Caesars Entertainment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caesars Entertainment Bundle

Caesars Entertainment faces intense rivalry within the gaming and hospitality sector, with established players and emerging online platforms vying for market share. Understanding the bargaining power of both their suppliers and their diverse customer base is crucial for navigating this dynamic landscape.

The threat of new entrants, while potentially mitigated by high capital requirements, remains a consideration, as does the constant pressure from substitute products and services that can draw customers away from traditional casino experiences. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Caesars Entertainment’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Caesars Entertainment's reliance on specialized technology providers for its online and mobile gaming, including sports betting, grants these suppliers a moderate bargaining power. Companies offering advanced gaming software, crucial data analytics, and robust cybersecurity are vital for Caesars' competitive online presence.

The high costs associated with switching these specialized technology partners, coupled with the critical nature of their services, amplify their influence. For instance, Caesars' integration of technology from Bragg Gaming underscores this dependency, where disruptions or price increases from such providers could significantly impact operations.

Caesars Entertainment's reliance on high-end entertainment, including top-tier artists and production services, grants suppliers significant leverage. The demand for exclusive residencies and large-scale events means that unique and in-demand talent can dictate terms, directly impacting Caesars' ability to differentiate its brand and drive revenue.

Construction and renovation contractors possess some bargaining power over Caesars Entertainment, especially given the company's significant capital expenditure plans. For instance, Caesars allocated approximately $1 billion towards modernizing its Las Vegas Strip properties and projected another $600 million in capital expenditures for fiscal year 2025.

The specialized nature of large-scale hospitality construction projects, combined with the potential for labor shortages and fluctuating material costs, can amplify the leverage these contractors hold. This means they can influence pricing and terms due to the high demand for their expertise and the critical role they play in developing and maintaining Caesars' extensive resort portfolio.

Food and Beverage Purveyors

Caesars Entertainment's vast array of dining experiences, from quick bites to gourmet meals, requires a wide selection of food and beverage suppliers. While a multitude of general suppliers exist, those providing specialized or premium ingredients for unique culinary offerings may possess greater bargaining power. However, Caesars' significant operational scale enables substantial bulk purchasing and the cultivation of a diversified supplier base, which generally mitigates the suppliers' leverage.

The bargaining power of food and beverage purveyors for Caesars Entertainment is a key consideration. The company's extensive portfolio of casinos and resorts, each with multiple dining venues, creates a consistent and substantial demand for a broad spectrum of food and beverage products. For instance, in 2023, Caesars Entertainment reported total revenue of $12.49 billion, underscoring the sheer volume of goods and services procured annually.

- Supplier Concentration: While many general food suppliers exist, the market for specialized or high-quality ingredients, such as premium wines, specific ethnic food items, or organic produce, may be more concentrated, giving those suppliers more influence.

- Switching Costs for Caesars: Caesars' ability to easily switch suppliers for commodity items is high due to the availability of multiple vendors. However, for unique or proprietary ingredients, the switching costs could be higher, potentially increasing supplier power.

- Supplier Differentiation: Suppliers who can offer unique products, consistent quality, or specialized services that align with Caesars' brand image and guest expectations may command more favorable terms.

- Impact on Margins: Higher bargaining power from suppliers can lead to increased input costs for Caesars, potentially squeezing profit margins in its food and beverage operations if these costs cannot be passed on to consumers.

Utility and Infrastructure Providers

Utility and infrastructure providers, such as electricity, water, and internet services, hold significant bargaining power over Caesars Entertainment. These essential services are non-negotiable for resort operations, and their suppliers often function as regulated monopolies or oligopolies within specific geographic areas. This limited competition allows them to dictate terms and pricing, impacting Caesars' operational costs. For instance, in 2024, energy costs represent a substantial portion of operating expenses for large hospitality venues.

The bargaining power of these utility suppliers is further amplified by regional regulations and the inherent infrastructure requirements. Caesars must secure these services to maintain operations, making them highly dependent.

- Essential Services Dependence: Casinos like Caesars rely heavily on uninterrupted access to electricity, water, and high-speed internet for gaming, hospitality, and guest services.

- Monopoly/Oligopoly Structure: In many locations, utility providers are sole providers or part of a small group, limiting competitive pressure and strengthening their negotiating position.

