and Community Engagement

CaixaBank actively pursues social impact, targeting benefits for 150,000 individuals by 2027 through programs focused on financial inclusion, fostering entrepreneurship, and enhancing the well-being of seniors. This commitment is deeply embedded in its operational strategy.

The bank's extensive presence, with branches in 3,704 municipalities, highlights its integral role within local communities. This broad network facilitates its engagement in societal well-being initiatives.

- Social Impact Goal: To benefit 150,000 people by 2027.

- Key Focus Areas: Financial inclusion, entrepreneurship support, senior well-being.

- Community Reach: Operates in 3,704 municipalities across Spain.

Talent Attraction and Workforce Development

CaixaBank's strategic focus on talent attraction and workforce development is paramount for its ongoing technological transformation. To bolster its competitive standing, the bank has outlined plans to onboard 3,000 young individuals, with a significant emphasis on technical expertise, throughout the 2025-2027 timeframe.

This initiative directly addresses the evolving needs of the financial sector, where digital skills are increasingly vital. By prioritizing the recruitment of tech-savvy talent, CaixaBank aims to accelerate its innovation pipeline and enhance its service offerings.

- Talent Acquisition Target: 3,000 young recruits planned between 2025-2027.

- Skill Focus: Emphasis on individuals with technical and digital proficiencies.

- Strategic Importance: Crucial for driving technological transformation and innovation.

Sociological factors significantly influence CaixaBank's strategy, particularly Spain's aging population, which drives demand for retirement planning and wealth management services. CaixaBank's 2025-2027 Sustainability Plan directly addresses this by enhancing services for seniors and promoting financial inclusion for vulnerable groups, recognizing the diverse needs within the Spanish community.

The increasing digital literacy in Spain fuels the demand for online and mobile banking, prompting CaixaBank's substantial technology investments. By 2024, over 70% of banking transactions in leading European banks are expected to be digital, reinforcing CaixaBank's focus on digital self-service and integrated banking channels, as evidenced by a 15% year-over-year increase in mobile banking app users in 2023.

CaixaBank's commitment to social impact is underscored by its goal to benefit 150,000 individuals by 2027 through financial inclusion, entrepreneurship support, and senior well-being programs. Its extensive network across 3,704 municipalities facilitates deep community engagement and the execution of these social initiatives.

Furthermore, CaixaBank is prioritizing talent acquisition, planning to recruit 3,000 young individuals with technical and digital skills between 2025 and 2027. This strategic move is crucial for driving its technological transformation and innovation in the evolving financial landscape.

| Sociological Factor | Impact on CaixaBank | CaixaBank's Strategic Response | Key Data/Targets |

|---|---|---|---|

| Aging Population | Increased demand for retirement and wealth management products. | Enhanced services for seniors, focus on pension plans and savings. | Part of 2025-2027 Sustainability Plan. |

| Digital Literacy Growth | Demand for user-friendly online and mobile banking. | Significant investments in technology and digital transformation. | Over 70% of transactions expected to be digital by 2024; 15% YoY increase in mobile app users (2023). |

| Social Impact Focus | Need for financial inclusion and community well-being initiatives. | Programs for financial inclusion, entrepreneurship, and senior well-being. | Target: 150,000 beneficiaries by 2027; Operates in 3,704 municipalities. |

| Talent Needs | Requirement for digital and technical skills in the workforce. | Recruitment of young talent with tech expertise. | Target: 3,000 young recruits (2025-2027) with technical skills. |

Technological factors

CaixaBank is aggressively pursuing digital transformation, earmarking a substantial €5 billion investment in technology over the coming three years. This strategic allocation, part of its ambitious 'Cosmos' plan, underscores a commitment to modernizing its operations and customer offerings.

The core objectives of this digital push include a significant boost in digital sales capabilities, the introduction of innovative new products tailored to evolving market demands, and a comprehensive upgrade of its existing channels and underlying infrastructure. These enhancements are crucial for maintaining CaixaBank's resilience and competitive standing in a rapidly changing financial sector.

CaixaBank is heavily investing in AI and ML to revolutionize its operations. Their strategy centers on using these technologies to elevate customer experiences, streamline internal workflows, and sharpen business insights. This commitment is evident in their development of AI-powered agents and their exploration of generative AI to bolster commercial and service functions, ultimately aiming for more informed decision-making.

CaixaBank's strategic 'Cosmos' plan heavily emphasizes technological advancements, particularly in cloud computing and AI-driven data analytics. This focus aims to create a more agile and robust technological backbone for the bank.

