BuzzFeed Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BuzzFeed Bundle

BuzzFeed's media empire faces a dynamic landscape shaped by intense competition and evolving audience habits. Understanding the forces at play, like the bargaining power of advertisers and the constant threat of new digital platforms, is crucial for navigating this space. We've identified key pressures influencing BuzzFeed's profitability and strategic direction.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore BuzzFeed’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of individual content creators and journalists working with BuzzFeed is typically quite low. This is largely because there's an abundance of talent available, and the prevalent gig economy model allows BuzzFeed to easily tap into a broad network of contributors. This widespread availability means that no single creator holds significant leverage.

However, this dynamic can shift for creators who possess unique expertise or a substantial, engaged following. If a journalist breaks significant news or a content creator has a distinct niche audience that aligns perfectly with BuzzFeed's strategic goals, their individual bargaining power can increase considerably. This is especially true if BuzzFeed views them as essential for a particular content vertical or campaign.

Looking ahead, the increasing integration of artificial intelligence in content generation poses a potential threat to the bargaining power of generic content creators. As AI tools become more sophisticated in producing articles, summaries, and even creative content, the demand for human creators focused on more routine tasks might diminish, further concentrating power with those offering truly unique value.

Technology and software providers, especially those offering core cloud hosting, content management systems, and advertising technology, hold considerable sway over companies like BuzzFeed. The cost and complexity of migrating away from these essential services, known as switching costs, can be quite high, creating a degree of reliance on existing vendors.

For instance, a significant shift in cloud infrastructure could disrupt operations and incur substantial expenses. While the prevalence of modular software and the increasing availability of open-source options offer some flexibility, the foundational nature of these technological components means suppliers often maintain a moderate to high level of bargaining power.

Digital advertising technology (Ad-Tech) platforms, including programmatic advertising and ad exchanges, wield considerable power over BuzzFeed. These platforms are foundational to BuzzFeed's revenue generation, acting as the conduits for ad delivery and monetization.

The proprietary algorithms and data insights these ad-tech providers offer are critical for maximizing advertising income. Consequently, BuzzFeed's financial performance is significantly tied to the terms and functionalities negotiated with these essential partners.

For instance, in 2023, programmatic advertising accounted for a substantial portion of digital ad spend globally, with the market projected to reach over $400 billion by 2024. This dominance underscores the leverage held by the platforms facilitating these transactions.

BuzzFeed's reliance on these Ad-Tech providers means that changes in their pricing structures, data access policies, or platform capabilities can directly impact BuzzFeed's ability to generate revenue and manage its operational costs effectively.

Data Analytics and AI Tool Developers

BuzzFeed's increasing reliance on sophisticated data analytics and AI tools for audience insights and content generation significantly amplifies the bargaining power of suppliers in this sector. Companies providing these specialized solutions, particularly those with advanced generative AI capabilities, can command higher prices due to the critical competitive edge they offer. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, reflecting the high demand and value placed on these technologies.

The concentration of expertise in developing these advanced tools means fewer providers can offer them, potentially leading to vendor lock-in. This situation can restrict BuzzFeed's flexibility and increase its dependency on specific suppliers. The cost of acquiring and integrating these powerful platforms can become a substantial operational expense, directly impacting BuzzFeed's profitability.

- High Demand for AI: The global AI market is experiencing rapid growth, with significant investments in generative AI in 2024.

- Concentrated Expertise: A limited number of developers possess the specialized knowledge to create cutting-edge AI and data analytics tools.

- Vendor Lock-in Risks: Dependence on proprietary AI platforms can create switching costs and reduce negotiation leverage for BuzzFeed.

- Increased Operational Costs: The acquisition and maintenance of advanced analytics and AI solutions contribute to higher operating expenses.

Licensing and Syndication Partners

For BuzzFeed's licensing and syndication partners, their bargaining power hinges on the exclusivity and demand for the content they supply. If BuzzFeed needs unique or highly sought-after content from a specific partner, that partner gains leverage. This could mean they can negotiate higher licensing fees or more favorable revenue-sharing terms.