- Cost Management Challenge: Caesars must actively manage fluctuating utility costs, which are influenced by factors like fuel prices, infrastructure investment needs, and environmental regulations, impacting overall profitability.

The bargaining power of suppliers for Caesars Entertainment is generally moderate, influenced by the specific industry and the company's purchasing scale. While Caesars' substantial size allows for bulk purchasing and diversification of suppliers, mitigating some leverage, specialized needs in areas like technology and premium entertainment can elevate supplier influence. For example, in 2024, the company's capital expenditures, projected at $600 million for the year, highlight its demand for contractors and specialized services, potentially increasing their negotiation strength.

| Supplier Category | Bargaining Power Level | Key Factors |

|---|---|---|

| Technology Providers (Gaming Software, Data Analytics) | Moderate to High | Specialized nature, high switching costs, critical for online operations. |

| Entertainment Talent (Artists, Production) | High | Demand for exclusive, in-demand talent, brand differentiation. |

| Construction & Renovation Contractors | Moderate | Large capital expenditures ($1 billion for Las Vegas modernization), specialized project needs, potential labor/material cost fluctuations. |

| Food & Beverage Suppliers | Low to Moderate | High volume purchasing, diversified supplier base for commodity items; higher for specialized/premium goods. |

| Utility & Infrastructure Providers | High | Essential services, often regulated monopolies/oligopolies, high dependence. |

What is included in the product

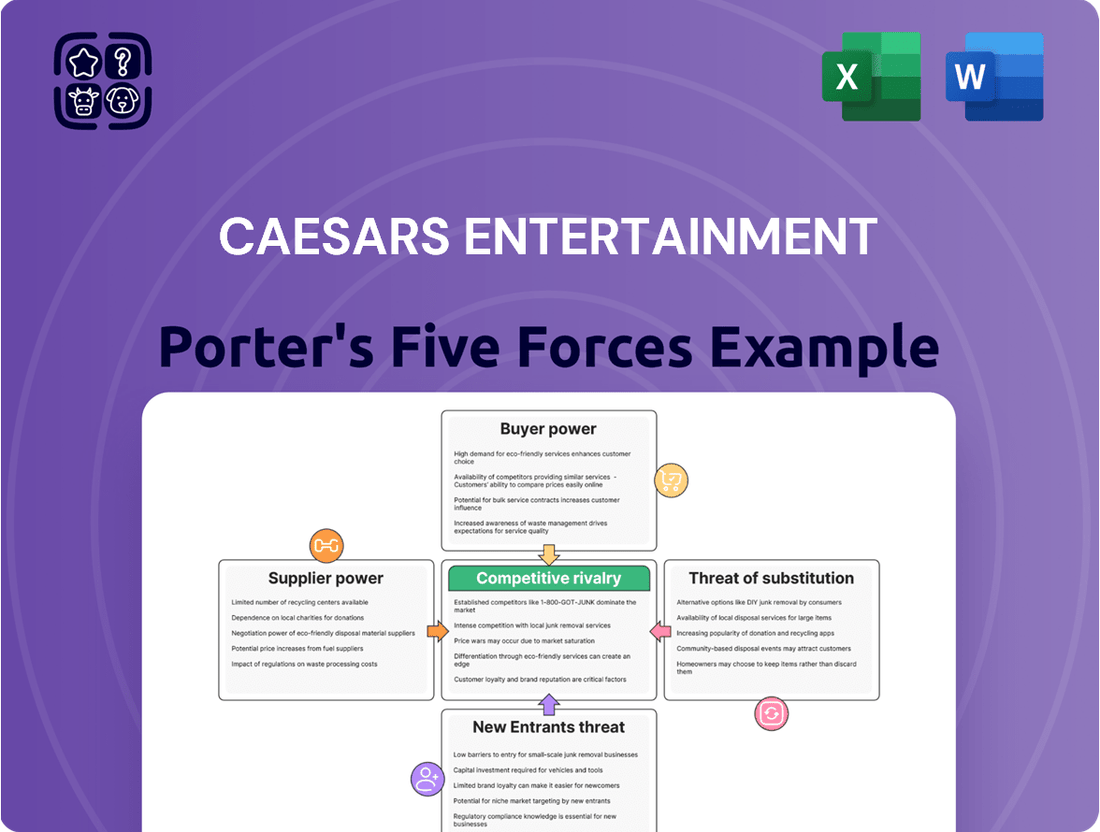

Tailored exclusively for Caesars Entertainment, analyzing its position within its competitive landscape by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, allowing for proactive strategy adjustments.

