Brunswick Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brunswick Bundle

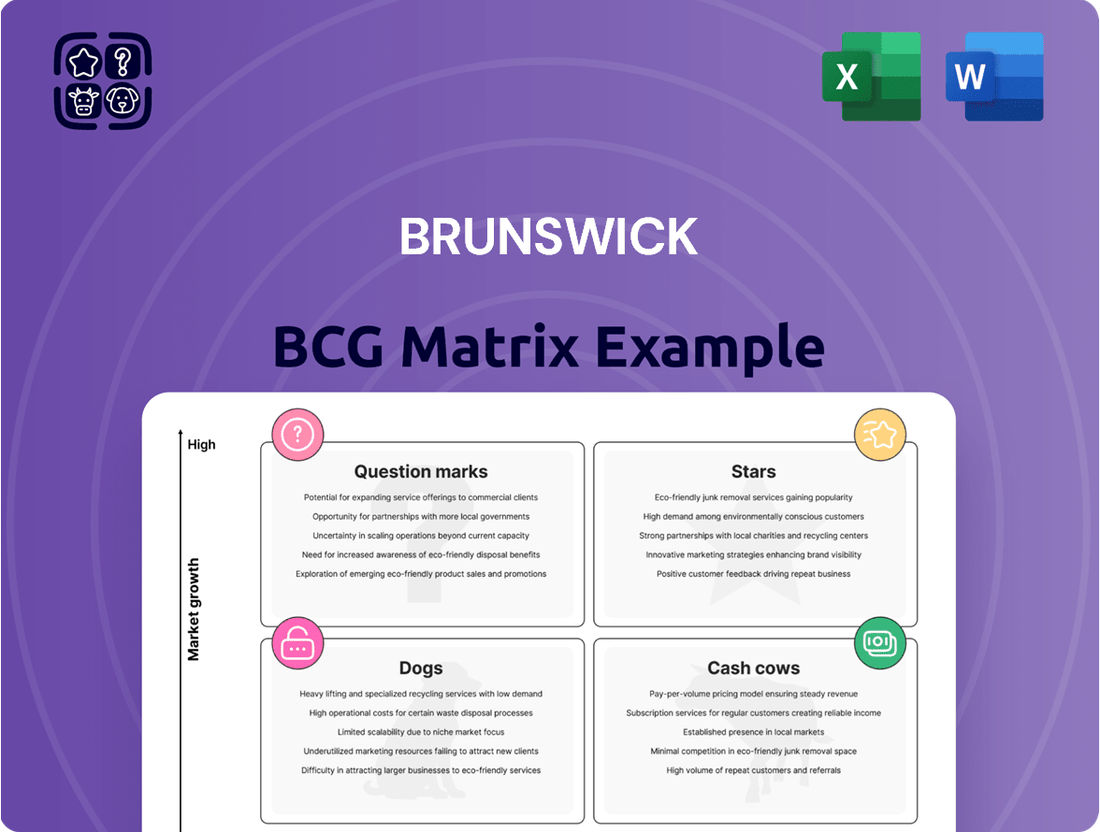

Understand the strategic positioning of your company's products with the insightful Brunswick BCG Matrix. This powerful tool categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual of market share and growth potential.

Don't settle for a glimpse; unlock the full strategic advantage. Purchase the complete BCG Matrix to gain detailed quadrant analysis, actionable recommendations, and a roadmap for optimizing your product portfolio and investment decisions.

Stars

Mercury Marine's outboard engines, especially their high-horsepower models, are a clear leader in the industry. They hold a dominant market share in crucial areas like Europe and North America.

This strong position is further bolstered by consistent market share gains, indicating robust leadership in a segment expected to expand through 2025. For instance, in 2023, Mercury Marine reported record revenue, partly driven by strong demand for their V12 Verado engines.

The introduction of their Avator electric outboards also places Mercury at the forefront of innovation in a rapidly evolving market. This combination of high market share and engagement in a growing sector firmly positions Mercury Marine's outboard engines as a Star in the BCG matrix.

Freedom Boat Club, as part of Brunswick's portfolio, fits the profile of a Star in the BCG matrix. Its status as the world's largest boat club network, marked by substantial membership growth and global expansion, clearly indicates a high-growth market segment. This shared-access model not only generates a consistent recurring revenue for Brunswick but also serves as a gateway for new individuals to engage with boating activities. The club's ongoing positive momentum, bolstered by strategic acquisitions, solidifies its robust market standing and significant growth prospects.

