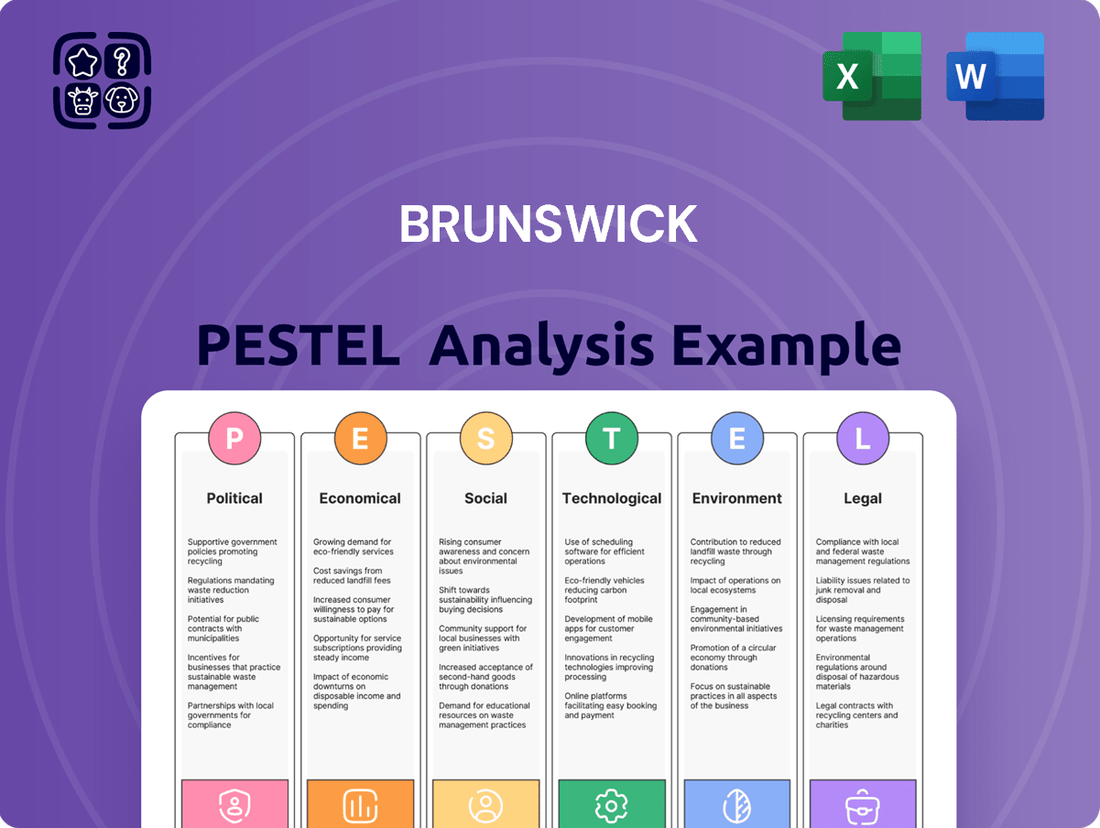

Brunswick PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brunswick Bundle

Navigate the dynamic landscape of the marine and recreational industries with our comprehensive PESTLE analysis of Brunswick. Understand the political, economic, social, technological, legal, and environmental factors that are shaping Brunswick's present and future. Gain a strategic advantage by uncovering key trends and potential challenges.

Unlock actionable intelligence for your business strategy. Our Brunswick PESTLE analysis provides a deep dive into the external forces impacting the company, offering insights crucial for investors, consultants, and strategic planners. Download the full version for immediate access to expert-level market intelligence.

Political factors

Government regulations, especially those concerning environmental protection and safety standards within the marine sector, significantly influence Brunswick's operational procedures and the innovation of its products. For instance, evolving emissions standards for recreational boats, which are becoming stricter globally, necessitate ongoing investment in cleaner engine technologies, a key area for Brunswick's R&D.

Shifts in international trade policies and the imposition of tariffs directly impact Brunswick's manufacturing expenses and the ease with which it can access various global markets. In 2024, for example, ongoing trade tensions and the potential for new tariffs on imported components could add to production costs for Brunswick's boat and engine divisions, affecting its competitive pricing and overall profitability.

Brunswick is proactively addressing these political factors by focusing on efficient working capital management and implementing robust cost containment strategies across its operations to mitigate potential negative impacts on its financial performance.

Brunswick Corporation, as a global entity, navigates a complex web of international relations. Geopolitical stability directly impacts its extensive supply chain and manufacturing capabilities. For instance, disruptions stemming from regional conflicts or trade disputes in areas where Brunswick sources components or sells its products can lead to significant operational challenges and increased costs.