Customers Bargaining Power

Caesars Rewards, Caesars Entertainment's flagship loyalty program, is a powerful tool for mitigating customer bargaining power. By rewarding repeat engagement across gaming, hospitality, and entertainment, it creates a sticky ecosystem that discourages customers from seeking alternatives. In 2023, Caesars reported approximately 69 million Caesars Rewards members, highlighting the program's extensive reach and influence.

Customers at Caesars Entertainment face a significant number of alternatives, which directly impacts their bargaining power. The gaming and entertainment landscape is crowded, with numerous land-based casinos, a rapidly growing online gaming sector, and a wide array of other leisure activities competing for consumer attention and dollars. This abundance of choices means customers can readily switch to a competitor if Caesars' pricing, service, or overall experience falls short of expectations. For instance, the global online gambling market was valued at approximately $72.04 billion in 2023 and is projected to grow, offering a direct and accessible alternative to physical casinos.

Customer spending on discretionary activities like gaming and hospitality is highly sensitive to economic conditions and individual disposable income. When the economy tightens, consumers tend to cut back on non-essential spending, which directly impacts companies like Caesars Entertainment. This increased price sensitivity gives customers more leverage to negotiate better deals or seek out lower-cost alternatives, thereby amplifying their bargaining power.

Caesars Entertainment's Q1 2025 performance highlighted these sensitivities, with revenues in its key Las Vegas market experiencing some headwinds. This suggests that consumers, facing potential economic pressures, are becoming more discerning with their entertainment budgets. For instance, reports indicated a slight dip in average daily room rates in some segments of the Las Vegas market during early 2025, a clear signal of increased customer price consciousness.

Information Access and Online Reviews

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online reviews, comparison websites, and social media platforms provide a wealth of data, allowing consumers to thoroughly research and compare offerings before making a decision. This transparency puts considerable pressure on companies like Caesars Entertainment to maintain high service standards and competitive pricing, as a single negative experience can be widely publicized.

The ease with which customers can share their experiences online means that a few bad reviews can quickly impact a company's reputation and deter potential patrons. For instance, in 2024, a study indicated that over 80% of consumers read online reviews before making a purchase decision, highlighting the direct influence of digital feedback on consumer behavior.

- Information Accessibility: Consumers can easily access and compare pricing and service quality across numerous competitors through online platforms.

- Reputation Management: Negative online reviews can rapidly damage a company's brand image, forcing businesses to prioritize customer satisfaction.

- Informed Decision-Making: The availability of detailed reviews and user-generated content empowers customers to make more informed choices, increasing their leverage.

- Social Proof: Positive reviews act as social proof, influencing other potential customers and creating a demand for transparent and high-quality experiences.

Digital Gaming Customer Acquisition

In the competitive digital gaming landscape, customers possess considerable bargaining power. High customer acquisition costs are a reality, especially as players can easily shift between various sports betting and iGaming platforms. This fluidity is driven by factors like favorable odds, enticing promotions, and overall user experience.

Caesars Digital has experienced robust growth, but the ease with which digital customers can switch providers remains a significant challenge. For instance, in 2023, the U.S. sports betting market alone generated an estimated $13.5 billion in gross gaming revenue, highlighting the scale of competition and the constant need to retain customers.

- Customer Switching: Digital gamers can readily switch platforms based on promotions, odds, and user interface.

- High Acquisition Costs: Acquiring new digital customers in the gaming sector is often expensive.

- Cross-Selling Strategy: Caesars aims to leverage its physical property loyalty programs to foster digital engagement and reduce churn.

- Market Competition: The digital gaming market is crowded, intensifying customer bargaining power.

The bargaining power of customers for Caesars Entertainment is significantly influenced by the sheer volume of available alternatives and the increasing ease of information access. In 2023, the global online gambling market alone was valued at over $72 billion, underscoring the vast array of choices consumers have beyond traditional brick-and-mortar casinos. This abundance, coupled with readily available online reviews and comparison tools, empowers customers to demand better value, pushing Caesars to maintain competitive pricing and superior service to retain their business.