By accelerating its cloud migration, CaixaBank anticipates a more scalable and resilient infrastructure, capable of handling increased data volumes and supporting real-time processing. This is crucial for enhancing business intelligence and decision-making.

The integration of AI into data analytics is expected to unlock deeper insights from customer data, leading to personalized services and more efficient risk management. For instance, by Q1 2024, CaixaBank had already reported a significant increase in digital transactions, underscoring the growing importance of its tech infrastructure.

Cybersecurity and Data Protection

CaixaBank's increasing reliance on digital platforms and vast amounts of customer data makes robust cybersecurity and data protection absolutely essential. The bank actively invests in advanced technological solutions to proactively defend against and swiftly identify cyber threats, ensuring the security of its own data, as well as that of its customers and employees.

The imperative for strong data protection is underscored by regulatory actions. For example, in 2023, Spanish data protection authorities imposed fines on various entities for GDPR non-compliance, emphasizing the significant financial and reputational risks associated with inadequate data safeguarding. CaixaBank's commitment to these measures is therefore a critical operational and strategic priority.

- Investment in advanced threat detection systems

- Ongoing training for employees on cybersecurity best practices

- Compliance with evolving data privacy regulations like GDPR

- Regular security audits and penetration testing

Innovation in Financial Products and Services

Technological advancements are a key driver for CaixaBank, allowing it to pioneer new financial products and services. By embracing innovations, the bank aims to provide more efficient and customer-centric solutions. This focus on technology is crucial for maintaining competitiveness in the evolving financial landscape.

CaixaBank is actively integrating cutting-edge technologies to enhance its offerings. For instance, the bank is exploring the use of blockchain for more secure and transparent trade finance operations. This move aligns with a broader industry trend towards digitizing traditional banking processes, promising faster settlement times and reduced operational costs.

The implementation of an open banking model is another significant technological factor. This allows CaixaBank to collaborate with third-party providers, fostering an ecosystem of innovative financial applications and services. By opening up its data and APIs, CaixaBank can offer customers more integrated and personalized financial management tools, as mandated by regulations like PSD2.

Furthermore, CaixaBank is investing in AI-powered self-service tools. These intelligent solutions aim to streamline customer interactions, from simple inquiries to complex transactions. For example, AI chatbots can handle a significant volume of customer queries 24/7, freeing up human agents for more complex issues and improving overall customer satisfaction. In 2024, digital channels accounted for over 70% of CaixaBank's customer interactions, highlighting the growing reliance on technology.

- Blockchain Integration: Exploring blockchain for trade finance to enhance security and efficiency.

- Open Banking Adoption: Developing an open banking strategy to foster innovation and customer choice.

- AI-Powered Services: Implementing AI chatbots and other tools for improved customer self-service and experience.

- Digital Channel Growth: Witnessing a significant increase in customer interactions via digital platforms, with over 70% in 2024.

CaixaBank's technological strategy, driven by its 'Cosmos' plan, involves a substantial €5 billion investment in digital transformation. This focus on AI, cloud computing, and data analytics is reshaping customer experience and operational efficiency.

The bank is actively integrating AI and machine learning to enhance customer interactions and internal processes, aiming for more informed decision-making.

By accelerating cloud migration, CaixaBank seeks a more scalable and resilient infrastructure, crucial for real-time data processing and business intelligence.

CaixaBank's commitment to cybersecurity is paramount, with ongoing investments in advanced threat detection and employee training to safeguard data amidst evolving regulations.

| Technology Focus | Key Initiatives | Impact/Goal |

|---|---|---|

| AI & Machine Learning | AI-powered agents, generative AI exploration | Elevated customer experience, streamlined workflows, sharper business insights |

| Cloud Computing | Accelerated cloud migration | Scalable and resilient infrastructure, enhanced business intelligence |

| Data Analytics | AI integration for data insights | Personalized services, efficient risk management |

| Cybersecurity | Advanced threat detection, employee training | Data protection, regulatory compliance (GDPR) |

Legal factors

CaixaBank operates under the watchful eyes of Spanish and European regulators, like the Bank of Spain and the European Central Bank. This means strict rules on how much capital they must hold, how liquid they need to be, and how they manage risks. For instance, as of early 2024, the European Banking Authority's stress tests continue to shape capital requirements, ensuring banks like CaixaBank can withstand economic shocks.

CaixaBank faces significant legal obligations regarding data protection, particularly with the General Data Protection Regulation (GDPR). Compliance is not optional; it's a fundamental requirement for operating within the European Union. Failure to adhere can lead to severe penalties, impacting both financial standing and reputation.

