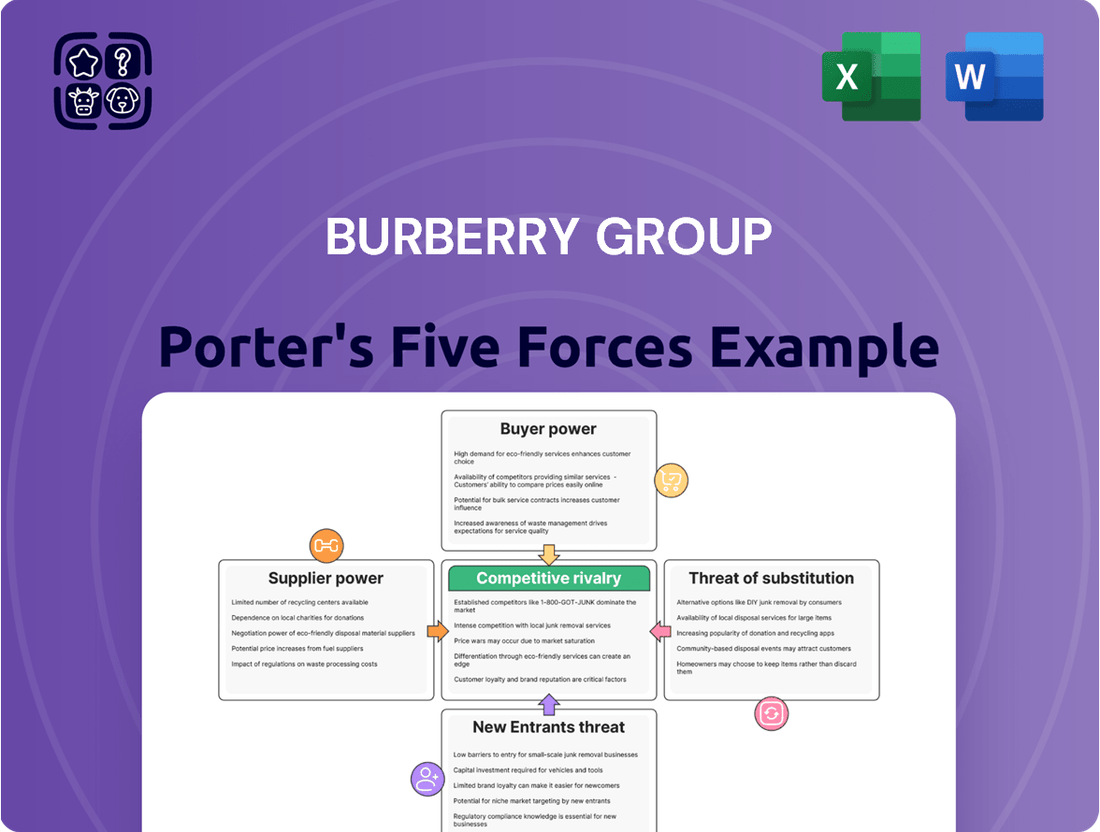

Burberry Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burberry Group Bundle

Burberry navigates a landscape shaped by intense rivalry and the significant bargaining power of its discerning clientele, impacting its pricing and product innovation. The threat of new entrants, while present, is somewhat mitigated by the brand's established luxury status and supply chain complexities.

The complete report reveals the real forces shaping Burberry Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Burberry's reliance on specialized raw materials like premium leathers and unique fabrics grants its suppliers a degree of bargaining power. These suppliers often possess niche production capabilities or exclusive access to certain resources, making them difficult to replace.

Burberry's reliance on specialized craftsmanship and unique manufacturing processes significantly bolsters supplier bargaining power. Suppliers possessing highly skilled artisans or proprietary techniques, essential for Burberry's luxury goods, can command higher prices and favorable terms. For instance, the intricate stitching and hand-finishing techniques characteristic of Burberry's iconic trench coats often necessitate suppliers with decades of specialized experience, making it difficult and costly for Burberry to switch providers. This dependence on niche expertise limits Burberry's ability to negotiate aggressively on price or terms.

