BYD Electronic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BYD Electronic Bundle

BYD Electronic faces significant pressure from powerful buyers, particularly large automotive manufacturers who demand competitive pricing and innovative features. The threat of new entrants is moderate, as establishing the necessary scale and technological expertise is challenging, but not insurmountable. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping BYD Electronic’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BYD Electronic's reliance on a select group of suppliers for critical, specialized components, especially those vital for its smartphone and automotive intelligent systems, can significantly amplify the bargaining power of these suppliers. This concentration means that if these suppliers possess proprietary technologies or operate in markets with minimal alternatives, they can dictate terms and pricing more effectively.

The bargaining power of suppliers for BYD Electronic is a crucial factor. The critical nature of certain components, like advanced semiconductors for AI servers or high-precision parts for Apple's supply chain, grants substantial leverage to those suppliers. BYD Electronic's reliance on these inputs to uphold product quality and technological advancement means it's quite sensitive to any disruptions or unfavorable pricing from these key suppliers.

Switching suppliers for BYD Electronic can be a significant undertaking, often involving substantial costs. These expenses can include re-tooling manufacturing lines, redesigning products to accommodate new components, and the rigorous process of qualifying new suppliers and their materials. For instance, in the complex world of electronics manufacturing, a single component change could necessitate extensive testing and certification, potentially delaying product launches.

These high switching costs effectively reduce BYD Electronic's flexibility in sourcing and negotiating. Incumbent suppliers are aware of these barriers, which naturally increases their bargaining power. They can leverage the cost and time involved in a potential switch to maintain favorable terms, knowing that BYD Electronic faces a considerable hurdle to change its supply chain.

For example, in 2023, the semiconductor industry, a critical supplier for electronics, experienced persistent supply chain disruptions and price volatility. Companies like BYD Electronic, heavily reliant on these components, found that the cost and lead times associated with qualifying new semiconductor suppliers could easily run into millions of dollars and months of delay, reinforcing the power of established relationships and the difficulty of abrupt changes.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into BYD Electronic's business can significantly amplify their bargaining power. If suppliers possess the capability and a strong incentive to manufacture components or even complete devices themselves, they can leverage this potential to dictate terms to BYD Electronic.

This situation could compel BYD Electronic to accept less favorable pricing or supply agreements to prevent its own suppliers from becoming direct competitors in the market. For instance, if a key component manufacturer for BYD Electronic's smartphones also started producing its own branded smartphones, BYD Electronic would face increased competitive pressure.

- Supplier Forward Integration Capability: Assess if key suppliers have the financial resources, technological expertise, and market access to produce finished electronic devices.

- Supplier Incentive for Integration: Evaluate if suppliers see greater profit potential or strategic advantage in moving up the value chain rather than just supplying components.

- Impact on BYD Electronic's Terms: Consider how the credible threat of supplier competition could force BYD Electronic to concede on price, quality, or delivery terms.

- Industry Examples: Research instances in the electronics sector where suppliers have successfully integrated forward, impacting their customers' operations.

Supplier's Ability to Differentiate

Suppliers who provide highly specialized or unique components, particularly in rapidly evolving fields such as AI data center solutions or sophisticated automotive digital key systems, wield significant bargaining power. BYD Electronic would face challenges in finding readily available substitutes for these one-of-a-kind inputs, thereby granting the supplier increased leverage in price negotiations.

For instance, in 2024, the semiconductor industry, a critical supplier for electronics manufacturers, experienced ongoing supply chain constraints for advanced chips. Companies like TSMC, a key player, demonstrated strong pricing power due to their proprietary manufacturing processes and high demand from major tech firms, impacting the cost of components for companies like BYD Electronic.

- Supplier Differentiation: Suppliers offering proprietary technology or unique components, such as specialized AI chips or advanced automotive control units, gain substantial bargaining power.

- Substitution Difficulty: When BYD Electronic cannot easily find alternative suppliers for these differentiated inputs, the original supplier's influence increases.

- Impact on BYD Electronic: This enhanced supplier power can lead to higher component costs for BYD Electronic, potentially affecting profit margins and product pricing.

- Market Example (2024): The persistent demand for high-bandwidth memory (HBM) in AI applications in 2024 allowed its primary suppliers to command premium pricing, illustrating the power of differentiation in critical component markets.