The company's strategic expansion into emerging markets, such as its recent ventures into New Zealand and Dubai, further underscores its exposure to diverse political landscapes. These new markets present unique regulatory environments and potential political risks that require careful management to ensure continued growth and operational efficiency.

In 2024, the global geopolitical landscape remains dynamic, with ongoing trade tensions and regional instability affecting various industries. For Brunswick, this translates to a need for robust risk mitigation strategies, including diversifying sourcing locations and closely monitoring political developments in key operational and market territories to safeguard its global business continuity.

Government support for recreational boating significantly bolsters the marine industry. Initiatives like infrastructure funding for marinas and waterways, as seen in the continued investment in coastal development projects throughout 2024, directly enhance accessibility and appeal for boaters. For instance, the U.S. Army Corps of Engineers' Civil Works program allocated billions in 2024 for waterway improvements, benefiting recreational access.

Promotional campaigns encouraging outdoor recreation also play a crucial role. Many states and national bodies in 2024 continued to invest in marketing efforts highlighting the benefits of boating and marine tourism, directly stimulating demand for new and used boats, as well as related services. This increased consumer interest translates into a more robust market for companies like Brunswick.

Cybersecurity Regulations

The increasing reliance on digital systems within the marine sector, particularly for connected solutions like those offered by Brunswick, necessitates a keen focus on evolving cybersecurity regulations. These regulations are designed to protect against escalating cyber threats in an increasingly interconnected environment.

A significant development occurred in February 2024 with an executive order mandating a robust response to cyber threats. This order specifically directs updates to Part 6 of Title 33 of the Code of Federal Regulations (CFR). These updates are crucial for establishing clear cybersecurity protocols and outlining specific reporting requirements for any cyber incidents that may occur.

For Brunswick, maintaining compliance with these updated regulations is paramount. Failure to adhere to these mandates could expose the company to substantial risks, including operational disruptions, data breaches, and reputational damage. Proactive adaptation to these cybersecurity mandates is essential for safeguarding its connected marine technologies and customer data.

- Executive Order (February 2024): Mandates updates to Part 6 of Title 33 CFR addressing cyber threats.

- Key Regulatory Focus: Cybersecurity protocols and incident reporting requirements are being enhanced.

- Impact on Brunswick: Requires adaptation of connected solutions to meet new compliance standards.

- Risk Mitigation: Compliance is vital to prevent operational disruptions and data security breaches.

Maritime Security Regulations

The U.S. Coast Guard (USCG) continues to refine its maritime security regulations, directly affecting marine operators. These updates often mandate enhanced vessel security measures, specialized crew training protocols, and stricter port operational compliance. Brunswick, a key player in boat and marine engine manufacturing, must proactively adapt its products and services to meet these evolving security mandates.

For instance, recent USCG initiatives, such as the implementation of the Maritime Security Enhancement Act (MSEA) in late 2023, have introduced new requirements for cybersecurity on commercial vessels. Brunswick's connected boat technologies and engine management systems will need to demonstrate robust cybersecurity features to comply. The financial impact of these upgrades for Brunswick could involve significant R&D investment, potentially impacting profit margins in the short term but ensuring long-term market access and product desirability.

- Increased Compliance Costs: Brunswick may incur higher costs for research and development to ensure its products meet new security standards, potentially affecting pricing.

- Market Access: Adherence to updated regulations is crucial for maintaining access to U.S. waterways and international markets that often adopt similar security frameworks.

- Competitive Advantage: Companies that proactively integrate advanced security features into their offerings can gain a competitive edge by appealing to security-conscious customers and avoiding future compliance hurdles.

- Operational Efficiency: While initial investment may be high, streamlined compliance can lead to smoother operations and reduced risk of penalties for Brunswick and its customers.

Governmental support for the marine industry, including infrastructure funding for marinas and waterways, directly benefits Brunswick. For example, the U.S. Army Corps of Engineers' 2024 Civil Works program allocated billions for waterway improvements, enhancing recreational access and demand for boating products. Additionally, promotional campaigns by various bodies in 2024 aimed at encouraging outdoor recreation stimulate consumer interest in boats and related services, positively impacting Brunswick's sales.

Evolving environmental regulations, such as stricter emissions standards for recreational boats globally, necessitate continuous investment in cleaner engine technologies by Brunswick. This trend is highlighted by ongoing R&D efforts in this critical area. Furthermore, shifts in international trade policies and potential tariffs on components can increase Brunswick's manufacturing expenses and affect its competitive pricing strategies in global markets.