Supplier concentration within the luxury goods sector, particularly for specialized materials like exotic leathers or high-quality fabrics, can significantly influence their bargaining power over brands like Burberry. If a limited number of suppliers control the production of these critical inputs, they can command higher prices.

For instance, in 2024, the global market for fine leather goods, a key component for many luxury fashion houses, is characterized by a few dominant players who supply to multiple high-end brands. This oligopolistic structure grants these suppliers considerable leverage, potentially increasing procurement costs for Burberry.

Brand Reputation of Suppliers

Suppliers with strong brand reputations, particularly those known for exceptional quality or ethical sourcing within the luxury sector, can command greater influence in negotiations. For Burberry, aligning with such suppliers can bolster its own brand image, but it simultaneously grants these reputable suppliers leverage due to their perceived intrinsic value.

This leverage can translate into less favorable terms for Burberry, such as higher material costs or stricter contract conditions. For instance, a supplier of high-quality, sustainably sourced cashmere might have a waiting list of luxury brands seeking their materials, giving them the power to dictate prices and terms.

- Reputable suppliers can demand premium pricing for their goods.

- Partnerships with well-regarded suppliers can enhance Burberry's brand perception.

- The exclusivity and quality associated with certain suppliers increase their bargaining power.

Burberry's Purchasing Volume

Burberry's substantial purchasing volume as a global luxury fashion leader grants it significant leverage with many suppliers. This scale allows for negotiation of favorable terms, particularly for more standardized materials, thereby reducing supplier influence.

In 2023, Burberry reported total revenue of £2.97 billion. This considerable financial clout translates into strong bargaining power when sourcing raw materials like cashmere, leather, and technical fabrics, as well as components for its iconic trench coats and accessories.

- Negotiating Power: Burberry's ability to place large orders and commit to long-term contracts provides a strong negotiating position.

- Cost Mitigation: This leverage helps to secure competitive pricing and favorable payment terms, directly impacting cost of goods sold.

- Supplier Dependence: For many suppliers, securing a contract with a brand like Burberry represents a significant portion of their business, further enhancing Burberry's bargaining position.

Burberry's bargaining power with suppliers is influenced by its scale and the nature of its inputs. While its substantial purchasing volume, evidenced by £2.97 billion in revenue in 2023, grants significant leverage for standardized materials, the reliance on specialized, high-quality inputs and unique craftsmanship limits this power.

The luxury sector's dependence on niche suppliers for premium leathers, unique fabrics, and specialized manufacturing processes means these suppliers can command higher prices and dictate terms. For example, in 2024, a concentrated market for fine leather goods with dominant players grants these suppliers considerable leverage over luxury brands like Burberry, potentially increasing procurement costs.

Suppliers with strong brand reputations for quality or ethical sourcing also hold sway, as aligning with them enhances Burberry's own brand image. This creates a dynamic where Burberry's scale benefits negotiations for common materials, but its need for exclusivity and specialized inputs empowers its suppliers.

| Factor | Impact on Burberry's Bargaining Power | Key Considerations |

|---|---|---|

| Supplier Concentration | Lowers Burberry's power | Limited number of suppliers for premium materials |

| Switching Costs | Lowers Burberry's power | High costs associated with finding and qualifying new specialized suppliers |

| Supplier Differentiation | Lowers Burberry's power | Unique craftsmanship and proprietary techniques |

| Purchasing Volume | Increases Burberry's power | Significant revenue (£2.97 billion in 2023) allows for strong negotiation on standardized inputs |

| Reputation of Suppliers | Lowers Burberry's power | Renowned suppliers can command premium pricing and terms |

What is included in the product

This analysis unpacks the competitive forces shaping Burberry Group's luxury fashion market, detailing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Burberry.

Customers Bargaining Power

Burberry's deep-rooted heritage and iconic brand identity cultivate a strong sense of loyalty among its affluent customer base. This loyalty means customers are less likely to be swayed by competitor pricing, effectively capping their bargaining power.

