BWX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BWX Bundle

BWX faces a dynamic competitive landscape, with the threat of new entrants and the bargaining power of buyers presenting significant challenges. Understanding these forces is crucial for navigating their market effectively.

The complete report reveals the real forces shaping BWX’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts BWX Limited's bargaining power. If BWX relies on a limited number of providers for its specialized natural and organic ingredients, these suppliers gain leverage. For instance, in 2023, BWX faced difficulties securing essential raw materials due to its cash flow issues, demonstrating how supplier concentration can create vulnerabilities.

Suppliers of unique or proprietary natural and organic ingredients, especially those with certifications or sustainable sourcing, hold considerable sway. BWX's focus on plant-based and eco-conscious products necessitates reliance on specific, often specialized, raw materials, giving these suppliers an edge.

The global beauty industry has seen a significant increase in raw material costs, with some reports indicating price hikes of up to 15% for certain botanical extracts in 2023-2024, further bolstering supplier leverage.

The costs BWX incurs when switching suppliers are a significant factor in supplier bargaining power. These costs can include the expense of researching and developing new product formulations to accommodate different ingredients, navigating the complex process of obtaining regulatory approvals for these new formulations, and the potential disruption to manufacturing operations during the transition period. For instance, if a key ingredient supplier changes, BWX might need to revalidate its entire product line, a process that can be both time-consuming and expensive.

While BWX has taken steps to improve its supply chain by investing in a new manufacturing facility, which offers greater control, altering deeply entrenched supplier relationships across its broad portfolio of brands remains a considerable challenge. The complexity of managing numerous suppliers for diverse product lines means that switching costs can remain high, thereby strengthening the bargaining position of existing suppliers.

Threat of Forward Integration by Suppliers

Suppliers could potentially threaten BWX by integrating forward into the production of natural and organic beauty products. This would allow them to directly compete with BWX, diminishing BWX's need for their raw materials and potentially increasing the overall supply of finished goods in the market. While specific instances for BWX's direct suppliers are not publicly detailed, this remains a prevalent strategic consideration within the broader beauty and personal care sector.

The threat of forward integration by suppliers is a significant aspect of their bargaining power. If suppliers were to move into producing finished goods themselves, they could capture more of the value chain. For instance, a supplier of botanical extracts might decide to launch their own line of skincare, directly challenging BWX's market position. This move would not only reduce BWX's purchasing power but also introduce new competitive pressures from entities that previously served as partners.

- Forward Integration Risk: Suppliers may develop their own branded natural and organic beauty products, becoming direct competitors to BWX.

- Market Impact: Such integration would reduce BWX's reliance on its suppliers and could lead to increased competition in the finished product market.

- Industry Trend: While not explicitly confirmed for BWX's specific suppliers, forward integration is a recognized strategy in the beauty industry to capture greater market share and profit.

- Strategic Consideration: BWX must monitor supplier capabilities and market dynamics to anticipate and mitigate potential threats from forward integration by its key material providers.

Importance of Supplier's Input to BWX's Product Differentiation

The bargaining power of suppliers for BWX is significantly influenced by the critical nature of their inputs to BWX's product differentiation. The quality and unique properties of natural and organic ingredients are paramount for BWX's brand integrity and its ability to stand out in a crowded market. If suppliers offer essential, high-quality ingredients that are challenging for competitors to source or replicate, their leverage over BWX naturally grows, as BWX depends on these inputs to uphold its brand promise of natural and organic products.

Consumer demand for transparency and ingredient scrutiny further amplifies supplier power. In 2024, reports indicated that over 70% of consumers actively check ingredient lists, especially for natural and organic products, reinforcing BWX's reliance on suppliers who can consistently deliver on these fronts. This reliance means suppliers who can guarantee purity, traceability, and unique ingredient profiles hold considerable sway.

- Ingredient Dependency: BWX's commitment to natural and organic ingredients makes it highly dependent on suppliers who can meet these specific quality and sourcing standards.

- Brand Reputation: Sourcing unique or high-quality ingredients from specific suppliers directly contributes to BWX's brand differentiation and consumer trust.