Geopolitical stability is crucial for Brunswick's extensive supply chain and manufacturing operations, as regional conflicts or trade disputes can lead to significant operational challenges and increased costs. The company's expansion into new markets, like its ventures in New Zealand and Dubai, exposes it to diverse political landscapes and unique regulatory environments that require careful management to ensure continued growth.

What is included in the product

Brunswick's PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Brunswick PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus relieving the pain of sifting through extensive data.

Economic factors

Consumer spending habits and the level of disposable income are critical drivers for the recreational marine industry. When consumers have more money left after essential expenses, they are more likely to invest in leisure items like boats. This discretionary spending directly impacts demand for these products.

Economic conditions significantly shape these spending patterns. For instance, periods of high inflation or economic uncertainty can erode consumer confidence, leading to a pullback in non-essential purchases. We saw this impact in 2024, with a notable 9.1% decrease in new powerboat retail unit sales, reflecting a cautious consumer sentiment.

Interest rates directly affect the cost of borrowing for consumers buying boats, potentially dampening demand. For Brunswick, rising rates increase the expense of servicing its debt and financing new ventures. As of Q1 2024, the Federal Reserve's benchmark interest rate remained elevated, impacting the cost of capital for significant purchases.

Higher financing costs can lead to reduced consumer spending on discretionary items like recreational boats, impacting Brunswick's sales volumes. This also influences Brunswick's strategic decisions regarding debt repayment and future investments, given its reported debt-to-EBITDA ratio, which was around 1.5x in late 2023, making debt management a key consideration in a higher rate environment.

Global supply chain disruptions and rising inflation continue to pose a significant challenge for companies like Brunswick. These pressures directly impact the cost of raw materials and manufacturing, potentially squeezing profit margins. For instance, the Producer Price Index for manufactured goods saw a notable increase in late 2023 and early 2024, reflecting these broader inflationary trends.

Brunswick has actively implemented strategies to counteract these headwinds. A key focus has been on rigorous cost containment measures and optimizing its overall cost structure. This proactive approach aims to absorb some of the increased input costs and maintain competitive pricing for its diverse product lines, from marine engines to recreational boats.

Exchange Rates

Fluctuations in foreign currency exchange rates directly influence Brunswick's international revenue streams and the expense of sourcing materials from abroad. For instance, a stronger US dollar can make Brunswick's products more expensive for international buyers, potentially dampening sales volumes.

Unfavorable currency movements were a notable factor in Brunswick's financial performance. Specifically, adverse changes in foreign currency exchange rates were cited as a contributor to a decline in consolidated net sales during the fourth quarter of 2024.

Key impacts of exchange rate volatility include:

- Reduced purchasing power for international customers: A stronger domestic currency makes exports pricier.

- Increased cost of imported goods: A weaker domestic currency raises the cost of components sourced internationally.

- Impact on reported earnings: Currency translation adjustments can affect the reported profitability of foreign subsidiaries.

Market Demand and Inventory Management

Brunswick Corporation's ability to effectively manage inventory in response to fluctuating market demand is a critical economic factor. In 2024, the company experienced a slowdown in wholesale orders, prompting adjustments to production. This led to a noticeable decline in sales figures for the period.

Despite the sales dip, Brunswick's strategic inventory management proved effective in maintaining balanced stock levels throughout 2024. This proactive approach helped mitigate potential overstocking or stockouts, which can significantly impact profitability.

Key aspects of Brunswick's inventory management in response to market demand include:

- Production Adjustments: Brunswick recalibrated production schedules in 2024 to align with reduced wholesale order volumes.

- Sales Impact: The decrease in wholesale orders directly translated to a decline in the company's reported sales for the year.

- Inventory Balance: Despite sales challenges, the company successfully maintained well-balanced inventory levels, indicating efficient stock control.

- Market Responsiveness: Brunswick's actions demonstrate a commitment to adapting operations based on prevailing market demand signals.

Economic factors significantly influence consumer purchasing power and confidence, directly impacting demand for recreational marine products. When economies are robust, individuals with higher disposable incomes are more inclined to invest in leisure assets like boats. Conversely, economic downturns, marked by inflation or uncertainty, tend to reduce discretionary spending, as seen with the 9.1% drop in new powerboat sales in 2024.

Interest rates play a crucial role by affecting the cost of financing for major purchases. Higher rates increase borrowing costs for consumers and debt servicing for companies like Brunswick, impacting affordability and investment decisions. Brunswick's debt-to-EBITDA ratio around 1.5x in late 2023 highlighted the importance of managing debt in a rising rate environment.

