BuzzFeed Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BuzzFeed Bundle

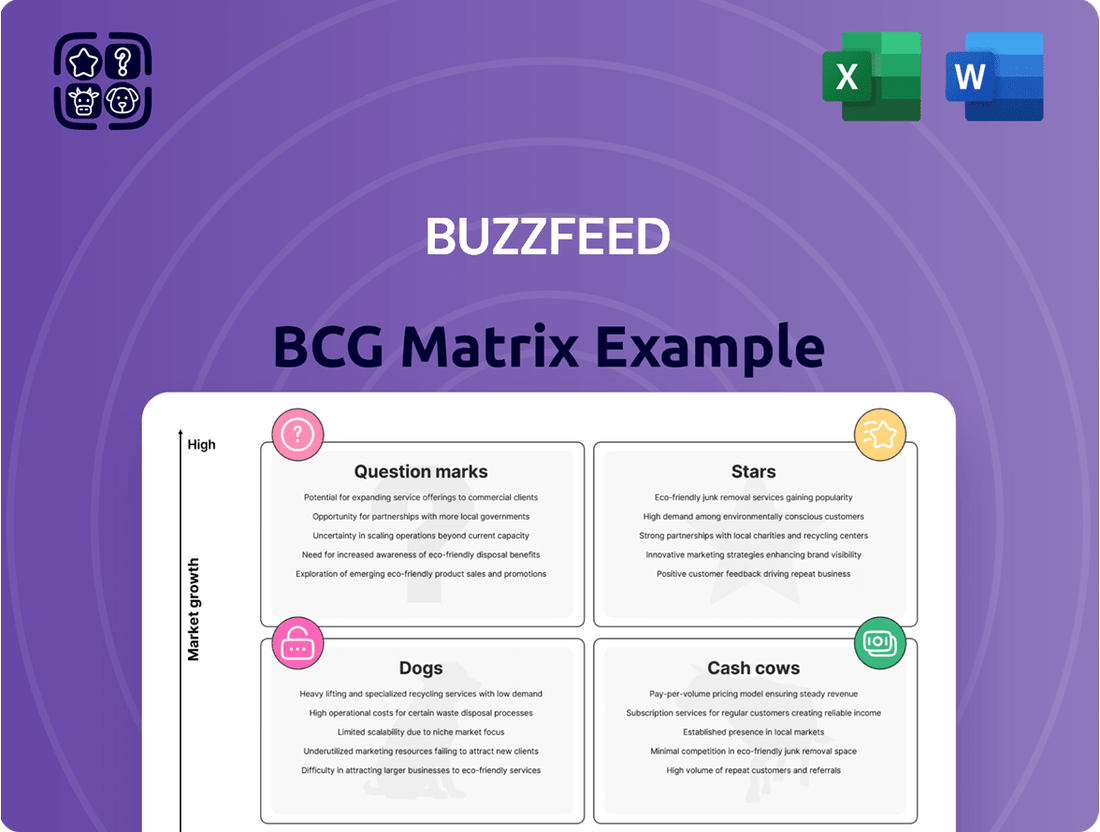

Curious about BuzzFeed's product portfolio? Our BCG Matrix preview reveals the landscape of their content, from potential Stars to established Cash Cows. Understanding this is key to their future growth and profitability.

But what about the nuanced strategies needed to navigate each quadrant? This glimpse is just the tip of the iceberg.

Purchase the full BuzzFeed BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Get the full report to gain a clear view of where BuzzFeed's products stand—Stars, Cash Cows, Dogs, or Question Marks.

This is your shortcut to competitive clarity in the fast-evolving digital media space.

Stars

Affiliate commerce represents a significant growth engine for BuzzFeed, driven by its ability to leverage content for product recommendations. In 2024, this sector saw a robust 23% revenue increase, a trend that has continued into the first quarter of 2025, underscoring its importance.

This revenue stream is characterized by its high margins and reliance on technology, making it a strategic focus for the company. BuzzFeed's success during major shopping events, such as Amazon Prime Days, highlights its strong position in content-driven e-commerce and its considerable potential for future expansion.

