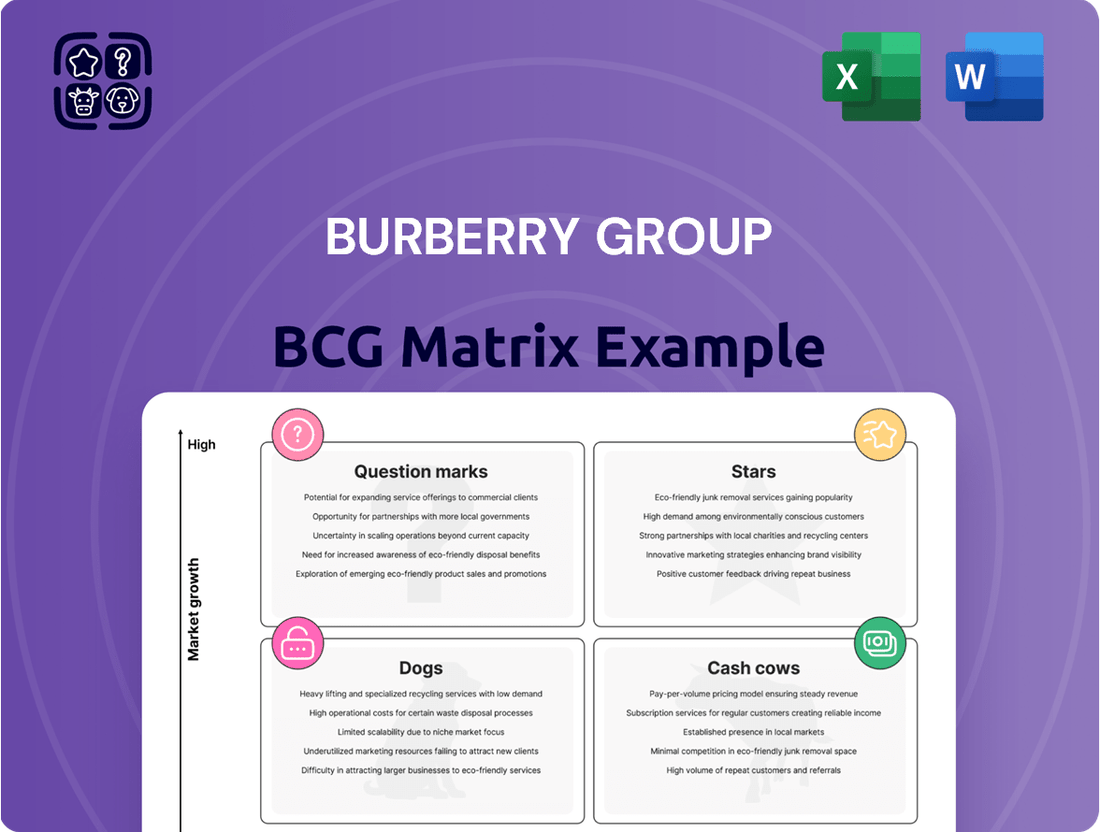

Burberry Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burberry Group Bundle

Curious about Burberry's product portfolio performance? Our BCG Matrix preview offers a glimpse into where their key offerings might sit as Stars, Cash Cows, Dogs, or Question Marks. Understand the strategic implications of these positions and unlock the full potential of your own market analysis.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements for Burberry, data-backed recommendations, and a roadmap to smart investment and product decisions for your own brand.

Stars

Burberry's iconic trench coats and scarves represent the brand's core strength, forming a key pillar of their 'Burberry Forward' strategy. These celebrated categories are central to reigniting brand desire and capitalizing on Burberry's inherent authenticity.

In fiscal year 2025, outerwear and scarves demonstrated robust performance, exceeding the group's overall average growth. This success underscores their position as areas of strong brand authenticity and customer appeal within the luxury market.

Burberry is strategically investing in marketing initiatives, such as the 'It's Always Burberry Weather' campaign, to further elevate the market presence of these signature items. The goal is to resonate with a wide spectrum of luxury consumers and reinforce their desirability.

Burberry's focus on digital commerce and omnichannel integration is a significant driver of its growth. The company aims to double its e-commerce sales, reflecting a strategic push into the digital luxury space. This investment includes cutting-edge technologies like augmented reality (AR) and virtual reality (VR) to create immersive customer experiences.