The Spanish data protection authority has levied fines, highlighting specific areas of concern for financial institutions like CaixaBank. In 2023, fines for data protection breaches in Spain reached €1.5 million, with common violations including inadequate security measures and improper handling of user consent. This emphasizes the need for CaixaBank to implement data protection by design and ensure robust security protocols are consistently maintained.

CaixaBank operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, a critical legal factor impacting its operations. Compliance necessitates robust internal controls, rigorous customer due diligence, and the vigilant reporting of suspicious transactions.

These obligations translate into significant operational complexity and demand ongoing investment in advanced compliance systems and personnel training. For instance, in 2023, the European Banking Authority reported that AML-related fines across the EU reached hundreds of millions of euros, underscoring the financial and reputational risks of non-compliance.

Consumer Protection Laws

CaixaBank, as a major retail banking provider, operates under stringent consumer protection laws designed to shield its customers. These regulations mandate clear and honest disclosure of product terms, promote responsible lending practices to prevent over-indebtedness, and establish effective channels for resolving customer complaints. For instance, in 2023, the European Banking Authority (EBA) continued to emphasize consumer protection, with ongoing reviews of banks' complaint handling procedures across the EU, impacting how CaixaBank structures its customer service and product development.

The bank must adhere to rules concerning transparent pricing, fair contract terms, and data privacy, all of which directly influence its marketing strategies and operational procedures. Failure to comply can result in significant fines and reputational damage. For example, the General Data Protection Regulation (GDPR) continues to shape how financial institutions handle customer data, with significant enforcement actions occurring throughout 2024, underscoring the importance of robust data protection for CaixaBank.

Key areas of consumer protection that directly affect CaixaBank include:

- Disclosure Requirements: Ensuring all fees, interest rates, and terms are clearly communicated before a customer commits to a product.

- Responsible Lending: Conducting thorough creditworthiness assessments to ensure customers can afford the loans they take out.

- Dispute Resolution: Providing accessible and efficient mechanisms for customers to raise and resolve grievances.

- Data Protection: Complying with regulations like GDPR regarding the collection, storage, and use of personal customer information.

Taxation Policies and Bank Levies

Spanish taxation policies, especially the extraordinary banking tax, directly affect CaixaBank's legal and financial standing. This levy, which is being accrued linearly throughout 2025, has a tangible impact on the bank's bottom line and strategic financial decisions.

The potential extension or modification of this banking tax creates uncertainty, influencing CaixaBank's profitability projections and capital allocation strategies. Such fiscal measures are critical legal considerations for the bank's ongoing operations and future planning.

- Impact of Banking Tax: The Spanish government's extraordinary banking tax directly reduces CaixaBank's net income.

- Accrual in 2025: The tax is being accrued linearly in 2025, meaning its financial impact is recognized consistently throughout the year.

- Profitability Influence: The existence and potential extension of this levy significantly influence CaixaBank's profitability and financial planning processes.

- Legal Framework: Taxation policies are a key legal factor that CaixaBank must navigate to ensure compliance and manage financial risks.

CaixaBank navigates a complex web of legal and regulatory frameworks, both in Spain and across the European Union. These include stringent capital adequacy requirements set by entities like the European Central Bank, as evidenced by ongoing stress tests influencing capital reserves. Furthermore, compliance with data protection laws, notably the GDPR, is paramount, with significant fines, such as those reaching €1.5 million in Spain in 2023 for data breaches, underscoring the financial and reputational risks of non-compliance.

The bank also faces rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, necessitating robust internal controls and vigilant transaction monitoring, with EU-wide AML fines in 2023 reaching hundreds of millions of euros. Consumer protection laws mandate transparency in pricing, fair contract terms, and responsible lending, with regulators like the EBA actively reviewing complaint handling procedures. Additionally, Spain's banking tax, accrued linearly throughout 2025, directly impacts CaixaBank's profitability and strategic financial planning.

Environmental factors

CaixaBank is deeply committed to addressing climate change, with a clear roadmap to achieve carbon neutrality by 2050. This ambition is backed by concrete interim goals, including significant emissions reductions by 2030 across key sectors like electricity and automotive, alongside a complete exit from thermal coal financing.

These environmental commitments directly shape CaixaBank's strategic financial decisions, influencing its sustainable finance offerings and lending practices. For instance, the bank actively directs capital towards green projects and businesses aligned with decarbonization, reflecting the growing importance of Environmental, Social, and Governance (ESG) factors in financial markets.