- Consumer Scrutiny: Increased consumer focus on ingredient transparency in 2024 means BWX must maintain strong relationships with suppliers providing verifiable, premium inputs.

- Supplier Leverage: Suppliers of rare or specialized organic ingredients, or those with robust sustainability certifications, possess higher bargaining power due to BWX's need for these differentiating factors.

The bargaining power of suppliers for BWX is substantial, driven by the critical nature of specialized natural and organic ingredients for brand differentiation. Suppliers of unique, certified, or sustainably sourced inputs hold significant leverage, especially as consumers increasingly scrutinize ingredient lists, with over 70% checking them in 2024. High switching costs, including reformulation and regulatory hurdles, further cement supplier influence, making it difficult for BWX to change providers without considerable expense and operational disruption.

| Factor | Impact on BWX | Supporting Data/Trend |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | BWX's reliance on specialized ingredients can mean few providers exist. |

| Switching Costs | High costs deter BWX from changing suppliers | Reformulation, regulatory approval, and operational disruption are significant expenses. |

| Ingredient Differentiation | Suppliers of unique ingredients have more power | BWX's brand promise relies on specific, hard-to-replicate natural components. |

| Consumer Scrutiny (2024) | Increases demand for verifiable, high-quality ingredients | Over 70% of consumers actively check ingredient lists, amplifying supplier importance. |

What is included in the product

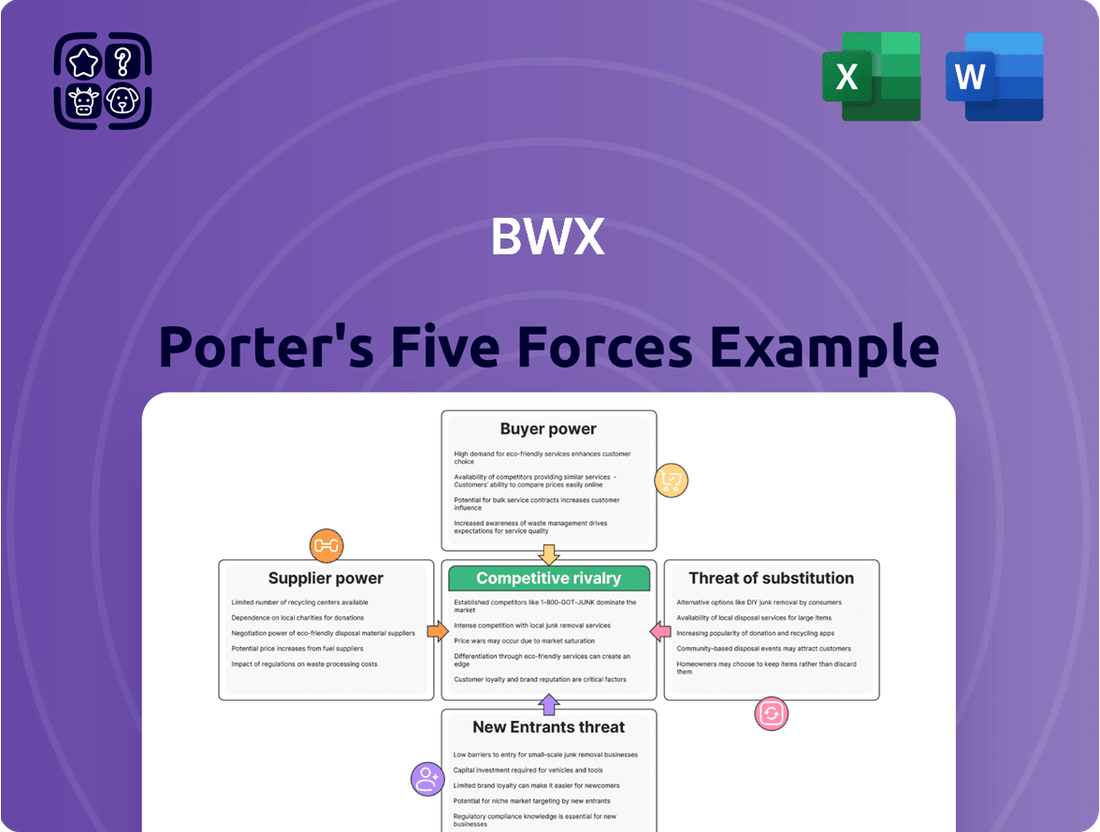

This Porter's Five Forces analysis provides a comprehensive understanding of the competitive forces impacting BWX, detailing industry rivalry, buyer and supplier power, threat of new entrants, and the risk of substitutes.

