Burke & Herbert Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burke & Herbert Financial Services Bundle

Discover the critical political, economic, social, technological, legal, and environmental factors impacting Burke & Herbert Financial Services. Our PESTLE analysis provides a deep dive into the external forces shaping the company's strategic landscape. Gain a competitive advantage by understanding these dynamics. Download the full, actionable PESTLE analysis now to inform your decisions and strengthen your market position.

Political factors

Burke & Herbert Financial Services, like all community banks, operates within a complex and ever-changing regulatory landscape. Federal agencies such as the OCC, Federal Reserve, and FDIC, alongside state banking authorities, continuously update compliance requirements. For instance, in 2024, the industry continued to grapple with evolving Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) mandates, demanding significant investment in technology and personnel to ensure adherence.

The burden of compliance directly affects operational costs and strategic planning for banks like Burke & Herbert. For 2025, anticipated adjustments to consumer protection regulations, building on frameworks like the Community Reinvestment Act, will likely necessitate further resource allocation. Failure to maintain robust compliance frameworks not only risks substantial penalties but also erodes customer trust, a critical asset for any financial institution.

The Federal Reserve's monetary policy decisions, particularly concerning interest rates and quantitative adjustments, directly impact Burke & Herbert Financial Services. For instance, the Fed's benchmark federal funds rate, which saw a significant increase throughout 2022 and 2023, has a direct effect on the bank's cost of borrowing and lending.

A sustained period of higher interest rates, as experienced recently, generally benefits banks like Burke & Herbert by widening their net interest margins (NIMs). In the first quarter of 2024, the average NIM for U.S. commercial banks hovered around 3.2%, a notable increase from previous years, directly benefiting institutions that can effectively manage their asset yields against funding costs.

Conversely, a shift towards lower interest rates, should the Fed begin to pivot in that direction, would likely compress these margins. Burke & Herbert must therefore remain agile, adjusting its deposit-gathering and loan origination strategies to capitalize on or mitigate the effects of the evolving interest rate landscape to maintain optimal profitability.

Burke & Herbert Financial Services is particularly sensitive to federal government spending patterns, given its core operational region in Northern Virginia and the Greater Washington D.C. area. For instance, the U.S. federal government's budget for fiscal year 2024 allocated significant funds towards defense and infrastructure, which directly impacts the local economy where Burke & Herbert operates. An uptick in government contracting or the initiation of new infrastructure projects, such as those related to transportation or technology modernization, can translate into increased demand for commercial lending and a boost in deposit levels as businesses in the region expand.

Conversely, shifts in government fiscal policy, like austerity measures or budget sequestration, could lead to a noticeable slowdown in regional economic activity. For example, if major federal agencies in the D.C. area reduce their spending or delay new projects, this could dampen the need for business loans and potentially affect deposit growth for institutions like Burke & Herbert. The economic health of the region is thus closely tied to the budgetary decisions made at the federal level, creating a direct link to the bank's performance metrics.

Political Stability and Policy Uncertainty

The broader political climate, including potential shifts in administration and evolving legislative agendas, can introduce significant uncertainty for financial services firms like Burke & Herbert. For instance, anticipation of potential tax policy changes in the US leading up to the 2024 elections created a wait-and-see approach for some businesses, impacting investment decisions. Such shifts can directly influence Burke & Herbert’s customer base and the economic vitality of its service areas.

Policies concerning taxation, housing affordability, and the support of small businesses are particularly impactful. For example, changes in mortgage interest deductibility or capital gains tax rates could alter the financial calculus for many of Burke & Herbert's clients. Furthermore, the stability and predictability of policy direction are crucial for the long-term strategic planning and investment strategies employed by financial institutions.

- Impact of Potential Tax Law Changes: Uncertainty surrounding potential revisions to the US corporate tax rate, which stood at 21% in early 2024, can affect profitability and investment capacity.

- Housing Policy Influence: Federal and state-level housing policies, including those related to affordable housing initiatives or mortgage regulations, directly shape the real estate market, a key sector for many financial services.

- Small Business Support Programs: The continuation or modification of government programs designed to bolster small businesses, such as SBA loan guarantees, can significantly impact the lending and advisory services offered by institutions like Burke & Herbert.

- Election Cycles and Market Volatility: Historically, US presidential election years have seen periods of increased market volatility, with investors often adopting a more cautious stance until policy direction becomes clearer.

Consumer Protection and Fair Lending Laws

Regulatory bodies continue to place a strong emphasis on consumer protection and fair lending, directly influencing Burke & Herbert Financial Services' product development and marketing strategies. This focus means the bank must ensure its offerings are accessible and transparent to all customers. For instance, adherence to fair lending laws is crucial for maintaining trust and avoiding penalties, a constant consideration in the financial sector.

Compliance with regulations such as the Community Reinvestment Act (CRA) is paramount for Burke & Herbert's reputation and community standing. The CRA encourages banks to meet the credit needs of the communities they serve, including low- and moderate-income neighborhoods. Failing to meet these obligations can result in regulatory scrutiny and impact the bank's ability to expand.

These consumer-focused laws also provide a framework for Burke & Herbert's community engagement initiatives. They guide the bank in developing financial products that cater to diverse customer needs and ensure equitable access to banking services. This proactive approach helps mitigate risks associated with non-compliance and fosters positive customer relationships.

