Build-A-Bear Workshops Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Build-A-Bear Workshops Bundle

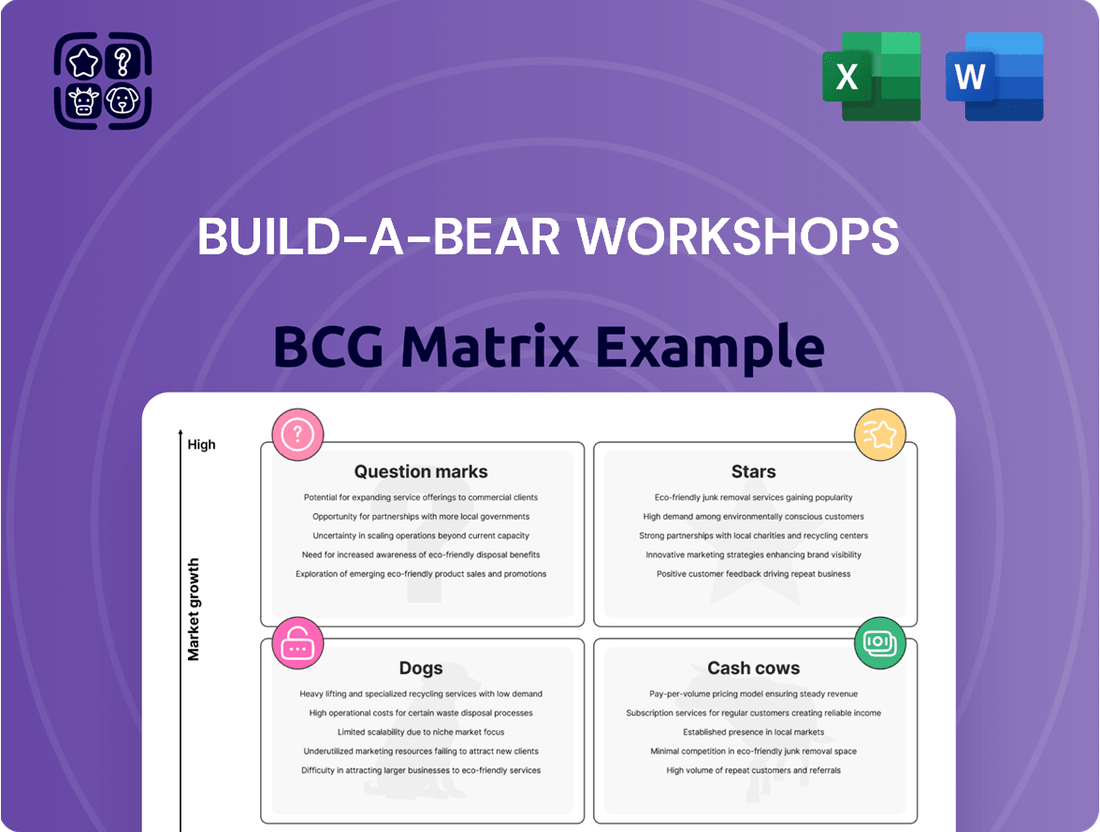

Explore Build-A-Bear Workshop's strategic positioning with our BCG Matrix analysis. Discover which of their offerings are thriving market leaders (Stars) and which are generating consistent profits with minimal investment (Cash Cows). This preview offers a glimpse into their product portfolio's health, but for a complete understanding of their potential growth areas and those needing careful consideration (Dogs and Question Marks), dive into the full report.

Unlock the full potential of Build-A-Bear Workshop's strategic landscape by purchasing the complete BCG Matrix. Gain detailed insights into each product's market share and growth rate, enabling you to make informed decisions about resource allocation and future investment. Don't miss out on the actionable strategies that will propel your understanding of this beloved brand's market dynamics.

Stars

Build-A-Bear Workshop is aggressively pursuing global retail expansion, aiming to open at least 50 new experience locations in fiscal 2025. This growth is largely driven by partner-operated models, allowing for efficient market entry.

The company's strategic expansion includes significant investments like a new flagship store in Orlando scheduled for 2026. This focus on high-traffic tourist destinations and new markets is a key component of their growth strategy, aiming to capture new customer bases.

The commercial and international franchise segments of Build-A-Bear Workshop are experiencing robust expansion. In fiscal year 2024, these segments saw a notable revenue increase of 20.5%.

Looking ahead, the first quarter of fiscal year 2025 continued this positive trend, with revenues climbing by an impressive 28.3% in these areas.