The bargaining power of BYD Electronic's suppliers is considerable, particularly for specialized components like advanced semiconductors for AI servers or high-precision parts for automotive systems. This reliance on a limited number of suppliers for critical, proprietary technologies means these suppliers can often dictate terms and pricing. For example, in 2024, the ongoing demand for advanced AI chips from manufacturers like TSMC, which possesses unique manufacturing processes, allowed them to maintain strong pricing power, directly impacting BYD Electronic's component costs.

Switching suppliers for BYD Electronic involves significant costs, including re-tooling manufacturing lines and extensive component qualification processes. These high switching costs, estimated to run into millions of dollars for a single component change in the electronics sector, reinforce the leverage of incumbent suppliers. This makes BYD Electronic more sensitive to price increases or supply disruptions from these key partners.

The threat of forward integration by suppliers also enhances their bargaining power. If suppliers have the capability and incentive to produce finished devices, they can leverage this potential to negotiate more favorable terms with BYD Electronic, potentially turning them into competitors. This dynamic can force BYD Electronic to accept less advantageous pricing to avoid direct market competition from its own component providers.

| Supplier Characteristic | Impact on BYD Electronic | 2024 Data/Example |

|---|---|---|

| Component Specialization & Proprietary Tech | High leverage for suppliers, limits BYD's alternatives | TSMC's advanced AI chip production; high demand for HBM |

| Switching Costs | Significant financial and time investment for BYD to change suppliers | Millions of dollars and months of delay for component qualification |

| Forward Integration Threat | Potential for suppliers to become competitors, impacting BYD's terms | Hypothetical scenario: Component maker entering smartphone market |