In 2024, Burberry's brand equity, a key driver of this loyalty, continued to be a significant asset, allowing them to maintain premium pricing and reduce price sensitivity among their core consumers.

Luxury consumers, including Burberry's clientele, typically place a high premium on perceived value, exceptional quality, and the exclusivity of a brand, rather than solely focusing on price. This inherent brand loyalty and desire for status significantly reduces the bargaining power of individual customers.

Burberry's commitment to superior design, meticulous craftsmanship, and heritage storytelling allows them to command premium pricing. Consequently, their customers are generally less price-sensitive, making them less inclined to negotiate on the cost of goods.

In 2024, the luxury goods market continued its robust growth, with global sales projected to reach over €360 billion, demonstrating the enduring appeal of brands that offer more than just a product. Burberry's ability to maintain its brand cachet directly translates to a lower threat from customer price pressure.

While Burberry doesn't face many direct substitutes for its specific brand of British luxury, the wider luxury fashion market is brimming with alternatives. Think of brands like Louis Vuitton, Gucci, or Chanel; these offer customers a wealth of choices in high-end apparel and accessories.

This abundance of options means that if Burberry doesn't consistently deliver on quality, design, or customer experience, consumers can easily shift their spending to a competitor. For instance, in 2023, the global luxury goods market was valued at approximately €362 billion, highlighting the sheer scale of competition and the power customers wield through their purchasing decisions.

Information Transparency

Burberry's customers benefit from increased information transparency, largely due to digital platforms and social media. This allows them to easily research products, compare pricing across different retailers, and access a wealth of customer reviews. For example, in 2024, the luxury goods market saw a significant rise in online research before purchase, with many consumers consulting multiple sources. This readily available information empowers customers, giving them a slightly stronger hand in their interactions with brands like Burberry.

This heightened transparency directly impacts Burberry's bargaining power of customers by:

- Facilitating Price Comparison: Customers can more easily compare Burberry's pricing against competitors, especially for similar luxury items.

- Accessing Product Reviews: Online reviews and social media discussions provide insights into product quality, fit, and overall customer satisfaction, influencing purchasing decisions.

- Demanding Better Value: With more information, customers can better assess the value proposition of Burberry's offerings, potentially leading to demands for better quality or pricing.

Customer Segmentation

Burberry caters to a wide array of customers, from those aspiring to own luxury goods to the ultra-wealthy. While ultra-high-net-worth individuals might demand exceptional service and customization, their desire for exclusivity and brand prestige often limits their ability to negotiate prices significantly.

This segmentation means that while some customer groups might have limited price sensitivity, others, particularly aspirational buyers, are more attuned to value and promotions. For instance, in 2023, luxury goods sales saw robust growth, indicating strong demand across various customer tiers, though price remains a consideration for many.

- Diverse Customer Base: Burberry serves both aspirational and ultra-high-net-worth individuals.

- Limited Price Power for UHNWIs: The pursuit of status and unique experiences often outweighs price concerns for the wealthiest segment.

- Value Sensitivity in Aspirational Tiers: Aspirational buyers are more likely to be influenced by pricing and promotional activities.

Burberry's strong brand heritage and the inherent loyalty of its affluent customer base significantly limit the bargaining power of individual customers. This loyalty is bolstered by the luxury market's emphasis on perceived value, quality, and exclusivity over mere price. In 2024, the global luxury goods market continued its upward trajectory, with sales projected to exceed €360 billion, underscoring the enduring appeal of brands like Burberry that offer more than just a product, thereby reducing customer price sensitivity.

| Customer Segment | Price Sensitivity | Bargaining Power Impact |

|---|---|---|

| Ultra-High-Net-Worth Individuals | Low | Limited due to focus on exclusivity and status. |

| Aspirational Buyers | Moderate to High | Higher due to greater consideration of value and promotions. |

Full Version Awaits

Burberry Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Burberry Group Porter's Five Forces Analysis presented here meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the luxury fashion industry. This comprehensive overview provides actionable insights into Burberry's strategic positioning and potential challenges.