Brunswick's ACES strategy, focusing on Autonomous, Connected, Electrified, and Shared mobility, is a cornerstone of its future expansion. The company is heavily invested in electrification, exemplified by products like the Mercury Avator electric outboards, which are poised to redefine the marine experience.

This strategic push towards electrification caters to a growing segment of environmentally aware consumers and opens doors to new markets within the burgeoning electric marine technology sector. Brunswick aims for its ACES segment to represent a substantial portion of its revenue by 2025, reflecting the significant growth anticipated in this area.

Premium Boat Brands (e.g., Boston Whaler)

Brunswick's premium boat brands, like Boston Whaler, demonstrate remarkable resilience. Despite broader market headwinds, these luxury segments have experienced steady retail performance, indicating strong underlying demand.

Boston Whaler, for instance, consistently holds a significant market share within the high-end recreational boating sector. This dominance is a testament to its enduring brand appeal and the loyalty it commands from affluent consumers.

The consistent demand for these premium offerings underscores their status as Stars within Brunswick's portfolio. Their ability to maintain strong sales even during market downturns highlights their competitive advantage and capacity for sustained growth.

- Boston Whaler's strong market share in the luxury segment.

- Steady retail performance despite broader market challenges.

- High brand loyalty contributing to consistent demand.

- Positioned as Stars due to sustained success and growth potential.

Strategic Investments in Boating Intelligence (AI)

Brunswick's strategic investment in Boating Intelligence, leveraging AI, positions it for significant future growth. This initiative focuses on integrating advanced technologies to improve user experience and operational efficiency.

- AI-Powered Enhancements: The company is actively developing AI features like virtual agents for customer support and autonomous docking systems, aiming to simplify boating for consumers.

- Market Leadership Aspiration: These investments are designed to solidify Brunswick's position as a market leader by offering innovative solutions that address evolving customer needs and industry trends.

- New Revenue Streams: The introduction of AI-driven functionalities is expected to unlock new revenue opportunities, capitalizing on the increasing demand for smart and connected marine products.

- Growth Potential: Boating Intelligence represents a high-growth segment for Brunswick, currently in its nascent stages but poised for substantial market penetration as the technology matures and adoption increases.

Stars represent business units or products with high market share in a high-growth industry. These are typically market leaders that require significant investment to maintain their growth and competitive edge. Brunswick's outboard engines, particularly its high-horsepower models, are a prime example, dominating key markets and showing consistent gains, as evidenced by record revenues in 2023 driven by strong demand for its V12 Verado engines.

Freedom Boat Club, as the world's largest boat club network, also fits the Star profile with its substantial membership growth and global expansion. The ACES strategy, with a strong focus on electrification and innovative products like the Mercury Avator electric outboards, positions Brunswick to capture growth in environmentally conscious markets, with the company aiming for ACES to contribute significantly to revenue by 2025.

Brunswick's premium boat brands, such as Boston Whaler, consistently perform well, maintaining strong market share in the luxury segment even amidst broader market challenges, underscoring their Star status due to enduring brand appeal and sustained growth potential.

The company's investment in Boating Intelligence, leveraging AI for features like autonomous docking, signals a commitment to innovation in a nascent but high-growth area, aiming to enhance customer experience and create new revenue streams.

| Business Unit/Product | Market Share | Market Growth | BCG Category | Key Growth Drivers |

|---|---|---|---|---|

| Mercury Outboard Engines (High-HP) | Dominant (e.g., leading in Europe & North America) | High (expected expansion through 2025) | Star | Strong demand for V12 Verado, market share gains, innovation (Avator electric) |

| Freedom Boat Club | World's largest network | High (global expansion, membership growth) | Star | Shared-access model, recurring revenue, strategic acquisitions |

| ACES Strategy (Electrification focus) | Emerging but significant | Very High (growing environmentally aware consumer segment) | Star | Mercury Avator electric outboards, catering to new markets |

| Boston Whaler (Premium Brands) | Significant in luxury segment | Steady (resilient despite headwinds) | Star | Brand loyalty, consistent demand from affluent consumers |

| Boating Intelligence (AI Integration) | Nascent | Very High (potential for substantial market penetration) | Star | AI-driven features (virtual agents, autonomous docking), enhanced user experience |

What is included in the product

Strategic guidance for managing a company's product portfolio based on market growth and share.

Visualize your portfolio's health, identifying underperformers and stars.

Strategic insights to reallocate resources and boost profitability.

Cash Cows

The Engine Parts & Accessories segment is a classic cash cow for Brunswick, consistently generating robust financial performance. This segment benefits from stable boating participation and Brunswick's expansive global distribution network, ensuring reliable cash flow. In 2023, this segment reported net sales of $1.6 billion, contributing significantly to Brunswick's overall profitability.