Instantly identify and prioritize competitive threats with a visual, easy-to-understand framework.

Customers Bargaining Power

Consumers in the natural and organic beauty market show a mixed response to pricing, particularly as economic pressures mount. While a core group prioritizes ethical sourcing and efficacy, and is willing to absorb higher costs, affordability is a significant barrier for others. For instance, a 2024 survey indicated that over 60% of consumers consider price a primary factor when purchasing beauty products, even within the natural segment.

The beauty industry, where BWX operates, is characterized by a vast array of natural and organic brands. Consumers also have access to traditional beauty products and even readily available DIY alternatives. This sheer abundance of choices significantly amplifies customer bargaining power.

If BWX's product offerings lack strong differentiation or competitive pricing, customers can readily shift their patronage to rival brands or entirely different product categories. For instance, in 2023, the global beauty and personal care market was valued at approximately $590 billion, showcasing intense competition and a wide spectrum of consumer options.

BWX faced substantial pressure from its customers, particularly its key distribution partners, who were holding elevated inventory levels in 2023. This situation, known as destocking, directly translated into reduced order volumes and dampened sales for BWX, highlighting the significant bargaining power these customers wielded by controlling their own inventory and, consequently, BWX's revenue streams.

The impact of this customer concentration and destocking was evident in BWX's financial performance. For instance, the company reported a net sales decline in its fiscal year 2023, partly attributed to these inventory adjustments by its retail partners, underscoring how the power of a few large customers can disproportionately affect a company's top line and cash flow.

Consumer Demand for Transparency and Sustainability

Consumers are increasingly prioritizing transparency and sustainability, directly impacting their purchasing decisions. This shift empowers them to demand more information about product origins, ingredients, and ethical sourcing practices. Brands that align with these values, like BWX, are better positioned to capture and retain market share.

This heightened consumer awareness translates into tangible market shifts. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products from brands committed to sustainability. This trend highlights the significant bargaining power customers wield when these ethical considerations are at play.

- Growing Demand for Clean Labels: Consumers are actively seeking products with fewer, recognizable ingredients, driving demand for transparency in ingredient lists.

- Preference for Plant-Derived and Ethical Sourcing: A significant portion of consumers now favor plant-based alternatives and products sourced through ethical labor practices, influencing brand choices.

- Impact on Brand Loyalty: Companies like BWX, which focus on sustainability and ethical production, find that meeting these evolving consumer expectations is crucial for maintaining customer loyalty and market relevance.

Low Switching Costs for Consumers

For consumers, the cost and effort involved in switching from one natural beauty brand to another are minimal. This ease of transition significantly amplifies their bargaining power within the market.

The widespread availability of natural beauty products through online platforms and various retail channels further simplifies the process for consumers to explore and switch between brands. In 2023, the global natural and organic beauty market was valued at approximately $59.2 billion, indicating a highly competitive landscape where brands must actively retain customers.

- Low Switching Costs: Consumers can easily move between natural beauty brands without incurring significant financial penalties or effort.

- Increased Competition: This low switching cost fuels intense competition among brands vying for consumer loyalty.

- Consumer Choice: The accessibility of a broad product range empowers consumers to demand better quality and pricing.

The bargaining power of customers is a significant force in the natural and organic beauty market, directly impacting companies like BWX. Consumers have a vast array of choices, from numerous natural brands to traditional beauty products and even DIY alternatives. This abundance, coupled with low switching costs and increasing price sensitivity—with over 60% of consumers in a 2024 survey citing price as a primary factor—empowers customers to demand better value and readily shift their allegiances.

