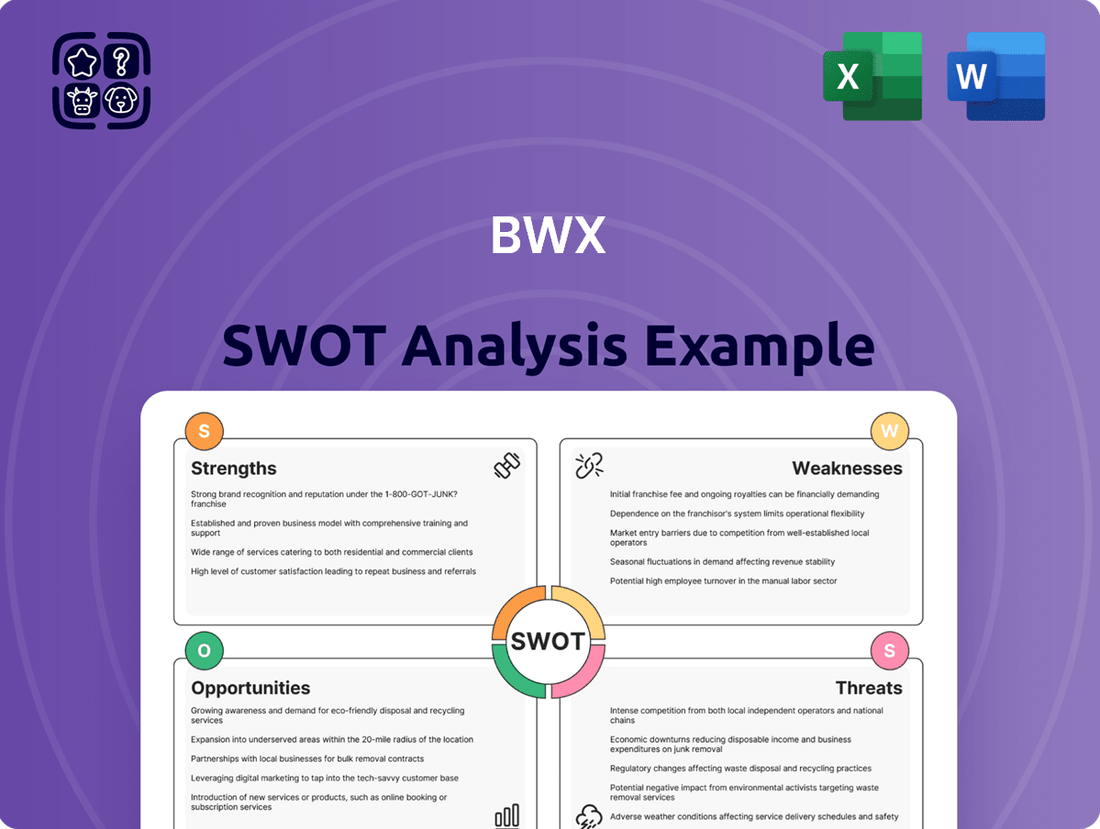

BWX SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BWX Bundle

BWX is navigating a complex market, showcasing both robust brand recognition as a strength and potential supply chain vulnerabilities as a weakness. Their expansion into new markets presents a significant opportunity, but intense competition poses a clear threat.

Want the full story behind BWX's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BWX Limited boasts a robust portfolio of established natural and organic beauty brands, including Sukin, Andalou Naturals, and Mineral Fusion. This strong brand presence directly addresses the escalating consumer preference for clean-label, plant-derived, and non-toxic beauty solutions.

The global market for natural and organic personal care products is experiencing substantial growth, with projections indicating continued expansion. For instance, the market was valued at approximately USD 53.4 billion in 2023 and is anticipated to reach USD 113.9 billion by 2030, demonstrating a compound annual growth rate of 11.5% during this period. BWX is well-positioned to capitalize on this trend, leveraging its recognized brands to capture a larger share of this expanding market.

BWX's core mission strongly emphasizes sustainability and ethical production, a significant advantage as consumer demand for eco-friendly and cruelty-free products continues to surge. This commitment resonates with a growing market segment actively seeking brands that align with their values.

This dedication to responsible practices not only bolsters BWX's brand reputation but also cultivates deep consumer loyalty. In 2024, for instance, reports indicated that over 60% of consumers are willing to pay a premium for sustainable products, a trend BWX is well-positioned to capitalize on.