Caesars' loyalty program, Caesars Rewards, with approximately 69 million members in 2023, serves as a crucial defense against customer bargaining power by fostering loyalty and creating a sticky ecosystem. However, the sensitivity of discretionary spending to economic shifts, as seen with slight dips in average daily room rates in Las Vegas during early 2025, means customers remain highly price-conscious. This economic sensitivity amplifies their leverage to seek out deals or less expensive options, a trend supported by over 80% of consumers consulting online reviews before purchasing in 2024.

| Factor | Impact on Caesars Entertainment | Supporting Data (2023-2025) |

| Availability of Alternatives | High | Global online gambling market valued at $72.04 billion (2023). |

| Information Accessibility | High | Over 80% of consumers read online reviews before purchasing (2024). |

| Customer Loyalty Program | Mitigates Power | 69 million Caesars Rewards members (2023). |

| Economic Sensitivity | Increases Power | Slight dip in Las Vegas average daily room rates (early 2025). |

Same Document Delivered

Caesars Entertainment Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Caesars Entertainment, detailing the competitive landscape, buyer and supplier power, threat of new entrants, and the intensity of rivalry within the gaming and hospitality industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You will receive this exact, professionally formatted analysis immediately after purchase, providing actionable insights into the strategic positioning of Caesars Entertainment.

Rivalry Among Competitors

The gaming and hospitality sector is a battlefield dominated by formidable global entities. Companies like MGM Resorts International, Las Vegas Sands Corporation, and Wynn Resorts Limited are constantly vying for a larger slice of the market. This intense rivalry is particularly evident in prime locations such as Las Vegas, where these giants invest heavily in upgrading their properties and refining their guest experiences.

In 2023, for instance, MGM Resorts reported total revenue of $15.2 billion, showcasing its substantial market presence. Similarly, Las Vegas Sands, despite divesting some U.S. assets, maintained significant international operations. This fierce competition compels all players to innovate relentlessly, whether through cutting-edge technology, unique entertainment offerings, or elevated service standards, to attract and retain customers.

Competitive rivalry is intensifying with the rapid expansion of online and mobile gaming, including sports wagering. Caesars Entertainment is a significant player in this digital space, but faces strong competition from pure-play online operators like FanDuel and DraftKings, which hold a large combined market share.

The digital segment is a key growth engine for Caesars, but it's also a battleground for market dominance. In the first quarter of 2024, Caesars reported digital net revenue of $349 million, a notable increase, yet the competitive landscape remains fierce. For instance, FanDuel and DraftKings consistently report substantial growth in their sports betting verticals, indicating the ongoing pressure on established players like Caesars to innovate and capture market share in this dynamic sector.

While Las Vegas, a key market for Caesars Entertainment, experienced flat same-store adjusted EBITDAR in recent periods, indicating intense rivalry and market maturity, the company is actively pursuing expansion into less saturated regional markets. This geographic push, including ventures into North Carolina, Virginia, and New Orleans, presents significant growth potential but also intensifies competition with established regional operators.

Caesars' strategy to navigate this competitive landscape involves forming strategic partnerships and investing in enhancing its offerings within these secondary markets. For instance, the company secured a management agreement for the Harrah's Cherokee Casino Resort in North Carolina, aiming to leverage its brand and operational expertise in a growing market, demonstrating a proactive approach to overcoming established regional rivals.

Capital Investments and Property Modernization

Competitive rivalry within the casino and hospitality sector is intensified by substantial capital investments in property modernization and new attractions. Caesars Entertainment, for instance, has been actively investing in upgrading its Las Vegas properties and digital infrastructure. This focus on enhancing the guest experience and staying technologically current is crucial for maintaining market share.

These significant capital expenditures act as a considerable barrier to entry for smaller or less capitalized competitors. For example, Caesars announced a $100 million renovation project for the Strip in 2023, aiming to refresh its iconic properties. Such ongoing investments in new attractions and technological upgrades are essential to attract and retain a discerning customer base in a highly competitive landscape.

- Caesars Entertainment's commitment to modernization drives intense rivalry.

- Significant capital outlays for renovations and new attractions create high barriers for smaller players.

- Investments in digital platforms are key to enhancing guest experience and competitive positioning.

- The need for continuous capital investment ensures a dynamic and competitive market.