BWX's experience with key distribution partners in 2023 exemplifies this power. Elevated inventory levels held by these partners led to destocking, resulting in reduced order volumes and dampened sales for BWX. This situation highlights how control over inventory by major customers can directly influence a company's revenue streams and financial performance, as seen in BWX's reported net sales decline for fiscal year 2023.

Furthermore, growing consumer demand for transparency and sustainability grants customers more leverage. Over 60% of consumers in a 2024 report indicated a willingness to pay more for sustainable products, forcing brands to align with ethical sourcing and ingredient transparency to maintain loyalty. This trend underscores the significant bargaining power customers wield when ethical considerations are paramount.

| Factor | Impact on BWX | Evidence (2023-2024) |

|---|---|---|

| Product Choice Abundance | Amplifies customer power | Global beauty market valued at ~$590 billion (2023) |

| Price Sensitivity | Drives demand for value | 60%+ consumers cite price as primary factor (2024 survey) |

| Distribution Partner Inventory | Directly impacts sales | BWX reported net sales decline in FY2023 due to destocking |

| Demand for Transparency/Sustainability | Influences brand loyalty | 60%+ consumers willing to pay more for sustainable products (2024 report) |

Preview the Actual Deliverable

BWX Porter's Five Forces Analysis

This preview showcases the exact BWX Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive breakdown of the competitive landscape affecting BWX. You'll gain immediate access to this fully formatted and professionally written document, providing actionable insights without any surprises or placeholders.

Rivalry Among Competitors

The natural and organic beauty market is intensely competitive, featuring a vast array of established global brands alongside a constant influx of nimble startups. This crowded landscape means companies like BWX Limited must continually innovate and differentiate themselves across skincare, haircare, and body care segments to capture consumer attention and market share.

In 2024, the global natural and organic personal care market was valued at approximately $60 billion, demonstrating significant growth potential but also highlighting the sheer volume of players vying for a piece of this expanding pie. This high number of competitors directly intensifies rivalry, putting pressure on pricing and requiring substantial marketing investment.

The natural and organic cosmetics market is booming, with projections showing it growing from $39.4 billion in 2024 to an impressive $69.8 billion by 2033. This robust expansion is a magnet for new companies and encourages existing players to ramp up their efforts, naturally leading to fiercer competition.

Consumers are increasingly prioritizing health and sustainability, fueling this market's upward trajectory. This shift in consumer preference is a significant driver for both established brands and emerging businesses to innovate and capture a larger share of this attractive, growing sector.

Competitive rivalry in the beauty sector, including for companies like BWX, is significantly fueled by product differentiation. Brands actively compete by highlighting unique formulations, obtaining certifications for ethical sourcing or efficacy, and showcasing commitment to sustainable practices. This drive for distinctiveness is a key battleground for market share.

While the pace of truly novel product introductions in the beauty industry experienced a slowdown in 2024, this hasn't diminished competitive intensity. Instead, companies are strategically focusing on reformulations of existing popular products and developing line extensions. These tactics aim to refresh brand appeal and maintain customer engagement without the higher risk and cost associated with entirely new product development.

Brand Loyalty and Marketing Intensity

Brand loyalty in the natural beauty industry is a hard-fought battle, demanding substantial marketing spend and a deep understanding of consumer values. Companies like BWX, with established brands, pour resources into connecting with eco-conscious consumers who often seek ethical and socially responsible products.

The intensity of marketing efforts directly correlates with a company's ability to foster and maintain brand loyalty. For instance, in 2023, the global beauty market saw significant investment in digital marketing and influencer collaborations, with brands actively promoting their sustainability initiatives to attract and retain customers. This competitive pressure means that companies must consistently innovate and communicate their brand's purpose to stand out.

- Marketing Spend: Brands in the natural beauty sector often allocate a substantial portion of their budget to marketing, with some estimates suggesting it can range from 15-25% of revenue to build and sustain brand awareness.

- Consumer Values: A 2024 consumer survey indicated that over 60% of beauty purchasers consider a brand's ethical sourcing and environmental impact when making a purchase decision.

- Brand Equity: Strong brand loyalty can translate into premium pricing power and reduced price sensitivity, allowing companies to weather competitive pressures more effectively.