Rivalry Among Competitors

The luxury fashion landscape is significantly shaped by global conglomerates such as LVMH Moët Hennessy Louis Vuitton and Kering. These entities, owning a stable of renowned brands, wield immense financial power and market influence, directly challenging Burberry for prime market positioning and skilled personnel. For instance, in 2023, LVMH reported revenue of €86.2 billion, showcasing the scale of resources available to these dominant players.

Burberry's competitive rivalry is deeply rooted in its brand differentiation and rich heritage, with competition centering on its distinctive British identity, unique design aesthetics, and compelling marketing narratives, rather than solely on price. For instance, in fiscal year 2024, Burberry continued its strategic focus on reinforcing its luxury positioning and brand equity.

The brand's commitment to its heritage and innovative designs is a key differentiator against a crowded luxury market. This focus helps them stand out from numerous competitors vying for market share in the high-end fashion sector.

The luxury sector, including brands like Burberry, is characterized by substantial upfront investments in areas such as design, high-quality manufacturing, global marketing campaigns, and prime retail locations. These significant fixed costs create a considerable financial hurdle for any company looking to enter or exit the market.

For established players like Burberry, these high fixed costs translate into high exit barriers. This means that once a company has invested heavily, it becomes very difficult and costly to withdraw from the market, forcing them to compete intensely to maintain profitability and market share.

In 2023, Burberry reported revenue of £2.97 billion, illustrating the scale of operations and the associated fixed costs required to maintain its position in the luxury fashion landscape. This level of investment underscores the commitment needed to stay competitive.

Intense Marketing and Innovation

The luxury fashion industry, including Burberry, is marked by intense rivalry driven by constant product innovation and aggressive marketing. Companies continually launch new collections and invest heavily in digital engagement and unique retail experiences to capture consumer interest. For instance, in the fiscal year ending March 2024, Burberry reported a 7% decrease in revenue to £2.97 billion, reflecting the challenging market conditions and the need for strategic adjustments in response to competitive pressures.

Burberry's competitive landscape demands significant and ongoing investment in creative direction and digital marketing. Staying ahead requires adapting to evolving consumer preferences and maintaining a strong brand presence across various platforms. This intense competition necessitates a proactive approach to innovation and customer engagement to maintain market share and brand desirability.

- Product Innovation: Competitors regularly introduce new designs, materials, and collections, forcing Burberry to continuously invest in its creative teams and product development.

- Marketing Campaigns: The luxury sector relies heavily on aspirational marketing; Burberry faces rivals with substantial marketing budgets for advertising, influencer collaborations, and digital content.

- Digital Engagement: Maintaining relevance requires significant investment in e-commerce platforms, social media presence, and innovative digital experiences to connect with a global audience.

- Experiential Retail: Creating memorable in-store experiences, pop-up events, and personalized services is crucial for differentiating brands and fostering customer loyalty in a crowded market.

Geographic and Channel Expansion

Burberry faces intense competitive rivalry as rivals aggressively expand their geographic reach and diversify sales channels, encompassing digital, wholesale, and direct-to-consumer concessions. This ongoing expansion by competitors, including LVMH and Kering brands, compels Burberry to continuously refine its own multi-channel strategy and global store network to secure customer access and market share.

In 2024, the luxury market saw continued investment in digital capabilities, with many brands enhancing their e-commerce platforms and exploring new online sales avenues. For instance, many competitors increased their investment in personalized online shopping experiences and virtual try-on technologies. Burberry's own digital sales accounted for a significant portion of its revenue, underscoring the importance of this channel in staying competitive.

- Geographic Footprint: Competitors are opening new stores in emerging luxury markets and key established cities, increasing direct customer touchpoints.

- Channel Diversification: Brands are leveraging online marketplaces, direct-to-consumer websites, and strategic wholesale partnerships to broaden reach.