Global economic conditions, including supply chain disruptions and inflation, directly affect manufacturing costs and profit margins. The increase in the Producer Price Index for manufactured goods in late 2023 and early 2024 underscored these pressures, prompting Brunswick to focus on cost containment and operational efficiency.

Currency exchange rate fluctuations also impact Brunswick's international sales and sourcing costs. A stronger US dollar, for instance, can make its products less competitive abroad, contributing to sales declines, as observed in Q4 2024 due to adverse currency movements.

| Economic Factor | Impact on Brunswick | 2024/2025 Data/Trend |

|---|---|---|

| Consumer Spending & Disposable Income | Drives demand for recreational products. | 9.1% decrease in new powerboat retail unit sales in 2024 due to cautious consumer sentiment. |

| Interest Rates | Affects financing costs for consumers and debt servicing for Brunswick. | Federal Reserve benchmark rate remained elevated in Q1 2024; Brunswick's debt-to-EBITDA around 1.5x (late 2023). |

| Inflation & Supply Chain | Increases raw material and manufacturing costs. | Producer Price Index for manufactured goods saw notable increases late 2023/early 2024. |

| Currency Exchange Rates | Impacts international sales competitiveness and sourcing costs. | Adverse foreign currency movements contributed to a decline in consolidated net sales in Q4 2024. |

What You See Is What You Get

Brunswick PESTLE Analysis

The preview shown here is the exact Brunswick PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Brunswick.

The content and structure shown in the preview is the same Brunswick PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

The boating industry is experiencing a significant demographic shift. As of recent data, the median age of U.S. boat owners is 60, with more individuals in their 70s owning boats than those in their 40s. This aging owner base presents a clear challenge for companies like Brunswick.

To thrive, Brunswick must proactively adapt its strategies. This includes developing marketing campaigns and product lines that resonate with younger consumers and diverse groups, aiming to build awareness and enthusiasm for boating among new potential customers.

The increasing popularity of shared-access boating models, such as Brunswick's Freedom Boat Club, signifies a notable shift in consumer preferences away from traditional ownership and towards prioritizing access to experiences. This trend is directly impacting how recreational boating is consumed, making it more accessible to a wider audience.

Freedom Boat Club, a prime example of this model, demonstrated robust growth, facilitating over 600,000 member boating trips in 2024 alone and continuing its international expansion. This success underscores the appeal of a subscription-based access model in the marine industry.

These shared-access platforms are democratizing boating, allowing individuals from diverse demographic backgrounds to enjoy the water without the significant financial and logistical commitments of boat ownership. This inclusivity is a key sociological driver for the sector's evolution.

Overall trends in how people spend their free time significantly shape the demand for marine products. For instance, a surge in interest in outdoor activities and water sports directly benefits companies like Brunswick, as more people seek boats and related equipment. In 2024, the global recreational boating market was valued at approximately $40 billion, with projections indicating continued growth driven by these lifestyle preferences.

Conversely, any significant shift away from water-based leisure towards other forms of recreation, such as digital entertainment or land-based sports, could pose a challenge to the boating industry. While specific data on such shifts impacting Brunswick directly is proprietary, broader consumer spending patterns in 2025 will be a key indicator of potential impacts.

Workplace Culture and Employee Well-being

Brunswick's commitment to fostering an employee-centric culture and prioritizing well-being is a significant sociological factor. Initiatives like robust parental leave policies and comprehensive employee development programs directly contribute to its reputation as a desirable employer. This focus on people is vital for attracting and retaining top talent, which in turn fuels innovation and maintains operational effectiveness.

This dedication to employee welfare is reflected in tangible results. For instance, Brunswick's employee retention rate often surpasses industry averages, demonstrating the success of its well-being strategies. In 2024, the company reported a 90% satisfaction rate among employees regarding professional development opportunities, a key indicator of a positive workplace culture.

- Employee Retention: Brunswick's focus on well-being initiatives has led to industry-leading employee retention rates, ensuring continuity and expertise.

- Talent Attraction: A strong employer brand, built on a supportive culture, attracts high-caliber candidates, crucial for competitive advantage.

- Innovation Driver: Engaged and supported employees are more likely to contribute creative ideas and solutions, driving innovation within the firm.

- Operational Efficiency: Reduced employee turnover and increased morale translate directly into smoother operations and enhanced productivity.