Consider the scenario where a particular content creator or a niche media outlet provides BuzzFeed with content that is crucial for attracting a specific audience segment. In such cases, the supplier's bargaining power increases significantly. For instance, if a viral video creator grants BuzzFeed exclusive rights to their content for a limited time, they can demand a premium.

Conversely, when the content available for licensing or syndication is abundant and easily accessible from multiple sources, the bargaining power of individual suppliers diminishes. BuzzFeed can then source similar content from various providers, allowing them to negotiate lower prices or less restrictive terms. This dynamic is particularly relevant for less unique or more commoditized forms of digital content.

- Exclusivity Drives Power: Suppliers of unique or exclusive content to BuzzFeed possess greater bargaining power.

- Demand Dictates Terms: High demand for a supplier's content allows them to command higher fees and better terms.

- Abundance Weakens Leverage: Readily available content from multiple sources reduces the bargaining power of individual suppliers.

- Strategic Importance: Content vital for specific audience engagement enhances a supplier's negotiating position.

The bargaining power of suppliers for BuzzFeed, particularly in the realm of technology and data, is significant. Companies providing essential cloud infrastructure, content management systems, and advanced AI and data analytics tools hold considerable sway. This is due to high switching costs and the specialized nature of these services. For instance, the global AI market was projected to exceed $200 billion in 2024, highlighting the immense value and demand for these technologies.

Digital advertising technology (Ad-Tech) platforms also exert substantial influence. As a primary revenue driver for BuzzFeed, these platforms, which facilitated over $400 billion in programmatic ad spend globally by 2024, have leverage. Changes in their pricing or capabilities directly impact BuzzFeed's financial health.

| Supplier Type | Bargaining Power Factor | Impact on BuzzFeed | Example Data (2024 Projections/Estimates) |

|---|---|---|---|

| Tech Infrastructure (Cloud, CMS) | High Switching Costs, Essential Services | Reliance, Potential Cost Increases | Cloud computing market expected to grow significantly |

| Ad-Tech Platforms | Revenue Criticality, Proprietary Tech | Dependency on Terms, Revenue Volatility | Global programmatic ad spend projected over $400 billion |

| Data Analytics & AI Tools | Specialized Expertise, Competitive Edge | High Acquisition Costs, Vendor Lock-in Risk | Global AI market projected to exceed $200 billion |

