Burke & Herbert Financial Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burke & Herbert Financial Services Bundle

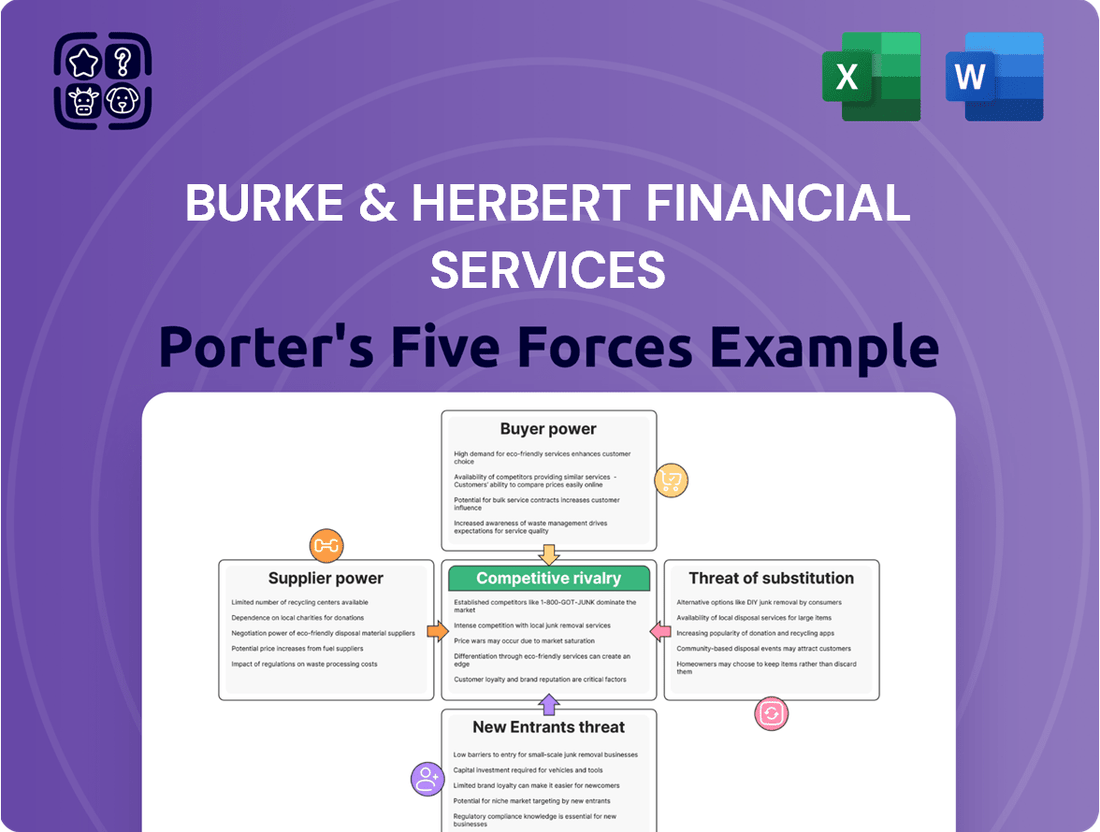

Understanding the competitive landscape for Burke & Herbert Financial Services is crucial for strategic planning. Our Porter's Five Forces analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes. These forces collectively shape profitability and market dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Burke & Herbert Financial Services’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The depositor base represents Burke & Herbert Financial Services' suppliers of capital, and their collective bargaining power is shaped by interest rate sensitivity and available alternatives. A large, stable depositor base at competitive rates is crucial for managing the bank's cost of funds, directly impacting its ability to lend profitably.

As of the first quarter of 2024, Burke & Herbert reported total deposits of $37.1 billion, a slight increase from the previous year. This substantial base provides a degree of stability, but depositors are increasingly seeking higher yields, especially with evolving market interest rates.

The bank's strategy to attract and retain these deposits involves offering a range of account types with varying interest rates, balancing the need for affordability with the necessity of remaining competitive. This careful management is key to controlling the cost of funds and supporting lending activities.

