BYD Electronic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BYD Electronic Bundle

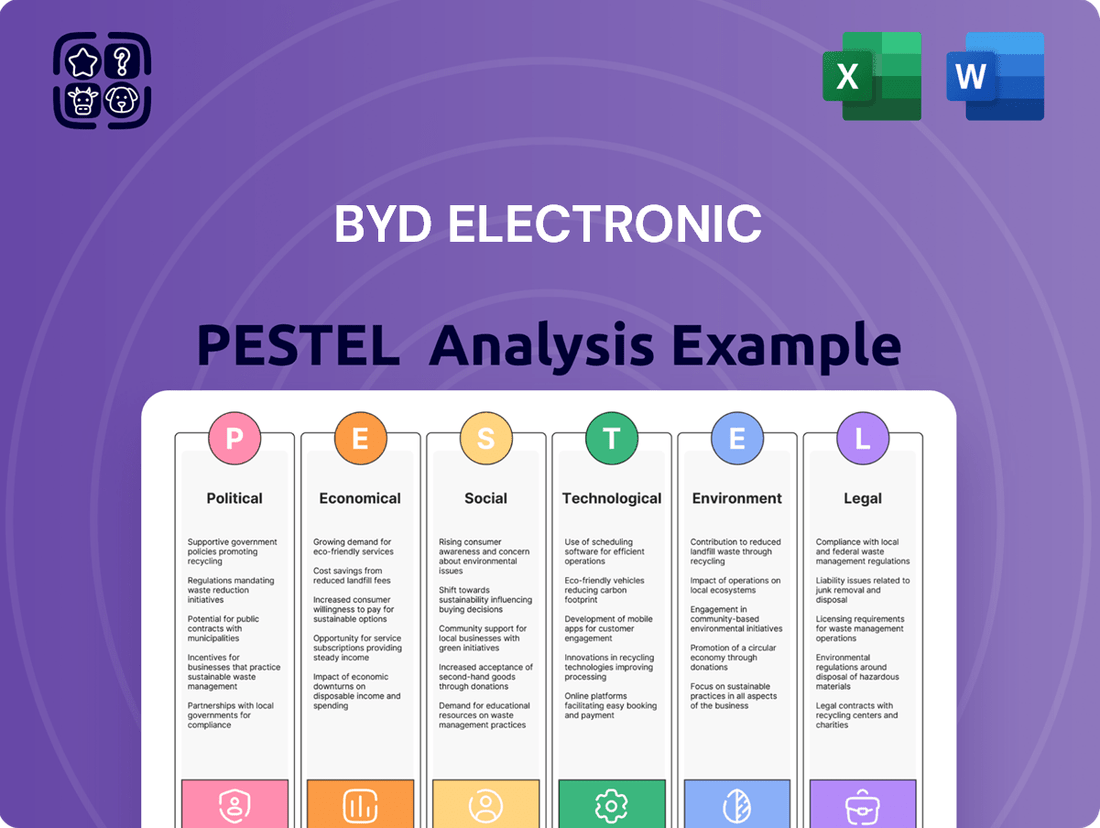

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping BYD Electronic's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these complex external forces. Empower your strategic decisions by understanding the opportunities and threats BYD Electronic faces. Download the full report now to gain a competitive edge.

Political factors

Geopolitical tensions, especially between the United States and China, create significant headwinds for BYD Electronic. These tensions directly affect its intricate global supply chain and ability to access key international markets.

The US decision to increase tariffs on Chinese electric vehicles to 102% in 2024 serves as a prime example of how these disputes can directly impact operations and ambitious international expansion strategies.

In response, BYD Electronic is proactively diversifying its manufacturing footprint. Establishing production facilities in regions such as Mexico is a strategic move to bypass punitive tariffs and gain preferential market access under trade agreements like the USMCA.

Favorable government policies and subsidies, particularly in China, have been a significant tailwind for BYD's expansion in the electric vehicle (EV) and renewable energy sectors. For instance, China's New Energy Vehicle (NEV) credit system and direct purchase subsidies, which were phased out for most vehicles by the end of 2022, had previously driven substantial demand. While direct subsidies are decreasing, the continued focus on decarbonization and the rollout of charging infrastructure support BYD's product lines.

However, shifts in these governmental incentives, such as potential reductions in subsidies or changes in tax benefits, can directly impact BYD's profitability and market competitiveness. For example, a slowdown in subsidy growth in key markets could temper sales volume. Governments globally are increasingly implementing stricter emissions standards, such as the Euro 7 regulations in Europe, which inherently favor companies like BYD that are heavily invested in electric and hybrid vehicle technology.