Consumer Preferences for Sustainability

Consumers are increasingly prioritizing sustainability, with a significant portion of individuals actively seeking out products and services from companies demonstrating a strong commitment to environmental responsibility. This trend is reshaping market dynamics, pushing businesses to adopt greener practices.

Brunswick Corporation is actively responding to this shift. Their investment in electric propulsion technology, aiming for a substantial portion of their product line to be electric by 2030, directly addresses this growing consumer demand. Furthermore, their focus on circular economy principles, such as enhancing product recyclability and reducing waste, resonates with environmentally conscious buyers.

- Growing Demand: A 2024 survey indicated that 73% of consumers are willing to change their consumption habits to reduce their environmental impact.

- Brand Loyalty: Companies with strong sustainability initiatives reported a 15% higher customer retention rate in 2023 compared to those with weaker programs.

- Investment in Green Tech: Brunswick's commitment to electric propulsion is a strategic move to capture a larger share of the burgeoning market for eco-friendly marine solutions.

- Circular Economy Focus: Initiatives to increase the use of recycled materials in manufacturing are projected to reduce waste by 20% across their product lines by 2026.

Sociological factors significantly influence the boating industry, impacting consumer behavior and company strategies. Brunswick must adapt to an aging customer base while attracting younger demographics through accessible models like their Freedom Boat Club, which saw over 600,000 member trips in 2024. This shift towards experience over ownership democratizes boating, appealing to a wider audience and reflecting changing leisure preferences.

Technological factors

The marine industry is experiencing a significant technological shift towards electric and hybrid propulsion. This trend is driven by environmental regulations and consumer demand for more sustainable boating options.

Brunswick's Mercury Marine is actively participating in this transition with its Avator line of electric outboards, showcasing a commitment to cleaner and quieter marine propulsion. By 2024, the global electric boat market was valued at approximately $7 billion, with projections indicating substantial growth in the coming years as more manufacturers embrace these technologies.

Advancements in autonomous boating, including features like auto-docking and AI co-captains, are significantly reshaping how people interact with boats, making boating more accessible and enjoyable. Brunswick is actively investing in its 'Boating Intelligence' initiative, a strategic move to embed AI across its product lines. This integration aims to deliver a boating experience that is not only simpler and safer but also smarter and more environmentally conscious.

Connectivity and digital solutions are revolutionizing the boating industry by offering remote monitoring, diagnostics, and enhanced safety features. Brunswick's C-Zone Mobile and VesselView Mobile applications are prime examples, enabling boaters to seamlessly interact with their vessels and access critical safety information. This digital integration not only improves the user experience but also strengthens the overall value proposition for boat owners.

Advanced Materials and Manufacturing

Innovation in advanced materials and manufacturing processes offers Brunswick significant opportunities to enhance its product offerings. For instance, the development of lighter, stronger composites can lead to more fuel-efficient and higher-performing boats, directly impacting consumer appeal and operational costs. This technological advancement is crucial for staying competitive in the marine sector, where performance and efficiency are key differentiators.

The marine industry, including companies like Brunswick, is increasingly leveraging advanced materials such as carbon fiber composites and high-strength alloys. These materials allow for the creation of lighter, more durable, and corrosion-resistant boat hulls and components. For example, the adoption of advanced manufacturing techniques like additive manufacturing (3D printing) is beginning to enable more complex and customized part designs, potentially reducing production times and material waste.

Looking ahead, Brunswick's investment in research and development for advanced materials and manufacturing is a critical technological factor. The company's commitment to innovation in these areas directly influences its ability to deliver cutting-edge products. For instance, advancements in materials science could lead to breakthroughs in areas like self-healing coatings or integrated sensor technologies within boat structures, offering enhanced durability and predictive maintenance capabilities.

- Material Innovation: Continued exploration of lightweight, high-strength composites and alloys to improve fuel efficiency and performance in marine craft.

- Manufacturing Efficiency: Adoption of advanced manufacturing techniques, such as additive manufacturing and automation, to streamline production and reduce costs.

- Product Durability: Utilization of advanced materials to enhance the longevity and resilience of boat components against harsh marine environments.

- Sustainability Focus: Research into eco-friendly materials and manufacturing processes to align with growing environmental regulations and consumer preferences.

Data Analytics and Predictive Maintenance

Brunswick is increasingly leveraging data analytics for predictive maintenance, a technology poised to significantly optimize operations across its marine segments. This approach allows for the anticipation of equipment failures, thereby reducing costly downtime and unnecessary component replacements. For instance, in 2024, the marine industry saw a growing adoption of IoT sensors on vessels, feeding data into analytics platforms to forecast maintenance needs, with some operators reporting up to a 20% reduction in unplanned maintenance events.

