Build-A-Bear Workshops Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Build-A-Bear Workshops Bundle

Build-A-Bear Workshops navigates a unique competitive landscape, where the threat of new entrants is moderate due to brand loyalty and the capital investment required for physical stores. Buyer power is also a significant factor, as customers can easily choose alternative entertainment or gift options.

The complete report reveals the real forces shaping Build-A-Bear Workshops’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Build-A-Bear Workshop's reliance on a concentrated supplier base, with around 12-15 core manufacturers for plush toys and accessories, grants significant leverage to these vendors. The top three suppliers alone manage between 55% and 60% of the company's supply chain, giving them considerable sway.

Furthermore, Build-A-Bear's dependency on a select group of material suppliers, from whom it sources 80% to 85% of its raw materials, amplifies the bargaining power of these specialized vendors. This limited pool of essential material providers means Build-A-Bear has fewer alternatives, potentially leading to less favorable terms.

Global manufacturing constraints and geopolitical factors, including tariffs, significantly influence Build-A-Bear's supplier relationships. These external pressures can lead to increased costs and potential shortages of essential materials, directly impacting the company's operational efficiency and profitability.

In 2023, supply chain disruptions affected an estimated 22-25% of production schedules for many retailers, including those supplying Build-A-Bear. This resulted in material cost increases ranging from 12-15%. Build-A-Bear is particularly exposed to potential tariff impacts, with projections indicating up to $10 million in additional expenses for fiscal year 2025.

Build-A-Bear Workshop is actively working to lessen the influence of its suppliers by diversifying its sourcing. They are expanding their factory base to include locations beyond China, such as Vietnam and the United States. This strategy is designed to create more options and reduce reliance on any single supplier or region.

A key goal for Build-A-Bear is to significantly decrease its dependence on China for inventory. For 2025, the company anticipates that less than half of its total U.S. inventory will be shipped from China. This shift is a direct response to manage potential disruptions and cost fluctuations associated with international trade policies.

Long-term Supplier Relationships

Build-A-Bear's long-term supplier relationships, often spanning 6-8 years, can create a stable operational environment. This extended engagement allows for deeper collaboration and potentially better pricing, as seen in negotiated contract values with primary suppliers ranging from $2.5 million to $7.3 million annually. However, these lengthy commitments can also reduce flexibility, making it harder to adapt to evolving market conditions or to seek out more advantageous terms from alternative suppliers.

- Supplier Relationship Length: 6-8 years on average.

- Contract Value Range: $2.5 million to $7.3 million annually with primary suppliers.

- Potential Benefit: Fosters stability and collaboration.

- Potential Drawback: Limits agility in switching suppliers due to long-term commitments.

Uniqueness of Specialized Components

While the basic stuffing and fabric for plush toys are widely available, Build-A-Bear Workshop's unique personalization experience relies on specialized components and accessories. These niche items, such as sound chips, unique outfits, and themed accessories, often come from a smaller pool of specialized suppliers. This limited supplier base for crucial personalization elements can give these suppliers increased bargaining power, as Build-A-Bear's ability to offer its signature customizable experience is directly tied to their availability and pricing.

Furthermore, Build-A-Bear's strategy heavily incorporates popular intellectual property and licensed characters, such as Disney or Star Wars themes. This necessitates sourcing materials and accessories from specific, authorized content providers. The exclusive nature of these licenses means Build-A-Bear is dependent on these particular suppliers, granting them significant leverage in negotiations for character-specific components and merchandise.

- Supplier Dependence: Build-A-Bear's reliance on specialized components for personalization increases supplier leverage.

- Niche Market: Fewer suppliers for unique accessories means less competition and more power for those suppliers.

- Intellectual Property: Licensing agreements for popular characters tie Build-A-Bear to specific content providers, enhancing their bargaining position.

Build-A-Bear Workshop faces considerable supplier bargaining power due to its reliance on a concentrated group of manufacturers for plush toys and accessories. With approximately 12-15 core suppliers, where the top three account for 55-60% of the supply chain, these vendors hold significant leverage. This is further amplified by the company's dependence on a limited pool of material providers, sourcing 80-85% of raw materials from them, which restricts Build-A-Bear's alternatives and can lead to less favorable terms.