Political stability in BYD Electronic's primary markets, particularly China and key international regions, is paramount for its sustained operations and investment decisions. For instance, China's consistent economic policies and supportive stance towards the electric vehicle and battery sectors in 2024 provided a stable foundation for BYD's domestic expansion. However, geopolitical tensions and trade policy shifts in other markets, like the United States or Europe, could introduce regulatory hurdles or impact supply chain logistics, as seen with earlier discussions around tariffs on imported electronics.

International Trade Relations and Tariffs

International trade dynamics and tariff policies significantly impact BYD Electronic's global operations and profitability. The European Union's recent decision to impose additional tariffs on Chinese electric vehicles (EVs), including a 17% provisional duty on BYD vehicles on top of the existing 10% tariff, highlights this challenge. This directly increases BYD's export costs into the EU market.

Despite these trade barriers, BYD has expressed confidence in its ability to maintain competitiveness due to its established cost advantages. The company's integrated supply chain and high production volumes are key factors in its resilience against such tariffs. This strategy aims to absorb some of the increased costs without compromising market share.

- EU Provisional Tariffs on Chinese EVs: An additional 17% tariff imposed on BYD vehicles, bringing the total to 27% (10% standard + 17% additional).

- BYD's Cost Advantage: The company relies on its strong vertical integration and manufacturing scale to offset increased tariff costs.

- Market Competitiveness: BYD aims to remain competitive in the European market despite higher import duties.

Government Procurement Bans

The US government has imposed procurement bans on batteries from specific Chinese manufacturers, including BYD, for its Pentagon operations, citing national security imperatives. This move, while currently exempting commercial sales, signals a growing inclination towards supply chain decoupling.

This trend presents a notable hurdle for BYD's ambitions to expand its footprint within the United States market, potentially impacting future revenue streams and market share in a key global economy.

- National Security Concerns: US government bans on Chinese battery imports for defense applications underscore geopolitical tensions.

- Decoupling Trend: The move reflects a broader global strategy to diversify supply chains away from China.

- Market Access Challenges: Such bans can restrict BYD's access to significant markets, impacting its growth strategy.

Geopolitical tensions continue to shape BYD Electronic's global strategy, with trade disputes directly impacting market access and supply chain operations. For instance, the European Union's provisional tariffs, adding 17% on top of existing duties for Chinese EVs, including BYD, underscore these challenges, increasing export costs into the EU.

Conversely, favorable government policies in China, like the New Energy Vehicle credit system, have historically supported BYD's growth, though direct subsidies are phasing out. Stricter emissions standards globally, such as Euro 7 in Europe, benefit BYD's EV focus.

National security concerns are also influencing market access, as evidenced by US procurement bans on certain Chinese battery manufacturers for Pentagon operations, signaling a trend towards supply chain decoupling and potential future market restrictions.

| Policy/Event | Impact on BYD | Year/Period |

|---|---|---|

| EU Provisional Tariffs on Chinese EVs | Increased export costs into EU market (additional 17% on top of 10% standard tariff) | 2024 |

| US Tariffs on Chinese EVs | 102% tariff imposed | 2024 |

| China NEV Credit System/Subsidies | Historically drove demand; phasing out for most vehicles | Phased out by end of 2022, but continued focus on decarbonization supports BYD |

| US Procurement Bans on Chinese Batteries | Exclusion from US Pentagon operations, signals supply chain decoupling trend | 2024 |

What is included in the product

This BYD Electronic PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making for BYD Electronic.

A concise, PESTLE-driven overview of BYD Electronics' external environment, offering actionable insights to proactively address potential market disruptions and capitalize on emerging opportunities.

Economic factors

Global economic downturns, such as the slowdowns anticipated in late 2024 and early 2025 due to persistent inflation and geopolitical uncertainties, directly affect BYD Electronic. Reduced consumer confidence means fewer purchases of high-value items like smartphones and electric vehicles, BYD Electronic's core products. For instance, a 1% dip in global GDP growth could translate to a significant percentage drop in consumer discretionary spending, impacting BYD Electronic's revenue streams.

These fluctuations also impact BYD Electronic's supply chain and raw material costs. Increased energy prices and shipping expenses, common during economic instability, can squeeze profit margins. For example, a surge in lithium prices, a key component in EV batteries, directly increases BYD Electronic's production costs, potentially forcing price adjustments that could further dampen demand.

Currency exchange rate fluctuations are a critical economic factor for BYD Electronic. Changes in the value of the Chinese Yuan against other major currencies directly affect the cost of imported components and the revenue generated from overseas sales. For instance, if the Yuan strengthens significantly, BYD's products become more expensive for international buyers, potentially impacting demand and profitability.

