Caesars Entertainment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caesars Entertainment Bundle

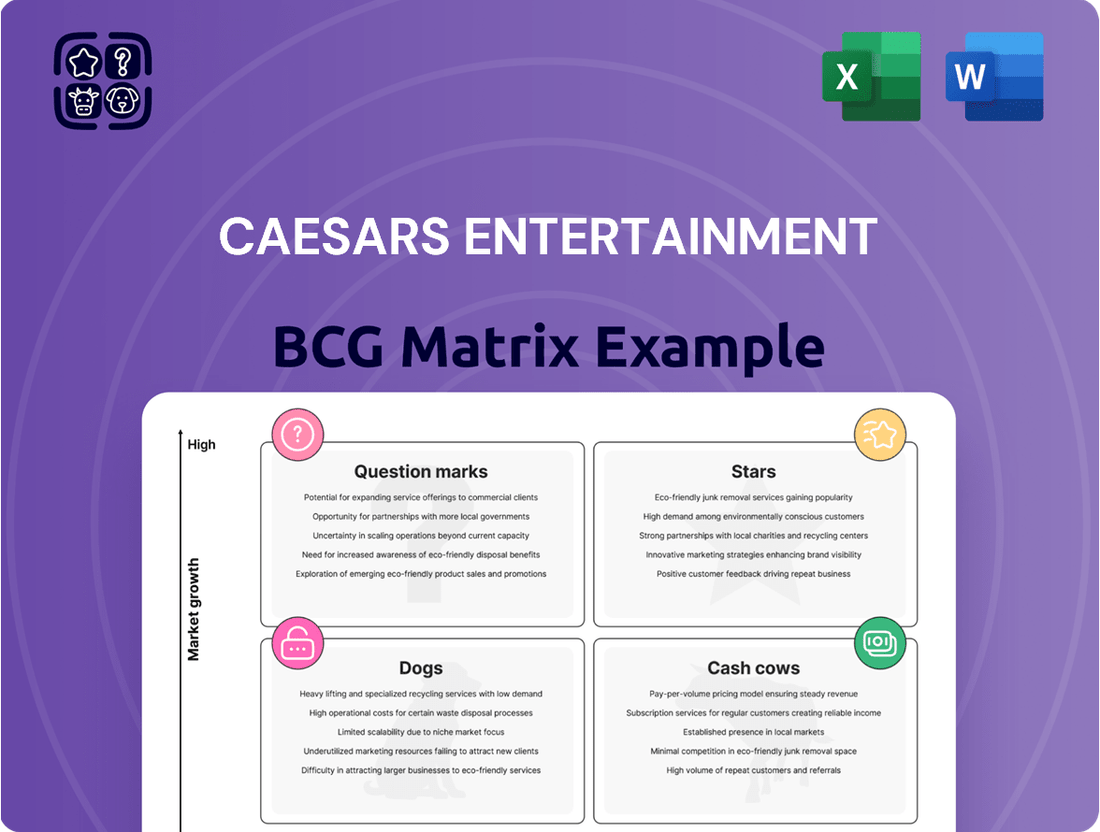

Curious about Caesars Entertainment's strategic product portfolio? Our BCG Matrix analysis reveals which ventures are market leaders, which are generating consistent cash flow, and which may require a closer look. Understand their current standing to anticipate future growth and resource allocation.

This preview offers a glimpse into the core of Caesars Entertainment's strategic positioning. For a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to drive your own business decisions, unlock the full BCG Matrix report today.

Stars

Caesars Digital, encompassing online sports betting and iGaming, is a significant growth driver for Caesars Entertainment. In the second quarter of 2025, this segment achieved a record $80 million in adjusted EBITDA, a substantial doubling compared to the previous year. Net revenue for the segment also saw a healthy increase of 24.3%, reaching $343 million.