The company's need for specialized components and licensed intellectual property for its unique personalization experience also strengthens supplier power. Niche suppliers for items like sound chips and character-specific outfits, along with authorized content providers for popular franchises, have increased leverage due to the limited availability of these crucial elements. This dependence grants these specialized vendors significant sway in negotiations, impacting Build-A-Bear's ability to offer its signature customizable products effectively.

| Factor | Impact on Build-A-Bear | Data Point |

|---|---|---|

| Supplier Concentration | High leverage for top suppliers | Top 3 suppliers account for 55-60% of supply chain |

| Material Dependency | Limited alternatives for raw materials | 80-85% of raw materials sourced from a select group |

| Specialized Components | Increased power for niche suppliers | Reliance on unique accessories and sound chips |

| Intellectual Property Licensing | Dependence on authorized content providers | Sourcing from specific, licensed character providers |

What is included in the product

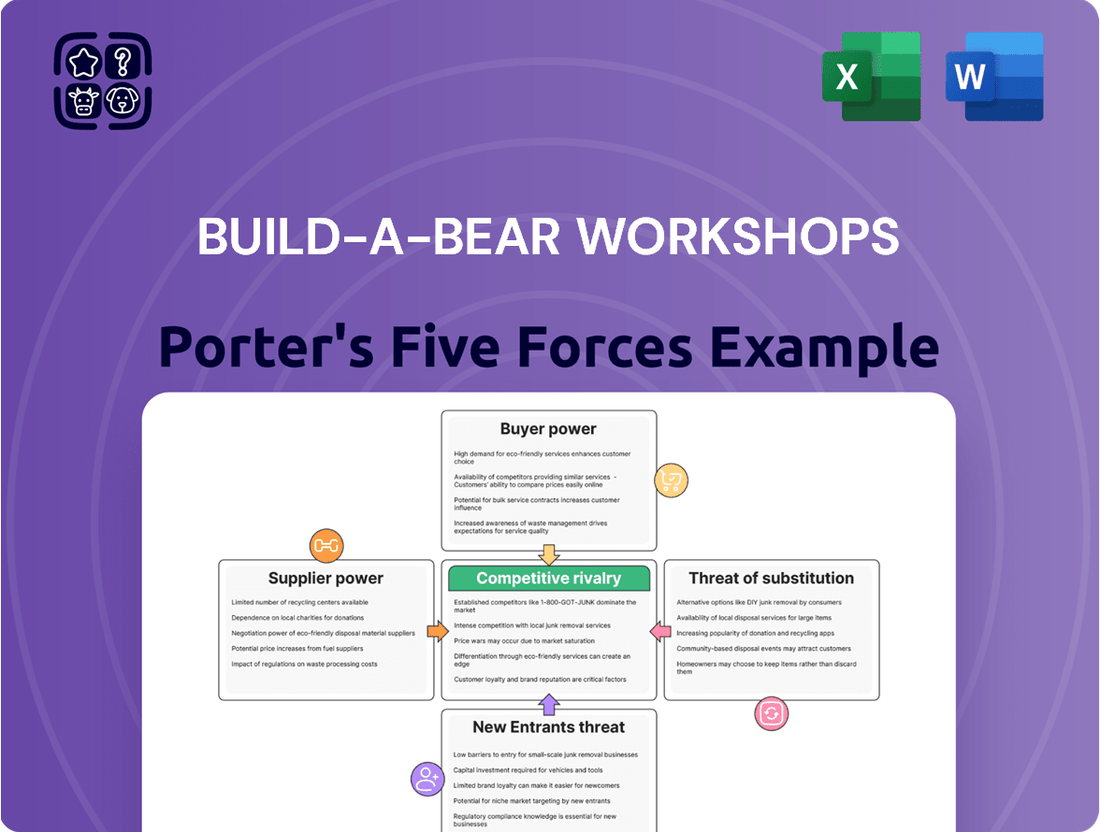

Build-A-Bear Workshops' Five Forces analysis details the intense rivalry from toy retailers and online entertainment, the significant bargaining power of parents and children, and the moderate threat of new entrants in the experiential retail space.