This substantial growth highlights the strong market reception to Build-A-Bear's brand and its adaptable business model across various global and commercial channels.

The company's strategic use of an asset-light franchise model is a key driver, contributing to enhanced profitability and improved cash flow generation from these expanding operations.

Build-A-Bear's strategic partnerships and licensing are key to its growth. Collaborations like the one with the Kansas City Chiefs, which saw a limited-edition Chiefs bear released in early 2024, tap into sports fandom and expand their reach. This move, alongside ongoing popular licenses like Hello Kitty, diversifies their product offerings beyond core plush toys.

These alliances are crucial for extending the brand into new consumer categories and entertainment. By aligning with popular franchises and cultural touchstones, Build-A-Bear effectively broadens its appeal and increases its addressable market, driving both brand visibility and potential revenue streams.

Mini Beans Collection

The Mini Beans Collection, introduced in early 2024, represents a significant new venture for Build-A-Bear Workshop, specifically designed to capture the burgeoning adult collector market. This demographic now accounts for a substantial 40% of the company's overall sales, highlighting a strategic shift in their customer base.

The collection has experienced remarkable success since its launch. By the end of 2024, over 1.25 million units of the Mini Beans had been sold, a testament to their strong appeal and market acceptance. This rapid adoption indicates a high-growth potential, positioning the Mini Beans as a key product within the company's portfolio.

Looking ahead, Build-A-Bear Workshop has ambitious plans for the Mini Beans collection, including a planned wholesale expansion in 2025. This move is expected to further broaden the reach of the collectible line, tapping into new sales channels and reinforcing its growth trajectory. The collection's performance and strategic expansion efforts firmly place it in the Stars category of the BCG Matrix, signifying high market share in a high-growth market.

- Product: Mini Beans Collection

- Launch Year: Early 2024

- Target Demographic: Adult collectors

- 2024 Sales Contribution from Adult Collectors: 40%

- 2024 Units Sold: Over 1.25 million

- Future Plans: Wholesale expansion in 2025

Multi-Generational Brand Appeal

Build-A-Bear has masterfully cultivated appeal across multiple age groups, a key strength in its BCG Matrix positioning. This isn't just about kids anymore; a significant portion of their revenue now comes from older demographics.

In fact, by 2024, it's estimated that 40% of Build-A-Bear's sales are generated by teens and adults. This demonstrates a successful evolution beyond its initial target market, making it a truly multi-generational brand. New marketing efforts, such as the 'The Stuff You Love' campaign, are designed to further solidify this broader customer connection.

- Broadened Customer Base: 40% of sales from teens and adults in 2024.

- Brand Evolution: Successfully transcended its initial child-centric appeal.

- Marketing Reinforcement: Campaigns like 'The Stuff You Love' target diverse age groups.

The Mini Beans Collection, launched in early 2024, has been a standout success, targeting the growing adult collector market. By the end of 2024, over 1.25 million units were sold, and adult collectors now represent a significant 40% of Build-A-Bear's total sales. This product line's strong performance and planned wholesale expansion in 2025 firmly place it in the Stars category of the BCG Matrix, indicating high market share within a rapidly growing segment.

| Product | Launch Year | Target Market | 2024 Adult Sales % | 2024 Units Sold |

| Mini Beans Collection | Early 2024 | Adult Collectors | 40% | 1.25 Million+ |

What is included in the product

Build-A-Bear's BCG Matrix analysis reveals a portfolio with potential Stars in new experiential offerings, Cash Cows in core plush customization, Question Marks in emerging digital platforms, and Dogs in underperforming retail locations.

Our Build-A-Bear BCG Matrix offers a clear, one-page overview of each business unit's strategic position, simplifying complex portfolio analysis.

This export-ready design allows for seamless integration into PowerPoint, streamlining executive reporting and decision-making.

Cash Cows

The core in-store experience at Build-A-Bear Workshops, where customers create personalized stuffed animals, continues to be a robust revenue driver. This interactive model builds strong customer loyalty and encourages repeat visits, solidifying its position as a mature, high-market-share segment.

Build-A-Bear's North American retail stores are the company's cash cows. Virtually all of these locations are profitable, boasting an impressive average contribution margin exceeding 25%. This strong performance highlights a stable and efficient operational model in their core market, consistently generating substantial cash flow.

Build-A-Bear Workshop benefits from over 25 years of building strong brand recognition and fostering customer loyalty. This deep-rooted equity in a mature market allows them to consistently capture a significant share and generate reliable revenue streams.

Their established presence means less reliance on costly new customer acquisition, as loyal patrons continue to drive sales. In 2023, Build-A-Bear reported net sales of $411.9 million, demonstrating the sustained appeal of their unique offering.