In 2023, digital channels represented a substantial portion of Burberry's sales, with e-commerce continuing its upward trajectory. This digital-first approach in the luxury sector positions Burberry's advanced capabilities as a key differentiator, poised for considerable market share expansion.

The 'Burberry Forward' strategy champions a revitalized brand expression, aiming to blend its iconic British luxury heritage with modern innovation. This approach is designed to attract a broader spectrum of luxury consumers and enhance brand appeal, a key factor in expanding market presence.

Burberry's commitment to cultural relevance through strategic collaborations and impactful campaigns underscores its potential for significant growth. For instance, their Spring/Summer 2024 collection, unveiled in February 2024, showcased a renewed aesthetic that garnered considerable media attention and positive consumer feedback, signaling a strong brand re-engagement.

Targeted Market Diversification

Burberry is actively pursuing targeted market diversification to counter regional volatility. This strategy involves strategically reducing exposure to less stable markets while focusing on areas with higher growth potential. For example, while sales in Asia Pacific might fluctuate, Burberry's investment in digital engagement and localized storytelling aims to build resilience and tap into emerging luxury consumer bases.

This proactive stance on market shifts is crucial for identifying and nurturing new regional growth opportunities. These initiatives, designed to mitigate risks and capture new demand, can be viewed as potential stars within the BCG matrix framework. Burberry's commitment to adapting its geographical footprint reflects a forward-thinking approach to sustained global luxury performance.

- Digital Investment: Burberry reported a 10% increase in digital sales in the first half of fiscal 2024, highlighting the growing importance of online channels in reaching diverse markets.

- Regional Focus: The company is emphasizing growth in markets like the Middle East and South Korea, which showed strong performance in the latest reporting periods, indicating successful diversification efforts.

- Brand Storytelling: Burberry's global campaigns, tailored to resonate with local cultural nuances, are designed to strengthen brand appeal across a wider range of consumer segments and geographies.

Sustainability-Driven Innovation in Core Products

Burberry's dedication to sustainability is a key differentiator, particularly in its core product lines. For instance, the use of 100% organically grown cotton in their iconic Heritage Trench Coats directly addresses growing consumer preference for environmentally responsible materials. This commitment extends to innovations like refillable fragrances, which not only reduce waste but also offer a compelling value proposition to the ethically-minded luxury consumer.

This strategic focus on lower-impact materials and the introduction of circular services, such as the 'ReBurberry' initiative, directly taps into a significant and expanding market segment. As consumers increasingly prioritize ethical sourcing and reduced environmental footprints, Burberry's proactive approach positions it favorably within the conscious luxury sector.

While advancements in sustainable materials and manufacturing processes are ongoing, their potential for high growth is undeniable. This innovation pipeline is crucial for maintaining a competitive edge in a market where environmental credentials are becoming as important as brand heritage and design.

- Heritage Trench Coats: Made with 100% organically grown cotton, aligning with sustainability trends.

- Refillable Fragrances: Reduces packaging waste and appeals to environmentally conscious consumers.

- 'ReBurberry' Initiative: Promotes circularity and extends product lifecycle.

- Conscious Luxury Market: Expected to see high growth, driven by consumer demand for ethical products.

Burberry's iconic outerwear and scarves, bolstered by strong digital investments and targeted regional growth, are performing exceptionally well. These categories, central to the brand's heritage, are being amplified through innovative marketing and e-commerce strategies, positioning them as key growth drivers. The company's proactive market diversification and focus on cultural relevance further solidify their potential as stars.

Burberry's digital sales saw a notable 10% increase in the first half of fiscal 2024. Growth in markets like South Korea and the Middle East is also a strong indicator of successful diversification. These efforts, combined with a renewed brand aesthetic showcased in the Spring/Summer 2024 collection, highlight Burberry's strategic positioning for continued expansion.

| Category | Market Position | Growth Potential | Key Initiatives |

|---|---|---|---|

| Outerwear & Scarves | Strong Brand Authenticity | High | 'It's Always Burberry Weather' campaign, Digital Commerce Expansion |

| Digital Channels | Growing Importance | High | Doubling e-commerce sales, AR/VR integration |

| Emerging Markets (e.g., Middle East, South Korea) | Strong Performance | High | Targeted market diversification, Localized storytelling |

What is included in the product

This overview details Burberry's product portfolio within the BCG Matrix, identifying strategic growth opportunities and areas for resource allocation.