Customer Experience and Loyalty Program Competition

Caesars Entertainment faces intense rivalry in its quest to win and retain customers, primarily through superior customer experience and compelling loyalty programs. This competition is fierce, as companies vie for attention by enhancing service quality and the perceived value of their rewards. Caesars Rewards, a cornerstone of their strategy, aims to differentiate by offering escalating benefits and unique promotions tied to customer engagement.

Competitors are not standing still; they also deploy robust loyalty programs designed to capture a significant share of the high-value customer segment. This creates a perpetual challenge for Caesars to consistently deliver exceptional value and personalized interactions that foster lasting loyalty. For instance, in 2024, the gaming industry continued to see significant investment in digital loyalty platforms and data analytics to better understand and cater to individual player preferences.

- Customer Experience Focus: Companies are heavily investing in staff training and technology to elevate the in-person and digital customer journey.

- Loyalty Program Differentiation: Caesars Rewards competes by offering tiered benefits, such as free play, hotel stays, and exclusive event access, to incentivize repeat business.

- Personalization Efforts: A key battleground is the ability to offer personalized promotions and experiences based on individual customer data and play history.

- Competitive Benchmarking: Caesars must continually assess and adapt its loyalty offerings to match or exceed those of major rivals like MGM Resorts International's M life Rewards and Wynn Rewards.

The competitive rivalry within the gaming and hospitality sector is exceptionally high, with major players like Caesars Entertainment, MGM Resorts International, and Wynn Resorts constantly vying for market share. This intensity is fueled by significant capital investments in property upgrades and new attractions, creating substantial barriers to entry for smaller competitors. For example, Caesars allocated $100 million for Strip property renovations in 2023, underscoring the need for continuous investment to maintain customer engagement and competitive positioning.

SSubstitutes Threaten

The most significant threat to Caesars Entertainment comes from the rapidly expanding online gaming and sports wagering sector. This digital arena, encompassing online casinos, poker, and sports betting, presents a highly convenient substitute for traditional, physical casinos. Accessibility via any internet-connected device means players can engage from virtually anywhere, anytime.

The sheer growth potential of this substitute is substantial. Projections indicate the global online gambling market will surge to an impressive $153.57 billion by 2030. This upward trajectory is largely fueled by increasing smartphone ownership and broader internet access worldwide, making it a formidable competitor for Caesars' land-based operations.

The threat of substitutes for Caesars Entertainment's core business, primarily casino resorts and entertainment, is significant and growing, particularly from the home entertainment and digital media sector. This broad category encompasses a wide array of options that compete for consumers' leisure time and disposable income.

Streaming services like Netflix, Disney+, and HBO Max offer vast libraries of movies and TV shows, providing a convenient and often more affordable alternative to live entertainment or travel. Similarly, the burgeoning video game industry, spanning consoles, PC, and mobile platforms, presents an immersive and interactive form of entertainment. The global games industry is projected to reach an impressive $236.9 billion by 2025, highlighting the substantial market and consumer engagement in these digital leisure activities. Virtual reality (VR) experiences are also emerging as a powerful substitute, offering increasingly realistic and engaging entertainment without the need to leave home.

Consumers today have a vast selection of leisure and vacation alternatives that compete with integrated casino resorts. Options like cruises, theme parks, cultural tours, and adventure travel offer distinct experiences that can attract a significant portion of potential customers. For instance, the global cruise industry, valued at approximately $47.1 billion in 2023, continues to grow and attract a broad demographic.

These substitute offerings can directly siphon demand away from Caesars Entertainment if the company doesn't provide a sufficiently compelling and unique value proposition. If these alternatives are perceived as more appealing or cost-effective, they represent a substantial threat to Caesars' market share and revenue streams. The ability of these substitutes to cater to diverse preferences means Caesars must constantly innovate and enhance its entertainment and hospitality offerings to remain competitive.

Esports and Competitive Gaming

The rise of esports presents a notable threat of substitutes for traditional entertainment, including casino resorts. The global esports market is booming, with projections indicating a viewership of 600 million by 2024. This growth translates into substantial revenue streams from sponsorships and advertising, directly competing for consumer attention and disposable income.

While esports may not directly replicate the full casino experience, it offers a compelling alternative for entertainment spending. The industry's increasing commercialization and accessibility mean consumers have more options for leisure time and financial allocation.