Burke & Herbert Financial Services relies heavily on technology and software providers for everything from core banking operations to digital customer interfaces and robust cybersecurity measures. The leverage these suppliers hold hinges on how unique their solutions are, the difficulty and expense involved in switching to a different provider, and how standardized the technology itself is across the industry. For instance, a specialized cybersecurity firm offering a proprietary threat detection system might wield considerable power if the bank finds it difficult to replicate that functionality elsewhere.

The rapid pace of technological advancement can amplify supplier bargaining power, especially when financial institutions like Burke & Herbert become dependent on providers offering cutting-edge solutions to maintain competitiveness. In 2024, the demand for advanced AI-driven analytics and cloud-based infrastructure solutions remained high, allowing prominent technology vendors in these spaces to command premium pricing and favorable contract terms. This dynamic underscores the strategic importance of managing these supplier relationships effectively to mitigate potential cost increases or service disruptions.

The availability and cost of skilled financial professionals, such as loan officers, wealth managers, and IT specialists, are a significant supplier force for Burke & Herbert Financial Services. In the competitive Northern Virginia and Greater D.C. market, attracting and retaining top talent can be difficult, often resulting in increased compensation expenses for the company.

The demand for specialized skills, especially in emerging fields like artificial intelligence and cybersecurity, further amplifies the bargaining power of this supplier group. For instance, the U.S. Bureau of Labor Statistics projected a 10% growth for information security analysts between 2022 and 2032, indicating a strong demand and potential for higher wages.

Regulatory Compliance Services

Burke & Herbert Financial Services, like all financial institutions, faces significant bargaining power from suppliers of regulatory compliance services. The sheer complexity and constant evolution of banking regulations, from capital adequacy rules to anti-money laundering (AML) protocols, necessitate specialized expertise. These service providers, including law firms, auditing firms, and specialized consulting groups, hold considerable sway because a financial institution's ability to operate and avoid hefty fines hinges on their accurate and timely guidance. For instance, the U.S. banking industry spent an estimated $30 billion on compliance in 2023 alone, a testament to the critical nature of these services and the power of the firms providing them.

The need for Burke & Herbert to maintain its operating license and avoid severe penalties for non-compliance grants these specialized suppliers substantial leverage. The evolving landscape, particularly with new data privacy laws and cybersecurity mandates emerging, means that banks must continuously adapt and often rely on external experts. This dependence can translate into higher service fees and less room for negotiation, as the cost of non-compliance far outweighs the cost of these essential services.

- Regulatory Dependence: Financial institutions are legally bound to adhere to a vast and intricate web of regulations, making them reliant on external expertise for interpretation and implementation.

- Cost of Non-Compliance: Penalties for regulatory breaches can be astronomical, ranging from millions to billions of dollars, granting compliance service providers significant pricing power.

- Specialized Knowledge: The niche and constantly changing nature of financial regulations means only a select few firms possess the deep expertise required, limiting the pool of alternative suppliers.

- Industry Spending: The U.S. financial services sector's compliance spending, estimated at $30 billion in 2023, underscores the significant market for these services and the suppliers' strong position.

Data and Information Providers

The bargaining power of data and information providers is a significant factor for Burke & Herbert Financial Services. Access to reliable economic data, credit information, market insights, and customer analytics is absolutely vital for Burke & Herbert's risk assessment, developing new products, and making smart strategic choices. The specialized nature and often proprietary aspects of the data supplied by credit bureaus, market research firms, and financial data aggregators mean these suppliers can hold considerable leverage.

High-quality data isn't just a nice-to-have; it's essential for creating personalized customer experiences and effectively detecting fraud. For instance, in 2024, the demand for granular customer analytics surged as financial institutions aimed to tailor offerings. Companies like Experian and Equifax, major credit information providers, often have unique datasets that are difficult for banks to replicate, thus strengthening their position.

- Data Dependency: Financial services firms like Burke & Herbert rely heavily on external data providers for critical operational functions.

- Proprietary Data: The unique and often exclusive nature of data from credit bureaus and market research firms grants these suppliers significant bargaining power.

- Quality Imperative: The need for high-quality data for risk management, customer personalization, and fraud prevention makes switching providers challenging and costly.