This impressive performance underscores the segment's strong trajectory, with projections indicating it will meet its goal of $500 million in annual EBITDA by 2026. The digital operations are clearly a key area of focus and investment for Caesars, demonstrating considerable potential in the rapidly expanding online gaming market.

Caesars Sportsbook, a key player in Caesars Digital, demonstrates significant growth potential within the rapidly expanding U.S. regulated online sports betting landscape. This digital segment's robust performance is bolstered by a rising sports betting handle and a focused approach to cost management.

In 2023, Caesars Entertainment reported that its digital segment, which includes sports betting and iGaming, saw a substantial increase in revenue, driven by market expansion and operational efficiencies. The company continues its strategic push into newly legalized states, aiming to capture a larger share of this lucrative market.

Caesars' iGaming operations are a clear star in its portfolio, showcasing impressive momentum. In the second quarter of 2025, revenue surged by a remarkable 51% year-over-year. This robust growth is fueled by strategic investments in proprietary content, including the expansion of in-house live gaming studios and the introduction of new branded slot titles.

Caesars Palace Online Casino

Caesars Palace Online Casino is a standout performer within Caesars Entertainment's digital offerings, clearly positioned as a high-growth product. Its strategic focus is yielding significant gains in key iGaming markets.

- Michigan Market Share: Grew from 4.5% in July 2023 to 6.6% by May 2025, indicating strong customer acquisition and retention.

- New Jersey Market Share: Saw an increase from 6.4% in May 2024 to 7.3% in May 2025, demonstrating sustained competitive advantage.

- Growth Trajectory: These figures highlight a consistent upward trend, solidifying its status as a star in the online casino segment.

Strategic Digital Investments and Expansion

Caesars Entertainment is strategically channeling significant resources into its digital ventures, recognizing their pivotal role in future growth. This focus includes bolstering existing platforms and expanding into new online markets.

These digital investments are designed to enhance customer experience and solidify Caesars' market position. For instance, the company rolled out a universal digital wallet and an in-house player account management system in Nevada during 2024. This move aims to streamline operations and foster greater customer engagement within its digital ecosystem.

The company's commitment to digital expansion is underscored by its ongoing product enhancements and technological upgrades. These efforts are crucial for maintaining a competitive edge in the rapidly evolving online gaming and entertainment landscape.

- Digital Platform Enhancements: Caesars is actively investing in improving its online offerings, including product upgrades and new feature rollouts.

- Market Expansion: The company is pursuing new market entries for its digital platforms to broaden its reach and customer base.

- Technological Upgrades: Significant investment is being made in technology, such as the 2024 Nevada rollout of a universal digital wallet and an in-house player account management system.

- Customer Experience Focus: These digital initiatives are fundamentally aimed at elevating the overall customer experience and driving growth in the online sector.

Caesars Entertainment's iGaming operations are a clear star in its portfolio, showcasing impressive momentum. In the second quarter of 2025, revenue surged by a remarkable 51% year-over-year. This robust growth is fueled by strategic investments in proprietary content, including the expansion of in-house live gaming studios and the introduction of new branded slot titles.

Caesars Palace Online Casino is a standout performer within Caesars Entertainment's digital offerings, clearly positioned as a high-growth product. Its strategic focus is yielding significant gains in key iGaming markets, with Michigan market share growing from 4.5% in July 2023 to 6.6% by May 2025, and New Jersey market share increasing from 6.4% in May 2024 to 7.3% in May 2025.

These digital initiatives are fundamentally aimed at elevating the overall customer experience and driving growth in the online sector. The company is actively investing in improving its online offerings, including product upgrades and new feature rollouts, and pursuing new market entries for its digital platforms to broaden its reach and customer base.