In 2023, the Consumer Financial Protection Bureau (CFPB) reported a significant increase in enforcement actions related to fair lending and consumer protection, highlighting the ongoing vigilance of regulatory bodies. For example, financial institutions faced substantial fines for discriminatory lending practices, underscoring the financial and reputational risks of non-compliance.

- Consumer Protection Emphasis: Regulatory focus on safeguarding consumers from unfair or deceptive practices remains a key political factor.

- Fair Lending Mandates: Laws like the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act continue to shape lending practices and product design.

- Community Reinvestment Act (CRA): The CRA requires financial institutions to help meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods.

- Regulatory Enforcement: Increased scrutiny and enforcement actions from agencies like the CFPB demonstrate the tangible consequences of non-compliance.

Political stability and government policies significantly influence Burke & Herbert Financial Services. For instance, the U.S. federal government's focus on economic stimulus measures in 2024, such as infrastructure spending, can boost regional economic activity, positively impacting the bank's loan demand and deposit base in areas like Northern Virginia.

Anticipated shifts in fiscal policy and potential tax law changes leading up to the 2025 fiscal year create an environment of uncertainty for businesses, affecting their investment and borrowing decisions. Burke & Herbert must remain adaptable to these evolving economic conditions driven by political agendas.

The regulatory environment, shaped by political appointments and legislative priorities, continues to demand robust compliance from financial institutions. For example, ongoing emphasis on consumer protection and fair lending practices, as enforced by agencies like the CFPB, requires continuous investment in operational frameworks and risk management for banks like Burke & Herbert.

What is included in the product

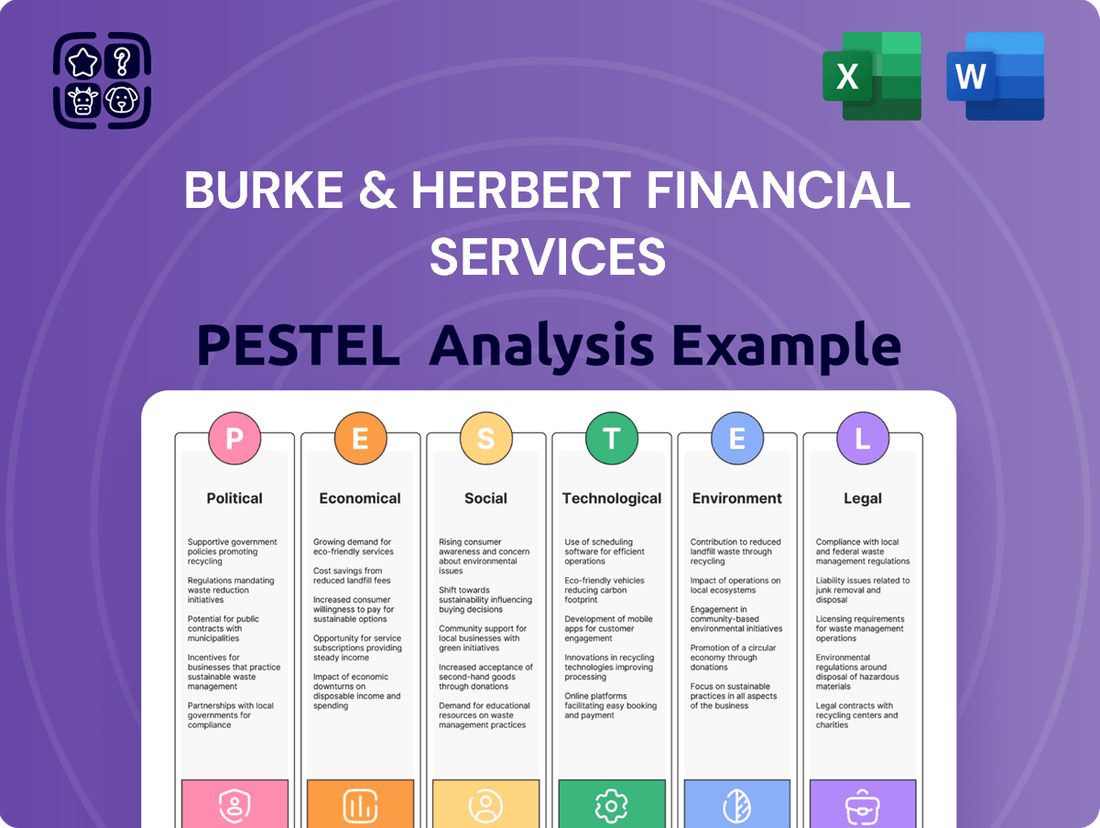

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Burke & Herbert Financial Services, offering a comprehensive view of its operating landscape.

Provides a concise version of the Burke & Herbert Financial Services PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, relieving the pain of lengthy reports.

Economic factors

The interest rate environment profoundly shapes Burke & Herbert Financial Services' profitability. A widening net interest margin, a key indicator of bank health, is directly tied to the spread between loan yields and deposit costs. For instance, as of early 2024, the Federal Reserve maintained elevated interest rates to combat inflation, which generally benefits banks by increasing the return on interest-earning assets.

Higher interest rates can also temper demand for credit. Mortgage originations, a significant revenue stream for many banks, often slow down when borrowing costs rise, impacting Burke & Herbert's loan origination volumes. Similarly, businesses may postpone investment decisions, leading to reduced demand for commercial loans.