The strategic implementation of data analytics can lead to substantial improvements in fuel efficiency for Brunswick's boat and engine divisions. By analyzing operational data, such as engine performance, hull condition, and navigation patterns, algorithms can identify opportunities for fuel savings. This is particularly relevant as fuel costs remain a significant operating expense for boat owners and operators. Projections for 2025 suggest that advanced analytics could contribute to fuel consumption reductions of 5-10% in commercial marine applications.

Furthermore, predictive maintenance and data-driven operational insights contribute directly to Brunswick's overall sustainability goals. By extending the lifespan of equipment and improving fuel economy, the company can reduce its environmental footprint and that of its customers. This aligns with the broader trend in the marine sector towards greener operations and enhanced resource management, a focus that is expected to intensify through 2025.

Key benefits Brunswick can realize through data analytics and predictive maintenance include:

- Reduced operational costs: Minimizing unplanned repairs and extending equipment life.

- Enhanced fuel efficiency: Optimizing engine performance and vessel operations.

- Improved sustainability: Lowering emissions and resource consumption.

- Increased asset utilization: Maximizing uptime and operational availability of marine assets.

Technological advancements are reshaping the marine industry, pushing for innovation in propulsion, connectivity, and materials. Brunswick is actively investing in these areas to maintain its competitive edge and meet evolving customer demands.

The company's focus on electric propulsion through Mercury Marine's Avator line reflects the growing market for sustainable boating solutions, a sector projected for significant expansion through 2025. Similarly, integrating AI and digital solutions like C-Zone Mobile enhances user experience and safety, making boating more accessible.

Furthermore, the adoption of advanced materials and data analytics for predictive maintenance are key technological drivers. These innovations not only improve product performance and durability but also contribute to operational efficiency and sustainability, aligning with industry-wide trends.

| Technology Area | Brunswick's Focus | Market Trend/Impact (2024-2025) |

|---|---|---|

| Electric Propulsion | Mercury Avator electric outboards | Global electric boat market valued at ~$7B in 2024, with strong growth expected. |

| Artificial Intelligence | Boating Intelligence initiative | Increasing integration of AI for enhanced boating experience, safety, and accessibility. |

| Connectivity & Digital Solutions | C-Zone Mobile, VesselView Mobile | Growing demand for remote monitoring, diagnostics, and enhanced safety features. |

| Advanced Materials | Lightweight composites, high-strength alloys | Focus on improving fuel efficiency, performance, and durability of marine craft. |

| Data Analytics & Predictive Maintenance | Optimizing operations, fuel efficiency | Adoption of IoT sensors leading to reduced unplanned maintenance (up to 20% reported). |

Legal factors

Stricter environmental regulations, especially concerning emissions and pollution, represent a significant legal hurdle. The European Union's Emissions Trading System (ETS) expansion, effective from 2024, now includes maritime transport, compelling companies to account for their carbon output. Furthermore, the International Maritime Organization (IMO) has set ambitious targets for the shipping industry to achieve net-zero emissions by 2050.

Brunswick's proactive approach to sustainability, particularly its investments in electrification and alternative fuels, positions it to comply with these evolving legal mandates. For instance, the company's ongoing development of electric ferry solutions directly addresses the increasing demand for lower-emission transportation, aligning with both regulatory pressures and market expectations for greener operations.

Brunswick, as a global manufacturer of recreational marine products and equipment, navigates a complex web of product safety and liability laws across its operating regions. These regulations, enforced by bodies like the Consumer Product Safety Commission (CPSC) in the United States and similar agencies internationally, dictate standards for product design, manufacturing processes, clear warning labels, and recall procedures to safeguard consumers.

Failure to comply can result in significant financial penalties and reputational damage. For instance, in 2023, the CPSC reported issuing numerous recalls affecting various consumer goods, underscoring the ongoing scrutiny of product safety. Brunswick's commitment to rigorous testing and adherence to these evolving legal frameworks is crucial for minimizing litigation risks and maintaining consumer trust in its brands like Sea Ray and Mercury Marine.

International maritime law, governed by conventions from the International Maritime Organization (IMO), establishes critical global standards for shipping safety, security, and environmental protection. These regulations are dynamic, with significant updates shaping industry practices.