What is included in the product

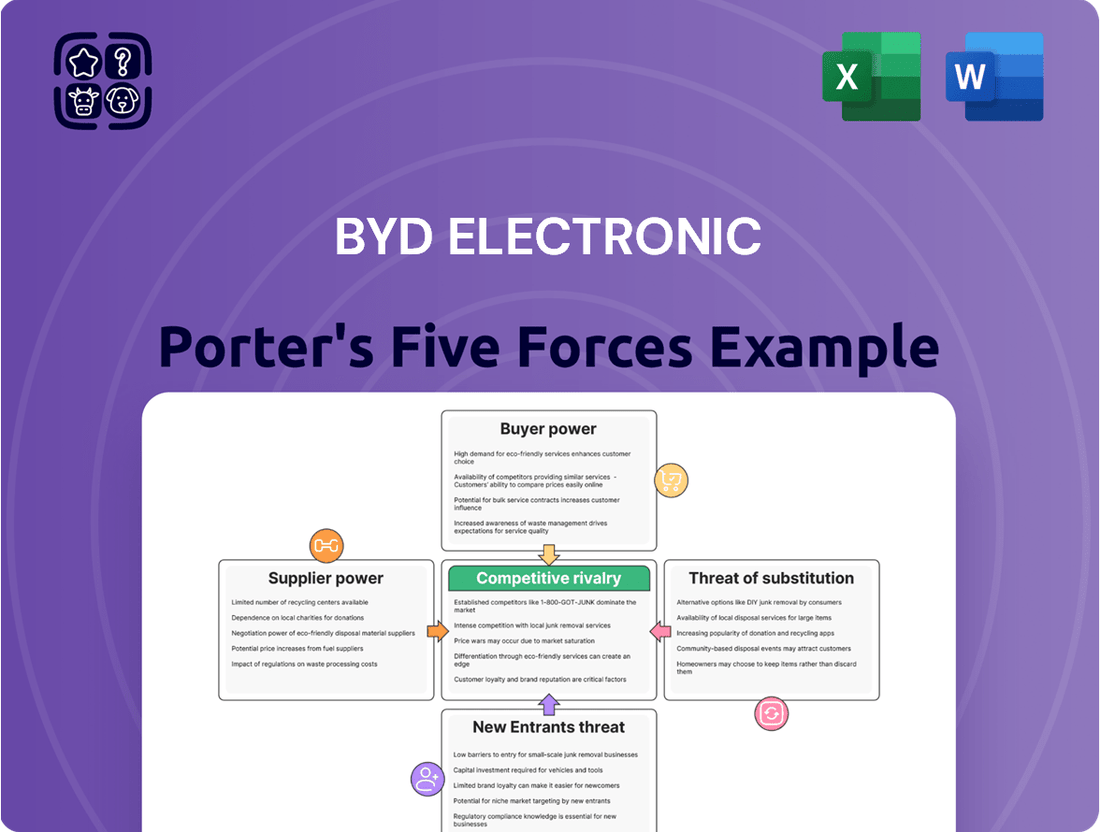

This analysis of BYD Electronic's competitive landscape examines the intensity of rivalry among existing players, the bargaining power of suppliers and buyers, the threat of new entrants, and the potential for substitute products.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing for rapid assessment of BYD's strategic landscape.

Customers Bargaining Power

BYD Electronic's reliance on key customers, such as Apple, is a significant factor in its customer bargaining power. This concentration means that a few large buyers account for a substantial portion of BYD's revenue, giving them considerable leverage.

For instance, Apple's substantial orders for components and manufacturing services empower them to negotiate for lower prices and more favorable contract terms. This dependency can pressure BYD Electronic's profit margins and operational flexibility, as they must cater to the demands of these high-volume clients.

In the highly competitive smart device and automotive intelligent systems sectors, customers frequently exhibit significant price sensitivity. This can translate into direct pressure on BYD Electronic, compelling them to lower prices and potentially squeeze their profit margins, especially when dealing with substantial, high-volume contracts.

For instance, in the global smartphone market, average selling prices (ASPs) have seen fluctuations. In 2023, the global smartphone ASP was around $375, a figure that underscores the importance of competitive pricing for component suppliers like BYD Electronic, particularly when vying for the business of major device manufacturers.

The bargaining power of customers for BYD Electronic is significantly influenced by the availability of substitute products and services. Customers can readily find alternative electronics manufacturing service (EMS) providers and suppliers for automotive intelligent systems. This abundance of choice empowers them to negotiate for more favorable pricing and contract terms, or to switch to a competitor if they are not satisfied with BYD Electronic's offerings.

Customer's Threat of Backward Integration

Large customers, particularly major electronics brands, often possess the substantial financial resources and technical expertise required to explore backward integration. This means they could potentially manufacture key components or even assemble entire products themselves, bypassing suppliers like BYD Electronic.

This looming threat directly influences BYD Electronic's strategy, compelling them to maintain competitive pricing and superior service levels. The goal is to make it more attractive for these significant clients to continue sourcing from BYD rather than investing in their own production capabilities.

- BYD's extensive supply chain integration and manufacturing scale provide a cost advantage that can deter customers from attempting in-house production.

- Customer reliance on BYD's specialized technology and R&D can also act as a barrier to their backward integration efforts.

- The capital expenditure and operational complexity of setting up and running component manufacturing can be prohibitive for many potential customer integrators.

Customer's Information Asymmetry

Customers possessing in-depth knowledge of BYD Electronic's supply chain, production expenses, and industry pricing standards can wield significant leverage during negotiations. This heightened transparency directly diminishes the company's capacity to sustain premium profit margins.

For instance, in the highly competitive automotive electronics sector, major OEMs often conduct thorough cost analyses. In 2024, it's common for large buyers to request detailed breakdowns of component costs and manufacturing overheads, pushing suppliers like BYD Electronic to justify their pricing more rigorously.

- Informed Negotiation: Buyers aware of market rates for raw materials and labor can challenge price increases effectively.

- Margin Pressure: Reduced information asymmetry forces BYD Electronic to operate with tighter margins, impacting profitability.

- Competitive Benchmarking: Customers can easily compare BYD Electronic's offerings against competitors, demanding equivalent or better terms.

- Demand for Transparency: Advanced customers increasingly expect open communication regarding cost structures and production efficiencies.

BYD Electronic's customer bargaining power is substantial, driven by the concentration of its customer base and the price sensitivity inherent in the electronics and automotive sectors. Major clients like Apple can exert significant leverage due to their order volume and ability to negotiate favorable terms, directly impacting BYD's profit margins.

The availability of numerous alternative EMS providers and automotive system suppliers further empowers customers. They can readily switch to competitors, forcing BYD Electronic to remain competitive in pricing and service to retain their business.