BuzzFeed is heavily investing in AI to sharpen its technology and advertising efforts. This strategic move is designed to boost audience interaction and the effectiveness of its content. The company reported a 25% increase in pageviews directly attributed to AI implementation, highlighting AI as a key driver of growth and personalization in the content space.

Programmatic advertising is a bright spot for BuzzFeed, showing resilience amidst broader advertising headwinds. While overall ad revenue faced pressures, this tech-driven channel has remained relatively flat or even seen slight growth. BuzzFeed is actively leaning into programmatic, recognizing it as a high-margin revenue stream that leverages their digital expertise. This strategic focus underscores their commitment to this segment, where they appear to hold a solid market position. Indeed, programmatic ad revenue saw an increase in Q1 2025, highlighting its current momentum and future promise within the digital advertising landscape.

Core Viral Entertainment Content (Quizzes, Listicles)

BuzzFeed's core viral entertainment content, particularly its quizzes and listicles, continues to be a powerful driver of audience engagement. In 2024, BuzzFeed.com remained a top destination for time spent by younger demographics like Gen Z and Millennials. These formats are designed for high shareability, ensuring broad reach and sustained interest in the casual digital entertainment sector.

The enduring popularity of these content types highlights BuzzFeed's ability to capture and hold attention in a competitive digital landscape. They represent a significant portion of BuzzFeed's market share within engaging, easily digestible online content.

- High Engagement: BuzzFeed’s quizzes and listicles consistently achieve high user interaction rates.

- Audience Reach: These formats are highly shareable, expanding reach across social platforms.

- Demographic Strength: BuzzFeed excels in capturing time spent among Gen Z and Millennial audiences with this content.

- Market Position: This content solidifies BuzzFeed's position in the casual, viral digital entertainment market.

Tasty Brand Content

Tasty Brand Content

Tasty, BuzzFeed's food content powerhouse, commands a vast global audience and exceptional engagement, primarily through its highly popular cooking videos. This strong performance solidifies Tasty's position as a dominant force within the digital food content landscape, consistently attracting a substantial viewership. In 2024, Tasty continued to leverage its extensive reach, with its social media channels amassing hundreds of millions of followers and billions of video views annually, demonstrating its market leadership.

Despite potential fluctuations in broader content revenue for its parent company, Tasty's robust brand recognition and loyal fan base translate into a high market share within its specific niche. This dedicated audience provides a fertile ground for continued growth and monetization opportunities. For instance, Tasty's branded merchandise and licensing deals have shown consistent revenue streams, underscoring its commercial viability.

- Market Dominance: Tasty consistently ranks among the top food content creators globally.

- Audience Engagement: Billions of video views across platforms in 2024 highlight deep audience connection.

- Brand Strength: High recognition and a dedicated following support its position as a market leader.

- Growth Potential: Monetization through merchandise and licensing indicates a strong future outlook.

Stars in the BCG Matrix represent high-growth, high-market-share products or business units. For BuzzFeed, its core viral entertainment content, like quizzes and listicles, and the Tasty brand clearly fit this category. These segments demonstrate strong audience engagement and market leadership, showing significant growth potential.

BuzzFeed's affiliate commerce is also a prime example of a Star, with its substantial revenue growth and high margins. The company's investment in AI to enhance content and advertising further solidifies its position in this high-growth, high-share quadrant. Programmatic advertising, while perhaps not a Star in terms of explosive growth, is a resilient and strategically important segment showing positive momentum.

| Business Segment | Market Growth | Market Share | BuzzFeed's Position |

| Viral Entertainment Content (Quizzes, Listicles) | High | High | Star |

| Tasty Brand Content | High | High | Star |

| Affiliate Commerce | High (23% in 2024) | High | Star |

| Programmatic Advertising | Moderate to High | High | Star / Question Mark (depending on specific sub-segments and future growth trajectory) |

What is included in the product

BuzzFeed's BCG Matrix offers a strategic view of its content verticals, guiding investment and resource allocation.