- Market Concentration: In some data segments, a limited number of providers dominate the market, further increasing their leverage.

Suppliers of capital, primarily depositors, exert bargaining power through their sensitivity to interest rates and the availability of alternative investment options. Burke & Herbert's substantial $37.1 billion deposit base as of Q1 2024 provides a stable foundation, but the increasing demand for higher yields in 2024 necessitates competitive rate offerings.

Technology and software providers hold significant leverage due to the specialized nature of their solutions and the high cost of switching. In 2024, the demand for AI analytics and cloud solutions allowed key vendors to command premium pricing. Similarly, the competition for skilled financial professionals, particularly in areas like cybersecurity, drives up labor costs for banks like Burke & Herbert.

The bargaining power of regulatory compliance service providers is substantial, driven by the complexity of banking laws and the severe financial penalties for non-compliance. The U.S. financial sector's estimated $30 billion compliance spending in 2023 highlights the critical reliance on these specialized firms.

Data and information providers also wield considerable influence. The necessity of high-quality data for risk management and customer analytics, coupled with the proprietary nature of information from firms like Experian, makes switching providers difficult and costly for Burke & Herbert.

What is included in the product

This analysis of Burke & Herbert Financial Services examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes within the financial services industry.

Instantly identify and prioritize competitive threats with a visual breakdown of each Porter's Five Force, making strategic planning more efficient for Burke & Herbert Financial Services.

Customers Bargaining Power

The availability of alternative financial institutions significantly empowers Burke & Herbert's customers. In the Northern Virginia and Greater D.C. region, customers can choose from a multitude of large national banks, numerous regional and community banks, and various credit unions. This extensive selection means customers have considerable leverage to switch to a provider offering better rates, lower fees, or superior services.

This competitive environment directly impacts Burke & Herbert, compelling them to continuously offer attractive value propositions to retain and attract clients. For instance, as of early 2024, interest rates on savings accounts varied widely across different institutions, with some online-only banks offering significantly higher Annual Percentage Yields (APYs) compared to traditional brick-and-mortar branches, presenting a clear incentive for customers to compare and switch.

For fundamental banking needs such as checking and savings accounts, customers often face minimal hurdles when switching providers. This low barrier allows them to readily move their funds in pursuit of more favorable interest rates or reduced fees. In 2024, the average consumer held 3.9 bank accounts, indicating a willingness to spread their assets across institutions.

However, the landscape shifts for more intricate financial products. For instance, transitioning business loans or comprehensive wealth management services can involve higher switching costs. These are often tied to the time invested in building relationships with financial advisors and the complexity of integrated financial planning services already in place.

Burke & Herbert Financial Services actively works to counteract this by emphasizing personalized customer relationships. This strategy aims to foster loyalty and increase the perceived switching costs, making it less likely for clients to move their business to competitors, especially for their more complex financial needs.

The rise of online comparison tools and readily available financial literacy content has significantly shifted the balance of power towards customers. In 2024, consumers can effortlessly compare interest rates, fees, and product offerings from numerous financial institutions, effectively leveling the playing field. This increased transparency dismantles information asymmetry, allowing customers to make more educated choices and strengthening their ability to negotiate better terms.

Interest Rate Sensitivity on Loans and Deposits

Customers, especially those with substantial deposits or requiring large loans, closely monitor Burke & Herbert's interest rates against those of its competitors. This keen awareness of market rates significantly influences their decisions, particularly for businesses seeking the best loan terms and depositors aiming for higher savings yields.

This competitive pressure compels Burke & Herbert to continually adjust its pricing for both lending and deposit services to remain attractive. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate, leading many banks, including those comparable to Burke & Herbert, to offer deposit rates in the 4.5% to 5.5% range for high-yield savings accounts, while loan rates varied significantly based on loan type and borrower creditworthiness.

- Customer Price Sensitivity: Banks must offer competitive interest rates to attract and retain customers, especially for larger deposit balances and significant loan volumes.

- Business Loan Shopping: Commercial clients actively compare loan offerings from multiple institutions to secure the most favorable terms, directly impacting a bank's lending business.

- Depositor Yield Maximization: Savvy individual depositors will move funds to institutions providing higher interest rates on savings and money market accounts.