Customers' access to cost data and market intelligence allows them to challenge pricing and demand transparency, intensifying margin pressure on BYD Electronic. For example, in 2024, major automotive OEMs routinely request detailed cost breakdowns, pushing suppliers to justify their pricing rigorously.

| Factor | Impact on BYD Electronic | Example/Data Point (2023-2024) |

|---|---|---|

| Customer Concentration | High leverage for key clients | Reliance on major brands like Apple for significant revenue |

| Price Sensitivity | Pressure on profit margins | Global smartphone ASP around $375 in 2023, reflecting competitive pricing |

| Availability of Substitutes | Encourages competitive pricing | Numerous EMS providers and automotive system suppliers available |

| Customer Information | Reduced pricing power | Automotive OEMs requesting detailed cost analyses in 2024 |

Full Version Awaits

BYD Electronic Porter's Five Forces Analysis

This preview showcases the complete BYD Electronic Porter's Five Forces analysis, detailing the competitive landscape for electric vehicle manufacturers. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, offering a thorough examination of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Rivalry Among Competitors

The electronics manufacturing services (EMS) and automotive intelligent systems sectors are crowded arenas. BYD Electronic faces a multitude of competitors, from global giants like Foxconn (Hon Hai Precision Industry) and Pegatron to specialized firms focusing on specific technologies or markets, particularly within China's dynamic ecosystem.

In 2024, the EMS market alone is projected to reach over $800 billion globally, highlighting the sheer scale and the number of companies vying for market share. This intense competition, especially in BYD Electronic's home market of China, necessitates constant innovation and cost optimization to maintain a competitive edge.

The electric vehicle (EV) and smart device sectors, where BYD Electronic primarily operates, are indeed experiencing robust growth. However, this expansion is tempered by fierce competition. In 2024, BYD Electronic saw substantial revenue increases, reaching approximately RMB 60.23 billion in the first quarter, a testament to its strong market position. Yet, aggressive pricing strategies, often referred to as price wars, particularly in certain segments of the EV market, can compress profit margins and slow down revenue growth for individual companies, even those with expanding market share.

While BYD Electronic highlights its technological prowess and integrated supply chain, many rivals also boast sophisticated offerings. The intense competition means BYD Electronic must continuously innovate to truly distinguish its products and services through superior quality and cost-effectiveness.

Exit Barriers

High fixed costs, such as those associated with extensive manufacturing facilities and research and development, can make it very difficult for companies like BYD Electronic to exit the market. For instance, in the automotive sector, where BYD has significant operations, the capital investment in factories and supply chains runs into billions of dollars. This massive sunk cost means that even if a division is not performing optimally, the financial penalty for shutting it down can be prohibitive, forcing continued operation.

Specialized assets, like proprietary battery technology or unique production lines for electric vehicles, also contribute to high exit barriers. These assets often have limited alternative uses outside of BYD's specific business. If BYD were to attempt to sell off these specialized components or plants, they might fetch a fraction of their original value, if a buyer could even be found. This lack of liquidity for specialized investments locks companies into their current operations.

Furthermore, strong customer relationships, built over years of product development and service, create another layer of exit barriers. For BYD Electronic, securing long-term contracts with major automakers or electronics manufacturers means that switching costs for these customers are substantial. These established partnerships make it challenging for BYD to simply walk away from existing commitments without significant contractual penalties or reputational damage, thereby reinforcing their continued presence and operational involvement.

- High Fixed Costs: BYD's significant investments in manufacturing plants and R&D, particularly in the automotive sector, represent billions in sunk costs, making market exit financially punitive.

- Specialized Assets: Proprietary technologies and unique production lines have limited resale value, effectively trapping capital and operational capacity within the company.

- Customer Relationships: Long-term contracts and established partnerships with major clients create substantial switching costs for customers, discouraging BYD from exiting these relationships.

Aggressiveness of Competitors

The automotive industry, where BYD Electronic operates significantly, is characterized by intense competition. Competitors such as Tesla, Xiaomi, and Geely are actively vying for market dominance. They are doing this through a constant stream of new vehicle introductions, rapid technological innovation, and strategic price adjustments. For instance, BYD itself saw its market share in China's new energy vehicle (NEV) market fluctuate, facing pressure from rivals who also introduced compelling models in 2024.