- Digital Investment: Significant capital is being allocated to enhance e-commerce functionality, mobile app experiences, and digital marketing efforts.

- Customer Access: The battle for customer attention and purchasing power is fierce, requiring a seamless omnichannel experience across all touchpoints.

Burberry operates in a highly competitive luxury fashion market, facing intense rivalry from global giants like LVMH and Kering, which possess substantial financial resources and brand portfolios. This competition is driven by continuous product innovation, aggressive marketing strategies, and significant investments in digital engagement and experiential retail. For example, in fiscal year 2024, Burberry reported a revenue of £2.97 billion, highlighting the scale of operations and the financial commitment required to maintain its market position amidst these strong competitors.

SSubstitutes Threaten

Premium segments of mass-market brands, often termed 'affordable luxury,' present a significant threat of substitution for Burberry. These brands, while not competing at the absolute highest luxury tier, capture consumers seeking current fashion trends and a certain aspirational quality at more accessible price points. For instance, brands like Coach and Michael Kors have successfully carved out this space, offering stylish leather goods and apparel that can appeal to a similar demographic as Burberry's more entry-level offerings.

The rise of the authenticated second-hand and vintage luxury market poses a substantial threat to Burberry. Consumers can now acquire genuine Burberry pieces, like iconic trench coats or classic handbags, at significantly lower prices than new items. For instance, the global luxury resale market was projected to reach around $77 billion in 2023, and this trend shows no signs of slowing down, potentially diverting sales from Burberry's primary offerings.

Consumers are increasingly diverting discretionary spending towards experiences like luxury travel and fine dining, which can act as a substitute for purchasing high-end fashion items. For instance, the global luxury travel market was valued at approximately $1.4 trillion in 2023 and is projected to grow, indicating a significant draw on consumer budgets that might otherwise go to luxury goods.

Counterfeit Goods

The pervasive market for counterfeit luxury goods presents a significant threat to Burberry. While these illegal imitations do not directly appeal to Burberry's core clientele seeking authenticity and quality, they can significantly dilute the brand's image and exclusivity. This dilution can occur as consumers see readily available, cheaper alternatives that mimic Burberry's designs.

The threat of substitutes, particularly in the form of counterfeit goods, can impact Burberry by capturing a segment of consumers who desire the brand's aesthetic but are unwilling or unable to pay premium prices. This can lead to a loss of potential sales, even if these customers are not the primary target market. For instance, in 2023, the global luxury counterfeit market was estimated to be worth hundreds of billions of dollars, highlighting the scale of this challenge.

- Brand Dilution: Counterfeits undermine Burberry's carefully cultivated image of luxury and craftsmanship.

- Market Capture: While not authentic buyers, counterfeit consumers represent a segment that could otherwise be converted.

- Economic Impact: The sheer volume of the counterfeit market, estimated to be in the hundreds of billions globally in 2023, represents a substantial lost revenue opportunity for legitimate brands like Burberry.

Changing Consumer Values

A significant shift in consumer values presents a potent threat of substitution for luxury fashion brands like Burberry. As society increasingly embraces sustainability and conscious consumption, consumers may opt for durable, ethically sourced, or minimalist items over the traditional desire for new luxury fashion. This evolving mindset can lead individuals to seek out fewer, higher-quality pieces, potentially from brands with a strong ethical or environmental focus, thereby substituting the allure of established luxury labels.

For instance, the global sustainable fashion market is projected to grow substantially. Reports from 2024 indicate a growing consumer preference for brands demonstrating transparency in their supply chains and commitment to eco-friendly practices. This trend could see consumers diverting spending from traditional luxury purchases towards alternatives that align better with their evolving ethical and environmental concerns.

- Growing Demand for Sustainable Alternatives: Consumers are increasingly seeking out clothing made from recycled materials or organic cotton, directly impacting the demand for conventionally produced luxury goods.