What is included in the product

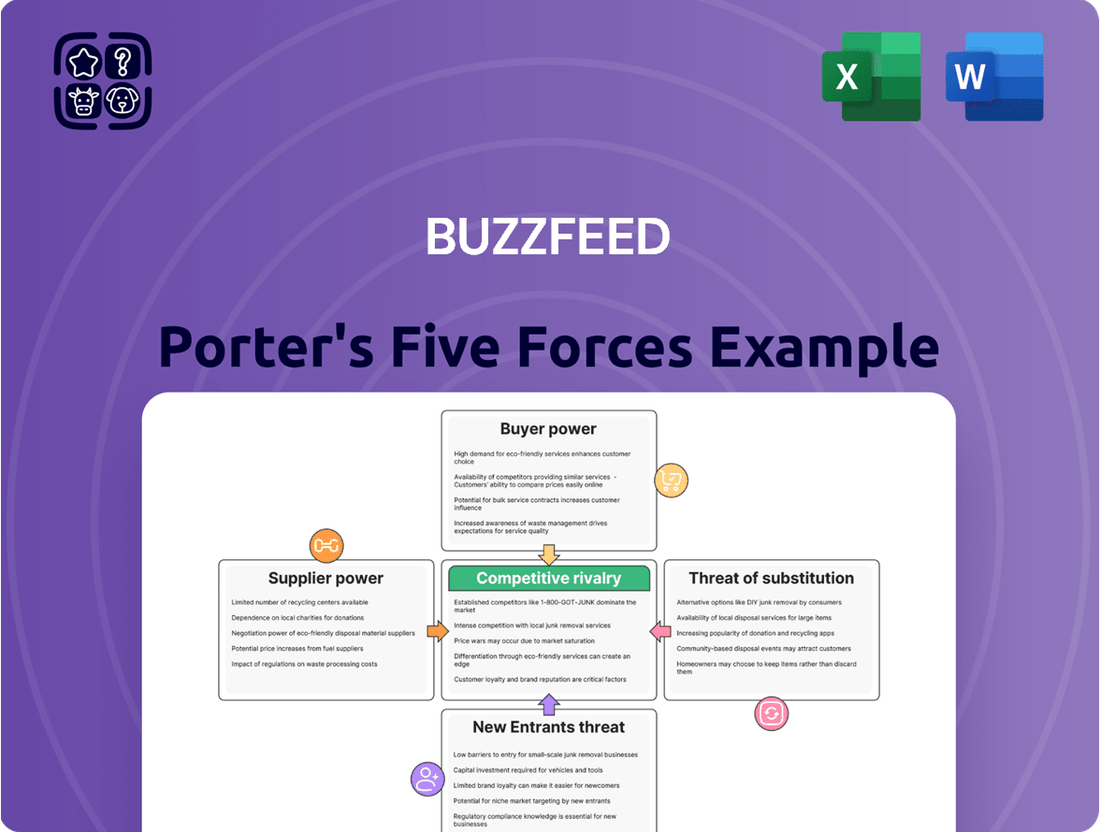

Analyzes BuzzFeed's competitive environment by examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the digital media landscape.

Instantly identify competitive threats and opportunities with a visual breakdown of each of Porter's Five Forces, making complex strategic analysis accessible.

Customers Bargaining Power

Direct-sold advertisers, especially major brands, wield considerable bargaining power. Their substantial ad budgets and the abundance of alternative digital advertising platforms allow them to negotiate favorable pricing and demand precise audience targeting. These advertisers leverage their spending volume to secure better terms and require demonstrable return on investment, putting pressure on BuzzFeed to deliver value.

While programmatic advertising streamlines negotiations, significant ad buyers still wield substantial influence due to their aggregated demand across multiple platforms. This allows them to shift spending towards networks offering better value, compelling BuzzFeed to maintain competitive programmatic ad rates and high-quality inventory to secure bids.

BuzzFeed's strategic focus on programmatic advertising is evident in its growth, with this channel seeing an increase in Q1 2025. Large advertisers can leverage their ability to optimize programmatic spend across various ad exchanges and publishers, thereby exerting downward pressure on pricing and demanding demonstrable ROI from platforms like BuzzFeed.

Individual content consumers wield significant power, largely fueled by the sheer volume of readily accessible free content online. This makes switching between platforms effortless, allowing them to directly influence which content becomes popular and impacts key engagement metrics that advertisers rely on. In 2023, social media platforms saw average daily time spent by users exceeding 150 minutes, highlighting the competition for audience attention.

E-commerce Partners and Affiliates

For BuzzFeed's commerce segment, e-commerce platforms and affiliate networks wield significant bargaining power. Their extensive market reach and ability to set commission rates directly influence BuzzFeed's revenue streams from affiliate marketing. While BuzzFeed leverages these partners for infrastructure and access to vast consumer bases, these external entities can adjust terms, impacting profitability. This dynamic is crucial as BuzzFeed's commerce revenue saw a notable increase, indicating a complex but evolving relationship with these powerful partners.

- Market Reach: Major e-commerce platforms and affiliate networks offer access to millions of potential buyers, a critical asset for BuzzFeed's affiliate sales.

- Commission Structures: These partners dictate the percentage of sales revenue BuzzFeed earns, directly affecting the profitability of its commerce operations.

- Infrastructure Dependence: BuzzFeed relies on partner platforms for transaction processing and customer data, creating a degree of dependence.