This aggressive stance by rivals necessitates that BYD Electronic remains agile and responsive. The company must continuously refine its product development cycles, enhance its technological capabilities, and manage its pricing strategies effectively to protect and grow its market share. Failing to adapt could lead to erosion of its competitive standing in a rapidly evolving market.

- Intense Rivalry: Major players like Tesla, Xiaomi, and Geely are aggressively launching new models and innovating.

- Price Competition: Strategic price reductions by competitors force BYD Electronic to consider its own pricing strategies.

- Market Share Focus: Competitors' pursuit of market share compels BYD Electronic to adapt its strategies to maintain its position.

- Technological Advancements: Rapid technological progress by rivals requires continuous investment and adaptation from BYD Electronic.

BYD Electronic operates in highly competitive sectors, facing global players like Foxconn and specialized firms, particularly within China. The electronics manufacturing services market, projected to exceed $800 billion globally in 2024, illustrates the intense rivalry. This environment demands continuous innovation and cost efficiency for BYD Electronic to maintain its advantage, especially as rivals engage in aggressive pricing, impacting profit margins despite market growth.

| Competitor | Primary Sector(s) | 2024 Market Focus |

|---|---|---|

| Foxconn (Hon Hai Precision Industry) | EMS, Consumer Electronics | Mass production, supply chain efficiency |

| Pegatron | EMS, Consumer Electronics | ODM services, diverse product manufacturing |

| Tesla | Automotive (EVs) | Innovation, direct-to-consumer sales, battery technology |

| Xiaomi | Consumer Electronics, Automotive (EVs) | Integrated ecosystem, competitive pricing, smart devices |

| Geely | Automotive (EVs) | Brand portfolio expansion, technological integration |

SSubstitutes Threaten

The threat of substitutes is significant for BYD Electronic. In the smart device sector, consumers can choose from a vast array of connected gadgets, or consolidate functions into existing devices like smart home hubs, potentially reducing demand for specialized BYD products. For instance, the smart home market saw a 10% growth in device shipments in 2023, indicating a competitive landscape where integration is key.

Within automotive intelligent systems, alternative technologies that offer similar connectivity or driver assistance features present a substitute threat. Companies are exploring various solutions, from enhanced traditional systems to entirely new paradigms in vehicle autonomy. The global advanced driver-assistance systems (ADAS) market was valued at over $30 billion in 2023, highlighting the breadth of competing technological approaches.

The threat of substitutes for BYD Electronic's products is a significant consideration, particularly when these alternatives offer a compelling price-performance trade-off. If substitute offerings deliver comparable functionality at a reduced cost, or superior performance at a similar price point, customers may be swayed away from BYD Electronic's solutions. This dynamic directly impacts market share and pricing power.

For instance, in the realm of intelligent systems, advancements in software-only solutions are increasingly capable of performing functions previously requiring dedicated hardware. This presents a tangible threat, as these software alternatives can often be implemented at a lower overall cost, potentially bypassing the need for BYD Electronic's hardware components. As of early 2024, the global market for AI-powered software solutions is experiencing rapid growth, with many startups offering highly competitive, software-centric alternatives to traditional hardware-based systems.

The threat of substitutes for BYD Electronic's offerings is influenced by how easily customers can switch. If switching to an alternative product or service requires little cost or effort, this threat becomes more significant. For example, consumers might readily adopt a competitor's smart device ecosystem or opt for a different digital key solution for their vehicles, especially if the perceived benefits or cost savings are substantial.

Customer Propensity to Substitute

Customer propensity to substitute is a significant factor for BYD Electronic. If consumers readily switch to alternative solutions that meet their needs, even if they are technologically different, the threat of substitutes intensifies. For instance, the increasing adoption of integrated smart home ecosystems could lead consumers to opt for comprehensive solutions rather than individual BYD Electronic components.

Consumer willingness to embrace new technologies directly impacts this threat. A market segment that actively seeks out and adopts novel ways to achieve similar outcomes, such as using voice-activated assistants for tasks previously done by dedicated electronic devices, poses a higher substitution risk. BYD Electronic's performance in 2024, particularly in its consumer electronics division, will be a key indicator of this trend.