Caesars Digital, encompassing online sports betting and iGaming, is a significant growth driver for Caesars Entertainment. In the second quarter of 2025, this segment achieved a record $80 million in adjusted EBITDA, a substantial doubling compared to the previous year, with net revenue for the segment also seeing a healthy increase of 24.3%, reaching $343 million.

| Segment | Q2 2025 Revenue | Q2 2025 Adj. EBITDA | Year-over-Year Revenue Growth | Market Share (May 2025) |

|---|---|---|---|---|

| Caesars Digital | $343 million | $80 million | 24.3% | N/A |

| iGaming | N/A | N/A | 51% | NJ: 7.3% |

| Sports Betting | N/A | N/A | N/A | MI: 6.6% |

What is included in the product

This BCG Matrix overview highlights which of Caesars Entertainment's business units are Stars, Cash Cows, Question Marks, or Dogs, guiding strategic investment decisions.

A clear BCG Matrix overview helps identify underperforming "Dogs" and "Cash Cows" to divest or optimize, relieving the pain of inefficient resource allocation.

Cash Cows

Las Vegas Strip properties are clear cash cows for Caesars Entertainment. These iconic casino hotels consistently generate substantial revenue and cash flow, forming the backbone of the company's earnings.

Despite a slight revenue dip in Q2 2025 due to softer market conditions, these Las Vegas assets still pulled in nearly $1.1 billion in revenue and $469 million in adjusted EBITDA. This demonstrates their enduring profitability even in less favorable periods.

Looking ahead, Caesars anticipates a robust recovery, with record group bookings projected for Q4 2025 and extending into 2026, further solidifying the cash-generating power of its Strip portfolio.

Caesars' regional casino portfolio stands as a robust Cash Cow within the company's BCG Matrix. These properties, spread across the United States, generate a dependable and substantial flow of revenue, underscoring their mature and profitable status.

In the second quarter of 2025, regional operations were the top revenue generator, bringing in $1.4 billion. This highlights their consistent performance and ability to attract and retain customers even outside of major tourist destinations like Las Vegas.

Ongoing investments in maintaining and upgrading these facilities are crucial. This strategic approach ensures that Caesars' regional casinos remain competitive, effectively capture local market share, and continue to be reliable profit centers.

The Caesars Rewards loyalty program is a significant Cash Cow for Caesars Entertainment, leveraging its massive member base of over 60 million individuals. This program is instrumental in driving both customer acquisition and retention, creating a strong foundation for repeat business across the company's land-based casinos and expanding digital offerings.

This loyalty program consistently generates substantial cash flow with a comparatively low need for incremental promotional spending. Its effectiveness in fostering cross-platform engagement ensures a steady stream of revenue, solidifying its position as a core, high-performing asset within Caesars Entertainment's portfolio.

Hotel and Food & Beverage Services

Caesars Entertainment's hotel and food & beverage services are considered Cash Cows within its BCG Matrix. These operations consistently generate substantial revenue, supporting the company's overall financial health. In the second quarter of 2025, hotel revenue reached $509 million, while food and beverage services contributed $428 million.

These figures demonstrate the enduring strength of these segments, even with minor year-over-year fluctuations. They are vital in maintaining high occupancy rates and complementing the primary gaming operations in a well-established hospitality market.

- Hotel Revenue (Q2 2025): $509 million

- Food & Beverage Revenue (Q2 2025): $428 million

- Market Position: Mature hospitality market

- Contribution: Stable revenue, complements gaming

Established Gaming Operations

Established Gaming Operations represent Caesars Entertainment's core business and are firmly positioned as Cash Cows within the BCG Matrix. This segment, encompassing traditional brick-and-mortar casinos with slot machines and table games, continues to be the primary revenue driver for the company. In the second quarter of 2025, this segment generated an impressive $1.67 billion in revenue.

The strength of this segment lies in its substantial market share within established gaming markets. While growth prospects are more modest compared to newer digital ventures, the mature nature of these operations ensures a steady and predictable stream of cash flow. This consistent performance makes it a vital contributor to funding other areas of the business.

- Revenue Contribution: $1.67 billion in Q2 2025 from traditional casino operations.