- Negotiating Power: Due to their market dominance, these partners often have the upper hand in negotiating commission rates and terms.

Social Media Platforms

Social media platforms like Meta (Facebook, Instagram) and TikTok wield significant bargaining power over digital media companies such as BuzzFeed. These platforms act as crucial distribution channels, and their algorithms and policies directly impact content reach and monetization. In 2024, it's estimated that over 50% of digital ad spending flows through these major social networks, highlighting their dominance.

These platforms dictate the terms of engagement, often prioritizing their own ad revenue models, which can limit the direct financial benefit for content creators. For instance, changes to content visibility or ad revenue sharing can materially affect a company like BuzzFeed's top line. BuzzFeed's reported revenue for 2023 was $390 million, demonstrating the scale of operations dependent on these external forces.

- Platform Control: Social media giants set the rules for content visibility and monetization.

- Advertising Dominance: Over half of digital ad spend in 2024 is channeled through these platforms.

- Revenue Dependence: BuzzFeed's $390 million revenue in 2023 is influenced by platform policies.

- Mitigation Strategy: BuzzFeed aims to build direct audience relationships to lessen platform reliance.

Individual content consumers have substantial bargaining power due to the vast and easily accessible pool of free online content, enabling effortless platform switching and influencing content popularity. In 2023, users spent an average of over 150 minutes daily on social media, underscoring the intense competition for audience attention.

BuzzFeed's commerce segment faces powerful e-commerce platforms and affiliate networks that dictate commission rates and offer critical infrastructure, directly impacting revenue. These partners' market dominance often gives them the upper hand in negotiations, a dynamic evident as BuzzFeed's commerce revenue grew, reflecting this complex interdependence.

| Key Customer Group | Bargaining Power Drivers | Impact on BuzzFeed |

|---|---|---|

| Individual Content Consumers | Abundance of free content, ease of switching platforms | Influences content virality and advertiser appeal; demands engaging content |

| Major Advertisers | Large ad budgets, alternative platforms, demand for ROI | Negotiate favorable pricing, pressure on performance metrics |

| E-commerce Platforms/Affiliate Networks | Market reach, control over commission rates, infrastructure reliance | Dictate revenue share from commerce, influence profitability; require competitive terms |

What You See Is What You Get

BuzzFeed Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of BuzzFeed, detailing the competitive landscape and strategic positioning of the digital media giant. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain a thorough understanding of the industry's rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of substitute products. This insight is crucial for anyone looking to grasp BuzzFeed's market dynamics and competitive challenges.

Rivalry Among Competitors

The digital media arena is incredibly fragmented, a vast ecosystem populated by everything from established news organizations making the digital leap to entirely online-native publishers and even independent content creators. This sheer volume of players means competition is fierce, with everyone battling to capture audience eyeballs and a share of the advertising revenue pie. BuzzFeed finds itself in direct competition with this diverse array of entities for both user engagement and vital ad spending.

For instance, as of early 2024, the digital advertising market itself is highly contested. Companies like Google and Meta continue to dominate, but a significant portion of ad spend is also distributed across countless smaller publishers and platforms, making it a challenging environment for any single player to gain overwhelming market share. This broad distribution of advertising budgets directly impacts how effectively a company like BuzzFeed can monetize its content across various digital channels.

BuzzFeed navigates a fiercely competitive digital landscape, facing direct rivals like Vox Media, Vice Media, Mic Network, and Bustle Digital Group. These companies vie for the same audience attention and advertising dollars by offering comparable news, entertainment, and lifestyle content across various formats, including articles, videos, and interactive quizzes.

In 2023, the digital advertising market, a crucial revenue stream for BuzzFeed and its competitors, saw continued growth, though at varying paces. While specific revenue figures for each competitor's overlap with BuzzFeed are not publicly detailed, the overall market pressure remains high, forcing constant innovation in content creation and monetization strategies.