BuzzFeed's BCG Matrix offers a clear, visual snapshot of its portfolio, alleviating the pain of deciphering complex business performance.

Cash Cows

Traditional direct-sold advertising has long been a cornerstone of BuzzFeed's revenue. In 2023, this segment, while still present, saw a continued strategic pivot away from it due to its lower profit margins. BuzzFeed's focus is increasingly on higher-margin digital advertising and other revenue-generating avenues.

HuffPost, now part of BuzzFeed, stands as a prominent global media entity, recognized for its extensive coverage of news, politics, and lifestyle. Its established brand presence and broad audience reach solidify its position in the market.

Although it experienced workforce adjustments in 2025 and navigates a fiercely competitive media environment, HuffPost continues to draw a considerable readership. This sustained audience engagement translates into consistent traffic and advertising income, making it a dependable source of revenue.

In 2024, digital advertising revenue for news media continued to be a significant, albeit competitive, sector. HuffPost's ability to maintain its audience in this landscape underscores its role as a mature asset within BuzzFeed's portfolio, contributing steadily to overall financial performance.

BuzzFeed's legacy evergreen video content, like its popular Tasty cooking tutorials, acts as a classic cash cow. This older content continues to attract significant viewership and ad revenue on platforms such as YouTube and Facebook, demonstrating sustained audience engagement. For instance, Tasty's YouTube channel alone boasts billions of views across its extensive catalog of recipes and food hacks.

While the cost of producing new viral content can be high and uncertain, these established videos require very little ongoing investment to maintain. This means the revenue generated from their existing audience base is largely profit, providing a consistent and predictable cash flow for BuzzFeed from a mature segment of its media offerings.

Licensing and Syndication of Established Content

BuzzFeed's licensing and syndication of its established content functions as a classic cash cow within its business model. This strategy capitalizes on the extensive library of popular articles, quizzes, and videos that have already resonated with audiences. By licensing this content, BuzzFeed can generate revenue from its existing intellectual property, essentially earning from assets that have minimal ongoing production costs.

This segment of BuzzFeed's operations reflects a low-growth, high-market-share dynamic. While the creation of entirely new viral content might drive significant growth, the consistent income derived from licensing proven, popular content provides a stable and predictable revenue stream. This is indicative of a mature product or service that has captured a substantial portion of its market.

In 2024, BuzzFeed continued to leverage its extensive content library. For instance, its partnerships with various media outlets and platforms for content syndication remained a key revenue driver. This approach allows BuzzFeed to extend the reach of its successful content without the need for substantial new investment, reinforcing its cash cow status.

- Revenue Generation: Licensing and syndication provide a steady income by monetizing existing popular content across multiple platforms and partners.

- Cost Efficiency: This strategy avoids significant new production costs, maximizing profitability from already created assets.

- Market Position: It represents a low-growth, high-market-share activity, indicative of a mature and well-established revenue source.

- 2024 Relevance: Continued partnerships in 2024 demonstrated the ongoing value and revenue potential of BuzzFeed's vast content archive.

BuzzFeed.com's Core Content (General Articles)

BuzzFeed.com's general articles and listicles form a significant part of its content ecosystem, contributing to user engagement and advertising revenue. While not experiencing rapid expansion, this content leverages BuzzFeed's strong brand recognition and established audience base. It acts as a reliable source of traffic, supporting the site's advertising model.

This core content provides a steady stream of ad impressions, underpinning BuzzFeed's financial stability. For instance, in 2024, general news and lifestyle articles on BuzzFeed.com continue to draw substantial, albeit mature, traffic. This consistent audience engagement translates into predictable advertising income.

- Stable Revenue: General articles are a predictable revenue source due to consistent traffic.

- Domain Authority: Leverages BuzzFeed's established online presence for steady readership.

- Ad Inventory: Provides a reliable base for ad impressions and revenue generation.

- Audience Retention: Contributes to overall time spent on the site, supporting engagement metrics.