Mercury MerCruiser, a cornerstone of Brunswick's marine propulsion, commands a substantial market share in sterndrive and inboard segments. Despite outboard engines representing a higher growth area, MerCruiser remains a vital cash cow, generating stable revenue from its mature market position and extensive installed base. Its consistent performance directly fuels Brunswick's overall profitability.

Navico Group's aftermarket business within Brunswick Corporation stands as a significant cash cow. Despite potential fluctuations in original equipment manufacturer (OEM) sales, this segment, specializing in marine electronics and power systems, has shown remarkable resilience.

The aftermarket segment thrives on a substantial existing customer base, driven by consistent demand for upgrades and replacements. This inherent need translates into a stable and predictable revenue stream, bolstering Brunswick's overall profitability.

For instance, Brunswick reported that its Parts & Accessories segment, which includes Navico's aftermarket operations, saw robust growth in recent years. In 2023, this segment contributed significantly to the company's financial health, helping to cushion the impact of any OEM market slowdowns and solidifying its role as a consistent cash generator.

Established Mid-Range Boat Brands (e.g., Lund)

Established mid-range boat brands like Lund are considered Cash Cows for Brunswick. These brands benefit from a stable market segment with consistent demand, translating into predictable revenue streams and strong cash flow generation. Their established reputation and loyal customer base allow for efficient operations and sustained profitability.

- Strong Market Presence: Lund, for example, holds a significant share in the aluminum fishing boat market, a testament to its enduring appeal.

- Steady Profitability: In 2024, Brunswick reported robust performance across its boat segment, with established brands like Lund contributing significantly to operating income due to their mature market position and efficient cost structures.

- Cash Generation: The consistent demand for these mid-range boats means they require minimal investment for growth while generating substantial cash, which can be reinvested into other areas of the business.

Brunswick's Overall Free Cash Flow Generation

Brunswick Corporation has showcased impressive free cash flow generation, setting a new record in Q2 2025 and marking a substantial increase from the first half of 2024. This strong performance underscores the company's operational efficiency and its capacity to translate profits into readily available cash.

This robust cash flow allows Brunswick to strategically reinvest in its business, pay down debt, or reward its shareholders. Such financial health is a hallmark of companies with established, highly profitable segments, often referred to as cash cows within the BCG matrix framework.

- Brunswick's Q2 2025 Free Cash Flow: Record-breaking performance.

- First Half 2024 Improvement: Significant year-over-year gains.

- Operational Efficiency: Strong conversion of earnings to cash.

- Financial Flexibility: Funds for investment, debt reduction, and shareholder returns.

Cash cows are business units or product lines that have a high market share in a mature industry, generating more cash than they consume. Brunswick's Engine Parts & Accessories segment, including Navico's aftermarket business and Mercury MerCruiser, exemplifies this. These segments benefit from stable demand and established market positions, providing consistent revenue streams that can fund other business initiatives.

| Brunswick Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Engine Parts & Accessories | Cash Cow | Stable demand, strong market share, consistent cash flow | Net sales of $1.6 billion in 2023 |

| Mercury MerCruiser | Cash Cow | Mature market, large installed base, reliable revenue | Significant contributor to propulsion segment profitability |

| Navico Aftermarket | Cash Cow | Resilient demand for upgrades/replacements, existing customer base | Contributed to robust growth in Parts & Accessories |

| Lund Boats | Cash Cow | Established brand, stable mid-range market, loyal customers | Strong contributor to operating income in 2024 |

Preview = Final Product

Brunswick BCG Matrix

The BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content—just a comprehensive, analysis-ready tool designed for strategic business planning and decision-making.

Dogs

Brunswick's value-segment boat brands, including models from Bayliner and Princecraft, are currently positioned as Dogs in the BCG Matrix. These brands, particularly in the pontoon segment, have seen notable sales drops and softening consumer interest. For example, the broader marine industry experienced a slowdown in new boat orders in late 2023 and early 2024, impacting entry-level segments more acutely.

Operating in a market that is either growing slowly or shrinking, these brands hold a comparatively small market share against Brunswick's more dominant offerings. Brunswick's strategy for these businesses focuses on improving profitability even with lower production levels, underscoring the challenges they face in the current economic climate.

Older boat models that lack distinct features or fail to align with current buyer tastes often struggle to gain traction, resulting in a low market share and dwindling sales. These products typically necessitate substantial price reductions to clear stock, thereby diminishing their contribution to the company's bottom line, and are prime candidates for sale or a major overhaul.