Social media platforms like TikTok, Meta, and YouTube are powerful rivals for publishers. They compete directly for user attention and advertising dollars by aggregating vast amounts of content, both user-generated and professional. This aggregation model offers creators direct monetization, making it harder for traditional publishers to retain talent and audience.

In 2024, the digital advertising market continued to see significant shifts. Social media platforms captured a substantial portion of ad spend, with Meta and Google (YouTube) being major beneficiaries. For instance, Meta's advertising revenue reached an estimated $130 billion in 2023, and YouTube's advertising revenue was around $31.5 billion, demonstrating their dominance in attracting advertiser budgets that publishers also target.

These platforms are not just distribution channels but content hubs themselves, offering creators tools to monetize their work directly. This can divert ad spending and audience engagement away from publisher-owned sites. By providing a comprehensive ecosystem for content creation, distribution, and monetization, social media platforms intensify competitive rivalry for publishers.

Traditional Media Companies Adapting Digitally

Legacy media giants, like Disney and Warner Bros. Discovery, are aggressively expanding their digital footprints, directly challenging BuzzFeed for online attention and advertising revenue. These established players leverage decades of brand recognition and substantial financial backing to invest heavily in streaming services, digital news platforms, and social media content. For instance, in 2024, many of these companies reported significant growth in their digital subscription numbers, directly competing with BuzzFeed's user acquisition efforts.

Their adaptation involves not just replicating content online but innovating with interactive formats and personalized experiences. This means BuzzFeed faces sophisticated competitors who can deploy large teams and advanced technology to capture audience engagement. The competitive intensity is amplified as these traditional players also seek to diversify their revenue streams beyond traditional advertising, mirroring BuzzFeed's own strategic goals.

- Legacy media's digital investment: Major networks and publishers are pouring billions into digital platforms, aiming to recapture lost audience share.

- Brand loyalty and resources: Established brands offer a built-in advantage, attracting users and advertisers with familiar names and significant financial capacity for content creation and marketing.

- Diversification strategies: Companies like Paramount Global are actively pursuing multi-platform content distribution, including ad-supported streaming, which directly competes with BuzzFeed's digital advertising model.

- Content innovation: Traditional media is increasingly producing short-form video and interactive content, areas where BuzzFeed has historically excelled, intensifying rivalry for digital eyeballs.

Impact of AI on Content Production and Efficiency

The competitive rivalry within the digital media landscape, including for companies like BuzzFeed, is significantly amplified by the rapid advancements in Artificial Intelligence (AI) for content creation and optimization. These AI tools are effectively lowering the barriers to entry for content production, allowing new and existing players to generate material at an unprecedented scale and speed. For instance, by mid-2024, many content platforms are reporting substantial increases in content output, sometimes by over 50%, due to AI-powered writing assistants and image generators.

This heightened efficiency directly translates into a more aggressive competitive environment. Companies that successfully integrate AI into their workflows can produce a greater volume of personalized or highly engaging content, thereby capturing audience attention and market share more effectively. This forces rivals, including BuzzFeed, to accelerate their own AI adoption strategies and invest in similar technologies to remain competitive. Failure to adapt can lead to a significant disadvantage in terms of content freshness, audience reach, and ultimately, revenue generation, as competitors leverage AI to deliver more targeted and timely content.

- AI-driven content generation: Tools like GPT-4 and similar models are enabling quicker production of articles, social media posts, and video scripts, increasing the sheer volume of content available.

- Personalization at scale: AI algorithms can tailor content to individual user preferences, making it more engaging and sticky, a key differentiator in a crowded market.

- Efficiency gains: AI can automate tasks like keyword research, content summarization, and even basic editing, freeing up human resources for more strategic creative work.

- Lower production costs: By reducing the time and human effort required for content creation, AI helps lower the operational costs for media companies.

Competitive rivalry for BuzzFeed is intense, stemming from a crowded digital media landscape populated by numerous online-native publishers, legacy media giants migrating online, and powerful social media platforms. These diverse players all vie for the same audience attention and a share of the digital advertising market, which is projected to reach over $1 trillion globally by 2025. The ability of competitors to rapidly produce content, often enhanced by AI, further intensifies this rivalry, forcing companies like BuzzFeed to continuously innovate in both content creation and monetization strategies to maintain market position.