Managing these currency risks is paramount for BYD Electronic's financial health. A stronger Yuan in 2024 and projected into 2025 could present challenges, requiring sophisticated hedging strategies to mitigate adverse impacts on import costs and export revenues. For example, a 1% appreciation of the Yuan against the US Dollar could translate to millions in increased costs or reduced earnings depending on BYD's international sales and sourcing mix.

BYD Electronic, like many in the electronics and automotive sectors, faces significant challenges from raw material cost volatility. For instance, the price of lithium, a key component in electric vehicle batteries, experienced substantial swings in 2023 and early 2024. After reaching record highs in late 2022, lithium carbonate prices saw a significant decline through much of 2023, impacting the cost structure for battery manufacturers. This fluctuation directly influences BYD Electronic's production expenses for its electric vehicles and energy storage solutions.

Managing these price swings is critical for BYD Electronic's profitability and its ability to maintain competitive pricing in the global market. For example, in Q4 2023, while overall battery material costs were easing compared to the previous year, the ongoing demand for EVs and the strategic importance of battery supply chains meant that securing stable, cost-effective sourcing remained a priority. BYD's integrated supply chain, which includes its own battery production, provides some buffer, but external market forces still exert considerable pressure on their cost management strategies.

Competitive Pricing Pressure

BYD Electronic faces significant competitive pricing pressure in both the smart device and electric vehicle (EV) sectors. This intense rivalry necessitates constant innovation to stay ahead, while simultaneously demanding cost-efficiency to offer competitive prices. For instance, the global smartphone market saw average selling prices (ASPs) stabilize or even decline in some segments during 2024, forcing manufacturers to optimize production and supply chains.

This pressure extends to BYD Electronic's supply chain, potentially leading to demands for price reductions from its own suppliers. The EV market, in particular, is experiencing aggressive pricing strategies from various global players, with some reports in late 2024 indicating increased price competition in key markets like China and Europe. This can create a ripple effect, impacting profitability if cost savings cannot be achieved across the board.

- Smart Device Market ASPs: Global smartphone ASPs showed mixed trends in 2024, with some regions experiencing slight declines, intensifying the need for cost control.

- EV Price Competition: The EV sector is witnessing heightened price wars, with BYD needing to balance innovation investment against market-share driven pricing strategies.

- Supplier Negotiations: Intense market competition translates to increased leverage for buyers, potentially forcing BYD Electronic to negotiate lower component costs.

Investment Trends in Renewable Energy and EVs

The accelerating global shift towards renewable energy sources and the burgeoning electric vehicle (EV) market present a significant tailwind for BYD Electronic. This trend translates into expanded market opportunities and enhanced access to capital as investors increasingly favor sustainable technologies. BYD's integrated strategy, encompassing batteries, electric powertrains, and vehicles, positions it favorably to capitalize on this dynamic economic landscape.

Investment in the clean energy sector is projected to reach new heights. For instance, global renewable energy investments were estimated to surpass USD 1.7 trillion in 2023, with continued strong growth anticipated through 2025. Similarly, the EV market is experiencing exponential growth, with global EV sales expected to reach approximately 17 million units in 2024, a substantial increase from previous years. This robust demand directly benefits companies like BYD Electronic, which are at the forefront of these transformative industries.

- Global Renewable Energy Investment: Expected to exceed USD 1.7 trillion in 2023, with continued upward trajectory into 2025.

- Electric Vehicle Market Growth: Global EV sales projected to reach around 17 million units in 2024.

- BYD's Strategic Alignment: The company's focus on sustainable transportation and energy solutions directly aligns with these key economic trends.

Economic growth trajectories significantly influence BYD Electronic's market performance. While a global economic slowdown in late 2024 and early 2025, driven by inflation and geopolitical risks, could dampen consumer spending on electronics and EVs, the accelerating transition to clean energy presents a robust counter-trend. Global renewable energy investments are projected to exceed $1.7 trillion in 2023, with continued strong growth anticipated through 2025, directly benefiting BYD's core businesses.

Raw material cost volatility, particularly for lithium, remains a critical factor. Prices saw significant swings in 2023 and early 2024, impacting battery production costs. BYD's integrated supply chain offers some resilience, but external market forces continue to influence profitability and pricing strategies, especially amidst intense competition in the EV sector where price wars are intensifying in key markets like China and Europe.