BuzzFeed's established video content, particularly from its Tasty brand, functions as a prime example of a cash cow. These videos, requiring minimal ongoing investment, continue to generate substantial ad revenue through massive viewership, evidenced by billions of views on platforms like YouTube.

This segment exhibits low growth but high market share in terms of audience engagement and ad monetization. The predictable cash flow generated from this existing content library provides a stable financial foundation for BuzzFeed.

In 2024, the continued performance of these evergreen videos underscored their role as a mature and profitable asset within BuzzFeed's portfolio, consistently contributing to the company's revenue stream without requiring significant new capital expenditure.

| BuzzFeed Cash Cow Segment | Description | 2024 Relevance | Key Financial Indicator |

|---|---|---|---|

| Evergreen Video Content (e.g., Tasty) | High viewership, low production cost video content. | Continued strong ad revenue generation from existing catalog. | Billions of views across platforms, consistent ad impressions. |

| Content Licensing & Syndication | Monetizing existing articles, quizzes, and videos. | Ongoing partnerships extending content reach and revenue. | Steady income from intellectual property monetization. |

| BuzzFeed.com General Articles | Core content driving traffic and ad revenue. | Maintains substantial, stable traffic for ad support. | Predictable advertising income from consistent readership. |

What You’re Viewing Is Included

BuzzFeed BCG Matrix

The BuzzFeed BCG Matrix preview you're viewing is the exact, unwatermarked document you'll receive immediately after purchase. This professionally crafted analysis provides a clear strategic overview, ready for immediate integration into your business planning. You're not seeing a demo; you're seeing the complete, actionable report designed for impactful decision-making.

Dogs

BuzzFeed News, once a prominent digital journalism outlet, was officially shuttered in April 2023. This decision stemmed from persistent financial losses and the formidable economic landscape of the hard news industry. The division operated as a classic 'Dog' in the BCG Matrix, characterized by low market share in a slow-growing sector.

The closure of BuzzFeed News was a direct consequence of its inability to generate sufficient returns despite substantial resource investment. It functioned as a cash trap, draining capital without yielding adequate profits. This aligns perfectly with the 'Dog' quadrant, where products or business units are typically divested or phased out to reallocate resources more effectively.

Direct-sold content deals, often characterized by lower margins, saw a considerable downturn in revenue during 2024 and the first quarter of 2025. This decline wasn't unexpected, as it aligns with a deliberate strategy to pivot away from these less profitable revenue streams. For instance, BuzzFeed’s direct-sold content revenue, a key component within this category, experienced a notable drop, underscoring the company's focus on higher-value offerings.

BuzzFeed's divestiture of Complex Networks in February 2024 and First We Feast in December 2024 signifies a strategic pivot. These sales, occurring in 2024, were aimed at streamlining operations and concentrating on more profitable ventures.

These media assets were likely categorized as 'Dogs' in the BCG matrix. They probably represented units with low market share and low growth potential, requiring significant investment without commensurate returns.

The divestitures are a clear indication of BuzzFeed's effort to shed underperforming or non-core assets. This move helps in eliminating potential cash traps and reallocating resources to more promising areas of the business.

Underperforming Niche Content Verticals

BuzzFeed's underperforming niche content verticals represent areas within its diverse portfolio that are struggling with audience engagement and market share. These segments, while consuming valuable resources for content creation and upkeep, are not generating enough new traffic or advertising income to justify their continued investment. For example, in 2024, certain specialized interest channels within BuzzFeed might have seen a year-over-year decline in unique visitors, potentially falling by 10-15% according to industry reports on digital media engagement.

These underperforming areas are prime candidates for strategic re-evaluation, fitting the profile of "Dogs" in the BCG Matrix. They operate in markets with low growth potential and possess a low relative market share. Consequently, BuzzFeed may consider restructuring these verticals or even divesting them entirely to reallocate resources towards more promising growth areas.

- Declining Audience Engagement: Specific niche verticals may be experiencing a noticeable drop in user interaction and time spent on site.