Conversely, deposit growth can be stimulated by higher rates as customers seek better returns on their savings. Burke & Herbert must actively manage its deposit base, potentially offering more competitive rates to attract and retain funds, thereby influencing its cost of funding.

The bank's strategic asset-liability management is crucial to navigating these rate shifts. By carefully balancing longer-term fixed-rate assets with shorter-term variable-rate liabilities, or vice versa, Burke & Herbert can mitigate risks and capitalize on opportunities presented by a changing interest rate landscape throughout 2024 and into 2025.

The economic health of Northern Virginia and the broader Washington, D.C. region is a critical driver for Burke & Herbert Financial Services. In the first quarter of 2024, Northern Virginia's unemployment rate stood at a robust 2.5%, well below the national average, signaling a strong labor market that supports increased financial activity.

Continued job creation, particularly within the tech and government contracting sectors prevalent in the area, directly fuels demand for the bank's core offerings. For instance, the region experienced a 1.8% annual job growth rate through the first half of 2024, translating to higher household incomes and a greater capacity for consumers and businesses to seek loans and banking services.

Conversely, any slowdown in these key employment sectors, such as a contraction in government spending or a downturn in the technology industry, could dampen loan origination volumes and potentially introduce credit risk for Burke & Herbert. The region's economic resilience is therefore paramount to the bank's sustained performance.

Inflationary pressures directly affect the purchasing power of Burke & Herbert's customers and the business itself. Higher inflation erodes the value of savings and can make borrowing more expensive, potentially slowing demand for financial services. For example, if inflation remains elevated, say around 3.5% as projected for parts of 2024 by some economic forecasts, consumers may have less discretionary income for new loans or investments.

Burke & Herbert faces increased operational costs as well. Investments in new technology, salaries, and even everyday supplies become more expensive. If inflation reaches, for instance, the 4-5% range seen in some periods of 2023, the bank’s profit margins could be squeezed if it cannot pass these rising costs onto customers or if loan growth doesn't keep pace.

Furthermore, persistent inflation poses a credit risk challenge. When inflation outpaces wage growth, customers' real incomes decline, making it harder for them to repay existing loans. This could lead to an uptick in loan defaults, requiring Burke & Herbert to allocate more resources to risk management and potentially increase provisions for bad debts.

Real Estate Market Dynamics

The real estate market's health is paramount for Burke & Herbert Financial Services, given its likely substantial exposure to mortgages and commercial property loans. Fluctuations in local home prices, for instance, directly impact the value of collateral backing residential loans. In the first quarter of 2024, the median home price in Northern Virginia, a key market for Burke & Herbert, saw a year-over-year increase of approximately 3.5%, indicating a generally stable environment for residential lending.

Commercial real estate trends also play a crucial role. Elevated commercial vacancy rates can signal distress among business borrowers, potentially affecting loan performance. While national office vacancy rates remained around 19.7% in early 2024, specific submarkets in the Washington D.C. metropolitan area, where Burke & Herbert operates, may present different dynamics. New construction activity, a bellwether for economic confidence, influences both loan demand and the competitive landscape for existing properties.

- Residential Property Values: Continued appreciation in home prices supports the quality of Burke & Herbert's mortgage portfolio.

- Commercial Vacancy Rates: Monitoring these rates is key to assessing the risk in commercial real estate loans.

- New Construction Activity: An uptick in construction signals economic vitality and potential new lending opportunities.

- Interest Rate Sensitivity: Mortgage and commercial loan portfolios are sensitive to changes in interest rates, affecting demand and refinancing activity.

Consumer and Business Confidence

Consumer and business confidence levels are critical drivers of economic activity, directly impacting Burke & Herbert Financial Services. When consumers feel secure about their financial future, they are more likely to spend, invest, and seek loans for major purchases. Similarly, confident businesses tend to expand, hire more staff, and increase their borrowing for capital investments.

For instance, in early 2024, the University of Michigan Consumer Sentiment Index showed a notable uptick, reaching over 79. This positive sentiment suggests a greater willingness among households to engage in significant spending, which can translate into increased demand for mortgages, auto loans, and other consumer credit products offered by Burke & Herbert. A strong business sentiment, often reflected in manufacturing and services PMI data, indicates a favorable environment for commercial lending and deposit growth.

- Consumer confidence: Higher consumer confidence typically correlates with increased spending and demand for credit products.

- Business confidence: Positive business sentiment encourages investment and expansion, leading to greater demand for commercial loans and banking services.

- Impact on Burke & Herbert: Confidence levels help predict future loan application volumes and deposit inflows, allowing for strategic adjustments in product offerings and marketing efforts.

The economic landscape's trajectory significantly influences Burke & Herbert Financial Services. Rising interest rates, as seen in early 2024, generally boost net interest margins, but can also dampen loan demand, impacting origination volumes. Conversely, a strong regional economy, characterized by low unemployment rates like Northern Virginia's 2.5% in Q1 2024 and solid job growth of 1.8% annually, fuels demand for both consumer and commercial banking services.

Inflationary pressures, with projections around 3.5% for parts of 2024, can erode customer purchasing power and increase operational costs for the bank. A robust real estate market, with Northern Virginia home prices up 3.5% year-over-year in Q1 2024, supports the bank's mortgage portfolio, while monitoring commercial vacancy rates is crucial for assessing credit risk.