Visually map competitive intensity and identify Build-A-Bear's strategic advantages with a dynamic, interactive Porter's Five Forces analysis.

Customers Bargaining Power

Customers show a significant leaning towards personalized stuffed animal experiences, with a notable 61% of Build-A-Bear's customers in the fourth quarter of 2023 specifically seeking this unique aspect. This strong demand for customization is a cornerstone of the company's appeal, effectively reducing the direct impact of price sensitivity on the core offering.

The average expenditure for a personalized bear creation hovers around $45.67, demonstrating a clear customer willingness to invest in a customized product and the overall experience. This willingness to pay for personalization directly influences the bargaining power of customers by making them less likely to switch based on minor price fluctuations.

The interactive, hands-on process of creating a stuffed animal, complete with a naming ceremony and birth certificate, cultivates a profound emotional bond with customers. This distinctive experiential retail approach generates enduring memories and robust brand loyalty that spans generations.

Build-A-Bear has effectively broadened its customer demographic, with a significant 40% of its revenue now originating from teens and adults. This growth is fueled by a potent blend of nostalgia and strategic collaborations with popular culture franchises.

Build-A-Bear's Bonus Club loyalty program is a key strategy to mitigate customer bargaining power. This program incentivizes repeat business through points, rewards, and birthday perks, fostering customer retention. By making customers feel valued and offering tangible benefits, Build-A-Bear encourages continued engagement, making it less likely for customers to seek out competitors.

Access to Product Information and Alternatives

In today's digital landscape, customers possess unprecedented access to product information and pricing comparisons. This readily available data allows them to easily research alternative products and their costs, both through online channels and by visiting competing retailers. For Build-A-Bear Workshop, while the core interactive experience of creating a personalized stuffed animal is distinctive, customers can still compare the cost of generic plush toys or other gift alternatives.

However, the unique, experiential nature of the Build-A-Bear Workshop significantly dampens the impact of direct price comparisons with standard, mass-produced stuffed animals. The value proposition extends beyond the physical product to include the memory and engagement of the creation process. For instance, in 2024, the company continued to emphasize in-store events and digital engagement strategies to reinforce this experiential differentiation, aiming to capture customer loyalty beyond mere price sensitivity.

- Information Accessibility: Customers can easily find pricing and product details for similar items online.

- Alternative Gifting: Options like personalized crafts or other toy brands offer competitive choices.

- Experiential Value: Build-A-Bear's unique creation process differentiates it from standard toy purchases, reducing direct price sensitivity.

- 2024 Focus: The company's strategies in 2024 highlighted in-store experiences and digital integration to maintain this competitive edge.

Low Switching Costs for Alternative Gifts

While customers develop a strong emotional attachment to their personalized Build-A-Bear creations, the financial barriers to switching to alternative gift options are minimal. This means that if a customer feels the experience or product doesn't align with their expectations or budget, they can readily opt for a different present or activity without significant financial penalty.

The ease of transitioning to other gift categories is a key factor. For instance, a customer might easily pivot from a Build-A-Bear purchase to buying a video game, a book, or tickets to an event if those options better suit the recipient's immediate desires or the occasion's perceived value. This low switching cost directly impacts Build-A-Bear's ability to retain customers solely based on the product itself.

Purchasing decisions for gifts are frequently tied to specific events like birthdays or holidays. In 2024, the gifting market remains highly competitive, with consumers having a vast array of choices. For example, the global toy market was projected to reach over $110 billion in 2024, indicating a wide competitive landscape where Build-A-Bear competes for consumer spending.

- Low Financial Switching Costs: Customers can easily shift spending to other gift categories without incurring significant financial penalties.

- Emotional vs. Financial Investment: High emotional investment in a custom bear doesn't translate to high financial switching costs.

- Event-Driven Purchases: Gift decisions are often tied to specific occasions, increasing the likelihood of exploring multiple options.

- Competitive Gifting Market: In 2024, the broad toy and gift market offers numerous alternatives, intensifying competition for consumer attention and spending.