- Competitive Pricing Necessity: Burke & Herbert faces pressure to align its deposit yields and loan rates with market averages to avoid losing business to more aggressive competitors.

Demand for Personalized and Digital Services

Customers today expect a highly personalized and convenient banking experience, with a strong preference for digital channels. Burke & Herbert's commitment to tailored solutions addresses this, but a lag in digital capabilities could push customers towards competitors offering more advanced online and mobile tools. For instance, a 2024 survey indicated that over 70% of consumers prefer managing their banking needs through mobile apps.

The demand for immediate access and sophisticated digital tools is escalating. Real-time payment capabilities and AI-driven financial management are no longer novelties but standard expectations. Failure to innovate in these areas can significantly weaken customer loyalty.

- Personalization: Customers seek banking experiences tailored to their individual financial situations.

- Digital Access: Seamless and intuitive digital platforms are paramount for managing finances.

- Real-time Services: Expectations for instant transactions and immediate information are growing.

- AI Integration: AI-powered tools for budgeting, insights, and support are becoming a key differentiator.

The bargaining power of customers is a significant force for Burke & Herbert, stemming from the broad availability of financial alternatives and increasing customer savviness. Customers can easily compare rates and fees across numerous institutions, especially for basic banking needs, driving a need for competitive offerings from Burke & Herbert. For instance, in early 2024, savings account APYs often ranged from 4.5% to 5.5% at various banks, pressuring institutions like Burke & Herbert to match or exceed these rates to retain deposits.

| Factor | Impact on Burke & Herbert | Customer Action |

|---|---|---|

| Availability of Alternatives | Forces competitive pricing and service offerings. | Switching to banks with better rates or lower fees. |

| Low Switching Costs (Basic Services) | Increases vulnerability to rate shopping. | Moving checking or savings accounts for marginal gains. |

| Digital Expectations | Requires investment in user-friendly online/mobile platforms. | Opting for institutions with superior digital tools. |

What You See Is What You Get

Burke & Herbert Financial Services Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for Burke & Herbert Financial Services meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

Burke & Herbert Financial Services contends with formidable competition from major national and regional banks in its Northern Virginia and Greater D.C. operating areas. These larger players possess significant advantages, including expansive branch footprints and substantial marketing expenditures, allowing them to reach a wider customer base. For instance, as of the first quarter of 2024, the largest national banks reported hundreds of billions in assets, dwarfing smaller regional institutions.

The sheer scale of national banks enables them to invest heavily in cutting-edge technology and offer a broad spectrum of financial products, from complex commercial lending to sophisticated wealth management services. This competitive pressure forces Burke & Herbert to differentiate itself through personalized service and a deep understanding of local market needs. Data from the FDIC in late 2023 showed that the top 10 U.S. banks held over 60% of the nation's total deposits, illustrating the market concentration.

Burke & Herbert operates in a landscape where strong local community banks and credit unions are a significant competitive force. These institutions, much like Burke & Herbert, often prioritize personalized service and deep community ties, creating a competitive environment for local deposits and small business lending.

This intense rivalry among local players often translates into competitive pricing strategies and a focus on service differentiation as key battlegrounds. The market dynamics suggest that building and maintaining strong customer relationships is paramount for success in this segment.

The 2024 merger with Summit Financial Group marked a pivotal moment, significantly bolstering Burke & Herbert's market presence and competitive scale. This strategic move likely enhanced its ability to compete more effectively against both larger national banks and the numerous community-focused competitors.

Burke & Herbert Financial Services operates in a market, specifically the D.C. metro area, where price competition for lending and deposit products is quite intense. This is a common characteristic of mature banking sectors, where differentiation often comes down to the cost of money.

Banks actively vie for customers by offering competitive interest rates on everything from mortgages and business loans to savings accounts and certificates of deposit. This direct price war can put significant pressure on a bank's net interest margin, which is the difference between the interest income generated and the interest paid out.

The digital age has amplified this competition. With a wealth of online comparison tools readily available, customers can easily see which institutions offer the best rates, forcing institutions like Burke & Herbert to constantly evaluate their pricing strategies. For instance, in early 2024, average savings account rates hovered around 4.35% APY nationally, while some online banks offered over 5%, highlighting the upward pressure on deposit costs.