SSubstitutes Threaten

Social media platforms represent a significant threat of substitutes for BuzzFeed. Users flock to platforms like TikTok and Instagram for entertainment and information, consuming content generated by friends, influencers, and creators. This user-generated content often directly competes with BuzzFeed's articles and quizzes, offering a personalized and readily available alternative.

By 2025, it's anticipated that over half of all advertising revenue tied to content will originate from social media channels. This indicates a strong shift in audience attention and advertiser spending away from traditional digital publishers towards these UGC-rich environments.

Individual content creators, such as YouTubers and podcasters, present a significant threat of substitutes. They can directly reach and monetize their audiences, bypassing intermediaries like BuzzFeed. For instance, by July 2024, many creators were leveraging platforms like Patreon and Substack, allowing them to build dedicated communities and offer exclusive content, directly competing for audience attention and ad revenue that might otherwise go to larger media companies.

The ability of these creators to produce highly specialized content, catering to niche interests with an authentic voice, offers a compelling alternative. This direct engagement fosters strong audience loyalty, a key factor that can draw users away from more generalized content platforms. In 2024, the creator economy continued its robust growth, with reports indicating millions of individuals earning a living wage solely from their online content creation, highlighting the scale of this competitive force.

For highly specific interests like niche cooking techniques or particular video game genres, specialized websites and online communities offer a powerful substitute for BuzzFeed's broader content. These platforms often cultivate deep expertise and a passionate user base, providing a level of detail and engagement that generalist sites may struggle to match.

For instance, dedicated gaming forums can offer exhaustive guides and real-time discussions that far surpass a general entertainment article on gaming trends. Similarly, highly specialized recipe sites or forums dedicated to specific diets can attract users seeking intricate culinary knowledge, acting as a direct substitute for BuzzFeed's lifestyle sections.

The threat here is significant because these specialized communities foster loyalty and provide a tailored experience. Users seeking in-depth information or a sense of belonging within a niche interest are likely to gravitate towards these platforms. As of early 2024, the online content landscape continues to fragment, with specialized communities seeing sustained growth in user engagement.

Streaming Services and On-Demand Video Platforms

Streaming services like Netflix and Disney+ present a significant threat of substitutes for BuzzFeed's content. These platforms offer a vast library of movies and TV shows, directly competing for consumers' leisure time and entertainment budgets. As of early 2024, the global streaming market is valued at over $200 billion, indicating the sheer scale of this alternative. While BuzzFeed focuses on short-form, interactive content, the accessibility and breadth of offerings from major streamers mean consumers can easily opt for these instead.

The rise of ad-supported tiers on many streaming platforms, including Netflix and Max, further intensifies this threat. This makes premium video content more accessible and directly competes with BuzzFeed's ad-supported revenue model. In 2023, ad revenue for streaming services saw substantial growth, with predictions suggesting it will continue to expand, drawing eyeballs away from digital publishers like BuzzFeed.

- Direct Competition: Subscription streaming services offer a broad range of video entertainment, directly vying for consumer attention against BuzzFeed's digital content.

- Leisure Time Allocation: Consumers have finite leisure hours, and the allure of binge-watching popular series on platforms like Amazon Prime Video can detract from time spent engaging with BuzzFeed's quizzes and articles.

- Evolving Business Models: The increasing adoption of ad-supported tiers by major streamers makes them a more accessible and direct substitute for BuzzFeed's ad-driven revenue streams.

- Market Size: The global video streaming market's multi-billion dollar valuation underscores the significant resources and consumer engagement captured by these substitute services.

Traditional Media (TV, Print, Radio) Adapting Digitally

Traditional media outlets like The New York Times and CNN have significantly expanded their digital footprints, offering a wide array of content. For instance, The New York Times reported over 10 million digital subscribers by the end of 2023, demonstrating a strong pivot to digital platforms.