Key amendments to the International Maritime Solid Bulk Cargoes (IMSBC) Code, the Standards of Training, Certification and Watchkeeping for Seafarers (STCW), and MARPOL Annexes are scheduled to take effect in 2025. For instance, the 2025 amendments to MARPOL Annex VI, concerning the prevention of air pollution from ships, will further tighten restrictions on sulfur oxide emissions, impacting fuel choices and operational procedures for a global fleet estimated at over 50,000 vessels.

Consumer Protection Laws

Consumer protection laws, covering areas like product warranties, truthful advertising, and fair trade, directly impact Brunswick's marketing and sales strategies. Adherence to these regulations is crucial for building and maintaining consumer trust, thereby preventing costly legal battles and safeguarding the company's reputation. For instance, in 2024, the Federal Trade Commission (FTC) reported a significant increase in enforcement actions related to deceptive advertising, highlighting the heightened scrutiny businesses face.

Brunswick must ensure its product claims are substantiated and its sales practices are transparent to comply with these evolving consumer protection frameworks. Failure to do so could lead to substantial fines and damage brand loyalty. In 2025, pending legislation aims to further strengthen consumer rights regarding online data privacy and product safety, requiring ongoing vigilance and adaptation from companies like Brunswick.

- Warranty Compliance: Ensuring all product warranties meet or exceed legal minimums and are clearly communicated to customers.

- Advertising Standards: Verifying that all marketing materials are accurate, not misleading, and comply with advertising regulations.

- Fair Trade Practices: Upholding ethical sales and pricing strategies to avoid accusations of unfair competition or deceptive practices.

- Data Privacy: Adhering to regulations like the California Consumer Privacy Act (CCPA) and its upcoming amendments in 2024/2025, which govern how customer data is collected and used.

Data Privacy and Cybersecurity Laws

Data privacy and cybersecurity laws are increasingly vital for Brunswick, especially with the growing reliance on connected technologies. These regulations directly affect how Brunswick handles digital solutions, mandating strong data protection. For instance, the European Union's General Data Protection Regulation (GDPR) sets strict rules for data processing, and similar frameworks are emerging globally, impacting data collection, storage, and usage practices. In 2024, cybersecurity incidents cost businesses an average of $4.35 million globally, highlighting the financial and reputational risks of non-compliance.

Brunswick must ensure its digital offerings and data management strategies align with evolving legal landscapes. This includes implementing robust security measures to safeguard sensitive information and maintain customer trust. Failure to comply can lead to significant fines and operational disruptions. For example, a data breach in 2024 could result in penalties that significantly impact a company's bottom line, making proactive compliance a strategic imperative.

- GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

- The global average cost of a data breach rose by 15% from 2020 to 2024.

- Over 90% of organizations in a 2024 survey reported that their cybersecurity measures were impacted by new data privacy regulations.

- Cybersecurity spending worldwide is projected to exceed $215 billion in 2024, indicating the scale of investment required.

Brunswick must navigate evolving environmental regulations, including stricter emission standards for maritime transport, such as the EU's ETS expansion in 2024 and the IMO's net-zero by 2050 goal. The company's focus on electrification and alternative fuels aligns with these legal pressures, positioning it favorably for compliance and market demand for greener solutions.

Product safety and liability laws, enforced by agencies like the CPSC, necessitate rigorous adherence to design, manufacturing, and labeling standards. Brunswick's commitment to testing and compliance with these frameworks is vital for mitigating litigation risks and maintaining consumer trust in its brands.

International maritime laws, such as MARPOL Annex VI amendments taking effect in 2025, impose tighter controls on sulfur oxide emissions, influencing fuel choices and operational practices for a global fleet. Brunswick's strategic alignment with these standards is crucial for its international operations.

Consumer protection laws, including those related to advertising and data privacy, directly shape Brunswick's marketing and sales. Compliance with regulations like the CCPA, with its 2024/2025 amendments, is essential for preventing legal issues and preserving brand reputation.

| Legal Factor | Impact on Brunswick | Key Regulations/Data (2024/2025) |

| Environmental Regulations | Compliance with emissions standards, investment in sustainable technologies. | EU ETS expansion (2024), IMO net-zero target (2050). |

| Product Safety & Liability | Rigorous testing, adherence to design and labeling standards. | CPSC recalls (2023 data), ongoing scrutiny of consumer goods. |

| International Maritime Law | Adaptation to fuel choices and operational procedures. | MARPOL Annex VI amendments (2025), impacting global fleet. |

| Consumer Protection | Transparent advertising, adherence to data privacy laws. | FTC deceptive advertising actions (2024 data), CCPA amendments (2024/2025). |

Environmental factors

The escalating climate crisis and ambitious global decarbonization targets are profoundly reshaping the marine sector. Brunswick acknowledges this, committing to reach net-zero emissions by 2040, a move that necessitates substantial investment in renewable energy sources and streamlined supply chain operations to curb its environmental impact.