The broader challenges faced by such products are underscored by Brunswick's overall performance, with the boat segment experiencing an 18% decrease in sales during the fourth quarter of 2024, indicating a market shift away from less differentiated offerings.

Navico Group's original equipment manufacturer (OEM) sales are a concern, showing a noticeable dip compared to its robust aftermarket performance. This indicates that product lines tied to new boat manufacturing are facing headwinds, likely due to a shrinking new boat market and potentially lower market penetration within that segment. For instance, in Q1 2024, Brunswick's overall marine engine sales saw a slight increase, but the OEM segment for electronics and related components, where Navico primarily operates, has been more challenging.

Non-Strategic or Divested Assets

Non-Strategic or Divested Assets represent business units or product lines that Brunswick Corporation might be looking to offload. These are typically operations with a consistently low share in their respective markets and facing minimal growth prospects.

These segments often hover around breaking even or can even become cash drains, tying up capital without generating significant returns. While Brunswick's recent public disclosures don't explicitly name specific divested assets fitting this description, their ongoing emphasis on portfolio optimization signals an active evaluation of such underperforming units. For example, in 2023, Brunswick reported that its Advanced Systems segment, which includes some electronics and controls, saw revenue growth of 1.7%, a notably slower pace compared to its Propulsion segment's 11.5% growth, hinting at potential areas for strategic review if this trend persists.

- Low Market Share & Growth: Units exhibiting sustained underperformance in market penetration and industry expansion.

- Cash Traps: Businesses that consume capital with negligible or negative returns on investment.

- Portfolio Optimization: Brunswick's strategic focus on streamlining its business portfolio to enhance overall profitability and efficiency.

Segments Impacted by High Discounts and Reduced Production

Segments of Brunswick's portfolio that consistently need significant price reductions to boost sales and require scaled-back manufacturing to control inventory are typically found in low-growth, low-market-share positions. This is observable in certain boat categories where Brunswick has decreased output due to declining wholesale orders and softening consumer demand.

For example, if a specific boat model consistently requires a 15% discount to move inventory and production has been cut by 20% year-over-year, it strongly suggests a 'Dog' classification within the BCG matrix. This scenario reflects a product line with limited market appeal and a shrinking presence.

- Low Market Share: Products requiring consistent high discounts indicate a struggle to capture and maintain market share against competitors.

- Low Market Growth: Reduced production levels are a direct response to lower demand, signaling that the market segment for these products is not expanding.

- Inventory Management Challenges: The need for discounts to sell excess inventory points to poor demand forecasting or an inability to adapt production to market realities.

- Financial Strain: High discount rates erode profit margins, making these segments a drain on resources and potentially hindering investment in more promising areas.

Brands like Bayliner and Princecraft, particularly in the pontoon segment, are classified as Dogs in Brunswick's BCG Matrix due to declining sales and consumer interest. These brands operate in slow-growth markets with a small market share compared to Brunswick's leading products.

Brunswick's strategy for these underperforming brands involves focusing on profitability through reduced production, a challenging approach given the current economic climate. The company's overall boat segment saw an 18% sales decrease in Q4 2024, highlighting a market shift away from less differentiated offerings.

Products needing significant discounts, like a 15% reduction to clear inventory, coupled with a 20% year-over-year production cut, strongly indicate a Dog classification. This reflects limited market appeal and a shrinking presence, as seen in Brunswick's overall marine engine sales where the OEM segment faced headwinds in early 2024.

| Brunswick Brand Segment | BCG Classification | Key Performance Indicators (2024 Data) | Strategic Focus |

|---|---|---|---|

| Bayliner/Princecraft (Pontoon) | Dog | Declining sales, softening consumer interest, low market share. | Improve profitability via lower production levels. |

| Navico Group (OEM) | Question Mark/Dog (potential) | Noticeable dip in OEM sales vs. aftermarket, challenging market for new boat manufacturing components. | Portfolio optimization, strategic review of underperforming units. |

Question Marks

Brunswick's ACES strategy heavily features advanced autonomous boating technologies, like self-docking systems. These represent a significant investment in a high-potential market for marine tech, though their current market share is minimal due to early development stages.

The marine autonomous sector, while nascent, is projected for substantial growth, with some analysts predicting it could reach billions in the coming decade. Brunswick's commitment here positions them to capture future market share, but requires substantial R&D and consumer education to drive adoption.

Fliteboard, through its FLITELab, is positioned as a Question Mark in Brunswick's BCG Matrix, focusing on the burgeoning electric foiling market. This niche segment is characterized by rapid innovation and high growth potential, but Fliteboard likely holds a relatively small market share as a newer entrant within Brunswick's diverse offerings.

