CaixaBank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CaixaBank Bundle

Curious about CaixaBank's strategic product positioning? This snapshot reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment strategy.

Stars

CaixaBank is aggressively investing over €5 billion in technology, with a strong focus on digital transformation and artificial intelligence. Initiatives like the Cosmos project and GalaxIA are central to this strategy, aiming to boost commercial performance and elevate the customer experience. This commitment underscores their ambition to maintain leadership, having been recognized as the Best Digital Bank in Spain for 2024.

The bank's forward-looking approach includes a significant talent acquisition plan, intending to hire 3,000 young professionals by 2027. A substantial portion of these new hires will possess critical technical skills, essential for driving the bank's AI-powered digital evolution and ensuring continued innovation.

CaixaBank is significantly ramping up its sustainable finance efforts, pledging to mobilize €100 billion by 2027. This represents a substantial 56% increase over its prior commitments, highlighting a strong commitment to environmental and social governance. This strategic move underscores the bank's dedication to fostering a more sustainable economy.

This ambitious €100 billion mobilization plan is intrinsically linked to CaixaBank's overarching objective of achieving carbon neutrality by 2050. The focus areas for these investments include critical sectors like renewable energy, clean mobility solutions, and initiatives promoting social inclusion. These targeted investments are designed to drive tangible progress towards a greener and more equitable future.

By setting such a bold target, CaixaBank is positioning itself as a frontrunner in the burgeoning sustainable finance market. This sector is experiencing rapid growth, driven by increasing investor demand and regulatory pressures for more responsible financial practices. CaixaBank's proactive stance demonstrates its leadership in this vital and expanding financial landscape.

CaixaBank's Wealth Management division shines as a Star within its BCG Matrix, boasting a commanding 29% market share in Spain.

This segment is experiencing robust expansion, with assets under management growing by a healthy 8% and attracting €5 billion in net inflows during the first half of 2025.

The combination of its dominant market position and sustained, strong growth trajectory solidifies Wealth Management's status as a key Star for CaixaBank.

HolaBank Connecta (International Customer Focus)

HolaBank Connecta, launched in July 2025, represents CaixaBank's strategic move to cater to its extensive international customer base, numbering over 160,000 individuals. This remote service model is specifically tailored to support clients heavily invested in Spain's dynamic real estate sector.

The initiative utilizes cutting-edge digital tools, including video conferencing and secure digital platforms, to deliver seamless, multilingual customer support. This focus on advanced technology aims to capture a high-growth demographic by offering a specialized and innovative banking experience.

- Target Market: Over 160,000 international customers, with a strong emphasis on those involved in Spanish real estate.

- Service Model: Remote, digitally enabled service leveraging video calls and secure digital walls.

- Key Features: Multilingual support and specialized services designed for a high-growth demographic.

- Strategic Goal: To enhance customer engagement and service delivery for international clients through innovation.

New Lending Origination

New lending origination within CaixaBank's portfolio demonstrates robust expansion. In the first half of 2025, the bank experienced significant double-digit growth in key lending areas. This surge highlights CaixaBank's strategic focus on expanding its market presence in segments experiencing favorable economic tailwinds.

- Mortgage Lending: Origination saw a substantial increase of 46.2% year-on-year, reflecting strong demand in the Spanish and Portuguese housing markets.

- Corporate Lending: This segment also performed exceptionally well, with a 25.5% year-on-year growth, indicating increased business investment and activity.

- Market Capture: The impressive growth rates suggest CaixaBank is effectively capitalizing on current economic conditions to acquire new customers and increase its share in vital lending sectors.

CaixaBank's Wealth Management division is a clear Star in its BCG Matrix, holding a dominant 29% market share in Spain. This segment is experiencing impressive growth, with assets under management increasing by 8% and attracting €5 billion in net inflows during the first half of 2025. This strong market position coupled with consistent growth solidifies its Star status.