Disciplined Expense Management

Build-A-Bear Workshop's commitment to disciplined expense management is a key driver of its cash cow status. By actively managing costs, the company ensures robust profitability even in a market with limited growth potential. This focus allows them to generate consistent cash flow, a hallmark of a successful cash cow.

The company's strategies to offset external pressures, like tariffs, highlight this discipline. For instance, their inventory management approach helps mitigate the financial impact of rising import costs. Furthermore, optimizing their retail footprint contributes to operational efficiencies, directly boosting profit margins.

- Inventory Strategy: Proactive management of inventory levels to buffer against tariff-related cost increases.

- Retail Footprint Efficiencies: Streamlining store operations and lease agreements to reduce overhead.

- Profit Margin Focus: Maintaining high profit margins through cost control in a mature market segment.

Shareholder Returns

Build-A-Bear Workshop demonstrates robust shareholder returns, a key indicator of its Cash Cow status. The company consistently channels excess capital back to its investors, signifying mature and highly profitable operations.

In fiscal year 2024, Build-A-Bear returned a substantial $42.0 million to shareholders. This impressive figure underscores the company's ability to generate significant free cash flow, exceeding its operational and growth investment requirements.

Further solidifying its Cash Cow profile, Build-A-Bear increased its quarterly dividend by 10% in fiscal 2024. This dividend hike reflects management's confidence in the sustained profitability and cash-generating power of the business.

The company's shareholder return strategy highlights its mature market position and efficient capital deployment:

- Share Repurchases: Significant capital allocated to buying back company stock, reducing share count and boosting earnings per share.

- Quarterly Dividends: Consistent and growing dividend payments to shareholders, signaling stable and predictable earnings.

- Fiscal 2024 Returns: $42.0 million returned to shareholders, demonstrating strong cash generation.

- Dividend Increase: A 10% increase in the quarterly dividend in fiscal 2024, reinforcing financial health and shareholder value focus.

Build-A-Bear's North American stores are prime examples of cash cows within its BCG Matrix. These locations, characterized by high market share and operating in a mature market, consistently generate substantial profits with minimal need for further investment.

The company's ability to maintain strong profit margins, with average contribution margins exceeding 25% in its North American retail locations, underscores their cash cow status. This financial strength allows them to fund other business initiatives and reward shareholders.

Build-A-Bear's strategic focus on cost management, including efficient inventory handling and optimizing its retail footprint, further solidifies the profitability of these mature segments. This disciplined approach ensures a steady cash flow, a defining trait of a cash cow.

The substantial capital returned to shareholders, such as the $42.0 million in fiscal year 2024, directly reflects the robust cash-generating capabilities of these core operations.

| Metric | Value | Significance |

|---|---|---|

| North American Store Profitability | Virtually all profitable | Indicates high market share and operational efficiency in a mature segment. |

| Average Contribution Margin (NA Stores) | Exceeds 25% | Demonstrates strong pricing power and cost control, leading to consistent cash generation. |

| Shareholder Returns (FY 2024) | $42.0 million | Highlights the excess cash generated by cash cows, available for distribution. |

| Quarterly Dividend Increase (FY 2024) | 10% | Signals management confidence in sustained profitability and cash flow. |

Delivered as Shown

Build-A-Bear Workshops BCG Matrix

The Build-A-Bear Workshops BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This ensures complete transparency and allows you to confidently assess the strategic insights before committing, as there are no hidden watermarks or altered content.

Rest assured, the BCG Matrix analysis for Build-A-Bear Workshops presented here is the exact file you will download upon completing your purchase. This comprehensive report is ready for immediate application in your strategic planning, offering a clear and actionable overview of their product portfolio.

What you see is precisely the Build-A-Bear Workshops BCG Matrix document that will be delivered to you after your purchase. This means you're getting a professionally designed, analysis-ready report that can be directly utilized for your business strategy without any need for further editing or modification.

Dogs

Build-A-Bear Workshop's e-commerce segment is showing signs of weakness, impacting its position in the BCG Matrix. Consolidated e-commerce demand experienced a notable decline, falling by 11.8% in fiscal 2024 and a further 11.3% in the first quarter of fiscal 2024.

While there was a marginal uptick of 0.5% in Q1 fiscal 2025, this slight recovery follows significant downturns. Despite the company's investments in digital transformation, the sluggish growth in its online channel indicates it's not keeping pace with the broader digital market expansion.