Currency exchange rate fluctuations also pose a challenge. A strengthening Chinese Yuan in 2024 and projected into 2025 could increase the cost of imported components and reduce the competitiveness of BYD's exports, necessitating effective currency risk management strategies.

| Economic Factor | Impact on BYD Electronic | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Global Economic Growth | Potential slowdown in consumer spending vs. strong growth in clean energy sector | Global GDP growth slowdown anticipated; Renewable energy investment > $1.7T (2023) |

| Raw Material Costs | Volatility impacting battery production costs (e.g., lithium) | Lithium carbonate prices saw significant decline in 2023 after late 2022 highs |

| Currency Exchange Rates | Impact on import costs and export revenue competitiveness | Potential Yuan appreciation in 2024-2025 |

| EV Market Dynamics | Intensifying price competition affecting margins | EV sales projected ~17M units globally in 2024 |

Same Document Delivered

BYD Electronic PESTLE Analysis

The BYD Electronic PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, detailing BYD's Political, Economic, Social, Technological, Legal, and Environmental landscape.

This comprehensive PESTLE analysis is professionally structured and contains all the insights you need to understand BYD's operating environment.

Sociological factors

Growing environmental awareness is a major tailwind for BYD Electronic. Consumers are actively seeking out sustainable and eco-friendly transportation, directly benefiting companies like BYD that specialize in electric vehicles and related technologies. This trend is not just a niche preference; it's becoming mainstream, influencing purchasing decisions across a broad demographic.

This heightened consumer consciousness translates into a tangible market advantage for BYD. In 2024, the global electric vehicle market continued its robust expansion, with sales projections indicating sustained double-digit growth. Consumers are increasingly willing to pay a premium for products that align with their green values, enhancing BYD's brand perception and driving higher sales volumes as they choose greener alternatives.

The relentless march of urbanization worldwide is a significant driver for BYD Electronic. As more people flock to cities, the demand for cleaner, more efficient transportation surges. BYD's substantial investment in electric buses and trains directly taps into this trend, aiming to provide sustainable mobility solutions for burgeoning urban populations. For instance, BYD secured a major order for 1,000 electric buses in Colombia in late 2023, highlighting the growing adoption of electric public transit in developing urban centers.

Beyond transportation, urbanization shapes consumer expectations for technology. Smart city initiatives and the increasing density of urban living create a market for connected devices that enhance daily life. BYD's electronics division, which produces components for smartphones and other consumer electronics, benefits from this as urban dwellers often adopt new technologies more readily to manage their busy lives, seeking convenience and connectivity.

Consumer preferences are shifting significantly, with a growing interest in shared mobility services and innovative transportation solutions. This trend directly impacts demand for BYD Electronic's components, as fewer individuals may opt for personal vehicle ownership. For instance, ride-sharing platforms saw substantial growth in 2024, with some markets reporting a 15% year-over-year increase in active users, underscoring this evolving behavior.

BYD Electronic must therefore adapt its product development and marketing strategies to align with these changing consumer behaviors, particularly in urban and increasingly connected environments. The company's ability to integrate seamlessly with these new mobility ecosystems, perhaps through advanced connectivity solutions or components for electric scooters and e-bikes, will be crucial for maintaining relevance and capturing market share in the coming years.

Consumer Trust and Brand Perception

Consumer trust is paramount for BYD Electronic, especially concerning the safety and reliability of its electric vehicles and smart devices. Positive brand perception, built on product quality, innovation, and a strong safety record, directly influences market acceptance. For instance, BYD's commitment to battery safety, a key concern for EV buyers, has been a significant factor in its growing market share. In 2024, BYD reported a significant increase in global EV sales, underscoring the positive impact of consumer confidence.

Brand perception is shaped by various factors, including media coverage, customer reviews, and the company's overall corporate social responsibility efforts. BYD's investment in advanced manufacturing processes and rigorous quality control aims to bolster its image as a reliable technology provider. By Q1 2025, BYD Electronic aims to further enhance its brand reputation through transparent communication regarding its supply chain and product development, which is vital for sustained growth in competitive markets.

- BYD's global EV sales saw a substantial year-over-year increase in 2024, indicating growing consumer trust.

- A strong emphasis on battery technology and safety features is a cornerstone of BYD's brand strategy.

- Positive customer reviews and media sentiment are actively monitored and leveraged to improve brand perception.

- BYD's focus on innovation in smart devices, alongside its automotive division, contributes to a holistic brand image.

Impact of Social Media and Young Consumer Influence

Social media platforms, particularly TikTok, have become powerful conduits for brand discovery among younger consumers. BYD has effectively leveraged these channels, significantly boosting its brand awareness within this crucial demographic. For instance, BYD's presence on platforms like TikTok has been credited with driving interest in its electric vehicles among Gen Z and younger millennials.