| Business Unit | Market Share (Spain) | H1 2025 Growth (Assets Under Management) | H1 2025 Net Inflows | BCG Matrix Status |

|---|---|---|---|---|

| Wealth Management | 29% | 8% | €5 billion | Star |

What is included in the product

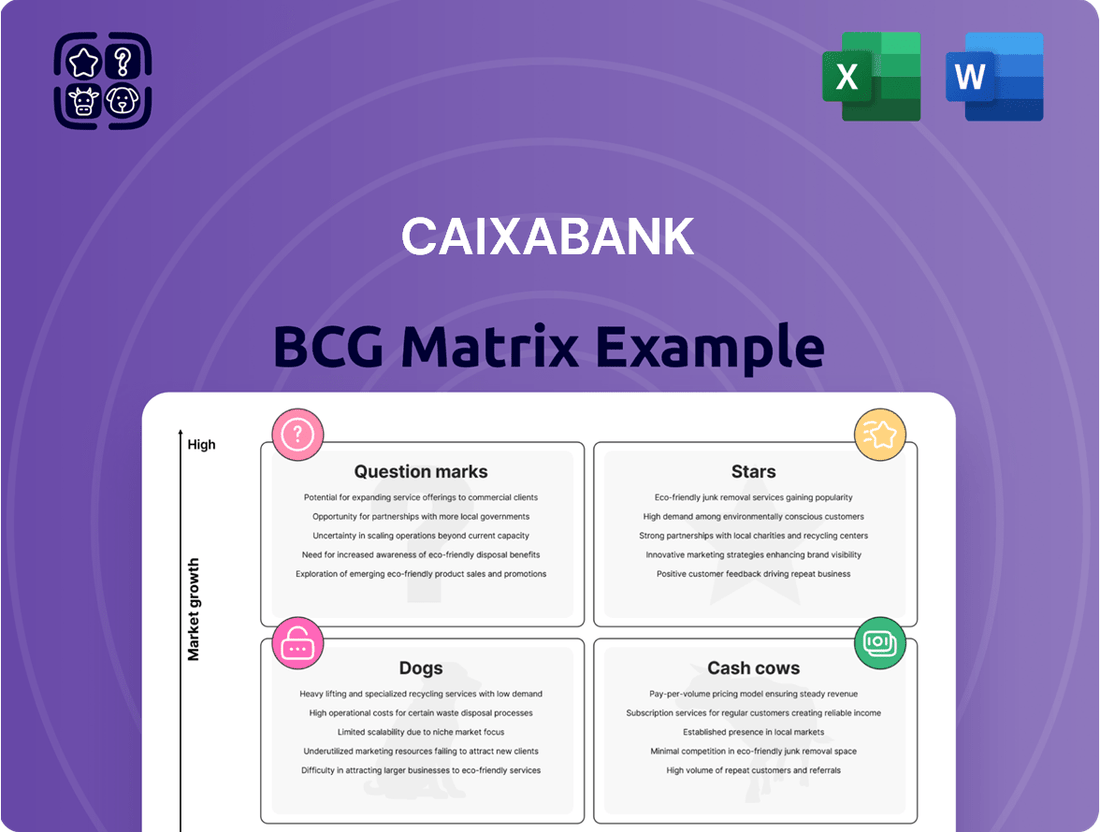

This CaixaBank BCG Matrix overview analyzes its business units, highlighting which to invest in, hold, or divest.

A clear BCG Matrix visualizes CaixaBank's portfolio, easing the pain of strategic uncertainty.

Cash Cows

CaixaBank's traditional retail banking and deposit base is a clear Cash Cow. With a commanding presence in Spain, serving 20.5 million customers and overseeing €717.65 billion in customer funds as of June 2025, this segment generates consistent and significant cash flow. This strong market penetration in a mature sector solidifies its position as a reliable profit generator for the company.

CaixaBank's extensive physical branch network, numbering over 4,100 locations across Spain and Portugal, firmly places it in the Cash Cows quadrant of the BCG Matrix. This vast infrastructure acts as a significant differentiator, ensuring consistent customer engagement and transaction volume.

This robust network generates predictable revenue streams, a hallmark of Cash Cows, by facilitating a wide range of banking services. Its sheer scale provides a stable foundation for CaixaBank's operations and market presence.

CaixaBank's insurance services stand as a prime example of a Cash Cow. This segment consistently generates substantial profits for the bank. In the first quarter of 2025, revenues from insurance services saw a healthy increase of 7.3%, demonstrating its ongoing strength and reliability.