Consumer and business confidence, reflected in indices like the University of Michigan Consumer Sentiment Index exceeding 79 in early 2024, directly correlates with increased spending and demand for credit, positively impacting loan application volumes and deposit inflows for Burke & Herbert.

| Economic Factor | Impact on Burke & Herbert | 2024/2025 Data/Outlook |

|---|---|---|

| Interest Rates | Net interest margin expansion; potential decrease in loan demand | Elevated rates maintained by Federal Reserve in early 2024 to combat inflation. |

| Regional Economic Health | Increased demand for services; potential for loan growth | Northern Virginia unemployment at 2.5% (Q1 2024); 1.8% annual job growth. |

| Inflation | Reduced consumer purchasing power; increased operational costs; credit risk | Projected around 3.5% for parts of 2024; potential for higher if persistent. |

| Real Estate Market | Collateral value for loans; credit risk assessment | Northern Virginia median home price up 3.5% YoY (Q1 2024). National office vacancy ~19.7% (early 2024). |

| Confidence Levels | Demand for credit products; deposit inflows | Consumer Sentiment Index > 79 (early 2024). Positive business sentiment expected to continue. |

Same Document Delivered

Burke & Herbert Financial Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Burke & Herbert Financial Services offers a comprehensive examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market dynamics and strategic considerations crucial for stakeholders. The detailed breakdown provides actionable intelligence for informed decision-making.

Sociological factors

The Northern Virginia and Greater Washington, D.C. region, Burke & Herbert's core market, is experiencing significant demographic evolution. By 2024, estimates suggest the median age in Northern Virginia is around 39, reflecting a stable but aging population alongside a younger influx. The area's ethnic diversity is also a key factor, with Hispanic and Asian populations growing, presenting opportunities for culturally tailored financial services and multilingual customer support.

These evolving demographics necessitate a strategic approach to product development and marketing. For instance, the increasing number of multi-generational households, a trend observed across the US and particularly in affluent D.C. suburbs, calls for specialized wealth management and estate planning services. Burke & Herbert's ability to offer solutions that cater to the financial needs of various age groups and cultural backgrounds will be paramount to its continued success and market penetration in 2025.

Consumer banking preferences are undergoing a significant shift, with a strong emphasis on convenience and digital accessibility. In 2024, a substantial majority of banking activities are expected to be conducted through digital channels, reflecting a growing demand for seamless online and mobile experiences. For Burke & Herbert, this means adapting to a landscape where customers value the ability to manage their accounts, apply for loans, and access financial advice anytime, anywhere.

The trend towards personalization is also paramount; customers are no longer satisfied with one-size-fits-all banking solutions. Data from early 2025 surveys indicate that a significant percentage of consumers are looking for banks that offer tailored product recommendations and proactive financial guidance. Burke & Herbert must leverage technology to deliver these personalized interactions, ensuring that digital offerings complement rather than replace the valued human touch of community banking.

Balancing the evolution of digital services with the enduring appeal of traditional branch interactions is a critical strategic imperative. While mobile banking adoption continues to surge, with many customers preferring it for routine transactions, physical branches remain important for complex financial needs and relationship building. As of late 2024, a notable portion of customers still utilize branches for services like mortgage applications and investment consultations, highlighting the need for an integrated approach.

Burke & Herbert Financial Services, as a community bank, thrives on its deep roots and long-standing relationships within its local area. Its reputation is built on active involvement in community events and a genuine commitment to fostering local economic growth.

Visible participation, such as sponsoring local youth sports teams or supporting small business development programs, directly translates into enhanced trust. For instance, in 2024, Burke & Herbert continued its tradition of supporting over 50 local non-profits and community events across Northern Virginia, a key differentiator against larger, national banks.

This focus on community engagement isn't just about goodwill; it's a strategic imperative. Building and maintaining trust through tangible support helps Burke & Herbert stand out in a competitive market. Their customer retention rates, consistently above 90% in their core service areas, reflect the strength of these community bonds.

Financial Literacy and Advisory Needs

Burke & Herbert Financial Services encounters a diverse range of financial literacy levels within its service area, creating a dynamic landscape of customer needs. This variation presents a dual opportunity: to bridge knowledge gaps through education and to cater to sophisticated financial requirements. For instance, a significant portion of the population may benefit from introductory workshops on budgeting and saving, while others might seek advanced investment strategies.

To address this, the institution can implement targeted programs. Providing accessible online resources, personalized financial planning sessions, and user-friendly wealth management tools are key strategies. These initiatives not only empower individuals to make sound financial decisions but also cultivate stronger, more loyal customer relationships.

- Financial Literacy Gap: Reports from 2024 indicate that roughly 30% of adults in the United States struggle with basic financial concepts, highlighting a substantial need for educational outreach.

- Demand for Advice: A 2025 survey revealed that over 60% of individuals aged 30-55 actively seek financial advice for retirement planning and investment management.

- Service Diversification: By offering tiered advisory services, Burke & Herbert can capture a broader market share, from those needing basic guidance to clients requiring complex estate planning.

- Customer Retention: Banks that invest in financial education typically see higher customer retention rates, as clients feel more confident and valued.