Customers' bargaining power is influenced by their access to information and the availability of alternatives. While Build-A-Bear's unique experience reduces direct price comparisons with generic toys, customers can easily find pricing for other gifts online. In 2024, the company's focus on in-store events and digital engagement aimed to counter this by emphasizing the experiential value, making customers less sensitive to price alone.

| Factor | Description | Impact on Build-A-Bear | 2024 Data/Context |

|---|---|---|---|

| Information Accessibility | Customers can easily compare prices and product details online. | Increases potential for price sensitivity. | Continued growth of e-commerce platforms facilitates easy comparison. |

| Alternative Gifting Options | Numerous other gift categories and toy brands exist. | Customers can easily switch spending to other options. | Global toy market projected over $110 billion in 2024, indicating high competition. |

| Low Financial Switching Costs | Minimal financial penalty for choosing other gifts. | Reduces customer lock-in based on price. | Customers can easily pivot to video games, books, or experiences. |

| Experiential Differentiation | Unique creation process offers emotional value. | Mitigates direct price sensitivity. | Build-A-Bear's 2024 strategies reinforced this through events and digital integration. |

What You See Is What You Get

Build-A-Bear Workshops Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Build-A-Bear Porter's Five Forces analysis details competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, offering a thorough strategic overview.

Rivalry Among Competitors

Build-A-Bear Workshop's competitive rivalry is shaped by its distinctive experiential retail model. Unlike many competitors, Build-A-Bear allows customers to actively participate in the creation of their own stuffed animals, a hands-on process that includes a "heart ceremony" and stuffing the toy. This interactive approach fosters a unique customer connection.

This experiential element serves as a significant differentiator against more traditional toy retailers and online sellers. In 2024, the company continued to lean into this model, with initiatives aimed at enhancing in-store engagement and expanding digital integration of the experience. This focus on interactive creation is a core strategy to attract and retain customers in a crowded market.

Build-A-Bear Workshop navigates a crowded market, facing direct competition from specialty toy retailers like American Girl, which emphasizes customization and storytelling, and the Disney Store, capitalizing on beloved characters and emotional resonance. Beyond these, mass-market giants such as Walmart and Target offer a wide array of toys, often at lower price points, further intensifying the competitive pressure.

Build-A-Bear has successfully built strong brand recognition and a deep emotional connection with customers across multiple generations, solidifying its position as a cherished brand. This robust brand equity, coupled with its nostalgic appeal, particularly resonates with adults and teens, who represent a significant 40% of its customer base.

Strategic Expansion and Omnichannel Presence

Build-A-Bear's competitive rivalry is intensified by its strategic expansion and robust omnichannel presence. The company has achieved remarkable financial success, reporting four consecutive record years for revenues and pre-tax income, signaling strong consumer demand and effective operational strategies. This performance fuels its ambition to grow its global retail footprint.

The company's aggressive expansion plans include adding at least 50 new locations in fiscal 2025. A significant portion of these new stores will utilize an 'asset-light,' partner-operated model, allowing for faster and more capital-efficient scaling. This approach directly challenges rivals by increasing market penetration without the full burden of direct ownership.

- Record Financial Performance: Four consecutive record years for revenues and pre-tax income demonstrate strong market traction.

- Global Expansion: Plans to open at least 50 new locations in fiscal 2025, broadening its reach.

- Asset-Light Model: Utilizing partner-operated stores for efficient and rapid global growth.

- Omnichannel Strength: A well-developed e-commerce platform complements its physical stores, enhancing customer access and loyalty against competitors.

Licensing and Intellectual Property

Build-A-Bear Workshop's competitive rivalry is significantly shaped by its licensing and intellectual property strategy. The company secures agreements with major entertainment brands like Disney and Pokémon, offering popular characters that draw in customers. These exclusive collaborations create unique product assortments, making it challenging for rivals to directly compete without similar high-profile partnerships.

These licensing deals act as a powerful differentiator, providing Build-A-Bear with access to beloved characters that resonate deeply with its target demographic. For instance, in 2023, the company continued to expand its popular Paw Patrol and Sanrio collections, further solidifying its market position. This strategy not only broadens the company's appeal but also fosters customer loyalty by offering exclusive and in-demand merchandise.

- Licensing Agreements: Build-A-Bear partners with leading intellectual property holders such as Disney, Pokémon, and Sanrio.