The growth in net subscriptions to savings insurance further underscores the maturity and high market share of this product line. These established offerings, deeply embedded in the bank's portfolio, reliably contribute to CaixaBank's overall profitability, acting as a stable source of income.

Established Corporate Banking Relationships

CaixaBank's established corporate banking relationships represent a core strength, functioning as significant cash cows within its business model. These aren't just about originating new loans; they encompass a deep, ongoing service provision to a broad base of businesses and institutions. This maturity translates into predictable revenue streams and a dominant position in the corporate market, ensuring consistent cash generation for the bank.

These long-standing ties provide a stable foundation, characterized by a high degree of customer loyalty and recurring business. For instance, in 2023, CaixaBank continued to solidify its position as a leading bank for businesses in Spain, evidenced by its strong market share in corporate lending and advisory services. This deep integration with its corporate clients allows for cross-selling of various financial products, further enhancing the cash flow from these established relationships.

- Stable Income Generation: Mature corporate relationships ensure consistent fee and interest income, acting as reliable cash cows.

- High Market Share: Dominance in the corporate segment provides a substantial and predictable customer base.

- Cross-Selling Opportunities: Deep client integration facilitates the sale of diverse financial products, boosting revenue.

- 2023 Performance: CaixaBank's continued leadership in Spanish corporate banking underscores the strength of these established relationships.

Core Payment Processing Services

CaixaBank's core payment processing services, encompassing debit and credit card transactions, represent a stable and significant revenue generator. These services are foundational to the bank's operations, facilitating a high volume of daily transactions.

These essential services, while operating in a mature, low-growth market, provide a consistent and predictable cash flow. In 2024, CaixaBank continued to see robust transaction volumes across its payment networks, underscoring the steady income these operations deliver.

- Debit and Credit Card Operations: These form the bedrock of transaction processing, handling millions of purchases daily.

- Digital Payment Solutions: CaixaBank offers a range of innovative digital payment options, catering to evolving consumer preferences.

- Recurring Fee Income: The high volume of transactions translates into substantial and recurring fee income for the bank.

- Low Growth, High Stability: While not a growth engine, these services are critical for their consistent cash generation and market stability.

CaixaBank's mortgage lending portfolio, particularly its established customer base and continued market share in Spain, functions as a significant Cash Cow. This segment benefits from a mature market and a strong brand presence, ensuring consistent interest income and fee generation.

The bank's consistent performance in originating and servicing mortgages, even in a competitive landscape, highlights the stability of this revenue stream. For instance, in 2023, CaixaBank maintained a leading position in the Spanish mortgage market, demonstrating the enduring strength of this business line.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Mortgage Lending | Cash Cow | Mature market, strong brand, consistent interest income | Leading market share in Spanish mortgages (2023) |

What You See Is What You Get

CaixaBank BCG Matrix

The CaixaBank BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase, ensuring full professional utility. This comprehensive analysis, detailing CaixaBank's strategic positioning across its business units, is ready for immediate integration into your business planning and decision-making processes. You can confidently expect the same high-quality, analysis-ready report to be delivered directly to you, without any alterations or limitations. This preview serves as a direct representation of the complete, editable file you will gain access to, empowering your strategic insights.

Dogs

CaixaBank's significant investment of €5 billion in technological modernization underscores the presence of outdated legacy IT infrastructure. These older systems are a drag on efficiency, demanding substantial maintenance budgets while limiting the bank's ability to adapt quickly to market changes.

The high costs associated with maintaining these legacy systems divert resources that could otherwise fuel innovation and competitive growth. This situation presents a classic challenge where the investment required to overcome inertia is substantial, impacting agility and potentially hindering the rollout of new digital services.

CaixaBank's Non-Performing Loan (NPL) portfolio, despite a significant reduction to a historic low of 2.3% by June 2025, represents assets that are not generating income. These NPLs demand ongoing resources for recovery efforts or provisioning, making them a drain on the bank's financial performance.

Within CaixaBank's diverse portfolio, certain highly specialized or niche financial products might be experiencing limited market traction and subdued growth. These could be products with a very specific target audience or those facing intense competition from more broadly appealing alternatives.