- Esports viewership is projected to reach 600 million globally in 2024.

- Significant revenue is generated through sponsorships and advertising in the esports sector.

- Esports competes for discretionary spending and consumer attention against traditional entertainment.

Social Gambling and Free-to-Play Games

The rise of free-to-play social casino games and casual mobile gaming presents a significant threat of substitutes for Caesars Entertainment. These platforms offer a low-barrier entry for entertainment, allowing players to experience the thrill of gaming without any financial outlay, directly competing for consumer leisure time and engagement.

While not a direct monetary substitute, these games can satisfy a portion of the underlying demand for gaming entertainment. For instance, the social casino gaming market, a segment that includes many free-to-play titles, was projected to reach over $11 billion globally by 2024, indicating a substantial user base seeking digital gaming experiences.

- Market Reach: Free-to-play games have a vast global reach, accessible on smartphones and web browsers, potentially capturing a significant portion of the entertainment budget and attention that might otherwise be directed towards physical casinos.

- Engagement Levels: Many social casino games incorporate engaging mechanics, loyalty programs, and social features that foster consistent user engagement, mirroring some aspects of the casino experience.

- Lower Perceived Cost: The absence of direct spending in free-to-play models makes them highly attractive, reducing the perceived need or incentive for some consumers to spend money at traditional brick-and-mortar casinos.

The threat of substitutes for Caesars Entertainment is substantial, driven by the expanding online gaming and digital entertainment sectors. These substitutes offer convenience, accessibility, and a wide array of choices that compete directly for consumer leisure time and discretionary spending.

The global online gambling market is expected to reach $153.57 billion by 2030, while the video game industry is projected to hit $236.9 billion by 2025. These figures underscore the significant consumer engagement and financial allocation towards digital entertainment alternatives.

| Substitute Category | Key Offerings | Projected Market Size (Approx.) | Impact on Caesars |

|---|---|---|---|

| Online Gaming & Sports Wagering | Online casinos, poker, sports betting | $153.57 billion by 2030 (Global Online Gambling) | Direct competition for gaming revenue and customer base. |

| Digital Home Entertainment | Streaming services (Netflix, Disney+), video games | $236.9 billion by 2025 (Global Games Industry) | Captures leisure time and entertainment budgets. |

| Alternative Leisure & Travel | Cruises, theme parks, cultural tours | $47.1 billion in 2023 (Global Cruise Industry) | Offers alternative vacation and experience spending. |

| Esports | Competitive video gaming | 600 million viewers by 2024 | Competes for entertainment spending and attention. |

| Social & Mobile Gaming | Free-to-play casino-style games | Over $11 billion by 2024 (Social Casino Gaming) | Satisfies some gaming demand with low perceived cost. |

Entrants Threaten

The integrated casino resort market demands substantial upfront capital for land, construction, licensing, and essential infrastructure. Caesars Entertainment, for instance, has earmarked $600 million for capital expenditures in fiscal year 2025, illustrating the significant financial hurdle for any newcomer aiming to compete at a similar scale.

The gaming industry, including major players like Caesars Entertainment, faces significant barriers to entry due to stringent regulatory and licensing hurdles. Obtaining the necessary permits involves exhaustive background checks and ongoing compliance with local, state, and federal laws, making it a costly and lengthy endeavor for any new operator. For example, in 2024, obtaining a new gaming license in a state like Nevada can cost hundreds of thousands of dollars in application fees alone, not to mention the ongoing compliance costs.

Established brand recognition and customer loyalty represent a significant barrier to entry for new players in the gaming and hospitality sector, a key consideration for companies like Caesars Entertainment. Caesars boasts decades of operational history, cultivating deep-seated trust and a loyal customer following. Their Caesars Rewards program, for instance, is a sophisticated ecosystem designed to retain customers through tiered benefits and exclusive experiences. In 2023, Caesars reported over $12 billion in net revenue, a testament to their established market position and customer engagement.

Limited Availability of Prime Locations

The scarcity of prime real estate in key gaming markets, like Las Vegas, presents a significant barrier for new entrants. For instance, Las Vegas Strip land values have seen substantial increases, with some parcels reportedly exceeding $20 million per acre in recent years, making acquisition prohibitively expensive for newcomers. This limited availability of desirable locations forces potential competitors to consider less optimal sites, which often translates to lower foot traffic and revenue potential, thereby deterring new physical casino operations.