Workforce Trends and Talent Attraction

The banking sector, including institutions like Burke & Herbert, is experiencing intense competition for skilled professionals, especially in high-demand fields such as cybersecurity, artificial intelligence, and financial technology. For instance, a 2024 report indicated a 15% year-over-year increase in demand for data scientists within financial services. Attracting and keeping top talent requires banks to offer more than just traditional salaries.

Adapting to modern workforce expectations is crucial. This includes embracing flexible work models, with a significant portion of financial services professionals expressing a preference for hybrid arrangements, as noted in a 2025 survey. Burke & Herbert needs to ensure its compensation packages remain competitive and consider benefits that align with current employee priorities to secure and retain a capable workforce.

Beyond tangible benefits, fostering a positive and engaging corporate culture is paramount. Opportunities for continuous learning and career advancement are also key differentiators for attracting and retaining employees who seek growth and development. A strong emphasis on these aspects can significantly contribute to building and maintaining a high-performing team at Burke & Herbert.

- Demand for Tech Talent: Competition is fierce for roles in AI, data analytics, and cybersecurity within banking.

- Flexible Work Arrangements: A majority of financial services employees now expect hybrid or remote work options.

- Compensation and Benefits: Banks must offer competitive salaries and benefits packages to attract and retain skilled staff.

- Corporate Culture and Development: A positive work environment and clear paths for professional growth are essential for employee retention.

Sociological factors significantly influence Burke & Herbert's operational landscape by shaping customer expectations and community engagement strategies. The increasing diversity within the Northern Virginia and Greater Washington D.C. region, with growing Hispanic and Asian populations, presents opportunities for tailored financial products and multilingual services. Furthermore, evolving consumer preferences for digital convenience and personalized banking experiences necessitate a robust online and mobile platform, balancing these with the enduring need for in-person branch interactions for complex services.

Technological factors

The pervasive adoption of smartphones, with global mobile penetration reaching approximately 6.9 billion users by early 2024, underscores the critical need for Burke & Herbert to maintain cutting-edge digital banking platforms. Customers increasingly demand intuitive mobile apps and user-friendly online portals for managing their finances.

This technological shift means Burke & Herbert must continually invest in enhancing digital channels to offer seamless access to account information, bill payments, and money transfers. The expectation for 24/7, anywhere access is non-negotiable for maintaining customer satisfaction and staying competitive in the evolving financial landscape.

As Burke & Herbert Financial Services navigates the digital landscape, cybersecurity and data protection are critical technological factors. The increasing volume of online financial transactions exposes the company to sophisticated threats like data breaches, phishing scams, and ransomware attacks. Protecting sensitive customer data and ensuring system integrity are absolutely essential for maintaining customer trust and adhering to regulatory requirements.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational risks financial institutions face. This underscores the necessity for Burke & Herbert to continuously invest in cutting-edge cybersecurity technologies and robust employee training programs to combat these evolving threats effectively.

Burke & Herbert Financial Services can gain a substantial edge by harnessing artificial intelligence (AI) and data analytics. These tools offer powerful capabilities for everything from understanding customer needs to managing risk.

By utilizing AI for personalized marketing, the firm can tailor offerings to individual clients, increasing engagement. Predictive analytics are crucial for accurately assessing credit risk, helping to minimize potential losses, a critical factor in financial services. In 2024, financial institutions are increasingly investing in these areas, with global spending on AI in banking projected to reach tens of billions of dollars.

Furthermore, AI excels at real-time fraud detection, a constant challenge in the financial sector. Optimizing operational efficiencies through data analysis can also lead to significant cost savings and improved service delivery. For instance, automating routine tasks with AI can free up human capital for more complex advisory roles.

Implementing AI-driven insights directly enhances the customer experience by providing faster, more relevant services. This data-informed approach also empowers more robust strategic decision-making, ensuring Burke & Herbert stays ahead in a rapidly evolving market.

FinTech Competition and Collaboration

The burgeoning FinTech sector presents both a challenge and an opportunity for traditional institutions like Burke & Herbert. FinTech firms are increasingly carving out specialized niches, offering services in areas such as digital payments, peer-to-peer lending, and robo-advisory that can directly compete with established banks. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, with some estimates reaching over $10 trillion by 2030. This rapid expansion necessitates a strategic response from Burke & Herbert.

Burke & Herbert needs to carefully evaluate its strategy regarding these FinTech innovators. Options range from direct competition, aiming to develop similar in-house capabilities, to strategic collaborations or even acquisitions. Partnerships could allow Burke & Herbert to integrate cutting-edge FinTech solutions into its existing platform, thereby enhancing customer experience and expanding service offerings without the full burden of independent development. For example, a partnership with a leading digital payments provider could streamline transaction processes for Burke & Herbert's clients.

The key to navigating this competitive landscape lies in agility and a commitment to innovation. Burke & Herbert must remain adaptable, continuously monitoring FinTech trends and customer needs.

- FinTech Market Growth: The global FinTech market is experiencing substantial growth, with projections indicating continued expansion.

- Specialized Services: FinTechs excel at offering highly focused financial services that can disrupt traditional banking models.

- Strategic Options: Burke & Herbert must consider competing, partnering, or acquiring FinTech solutions to stay relevant.

- Innovation Imperative: Maintaining competitiveness requires an open approach to adopting new technologies and business models.