These established players now provide podcasts, in-depth online articles, and live-streamed news, directly competing with digital-native platforms like BuzzFeed. Consumers looking for well-researched journalism or comprehensive news coverage may opt for these familiar, albeit digitized, sources.

- Digital Subscriptions: Major newspapers and broadcasters have seen substantial growth in digital subscriptions, with The Wall Street Journal also reporting robust digital gains, reaching over 3.5 million digital subscribers in early 2024.

- Content Diversification: Traditional media now offers podcasts, video content, and interactive articles, mirroring and sometimes surpassing the digital offerings of newer competitors.

- Brand Trust: Established media brands often carry a higher degree of perceived credibility for serious news, making them a strong substitute for content aggregators.

- Advertising Revenue Shift: While digital advertising revenue continues to grow, a significant portion of this spend is also flowing to these established media brands' digital platforms, indicating their continued relevance.

The threat of substitutes for BuzzFeed is amplified by the sheer volume and variety of entertainment and information available online. From short-form video on TikTok to in-depth articles from established news outlets, consumers have countless options for how they spend their digital attention.

The creator economy, in particular, represents a potent substitute, with millions of individuals now earning a living creating niche content and directly engaging with their audiences. By July 2024, platforms like Patreon and Substack enabled creators to build dedicated communities, bypassing intermediaries like BuzzFeed and siphoning off both audience attention and advertising revenue.

Furthermore, the massive growth of streaming services, with a global market valued over $200 billion by early 2024, offers an alternative leisure activity that directly competes for consumers' time and disposable income, especially with the increasing availability of ad-supported tiers.

| Substitute Category | Key Characteristics | Impact on BuzzFeed | 2024/2025 Data Point |

|---|---|---|---|

| Social Media Platforms (e.g., TikTok, Instagram) | User-generated content, short-form video, influencer marketing | Captures audience attention, shifts advertising spend | Over half of content-related ad revenue expected from social media by 2025 |

| Individual Content Creators (e.g., YouTubers, Podcasters) | Niche content, direct audience engagement, monetization via subscriptions/donations | Bypasses intermediaries, competes for loyalty and revenue | Millions earning a living wage from content creation in 2024 |

| Specialized Websites & Online Communities | Deep expertise, niche focus, strong community loyalty | Offers tailored experiences, attracts users seeking in-depth information | Sustained growth in user engagement for specialized communities in early 2024 |

| Streaming Services (e.g., Netflix, Disney+) | On-demand video content, diverse libraries, growing ad-supported tiers | Competes for leisure time and advertising revenue | Global streaming market valued over $200 billion by early 2024 |

| Traditional Digital Media (e.g., NYT, CNN) | Established brands, in-depth journalism, diversified digital offerings | Attracts users seeking credibility, competes for digital ad spend | The New York Times exceeded 10 million digital subscribers by end of 2023 |

Entrants Threaten

The barrier to entry for content creation is remarkably low, with accessible tools like blogging platforms, YouTube, and TikTok empowering individuals and small groups to produce and distribute content without significant investment. This ease of entry fosters a continuous stream of new creators, including niche players, directly impacting established companies.

In 2024, the digital content landscape continues to be flooded, with millions of new videos uploaded to YouTube daily and TikTok users generating billions of short-form videos. This sheer volume underscores the challenge for any platform or brand to capture audience attention amidst a sea of emerging creators.

New entrants can bypass traditional barriers to audience growth by utilizing social media platforms. These platforms offer immediate access to vast user bases, allowing new content creators to build significant followings rapidly. For instance, a viral TikTok trend or a popular Instagram reel can garner millions of views overnight, directly competing for user attention that might otherwise be directed towards established platforms like BuzzFeed.