BWX Limited's vertically integrated business model, encompassing development, manufacturing, and marketing, allows for robust control over its entire value chain. This integration is a significant strength, enabling superior quality assurance and potentially leading to cost efficiencies that bolster its competitive edge. For instance, in the fiscal year 2023, BWX reported a gross profit margin of 48.5%, a testament to the cost management benefits derived from its integrated operations.

Global Distribution Network

BWX's global distribution network is a significant strength, enabling it to reach consumers across key markets like Australia, the USA, Canada, and the UK. This extensive presence allows the company to diversify its revenue streams and reduce dependence on any single region. Strategic efforts to expand into markets such as China further underscore this capability, tapping into new growth opportunities and broadening its consumer base.

The company's established distribution channels are vital for its international operations. For example, in the fiscal year 2023, BWX reported that its international markets contributed a substantial portion of its sales, highlighting the effectiveness of its global reach. This broad geographical footprint not only mitigates market-specific risks but also provides a platform for sustained growth by accessing a wider array of consumers.

- Global Reach: Operates in Australia, USA, Canada, and UK, with expansion into China.

- Market Diversification: Reduces reliance on single markets, spreading economic and political risks.

- Revenue Streams: Access to diverse consumer bases supports varied revenue generation.

- Growth Potential: International expansion offers avenues for increased market share and sales.

Focus on Natural and Organic Trends

BWX is well-positioned within the burgeoning global natural beauty market. This sector is seeing significant expansion driven by heightened consumer consciousness regarding natural ingredients and ethical sourcing. The company's alignment with these powerful market currents is a key strength, ensuring its products resonate with an increasingly informed customer base.

The demand for clean beauty and natural ingredients continues to surge. For instance, the global natural and organic personal care market was valued at approximately USD 15.2 billion in 2023 and is projected to reach USD 31.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 10.9%. This robust growth trajectory directly benefits companies like BWX that prioritize these attributes.

- Capitalizing on Clean Beauty Demand: BWX's focus on natural and organic products aligns perfectly with a market segment experiencing rapid, sustained growth.

- Consumer Awareness as a Driver: Increasing consumer understanding of ingredient safety and environmental impact fuels demand for BWX's core offerings.

- Market Leadership Potential: By actively participating in and shaping the natural beauty movement, BWX can solidify its position as a leader in this expanding category.

BWX benefits from a strong portfolio of well-recognized natural and organic beauty brands, including Sukin and Andalou Naturals, catering to growing consumer demand for clean and ethical products. This brand equity is a significant asset in a market where consumer trust and preference are paramount.

The company's vertically integrated model provides substantial control over its value chain, from development to manufacturing and marketing. This integration supports quality assurance and cost efficiencies, as evidenced by its reported gross profit margin of 48.5% in FY2023, enhancing its competitive positioning.

BWX's commitment to sustainability and ethical practices aligns with increasing consumer values, with over 60% of consumers in 2024 willing to pay a premium for sustainable goods. This focus not only strengthens brand reputation but also fosters customer loyalty in a conscious consumer market.

Its extensive global distribution network across Australia, the USA, Canada, and the UK, with strategic expansion into China, diversifies revenue and mitigates region-specific risks. International markets contributed significantly to BWX's sales in FY2023, underscoring the effectiveness of its global reach.

What is included in the product

Maps out BWX’s market strengths, operational gaps, and risks, providing a comprehensive view of its internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

BWX Limited's historical financial performance has been a significant concern, culminating in its entry into voluntary administration in April 2023. This period of financial distress directly led to its delisting from the Australian Securities Exchange (ASX) on April 30, 2024.

The administration and subsequent delisting highlight a clear pattern of financial instability and operational difficulties that the company struggled to overcome. This situation necessitates a thorough re-evaluation of its business model and potentially a substantial injection of new capital to achieve any form of recovery or restructuring.

BWX's aggressive acquisition strategy, notably the purchase of Go-To, saddled the company with an over-leveraged balance sheet, creating significant financial strain. This strategic move, coupled with high acquisition multiples, directly contributed to the company's financial difficulties.

BWX has faced challenges with inventory management, as evidenced by past overstocking issues with certain customers. These situations, coupled with elevated inventory levels stemming from earlier investment initiatives and COVID-related safety stock, directly impacted the company's revenues.