Build-A-Bear Workshop's reliance on seasonal sales, particularly during holidays like Christmas and Halloween, places it in a challenging position within the BCG Matrix. This cyclical demand pattern, common in mature markets, can lead to unpredictable revenue streams.

For instance, in fiscal year 2023, Build-A-Bear reported a 2.3% decrease in net sales to $383.1 million, partly attributed to a less robust holiday season compared to the prior year's strong performance. This illustrates the vulnerability to economic shifts and consumer spending during key selling periods.

Such dependence can classify Build-A-Bear as a potential cash trap if the company cannot effectively diversify its revenue streams or mitigate the impact of off-peak seasons. Without consistent demand, reinvestment opportunities may be limited, hindering overall growth.

Build-A-Bear Workshop's core product, the stuffed animal, represents a limited offering within the broader toy industry. While customization is a key differentiator, the reliance on plush toys, a segment that saw a 3% decline in sales in 2023 according to Circana data, presents a challenge.

This narrow product focus, despite attempts at diversification like the launch of their own digital platform and partnerships, places them in a category that might not align with the highest market growth trajectories. The toy market in 2024 continues to be dynamic, with innovation in electronic and educational toys capturing significant consumer interest.

Potential for High Operational Costs

Build-A-Bear Workshop's physical store model, while core to its brand, presents a significant challenge in terms of operational costs. Keeping brick-and-mortar locations running, complete with trained staff and inventory, demands substantial investment. This is particularly true as consumer preferences increasingly lean towards digital shopping experiences.

The company's high fixed costs associated with its store footprint can be a drag on profitability, especially for underperforming locations. In 2024, Build-A-Bear continued to navigate the complexities of its retail strategy, with some stores in less-than-ideal mall environments potentially falling into the 'dog' category of the BCG matrix. This classification stems from their low relative market share combined with low market growth, exacerbated by these high operational expenses.

- High Fixed Costs: Maintaining a physical store network requires significant ongoing expenditure for rent, utilities, and staffing.

- Staffing Needs: The interactive nature of the Build-A-Bear experience necessitates well-trained, customer-facing employees, adding to labor costs.

- Mall Environment Impact: Stores located in declining or less-trafficked malls face reduced foot traffic, making it harder to offset their operational overhead.

- Digital Shift Pressure: The ongoing shift to e-commerce puts pressure on physical retail models, potentially increasing the cost burden per transaction for in-store sales.

Underperforming Older Store Formats

Certain older Build-A-Bear Workshop store formats, typically found in traditional malls and managed directly by the corporation, are showing signs of struggle. These locations often face declining foot traffic and slower growth compared to more modern, strategically placed stores. For instance, while the overall retail sector in 2024 continued to navigate evolving consumer habits, many legacy mall-based stores, including those for specialty retailers like Build-A-Bear, saw market share erosion in a mature, low-growth segment.

These underperforming older formats can be categorized as Dogs within the BCG Matrix. They likely represent a low market share within a low-growth industry. This situation necessitates a thorough analysis to determine the best course of action, which could involve significant investment for a turnaround or a strategic decision to divest or close these locations.

Key considerations for these underperforming stores include:

- Declining Foot Traffic: Many traditional malls experienced a continued decrease in visitor numbers throughout 2024, directly impacting sales for stores reliant on mall traffic.

- High Operating Costs: Older, corporately-managed stores may have lease agreements and operational structures that are less efficient in the current retail climate.

- Shifting Consumer Preferences: Newer store formats, often in high-traffic tourist areas or featuring unique experiential elements, are capturing a larger share of the market.

Certain older Build-A-Bear Workshop store formats, particularly those in traditional malls, are struggling due to declining foot traffic and high operating costs. These locations often have a low market share in a mature, low-growth segment of the retail industry. For example, many legacy mall-based stores saw market share erosion in 2024, a trend impacting specialty retailers.

These underperforming stores can be classified as Dogs in the BCG Matrix, characterized by low relative market share and low market growth. Their high fixed costs, like rent and staffing, make it difficult to achieve profitability, especially when facing reduced customer visits.

The company's strategy may involve significant investment for a turnaround, or a decision to divest or close these locations to reallocate resources more effectively.

The shift in consumer preferences towards newer, experiential retail formats further challenges these older store models.

| Store Format Characteristic | BCG Matrix Classification | Key Challenges |

|---|---|---|

| Older, traditional mall locations | Dog | Declining foot traffic, high operating costs, low market share |

| Corporately managed, legacy stores | Dog | Inefficient lease agreements, reduced growth potential |

| Stores in declining malls | Dog | Limited customer reach, difficulty offsetting overhead |

Question Marks

Build-A-Bear's foray into new digital initiatives, such as the Build-A-Bear Tycoon game on Roblox and digital collectibles, positions them in high-growth emerging digital entertainment spaces. While these ventures offer significant future potential, their current market share and direct revenue impact are likely minimal, reflecting their early-stage development.