CaixaBank is actively channeling significant capital into sustainable finance, pledging to mobilize €100 billion by 2027. This ambitious target represents a substantial escalation of their commitment to environmental stewardship.

This substantial financial commitment is earmarked for critical environmental transition projects. These include investments in renewable energy infrastructure, the advancement of clean mobility solutions, and initiatives aimed at industrial decarbonization, directly contributing to global sustainability objectives.

CaixaBank demonstrates a strong commitment to sustainability, evidenced by its inclusion in prestigious indices like the S&P Global-DJSI and its high ESG ratings from MSCI. Sustainable Fitch also affirmed its ESG Entity Rating, underscoring the bank's robust environmental, social, and governance practices.

Transparent and detailed reporting on environmental and social performance is paramount for CaixaBank. This commitment not only bolsters investor confidence but also ensures compliance with increasingly stringent sustainability disclosure regulations, which are rapidly evolving in the financial sector.

Environmental Risk Management in Lending

CaixaBank actively incorporates environmental factors into its lending practices, demonstrating a commitment to sustainable finance. A significant portion of its corporate loan book is allocated to projects with a positive environmental or social impact, reflecting a strategic focus on green and social finance.

The bank's approach involves a thorough assessment of environmental risks associated with financed projects. This diligence is crucial for mitigating potential liabilities and ensuring the long-term viability of its lending portfolio. CaixaBank's alignment with international standards like the Equator Principles for large-scale projects underscores its dedication to responsible financing.

- Green Loan Portfolio Growth: As of the end of 2023, CaixaBank reported a substantial increase in its sustainable financing portfolio, reaching €52.1 billion, up from €39.9 billion in 2022. This highlights a clear trend towards financing environmentally beneficial projects.

- Equator Principles Adoption: CaixaBank is a signatory to the Equator Principles, a risk management framework for financial institutions to manage environmental and social issues in project finance. This framework guides the assessment of projects exceeding $10 million in value.

- Climate Risk Management: The bank is actively enhancing its climate risk management capabilities, integrating climate-related scenario analysis into its risk assessments to better understand and manage potential impacts on its lending activities.

Resource Efficiency and Waste Management

CaixaBank is actively addressing its operational environmental impact, going beyond its core financing business. A key focus is on decarbonization through energy efficiency improvements and the adoption of renewable energy sources across its operations. This commitment is reflected in tangible waste management strategies, where a significant portion of waste is reclaimed, contributing to a circular economy model.

Further demonstrating its dedication to environmental stewardship, CaixaBank actively participates in reforestation initiatives. For instance, in 2023, the bank supported projects aimed at planting trees, contributing to carbon sequestration and biodiversity. These efforts underscore a holistic approach to environmental responsibility, integrating resource efficiency and waste reduction into its broader sustainability agenda.

- Energy Efficiency: CaixaBank implements measures to reduce energy consumption in its branches and offices.

- Renewable Energy: The bank is increasing its use of electricity generated from renewable sources.

- Waste Reclaiming: A substantial percentage of waste generated by CaixaBank is reclaimed and recycled.

- Reforestation Projects: The bank contributes to environmental projects focused on planting trees and restoring natural habitats.

CaixaBank is actively integrating environmental considerations into its core business, evident in its substantial growth in sustainable financing. By the close of 2023, the bank's sustainable finance portfolio reached €52.1 billion, a significant leap from €39.9 billion in 2022, showcasing a clear strategic shift towards environmentally beneficial investments.

The bank's commitment extends to managing climate-related risks, with ongoing enhancements to its assessment capabilities. CaixaBank's adherence to the Equator Principles further solidifies its responsible approach to project finance, ensuring that projects exceeding $10 million undergo rigorous environmental and social evaluations.

CaixaBank's operational footprint is also subject to environmental scrutiny, with a focus on energy efficiency and the increased use of renewable energy sources. The bank actively pursues waste reduction and reclamation strategies, contributing to a more circular economy model.

| Metric | 2022 | 2023 | Change |

|---|---|---|---|

| Sustainable Finance Portfolio | €39.9 billion | €52.1 billion | +30.6% |

| Equator Principles Application Threshold | Projects > $10 million | Projects > $10 million | N/A |

| Operational Waste Reclaimed | Significant portion | Significant portion | N/A |

PESTLE Analysis Data Sources

Our CaixaBank PESTLE analysis is built on a robust foundation of data from official Spanish government agencies, European Union policy updates, and leading financial and economic institutions like the IMF and World Bank. We incorporate insights from reputable market research firms and industry-specific reports to ensure a comprehensive and accurate view of the macro-environment.