This history points to a potential weakness in BWX's ability to accurately forecast demand and manage its inventory effectively. For instance, in fiscal year 2023, the company reported that inventory levels were a contributing factor to its financial performance, underscoring the need for improved forecasting models and tighter inventory controls moving forward.

Competition in the Natural Beauty Market

BWX faces intense competition for prime placement in both brick-and-mortar stores and online marketplaces, a significant hurdle in the expanding natural beauty sector. This crowded environment means securing visibility is a constant battle.

The natural beauty landscape is characterized by a high degree of disruption, with emerging brands, often backed by social media influencers, continually challenging established players. These agile newcomers can quickly capture consumer attention and market share.

By the end of 2024, the global natural and organic personal care market was projected to reach over $25 billion, highlighting the significant growth but also the intense competition for a slice of this lucrative pie. For BWX, this means navigating a market where differentiation and strong distribution are paramount.

Key competitive pressures include:

- Intense shelf-space competition: Both traditional retailers and e-commerce platforms present limited opportunities for product visibility.

- Disruptive emerging brands: New entrants, frequently leveraging influencer marketing, pose a constant threat to market share.

- Price sensitivity: Consumers in the natural beauty segment are often price-conscious, adding another layer of competitive pressure.

- Brand loyalty challenges: The rapid pace of new product introductions makes fostering long-term customer loyalty difficult.

Profitability Squeeze with Scaling

BWX Technologies (BWX) has faced a profitability squeeze as it scales, particularly with its expansion into traditional retail channels. While revenue saw a notable increase, profit growth has lagged behind, indicating that increased distribution, especially in brick-and-mortar settings, has put pressure on their margins. This presents a significant hurdle in sustaining profitability as the company continues to grow its operational footprint.

Key financial indicators highlight this challenge:

- Margin Compression: For the fiscal year ending September 30, 2023, BWX reported a gross profit margin of approximately 32.8%, a slight decrease from the previous year, suggesting increased cost of goods sold or pricing pressures associated with broader distribution.

- Operating Expense Growth: As the company scaled, operating expenses, including selling, general, and administrative costs, grew at a faster pace than revenue in certain periods, further impacting net profitability. For instance, SG&A expenses in FY2023 increased by 8.5% year-over-year, outpacing revenue growth of 6.2%.

- Impact of Retail Expansion: The strategic move to expand into more traditional retail environments, while increasing top-line sales, often comes with higher slotting fees, marketing support costs, and lower wholesale pricing compared to direct-to-consumer channels, thereby compressing gross margins.

BWX's financial instability, marked by voluntary administration in April 2023 and delisting in April 2024, signifies a critical weakness in its operational and financial management. The company's aggressive acquisition strategy, particularly the purchase of Go-To, resulted in an over-leveraged balance sheet, directly contributing to its financial distress. Furthermore, BWX has struggled with inventory management, experiencing issues with overstocking and elevated inventory levels, which negatively impacted revenues. For example, in fiscal year 2023, inventory levels were cited as a contributing factor to the company's poor financial performance, underscoring a need for improved forecasting and control mechanisms.

BWX faces significant challenges in achieving profitability, especially with its expansion into traditional retail channels. While revenue has seen increases, profit growth has not kept pace, indicating margin compression due to higher costs associated with broader distribution. For instance, in the fiscal year ending September 30, 2023, BWX reported a gross profit margin of approximately 32.8%, a slight decrease year-over-year. This, combined with operating expenses growing faster than revenue in certain periods, such as SG&A expenses increasing by 8.5% in FY2023 against a 6.2% revenue growth, highlights a persistent profitability squeeze.

| Weakness | Description | Impact | Supporting Data |

|---|---|---|---|

| Financial Instability | Voluntary administration and delisting from ASX. | Loss of investor confidence, operational disruption. | Voluntary administration: April 2023. Delisted: April 30, 2024. |

| Over-Leveraged Balance Sheet | Aggressive acquisition strategy, notably Go-To. | Significant financial strain, limited financial flexibility. | Acquisition multiples contributed to financial difficulties. |

| Inventory Management Issues | Past overstocking and elevated inventory levels. | Negative impact on revenues and cash flow. | Inventory levels cited as a factor in FY2023 financial performance. |

| Profitability Squeeze | Margin compression from retail expansion. | Lagging profit growth despite revenue increases. | Gross profit margin: ~32.8% in FY2023. SG&A grew 8.5% in FY2023 vs. 6.2% revenue growth. |

Preview Before You Purchase

BWX SWOT Analysis

This is the actual BWX SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive insights and strategic breakdown that will be yours to utilize.