These digital endeavors demand substantial investment to build user bases and establish long-term viability. For instance, in 2024, the gaming industry continued its robust growth, with the global mobile gaming market alone projected to reach over $107 billion. Build-A-Bear's presence in this space, though nascent, taps into a massive and engaged audience.

Build-A-Bear Workshop is actively exploring international markets, but many regions remain largely untapped, presenting significant growth potential. These emerging markets, while offering the promise of new customer bases, also come with the challenges of substantial upfront investment and the uncertainty of initial consumer acceptance. For instance, while the company has a presence in countries like Canada and the UK, vast areas across Asia, Africa, and South America represent largely unexplored territories.

Build-A-Bear Workshop's foray into non-plush consumer categories via licensing represents a strategic pivot to broaden its appeal beyond its core stuffed animal offering. While these licensed products tap into existing, growing consumer goods markets, their current market share remains minimal, indicating these are early-stage ventures.

The success of these non-plush categories hinges on Build-A-Bear's ability to execute effectively and gain traction with consumers. For instance, in 2024, the company reported that its digital and international segments, which include some of these newer initiatives, were showing promise, though specific revenue breakdowns for individual licensing categories are not yet substantial enough to dominate overall performance.

Experiential Retail Innovations (e.g., ICON Park Orlando)

Build-A-Bear's investment in a multi-level immersive experience at ICON Park, Orlando, slated for 2026, positions it within the high-growth experiential retail sector. This venture represents a significant capital commitment, aiming to capture a larger share of a nascent, potentially lucrative market.

The ICON Park project, with its ambitious design, could evolve into a 'Star' in Build-A-Bear's portfolio, signifying high growth and high market share. However, at its current stage, it's more akin to a 'Question Mark'.

- High Growth Potential: The experiential retail market is expanding, with consumers increasingly seeking unique, engaging activities.

- Low Market Share in New Format: Build-A-Bear is entering this specific multi-level immersive format, meaning its current market share within this niche is likely minimal.

- Capital Intensive: Developing such an experience requires substantial upfront investment, impacting cash flow and requiring careful financial management.

- Execution Risk: The success of the ICON Park venture hinges on effective planning, design, and operational execution to attract and retain customers.

Omnichannel Integration Evolution

Build-A-Bear Workshop is actively evolving its omnichannel strategy, exemplified by the enhanced Bear Builder 3D Workshop, designed to foster high growth through seamless consumer engagement.

These initiatives aim to bridge the gap between online and in-store experiences, offering a more connected journey for customers.

Despite these efforts, the company's current market share in the competitive digital landscape remains relatively low as these integrated platforms continue to mature and gain wider consumer adoption.

- Omnichannel Investment: Build-A-Bear has invested in digital platforms to enhance customer experience.

- 3D Bear Builder: The updated Bear Builder 3D Workshop is a key component of this omnichannel strategy.

- Market Position: While efforts are underway, the company's share in the competitive digital space is still developing.

- Consumer Adoption: The success of these integrated experiences hinges on ongoing market adoption and effectiveness.

Build-A-Bear's new ventures, like the ICON Park experience and digital gaming, represent significant investments in high-growth areas. These initiatives currently have low market share due to their nascent stage, requiring substantial capital and facing execution risks. Their future success hinges on capturing a significant portion of these developing markets.

Build-A-Bear's investment in experiential retail, such as the planned multi-level immersive experience at ICON Park, Orlando, positions it in a sector with considerable growth potential. However, as a new format for the company, its current market share within this specific niche is minimal. This venture is capital-intensive, demanding significant upfront investment and carrying inherent execution risks that need careful management to ensure customer attraction and retention.

| Initiative | Market Potential | Current Market Share | Investment Required | Risk Factor |

|---|---|---|---|---|

| ICON Park Experience | High (Experiential Retail) | Low (New Format) | High | Execution Risk |

| Digital Gaming (Roblox) | High (Metaverse/Gaming) | Low (Nascent) | Moderate | User Adoption |

| International Expansion | High (Untapped Markets) | Low (Selective Presence) | High | Market Acceptance |

| Non-Plush Licensing | Moderate (Consumer Goods) | Low (Diversification) | Low to Moderate | Brand Extension Success |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.