- Product Exclusivity: These partnerships enable the creation of unique, character-based products that are difficult for competitors to replicate.

- Competitive Advantage: The access to popular characters provides a significant edge, attracting customers seeking branded merchandise.

- Market Appeal: Collaborations with entertainment giants enhance brand visibility and broaden the company's customer base.

Build-A-Bear Workshop faces intense competition from both specialized toy stores and large mass retailers. While its interactive model differentiates it, rivals like American Girl and Disney Store offer strong brand loyalty and character appeal. Mass-market players such as Walmart and Target compete on price and convenience, presenting a constant challenge to Build-A-Bear's market share.

The company's strong financial performance, including four consecutive record years for revenue and pre-tax income, indicates its ability to effectively navigate this competitive landscape. This success is partly driven by its strategic expansion, with plans for at least 50 new locations in fiscal 2025, many using an asset-light model to increase market penetration.

Build-A-Bear's licensing deals with major brands like Disney and Pokémon provide a crucial competitive edge by offering exclusive, in-demand merchandise. These partnerships, evident in continued expansions of popular collections like Paw Patrol and Sanrio, create unique product assortments that are difficult for competitors to replicate, thereby fostering customer loyalty and attracting new demographics.

| Competitor Type | Examples | Competitive Tactics | Build-A-Bear's Response |

|---|---|---|---|

| Specialty Toy Retailers | American Girl, Disney Store | Customization, brand loyalty, character appeal | Experiential retail, licensing deals, emotional connection |

| Mass Market Retailers | Walmart, Target | Price, convenience, broad product selection | Brand differentiation, unique experiences, omnichannel strategy |

SSubstitutes Threaten

The increasing popularity of digital entertainment and electronic toys presents a substantial threat to businesses like Build-A-Bear Workshop. Platforms offering video games and interactive digital experiences compete directly for children's attention and discretionary spending, diverting funds that might otherwise go towards physical toys and related activities. For example, the global video game market was projected to reach over $200 billion in 2023, showcasing the immense scale of this digital alternative.

Generic plush toys from mass-market retailers like Walmart and Target, along with online marketplaces, present a significant threat of substitution. These alternatives are readily available and typically priced much lower than Build-A-Bear's customizable offerings. For instance, in 2024, the average price of a generic stuffed animal at a major retailer often falls below $20, a stark contrast to the average Build-A-Bear purchase which can range from $30 to $50 or more depending on customization.

While these mass-market options do not replicate the interactive, personalized experience of creating a stuffed animal at Build-A-Bear, they effectively satisfy the fundamental need for a plush toy. This accessibility and lower cost can sway budget-conscious consumers, diminishing the perceived uniqueness and value of the Build-A-Bear workshop experience, especially for those prioritizing price over personalization.

The threat of substitutes for Build-A-Bear Workshop is significant, particularly from DIY stuffed animal kits. Companies like Noah's Ark Workshop allow consumers to create plush toys at home, offering a comparable creative experience without the need for a physical store visit. This convenience, coupled with often lower price points, appeals to parents seeking affordable craft activities or party entertainment for their children.

Personalized Gifts Beyond Plush Toys

The market for personalized gifts is vast, offering alternatives that can directly compete with Build-A-Bear's core offering. Platforms like Personalization Mall, Etsy, and Shutterfly provide custom-engraved jewelry, personalized photo albums, and bespoke home decor, all tapping into the consumer desire for unique and thoughtful presents. These substitutes allow consumers to express individuality and sentiment without necessarily opting for a stuffed animal, potentially diverting sales from Build-A-Bear.

The threat of substitutes is amplified by the increasing accessibility and variety of personalized goods. For instance, the global personalized gifts market was valued at approximately $30 billion in 2023 and is projected to grow significantly. This growth indicates a strong consumer demand for unique items, a segment Build-A-Bear operates within, but also highlights the breadth of competition beyond traditional toy retailers.

- Custom apparel and accessories: Services offering personalized t-shirts, hats, and bags provide a wearable form of self-expression.

- Engraved and customized homeware: Items like custom mugs, cutting boards, and photo frames offer lasting personalization for the home.