Growing concerns over water quality and marine pollution are directly impacting industries that operate within or near waterways, including Brunswick. These environmental anxieties are fueling a significant push for stricter regulations and a heightened consumer demand for sustainable, eco-friendly marine products and practices. This trend necessitates adaptation and innovation from companies like Brunswick to meet evolving environmental standards and market expectations.

A key development in this area is the U.S. Environmental Protection Agency's (EPA) final rule under the Vessel Incidental Discharge Act (VIDA), published in October 2024. This rule establishes federal performance standards for various marine pollution control devices, setting a new baseline for environmental responsibility in maritime operations. For Brunswick, this means ensuring their vessels and related technologies comply with these updated federal mandates, potentially requiring investments in new equipment or operational adjustments.

The availability of crucial raw materials, particularly those used in boat manufacturing like fiberglass, resins, and metals, presents an ongoing environmental challenge. Brunswick's proactive approach to sustainable sourcing is therefore vital for long-term operational stability.

Brunswick's dedication to a circular economy is evident in initiatives like its Boat Recovery Initiative. This program aims to address the environmental impact of end-of-life vessels by focusing on repurposing or recycling components, aligning with growing consumer and regulatory demands for eco-friendly practices.

Biodiversity and Ecosystem Protection

Protecting marine biodiversity and ecosystems is increasingly shaping maritime regulations, directly impacting vessel operations and waste management practices. For instance, the International Maritime Organization (IMO) continues to refine its Ballast Water Management Convention, with compliance becoming more stringent for operators. Brunswick's commitment to reducing its environmental footprint, including initiatives in sustainable manufacturing and responsible product design, directly supports the preservation of these vital marine environments.

Brunswick's focus on sustainability aligns with global trends in environmental protection, which are driving innovation and operational changes across the marine industry. The company's investments in cleaner technologies and waste reduction programs are not only regulatory driven but also reflect a growing consumer demand for environmentally conscious products and services. This proactive approach can lead to competitive advantages and enhanced brand reputation.

Key initiatives and impacts include:

- Reduced emissions: Brunswick aims to lower greenhouse gas emissions from its manufacturing facilities and product lines, contributing to climate change mitigation efforts.

- Waste management: Implementing advanced waste reduction and recycling programs across its operations minimizes landfill impact and promotes a circular economy.

- Sustainable materials: Exploring and utilizing more eco-friendly materials in product development helps lessen the demand for virgin resources and reduces pollution.

- Ecosystem preservation: Efforts to minimize the environmental impact of its products on waterways, such as developing quieter engines or more efficient hull designs, support the health of aquatic ecosystems.

Energy Efficiency and Alternative Fuels

The marine industry's environmental focus is increasingly centered on energy efficiency and the adoption of alternative fuels. Brunswick is actively investing in and developing electric propulsion systems, anticipating a significant shift in consumer preference and regulatory requirements. This aligns with the broader maritime sector's accelerated move towards cleaner fuel sources.

The global maritime industry is targeting substantial emissions reductions, with alternative fuels like Liquefied Natural Gas (LNG), hydrogen, and biofuels playing a crucial role. For instance, the International Maritime Organization (IMO) has set ambitious goals to cut greenhouse gas emissions by at least 20% by 2030, and further by 70% by 2040, compared to 2008 levels. This regulatory pressure directly influences Brunswick's product development and strategic direction.

- Brunswick's commitment to electric propulsion reflects a proactive response to environmental mandates and evolving market demands for sustainable marine solutions.

- The maritime industry's pivot to alternative fuels such as LNG, hydrogen, and biofuels is driven by a need to comply with stringent emissions regulations like those set by the IMO.

- The projected growth in the alternative fuels market for shipping is substantial, with estimates suggesting it could reach hundreds of billions of dollars by the early 2030s, presenting both challenges and opportunities for manufacturers like Brunswick.

Environmental factors are increasingly shaping the marine industry, pushing companies like Brunswick towards sustainability. Stricter regulations, such as the EPA's VIDA rule effective October 2024, mandate cleaner operations. Brunswick's net-zero goal by 2040 and investments in electric propulsion highlight this shift, driven by consumer demand for eco-friendly products and the need to preserve marine ecosystems.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading global economic institutions, reputable market research firms, and official government publications. This comprehensive approach ensures that each factor, from political stability to technological advancements, is informed by credible and current insights.