Navigating this landscape requires a delicate balance. Burke & Herbert must offer prices that attract and retain customers while simultaneously ensuring that these prices are sustainable and contribute to the company's overall profitability. This dynamic means that pricing decisions are critical for maintaining market share and financial health.

Digital Innovation and Service Offerings

The competitive landscape for Burke & Herbert Financial Services is increasingly shaped by digital innovation. Rivals are pouring resources into sophisticated online and mobile banking platforms, instant payment solutions, and AI-powered customer service. This digital arms race means Burke & Herbert must consistently enhance its digital capabilities to keep pace, as customers increasingly expect seamless, technologically advanced interactions. A superior digital experience is no longer a bonus; it's a critical factor in attracting and keeping clients in today's market.

Financial institutions are seeing a significant shift in customer preference towards digital channels. For instance, by the end of 2023, digital banking transactions accounted for a substantial majority of customer interactions across the industry. Burke & Herbert’s ability to offer:

- Advanced mobile banking features

- User-friendly online account management

- Integration of AI for personalized financial advice

- Swift digital onboarding processes

will directly impact its ability to attract and retain customers. The ongoing digital transformation necessitates continuous investment to ensure its service offerings remain competitive and meet evolving customer expectations for convenience and technological sophistication.

Geographic Concentration and Market Saturation

Burke & Herbert Financial Services operates within Northern Virginia and the Greater D.C. area, a region characterized by its high population density and robust economic activity. This attractiveness, however, also translates to significant market saturation, with numerous financial institutions vying for customers.

The intense competition fuels aggressive strategies, including innovative product development and robust marketing campaigns, as institutions fight to gain or maintain market share. Customer retention becomes paramount in such an environment, with banks focusing on loyalty programs and superior service to keep clients engaged.

Real estate market dynamics in Northern Virginia directly impact banking. For instance, in 2023, Northern Virginia saw a median home price of approximately $570,000, indicating a strong market for mortgage lending and related financial services. Fluctuations in housing prices and transaction volumes directly affect the demand for banking products.

- High Concentration of Financial Institutions: Northern Virginia and Greater D.C. host a dense network of community banks, credit unions, and larger national banks.

- Aggressive Competition: Market saturation compels competitors to engage in price wars, enhanced product offerings, and targeted marketing efforts.

- Customer Retention Focus: Banks prioritize building strong customer relationships and loyalty to combat churn in a competitive landscape.

- Real Estate Market Influence: Banking activity, particularly mortgage lending, is closely tied to the health and trends of the regional real estate market, which remained active through 2024.

Burke & Herbert Financial Services faces intense rivalry from large national banks with vast resources and local community banks prioritizing personalized service. This competitive pressure forces the company to differentiate through specialized offerings and strong customer relationships.

The market's saturation in the Northern Virginia and Greater D.C. area fuels aggressive pricing strategies and a focus on digital innovation, as seen with national banks holding over 60% of U.S. deposits by late 2023. Burke & Herbert's 2024 merger with Summit Financial Group aimed to bolster its competitive standing.

The digital banking arms race is critical, with customers expecting seamless online and mobile experiences. By early 2024, online banks offered higher savings rates than traditional institutions, around 5% APY compared to the national average of 4.35%, highlighting the need for competitive digital products and pricing.

Regional real estate activity, with median home prices around $570,000 in Northern Virginia in 2023, directly influences mortgage lending and related banking services, adding another layer to competitive dynamics.

| Competitor Type | Key Advantages | Impact on Burke & Herbert |

|---|---|---|

| National Banks | Scale, extensive branch networks, large marketing budgets, advanced technology | Pressure on pricing, need for differentiation in service and technology |

| Local Community Banks/Credit Unions | Personalized service, deep community ties | Competition for local deposits and small business lending, emphasis on relationship banking |

| Digital-Only Banks | Higher interest rates, user-friendly platforms | Need for robust digital offerings, potential for customer attrition if digital experience lags |

SSubstitutes Threaten

Fintech lending platforms and digital lenders represent a substantial threat. These companies, offering everything from peer-to-peer loans to online-only credit, provide alternatives to traditional banking for both individuals and businesses seeking capital. Their streamlined processes and often tailored offerings can attract customers away from established institutions like Burke & Herbert Financial Services.