- Consumer Preferences: A growing preference for open-source platforms or cross-brand compatibility could encourage consumers to move away from proprietary BYD Electronic solutions.

- Technological Advancements: Innovations in areas like AI-powered personal assistants or advanced wearable technology might offer functionalities that directly compete with BYD Electronic's product offerings.

- Price Sensitivity: If substitute products offer comparable functionality at a significantly lower price point, customers are more likely to switch, especially in price-sensitive markets.

- Brand Loyalty: While BYD Electronic has built some brand recognition, a lack of strong emotional connection or perceived unique value can make customers more susceptible to switching.

Evolution of Business Models

The threat of substitutes for BYD Electronic is amplified by the rapid evolution of business models within the automotive and electronics sectors. New approaches, like subscription services for advanced vehicle features or cloud-based device management, can directly replace traditional hardware sales or service agreements. For instance, the automotive industry is increasingly exploring software-defined vehicles, where functionality is delivered and updated via subscriptions, potentially reducing the need for upfront hardware purchases or traditional maintenance packages.

These evolving models present a significant challenge. Consider the rise of over-the-air updates that enhance vehicle performance or add new capabilities, a model that bypasses the need for physical upgrades or dealership visits. By 2024, many automakers are investing heavily in these digital services, indicating a shift in how consumers will access and pay for automotive technology. This trend directly impacts BYD Electronic's traditional revenue streams tied to hardware sales and component supply.

- Subscription Services: Growing adoption of subscription models for in-car entertainment, navigation, and driver-assistance features.

- Cloud-Based Management: Increased reliance on cloud platforms for vehicle diagnostics, updates, and personalized user experiences.

- Software-Defined Vehicles: A market trend where core vehicle functionalities are increasingly controlled and delivered through software, enabling new service-based revenue streams.

- Digital Ecosystems: Integration of vehicles into broader digital ecosystems, offering alternatives to proprietary hardware solutions.

The threat of substitutes for BYD Electronic is substantial, driven by the broad availability of alternative technologies and integrated solutions across its operating segments. In smart devices, consumers can opt for consolidated smart home hubs or leverage existing personal devices, diminishing the need for specialized gadgets. The smart home market alone saw a 10% growth in device shipments in 2023, underscoring the competitive pressure from integrated offerings.

For automotive intelligent systems, alternative technologies such as enhanced traditional systems or emerging autonomous driving solutions present a direct substitute threat. The global advanced driver-assistance systems (ADAS) market, valued at over $30 billion in 2023, illustrates the wide array of competing technological approaches that can fulfill similar functions.

Price-performance is a critical factor; if substitutes offer comparable functionality at lower costs or superior performance at similar prices, BYD Electronic faces market share erosion and reduced pricing power. The increasing capability of software-only solutions to perform hardware-dependent functions, often at a lower cost, poses a tangible threat to BYD Electronic's hardware components. The rapid growth of AI-powered software solutions in early 2024 highlights this trend.

| Segment | Substitute Threat Factor | Example Substitute | Market Data Point (2023/2024) |

| Smart Devices | Function Consolidation & Integration | Smart Home Hubs, Smartphones | Smart Home Device Shipments: +10% |

| Automotive Intelligent Systems | Alternative Technologies & Software Solutions | ADAS, Software-Defined Vehicles | ADAS Market Value: >$30 Billion |

| General Electronics | Price-Performance Trade-offs & Software Alternatives | AI Software Solutions | AI Software Market Growth: Rapid |

Entrants Threaten

Entering the competitive landscape of electronics manufacturing and automotive intelligent systems demands significant upfront capital. BYD, for instance, invests billions annually in research and development, advanced manufacturing facilities, and robust supply chain networks. In 2023, BYD's capital expenditures reached approximately RMB 122.3 billion (around $17 billion USD), highlighting the sheer scale of investment needed to establish and maintain operations in these sectors.

Established players like BYD Electronic leverage significant economies of scale, particularly in high-volume manufacturing of electronic components and finished products. This scale allows them to negotiate better prices for raw materials and components, driving down per-unit production costs. For instance, BYD's extensive supply chain management and massive production capacity, which saw them deliver over 3 million new energy vehicles in 2023, directly contribute to cost efficiencies that are difficult for new entrants to replicate.