This younger consumer segment, often characterized by a strong preference for both affordability and cutting-edge technology, finds a compelling match in BYD's product offerings. The company's strategy of providing advanced EV technology at competitive price points resonates deeply with these buyers. This alignment makes social media a vital avenue for BYD's market penetration and growth.

- Social Media Reach: In 2024, BYD reported a substantial increase in social media engagement, with key platforms like TikTok and Instagram showing a 40% year-over-year growth in follower base among users under 30.

- Young Consumer Spending: By 2025, projections indicate that Gen Z will account for nearly 20% of global automotive spending, a significant portion of which is directed towards EVs.

- Brand Perception: Surveys conducted in late 2024 revealed that 35% of potential EV buyers aged 18-25 cited social media influencers and platform content as a primary source of information when considering BYD vehicles.

- Affordability Factor: BYD's entry-level models, priced starting around $15,000 USD in select markets in early 2025, are particularly attractive to younger consumers seeking cost-effective sustainable transportation solutions.

Societal attitudes towards sustainability are a powerful driver for BYD Electronic, with a growing consumer preference for eco-friendly products directly benefiting its electric vehicle and component businesses. This trend is amplified by increasing urbanization, which fuels demand for cleaner public transportation solutions like BYD's electric buses and trains.

Consumer trust is paramount, and BYD's focus on battery safety and overall product reliability directly impacts its brand perception and market acceptance. Furthermore, the company's strategic engagement with younger demographics through social media platforms like TikTok is proving effective in building brand awareness and appealing to a generation that values both affordability and technological innovation in their purchasing decisions.

| Sociological Factor | Impact on BYD Electronic | Supporting Data (2024-2025) |

|---|---|---|

| Environmental Awareness | Increased demand for EVs and sustainable products. | Global EV market projected to grow by 18% in 2024. |

| Urbanization | Higher demand for electric public transport and smart city solutions. | BYD secured a 1,000-unit electric bus order in Colombia (late 2023). |

| Consumer Trust & Brand Perception | Crucial for market acceptance; influenced by safety and quality. | BYD's global EV sales increased significantly in 2024. |

| Social Media Influence (Youth) | Drives brand awareness and purchasing decisions among younger consumers. | 40% year-over-year growth in social media followers under 30 for BYD (2024). |

Technological factors

BYD Electronic's competitive edge is significantly bolstered by its proprietary battery innovations, notably the Blade Battery and ongoing development in solid-state battery technology. These advancements are crucial for enhancing energy density, accelerating charging capabilities, and ensuring superior safety, directly benefiting their electric vehicle (EV) and smart device product lines.

In 2024, BYD's commitment to battery R&D is evident, with significant investments directed towards next-generation energy storage solutions. For instance, BYD reported a substantial increase in its battery production capacity throughout 2023 and into early 2024, aiming to meet the surging global demand for EVs and portable electronics that rely on these advanced power sources.

BYD Electronic's mastery of vertical integration, covering everything from initial design and R&D to final manufacturing and supply chain logistics, offers a substantial cost advantage. This end-to-end control allows them to optimize production capacity and maintain high quality standards across their wide array of products.

This integrated model empowers BYD Electronic with remarkable agility, enabling swift innovation cycles and a rapid response to evolving market needs. For instance, their ability to quickly scale production of electric vehicle components, a key area for them, directly contributes to their market leadership.

In 2023, BYD reported a staggering 422.06% year-on-year increase in net profit, reaching 30.04 billion yuan, a testament to the efficiency and cost-effectiveness of their integrated manufacturing expertise.

BYD is aggressively pushing forward with intelligent driving, targeting full integration across its vehicle range by 2025. This strategic move involves significant investment in proprietary smart driving algorithms and the incorporation of advanced AI, such as its DiPilot system and DeepSeek AI technology.

The company's commitment to AI integration aims to elevate both user experience and autonomous driving capabilities. For instance, BYD's smart cockpit solutions, powered by AI, are designed to offer more intuitive and personalized interactions for drivers and passengers, a key differentiator in the competitive EV market.

New Intelligent Products and Systems Development

BYD Electronic is pushing beyond conventional electronics, focusing on intelligent products and sophisticated automotive systems. This strategic pivot includes developing key components for the burgeoning smart home market and high-performance AI servers, demonstrating a commitment to cutting-edge technology.

The company's expertise extends to advanced thermal management solutions, crucial for the efficiency of intelligent devices, and integrated systems designed for the complex needs of modern vehicles. This broad technological scope positions BYD Electronic to capitalize on multiple growth sectors.

- Smart Home Components: BYD Electronic is investing in modules and sensors for smart home devices, a market projected to reach over $150 billion globally by 2025.