- Resource Drain: Continued investment in content creation and maintenance for these underperforming segments fails to yield sufficient advertising revenue or new audience acquisition.

- Low Market Growth: The specific niche markets these verticals cater to may be stagnant or shrinking, limiting future growth prospects.

- Divestiture Consideration: Such verticals are candidates for restructuring or sale to streamline operations and focus on high-potential areas.

Outdated or Less Engaging Content Formats

As the digital landscape shifts, certain content formats, once crowd-pleasers, now struggle to capture audience attention. These formats, while part of a larger library, demand upkeep with little reward, akin to a low-market-share product in the BCG matrix. They are inefficient investments of time and resources in today's fast-paced media environment.

For example, static infographics or lengthy text-based articles without interactive elements might fall into this category. In 2024, user preferences lean towards dynamic, easily digestible content like short-form video or interactive polls. A study by Statista in late 2023 indicated that video content accounted for over 80% of all internet traffic, highlighting the decline in engagement for static formats.

- Declining Engagement: Older formats often exhibit lower click-through rates and dwell times compared to newer, more interactive options.

- Resource Drain: Maintaining and updating these formats consumes resources that could be better allocated to high-growth content types.

- Diminishing Returns: The effort invested in these legacy formats yields progressively smaller returns in terms of traffic and audience interaction.

- Market Irrelevance: They represent a low-market-share segment, failing to attract significant new audiences or retain existing ones effectively.

BuzzFeed's former media assets, Complex Networks and First We Feast, sold in late 2024, likely fit the 'Dog' category of the BCG Matrix. These units probably operated with low market share within their respective segments and faced limited growth prospects, making them candidates for divestiture to optimize resource allocation.

The divestment of these assets in 2024 highlights BuzzFeed's strategy to shed underperforming or non-core operations, thereby reducing potential cash drains. This move allows for a more focused investment in areas with higher potential for growth and profitability.

BuzzFeed's underperforming niche content verticals, as seen in 2024 with potential declines in unique visitors of 10-15% for certain specialized channels, exemplify 'Dogs'. These segments struggle with audience engagement and market share, consuming resources without generating sufficient returns, fitting the description of low market share in slow-growing sectors.

Legacy content formats, such as static infographics, are also 'Dogs' due to declining audience engagement, as indicated by user preferences shifting towards dynamic content like short-form video, which accounted for over 80% of internet traffic in late 2023. These formats represent a resource drain with diminishing returns.

Question Marks

BF Island, BuzzFeed's new social platform centered on interactive storytelling and AI, is positioned as a Question Mark in the BCG Matrix. It represents a significant, long-term bet on the burgeoning social media space, a market projected to reach over $2.5 trillion globally by 2028, according to recent industry analyses.

While it targets a high-growth sector, BF Island is in its nascent stages, meaning its current market share is negligible as it prepares for private beta testing in Q2 2025. This launch phase necessitates substantial capital expenditure for research, development, and aggressive user acquisition strategies.

The platform's success hinges on its ability to capture user interest and differentiate itself in a crowded digital landscape, offering potentially high rewards if it achieves substantial adoption. However, the inherent uncertainty of user acceptance and competitive pressures means its future trajectory remains unconfirmed, requiring careful monitoring of its performance and market response.

BuzzFeed's investment in new AI-powered content creation tools positions them in the "Question Marks" category of the BCG matrix. These tools aim to boost efficiency and virality, a high-growth area, but their direct impact on revenue and market adoption are still developing.

The company is actively exploring these new frontiers in content production, which naturally requires significant initial investment. This exploration phase is characteristic of Question Marks, where future success is uncertain but holds considerable potential.

BuzzFeed is actively pursuing strategic partnerships to broaden its audience and explore new revenue avenues. A prime example is their collaboration with The Independent in the UK and Ireland, a move designed to tap into these specific markets and potentially solidify their presence there.

These ventures are considered high-growth potential opportunities, allowing BuzzFeed to either enter new territories or strengthen its foothold in existing ones. For instance, in 2023, BuzzFeed’s international revenue saw a notable increase, partly driven by such strategic alliances.