- Digital Engagement: Companies are increasingly leveraging social media and content marketing to build community and engage consumers directly, fostering a sense of shared values.

Diverse Distribution Channels

BWX Limited faces intense competition due to its diverse distribution channels. The company's products are available through traditional retail stores, pharmacies, and a rapidly expanding online marketplace. This multi-channel approach means BWX must vie for consumer attention and shelf space across various platforms, increasing the competitive pressure.

The surge in e-commerce, in particular, has lowered barriers to entry for new competitors and amplified the reach of existing ones. For instance, in 2024, online sales for beauty and personal care products continued their upward trajectory, with many smaller, direct-to-consumer brands leveraging digital channels to directly challenge established players like BWX. This accessibility means brands are no longer just competing on product quality but also on their ability to navigate and optimize across these varied retail landscapes.

- Traditional Retail: BWX competes with numerous brands for limited shelf space in physical stores, requiring strong relationships with retailers and effective in-store marketing.

- Pharmacies: The pharmacy channel often involves competing on efficacy, trust, and specific product benefits, with brands like CeraVe and La Roche-Posay demonstrating strong performance in 2024.

- Online Retailing: The digital space is highly dynamic, with brands needing robust e-commerce strategies, digital advertising, and efficient logistics to stand out. In 2024, online beauty sales represented a significant portion of the total market, estimated to be over 30% in many developed economies.

The competitive rivalry within the natural and organic beauty market is extremely high, characterized by a vast number of players, from global giants to emerging startups.

This intense competition forces companies like BWX to constantly innovate and differentiate their offerings, impacting pricing strategies and requiring significant marketing investment, with the global natural and organic personal care market valued at around $60 billion in 2024.

The market’s projected growth, from $39.4 billion in 2024 to $69.8 billion by 2033, attracts new entrants and intensifies existing players’ efforts, making brand loyalty a critical but costly battleground, often involving substantial digital marketing spend.

| Factor | Description | Impact on BWX |

|---|---|---|

| Market Saturation | Numerous established and new brands compete in the natural beauty space. | Requires continuous innovation and marketing to gain and maintain market share. |

| Product Differentiation | Emphasis on unique formulations, certifications, and sustainability. | BWX must clearly communicate its unique selling propositions to stand out. |

| Marketing & Brand Loyalty | High marketing spend needed to build and sustain brand awareness and customer loyalty. | Significant investment required in digital marketing and communicating brand values. |

| Distribution Channels | Competition across traditional retail, pharmacies, and online platforms. | BWX needs optimized strategies for each channel to capture consumer attention. |

SSubstitutes Threaten

Traditional, non-personalized skincare products represent a substantial threat to companies like BWX, which often focus on natural or specialized formulations. These readily available alternatives, found in mass-market drugstores and online, typically come with lower price tags. For instance, the global mass skincare market, valued at billions, offers a vast array of options that can satisfy basic consumer needs, potentially drawing customers away from premium or niche natural products.

The threat of substitutes for BWX Limited's products, particularly in the skincare and wellness sectors, is amplified by the growing popularity of DIY and natural remedies. Consumers are increasingly exploring homemade concoctions and readily available natural ingredients as alternatives to commercially produced goods. This trend is driven by a desire for cost savings and a preference for chemical-free options, even if the perceived efficacy might not always match that of scientifically formulated products.

In 2024, the global natural and organic personal care market was valued at approximately $59.3 billion, indicating a significant consumer shift towards natural alternatives. This segment is expected to continue its upward trajectory, posing a direct challenge to established brands like BWX. For instance, the accessibility of ingredients like aloe vera, honey, and essential oils allows consumers to create their own skincare treatments at home, bypassing the need to purchase specialized products.

The expansion of personalized beauty products into haircare and fragrance, beyond just skincare, significantly broadens the threat of substitutes. Consumers increasingly desire tailored solutions across their entire beauty regimen, not just for their skin. This diversification means that a brand focusing solely on natural organic skincare might see customers shifting their spending to personalized haircare or fragrance options that offer a similar bespoke experience.