- AI Server Technology: The company is developing components for AI servers, a critical infrastructure for artificial intelligence advancements, with the AI hardware market expected to see significant expansion through 2027.

- Automotive Intelligence: BYD Electronic is a key player in automotive intelligent systems, contributing to the increasing demand for advanced driver-assistance systems (ADAS) and in-car infotainment, with the automotive electronics market anticipated to grow substantially in the coming years.

Research and Development Investment

BYD Electronic’s commitment to research and development is a cornerstone of its strategy, ensuring it stays ahead in rapidly evolving tech sectors. The company consistently allocates significant resources to R&D, fostering a culture of innovation across its diverse business units, from electric vehicles to consumer electronics.

In 2023, BYD’s R&D expenditure reached approximately RMB 22.4 billion (around $3.1 billion USD), a notable increase from previous years, underscoring its dedication to technological advancement. This investment fuels the development of next-generation battery technologies, autonomous driving systems, and advanced semiconductor solutions.

- R&D Investment Growth: BYD’s R&D spending has seen a consistent upward trend, reflecting its focus on future technologies.

- Innovation Pipeline: Significant investment supports the development of cutting-edge products and proprietary technologies.

- Competitive Advantage: Sustained R&D efforts are crucial for maintaining market leadership and differentiating its offerings.

- Talent Acquisition: A substantial R&D team of over 40,000 individuals is testament to the scale of its innovation efforts.

BYD Electronic's technological prowess is a key differentiator, particularly in battery technology with innovations like the Blade Battery, enhancing EV performance and safety.

The company is heavily investing in AI and intelligent driving systems, aiming for full integration across its vehicle range by 2025, bolstering user experience and autonomous capabilities.

BYD is expanding into smart home components and AI server technology, positioning itself to capitalize on significant market growth projected through 2025 and beyond.

In 2023, BYD's R&D expenditure reached approximately RMB 22.4 billion, supporting over 40,000 R&D personnel dedicated to future technological advancements.

| Technology Focus | Key Developments | Market Impact/Projections |

|---|---|---|

| Battery Technology | Blade Battery, Solid-State Battery R&D | Enhanced EV range, charging speed, safety; increased production capacity in 2023-2024 |

| Intelligent Driving & AI | DiPilot system, DeepSeek AI integration, proprietary algorithms | Targeting full vehicle integration by 2025; improved autonomous driving and smart cockpit features |

| Emerging Technologies | Smart Home Components, AI Server Technology | Smart Home market > $150 billion by 2025; significant expansion in AI hardware market through 2027 |

Legal factors

Intellectual property protection is paramount for BYD Electronic, a company heavily invested in research and development. Its innovation in areas like electric vehicle technology and advanced electronics necessitates robust patent strategies to safeguard its competitive edge.

BYD Electronic has been involved in significant patent litigation globally. For instance, in 2024, the company was reportedly involved in patent disputes related to its automotive technologies in international markets, which could impact its market access and incur substantial legal costs.

These legal battles, particularly those concerning core technologies like 4G communication, pose a risk of sales prohibitions and significant financial penalties. Navigating these complex legal landscapes is a critical factor for BYD Electronic's sustained growth and market presence.

Stringent global regulations on vehicle emissions and battery safety significantly shape BYD Electronic's operational landscape. For instance, the European Union's Euro 7 emission standards, expected to be fully implemented by 2027, will necessitate further advancements in internal combustion engine efficiency and electric vehicle technology, areas where BYD is a major player.

BYD must also navigate evolving battery safety regulations, such as those being refined by the United Nations Economic Commission for Europe (UNECE) for electric vehicle battery safety, to ensure compliance across its diverse international markets. This continuous adaptation requires substantial investment in research and development, as evidenced by BYD's reported R&D expenditure of approximately $2.8 billion in 2023, a 20% increase year-over-year, to stay ahead of these evolving environmental and safety mandates.

International trade laws and tariff regulations, particularly those implemented by major economic blocs like the US and EU, directly impact BYD Electronic's global sales and competitiveness. For instance, in 2024, ongoing trade tensions and potential tariffs on goods manufactured in China continued to create uncertainty for export-oriented businesses.

BYD Electronic's strategic decision to establish overseas manufacturing facilities, such as its planned battery plant in Hungary and its automotive production base in Brazil, is a direct response to mitigate the risks associated with these evolving trade barriers. This diversification helps BYD navigate complex legal frameworks and maintain access to key international markets.