It's plausible that these underperforming niche products, while potentially serving a small but dedicated client base, may not be contributing significantly to overall revenue growth. Their continued existence could represent a drain on resources, including marketing, compliance, and specialized personnel, without a proportional return. For instance, a report from S&P Global Market Intelligence in late 2023 highlighted that while the overall banking sector saw improved profitability, specialized loan segments sometimes struggled with scale and profitability.

Inefficient Small/Rural Branches

While CaixaBank's extensive branch network is a significant asset, some smaller or rural locations are experiencing challenges. These branches often see reduced customer footfall and incur higher operating expenses compared to the income they generate. In 2023, CaixaBank continued its strategy of branch network optimization, which included closing underperforming locations. Data from the first half of 2024 indicates a continued focus on efficiency, with the bank aiming to consolidate its presence in areas with lower customer density.

These specific branches may hold a small market share within their immediate local areas and contribute little to overall growth. Consequently, they might be candidates for strategic review, potentially leading to consolidation or closure to improve the efficiency of the broader network. This approach aligns with industry trends of digital transformation and the evolving needs of banking customers.

- Declining Customer Traffic: Certain rural branches are experiencing a noticeable drop in the number of customers visiting in person.

- Rising Operational Costs: The expenses associated with maintaining these smaller branches are increasing relative to their generated revenue.

- Low Micro-Market Share: These locations often represent a minimal share of the customer base in their very specific local areas.

- Potential for Optimization: Management may consider consolidating services or closing these branches to enhance overall network efficiency and profitability.

Traditional Paper-Based Processes

As CaixaBank embraces its digital transformation, its reliance on traditional paper-based processes is increasingly becoming a significant drag. These methods, from internal documentation to customer onboarding, are not only time-consuming but also incur substantial costs in terms of printing, storage, and manual handling. In 2024, many financial institutions are still grappling with the inefficiencies of paper, which directly impacts operational speed and customer satisfaction.

These legacy systems represent a classic 'dog' in the BCG matrix context for CaixaBank. They consume resources without generating commensurate returns, and their inherent slowness directly contradicts the agility required in today's digital-first banking landscape. For instance, manual form processing and physical document archiving are prime examples of activities that offer low growth potential and weak competitive advantages.

- Inefficiency: Paper-based workflows are inherently slower than digital alternatives, leading to delays in service delivery and internal operations.

- Cost: Costs associated with printing, paper, storage, and manual data entry are significant and represent a drain on resources.

- Low ROI: These processes offer minimal return on investment as they do not contribute to growth or competitive advantage in a digital economy.

- Hindrance to Digitalization: Traditional paper processes act as a barrier to achieving the full benefits of digital transformation initiatives.

CaixaBank's legacy IT infrastructure and certain underperforming niche financial products can be categorized as 'Dogs' in the BCG matrix. These segments require significant resources for maintenance and operation but generate minimal returns, hindering overall growth and efficiency. For example, the bank's ongoing investment in modernizing outdated systems highlights the drag these legacy assets represent.

Similarly, specialized financial products with limited market traction, as noted in industry reports from late 2023, also fit the 'Dog' profile. They consume management attention and operational capacity without contributing substantially to revenue, reflecting a low market share and low growth rate.

The continued optimization of CaixaBank's branch network, particularly in rural areas, addresses 'Dog' elements. Branches with declining customer traffic and high operational costs, as seen in the bank's 2023 and H1 2024 strategies, are prime examples of units that are not generating sufficient returns relative to their investment.

These 'Dog' segments, characterized by low growth and low market share, necessitate strategic decisions regarding divestment, consolidation, or significant restructuring to reallocate capital towards more promising areas of the business.

| BCG Category | CaixaBank Examples | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | Legacy IT Infrastructure | Low | Low | Divest, Harvest, or Restructure |

| Dogs | Underperforming Niche Financial Products | Low | Low | Divest, Harvest, or Restructure |

| Dogs | Selected Rural Branches | Low | Low | Divest, Harvest, or Restructure |

| Dogs | Paper-Based Processes | Low | Low | Divest, Harvest, or Restructure |

Question Marks

CaixaBank's exploration into blockchain and quantum computing signifies a forward-looking strategy, aiming to tap into potential future growth sectors within finance. These technologies, while promising, are still in their early stages of adoption in banking, meaning their immediate impact on CaixaBank's market share or revenue is minimal, necessitating continued investment in research and development.