- Rise of the Second-Hand Luxury Market: Platforms offering pre-owned luxury items are experiencing robust growth, providing a more affordable and sustainable way for consumers to access high-end fashion, acting as a direct substitute.

- Minimalist and Capsule Wardrobe Trends: The popularity of owning fewer, more versatile, and high-quality items means consumers may purchase fewer new luxury pieces, favoring longevity and timeless style over frequent brand-driven updates.

The increasing popularity of the authenticated second-hand and vintage luxury market presents a significant substitute threat to Burberry. Consumers can acquire genuine Burberry items at considerably lower prices than new ones. The global luxury resale market was projected to reach around $77 billion in 2023, and this growth is expected to continue, diverting potential sales from Burberry's new product lines.

Consumers are also redirecting discretionary spending towards experiences like luxury travel and fine dining, which act as substitutes for high-end fashion purchases. The global luxury travel market was valued at approximately $1.4 trillion in 2023, highlighting a substantial draw on consumer budgets that could otherwise be allocated to luxury goods.

The pervasive market for counterfeit luxury goods poses a considerable threat by mimicking Burberry's designs and diluting brand exclusivity. While not attracting core clientele, these fakes capture consumers seeking the brand's aesthetic at lower prices. The global luxury counterfeit market was estimated to be worth hundreds of billions of dollars in 2023, representing a significant lost revenue opportunity.

Furthermore, evolving consumer values favoring sustainability and conscious consumption are leading some to opt for durable, ethically sourced items over new luxury fashion. The global sustainable fashion market is growing, with 2024 data showing increased consumer preference for transparent and eco-friendly brands, potentially substituting traditional luxury purchases.

| Substitute Category | Key Characteristics | Impact on Burberry | Market Size/Growth (Illustrative) |

|---|---|---|---|

| Affordable Luxury Brands | Current trends, aspirational quality, accessible price points | Captures consumers seeking style without premium cost | Brands like Coach, Michael Kors |

| Second-Hand/Vintage Luxury | Authenticity, lower prices, sustainability | Diverts sales from new items, offers value proposition | Global resale market ~$77 billion (2023 projection) |

| Experiential Spending | Luxury travel, fine dining | Reduces discretionary income for fashion purchases | Global luxury travel market ~$1.4 trillion (2023 valuation) |

| Counterfeit Goods | Mimicked designs, low prices | Dilutes brand image, captures price-sensitive segment | Global counterfeit market in hundreds of billions (2023 estimate) |

| Sustainable/Ethical Fashion | Durability, ethical sourcing, eco-friendly practices | Appeals to evolving consumer values, shifts spending priorities | Growing market, increasing consumer preference (2024 data) |

Entrants Threaten

Establishing a global luxury fashion house like Burberry demands substantial capital. Think design studios, high-quality manufacturing, extensive marketing, and a worldwide retail presence. In 2023, the global luxury goods market was valued at approximately $362 billion, showcasing the scale of investment needed to compete.

These immense financial requirements act as a significant hurdle, effectively deterring most aspiring new entrants from even attempting to enter the luxury fashion arena. The sheer upfront cost makes it incredibly challenging for smaller or less-funded entities to gain a foothold against established players like Burberry.

Burberry's formidable brand loyalty, cultivated over decades of heritage and meticulous brand building, presents a significant barrier to new entrants. This deep-seated trust and emotional connection with luxury consumers is exceptionally difficult and costly for newcomers to replicate, making market entry a steep uphill battle.

New entrants face significant challenges in accessing established distribution channels within the luxury fashion market. Burberry, for instance, has cultivated a global network of directly operated stores, concessions in high-end department stores, and robust digital commerce platforms, making it difficult for newcomers to gain similar visibility and reach.

Securing prime retail locations in key fashion capitals is a major hurdle, as these spaces are often occupied by established brands with long-standing leases and strong relationships with landlords. Furthermore, the cost associated with building and maintaining such a physical presence, alongside a sophisticated online storefront, represents a substantial capital investment for any aspiring competitor.