Significant investment in marketing and research and development is crucial to capture a larger portion of this expanding market. For instance, the electric hydrofoil market was projected to reach $1.5 billion by 2027, indicating substantial room for growth.

Freedom Boat Club, a strong performer within Brunswick's portfolio, exhibits characteristics of a Star. Its strategic push into new international markets, where its shared access boating model is still developing, presents a classic Question Mark scenario. These regions offer considerable growth potential, but current market penetration is low.

Significant investment is required in these emerging markets to build brand awareness, establish operational infrastructure, and attract new members. For instance, Brunswick's 2024 financial reports indicate substantial capital allocation towards international growth initiatives, reflecting the high costs associated with entering and cultivating these nascent markets.

Emerging Digital and Connectivity Solutions (e.g., C-Zone Mobile, VesselView)

Brunswick's investment in emerging digital and connectivity solutions, like the advanced C-Zone mobile app and VesselView systems, aligns with the high-growth 'Connected' segment within their ACES (Advanced Control, Enhanced Experience, Advanced Connectivity) strategy. These innovations are designed to significantly improve the boating experience, offering greater control and data access for users.

While these digital offerings hold substantial future potential, their current market penetration and revenue contribution may be modest when measured against Brunswick's more established product lines. This is typical for new technologies seeking to gain traction in a developing market.

- Market Position: These solutions are likely classified as 'Question Marks' due to their high growth potential but currently low market share in the rapidly evolving marine technology sector.

- Investment Needs: Continued significant investment is crucial for Brunswick to refine these digital platforms, expand their feature sets, and build brand awareness to capture a leading position.

- Growth Potential: The increasing demand for integrated boat systems and remote monitoring capabilities suggests a strong future growth trajectory for these connected solutions. For example, the global marine electronics market was valued at approximately $3.5 billion in 2023 and is projected to grow, indicating fertile ground for these innovations.

- Strategic Importance: Successfully developing these digital offerings is vital for Brunswick to stay competitive and meet the evolving expectations of modern boaters who seek seamless connectivity and intuitive control.

Any New Product Categories Outside Core Marine Recreation

Brunswick Corporation, a leader in marine recreation, faces a strategic decision regarding diversification into entirely new product categories. Venturing beyond its established marine segments, such as outboard engines and boat manufacturing, into areas like advanced robotics or sustainable energy solutions presents both significant opportunities and considerable risks.

These new ventures would likely begin with minimal market share, requiring substantial capital allocation for research and development, market penetration, and brand establishment. Without successful market traction and rapid growth, these initiatives could quickly become cash drains, mirroring the characteristics of "Dogs" in the BCG Matrix. For instance, a hypothetical foray into the electric mobility sector, while a high-growth area, would necessitate competing against established players with significant market presence and technological advancements.

- High Investment, Low Initial Share: New product categories outside marine recreation demand significant upfront investment in R&D and market entry, starting with negligible market share.

- Risk of Becoming a "Dog": Without substantial growth and market acceptance, these ventures risk becoming underperforming "Dogs" that consume resources without generating adequate returns.

- Potential for Future Stars: Successful diversification into high-growth adjacent or entirely new markets could transform these initial investments into future "Stars" for Brunswick.

- Strategic Resource Allocation: Brunswick must carefully evaluate the potential return on investment and the strategic fit of any new product category against its core competencies and financial capacity.

Question Marks in Brunswick's portfolio represent business units with high growth potential but currently low market share. These often include new technologies or market entries where significant investment is required to gain traction.

Fliteboard, with its focus on the rapidly expanding electric foiling market, exemplifies a Question Mark. While the market is growing, Fliteboard's current share is likely small, necessitating substantial R&D and marketing to compete effectively.

Similarly, Brunswick's international expansion of the Freedom Boat Club model places these new regions in the Question Mark category. They offer high growth prospects, but require significant investment to build awareness and infrastructure.

Emerging digital and connectivity solutions, such as advanced C-Zone and VesselView systems, also fit the Question Mark profile. They hold considerable future promise in the connected boating trend, but their current market penetration and revenue contribution are still developing.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Category | Strategic Consideration |

|---|---|---|---|---|

| Fliteboard (Electric Foiling) | High | Low | Question Mark | Invest in R&D and marketing to increase market share. |

| Freedom Boat Club (International Expansion) | High | Low | Question Mark | Focus on brand building and operational setup in new markets. |

| Digital & Connectivity Solutions (C-Zone, VesselView) | High | Low | Question Mark | Enhance features and user adoption to drive revenue. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust market data, including sales figures, industry growth rates, and competitive analysis, to accurately position each business unit.