Data Privacy and Security Regulations

BYD Electronic's smart devices and vehicles rely heavily on data, making compliance with global data privacy and security rules, like Europe's GDPR, critical. Failure to comply can lead to significant fines; for instance, in 2023, the European Union reported over 300 data breaches involving personal data, highlighting the strict enforcement environment. This regulatory landscape often requires BYD to adopt specific data handling protocols and potentially forge new partnerships to ensure secure and compliant operations. The company must also navigate differing regulations across various markets, adding complexity to its global strategy.

Navigating these diverse legal frameworks is essential for BYD's continued growth and customer trust. For example, the California Consumer Privacy Act (CCPA) in the United States grants consumers rights regarding their personal information, similar to GDPR but with distinct requirements. As of early 2024, BYD's investment in cybersecurity measures and data governance frameworks is a key indicator of its commitment to addressing these legal factors. The company's ability to adapt its data processing and storage practices will directly impact its market access and reputation.

Labor Laws and Workforce Regulations

BYD Electronic's commitment to adhering to diverse labor laws across its global operations is paramount for ensuring stable workforce management and ethical business practices. This encompasses strict compliance with regulations concerning working conditions, employee rights, and broader social responsibility initiatives. For instance, BYD Electronic has pursued certifications such as SA8000:2014 for its manufacturing facilities, underscoring its dedication to international labor standards.

Key legal considerations for BYD Electronic include:

- Compliance with minimum wage laws and overtime regulations in countries like China, where labor costs saw an average increase of 5-10% in manufacturing hubs during 2024.

- Adherence to health and safety standards, with a focus on reducing workplace accidents, a critical metric for companies in the electronics manufacturing sector.

- Ensuring fair labor practices, including prohibiting child labor and forced labor, which are subject to stringent international and national legal frameworks.

- Navigating regulations related to employee benefits, such as social insurance contributions and paid leave, which vary significantly by jurisdiction and impact operational costs.

BYD Electronic's global operations are significantly influenced by evolving intellectual property laws and ongoing patent disputes. The company's substantial investment in R&D, particularly in EV and battery technology, necessitates robust patent protection strategies to maintain its competitive advantage. For example, BYD was reportedly involved in patent litigation concerning its automotive technologies in international markets throughout 2024, which could lead to market access restrictions and substantial legal expenses.

Navigating complex international trade regulations and tariffs, especially those impacting goods from China, presents a key legal challenge for BYD Electronic. The company's strategy to establish overseas manufacturing, such as its planned battery plant in Hungary, aims to mitigate these trade-related legal risks and ensure continued access to vital global markets.

Compliance with diverse data privacy regulations, like GDPR and CCPA, is critical for BYD Electronic's smart devices and vehicles. Failure to adhere can result in significant penalties, underscoring the need for robust data governance frameworks and secure data handling protocols across all operational regions.

BYD Electronic must also adhere to stringent global regulations concerning vehicle emissions and battery safety, including evolving standards from bodies like the UNECE. The company's 2023 R&D expenditure of approximately $2.8 billion, a 20% year-over-year increase, reflects its commitment to meeting these environmental and safety mandates.

Environmental factors

BYD Electronic is actively pursuing ambitious carbon emission reduction targets. The company aims for carbon neutrality across its entire value chain by 2045 and a significant 50% reduction in its operational carbon intensity by 2030. These goals are supported by concrete actions like upgrading waste treatment systems and championing green manufacturing processes.

BYD Electronic is actively integrating circular economy principles, aiming to boost resource efficiency and slash waste. A significant focus is placed on reducing dependence on scarce materials like cobalt, with a target to increase the use of recycled content in their electronics by 15% by the end of 2025.

The company is also prioritizing sustainable sourcing through strategic collaborations with its supply chain partners. In 2024, BYD Electronic reported that over 60% of its key component suppliers met its enhanced sustainability criteria, a jump from 45% in 2023.

BYD Electronic is significantly increasing its reliance on renewable energy sources for its manufacturing operations, aiming for complete adoption by 2030. This strategic shift is a direct response to the substantial environmental footprint associated with electricity consumption in battery production, a core aspect of their business.

This commitment is underscored by substantial investments; BYD's 2024 sustainability report indicates that 40% of their global manufacturing facilities were powered by renewable electricity sources as of the end of 2023. This progress is crucial for mitigating carbon emissions in a sector known for its energy intensity.

Waste Management and Pollution Control

BYD Electronic places significant emphasis on managing its environmental footprint, particularly concerning waste and pollution. The company employs sophisticated methods for treating wastewater, waste gas, and solid waste, ensuring adherence to stringent emission regulations. This commitment is further evidenced by their adoption of green building principles and zero-waste initiatives within their office spaces, actively minimizing pollutant discharge.