- Digital and experience-based gifts: Personalized digital art, custom playlists, or even curated experience boxes can serve as unique alternatives.

- DIY and craft kits: The rise of accessible craft kits allows consumers to create their own personalized items, offering a different kind of engagement.

Alternative Experiential Activities

Families and individuals looking for entertainment often have a wide array of options competing for their attention and discretionary spending. These alternatives can range from traditional venues like movie theaters and amusement parks to newer, niche experiences. For instance, the global amusement park industry was projected to reach over $60 billion in 2024, highlighting the significant competition for leisure dollars.

Build-A-Bear Workshops face direct competition from other specialty retail experiences that offer unique, hands-on activities. Think of places focused on arts and crafts, pottery painting, or even interactive educational centers. These businesses vie for the same customer base seeking memorable outings, particularly those with children.

- Competition from Entertainment Venues: Movie theaters, amusement parks, and family entertainment centers offer alternative leisure activities that draw from the same pool of family entertainment budgets.

- Rise of Niche Experiential Retail: The growth of businesses focused on creative workshops, interactive museums, and unique craft experiences presents a direct substitute for the personalized activity offered by Build-A-Bear.

- Impact on Discretionary Spending: Consumers have limited disposable income for entertainment. When choosing how to spend this income, families weigh the perceived value and enjoyment of various activities.

- Shifting Consumer Preferences: There's a growing trend towards "experience economy," where consumers prioritize spending on activities and memories over material goods, increasing the threat from diverse experiential substitutes.

The threat of substitutes for Build-A-Bear Workshop is multifaceted, encompassing both tangible products and experiential alternatives. Digital entertainment, generic plush toys, and personalized gift markets all present viable options that can satisfy consumer needs for toys, gifts, or creative engagement, often at lower price points or with greater convenience.

DIY craft kits and personalized goods from online platforms offer direct substitutes, allowing consumers to create unique items at home or through accessible e-commerce channels. The global personalized gifts market, valued at approximately $30 billion in 2023, underscores the broad appeal of customization beyond traditional toy retail.

Furthermore, the broader entertainment landscape poses a significant threat. Families have numerous choices for leisure activities, from amusement parks, projected to reach over $60 billion in 2024, to other experiential retail concepts, all competing for discretionary spending on memorable outings.

| Substitute Category | Example | Key Differentiator | Potential Impact on Build-A-Bear | 2024 Market Data/Trend |

|---|---|---|---|---|

| Digital Entertainment | Video Games, Interactive Apps | Convenience, Variety, Lower Cost of Entry | Diverts attention and spending from physical toys. | Global video game market projected to exceed $200 billion. |

| Mass-Market Plush Toys | Generic stuffed animals from big-box retailers | Lower Price Point, Immediate Availability | Appeals to budget-conscious consumers prioritizing basic toy needs. | Average price under $20 compared to Build-A-Bear's $30-$50+. |

| DIY & Craft Kits | Home-based plush toy creation kits | Cost-effectiveness, At-home convenience | Offers a similar creative experience without store visit. | Growing trend in accessible at-home craft activities. |

| Personalized Gifts (Non-Toy) | Custom jewelry, photo albums, apparel | Broader gifting appeal, Different form of personalization | Captures discretionary spending on unique, personalized items. | Global personalized gifts market valued at ~$30 billion (2023). |

| Experiential Entertainment | Amusement parks, pottery painting, interactive museums | Alternative leisure activities, Diverse entertainment options | Competes for family entertainment budgets and time. | Amusement park industry projected over $60 billion (2024). |

Entrants Threaten

The significant capital required to establish a physical retail footprint presents a substantial barrier for potential new entrants. Building out a network of stores, similar to Build-A-Bear Workshop's extensive global presence, demands considerable investment in leases, store design, and initial inventory.

Build-A-Bear Workshop, as of its latest reports, operates over 600 locations worldwide, a scale that is challenging for newcomers to replicate. This vast network, managed through various corporate, partner, and franchise arrangements, underscores the high initial investment needed to compete effectively in the brick-and-mortar segment of the toy and entertainment industry.