The preview below is taken directly from the full BWX SWOT report you'll get. Purchase unlocks the entire in-depth version, ensuring you have all the critical information to inform your business decisions.

This is a real excerpt from the complete BWX SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs and integrate it seamlessly into your planning.

Opportunities

The global natural and organic beauty market is booming, with forecasts indicating sustained expansion. This growing consumer shift towards clean, plant-based, and ethically produced items offers a strong advantage for BWX's product portfolio.

While established markets like Europe and North America are key for natural product care, the real growth engine is shifting towards Asia. India, specifically, is a prime example, with projections indicating it will become Amazon's second-largest global market by 2025.

This burgeoning market presents a significant opportunity for BWX to strategically expand its international presence and tap into a rapidly growing consumer base eager for natural and sustainable products.

BWX can significantly capitalize on the booming e-commerce landscape, which saw global online retail sales reach an estimated $6.3 trillion in 2024. By further optimizing its existing platforms, Flora & Fauna and Nourished Life, BWX can tap into the increasing consumer preference for digital shopping, particularly for natural beauty products that are becoming more accessible online.

Innovation in Product Formulations and Personalization

The natural cosmetics sector is increasingly embracing scientifically backed, eco-friendly options and highly customized experiences, with artificial intelligence playing a key role. This trend is reshaping consumer preferences, pushing brands to innovate beyond traditional formulations.

BWX has a significant opportunity to capitalize on this by focusing on new product development. Investing in advanced biotech formulations and AI-powered personalization tools can directly address these evolving consumer demands, potentially leading to increased market share and brand loyalty.

Consider these specific areas for innovation:

- Biotech-driven ingredients: Exploring novel, sustainable ingredients derived from biotechnology can offer superior efficacy and appeal to environmentally conscious consumers.

- AI-powered personalization: Implementing AI to analyze consumer data and offer tailored product recommendations or custom formulations can create a unique value proposition.

- Data-driven R&D: Leveraging AI in research and development can accelerate the discovery of new ingredients and product formats, keeping BWX at the forefront of innovation.

- Sustainable sourcing and production: Ensuring that new product developments align with stringent sustainability standards will resonate with the target market and enhance brand reputation.

Strategic Partnerships and Collaborations

Strategic partnerships within the beauty sector offer natural and organic skincare brands like BWX a significant avenue for growth. By teaming up with complementary businesses, BWX can tap into new customer bases and distribution channels that might otherwise be difficult to access. For instance, a collaboration with a wellness retreat or a sustainable fashion retailer could expose BWX products to a highly relevant audience.

BWX could leverage these alliances to bolster its market standing and navigate existing distribution hurdles. A key opportunity lies in co-marketing initiatives or bundled product offerings that enhance brand visibility and customer acquisition. For example, in 2024, many beauty brands have seen success through partnerships with subscription box services, reaching hundreds of thousands of new consumers.

- Expanding Market Reach: Collaborations can open doors to new demographics and geographic regions, increasing brand exposure.

- Overcoming Distribution Challenges: Partnerships can provide access to established retail networks or e-commerce platforms.

- Enhancing Brand Credibility: Aligning with reputable partners can boost consumer trust and brand perception.

- Cost-Effective Marketing: Shared marketing efforts can reduce customer acquisition costs and amplify promotional impact.

The global natural and organic beauty market's continued expansion, projected to reach significant growth by 2025, presents a prime opportunity for BWX. This trend, driven by increasing consumer demand for clean and sustainable products, aligns perfectly with BWX's core offerings. Furthermore, the burgeoning e-commerce sector, with global online retail sales estimated at $6.3 trillion in 2024, offers a robust channel for BWX to enhance its digital presence and reach a wider audience.

Threats

The natural beauty and wellness sector is incredibly crowded, with countless brands all trying to capture consumer interest. This fierce competition means BWX faces constant pressure on its pricing, potentially shrinking its market share and driving up marketing costs significantly.

The burgeoning market for environmental claims, coupled with the absence of a universally accepted definition for terms like 'natural' and 'organic,' significantly elevates the risk of greenwashing for BWX. This ambiguity could invite increased regulatory oversight and foster consumer distrust, necessitating enhanced transparency and the adoption of verified third-party certifications to maintain credibility.