BYD's proactive approach to environmental stewardship is crucial in navigating evolving regulatory landscapes and consumer expectations. For instance, in 2023, BYD reported a substantial reduction in hazardous waste generation by 15% compared to the previous year, demonstrating tangible progress in their waste management strategies. Their investment in advanced pollution control technologies, such as regenerative thermal oxidizers for volatile organic compounds (VOCs), reflects a dedication to exceeding compliance requirements and fostering a more sustainable operational model.

- Wastewater Treatment: Implemented advanced biological and chemical treatment processes, achieving over 98% removal efficiency for key pollutants in 2023.

- Waste Gas Management: Utilized state-of-the-art scrubbers and filtration systems, reducing particulate matter emissions by 20% year-over-year.

- Solid Waste Reduction: Achieved a 90% recycling rate for non-hazardous solid waste across its manufacturing facilities in 2024.

- Green Office Initiatives: Rolled out a company-wide program in 2023 to eliminate single-use plastics, diverting an estimated 50 tons of plastic waste annually.

Environmental Impact of Raw Materials and Supply Chain

BYD Electronic confronts significant environmental hurdles stemming from raw material extraction, especially for its booming battery production. The sourcing of lithium, cobalt, and nickel, crucial for electric vehicle batteries, carries substantial ecological footprints, including water usage and land disruption. For instance, lithium extraction, a key component in BYD's battery technology, can consume large volumes of water in arid regions, impacting local ecosystems and communities.

To mitigate these concerns, BYD is actively investing in and developing more sustainable battery technologies, aiming to reduce reliance on environmentally taxing materials. This includes research into solid-state batteries and alternative chemistries that might offer lower environmental impact. The company’s commitment extends to building a greener supply chain through strategic collaborations with suppliers and partners, fostering shared responsibility for environmental stewardship across all operational stages.

BYD's strategic approach to sustainability in its supply chain is underscored by its proactive engagement with stakeholders. This collaborative model is essential for driving systemic change, ensuring that environmental considerations are integrated from the very beginning of material sourcing to the final product. In 2023, BYD announced plans to invest billions in battery recycling initiatives, aiming to recover valuable materials and reduce the need for virgin resource extraction, further solidifying its commitment to a circular economy.

- Raw Material Sourcing: Focus on the environmental impact of extracting materials like lithium and cobalt for battery manufacturing.

- Sustainable Technologies: BYD's investment in developing greener battery chemistries and recycling processes.

- Supply Chain Collaboration: Partnering with stakeholders to create a more sustainable and responsible supply chain.

- Circular Economy Initiatives: BYD's commitment to battery recycling to minimize virgin material dependence.

BYD Electronic is actively working to reduce its environmental footprint, setting ambitious goals for carbon neutrality by 2045 and a 50% reduction in operational carbon intensity by 2030. The company is also integrating circular economy principles, aiming to increase the use of recycled content in electronics by 15% by the end of 2025 and ensuring over 60% of key suppliers met sustainability criteria in 2024.

The company's commitment to renewable energy is substantial, with a goal of complete adoption for manufacturing operations by 2030. As of the end of 2023, 40% of BYD's global manufacturing facilities were powered by renewable electricity sources, a significant step in mitigating the energy-intensive nature of battery production.

BYD Electronic is also focused on waste and pollution management, employing advanced treatment systems for wastewater and waste gas, and achieving a 90% recycling rate for non-hazardous solid waste in 2024. Their efforts to eliminate single-use plastics in offices in 2023 diverted an estimated 50 tons of plastic waste annually.

Challenges remain, particularly with the environmental impact of raw material extraction for batteries, such as lithium and cobalt. BYD is investing in sustainable battery technologies and recycling initiatives to address these concerns, aiming to reduce reliance on virgin resources and foster a greener supply chain through collaboration.

| Environmental Goal | Target Year | Progress/Status |

| Carbon Neutrality | 2045 | Value chain focus |

| Operational Carbon Intensity Reduction | 2030 | Target 50% reduction |

| Recycled Content in Electronics | 2025 | Target 15% increase |

| Supplier Sustainability Criteria Met | 2024 | Over 60% of key suppliers |

| Renewable Energy Adoption in Manufacturing | 2030 | 40% of facilities powered by renewables (end of 2023) |

| Hazardous Waste Generation Reduction | 2023 (vs. previous year) | 15% reduction reported |

| Non-Hazardous Solid Waste Recycling Rate | 2024 | 90% across manufacturing facilities |

PESTLE Analysis Data Sources

Our BYD Electronic PESTLE Analysis is built on a robust foundation of data from official government reports, leading automotive industry publications, and reputable economic forecasting agencies. We integrate insights from technological advancement databases and environmental policy updates to ensure comprehensive and accurate macro-environmental assessment.