Build-A-Bear Workshop's strong brand recognition, cultivated over more than 25 years, acts as a significant deterrent to new market entrants. This established brand equity, coupled with a deeply loyal, multi-generational customer base, creates a formidable barrier.

The emotional connection consumers forge with the unique Build-A-Bear experience is difficult and time-consuming for competitors to replicate. In 2024, the company continued to leverage this loyalty through targeted marketing campaigns and in-store events, reinforcing its market position.

Build-A-Bear's proprietary interactive retail model, centered on the personalized creation of plush animals, presents a significant barrier to entry. This unique "Workshop" experience, encompassing selection, stuffing, accessorizing, and naming, is deeply ingrained in the brand and difficult for competitors to authentically replicate without facing intellectual property challenges or requiring substantial innovation.

While the concept of customizable toys isn't entirely novel, the specific, engaging, and memorable ceremonies associated with Build-A-Bear are a key differentiator. New entrants would find it challenging to capture the same emotional connection and brand loyalty without offering a truly distinct and compelling alternative, a feat that requires considerable investment in concept development and execution.

Extensive Licensing Agreements and Supply Chain Relationships

Build-A-Bear Workshop's extensive licensing agreements with major entertainment brands like Disney and Pokémon present a significant barrier to new entrants. Securing these high-profile partnerships requires substantial investment and proven track records, making it difficult for newcomers to replicate the brand appeal and customer draw. In 2023, the company continued to leverage these relationships, with licensed merchandise forming a core component of their product offerings.

Furthermore, the company has cultivated robust, long-term supply chain relationships with specialized manufacturers capable of producing their unique plush products. For instance, their commitment to quality and specific manufacturing processes means new competitors would face considerable challenges in establishing comparable supplier networks. These established relationships ensure consistent product quality and availability, which are critical for maintaining customer satisfaction and operational efficiency.

- Licensing Power: Partnerships with Disney, Sanrio, and Pokémon are key revenue drivers.

- Supply Chain Hurdles: Specialized manufacturing relationships are difficult to replicate.

- Brand Equity: Established licensing deals contribute significantly to Build-A-Bear's brand recognition and customer loyalty.

Economies of Scale and Distribution Networks

Build-A-Bear Workshop's established global presence grants significant economies of scale in manufacturing and procurement. In 2023, the company reported revenues of $399.1 million, allowing for bulk purchasing power that lowers per-unit costs.

The existing distribution network, encompassing numerous retail locations and warehousing facilities, provides an operational advantage. New entrants would need substantial investment to replicate this infrastructure, facing higher initial per-unit costs and logistical hurdles in achieving comparable efficiency and product availability.

- Economies of Scale: Lower per-unit costs for established players due to high production volumes.

- Distribution Network: Existing infrastructure provides efficient delivery and market reach.

- Capital Investment: New entrants require significant capital to build comparable scale and distribution.

- Competitive Pricing: Established players can often offer more competitive pricing due to lower operational costs.

The threat of new entrants for Build-A-Bear Workshop is moderate. While the core concept of customizable plush toys is imitable, the significant capital investment required for a physical retail presence, coupled with established brand loyalty and proprietary interactive experiences, presents considerable barriers. Newcomers would struggle to match Build-A-Bear's global store footprint and its carefully cultivated emotional connection with customers.

| Factor | Build-A-Bear Workshop's Position | Impact on New Entrants |

|---|---|---|

| Capital Investment for Retail Presence | High (over 600 global locations) | Significant barrier; requires substantial funding to establish comparable scale. |

| Brand Recognition & Loyalty | Strong, multi-generational customer base | Difficult and time-consuming to replicate; emotional connection is a key differentiator. |

| Proprietary Interactive Model | Unique "Workshop" experience | Challenging to authentically replicate without IP issues or substantial innovation. |

| Licensing Agreements | Key partnerships with Disney, Pokémon, etc. | Difficult for newcomers to secure comparable high-profile brand collaborations. |

| Economies of Scale | Leveraged through global operations ($399.1M revenue in 2023) | New entrants face higher initial per-unit costs and logistical hurdles. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Build-A-Bear Workshop is informed by a diverse range of data, including company financial reports, industry-specific market research from firms like IBISWorld, and consumer trend analyses from publications like Statista.