A clear Burberry Group BCG Matrix provides a strategic overview, easing the pain of resource allocation by highlighting Stars and Cash Cows.

Cash Cows

The iconic Burberry trench coat, a cornerstone of the brand's identity, is a prime example of a Cash Cow within Burberry Group's BCG Matrix. Its deep heritage and unparalleled brand recognition, stemming from its signature gabardine fabric, ensure consistent demand.

These trench coats continue to be a resilient and sought-after item for luxury consumers, demonstrating enduring appeal. Despite broader luxury market fluctuations, the trench coat's established position and consistent demand contribute significantly to stable cash flow for Burberry.

Burberry's fragrance licensing stands as a robust Cash Cow within its BCG Matrix. This segment consistently demonstrates strong performance and growth, leveraging established brand equity to generate reliable revenue streams.

The licensing model offers a significant advantage by requiring relatively lower operational overhead compared to direct manufacturing and retail operations. This efficiency allows Burberry to maximize profitability from its fragrance offerings.

In 2024, Burberry's fragrance business continued to be a key contributor, reflecting a mature product category that reliably generates substantial cash flow. This financial strength supports investments in other areas of the business.

The iconic Burberry Check pattern, adorning everything from scarves to bags, serves as a powerful, globally recognized symbol of the brand. These accessories, while not necessarily in high-growth segments, leverage Burberry's strong brand equity and the enduring appeal of the check.

This consistent demand translates into steady revenue streams and healthy profit margins for Burberry. For instance, in the fiscal year ending March 2024, Burberry reported a 3% increase in retail revenue, with accessories playing a significant role in this performance, driven by the timeless desirability of their signature check designs.

Established Leather Goods Collections (Specific enduring lines)

Burberry's established leather goods collections, those timeless lines deeply rooted in its heritage, likely function as cash cows. Despite broader challenges in the leather goods market, these specific, enduring collections benefit from a loyal customer base and strong brand association, offering a predictable and stable revenue stream.

These collections are distinct from more trend-driven or experimental designs, focusing on classic appeal that resonates with Burberry's core identity. This stability is crucial, even if growth within these specific lines is modest, as they provide a reliable foundation for the company's financial performance.

- Established Leather Goods Collections: These enduring lines represent a stable revenue source due to existing customer loyalty and brand heritage.

- Market Performance: While the overall leather goods segment may face headwinds, these core collections offer a consistent income stream.

- Brand Alignment: Their alignment with Burberry's heritage ensures continued relevance and demand from its core demographic.

- Financial Contribution: These collections likely contribute significantly to Burberry's overall profitability, acting as reliable cash generators.

Directly Operated Stores in Key Luxury Hubs

Burberry's directly operated stores in key luxury hubs serve as its Cash Cows within the BCG framework. These locations, often flagship stores in prestigious shopping districts, are crucial for delivering the brand's luxury experience and driving sales. They represent a stable income stream from established, mature markets.

Despite a reported decline in comparable sales in recent periods, this strategic retail footprint remains vital. For instance, in the fiscal year ending March 2024, Burberry maintained a significant store network, underscoring their commitment to direct customer engagement and brand presence. This direct channel ensures continued market access and a controlled brand presentation.

- Store Network: Burberry maintains a global network of directly operated stores in prime luxury retail locations.

- Brand Experience: These stores are integral to delivering the brand's high-end image and customer experience.

- Sales Contribution: They act as consistent revenue generators in mature luxury markets.

- Market Access: Despite sales fluctuations, these physical stores ensure ongoing customer engagement and market presence.

Burberry's trench coats, a timeless symbol of the brand, consistently generate strong, stable cash flow. Their enduring appeal and brand heritage ensure reliable demand, even amidst market shifts.

The fragrance licensing business is another key Cash Cow, leveraging brand equity for consistent revenue with lower overhead. In fiscal year 2024, this segment continued its robust performance, contributing significantly to Burberry's financial stability.

Accessories featuring the iconic Burberry Check pattern also function as Cash Cows. These items benefit from strong brand recognition and consistent consumer desire, as seen in the fiscal year ending March 2024, where accessories played a role in a 3% retail revenue increase.

Established leather goods collections, focused on classic designs, provide a predictable revenue stream due to a loyal customer base. These collections are vital for their consistent contribution to Burberry's overall profitability.