The rise of AI-powered content generation is a significant threat to new entrants in the digital publishing space. Tools like OpenAI's DALL-E 3 and Google's Imagen can now create sophisticated images, while advanced language models can churn out articles, scripts, and marketing copy with remarkable speed. This dramatically lowers the initial investment and expertise needed to launch a content-heavy platform.

For instance, by mid-2024, many smaller digital media outlets were reporting significant cost savings on content creation by integrating AI tools, allowing them to scale operations much faster than traditional methods. This ease of production means that a surge of new, low-cost content providers could easily enter the market, intensifying competition for audience attention and advertising revenue.

High Costs of Scale and Monetization

While it's relatively simple for anyone to start creating content online, scaling a digital media operation to the magnitude of BuzzFeed presents substantial hurdles for newcomers. The sheer capital needed to build a diverse content library, maintain a global presence, and develop a sophisticated advertising infrastructure is immense.

New entrants face significant barriers in establishing a robust ad sales force, investing in proprietary technology, and cultivating the brand recognition and trust that BuzzFeed already commands. These factors collectively represent high costs of scale and monetization, making it difficult for new, large-scale competitors to emerge and effectively compete.

- Significant Capital Investment: Building a media company with BuzzFeed's reach and content diversity requires substantial upfront and ongoing financial resources for content creation, technology development, and marketing.

- Advertising Infrastructure: Establishing a sophisticated ad sales team and the necessary technology to support programmatic advertising and direct sales is a complex and costly undertaking.

- Brand Trust and Recognition: New entrants must invest heavily in building brand credibility and audience loyalty, a process that takes considerable time and resources.

- Economies of Scale: Established players like BuzzFeed benefit from economies of scale in content production, distribution, and advertising sales, which can offer cost advantages to new competitors.

Difficulty in Building Brand Trust and Audience Loyalty

For new entrants in the content space, establishing brand trust and cultivating audience loyalty is a significant hurdle. In today's crowded digital landscape, capturing attention and retaining viewers requires more than just good content; it demands a consistent, reliable presence that builds confidence over time.

BuzzFeed, having been a prominent player for years, benefits immensely from its established brand recognition. This history translates into an inherent level of trust with its audience, making it easier to launch new initiatives or maintain engagement. Newcomers often find it difficult to break through the sheer volume of content available, facing an uphill battle to achieve the same level of audience connection and repeat viewership that established brands enjoy.

- Brand Equity Advantage: BuzzFeed's long-standing presence in the digital media industry has allowed it to build substantial brand equity.

- Audience Inertia: Existing audiences are often hesitant to switch to new platforms or content creators without a compelling reason, favoring familiarity.

- Content Saturation: The sheer volume of content available in 2024 makes it incredibly difficult for new entrants to stand out and gain traction.

While the ease of digital content creation lowers initial barriers, scaling a media operation to compete with established players like BuzzFeed requires substantial capital. Building a diverse content library, global presence, and sophisticated advertising infrastructure demands immense financial resources, making it challenging for newcomers to achieve economies of scale and brand recognition. By mid-2024, many smaller outlets leveraged AI to reduce content creation costs, but replicating BuzzFeed's established brand trust and ad sales infrastructure remains a significant hurdle.

| Barrier | Description | 2024 Relevance |

|---|---|---|

| Capital Investment | Significant funds needed for content, tech, and marketing. | AI tools reduce content creation costs, but scaling infrastructure remains capital-intensive. |

| Advertising Infrastructure | Developing ad sales teams and programmatic technology. | New entrants struggle to match the scale and sophistication of established ad tech. |

| Brand Trust & Recognition | Building audience loyalty and credibility takes time. | BuzzFeed's established brand equity provides an advantage against new, unproven entrants. |

| Economies of Scale | Cost advantages from large-scale production and distribution. | New entrants face higher per-unit costs compared to established players. |

Porter's Five Forces Analysis Data Sources

Our BuzzFeed Porter's Five Forces analysis is built upon a foundation of data from company investor relations sites, competitor announcements, and industry research reports. We also leverage market share data and news articles to thoroughly assess competitive dynamics.