For instance, the global blockchain in banking market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, but widespread implementation is still developing. Similarly, quantum computing's application in finance, while holding immense potential for complex problem-solving like fraud detection and portfolio optimization, is largely experimental, with early-stage projects requiring substantial capital allocation rather than generating immediate returns.

CaixaBank's engagement in the digital euro initiatives positions it within a high-growth sector, potentially revolutionizing payment systems. This involvement signifies a strategic move towards future financial infrastructure, aligning with evolving digital trends.

Given the nascent stage of the digital euro, CaixaBank's current market penetration in this specific domain is minimal. Significant investment will be crucial to secure a substantial market share should the digital euro achieve widespread adoption, reflecting its position as a question mark in the BCG matrix.

New generative AI applications, like those emerging from CaixaBank's Cosmos and GalaxIA projects, are positioned as Stars within the BCG Matrix. While the underlying AI technology is a strong performer, these specific, newly deployed generative AI tools are still in their nascent stages of market adoption and integration.

These applications, including AI agents designed for sophisticated business intelligence and advanced customer service chatbots, represent high-growth potential. However, they currently necessitate substantial investment for scaling and demonstrating their complete market value and profitability.

Specific Tailored Products for New Demographic Segments

CaixaBank's strategic focus on developing tailored financial products for emerging demographic segments, particularly vulnerable groups and seniors, signifies a proactive approach to market evolution. These initiatives, such as specific savings products for individuals aged 50-67, are designed to address growing needs within these populations, aligning with broader sustainability objectives. For instance, Spain's aging population is a significant trend, with the percentage of individuals over 65 projected to increase substantially in the coming years, underscoring the market potential.

However, these new product lines are likely in their nascent stages of market penetration. This implies a critical need for robust marketing strategies and sustained customer adoption efforts to capture significant market share. The success of these offerings will depend on effectively communicating their value proposition to these distinct demographic segments.

- Targeting Seniors: Enhanced services and specific savings products for those aged 50-67 are being developed to meet evolving financial needs.

- Vulnerable Groups: New tailored financial products are being created as part of CaixaBank's commitment to its sustainability plan.

- Market Penetration: These initiatives are in the initial phases, requiring focused marketing and adoption strategies to gain traction.

- Demographic Trends: The development aligns with Spain's demographic shifts, including an increasing proportion of older adults.

Advanced Data Analytics & Cloud Adoption Acceleration

CaixaBank is heavily investing in its cloud strategy and real-time data analytics capabilities. This initiative is a cornerstone of their broader digital transformation, aiming to unlock future efficiencies and innovative services.

While the potential for advanced data analytics and cloud adoption is significant, its direct impact on market share is still in its nascent stages of development. The bank is channeling substantial resources into infrastructure and skilled personnel to realize these advanced data capabilities.

- Cloud Roadmap Acceleration: CaixaBank is actively advancing its cloud adoption, a critical step for modernizing its IT infrastructure and enabling agile operations.

- Real-Time Data & Analytics Programs: Development of programs for immediate data access and sophisticated analytics is underway, promising deeper insights into customer behavior and market trends.

- Investment in Infrastructure and Talent: Significant capital is being allocated to build robust cloud infrastructure and acquire specialized talent, essential for leveraging advanced data analytics.

- Developing Market Impact: While foundational for digital transformation, the full market realization and competitive advantage from these advanced data capabilities are still evolving, currently showing a low direct market share impact.

CaixaBank's ventures into emerging technologies like blockchain and quantum computing, alongside its participation in digital euro initiatives, represent significant investments in future financial landscapes. These areas, while holding immense long-term promise, currently exhibit limited immediate market share and revenue generation, characteristic of question marks in the BCG matrix.

The bank's focus on new demographic segments and tailored financial products also falls into this category, requiring substantial marketing and adoption efforts to translate potential into tangible market gains.

Similarly, the ongoing acceleration of cloud strategy and real-time data analytics, while foundational for future competitiveness, is still in its early stages of market impact. These initiatives demand considerable capital and talent investment before their full market value is realized.

BCG Matrix Data Sources

Our CaixaBank BCG Matrix is constructed using a blend of internal financial statements, market share data, and external industry growth reports. This ensures a comprehensive view of each business unit's performance and market position.