While promising, these partnerships are still in their nascent stages, meaning their current market share and financial contribution are still growing. Initial investments are necessary to nurture these relationships and realize their full potential.

The company’s strategy involves carefully selecting partners that align with its brand and can offer synergistic benefits. This approach is crucial for maximizing the return on investment and ensuring sustainable growth in a competitive digital media landscape.

Expansion into Emerging Digital Platforms/Formats

BuzzFeed's exploration into emerging digital platforms and formats represents a strategic move into potentially high-growth areas, though currently characterized by a nascent market share. These ventures, such as exploring decentralized social media or novel interactive content, demand substantial investment to build brand recognition and user engagement from the ground up. For instance, while the metaverse and Web3 technologies are projected to grow significantly, BuzzFeed's presence and revenue generation within these nascent ecosystems are minimal as of 2024.

- Exploration of Web3 and Metaverse: BuzzFeed is likely investigating opportunities in these rapidly developing spaces, which are anticipated to see substantial growth in user adoption and advertising revenue in the coming years.

- Low Initial Market Share: Despite the potential, BuzzFeed's current penetration and revenue contribution from these emerging platforms are negligible, reflecting their early-stage nature for the company.

- High Investment Requirement: Establishing a presence and scaling operations in these new digital frontiers necessitates significant upfront capital for content creation, technology integration, and community building.

- Future Growth Potential: These experimental platforms represent a key area for future diversification and audience expansion, aligning with broader trends in digital media consumption.

Experimental Direct-to-Consumer (DTC) Initiatives

BuzzFeed's experimental direct-to-consumer (DTC) initiatives represent a strategic move into a burgeoning e-commerce landscape. While the company has a proven track record in affiliate commerce, these new ventures are in their early stages, aiming to establish a foothold in specific product categories where their current market share is minimal.

These nascent DTC efforts are positioned within a high-growth e-commerce market, a sector that saw continued expansion throughout 2024. For example, global e-commerce sales were projected to reach over $6.5 trillion in 2024, highlighting the significant opportunity. However, BuzzFeed's penetration in these particular DTC product lines remains low, indicating substantial room for growth but also the inherent risk of early-stage ventures.

- Market Potential: The global e-commerce market continues its upward trajectory, offering a fertile ground for new DTC brands.

- Low Current Share: BuzzFeed's established audience presents an opportunity, but market share in these specific DTC categories is currently low.

- Investment Needs: Success requires significant capital allocation for product innovation, targeted marketing campaigns, and robust distribution networks.

- Viability Assessment: These initiatives are crucial for identifying future revenue streams, but their long-term viability is yet to be proven.

BuzzFeed's investment in new AI-powered content creation tools and platforms like BF Island places them squarely in the Question Mark category of the BCG Matrix. These initiatives are in high-growth markets, but their current market share is negligible, necessitating significant upfront investment. The success of these ventures is uncertain, making them critical areas for future growth but also carrying substantial risk.

| Initiative | Market Growth | BuzzFeed Market Share (Est.) | Investment Needs | Potential |

|---|---|---|---|---|

| BF Island (Social Platform) | High (Social Media Market > $2.5T by 2028) | Negligible (Pre-beta) | High (R&D, User Acquisition) | High (if successful adoption) |

| AI Content Tools | High (AI in Media growing rapidly) | Developing | Moderate to High | High (Efficiency, Virality) |

| Web3 & Metaverse Exploration | Very High (Emerging) | Minimal (as of 2024) | High (Tech Integration, Community) | Very High (Diversification) |

| DTC E-commerce Ventures | High (Global E-commerce > $6.5T in 2024) | Low (in specific categories) | High (Product, Marketing, Distribution) | High (New Revenue Streams) |

BCG Matrix Data Sources

Our BuzzFeed BCG Matrix leverages comprehensive data from internal performance metrics, audience engagement analytics, and content consumption trends to accurately map product portfolio strength and market position.