Beauty Dupes and Affordable Alternatives

The rise of 'beauty dupes' significantly heightens the threat of substitutes for companies like BWX. These affordable alternatives offer consumers similar product performance at a fraction of the cost, making premium beauty more accessible. For instance, the global beauty and personal care market was valued at approximately $511 billion in 2023, with a substantial portion driven by innovation and brand loyalty, both of which are challenged by the dupe trend.

This trend forces BWX to continuously differentiate its offerings and reinforce its unique selling propositions to justify premium pricing. Consumers are increasingly savvy about ingredient efficacy and performance, readily switching to less expensive options if the perceived value is comparable. This dynamic puts pressure on brand loyalty and necessitates a strong focus on product innovation and demonstrable quality.

The accessibility of dupes means BWX must work harder to communicate its brand story, ingredient sourcing, and manufacturing standards.

- Growing popularity of 'beauty dupes' directly challenges premium pricing strategies.

- Increased accessibility of quality beauty products pressures BWX's value proposition.

- Consumer focus on performance over brand name amplifies substitution risk.

- The global beauty market's size highlights the significant financial impact of this trend.

Wellness-Centric Lifestyles

The growing trend towards wellness-centric lifestyles acts as a significant substitute threat for traditional beauty product companies. Consumers are increasingly viewing internal health and nutrition as the primary drivers of beauty, potentially diminishing their need for external cosmetic solutions. This shift emphasizes a holistic approach where diet, exercise, and mental well-being are prioritized, offering an indirect but potent alternative to conventional beauty routines.

This evolving consumer mindset means that spending on supplements, organic foods, and fitness programs could divert funds previously allocated to skincare and makeup. For example, the global wellness market was valued at approximately $5.6 trillion in 2023, with significant growth projected in areas directly impacting internal health. This suggests a substantial portion of consumer budgets could be reallocated away from beauty products.

- Holistic Health Focus: Consumers are prioritizing internal wellness, seeing it as the foundation for external beauty.

- Dietary and Nutritional Alternatives: Increased investment in healthy eating and supplements offers a substitute for topical beauty treatments.

- Market Diversion: The expanding wellness industry, valued in trillions, presents a significant channel for consumer spending that bypasses traditional beauty markets.

- Shifting Perceptions: Beauty is increasingly defined by overall health rather than solely by cosmetic applications.

The proliferation of affordable, high-performing beauty alternatives, often termed 'dupes,' presents a significant substitute threat. These products mimic the efficacy and sensory experience of premium brands at a lower price point, directly challenging BWX's value proposition. In 2023, the global beauty and personal care market reached approximately $511 billion, with a notable portion of this growth fueled by accessible innovation that dupe products capitalize on.

Consumers are increasingly discerning, prioritizing demonstrable performance and ingredient efficacy over brand prestige alone. This shift means that if BWX's products do not clearly articulate and deliver superior value, consumers may readily switch to more economical substitutes. The accessibility of these dupes pressures BWX to continuously innovate and reinforce its unique selling propositions to justify its pricing structure.

The growing emphasis on wellness and internal health also acts as a substitute. Consumers are redirecting spending towards supplements, organic foods, and fitness, viewing these as foundational to beauty. The global wellness market, estimated at $5.6 trillion in 2023, highlights the substantial financial reallocation away from traditional beauty expenditures.

BWX must therefore emphasize its product differentiation, ingredient quality, and brand story to maintain customer loyalty and justify premium pricing in a market increasingly influenced by accessible alternatives and a holistic approach to well-being.

Entrants Threaten

The natural beauty market, while expanding, presents a significant hurdle for new entrants due to the formidable brand loyalty commanded by established players. Brands that have cultivated trust and recognition over years, such as those previously under BWX's umbrella, create a substantial barrier to entry. Newcomers must invest heavily in marketing and product development to even begin building a comparable reputation in this competitive landscape.

Setting up manufacturing facilities, particularly those focused on sustainable and ethical production, demands significant capital. For instance, BWX's investment in a new factory in 2024 to boost efficiency and supply chain oversight highlights these substantial upfront costs.