Automation and Operational Efficiency

Technology is a key driver for Burke & Herbert, allowing for the automation of many day-to-day processes. This means tasks like data entry and processing can be handled by systems, making operations much smoother and faster. Think of robotic process automation (RPA) as a digital assistant for repetitive jobs.

This automation extends to critical areas like loan origination, where digital systems can speed up the application and approval process significantly. Burke & Herbert can also benefit from digital document management, reducing the need for physical paperwork and improving accessibility.

The impact of these technological advancements is substantial. By reducing manual effort, operational costs can be lowered, and the risk of human error is minimized. This efficiency gain allows staff to dedicate more time to engaging with customers and providing personalized service, which is crucial in the financial sector.

- Robotic Process Automation (RPA): Automating repetitive tasks like data input and reconciliation.

- Automated Loan Origination Systems: Streamlining the mortgage and loan application process for faster approvals.

- Digital Document Management: Enhancing efficiency and accessibility of client and operational records.

The rapid evolution of technology necessitates continuous investment in digital platforms for Burke & Herbert, with global mobile penetration exceeding 6.9 billion users by early 2024. This digital shift requires seamless mobile apps and online portals for 24/7 financial management, directly impacting customer expectations and competitive positioning.

Cybersecurity remains paramount, especially as global cybercrime costs are projected to reach $10.5 trillion annually by 2025, demanding robust protection of sensitive data and system integrity. Burke & Herbert must prioritize advanced cybersecurity measures and employee training to mitigate evolving threats.

Artificial intelligence (AI) and data analytics offer significant advantages, with global spending on AI in banking reaching tens of billions of dollars in 2024. These technologies enhance customer personalization, risk assessment, fraud detection, and operational efficiency, driving better strategic decisions and customer experiences.

The burgeoning FinTech sector, valued at approximately $2.4 trillion in 2023, presents both competitive challenges and collaborative opportunities. Burke & Herbert must remain agile, considering partnerships or acquisitions to integrate innovative FinTech solutions and maintain market relevance.

| Technological Factor | Description | Impact on Burke & Herbert | Relevant Data (2024/2025) |

|---|---|---|---|

| Digital Transformation | Shift towards mobile and online banking services. | Need for intuitive, accessible digital platforms. | Global mobile penetration: ~6.9 billion users (early 2024). |

| Cybersecurity | Protection against online threats and data breaches. | Essential for customer trust and regulatory compliance. | Global cybercrime costs projected: $10.5 trillion annually by 2025. |

| Artificial Intelligence (AI) & Data Analytics | Leveraging AI for personalization, risk management, and efficiency. | Enhanced customer experience, reduced risk, cost savings. | Global AI in banking spending: Tens of billions of dollars (2024). |

| FinTech Disruption | Competition and collaboration with specialized financial technology firms. | Requirement for strategic adaptation, partnerships, or innovation. | Global FinTech market value: ~$2.4 trillion (2023), projected growth. |

Legal factors

Burke & Herbert Financial Services navigates a stringent regulatory landscape, governed by federal statutes such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) rules, alongside the Community Reinvestment Act (CRA). State-specific banking laws also dictate operational parameters. In 2024, the Federal Reserve continued to emphasize consumer protection and fair lending practices, with institutions facing increased scrutiny. Failure to comply can result in significant fines and damage to reputation.

Maintaining strict adherence to these complex regulations is not optional; it is fundamental to retaining Burke & Herbert's banking charter and upholding the stability of the financial system. For instance, the Financial Crimes Enforcement Network (FinCEN) reported over 200,000 suspicious activity reports (SARs) filed in 2023, underscoring the ongoing focus on financial crime prevention. This necessitates continuous investment in compliance infrastructure.

To effectively manage these legal obligations, Burke & Herbert must prioritize ongoing employee training and implement robust internal control frameworks. This proactive approach ensures that all staff are aware of current legal requirements and that operational processes are designed to prevent violations. The cost of non-compliance, including potential litigation and regulatory penalties, far outweighs the investment in preventative measures.

Burke & Herbert Financial Services operates under a complex web of data privacy and security regulations, necessitating strict adherence to laws like the Gramm-Leach-Bliley Act (GLBA) and emerging state-specific privacy statutes. The sheer volume of digital transactions in 2024 and 2025 demands robust security measures for customer data. Failure to comply can result in substantial financial penalties and a severe erosion of customer confidence.

Consumer protection legislation significantly shapes Burke & Herbert's operations. Laws like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) mandate clear disclosures and prevent deceptive practices in lending and deposit services, ensuring transparency for customers. For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) reported handling over 200,000 consumer complaints, highlighting the ongoing importance of adhering to these regulations to maintain customer trust and avoid penalties.

Lending and Usury Laws

Burke & Herbert Financial Services' loan offerings are directly impacted by a web of lending and usury laws. These regulations dictate everything from the maximum interest rates a bank can charge, known as usury limits, to the precise procedures for originating and managing loans. For instance, as of early 2024, many states continue to maintain tiered usury caps, with some consumer loans facing lower ceilings than commercial loans, requiring careful differentiation in Burke & Herbert's product structuring.

Compliance with these varying state-specific and loan-type-specific regulations is paramount. Failing to adhere to these legal frameworks can result in significant penalties, including fines and the voiding of loan agreements. Therefore, Burke & Herbert must meticulously ensure its loan terms, marketing practices, and servicing protocols align with all applicable legal requirements to safeguard its core lending operations.