- Market Position: High market share in established gaming markets.

- Cash Flow Generation: Provides consistent and reliable cash flow.

- Growth Outlook: Lower growth prospects compared to digital segments.

Caesars Entertainment's established gaming operations are classic Cash Cows, consistently delivering strong financial results. These traditional casinos, the bedrock of the company, generated $1.67 billion in revenue in the second quarter of 2025, showcasing their enduring profitability and significant market presence.

The loyalty program, Caesars Rewards, with over 60 million members, also acts as a powerful Cash Cow. It efficiently drives repeat business and cross-platform engagement with minimal incremental marketing spend, ensuring a steady and high-margin cash flow.

Furthermore, the company's Las Vegas Strip properties and its diverse regional casino portfolio are firmly established as Cash Cows. These assets, despite market fluctuations, generated substantial revenue and EBITDA in Q2 2025, with the regional segment alone bringing in $1.4 billion, highlighting their mature and dependable cash-generating capabilities.

| Segment | Q2 2025 Revenue (Billions) | Q2 2025 Adjusted EBITDA (Millions) | BCG Category |

|---|---|---|---|

| Established Gaming Operations | $1.67 | N/A | Cash Cow |

| Las Vegas Strip Properties | $1.10 | $469 | Cash Cow |

| Regional Casinos | $1.40 | N/A | Cash Cow |

| Caesars Rewards Program | N/A (Drives revenue across segments) | N/A (High margin, low cost) | Cash Cow |

What You See Is What You Get

Caesars Entertainment BCG Matrix

The Caesars Entertainment BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted with industry-standard metrics, will be delivered without any watermarks or demo content, ensuring you have a professional and actionable strategic tool.

Dogs

Caesars Entertainment has strategically divested several non-core assets, a move that aligns with the Dogs category in the BCG Matrix. A prime example is the sale of the Rio Hotel, a property that had been a significant part of its portfolio but was ultimately deemed non-essential. This divestiture was primarily driven by the company's efforts to manage and reduce its substantial debt burden, a common characteristic of companies shedding underperforming assets.

These divestitures suggest that properties like the Rio were likely underperforming or did not fit Caesars' future strategic direction. By selling these assets, Caesars can redirect capital towards its core businesses, aiming for improved profitability and growth. This action is typical for assets that are no longer generating sufficient returns or exhibiting strong growth potential, fitting the profile of 'Dogs' that require careful management or disposal.

Certain older properties within Caesars Entertainment's portfolio, particularly those predating recent significant refurbishment efforts, may have been classified as Dogs. These assets could have been experiencing a decline in market share or profitability, even as other Las Vegas properties performed strongly as cash cows.

The company's substantial $1 billion refurbishment initiative, which included major upgrades at properties like Caesars Palace and Flamingo Las Vegas, highlights that some of these older assets required considerable investment to prevent them from becoming cash traps, a characteristic of Dog business units.

Caesars Entertainment's approach to international markets, as highlighted by its CEO, suggests a cautious strategy. The company's current assessment indicates no international market offers opportunities on par with domestic prospects, meaning any smaller, less impactful international ventures would likely be classified as Dogs.

These Dog segments, characterized by low growth and minimal market share, would receive little strategic investment. For instance, if Caesars had a small presence in a market like Japan, which has complex regulations and a highly competitive gaming landscape, and it wasn't generating significant revenue, it would fit this category. As of early 2024, the global gaming market is projected to reach over $200 billion, but Caesars' focus remains on maximizing its strong domestic position.

Legacy Technology Systems

Legacy technology systems, characterized by their outdated nature and high maintenance costs, often represent a drain on resources without yielding significant competitive advantages or growth potential. These systems, if they exist within Caesars Entertainment, would likely fall into the question mark category of the BCG matrix, requiring substantial investment for uncertain future returns.