This geographical constraint directly impacts the threat of new entrants by increasing the capital required for market entry. New casino developers face not only construction costs but also the substantial investment in securing a competitive physical footprint. This barrier is particularly relevant for large-scale integrated resorts, which demand significant land area and prime visibility to be successful.

- Limited prime real estate in major gaming hubs like Las Vegas and Atlantic City.

- High acquisition costs for desirable land parcels, often exceeding tens of millions of dollars per acre.

- New entrants must consider less lucrative or saturated areas, impacting competitive positioning.

- The need for substantial capital investment for land acquisition and development deters smaller players.

Digital Market Entry Barriers (for Online Gaming)

The threat of new entrants in the online gaming sector, particularly for Caesars Entertainment's digital operations, is moderately low despite seemingly lower capital needs than brick-and-mortar casinos. While the initial investment might not mirror building a physical resort, establishing a competitive online presence demands substantial capital for sophisticated technology platforms, robust cybersecurity, and aggressive marketing campaigns to acquire and retain users. For instance, in 2024, major operators continued to invest heavily in user acquisition, with some reporting marketing expenses in the hundreds of millions of dollars annually.

Furthermore, the regulatory landscape for online gambling is becoming increasingly complex and costly to navigate. Obtaining licenses and ensuring compliance across various jurisdictions requires significant legal and operational resources. Existing players like Caesars Digital benefit from established brand recognition and a loyal customer base, making it harder for newcomers to gain traction. By the end of 2023, a few dominant players held substantial market share in key US states, indicating high concentration and entrenched competitive advantages.

- Significant Technology Investment: New entrants must invest heavily in scalable, secure, and user-friendly platforms.

- High Marketing & Customer Acquisition Costs: Acquiring customers in the competitive online gaming market is expensive, with some states seeing customer acquisition costs exceeding $500 per new depositing player in 2024.

- Increasing Regulatory Hurdles: Navigating licensing and compliance across different states adds substantial cost and complexity.

- Established Brand Loyalty and Market Share: Incumbents like Caesars Digital benefit from existing brand equity and customer databases, creating a barrier for new entrants.

The threat of new entrants for Caesars Entertainment is generally considered moderate to low due to significant barriers. High capital requirements for physical resorts, coupled with stringent licensing and regulatory hurdles, deter many potential competitors. Established brands like Caesars also benefit from strong customer loyalty and extensive reward programs, making it difficult for newcomers to gain market share.

In the online gaming space, while initial capital needs might seem lower, substantial investments in technology, marketing, and compliance remain significant deterrents. Customer acquisition costs in 2024 have been particularly high, with some markets seeing figures over $500 per new depositing player, further solidifying the advantage of established players like Caesars Digital.

Limited availability of prime real estate in key gaming markets, such as Las Vegas, also restricts new physical casino development. The cost of acquiring desirable land parcels, potentially exceeding $20 million per acre, makes market entry prohibitively expensive for many, forcing new entrants into less advantageous locations.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2024/2025) |

|---|---|---|---|

| Capital Requirements | High costs for land, construction, licensing, and infrastructure. | Deters smaller players and requires significant funding. | Caesars' 2025 capital expenditure target of $600 million highlights the scale. |

| Regulatory Hurdles | Complex and costly licensing and ongoing compliance. | Increases time and expense for market entry. | Nevada gaming license application fees can reach hundreds of thousands of dollars. |

| Brand Loyalty & Programs | Established customer bases and loyalty programs. | Makes customer acquisition and retention difficult for newcomers. | Caesars Rewards program fosters deep customer engagement. |

| Real Estate Scarcity | Limited prime locations in key gaming markets. | Drives up acquisition costs and limits competitive positioning. | Las Vegas Strip land values can exceed $20 million per acre. |

| Online Marketing Costs | High customer acquisition costs in digital gaming. | Favors incumbents with existing customer databases. | Customer acquisition costs exceeding $500 per new depositing player in some markets. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Caesars Entertainment is built upon a foundation of comprehensive data, including their annual reports, SEC filings, and investor relations materials. We also incorporate industry-specific market research reports and competitor analysis to capture the full competitive landscape.