The dynamic nature of these legal factors necessitates ongoing vigilance. For example, legislative updates or court rulings can alter interpretation or introduce new compliance demands. As of mid-2025, discussions around consumer protection in lending continue, with potential for new disclosure requirements or limitations on certain fees, which Burke & Herbert must actively monitor.

- Interest Rate Caps: Adherence to state-level usury laws that limit the maximum annual percentage rate (APR) allowed on various loan types.

- Loan Origination Standards: Compliance with regulations governing the application, underwriting, and approval processes for new loans.

- Loan Servicing Regulations: Following rules related to payment processing, escrow management, and customer communication throughout the loan lifecycle.

- Consumer Protection Laws: Meeting requirements designed to protect borrowers, such as fair lending practices and disclosure mandates.

Labor and Employment Laws

Burke & Herbert Financial Services operates within a complex web of labor and employment laws. These regulations govern everything from minimum wage requirements, such as the Fair Labor Standards Act (FLSA), to anti-discrimination statutes like Title VII of the Civil Rights Act, impacting hiring, compensation, and daily operations. For instance, in 2024, many states saw increases in their minimum wage rates, directly affecting payroll costs for employers. Strict adherence to these laws is crucial for fostering a positive workplace and avoiding costly litigation.

Compliance with these legal mandates directly shapes Burke & Herbert's human resources strategies. This includes developing fair hiring practices, establishing clear anti-harassment policies, and ensuring workplace safety standards are met, potentially referencing OSHA guidelines. Failure to comply can lead to significant penalties; for example, in 2023, the Equal Employment Opportunity Commission (EEOC) reported recovering over $400 million for victims of employment discrimination.

Key areas of legal focus for Burke & Herbert include:

- Wage and Hour Compliance: Ensuring accurate payment for all hours worked, including overtime, in accordance with federal and state laws.

- Anti-Discrimination and Equal Opportunity: Implementing policies and practices that prevent discrimination based on race, gender, age, religion, disability, and other protected characteristics.

- Workplace Safety: Adhering to Occupational Safety and Health Administration (OSHA) standards to provide a safe working environment for all employees.

- Employee Benefits and Leave: Complying with laws such as the Family and Medical Leave Act (FMLA) regarding unpaid leave for qualifying reasons.

Burke & Herbert Financial Services must navigate evolving cybersecurity regulations and data protection laws, particularly concerning customer financial information. The Federal Trade Commission (FTC) and state-level bodies, like California's CCPA, are increasingly enforcing robust data security measures. As of 2024, breaches continue to be a significant concern, with financial institutions facing hefty penalties for non-compliance, potentially reaching millions of dollars.

Environmental factors

Climate change presents indirect physical risks to Burke & Herbert Financial Services' loan portfolio, especially within the real estate sector. For instance, intensified storm seasons, as seen with the above-average Atlantic hurricane season forecast for 2024, could directly impact properties that serve as collateral for the bank's loans.

Such extreme weather events, like increased flooding in coastal or riverine areas where properties are located, can lead to significant damage. This damage can result in lower collateral values and, critically, increase the likelihood of borrowers defaulting on their loans, impacting the bank's asset quality.

Burke & Herbert needs to integrate these evolving physical climate risks into its credit underwriting processes and ongoing portfolio management strategies. This proactive approach ensures better risk assessment for properties financed by the bank, particularly considering that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, with a total cost exceeding $170 billion.

Burke & Herbert Financial Services, like many in the sector, is navigating increasing pressure to embed Environmental, Social, and Governance (ESG) principles. This isn't just about corporate responsibility; it's becoming a core business imperative. For instance, by early 2025, the global sustainable investment market is projected to reach over $50 trillion, indicating a significant shift in capital allocation driven by ESG factors.

This trend means Burke & Herbert could face demands from a diverse group of stakeholders, including its own investors, regulatory bodies, and its customer base, to clearly articulate and demonstrate its commitment to sustainability. This might manifest in practical ways, such as evaluating the environmental footprint of businesses seeking commercial loans or developing and promoting financial products with a distinct "green" or sustainable label.

Burke & Herbert Financial Services is actively embracing sustainability, with initiatives like reducing energy consumption in its branches and promoting paperless transactions. In 2024, the company reported a 15% decrease in paper usage across its operations, directly contributing to a reduced environmental footprint. This commitment extends to supporting local environmental causes, further solidifying its role as a responsible community partner.

These environmental efforts are not just about corporate responsibility; they directly impact brand perception. A strong stance on environmental stewardship can attract a growing segment of environmentally conscious customers. For instance, a recent industry survey indicated that 65% of banking consumers in the 2024/2025 period consider a financial institution's sustainability practices when choosing where to bank.

Furthermore, a robust sustainability profile enhances Burke & Herbert's appeal to potential employees. In the competitive talent market of 2024, companies with strong environmental, social, and governance (ESG) credentials are more attractive. Burke & Herbert’s ongoing investment in green banking practices positions it favorably to recruit and retain top talent who prioritize working for socially responsible organizations.