While specific details on Caesars' legacy tech are not publicly disclosed, the company's strategic emphasis on digital transformation and enhancing its online gaming and loyalty platforms suggests a proactive approach to modernizing its technological infrastructure. For instance, Caesars invested heavily in its digital operations, aiming to capture a larger share of the rapidly growing online betting market. This focus inherently means phasing out or significantly overhauling systems that do not support innovation or customer engagement.

- Outdated Infrastructure: Legacy systems may hinder operational efficiency and innovation.

- High Maintenance Costs: Continued expenditure on old technology without clear ROI.

- Strategic Shift: Caesars' investment in digital platforms indicates a move away from non-strategic tech.

- Resource Allocation: Resources are likely being redirected from legacy systems to growth areas.

Segments Impacted by High Competition in Saturated Markets

In highly saturated regional markets, Caesars Entertainment faces pressure on margins and market share due to increasing competition. New casinos and tribal gaming venues are entering these established areas, intensifying the rivalry. This dynamic could lead to a situation where some of Caesars' properties, particularly those lacking unique attractions, struggle to maintain growth and could be considered question marks in the BCG matrix.

For instance, consider the competitive landscape in specific Midwestern or Southern states where multiple casino operators vie for the same customer base. In 2024, reports indicated that while overall gaming revenue saw modest growth in many regions, certain markets experienced a slowdown due to this increased competition. Properties that haven't invested in differentiating amenities or experiences might find their market share eroding.

- Intensified Competition: New entrants, including tribal casinos and expanded offerings from existing competitors, are saturating regional markets.

- Margin Pressure: Increased competition often leads to promotional battles and reduced pricing power, impacting profitability.

- Market Share Erosion: Properties without distinct advantages may see their share of the gaming and entertainment market decline.

- Struggling Growth: Locations facing significant local rivalry without unique selling propositions could find it difficult to achieve meaningful growth.

Caesars Entertainment has divested underperforming assets like the Rio Hotel, a move aligning with the 'Dogs' category in the BCG Matrix, aimed at debt reduction. These divestitures suggest properties lacking strong growth or profitability were sold to focus capital on core businesses. Older, less competitive properties requiring significant investment to avoid becoming cash traps also fit this 'Dog' profile.

The company's strategic focus on digital transformation and modernization implies a move away from legacy technology systems, which often represent resource drains. While specific details on Caesars' outdated tech aren't public, their investment in online gaming and loyalty platforms suggests a proactive overhaul of systems not supporting innovation. This strategic shift means resources are likely being redirected from legacy systems to growth areas.

In saturated regional markets, Caesars faces margin and market share pressure from increased competition, including tribal gaming venues. Properties without unique attractions may struggle to grow, potentially becoming 'Dogs' or 'Question Marks' in the BCG matrix. For example, in 2024, some markets experienced growth slowdowns due to intense local rivalry, impacting properties that hadn't invested in differentiating amenities.

Question Marks

Caesars Entertainment's expansion into newly legalized states for digital gaming, such as online casinos and sports betting, positions them as a 'Question Mark' in the BCG Matrix. These markets offer substantial growth potential as they are in their early stages of development.

For instance, in 2024, states like North Carolina launched mobile sports betting, presenting a fresh opportunity for operators like Caesars. However, entering these nascent markets demands considerable upfront investment in marketing and customer acquisition to build brand awareness and gain a competitive edge against established players.

Caesars Entertainment is actively venturing into hybrid entertainment concepts like esports arenas and immersive theater. These represent emerging, high-growth sectors where the company currently has a limited market presence. This strategic exploration places these initiatives in the 'Question Mark' category of the BCG Matrix, characterized by uncertain but potentially significant future returns.

Caesars Entertainment is actively monitoring prediction markets, viewing them as a promising avenue to enhance its digital offerings. This strategic interest suggests prediction markets represent a high-growth, innovative sector where Caesars currently holds minimal to no market share.