Existing players like Burberry benefit from well-established supply chains and strong relationships with suppliers and manufacturers. This allows for better control over product quality, timely delivery, and potentially more favorable pricing, creating a significant barrier for new entrants who must build these networks from scratch.

Expertise in Design and Craftsmanship

The threat of new entrants for Burberry, particularly concerning its expertise in design and craftsmanship, is relatively low. Developing the specialized design talent, manufacturing know-how, and intricate supply chain relationships essential for producing high-quality luxury goods is a significant hurdle.

Newcomers often struggle to replicate the deep industry knowledge and access to skilled artisans that established brands like Burberry have cultivated over decades. This inherent complexity in replicating luxury production capabilities acts as a substantial barrier.

- High Barrier to Entry: Replicating Burberry's heritage in design and its network of skilled craftspeople requires substantial time and investment, deterring many potential new entrants.

- Brand Equity & Reputation: Burberry's established reputation for quality and design excellence, built over many years, is not easily matched by newcomers.

- Supply Chain Complexity: Access to the specialized suppliers and artisans needed for luxury leather goods and iconic trench coats is a significant challenge for new firms.

- Intellectual Property: Burberry's design patents and trademarks further protect its unique offerings from imitation.

Regulatory and Intellectual Property Hurdles

The luxury fashion industry, including brands like Burberry, faces significant barriers to entry due to complex regulatory landscapes and robust intellectual property protections. New companies must navigate a web of international trade regulations, customs duties, and varying import/export laws, which can be costly and time-consuming. For instance, in 2024, the European Union continued to enforce strict regulations on product safety and labeling, requiring extensive documentation and testing for any new apparel entering the market.

Furthermore, safeguarding brand identity and design originality is paramount in luxury goods. Protecting trademarks, copyrights, and design patents against infringement requires substantial legal investment and ongoing vigilance. Burberry, for example, actively defends its iconic check pattern and brand name, making it difficult for new entrants to establish a distinct and legally protected presence without facing potential litigation. This legal overhead deters many potential competitors.

- Regulatory Complexity: International trade laws and product compliance standards create significant hurdles.

- Intellectual Property Protection: Strong legal frameworks for trademarks and designs require substantial investment to navigate.

- Ethical Sourcing & Sustainability: Compliance with evolving standards for ethical sourcing and sustainability adds further cost and complexity for new entrants.

The threat of new entrants for Burberry remains relatively low due to the immense capital required to establish a luxury brand. The global luxury goods market, valued at around $362 billion in 2023, demands significant investment in design, manufacturing, marketing, and retail infrastructure, creating a substantial financial barrier.

New entrants also struggle to replicate Burberry's established brand loyalty and its intricate global distribution network, which includes prime retail locations and robust e-commerce platforms. The cost and time needed to build such a presence, coupled with securing access to specialized suppliers and skilled artisans, present formidable challenges.

Furthermore, navigating complex international regulations and protecting intellectual property, such as Burberry's iconic check pattern, requires considerable legal investment. In 2024, ongoing compliance with evolving standards for ethical sourcing and sustainability adds further cost and complexity for any aspiring competitor.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | High investment needed for design, manufacturing, marketing, and retail. | Deters most new entrants due to prohibitive upfront costs. |

| Brand Equity & Loyalty | Decades of heritage and meticulous brand building. | Difficult and costly for newcomers to replicate consumer trust and emotional connection. |

| Distribution Channels | Global network of directly operated stores, department store concessions, and e-commerce. | Challenging for new entrants to gain similar visibility and reach. |

| Supply Chain & Craftsmanship | Established relationships with suppliers and skilled artisans. | Newcomers must build these networks from scratch, facing quality and access challenges. |

| Intellectual Property & Regulation | Strong trademarks, design patents, and complex international trade laws. | Requires substantial legal investment and ongoing vigilance to navigate and protect. |

Porter's Five Forces Analysis Data Sources

Our Burberry Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Burberry's official annual reports and investor presentations, alongside industry-specific market research reports and reputable financial news outlets.