These digital alternatives frequently offer faster application and approval times, a significant draw for borrowers. For instance, by mid-2024, many online lenders were reporting loan approvals within hours, a stark contrast to the days or weeks often associated with traditional bank loans. This speed, coupled with specialized lending options for niche markets, directly challenges the market share of incumbent financial services.

The appeal of fintech lending is amplified by potentially more flexible terms and rates, particularly for borrowers who might not fit the standard credit profiles of traditional banks. This can siphon off valuable customer segments, impacting the volume of lending and associated revenue for established players. By 2024, the fintech lending sector continued its robust growth, with transaction volumes consistently increasing, underscoring the persistent competitive pressure.

Digital payment systems and mobile wallets represent a significant threat of substitutes for traditional banking services. Platforms like Apple Pay and Google Pay, alongside peer-to-peer payment apps such as Venmo and PayPal, offer users increasingly seamless and often faster transaction methods. These alternatives directly compete with Burke & Herbert Financial Services' core payment processing and account-based services, as consumers can bypass traditional channels for many everyday purchases and transfers.

The convenience and speed offered by these digital substitutes are key drivers of their adoption. For example, by early 2024, the global mobile payment market was projected to exceed $3 trillion, demonstrating a clear consumer shift towards these technologies. This trend means that fewer transactions might flow through traditional bank accounts, potentially impacting fee income and customer engagement for institutions like Burke & Herbert.

Emerging blockchain-based payment solutions also pose a growing threat, offering decentralized and potentially lower-cost alternatives for cross-border transactions and other financial activities. While still evolving, these technologies could further erode reliance on established banking infrastructure for payment services, presenting a long-term challenge to revenue streams that depend on transaction volumes and associated fees.

Robo-advisors and online investment platforms present a significant threat to Burke & Herbert's traditional wealth management services. These digital alternatives, like Betterment and Wealthfront, provide automated, low-cost investment management, directly competing with personalized advisory offerings. The accessibility and reduced fees appeal strongly to a growing segment of investors, particularly younger demographics, who are comfortable with digital solutions.

The shift towards digital financial management is evident in market growth. For instance, the robo-advisor market was projected to manage over $3.9 trillion globally by 2026, showcasing the increasing adoption of these services. This trend democratizes investment management, lowering the traditional barriers to entry and making sophisticated investment strategies available to a wider audience than ever before.

Credit Unions and Non-Bank Financial Institutions

Credit unions present a significant threat of substitution for Burke & Herbert's retail banking services. As member-owned entities, they often provide more favorable interest rates and lower fees compared to traditional banks. In 2024, credit union membership continued its upward trend, reflecting their appeal to consumers seeking cost-effective financial solutions.

Beyond credit unions, a diverse array of non-bank financial institutions also acts as a substitute. These include specialized firms focusing on areas like lending, payment processing, and investment management, which can fulfill specific customer needs more efficiently or at a lower cost than a full-service bank. For instance, the rise of digital payment platforms offers a convenient alternative for everyday transactions, diverting volume from traditional banking channels.

- Credit Union Growth: By the end of 2023, U.S. credit unions served over 136 million members, a testament to their competitive offerings.

- Fee Sensitivity: Data from 2024 surveys indicate that a significant percentage of consumers consider fees a primary factor when choosing a financial institution.

- Specialized Finance: The market for non-bank lending, particularly in areas like small business and personal loans, saw continued expansion in 2024, attracting customers who may find traditional bank lending processes cumbersome.

- Digital Alternatives: The adoption of fintech solutions for payments and money transfers continues to grow, offering convenient substitutes for basic banking functions.

Emerging Technologies like Cryptocurrency and Decentralized Finance (DeFi)

While still in early stages for widespread use, cryptocurrencies and decentralized finance (DeFi) present a growing threat. These technologies offer alternative ways to handle lending, borrowing, and managing assets, potentially cutting out traditional financial institutions like Burke & Herbert. As they develop and regulations become clearer, DeFi could revolutionize financial transactions for both individuals and companies.