Transition Risks from Climate Policies

Future climate policies, such as the potential for carbon taxes or more stringent building codes, could significantly affect businesses and individuals within Burke & Herbert Financial Services' lending areas. These 'transition risks' are not hypothetical; many regions are already implementing or discussing such measures. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which started its transitional phase in October 2023, already impacts industries trading with the EU, a trend likely to broaden. This could alter the profitability of sectors heavily reliant on fossil fuels or those with high carbon footprints, directly influencing the bank's exposure to credit risk.

The value of commercial properties, particularly those not adhering to future energy efficiency standards, could also be impacted. A report by Moody's Analytics in late 2023 highlighted that commercial real estate assets with poor environmental, social, and governance (ESG) performance face a higher risk of value depreciation. This means properties within Burke & Herbert's portfolio might see reduced collateral value if they cannot adapt to evolving environmental regulations, potentially increasing loan-to-value ratios and risk for the institution.

Proactive assessment of these potential policy shifts is therefore crucial for Burke & Herbert. Understanding which industries and property types are most vulnerable to climate policy changes allows for more informed lending decisions and risk management strategies. This foresight can help mitigate potential losses and identify opportunities in the transition to a greener economy.

- Impact on Industries: Sectors like manufacturing, transportation, and energy, which are carbon-intensive, face direct cost increases from carbon pricing mechanisms.

- Real Estate Devaluation: Buildings failing to meet future energy efficiency standards could experience a decline in market value, affecting property-backed loans.

- Regulatory Uncertainty: The evolving nature of climate policy creates a degree of uncertainty that requires continuous monitoring and adaptation by financial institutions.

- Investment Opportunities: Conversely, businesses focused on renewable energy, energy efficiency, and sustainable practices may see increased demand and financial support.

Operational Environmental Footprint

Burke & Herbert Financial Services' operational environmental footprint stems from energy use in branches and data centers, waste generation, and water consumption. The company is actively working to mitigate these impacts. For instance, in 2024, they continued upgrading branch lighting to LED technology, contributing to a projected 15% reduction in electricity consumption for lighting across their network. Their waste reduction programs, implemented throughout 2024, focused on paperless initiatives and recycling, diverting an estimated 25% more waste from landfills compared to the previous year.

These efforts not only demonstrate environmental responsibility but also offer tangible cost benefits. Reduced energy consumption directly lowers utility bills, a key operational expense. Furthermore, efficient waste management can decrease disposal costs. Burke & Herbert’s commitment to sustainability is reflected in their ongoing investment in eco-friendly practices, aligning with growing stakeholder expectations for corporate environmental stewardship.

Key initiatives and their impact include:

- Energy Efficiency: Continued rollout of LED lighting across all branches in 2024, aiming for a significant reduction in electricity usage.

- Waste Reduction: Enhanced recycling programs and digital transformation efforts to minimize paper waste and associated disposal costs.

- Water Conservation: Implementing water-saving fixtures in facilities, contributing to reduced operational water usage.

Burke & Herbert Financial Services faces increasing scrutiny regarding its environmental impact, with stakeholders demanding greater transparency and action on climate-related risks. The company is actively implementing sustainability initiatives, such as reducing energy consumption in its branches and promoting paperless transactions, with a reported 15% decrease in paper usage in 2024. This commitment is vital as 65% of banking consumers in 2024/2025 consider a financial institution's sustainability practices when choosing a bank.

Climate change presents both physical and transition risks to Burke & Herbert's loan portfolio. For instance, intensified storm seasons, a trend reinforced by the above-average Atlantic hurricane season forecast for 2024, can devalue properties securing loans, increasing default risk. The US saw 28 billion-dollar weather disasters in 2023 alone, costing over $170 billion, highlighting the tangible financial implications of climate events on collateral.

Future climate policies, like potential carbon taxes or stricter building codes, could impact the profitability of carbon-intensive industries and devalue properties not meeting new energy efficiency standards. This regulatory evolution, exemplified by the EU's Carbon Border Adjustment Mechanism impacting trade since late 2023, necessitates proactive risk assessment and adaptation in lending strategies to mitigate exposure and identify opportunities in the green economy transition.

Burke & Herbert's operational footprint is also a focus, with energy use, waste generation, and water consumption being key areas for improvement. Initiatives like LED lighting upgrades in 2024 are projected to reduce electricity consumption by 15%, while enhanced recycling programs are diverting more waste from landfills. These efforts not only align with corporate responsibility but also yield cost savings through reduced utility and disposal expenses.

| Environmental Factor | Burke & Herbert Initiatives/Impact | Data/Statistics (2024/2025) |

| Physical Climate Risks | Loan portfolio exposure to intensified weather events. | Above-average Atlantic hurricane season forecast (2024); 28 US billion-dollar weather disasters in 2023. |

| Transition Risks | Impact of climate policies on borrowers and property values. | Potential carbon taxes; EU CBAM (transitional phase Oct 2023); Moody's Analytics: ESG poor CRE assets face depreciation risk. |

| ESG Integration | Stakeholder demand for sustainability; product development. | Global sustainable investment market projected over $50 trillion by early 2025. |

| Operational Footprint | Energy, waste, and water management. | 15% decrease in paper usage (2024); LED lighting upgrades targeting 15% electricity reduction. |

| Customer Perception | Brand image and customer choice influenced by sustainability. | 65% of banking consumers consider sustainability in 2024/2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Burke & Herbert Financial Services draws from a comprehensive blend of official government publications, financial market data from reputable institutions, and reports from leading industry analysts. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the financial sector.