New entrants face a considerable hurdle due to the high initial investment needed for production and building a reliable distribution network. This capital intensity can deter potential competitors from entering the market, thereby reducing the threat.

The natural and organic beauty sector presents significant barriers to entry due to stringent regulatory hurdles and the necessity for third-party certifications. For instance, obtaining certifications like COSMOS or USDA Organic requires substantial investment in time and resources, which can deter new companies.

These certifications are crucial for validating 'natural' or 'organic' claims, building consumer trust. In 2024, the global organic beauty market was valued at approximately $25 billion, with a projected compound annual growth rate of over 8% through 2030, underscoring the importance of these credentials for market access and credibility.

Access to Raw Materials and Supply Chain

New entrants in the natural and organic sector face significant hurdles in securing reliable access to high-quality raw materials. Established companies often leverage long-term contracts and strong supplier relationships, creating a competitive disadvantage for newcomers. For instance, in 2024, the global organic food market saw continued growth, but this also intensified competition for premium ingredients, with some key commodities experiencing price increases of 5-10% due to demand outstripping supply.

These supply chain challenges can directly impact a new entrant's ability to scale operations and maintain consistent product quality. Potential disruptions, such as adverse weather events affecting crop yields or geopolitical issues impacting global trade, further exacerbate these difficulties. By 2025, projections indicate that the cost of certain organic certifications and sustainably sourced ingredients could rise further, making initial market entry more capital-intensive.

- Sourcing Challenges: New entrants struggle to secure consistent, high-quality organic ingredients, often facing higher prices than established competitors.

- Supplier Relationships: Existing players benefit from entrenched supplier partnerships, limiting access for newcomers.

- Cost Pressures: Rising ingredient costs, exacerbated by supply chain volatility, increase the barrier to entry in 2024 and beyond.

Marketing and Consumer Education Costs

The threat of new entrants in the natural and organic beauty sector, specifically for brands like BWX, is significantly influenced by the substantial marketing and consumer education costs required. New players must invest heavily to build brand recognition and clearly communicate their natural and organic value proposition. This is particularly challenging given widespread consumer skepticism due to prevalent greenwashing claims.

Consumers today are more discerning and demand verifiable proof of product claims, making education a critical component of market entry. For instance, in 2024, the global beauty market saw continued growth in the natural and organic segment, but also increased scrutiny on ingredient sourcing and sustainability claims. Brands failing to adequately educate consumers on their unique selling points and ethical practices face an uphill battle.

- Marketing Investment: New entrants must allocate significant budgets to digital marketing, influencer collaborations, and traditional advertising to cut through the noise.

- Consumer Education: Explaining the benefits of specific natural ingredients and the brand's commitment to sustainability requires ongoing communication efforts.

- Greenwashing Concerns: Overcoming consumer distrust demands transparency and robust certifications, adding to the cost of building credibility.

- Competitive Landscape: Established brands already possess significant brand equity, making it harder for newcomers to capture market share without substantial marketing spend.

The threat of new entrants into the natural beauty market is tempered by high capital requirements for manufacturing and distribution, alongside the significant investment needed for marketing and consumer education. Additionally, stringent regulatory requirements and the necessity for third-party certifications, such as COSMOS, create substantial barriers. Established brands benefit from existing supplier relationships and brand loyalty, making it difficult for newcomers to compete on price or trust.

| Barrier Type | Description | Estimated Impact (2024 Data) |

|---|---|---|

| Capital Investment | Setting up production facilities and distribution networks. | Millions to tens of millions USD. |

| Brand Loyalty & Marketing | Building consumer trust and recognition against established players. | Significant marketing spend required, potentially 15-25% of revenue. |

| Regulatory & Certification | Meeting stringent standards and obtaining organic/natural certifications. | Time and resource intensive, potentially adding 5-10% to initial costs. |

| Supplier Relationships | Securing access to high-quality, sustainably sourced ingredients. | Established players may have preferential pricing and access, impacting newcomer costs by 5-10% for key ingredients. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from financial reports, industry-specific market research, and publicly available company disclosures to provide a comprehensive view of competitive dynamics.