The total value locked in DeFi protocols, a key metric for its growth, reached over $100 billion in early 2024, indicating significant user adoption and capital inflow into these alternative financial systems. This growing ecosystem provides a viable substitute for many services traditionally offered by banks, including high-yield savings accounts and peer-to-peer lending. The continued innovation in areas like stablecoins and decentralized exchanges further strengthens their position as potential disruptors.

- DeFi Growth: Total Value Locked (TVL) in DeFi surpassed $100 billion in early 2024.

- Service Substitution: DeFi offers alternatives for lending, borrowing, and asset management.

- Regulatory Impact: Increased regulatory clarity could accelerate mainstream adoption of crypto and DeFi.

- Technological Advancement: Innovations in stablecoins and DEXs enhance DeFi's appeal.

The threat of substitutes for Burke & Herbert Financial Services is substantial, stemming from a variety of non-traditional financial offerings. Fintech lending platforms, digital payment systems, robo-advisors, credit unions, and emerging decentralized finance (DeFi) all present viable alternatives for consumers and businesses seeking financial services. These substitutes often compete on speed, convenience, cost, and specialized offerings, directly challenging incumbent banks.

By mid-2024, online lenders were frequently approving loans within hours, a stark contrast to traditional banking timelines. Global mobile payment markets were projected to exceed $3 trillion by early 2024, highlighting a significant consumer shift away from traditional transaction methods. Furthermore, the total value locked in DeFi protocols surpassed $100 billion in early 2024, signaling robust growth in alternative financial ecosystems.

| Substitute Category | Key Offerings | Competitive Advantage | 2024 Impact/Projection |

|---|---|---|---|

| Fintech Lenders | Peer-to-peer loans, online credit | Speed, tailored options, faster approvals | Continued growth in transaction volumes |

| Digital Payments | Mobile wallets, P2P apps | Convenience, speed for everyday transactions | Global market exceeding $3 trillion |

| Robo-Advisors | Automated investment management | Low cost, accessibility, digital-first | Global market projected to exceed $3.9 trillion by 2026 |

| Credit Unions | Retail banking services | Potentially better rates, lower fees | Serving over 136 million U.S. members (end of 2023) |

| DeFi | Decentralized lending, borrowing, asset management | Decentralization, potentially lower costs | Total Value Locked (TVL) surpassed $100 billion (early 2024) |

Entrants Threaten

The banking sector, including institutions like Burke & Herbert Financial Services, faces significant threats from new entrants due to substantial regulatory and capital barriers. New banks must contend with intricate licensing processes, substantial minimum capital requirements mandated by regulators, and ongoing, rigorous compliance obligations. For instance, in 2024, the average capital requirement for a new national bank charter in the US can easily run into tens of millions of dollars, a significant hurdle for many entrepreneurs.

These stringent regulations, designed to safeguard consumers and maintain the stability of the financial system, effectively deter most potential new players. The sheer complexity and cost associated with meeting these demands make it exceedingly difficult for aspiring competitors to establish a direct foothold in the market, thereby limiting the threat of new entrants.

For community banks like Burke & Herbert, cultivating brand trust and deep-rooted customer relationships is paramount. This process often spans many years, as financial decisions require a high degree of confidence. Newcomers, particularly those lacking a recognized name, find it incredibly challenging to attract customers away from established institutions, needing to overcome ingrained loyalty and perceived security.

Burke & Herbert's advantage is amplified by its extensive history in the D.C. metro area, a testament to its enduring presence and the trust it has built. In 2024, customer retention remains a key metric for community banks, with many reporting retention rates exceeding 90% for long-term clients. This loyalty acts as a significant barrier to entry for new financial service providers.

Established financial institutions, including Burke & Herbert Financial Services, leverage significant economies of scale. This allows them to spread substantial fixed costs across a larger operational base, particularly in technology, marketing, and extensive branch networks. For instance, in 2023, the banking sector saw continued investment in digital transformation, with major banks allocating billions to enhance their IT infrastructure, a cost prohibitive for many new entrants.