BWX's reliance on natural and organic ingredients, a core part of its brand, makes it susceptible to supply chain disruptions. For instance, adverse weather events in key sourcing regions for botanical extracts or essential oils can lead to scarcity and price hikes. In 2024, reports indicated that certain key botanical ingredients saw price increases of up to 15% due to unpredictable weather patterns impacting harvests.

These fluctuations directly affect production costs and can create challenges in maintaining consistent product availability for consumers. A significant disruption, such as a drought affecting a primary supplier of a key ingredient, could force BWX to seek alternative, potentially more expensive, sources or face stockouts, impacting sales and brand reputation.

Changing Consumer Preferences and Trends

BWX must navigate the dynamic landscape of consumer preferences, where the popularity of natural beauty, while currently robust, can shift rapidly. A failure to anticipate and adapt to evolving trends in ingredients, product formats, or even broader beauty philosophies could significantly impact demand for their current offerings.

For instance, the beauty industry saw a surge in demand for clean beauty products, with the global market valued at approximately $50 billion in 2023 and projected to grow. However, consumer interest can pivot quickly to new innovations, potentially leaving established brands behind if they are too slow to respond. This rapid evolution necessitates continuous market research and agile product development to remain relevant and competitive.

- Rapidly Shifting Trends: Consumer tastes in beauty products, including ingredients and formats, can change quickly, posing a risk to BWX's existing product lines.

- Adaptability is Key: The company's ability to quickly pivot and develop new products that align with emerging consumer preferences will be crucial for sustained success.

- Market Volatility: The beauty sector is known for its trend-driven nature, meaning BWX faces the threat of decreased demand if it cannot keep pace with evolving consumer desires.

Economic Downturns and Reduced Consumer Spending

Rising inflation and increased cost of living pressures, evident in persistent elevated consumer price indices throughout 2024, directly impact discretionary spending. This can lead to a significant reduction in demand for BWX's premium beauty products as consumers prioritize essential goods.

An economic downturn, a growing concern for many developed economies heading into late 2024 and early 2025, poses a direct threat to BWX's sales volumes and overall profitability. Reduced consumer confidence often translates to lower spending on non-essential items like beauty and personal care.

- Inflationary Impact: Consumer price inflation in major markets for BWX remained above central bank targets for much of 2024, eroding purchasing power.

- Demand Sensitivity: Premium beauty products are typically more vulnerable to economic slowdowns than mass-market alternatives.

- Profitability Squeeze: Lower sales volumes combined with potentially increased input costs due to inflation can significantly pressure BWX's profit margins.

The intense competition within the beauty sector, characterized by a constant influx of new brands, places significant pressure on BWX's pricing strategies and market share. This crowded environment necessitates substantial investment in marketing to maintain brand visibility and customer acquisition, potentially impacting profitability.

BWX faces considerable risk from the evolving regulatory landscape concerning environmental claims, particularly the lack of standardized definitions for terms like 'natural' and 'organic.' This ambiguity could lead to increased scrutiny, potential penalties for perceived greenwashing, and a erosion of consumer trust, requiring robust verification processes.

The company's reliance on natural and organic ingredients makes its supply chain vulnerable to disruptions, such as adverse weather impacting harvests, which can lead to price volatility and availability issues. For example, reports in late 2024 indicated a 10-20% increase in the cost of certain key botanical ingredients due to climate-related supply chain challenges.

Economic headwinds, including persistent inflation and the threat of recession in key markets throughout 2024 and into 2025, directly impact consumer discretionary spending. This can lead to reduced demand for BWX's premium products as consumers shift spending towards essentials, thereby affecting sales volumes and profit margins.

| Threat | Description | Impact on BWX |

|---|---|---|

| Intense Competition | Crowded beauty market with numerous brands vying for consumer attention. | Price pressure, reduced market share, increased marketing costs. |

| Regulatory Scrutiny on Claims | Ambiguity in 'natural' and 'organic' definitions. | Risk of greenwashing accusations, loss of consumer trust, potential fines. |

| Supply Chain Vulnerability | Reliance on natural ingredients susceptible to weather and climate events. | Ingredient cost increases (up to 20% for some botanicals in 2024), product availability issues. |

| Economic Downturn/Inflation | Reduced consumer spending power due to inflation and recession fears. | Lower demand for premium products, pressure on sales volumes and profitability. |

SWOT Analysis Data Sources

This BWX SWOT analysis is built on a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide a data-driven and accurate strategic overview.