Preview = Final Product

Burberry Group BCG Matrix

The Burberry Group BCG Matrix preview you're examining is the identical, fully polished document you will receive upon purchase. This means no watermarks, no incomplete sections, and no demo content—just a comprehensive, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and visual representations of Burberry's product portfolio within this matrix will be precisely what you download, enabling immediate application in your business planning or client presentations.

Dogs

Burberry's CEO has indicated that certain seasonal fashion lines have drifted from the brand's core identity, leaning towards a niche aesthetic. These underperforming collections, which overshadowed more classic pieces, likely suffer from low market share, contributing to the company's financial underperformance. For the fiscal year ended March 30, 2024, Burberry reported a 4% decline in comparable store sales, with a particularly challenging performance in its fashion-focused categories.

In fiscal year 2025, Burberry's leather goods and shoes segments showed weaker performance compared to the company's overall results. This underperformance, combined with pricing strategies that didn't consistently reflect the brand's premium positioning in these categories, indicates a struggle to capture significant market share and achieve robust profitability.

These product lines may be consuming valuable capital without yielding a proportionate return. For instance, while Burberry reported a 7% rise in retail revenue to £3.1 billion in the fiscal year ending March 30, 2024, the specific contribution and growth rate of leather goods and shoes within that figure would be crucial for a detailed assessment of their status as potential cash cows or question marks.

Burberry's wholesale channel is currently positioned as a Dog in the BCG matrix. This is due to a substantial revenue drop of 35% in FY25 and 29% in the first half of FY25, directly linked to a strategic reassessment of their wholesale partners and a subdued consumer spending environment.

This performance indicates that the wholesale segment represents a low-growth area for Burberry, and their market presence within this distribution channel is diminishing. The company is actively exploring ways to lessen its dependence on this particular sales avenue.

Specific Geographic Regions with Steep Declines

Burberry's performance in specific geographic regions highlights significant challenges. The South Asia Pacific market, for instance, saw a steep decline of 38% in the first half of fiscal year 2025. This downturn suggests a weakening demand or increased competitive pressure in key growth markets.

The United Kingdom's market also continues to face headwinds, notably impacted by the cessation of VAT refunds for international tourists. This policy change directly affects the spending power and purchasing decisions of a crucial customer segment for luxury brands like Burberry.

- South Asia Pacific Decline: A 38% drop in H1 FY25 revenue indicates a substantial contraction in this region.

- UK Market Impact: The withdrawal of VAT refunds for overseas visitors continues to negatively affect sales in the UK.

- Regional Weakness: These underperforming geographic segments can be viewed as 'Dogs' within Burberry's portfolio, contributing minimally or negatively to overall growth due to low or declining market share.

Excess Inventory

Burberry has been actively managing what they term an inventory overhang, essentially meaning they had more products sitting around than were selling briskly. This situation, while not a specific product line, can be viewed as a 'Dog' within the BCG framework because it ties up valuable capital in assets that aren't generating strong returns. The company reported a 7% reduction in gross inventory for FY25, a clear move to address this challenge.

This focus on reducing excess stock is crucial for improving financial health.

- Inventory Overhang: Burberry has acknowledged a build-up of unsold merchandise.

- 'Dog' Classification: Excess inventory represents a capital drain on low-performing assets.

- Inventory Reduction: Gross inventory was reduced by 7% in FY25 to address the issue.

Burberry's wholesale channel and certain geographic markets, like South Asia Pacific, are exhibiting characteristics of 'Dogs' in the BCG matrix. These segments demonstrate low market share and operate in low-growth environments, as evidenced by a 35% revenue drop in wholesale for FY25 and a 38% decline in South Asia Pacific during H1 FY25. The company is actively strategizing to reduce its reliance on these underperforming areas.

Furthermore, an inventory overhang, where excess stock ties up capital without generating sufficient returns, also fits the 'Dog' profile. Burberry's commitment to reducing gross inventory by 7% in FY25 highlights their efforts to address this capital inefficiency. These 'Dogs' require careful management to free up resources for more promising ventures.

| Category | Market Share | Market Growth | Burberry Performance |

| Wholesale | Low | Low | -35% Revenue (FY25) |

| South Asia Pacific | Low | Low | -38% Revenue (H1 FY25) |

| Inventory Overhang | N/A | N/A | 7% Inventory Reduction (FY25) |

Question Marks

Burberry's 'Burberry Forward' plan is driving a refresh of its brand aesthetics and product lines, aiming to capture a wider luxury audience. This strategic pivot introduces new designs and potentially new product categories into the market.