New banks must attract a critical mass of customers to achieve profitability, a hurdle made steeper by the need to cover these high fixed costs. Burke & Herbert's recent merger, completed in early 2024, has further solidified its market position and increased its scale, making it even more challenging for new, smaller players to compete effectively and gain market share quickly.

Digital-Only Bank Models and Fintech Entrants

The threat of new entrants is heightened by the proliferation of digital-only banks and fintech firms, which often face less stringent regulatory hurdles than traditional institutions like Burke & Herbert. These agile competitors can enter specific market niches, such as payments or lending, with significantly lower operational costs.

These new entrants often leverage advanced technology to provide superior customer experiences or specialized services, creating an indirect competitive pressure. For instance, by mid-2024, several neobanks reported substantial user growth, with some exceeding several million customers in markets like the US and UK, demonstrating their ability to attract market share.

- Fintechs like Square and Stripe have captured significant portions of the payment processing market, which historically was a core banking service.

- Digital banks are increasingly offering competitive savings rates and user-friendly mobile interfaces, directly challenging traditional deposit-gathering models.

- The regulatory landscape, while complex, allows for specialized licenses that enable fintechs to operate with a lighter touch compared to full-service banking charters.

Niche Market Focus and Specialized Financial Services

New entrants can sidestep the significant hurdles of full-service banking by concentrating on niche markets or specialized financial services. These could include areas like specific lending types, payment processing, or wealth management technology. For example, in 2024, the fintech sector continued to see substantial investment, with particular growth in specialized lending platforms that cater to underserved demographics.

These focused competitors can build momentum by delivering highly customized solutions and exceptional user experiences within their chosen segments. This approach can attract customers who might otherwise be served by broader community bank offerings. The digital banking sector, for instance, saw a continued rise in customer acquisition for challenger banks in 2024, many of which focus on specific user needs or fee structures.

- Niche Market Entry: Focusing on underserved segments like small business lending or specific investment vehicles.

- Specialized Services: Offering tailored solutions in areas like cross-border payments or ESG-focused wealth management.

- User Experience Advantage: Leveraging technology to provide a more seamless and personalized customer journey.

- Competitive Threat: Drawing customers away from traditional, broader service providers by excelling in a specific area.

While traditional banking faces high barriers to entry, the threat from specialized fintechs and digital banks is notable. These firms, often operating with lower overhead and less stringent regulations, can target specific profitable niches. For instance, by early 2024, several neobanks in the US had amassed millions of users by focusing on user experience and competitive rates for deposits.

These agile new entrants are challenging established players like Burke & Herbert by offering innovative solutions in areas like payments and lending. Their ability to attract customers through technology-driven convenience and specialized offerings presents an evolving competitive landscape, even if they do not offer a full spectrum of banking services initially.

The threat of new entrants is thus multifaceted; while capital and regulatory hurdles remain significant for full-service banks, the digital disruption by specialized financial technology companies continues to grow. These firms can rapidly gain traction in specific market segments, forcing traditional institutions to adapt and innovate to maintain their customer base and competitive edge.

| New Entrant Type | Key Differentiator | 2024 Market Impact Example | Barrier Circumvention |

|---|---|---|---|

| Digital-Only Banks (Neobanks) | User-friendly mobile apps, low fees, high-yield savings accounts | Achieved millions of active users by offering superior digital experiences and competitive interest rates. | Lower operational costs, focus on specific customer segments. |

| Fintech Payment Processors | Seamless online payment solutions, integrated business tools | Captured significant market share in small business transactions, often exceeding the volume handled by traditional merchant services. | Specialized licensing, focus on a single core service. |

| Niche Lending Platforms | Targeted loan products for specific industries or demographics | Facilitated billions in specialized loans, serving markets underserved by traditional banks. | Streamlined underwriting, reduced regulatory burden for specific loan types. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Burke & Herbert Financial Services is built upon a robust foundation of data, including their official annual reports, filings with regulatory bodies like the SEC, and comprehensive industry research from reputable sources such as IBISWorld and S&P Capital IQ.