The company's exploration of prediction markets aligns with a "question mark" classification in a BCG matrix, signifying a potential star that requires substantial investment to gauge its viability and establish market leadership. For instance, the global prediction market industry, though nascent, is projected for significant expansion, with some estimates suggesting it could reach billions in value within the next decade, presenting a compelling opportunity for early movers.

Recently Opened Regional Properties (Initial Phase)

Recently opened regional properties, such as Caesars Virginia in Danville and the rebranded Caesars New Orleans, are currently in the 'Question Mark' category of the BCG Matrix. These locations are in their initial phases of market penetration, aiming to capture significant market share within their respective regions. While they possess high growth potential as they mature, their current market position is still developing.

Caesars Virginia, which opened in July 2024, represents a significant investment in a growing market. Similarly, the rebranding of Caesars New Orleans positions it to capitalize on the city's robust tourism sector. Both properties are expected to contribute to Caesars Entertainment's overall regional growth strategy, but their initial performance metrics are still being established.

- Caesars Virginia: Opened July 2024, contributing to regional market growth.

- Caesars New Orleans: Rebranded, focusing on establishing a stronger market presence.

- Market Position: Early stages of development, with high growth prospects.

- BCG Matrix Classification: 'Question Marks' due to developing market share and high growth potential.

Proprietary Digital Content Development

Caesars Entertainment's investment in proprietary digital content, such as their live gaming studios and exclusive slot titles, positions these as potential Stars or Question Marks within the BCG Matrix. This strategy aims to differentiate their online offerings and capture a larger share of the rapidly expanding iGaming market.

While the overall digital segment is a strong performer, individual content pieces are still establishing their market presence. For instance, Caesars launched new exclusive slot titles throughout 2023 and early 2024, the long-term revenue generation and player engagement for which are still under evaluation, making them candidates for the Question Mark category.

- Investment in proprietary content: Caesars is actively developing in-house live gaming studios and exclusive slot games to enhance its digital casino offerings.

- High-growth potential: This strategy is designed to tap into the expanding iGaming market and create unique player experiences.

- Market adoption is key: The success of these new content assets, like recently launched exclusive slots, is still being measured by player adoption and revenue generation.

- Categorization as Question Marks: Until their market share and profitability are firmly established, these specific content developments can be viewed as Question Marks in the BCG Matrix.

Caesars Entertainment's ventures into new digital gaming states and emerging entertainment concepts like esports arenas are classified as Question Marks. These initiatives, while offering significant growth potential as seen in the 2024 launch of mobile sports betting in North Carolina, require substantial investment to build market share against established competitors.

The company's strategic interest in prediction markets and the development of proprietary digital content, such as exclusive slot titles launched in early 2024, also fall into this category. Their success hinges on player adoption and market penetration, with long-term revenue generation still under evaluation.

Recently opened regional properties, like Caesars Virginia which debuted in July 2024, are also considered Question Marks. They are in early stages of market development, aiming to capture significant regional share and exhibit high growth prospects as they mature.

These Question Marks represent opportunities for future growth, but their uncertain market position and the significant capital required for development and marketing place them in a category demanding careful strategic management and ongoing performance monitoring.

| Initiative | BCG Category | Rationale | Growth Potential | Market Share |

|---|---|---|---|---|

| New Digital Gaming States | Question Mark | Early stage development, high investment needed | High | Low/Developing |

| Esports Arenas/Immersive Theater | Question Mark | Emerging sectors, limited presence | High | Low/Developing |

| Prediction Markets | Question Mark | Nascent industry, significant expansion projected | High | Very Low/None |

| Proprietary Digital Content | Question Mark | New content, adoption still being measured | High | Low/Developing |

| Caesars Virginia (Opened July 2024) | Question Mark | Initial market penetration, developing market position | High | Low/Developing |

| Caesars New Orleans (Rebranded) | Question Mark | Establishing stronger market presence, early phase | Moderate to High | Low/Developing |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.