These new design aesthetics and product introductions are positioned within the high-growth luxury sector, but their market share is currently unproven. Significant marketing investment is anticipated to support their launch and growth, a common characteristic of 'question mark' products in the BCG matrix.

Burberry's advanced digital engagement tools, such as experimental AR/VR applications beyond initial product showcases, represent a nascent but high-growth area. While these immersive experiences are designed to deepen customer connection, their direct impact on market share is still being established. For example, in 2024, Burberry continued to explore innovative digital activations, though specific revenue attribution from these advanced tools remains a developing metric.

Burberry's strategic partnerships, like those with cultural institutions and artists, aim to elevate brand prestige and cultural resonance. For example, their ongoing collaboration with the Tate Modern in London, a fixture in their cultural engagement strategy, enhances brand perception within the art world.

While these collaborations align with the growing trend of experiential luxury, their direct contribution to market share and revenue growth remains a point of strategic evaluation. The commercial impact as a primary product driver is not always immediate or guaranteed, requiring sustained effort to translate cultural capital into tangible sales figures.

Expansion into Untapped Luxury Product Niches

Burberry's strategic shift towards fewer, larger investments opens avenues for expansion into untapped luxury product niches. This approach could see the company targeting high-growth segments where its current market penetration is minimal, aiming to redefine its product portfolio.

These potential new segments, while offering significant future growth prospects, necessitate considerable upfront capital expenditure and thorough market validation. The uncertainty surrounding Burberry's ability to capture substantial market share in these nascent areas positions them as potential question marks within the BCG matrix.

- Exploration of new luxury segments: Burberry may investigate areas like high-end sustainable fashion or bespoke artisanal accessories.

- Investment requirements: Significant capital will be needed for research, development, marketing, and potential acquisitions in these new niches.

- Market uncertainty: The success of entering these less-established luxury markets carries inherent risks and an unproven track record.

Re-pricing Strategy for Leather Goods

Burberry's strategic re-pricing of its leather goods aims to solidify its position as a category authority in the luxury market, seeking to draw in a wider customer demographic. This move is a direct effort to revitalize a segment that has been underperforming within the rapidly expanding luxury accessories sector.

The effectiveness of this pricing adjustment in capturing greater market share and boosting profitability is still under scrutiny, particularly given its origins as a corrective measure for past challenges. For instance, in the first half of fiscal year 2024, Burberry reported a 2% decline in retail sales to £1.16 billion, with leather goods being a notable area of focus for improvement.

- Category Authority: Burberry is recalibrating prices to reinforce its brand prestige and perceived value in the luxury leather goods segment.

- Customer Base Expansion: The strategy targets a broader audience, balancing exclusivity with accessibility to drive sales volume.

- Underperforming Segment Turnaround: This initiative is a critical response to the underperformance of leather goods, a key category for luxury brands.

- Market Share and Profitability: The ultimate success hinges on whether the re-pricing can translate into tangible gains in market share and improved financial returns.

Burberry's exploration into new luxury segments, such as high-end sustainable fashion or bespoke artisanal accessories, represents potential question marks. These ventures require significant capital for R&D and marketing, with market success being uncertain. The company's strategic shift towards fewer, larger investments could see it targeting these high-growth niches where its current penetration is minimal, making them prime candidates for question mark status.

The re-pricing of leather goods to establish category authority and expand the customer base also falls into the question mark category. While aiming to revitalize an underperforming segment, the effectiveness of this strategy in capturing greater market share and boosting profitability is still being evaluated. For instance, in the first half of fiscal year 2024, Burberry's retail sales saw a 2% decline, highlighting the challenges in turning around key categories.

| Initiative | Market Potential | Current Market Share | Investment Required | Risk Level |

|---|---|---|---|---|

| New Luxury Segments (e.g., sustainable fashion) | High Growth | Low/Unproven | High | High |

| Leather Goods Repositioning | Moderate Growth | Moderate/Underperforming | Moderate | Moderate |

| Advanced Digital Engagement (AR/VR) | High Growth | Low/Nascent | Moderate | High |

BCG Matrix Data Sources

Our Burberry Group BCG Matrix leverages comprehensive data from annual reports, market research firms, and internal sales figures to accurately assess product performance and market share.