BYD Electronic's formidable technological expertise, particularly in advanced battery solutions like its proprietary Blade battery and sophisticated intelligent systems, creates a substantial barrier to entry. Newcomers would face immense capital requirements and a lengthy development cycle to replicate or acquire comparable innovations, effectively deterring potential competitors.

Brand Loyalty and Switching Costs for Customers

BYD Electronic, like many established players, benefits from significant brand loyalty. Building this recognition and trust requires substantial, sustained marketing investment, making it a formidable barrier for newcomers. For instance, in the competitive consumer electronics space, brands often spend billions annually on advertising and promotions to maintain their market position.

Furthermore, customer switching costs can be a powerful deterrent. These costs aren't just monetary; they can include the time and effort required to learn new software interfaces, re-integrate existing systems, or transfer data. For example, a business reliant on a specific enterprise resource planning (ERP) system might face millions in costs to migrate to a competitor's platform, effectively locking them in.

- Brand loyalty: Established brands invest heavily in marketing, creating a significant hurdle for new entrants.

- Switching costs: Technical integration, data migration, and user retraining represent substantial barriers for customers considering alternatives.

- Market penetration: New entrants must overcome not only product parity but also the inertia created by existing customer relationships and investments.

Access to Distribution Channels and Supply Chains

Newcomers to the electronics manufacturing sector, including BYD Electronic, often grapple with gaining access to established distribution networks and securing dependable, cost-efficient supply chains. These essential components are critical for reaching customers and managing production costs effectively.

BYD Electronic's significant advantage lies in its highly developed, vertically integrated supply chain. This integration allows for greater control over production, costs, and quality, creating a substantial barrier for new entrants attempting to match its operational efficiency and scale.

- Distribution Challenges: New companies may struggle to secure shelf space or partnerships with major retailers and online platforms, which are often dominated by established players like BYD Electronic.

- Supply Chain Integration: BYD Electronic's control over raw materials, component manufacturing, and assembly provides cost benefits and supply stability that are difficult for new entrants to achieve. For instance, BYD's significant investments in battery technology and semiconductor manufacturing in 2024 directly bolster its supply chain resilience.

- Capital Investment: Building a comparable supply chain and distribution network requires immense capital, posing a significant hurdle for potential new competitors.

The threat of new entrants for BYD Electronic is moderate, primarily due to high capital requirements and established brand loyalty. However, the company's integrated supply chain and technological prowess present significant barriers. Newcomers would need substantial investment to compete effectively in areas like advanced battery technology and intelligent systems.

BYD Electronic's deep vertical integration, from battery production to vehicle assembly, creates a formidable moat. This control over its supply chain, including significant 2024 investments in semiconductor manufacturing, allows for cost efficiencies and supply stability that are extremely difficult for new players to replicate. The sheer scale of BYD's operations, evidenced by their 2023 vehicle sales exceeding 3 million units, further solidifies this advantage.

New entrants face considerable challenges in establishing comparable distribution networks and securing reliable, cost-effective supply chains. BYD's established relationships with suppliers and its extensive sales channels, bolstered by continuous investment in infrastructure, present a significant hurdle. The cost of building out such capabilities is immense, acting as a substantial deterrent.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and supply chain setup. | Significant deterrent due to the scale of BYD's existing infrastructure. |

| Economies of Scale | BYD's large production volumes lead to lower per-unit costs. | New entrants struggle to match cost competitiveness. |

| Technological Expertise | Proprietary technologies like Blade battery and intelligent systems. | Requires substantial R&D investment and time to replicate. |

| Brand Loyalty & Switching Costs | Established customer relationships and integration challenges. | New entrants must offer superior value to overcome inertia. |

| Supply Chain & Distribution | BYD's integrated and efficient network. | Difficult and costly for new players to build comparable access and control. |

Porter's Five Forces Analysis Data Sources

Our BYD Electronic Porter's Five Forces analysis is built upon a foundation of comprehensive data, including BYD's annual reports, investor presentations, and official press releases. We also leverage industry-specific market research reports and automotive sector publications to capture broader competitive dynamics.